Diamond Turning Machines Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435692 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Diamond Turning Machines Market Size

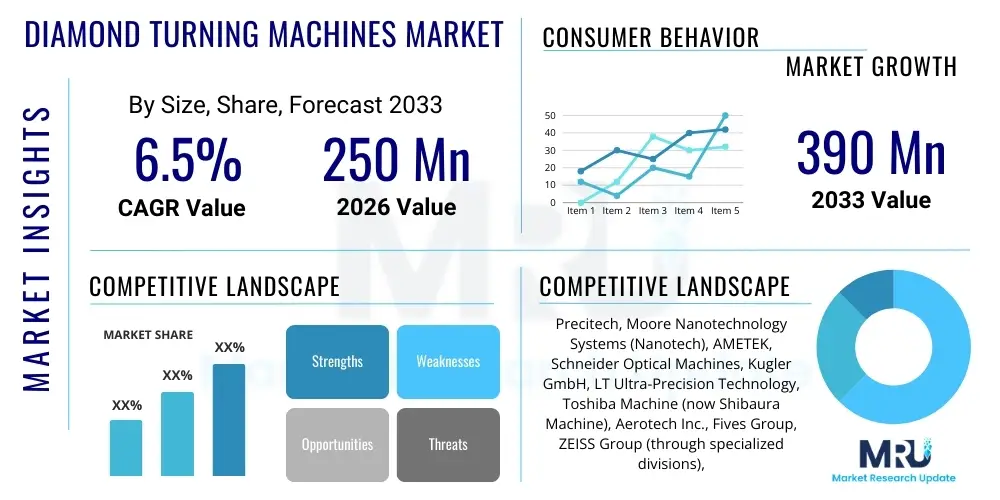

The Diamond Turning Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 250 Million in 2026 and is projected to reach USD 390 Million by the end of the forecast period in 2033.

Diamond Turning Machines Market introduction

Diamond Turning Machines (DTMs) represent a cornerstone technology in ultra-precision machining, specifically designed for the creation of components requiring surface finish quality in the nanometer range and form accuracy approaching sub-micrometer levels. These machines utilize single-crystal diamond tools and specialized motion control systems, such as air or hydrostatic bearings, coupled with advanced vibration isolation, to achieve deterministic material removal. The core functionality of a DTM is to precisely machine non-ferrous materials, crystalline materials, and polymers, enabling the creation of complex geometries that are often impossible to achieve through conventional grinding or milling processes.

The primary applications for DTM technology are concentrated in high-value, high-specification industries, most notably optics, defense, and healthcare. In the optics sector, DTMs are indispensable for manufacturing molds for optical lenses, freeform optics, and large aperture mirrors required for telescopes and advanced imaging systems. The increasing demand for miniaturization and high performance in consumer electronics, especially in smartphone camera modules and augmented reality (AR) devices, further accelerates the adoption of these machines, as they offer unparalleled repeatability and accuracy necessary for mass production of micro-optical components. The technological capability to produce complex, non-spherical surfaces efficiently provides a significant competitive advantage.

Key market driving factors include the escalating global investment in aerospace and defense sectors, which requires ultra-precise components for guidance systems, infrared sensors, and specialized mirrors. Furthermore, the rapid expansion of semiconductor manufacturing, particularly in photolithography systems, relies heavily on DTMs for producing high-quality molds and tooling inserts. Benefits derived from using DTMs include superior surface quality, reduced post-processing requirements, material versatility for non-ferrous alloys, and the ability to integrate complex geometries directly into the design, leading to lighter, more efficient end-products. However, the high initial capital expenditure and the necessity for specialized operator skillsets pose foundational barriers to broader market entry, balancing the significant technological drivers.

Diamond Turning Machines Market Executive Summary

The Diamond Turning Machines market is witnessing robust growth, driven primarily by the global shift towards precision engineering and the proliferation of advanced optical systems. Current business trends indicate a strong emphasis on automation and the integration of in-situ metrology capabilities within DTMs to minimize human error and accelerate the feedback loop, thereby improving yield rates in highly sensitive manufacturing environments. Manufacturers are increasingly focusing on developing hybrid machines that combine diamond turning with other processes, such as ultra-precision grinding or micro-milling, to handle a wider array of materials and component complexities. This trend toward integrated manufacturing solutions is crucial for meeting the stringent requirements of next-generation photonics and defense contracts.

From a regional perspective, Asia Pacific (APAC) stands out as the primary engine of growth, largely due to massive investments in electronics manufacturing, optical component production (driven by China, Taiwan, and South Korea), and expanding medical device fabrication industries. North America and Europe maintain significant market share, characterized by high spending in R&D, aerospace, and advanced scientific infrastructure, demanding the most sophisticated multi-axis DTM systems. Regional trends show a bifurcated market: APAC focusing on high volume, cost-efficient DTMs for consumer electronics, while Western markets prioritize custom, ultra-high-accuracy machines for scientific research and strategic defense applications.

Segment trends highlight the dominance of 3-axis DTMs in basic optical applications, but the fastest growth is observed in 5-axis and multi-axis DTMs, which are essential for producing complex freeform and aspherical surfaces crucial for modern camera lenses and display technologies. The material segment confirms the sustained importance of machining aluminum and nickel for molds, but the processing of newer materials like silicon and specialized ceramics, particularly within the semiconductor industry, is projected to accelerate. Furthermore, the increasing adoption of hydrostatic bearings over air bearings in the highest-precision models signals a move toward maximizing stiffness and damping for vibration minimization, directly addressing the industry’s incessant need for enhanced surface quality.

AI Impact Analysis on Diamond Turning Machines Market

User inquiries regarding AI's influence on the Diamond Turning Machines Market commonly center on topics such as predictive maintenance, optimization of machining parameters, and integration of smart metrology. Users are keen to understand how AI can reduce the steep learning curve associated with DTM operations and minimize the cost implications of scrapping expensive, high-precision components due to process variability. Key concerns revolve around the reliability of AI algorithms in ultra-precision environments where sub-nanometer errors are critical, and the perceived difficulty of retrofitting existing high-capital DTM hardware with advanced AI monitoring systems. Expectations are high regarding AI's potential to enable true adaptive control—where machine parameters adjust in real-time based on in-situ feedback, compensating for thermal drift or tool wear instantaneously.

The application of Artificial Intelligence and Machine Learning (ML) is fundamentally shifting DTM operations from purely deterministic processes to highly adaptive manufacturing systems. AI algorithms are being deployed to analyze vast datasets generated by sensors monitoring spindle speed, temperature, vibration, and acoustic emissions during the turning process. This data intelligence allows DTM operators to accurately predict the remaining useful life of the diamond tool, thereby preventing catastrophic failures and maintaining consistent surface quality over long production runs. Furthermore, ML models are proving instrumental in correlating input parameters with final surface roughness and form accuracy, enabling automated optimization of cutting speeds and depths to minimize cycle time while adhering to strict quality tolerances, especially critical in the manufacturing of high-definition aspheric lenses.

The future impact of AI will likely involve fully autonomous process planning and fault diagnosis within the DTM ecosystem. By leveraging computer vision and neural networks to analyze digital microscope images of the machined surface, AI can instantly identify defects such as chatter marks or subsurface damage and automatically recalibrate the machining path or tool orientation. This level of self-correction significantly reduces the reliance on highly skilled operators for manual parameter tuning and quality control checks, accelerating throughput and lowering operational costs. The focus on integrating edge computing capabilities ensures that real-time decisions are made directly at the machine level, enhancing both speed and security of the manufacturing process.

- Real-Time Parameter Optimization: AI algorithms adjust feed rate and spindle speed dynamically to maintain target surface roughness, compensating for environmental variations.

- Predictive Tool Wear Analysis: Machine Learning models forecast the degradation of the diamond tool tip, scheduling proactive replacement and preventing defective output.

- Enhanced Process Control: Utilization of deep learning for automated detection and correction of process instabilities like thermal drift and subtle machine vibration (chatter).

- Automated Quality Inspection: Integration of computer vision systems to conduct instantaneous, high-resolution inspection and classification of surface defects.

- Generative Design Integration: AI assists in designing optimal freeform optics structures that are mathematically tailored for ultra-precision diamond turning manufacturing.

- Reduced Setup Time: ML models analyze previous successful setups to recommend optimal alignment and tooling configurations for new component geometries.

DRO & Impact Forces Of Diamond Turning Machines Market

The Diamond Turning Machines market is primarily driven by the escalating demand for ultra-precision components across advanced technological sectors, coupled with transformative opportunities presented by emerging material sciences and digital integration. However, this growth trajectory is tempered by significant constraints related to cost and skill requirements. The overarching impact forces are characterized by strong supplier power due to high specialization and moderate buyer power in critical sectors where DTMs are indispensable for product performance, leading to sustained market value and focus on technological superiority rather than mere price competition. This dynamic ensures continuous investment in research and development to maintain competitive edge in accuracy and throughput.

The dominant driver is the pervasive need for extreme accuracy in modern optical systems, particularly the miniaturization of optics for consumer devices (e.g., Virtual Reality/Augmented Reality headsets, smartphone lenses) and the requirement for large, high-quality optics in astronomical and military applications. Opportunities mainly reside in the development of next-generation hybrid DTMs that can handle brittle materials like ceramics and glass with diamond tooling through specialized auxiliary processes, opening up new markets in extreme environment components and semiconductor lithography. Furthermore, the development of turnkey solutions, combining DTMs with automated loading/unloading and integrated cleaning stations, reduces operational complexity, making the technology more accessible to smaller specialized manufacturers.

Key restraints include the exceptionally high capital expenditure required for acquiring advanced DTMs, which often exceeds several million dollars, making market entry challenging for small and medium enterprises. Additionally, the operation and maintenance of these ultra-precision systems demand highly specialized engineers and technicians, creating a significant labor skill gap globally. Competitive intensity within the DTM manufacturing sector remains high, driven by technological differentiation, while the threat of substitutes is relatively low, as few alternative technologies can reliably and cost-effectively achieve nanometer-level surface finishes and micro-scale form accuracy on complex geometries. These interacting forces dictate a market focused on continuous technological innovation and the creation of highly protected intellectual property related to motion control and error compensation systems.

Segmentation Analysis

The Diamond Turning Machines market is intricately segmented based on core variables including machine type, application area, end-user industry, and bearing technology utilized. Understanding these segmentations is critical for manufacturers to tailor their product offerings and for investors to identify high-growth niches. Segmentation by machine type often reflects capability, ranging from simpler 2-axis systems used primarily for rotationally symmetric parts to highly sophisticated 5-axis and multi-axis machines capable of producing complex freeform and non-rotationally symmetric optical components. The distinction between horizontal and vertical configurations also plays a role, with vertical axis machines often favored for larger, heavier workpieces where gravity assistance simplifies loading and minimizes deflection.

Analysis of application segmentation reveals that optics manufacturing—encompassing spherical, aspheric, and freeform lenses, mirrors, and prisms—represents the largest and fastest-growing segment, propelled by advancements in digital imaging and medical diagnostics. Aerospace and Defense applications, requiring components like infrared windows, domes, and reflective mirrors for satellite guidance, constitute another high-value segment characterized by stringent quality standards and long product lifecycles. Material processing segmentation remains vital, with segments for aluminum/non-ferrous metals and plastics/polymers forming the traditional base, while the higher-precision machining of silicon and ceramics is rapidly emerging due to the needs of the semiconductor and micro-electromechanical systems (MEMS) industries.

The market structure is further detailed by bearing technology, which fundamentally dictates the precision capability of the machine. Air bearings currently dominate the ultra-precision segment due to their near-frictionless motion, but hydrostatic bearings, offering superior stiffness and damping characteristics crucial for heavy-duty or high-acceleration cuts, are gaining traction, especially in specialized 5-axis applications. End-user segmentation, spanning commercial optics, government research facilities, academic institutions, and dedicated contract manufacturers, helps in identifying purchasing behaviors and volume requirements. This detailed segmentation allows stakeholders to accurately gauge market penetration potential across diverse technological ecosystems.

- By Machine Type:

- 2-Axis DTMs

- 3-Axis DTMs

- 4-Axis DTMs

- 5-Axis and Multi-Axis DTMs (Freeform Machining)

- Hybrid Diamond Turning Systems

- By Application:

- Aspheric Optics Manufacturing

- Freeform Optics Manufacturing

- Spherical Optics Manufacturing

- Molds and Dies Manufacturing (e.g., for Injection Molding)

- Mechanical Components (e.g., Fluid Bearings, Calibration Artifacts)

- By Bearing Technology:

- Air Bearings (Aerostatic)

- Hydrostatic Bearings

- Mechanical Bearings (Less common in ultra-precision)

- By End-User Industry:

- Optics and Photonics

- Aerospace and Defense

- Healthcare and Medical Devices (e.g., Intraocular Lenses)

- Consumer Electronics (e.g., Camera Modules, Display Technology)

- Automotive (e.g., Head-up Displays, Sensor Components)

Value Chain Analysis For Diamond Turning Machines Market

The Diamond Turning Machines value chain is highly specialized, beginning with the upstream supply of ultra-precision components and culminating in the highly specialized end-product application. Upstream activities are dominated by niche suppliers providing critical subsystems such as nano-positioning stages, laser interferometric metrology systems, vibration isolation tables, and the specialized air or hydrostatic bearing systems that determine the machine's accuracy limits. A key component of upstream analysis is the supply of high-quality, single-crystal diamond tools, often sourced from a limited number of specialized manufacturers globally. The cost and quality of these upstream inputs significantly impact the final price and performance of the DTM system, granting substantial leverage to these specialized component manufacturers.

The middle segment of the value chain involves the DTM Original Equipment Manufacturers (OEMs), who integrate these sophisticated components, develop proprietary motion control software, and assemble the final machines. Due to the complexity and intellectual property involved, market entry barriers are extremely high. OEMs engage in direct sales and technical consultation with major buyers, necessitating highly technical sales teams. Distribution channels are typically direct, bypassing conventional distributors for high-end systems, ensuring that installation, calibration, and extensive post-sale training are managed by the OEM or authorized, highly skilled integration partners. Indirect distribution may be utilized only for standardized, lower-axis DTM models aimed at general academic research or contract manufacturing.

Downstream analysis focuses on the end-users and the highly specialized services that utilize DTM capabilities. These services include dedicated contract manufacturers specializing in ultra-precision optics (who serve clients across multiple industries) and large captive manufacturing facilities within defense or high-tech electronics companies. The downstream value added comes from applying the DTM technology to transform raw materials into complex, functioning components that meet extreme specifications. The reliance on indirect channels (contract manufacturers) for outsourcing complex optical production is growing, indicating a shift where smaller end-users can access DTM quality without the capital investment, thereby expanding the overall market reach of the technology.

Diamond Turning Machines Market Potential Customers

The primary end-users and buyers of Diamond Turning Machines are enterprises and institutions operating at the frontier of high-precision manufacturing and scientific inquiry, where surface finish and form accuracy are non-negotiable performance factors. Optical component manufacturers, particularly those producing large-scale mirrors for space telescopes, molds for consumer optics (e.g., smartphone cameras, VR/AR lenses), and freeform optics for advanced illumination systems, constitute the largest customer base. These organizations demand robust, multi-axis DTMs capable of high throughput and consistent nanometer precision across diverse materials like optical plastics, copper, nickel, and various aluminum alloys. The buying criteria for this segment heavily emphasize machine stability, control system responsiveness, and comprehensive after-sales support.

Another critical segment includes government entities and defense contractors globally, specifically those involved in the fabrication of strategic military and surveillance equipment. Customers in the Aerospace and Defense sector require DTMs for manufacturing specialized infrared optics, guidance system components, and hardened mirrors designed to withstand extreme environments. These contracts often involve highly customized DTMs with enhanced environmental controls and security features. Procurement decisions in this sector are driven less by initial cost and more by certified accuracy, reliability under extreme conditions, and adherence to specific national security and quality assurance protocols, often necessitating bespoke machine configurations.

Furthermore, medical device manufacturers and research institutions represent a high-potential growth segment. The healthcare industry utilizes DTMs for producing highly accurate molds for contact and intraocular lenses (IOLs), microfluidic channels, and components for diagnostic imaging equipment. Research laboratories and universities, particularly those focused on materials science and photonics, purchase DTMs not only for component production but also for developing new ultra-precision machining techniques and exploring novel material properties. These buyers often seek flexible, research-grade machines that offer extensive parameter control and data logging capabilities, enabling experimental work and rapid prototyping of next-generation devices.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 250 Million |

| Market Forecast in 2033 | USD 390 Million |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Precitech, Moore Nanotechnology Systems (Nanotech), AMETEK, Schneider Optical Machines, Kugler GmbH, LT Ultra-Precision Technology, Toshiba Machine (now Shibaura Machine), Aerotech Inc., Fives Group, ZEISS Group (through specialized divisions), Synova SA, RMC (Research Manufacturing Corporation), Son-X GmbH, Optimus Micro, KERN Microtechnik GmbH, J. G. Weisser Söhne GmbH & Co. KG, Okuma Corporation (specialized ultra-precision offerings), Microlution Inc., Fanuc Corporation (high-end controls integration), Nippon Thompson Co., Ltd. (IKO). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Diamond Turning Machines Market Key Technology Landscape

The technological landscape of the Diamond Turning Machines market is defined by continuous advancements aimed at mitigating environmental factors and achieving deterministic motion control at the nanometer scale. Central to this landscape are ultra-precision bearing technologies, primarily air bearings and hydrostatic bearings. Air bearings are favored for their low friction and smooth motion, crucial for generating mirror-like surface finishes. Conversely, hydrostatic bearings, which use a pressurized fluid film, offer significantly higher stiffness and damping capacity, making them ideal for heavy-duty cuts, multi-axis movements, and handling larger workpieces with sustained accuracy. The trend is moving towards combining the benefits of both, often utilizing air bearings for the primary spindle and hydrostatic bearings for translational axes demanding greater load capacity and resistance to dynamic forces.

The control systems and metrology integration represent another critical technological domain. Modern DTMs utilize sophisticated Computer Numerical Control (CNC) systems capable of handling extremely high data throughput to execute complex tool paths required for freeform optics. These systems are invariably paired with high-resolution, non-contact metrology tools, such as laser interferometers and capacitance gauges, which measure position feedback and environmental factors in real-time. The integration of in-situ metrology—where components are measured directly on the machine without removal—is vital for minimizing thermal deformation errors and maximizing closed-loop accuracy, a foundational element of Answer Engine Optimization (AEO) requirements for precision manufacturing users seeking error mitigation solutions.

Furthermore, thermal management and vibration isolation are indispensable technological aspects. Since thermal expansion of even a few degrees can render nanometer precision impossible, DTMs are housed in highly controlled environments and employ extensive fluid cooling systems to stabilize the temperature of critical machine components. Active vibration isolation systems, utilizing pneumatic or electromagnetic actuators, isolate the machine structure from external disturbances, ensuring the integrity of the machining process. Emerging technologies also include novel tool servo mechanisms, such as fast tool servo (FTS) and slow tool servo (STS), which allow the diamond tool to oscillate or move rapidly perpendicular to the feed direction, enabling the generation of complex, micro-structured surfaces and diffractive optical elements crucial for advanced photonics research and commercialization.

Regional Highlights

Regional dynamics within the Diamond Turning Machines market demonstrate clear distinctions based on application maturity and manufacturing scale. Asia Pacific (APAC) leads the global market in terms of volume and consumption growth. This dominance is primarily fueled by the region's massive manufacturing base for consumer electronics, including smartphones, cameras, and display technologies, which require billions of precision optical components annually. Key countries like China, Japan, and South Korea are heavily investing in localized high-precision manufacturing capabilities to reduce reliance on Western technology, establishing dedicated technology parks and offering substantial subsidies. This region is a major consumer of both standardized 2-axis DTMs for high volume molding and advanced multi-axis systems for complex AR/VR optics production.

North America and Europe represent mature, high-value markets characterized by demand for ultra-high-end, customized DTMs primarily driven by the aerospace, defense, and specialized medical device sectors. In North America, the focus is heavily on strategic defense projects and the expansion of private space ventures requiring large, precision-machined optics and mirrors. European market growth is supported by robust academic research infrastructure and high-quality industrial automation sectors, particularly in Germany and Switzerland, which prioritize innovation in hybrid machining and advanced metrology integration. Although the unit volume in these regions is lower than APAC, the average transaction value per machine is significantly higher due to the bespoke nature and complexity of the installed systems.

The Middle East and Africa (MEA) and Latin America (LATAM) currently hold smaller market shares but are exhibiting promising growth potential, particularly in the healthcare and regional defense sectors. LATAM’s market development is linked to the establishment of specialized medical device manufacturing hubs, especially in Brazil and Mexico, creating niche demand for DTMs used in optical component molds. MEA growth is driven by increasing investment in high-tech infrastructure and defense modernization programs, prompting interest in localized production of specialized optical sensors and guidance system components. However, growth in these regions is often constrained by the high cost of DTM installation and the limited availability of highly skilled local technical expertise necessary for maintenance and operation.

- Asia Pacific (APAC): Dominant region driven by consumer electronics and volume manufacturing; significant investment in Chinese and Korean optical fabrication centers.

- North America: High-value market focused on defense, aerospace, and cutting-edge research; strong demand for multi-axis freeform machining capabilities.

- Europe: Mature market concentrating on ultra-precision applications, medical technology, and sophisticated machine tools; strong presence of key DTM OEMs.

- Latin America (LATAM): Emerging market driven by expansion of specialized medical and optical manufacturing services.

- Middle East and Africa (MEA): Growth potential linked to defense expenditure and initial infrastructure investment in advanced technology parks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Diamond Turning Machines Market.- Precitech

- Moore Nanotechnology Systems (Nanotech)

- AMETEK

- Schneider Optical Machines

- Kugler GmbH

- LT Ultra-Precision Technology

- Toshiba Machine (now Shibaura Machine)

- Aerotech Inc.

- Fives Group

- ZEISS Group (through specialized divisions)

- Synova SA

- RMC (Research Manufacturing Corporation)

- Son-X GmbH

- Optimus Micro

- KERN Microtechnik GmbH

- J. G. Weisser Söhne GmbH & Co. KG

- Okuma Corporation (specialized ultra-precision offerings)

- Microlution Inc.

- Fanuc Corporation (high-end controls integration)

- Nippon Thompson Co., Ltd. (IKO)

Frequently Asked Questions

Analyze common user questions about the Diamond Turning Machines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using Diamond Turning Machines over conventional ultra-precision machining methods?

DTMs provide deterministic material removal resulting in superior surface finishes (sub-10 nm Ra) and exceptional form accuracy (sub-micrometer PV). They are optimal for machining complex freeform optics, non-ferrous materials, and molds, significantly reducing or eliminating the need for post-processing steps like polishing and lapping.

Which industry segments generate the highest demand for advanced 5-axis Diamond Turning Machines?

The highest demand stems from the Freeform Optics segment, particularly manufacturers producing advanced components for Augmented Reality (AR) and Virtual Reality (VR) headsets, high-end defense sensors, and complex medical optics, where non-rotationally symmetric surfaces are critical for performance.

What is the typical lifespan and maintenance requirement for the diamond cutting tool?

The lifespan of a diamond tool is highly variable, depending on the material being cut and the process parameters; it can range from hours to hundreds of hours. Maintenance primarily involves careful handling, specialized cleaning, and re-tipping/re-polishing by experts when edge quality degrades, necessitating precise tool management protocols.

How does the choice between Air Bearings and Hydrostatic Bearings impact DTM performance?

Air bearings (Aerostatic) offer the lowest friction, achieving the best surface finish on light cuts and high speeds. Hydrostatic bearings provide significantly greater stiffness and damping, which is crucial for maximizing material removal rates, handling heavier workpieces, and maintaining accuracy during high-acceleration 5-axis movements.

Is the Diamond Turning Machines market currently affected by supply chain disruptions, especially concerning critical components?

While the market is specialized, it is vulnerable to disruptions in the supply of ultra-precision components, notably laser interferometers and specialized high-purity single-crystal diamond blanks. Due to the high-value nature, OEMs often maintain strategic component stockpiles, but lead times for complete systems can still be extended during global economic instability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager