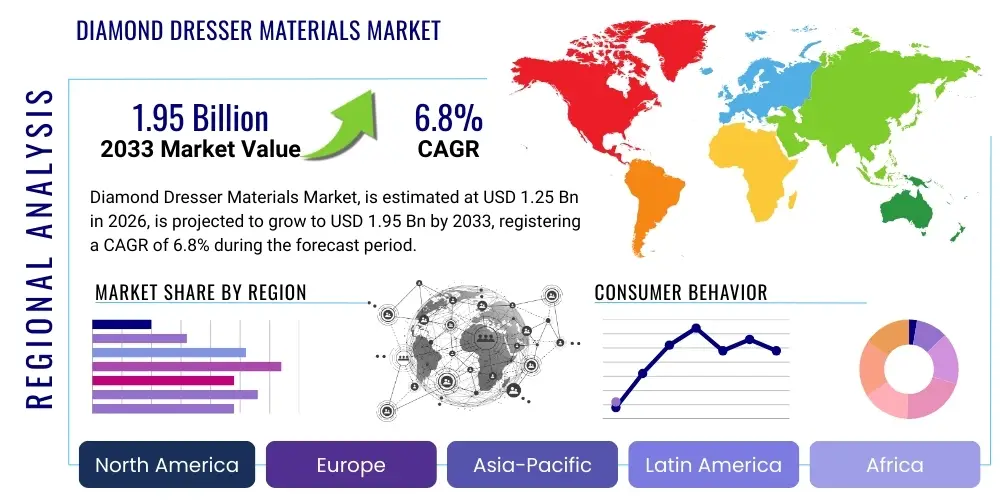

Diamond Dresser Materials Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436155 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Diamond Dresser Materials Market Size

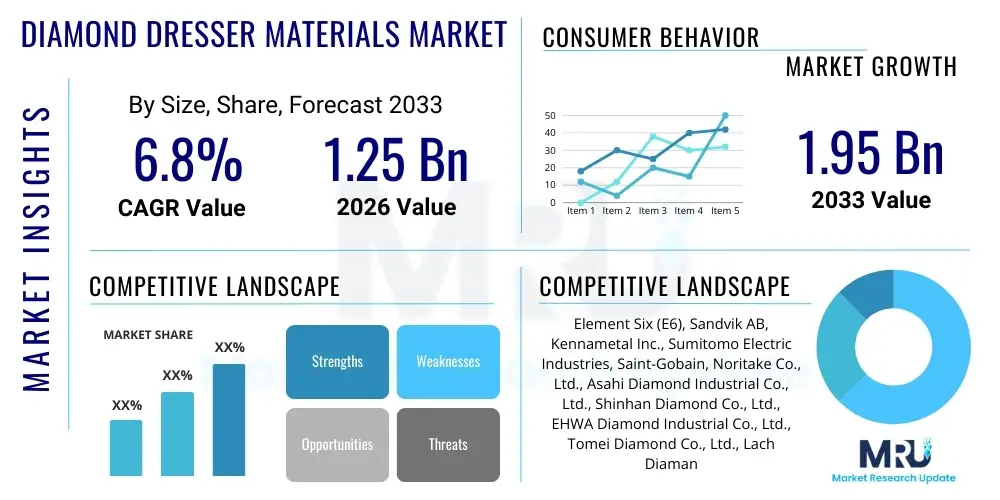

The Diamond Dresser Materials Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.95 Billion by the end of the forecast period in 2033. This consistent growth trajectory is fundamentally driven by the escalating global demand for precision machining components, particularly within high-growth sectors such as electric vehicle manufacturing, advanced aerospace parts production, and the intricate tooling required for modern electronics. The performance stability and unparalleled hardness of diamond materials, both natural and synthetic, position them as indispensable resources for maintaining the dimensional accuracy and surface integrity of grinding wheels, which are central to modern high-tolerance manufacturing processes. The shift toward automated, high-throughput manufacturing lines further accentuates the need for durable and reliable dresser materials capable of withstanding extreme operational demands and extending the mean time between dressing cycles, thereby enhancing overall production efficiency and reducing non-productive downtime across critical industrial applications worldwide.

Diamond Dresser Materials Market introduction

The Diamond Dresser Materials Market encompasses the supply and utilization of specialized diamond-based tools critical for shaping, cleaning, and conditioning abrasive grinding wheels, thereby ensuring the geometrical accuracy and cutting efficiency essential for precision manufacturing. These materials, which range from natural industrial diamonds to sophisticated forms of synthetic polycrystalline diamond (PCD) and chemical vapor deposition (CVD) diamonds, are engineered to tolerate high thermal stress and immense mechanical wear encountered during the wheel dressing process. Effective wheel dressing is paramount in operations that demand micrometer-level precision, as the dresser material dictates the sharpness profile and overall structure of the grinding wheel surface, directly impacting the quality, tolerance, and surface finish of the final manufactured component. The core application spectrum is exceptionally broad, spanning industries that rely heavily on the precise shaping of hard metals, ceramics, and composite materials, ensuring the functional integrity and longevity of parts such as engine components, turbine blades, bearings, and high-precision molds.

Product descriptions within this market segment are characterized by diverse formats tailored for specific dressing tasks, including single-point dressers for detailed profile generation, multi-point dressers offering cost-effectiveness and broad coverage, and sophisticated rotary dressers designed for continuous, high-speed contour dressing in automated production environments. The primary benefits derived from using diamond dresser materials include exceptional material hardness, ensuring minimal wear rate; superior thermal conductivity, which rapidly dissipates heat generated during dressing and preserves the crystal structure; and chemical inertness, which prevents unwanted reactions with the grinding wheel matrix. These characteristics collectively translate into extended tool life for the grinding wheels, reduced production variance, improved surface finish quality on manufactured parts, and a measurable decrease in overall manufacturing cost per unit by optimizing machine uptime and reducing scrap rates.

Key driving factors propelling the growth of this market include the global expansion of automotive production, particularly the rising investments in Electric Vehicle (EV) driveline components which require extremely high precision grinding of gears and shafts; the stringent quality demands imposed by the aerospace and defense sectors for materials processing; and the ongoing trend toward miniaturization and high-tolerance requirements in the electronics and medical device industries. Furthermore, the continuous advancements in synthetic diamond synthesis technologies, particularly in CVD techniques, are improving the consistency, purity, and structural integrity of the dressing materials, offering performance advantages over natural diamonds and ensuring a more stable and predictable supply chain, which is a significant factor for high-volume manufacturers relying on just-in-time inventory management. The technological push toward fully automated CNC grinding centers mandates the integration of high-performance, long-life diamond dressers to maximize operational efficiency and maintain continuous high-quality output.

Diamond Dresser Materials Market Executive Summary

The Diamond Dresser Materials Market is currently defined by robust expansion driven by global industrial automation and the unrelenting pursuit of manufacturing precision across critical sectors. Business trends indicate a significant consolidation among leading manufacturers who possess superior technological capabilities in synthetic diamond production (HPHT and CVD), allowing them to offer customized and complex dresser geometries, especially in the highly lucrative rotary dresser segment. There is a perceptible shift in material preference toward engineered synthetic diamonds, which provide superior consistency and predictable performance compared to their natural counterparts, thereby reducing supply chain volatility for end-users. The market is also experiencing heightened activity in R&D aimed at developing smart dressing tools integrated with sensors for real-time monitoring of dressing forces and wear, enabling truly adaptive manufacturing systems and optimizing material usage, thus aligning with global efficiency and sustainability mandates.

Regional trends distinctly highlight the dominance of the Asia Pacific (APAC) region, largely fueled by massive manufacturing bases in China, India, Japan, and South Korea, which are leading global production in automotive components, heavy machinery, and consumer electronics. The swift adoption of advanced CNC grinding technologies in APAC, supported by government initiatives promoting local manufacturing excellence, ensures this region remains the primary consumption hub. Europe and North America, while mature markets, emphasize high-value, specialized, and low-volume applications, particularly within aerospace, medical, and specialized tooling sectors, focusing heavily on adopting highly technical and integrated dressing solutions, often requiring bespoke material formulations for super-hard alloys. These developed regions are the early adopters of next-generation rotary and blade dressers, prioritizing innovation and long-term cost reduction through enhanced tool life and process stability.

Segmentation trends reveal strong growth in the Rotary Dressers segment, directly proportional to the increased deployment of automated, high-volume production lines where continuous, high-speed dressing is mandatory for throughput maintenance. Material-wise, Polycrystalline Diamond (PCD) and Chemical Vapor Deposition (CVD) diamonds are gaining substantial market share, displacing traditional single-point natural diamond tools in many industrial applications due to superior thermal stability and structural homogeneity, which translates into better performance repeatability. Application trends underscore the paramount role of the automotive sector, driven particularly by the transition to Electric Vehicles (EVs), where the grinding of high-precision gears, shafts, and bearing components demands exceptional surface integrity, making high-quality diamond dressers an irreplaceable requirement in the advanced component manufacturing workflow. This dynamic segmentation reflects the industry’s broader move toward efficiency, reliability, and precision at scale.

AI Impact Analysis on Diamond Dresser Materials Market

Common user inquiries regarding the influence of Artificial Intelligence (AI) on the Diamond Dresser Materials Market frequently revolve around optimizing the dressing cycle, predicting tool wear, and improving the material synthesis process. Users are keenly interested in how AI can move the dressing operation from a scheduled or reactive maintenance task to a fully predictive and prescriptive process, minimizing material consumption and maximizing grinding wheel utilization. Specific concerns often center on the practical implementation of machine learning algorithms to interpret complex sensor data (acoustic emission, force sensors, power consumption) generated during the grinding and dressing operations to precisely determine the optimal moment for dressing and the ideal dressing parameters (speed, depth of cut, feed rate). Furthermore, there is significant interest in utilizing AI to accelerate the R&D cycle for new dresser material compositions and complex geometries, ensuring they are optimized for novel super-hard workpieces and high-performance grinding fluids.

Based on this analysis, the key themes summarizing AI’s influence are predictive optimization, enhanced quality control, and advanced material formulation. AI integration promises to drastically reduce the variability inherent in traditional dressing methods, leading to fewer defects, lower operating costs, and longer tool life for both the dresser and the grinding wheel. By applying deep learning techniques to large datasets from manufacturing floors, AI systems can establish complex relationships between machine parameters, diamond wear patterns, and final component quality, providing prescriptive feedback that manual operators or simpler automated systems cannot achieve. This capability is particularly critical for high-value applications in aerospace and medical device manufacturing where material waste is highly costly and quality failure is intolerable, positioning AI as a critical enabler of next-generation precision manufacturing.

The integration of AI also addresses core operational challenges related to the complexity of multi-axis CNC grinding machines. AI models can manage the trade-offs between maximizing material removal rates and maintaining the required surface finish, dynamically adjusting the dressing strategy in real-time as conditions change, such as thermal drift or minor wheel imbalances. This level of autonomous process control is vital for factories aiming for lights-out manufacturing. Furthermore, AI-powered image processing systems are increasingly used for post-production inspection of diamond dressers to detect microscopic flaws or structural inconsistencies in materials like PCD or CVD films, ensuring only the highest quality tools enter the production line, thus improving overall consistency and performance predictability for the end-user.

- AI-driven predictive maintenance optimizes the timing of dresser usage, minimizing non-productive machine downtime.

- Machine Learning algorithms analyze acoustic and vibration data to prescribe optimal dressing parameters (e.g., infeed, traverse speed) in real-time.

- Deep learning enhances quality control through sophisticated machine vision systems that inspect the diamond tip geometry for micron-level wear or damage.

- AI simulation accelerates the development of novel polycrystalline diamond (PCD) binder formulations and CVD growth recipes, optimizing material performance.

- Automated anomaly detection in the grinding process uses AI to identify when dressing is critically required, reducing scrap rate and improving yield.

- Integration of AI control loops facilitates Adaptive Dressing, allowing the dressing process to react dynamically to changes in workpiece hardness or grinding fluid temperature.

DRO & Impact Forces Of Diamond Dresser Materials Market

The Diamond Dresser Materials Market is influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO) which collectively shape its growth trajectory and competitive landscape. A primary driver is the accelerating pace of industrial modernization globally, specifically the massive investment into automated, high-precision CNC grinding machinery across Asia Pacific and emerging economies. This automation mandates highly reliable and long-lasting dressing tools, directly benefiting segments like rotary dressers. A second critical driver is the exponential growth in the Electric Vehicle (EV) industry, where the need for extremely precise gears, rotors, and lightweight structural components requires sophisticated grinding operations maintained by superior diamond dressers to achieve the required noise reduction, efficiency, and durability standards. Furthermore, the defense and aerospace sectors consistently demand higher material removal rates for superalloys (like Inconel and titanium) while maintaining strict geometrical tolerances, making advanced synthetic diamond dressers indispensable.

Conversely, the market faces significant restraints, chiefly the high initial investment required for sophisticated diamond dressing tools, particularly the intricate rotary profiles which involve substantial upfront cost compared to conventional abrasive sticks or single-point tools. This cost barrier can deter smaller manufacturers or those operating in low-volume specialty production. Additionally, the increasing focus on sustainability presents a challenge regarding the end-of-life management and recycling of spent diamond dresser tools, particularly those bonded in complex metal matrices, where the separation and recovery of the valuable superabrasive material can be technically and economically prohibitive. Another restraint involves the volatility associated with the sourcing and pricing of natural industrial diamonds, although this is being increasingly mitigated by the stable supply chain of high-quality synthetic diamond alternatives.

Opportunities for market growth are vast, predominantly stemming from the continuous advancements in synthetic diamond technology, such as optimized CVD diamond coatings that offer enhanced thermal shock resistance and improved wear characteristics for demanding applications. The rise of Additive Manufacturing (AM) processes creates new demand for dressers capable of conditioning grinding wheels used to finish AM parts, which often feature unique and challenging material structures. Furthermore, the development of intelligent dressing systems incorporating IoT sensors offers a substantial opportunity for manufacturers to differentiate their products by providing real-time performance feedback, enabling predictive fault detection, and offering services based on data analytics, moving the market toward a service-oriented business model. Finally, penetrating emerging markets in Southeast Asia and Latin America, driven by infrastructure and machinery development, represents a key expansion opportunity for established global players seeking new industrial adoption points.

Segmentation Analysis

The Diamond Dresser Materials Market is comprehensively segmented based on Type, Material, and Application, reflecting the highly specialized nature of the tool manufacturing industry. The segmentation by Type primarily differentiates tools based on their operational mechanism and complexity, ranging from basic, cost-effective single-point tools to highly engineered, automated rotary systems. This differentiation is critical as end-users choose tools based on their production volume, required precision level, and the specific geometry needed on the grinding wheel. High-volume automotive plants heavily favor rotary dressers for continuous profiling, whereas maintenance shops or specialized low-volume production might utilize single-point or blade dressers for versatility and lower capital expenditure, indicating a strong correlation between type preference and industrial scale.

Material segmentation is central to performance, distinguishing between natural diamonds (often used for simple, large single crystals) and advanced synthetic diamonds, including Polycrystalline Diamond (PCD) and Chemical Vapor Deposition (CVD) diamond layers. The synthetic material segment, particularly PCD, is witnessing accelerated growth due to its superior toughness, homogeneous crystal structure, and predictable performance, making it ideal for the most demanding, continuous industrial grinding applications. CVD diamond, known for its extreme purity and tailored properties, is increasingly adopted for precision dressing where thermal management and minimal friction are critical requirements, showcasing the market’s technological maturity and focus on advanced material science solutions.

Application analysis highlights the dominant end-use sectors, with Automotive, Aerospace, and Bearing Manufacturing being the primary consumers. The shift in automotive focus towards EV components has elevated the requirement for specialized dressers capable of handling high-strength alloys and ceramics used in batteries and electric drivetrain systems. The aerospace sector demands diamond materials with maximum stability and longevity due to the high cost and criticality of components like turbine disks and structural elements. Overall, market growth is intrinsically linked to the health and technological progression of these core manufacturing industries, with the demand for tighter tolerances and better surface finishes continually driving innovation across all segmented product categories.

- By Type:

- Single-Point Diamond Dressers

- Multi-Point Diamond Dressers

- Blade Diamond Dressers

- Rotary Diamond Dressers

- Impregnated Diamond Dressers

- By Material:

- Natural Diamond

- Synthetic Diamond

- Polycrystalline Diamond (PCD)

- Chemical Vapor Deposition (CVD) Diamond

- By Application:

- Automotive Industry (including EV components)

- Aerospace and Defense Industry

- Bearing Manufacturing

- Machine Tooling and Mold Making

- Precision Engineering and Electronics

- Heavy Machinery and Industrial Components

Value Chain Analysis For Diamond Dresser Materials Market

The Value Chain for the Diamond Dresser Materials Market is complex and highly specialized, beginning with the upstream sourcing of raw diamond materials, which dictates the quality and cost structure of the final product. Upstream analysis involves the procurement of industrial-grade natural diamonds from mining operations, or, increasingly, the sophisticated synthesis of high-purity synthetic diamonds (PCD blanks, CVD films) through capital-intensive processes like HPHT (High-Pressure High-Temperature) or advanced plasma reactors. This initial stage requires significant R&D investment and technological expertise, positioning specialized material producers like Element Six and Sumitomo as critical gatekeepers. The subsequent manufacturing phase involves highly skilled processes such as laser cutting, brazing, sintering, and precise lapping to form the final dresser geometry, where quality control is paramount to ensure the micro-geometry of the diamond tip or profile aligns with stringent industrial tolerances demanded by end-users.

The middle segment involves the distribution and sales channel, which is typically bifurcated into direct sales for large, customized orders (especially rotary dressers) and indirect channels utilizing a network of industrial distributors and specialized tooling suppliers for standard items like single-point dressers. Direct sales ensure tight technical communication between the manufacturer and the high-volume consumer (e.g., major automotive tier-one suppliers), allowing for co-development of optimized dressing solutions. Conversely, indirect channels provide necessary reach and local inventory for smaller shops and general machine maintenance needs. These distributors often add value by offering technical consultation, local inventory management, and immediate delivery of critical spare parts, integrating themselves deeply into the customer's supply logistics and maintaining a relationship critical for market presence.

Downstream analysis focuses on the end-user application and the integration of the dresser tool into the sophisticated grinding ecosystem. The performance feedback loop from the end-user back to the manufacturer is crucial for continuous product improvement, especially regarding wear rates and thermal performance in novel applications like advanced ceramics grinding. Key downstream sectors, such as precision bearing and aerospace component manufacturers, demand comprehensive technical support, including training and troubleshooting services, often requiring manufacturers to act as solutions providers rather than merely product sellers. The overall chain is characterized by a high degree of integration between material science expertise and mechanical engineering know-how, ensuring the diamond tool’s physical properties are perfectly matched to the operational demands of high-speed, high-precision grinding machines.

Diamond Dresser Materials Market Potential Customers

The primary potential customers and end-users of Diamond Dresser Materials are predominantly large-scale manufacturing entities and specialized industrial processors that rely on high-precision grinding operations to achieve necessary component tolerances. The largest segment remains the Automotive Industry, encompassing traditional internal combustion engine (ICE) component suppliers, but with accelerating demand from Electric Vehicle (EV) manufacturers. EV production requires grinding complex transmission gears, high-precision motor shafts, and battery cooling plate surfaces where minimal dimensional variance is essential for efficiency and longevity, making high-quality diamond dressers a non-negotiable input. These customers prioritize rotary dressers and complex profiling tools capable of high throughput and extended operational life in automated environments, often requiring specific certifications related to quality management systems like ISO/TS 16949.

Another critical customer base resides within the Aerospace and Defense Industry, encompassing manufacturers of aircraft engines, landing gear systems, and specialized military hardware. The processing of high-temperature superalloys (e.g., nickel-based and titanium alloys) used in turbine blades and structural components necessitates grinding wheels that are constantly maintained at peak efficiency. These customers demand the highest quality materials, often favoring custom-designed PCD or CVD tools that offer maximum thermal stability and wear resistance to minimize the risk of component failure in safety-critical applications. Decision-making in this sector is driven by performance repeatability, traceability of materials, and compliance with rigorous quality standards such as AS9100, often leading to long-term supplier relationships with highly specialized dresser manufacturers.

Furthermore, the Bearing Manufacturing sector represents a substantial and consistent customer segment. The production of high-precision bearings for industrial machinery, automotive applications, and specialized instruments requires exceptionally smooth and geometrically accurate raceways, achieved solely through precise grinding and subsequent superfinishing. The high-volume nature of bearing manufacturing mandates the use of highly durable rotary dressers to maintain consistent wheel profiles over extended runs. Potential customers also include machine tool builders who use dressers to condition wheels for internal component production, as well as job shops and mold makers specializing in complex, tight-tolerance tooling for the electronics and medical device industries, which require highly versatile, often single-point or blade-type, dressers for varied, low-volume profile generation tasks. Their purchasing criteria are centered on cost-efficiency, versatility, and the ability to achieve stringent surface roughness specifications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.95 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Element Six (E6), Sandvik AB, Kennametal Inc., Sumitomo Electric Industries, Saint-Gobain, Noritake Co., Ltd., Asahi Diamond Industrial Co., Ltd., Shinhan Diamond Co., Ltd., EHWA Diamond Industrial Co., Ltd., Tomei Diamond Co., Ltd., Lach Diamant, Advanced Superabrasives Inc., K.M. Kothari & Co., Industrial Diamond Products Ltd., Diagrind Inc., Triefus Industries, Disco Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Diamond Dresser Materials Market Key Technology Landscape

The technological landscape of the Diamond Dresser Materials Market is dominated by advancements in superabrasive material synthesis and precision tool fabrication, driving improvements in dresser longevity, consistency, and performance under extreme conditions. A foundational technology remains the synthesis of Polycrystalline Diamond (PCD) through the High-Pressure High-Temperature (HPHT) method, where micron-sized diamond particles are sintered together using a metallic binder (typically Cobalt) under conditions mimicking the Earth's mantle. Recent technological improvements focus on optimizing the binder chemistry and microstructure to enhance the PCD’s toughness and thermal stability, specifically creating binderless or lower-cobalt content PCD grades that resist thermal degradation (graphitization) during high-speed, dry dressing operations, thereby extending tool life significantly and enabling higher material removal rates from the grinding wheel with minimal thermal impact.

Another pivotal technology is Chemical Vapor Deposition (CVD), which allows for the creation of exceptionally pure, dense, and thick diamond films on substrates. CVD technology is rapidly evolving, enabling manufacturers to produce bespoke diamond materials with tailored properties, such as specific grain orientations or nitrogen incorporation to fine-tune electronic and mechanical properties. This technology is particularly valuable for producing high-performance blade dressers and specialized single-point tools where maximum thermal dissipation and chemical inertness are essential. The ability to deposit highly uniform diamond layers on complex ceramic or carbide substrates allows for the creation of intricate rotary dresser profiles that maintain their geometry with superior fidelity throughout their operational life, offering a significant performance advantage over older, brazed-in diamond segments.

Fabrication technologies are equally critical, particularly the use of advanced laser ablation and precision Electric Discharge Machining (EDM) techniques to accurately shape, cut, and profile the super-hard diamond materials. Laser technology allows for non-contact, high-precision shaping of complex rotary dresser profiles and the creation of highly specialized micro-geometries on single-point tips, which are impossible to achieve via traditional mechanical grinding methods. Furthermore, the evolution of sophisticated bonding technologies, such as vacuum brazing and advanced sintering processes, is crucial for securely affixing the diamond element to the tool shank or rotary body, ensuring mechanical stability and optimal heat transfer during severe dressing cycles. The confluence of these advanced material synthesis and fabrication technologies is fundamentally driving the market toward tools that enable even tighter tolerances and faster cycle times in modern manufacturing environments globally.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market volume due to massive expansion in manufacturing (Automotive, Electronics, Heavy Machinery), led by China, India, and Japan.

- North America: Characterized by high-value, specialized demand in Aerospace & Defense and high-precision medical device manufacturing, prioritizing sophisticated synthetic dressers.

- Europe: A mature market focused on innovation, particularly in high-quality machining, automotive premium segments (Germany), and adopting advanced rotary dresser solutions and digitalization.

- Latin America (LATAM): Exhibits growing potential driven by automotive assembly and infrastructure development, favoring cost-effective and general-purpose diamond dressing tools initially.

- Middle East and Africa (MEA): A nascent market segment primarily driven by infrastructure projects, oil & gas industry maintenance, and localized manufacturing expansion efforts, with steady, manageable growth expected.

The Asia Pacific (APAC) region stands as the powerhouse of the Diamond Dresser Materials Market, commanding the largest market share primarily due to the sheer scale of its manufacturing output, particularly in key economies like China, which serves as the global manufacturing center for automotive parts, consumer electronics, and industrial machinery. Japan and South Korea maintain their positions as leaders in high-technology precision engineering, driving demand for the most sophisticated rotary and custom-profile dressers required for advanced machine tool production and semiconductor manufacturing equipment components. The rapid urbanization and industrial policy initiatives in India and Southeast Asian nations are fueling significant investments in new production capacities, necessitating a parallel surge in demand for diamond dressers to maintain the efficiency and quality of newly installed grinding equipment, thereby solidifying APAC's market dominance through both volume and rapid adoption of automated manufacturing practices and continuous high-throughput production lines.

North America represents a mature, yet highly dynamic, market characterized by a strong emphasis on technological leadership and high-value manufacturing segments rather than sheer volume. The core demand is driven by the robust Aerospace and Defense sectors, where the grinding of complex, high-tolerance components from difficult-to-machine superalloys requires the highest performance CVD and PCD diamond dressers available, prioritizing reliability and traceable quality over cost. The resurgence of domestic manufacturing, particularly in specialized tooling and medical device production, mandates the use of precision dressing tools to meet exceptionally strict regulatory and dimensional requirements. Furthermore, North American manufacturers are often early adopters of AI-integrated and sensor-equipped dressing systems, seeking to optimize operational efficiency and integrate dressing processes seamlessly into highly automated, Industry 4.0 compliant factories, reflecting a trend towards total cost of ownership rather than initial purchase price.

Europe, anchored by Germany's dominant machine tool and automotive industries, remains a critical hub for innovation and consumption of premium diamond dresser materials. European manufacturers prioritize environmentally sustainable processes and often demand dresser materials offering superior tool life to minimize material waste and energy consumption. The market is defined by a strong preference for highly accurate rotary dressers and custom-engineered solutions that integrate perfectly with high-end CNC grinding centers used in luxury automotive component production and advanced mechanical engineering. The stringent quality standards and focus on energy efficiency across the European industrial base ensure sustained demand for advanced synthetic diamonds (PCD and CVD) that offer predictable, stable performance, with significant R&D efforts focused on developing novel bonding technologies to enhance the integrity and thermal performance of rotary dressing systems used in high-speed dry grinding applications.

Latin America (LATAM) and the Middle East and Africa (MEA) currently represent smaller but significantly growing regional markets. In LATAM, demand is closely tied to the automotive manufacturing clusters in Brazil and Mexico and ongoing large-scale infrastructure and mining operations. As these economies industrialize further, the need for general-purpose and multi-point dressers for maintenance and new manufacturing setups grows steadily. The MEA region's demand is primarily driven by capital expenditure in the oil and gas sector, which requires specialized machinery maintenance, alongside burgeoning diversification efforts into non-oil manufacturing sectors and construction infrastructure projects. Growth in these regions is heavily dependent on stable economic conditions and foreign direct investment in manufacturing capabilities, which increases the installed base of grinding machines requiring regular dressing services, positioning them as important secondary markets for future expansion in the consumption of foundational diamond dresser materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Diamond Dresser Materials Market.- Element Six (E6)

- Sandvik AB

- Kennametal Inc.

- Sumitomo Electric Industries

- Saint-Gobain

- Noritake Co., Ltd.

- Asahi Diamond Industrial Co., Ltd.

- Shinhan Diamond Co., Ltd.

- EHWA Diamond Industrial Co., Ltd.

- Tomei Diamond Co., Ltd.

- Lach Diamant

- Advanced Superabrasives Inc.

- K.M. Kothari & Co.

- Industrial Diamond Products Ltd.

- Diagrind Inc.

- Triefus Industries

- Disco Corporation

- M.M. International

- Tyrolit Group

- Diatos

Frequently Asked Questions

Analyze common user questions about the Diamond Dresser Materials market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary performance advantages of synthetic diamond dressers (PCD/CVD) over natural diamond dressers?

Synthetic diamonds, specifically Polycrystalline Diamond (PCD) and Chemical Vapor Deposition (CVD) diamonds, offer superior performance advantages due to their structural homogeneity and predictable mechanical properties. They exhibit higher consistency in wear resistance and thermal stability compared to natural industrial diamonds, which often contain inherent flaws, leading to more reliable, longer-lasting tools that are ideal for high-volume, automated production lines requiring consistent results and reduced dressing cycle variance.

How is the Electric Vehicle (EV) transition impacting the demand dynamics for high-precision diamond dressers?

The transition to EVs is significantly boosting demand for advanced diamond dressers because EV drivetrain components (e.g., gears, shafts, bearings) require extremely high precision grinding to ensure efficiency, minimize noise, and enhance durability. This necessitates the use of high-performance rotary and customized profile dressers, often made from advanced synthetic materials, to consistently maintain the tight dimensional tolerances and superior surface finishes required for these critical components, driving growth in the high-end segment.

What role does Artificial Intelligence (AI) play in optimizing the diamond dressing process?

AI is increasingly used to optimize the dressing process by enabling predictive maintenance and prescriptive control. Machine learning algorithms analyze real-time sensor data (vibration, force, acoustics) to accurately predict the optimal moment for dressing, determining the minimum effective dressing depth, and automatically adjusting parameters. This reduces unnecessary dressing, extends the life of both the dresser and the grinding wheel, minimizes scrap, and ensures maximum machine utilization, transitioning the process from reactive to highly intelligent.

Which dresser type is preferred for high-volume, continuous manufacturing applications?

Rotary diamond dressers are overwhelmingly preferred for high-volume, continuous manufacturing applications, particularly in the automotive and bearing industries. These tools are engineered with complex, fixed diamond profiles, allowing for rapid, consistent, and continuous conditioning of the grinding wheel profile at high speed. Their robust design facilitates integration into automated CNC grinding systems, significantly reducing cycle times and increasing overall production throughput compared to intermittent single-point dressing methods.

What are the key technological challenges currently restraining material innovation in this market?

The primary technological challenges include improving the thermal shock resistance and overall toughness of synthetic diamonds, especially for dry grinding applications where extreme heat is generated. Additionally, developing cost-effective, high-integrity bonding techniques to affix large or complex PCD/CVD elements to tool bodies without compromising their mechanical stability is a persistent constraint. Manufacturers are continuously working on advanced binder chemistry and sophisticated brazing methods to overcome these limitations and enhance tool life under increasingly severe operating conditions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager