Diaphragm Coupling Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432780 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Diaphragm Coupling Market Size

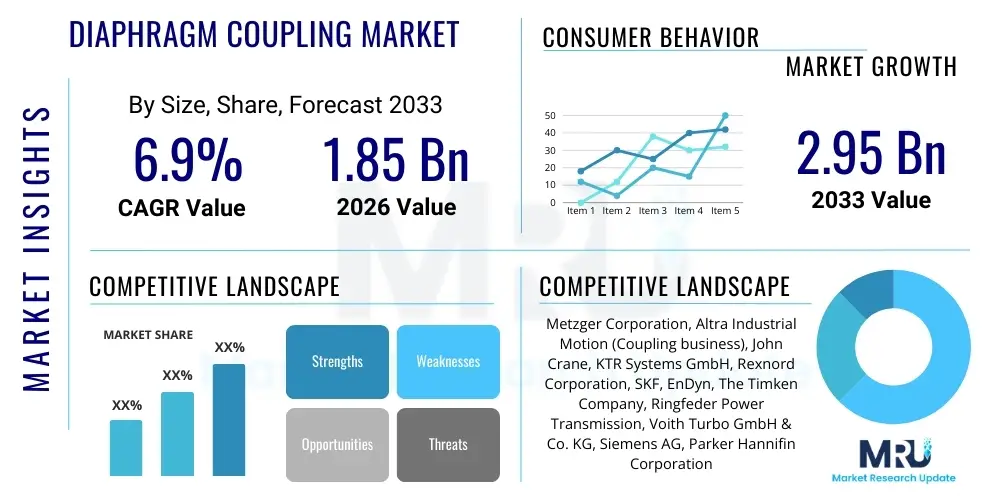

The Diaphragm Coupling Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.9% between 2026 and 2033. The market is estimated at $1.85 Billion in 2026 and is projected to reach $2.95 Billion by the end of the forecast period in 2033. This consistent growth trajectory is fundamentally underpinned by the escalating demand for high-performance, non-lubricated power transmission solutions across critical heavy industries, including power generation, oil and gas, and high-speed industrial turbomachinery. The inherent advantages of diaphragm couplings—such as zero backlash, minimal maintenance requirements, and capability to handle high rotational speeds—make them the preferred choice over traditional coupling types in precision-demanding applications, ensuring sustained market expansion throughout the forecast horizon.

Diaphragm Coupling Market introduction

The Diaphragm Coupling Market encompasses the production, distribution, and utilization of flexible metallic power transmission components designed to connect two rotating shafts, accommodating inherent misalignments while transmitting torque efficiently. These couplings are characterized by one or more diaphragms—thin, flexible metallic discs—that flex to absorb misalignment, eliminating the need for lubrication, a major advantage over gear or grid couplings. Primarily fabricated from high-strength stainless steel or specialty alloys like Inconel, these couplings are engineered for severe operating environments, including high temperatures, corrosive atmospheres, and high-speed applications typical in modern industrial plants. The foundational technology ensures precise torque delivery with zero backlash, critical for sensitive machinery operations.

Major applications for diaphragm couplings are concentrated in industries where equipment reliability and uptime are paramount. These include driving massive industrial compressors and pumps used in chemical processing and pipeline transportation, as well as connecting steam and gas turbines to electrical generators in the power generation sector. Their application is extending into specialized fields such as aerospace test stands and marine propulsion systems due to their robust design and inherent stability under dynamic loads. The critical benefit driving adoption lies in their low maintenance profile; the absence of sliding or wearing parts means fewer scheduled shutdowns for lubrication or component replacement, significantly lowering the total cost of ownership (TCO) compared to alternative coupling technologies.

Driving factors fueling this market include the global expansion of liquefied natural gas (LNG) infrastructure, which requires high-speed, high-power turbomachinery, and the continuous modernization of aging industrial plants focused on energy efficiency and operational safety. Furthermore, stringent safety regulations, particularly in the oil and gas industry, favor non-sparking, non-lubricated components. Technological advancements in metallurgy, allowing for the creation of diaphragms with enhanced flexibility and fatigue resistance, further solidify the position of diaphragm couplings as the optimal solution for high-performance, critical torque transmission applications globally.

Diaphragm Coupling Market Executive Summary

The Diaphragm Coupling Market is experiencing robust growth driven by accelerating industrialization in Asia Pacific and the renewed focus on energy infrastructure upgrades across North America and Europe. Business trends indicate a strong shift towards standardized, modular coupling designs that facilitate easier installation and replacement, coupled with an increasing demand for predictive maintenance compatibility through integrated sensor technologies. The market remains competitive, with key players focusing on proprietary material science and design patents to achieve higher torque density and increased fatigue life, essential for next-generation turbomachinery. Geographically, Asia Pacific, particularly China and India, is emerging as the dominant region, propelled by massive investments in chemical and petrochemical production capacities and renewable energy infrastructure that requires reliable high-speed shaft connections.

Segment trends highlight the sustained dominance of double diaphragm designs, favored for their capacity to accommodate larger parallel misalignment while maintaining balance integrity at high speeds, critical in large-scale power generation equipment. However, the single diaphragm segment is gaining traction in specialized, compact industrial equipment where space constraints are severe and misalignment is predominantly angular. From an application perspective, the Oil & Gas sector remains the largest consumer, primarily due to the stringent requirements associated with LNG compressors and crude oil pumps. This sector's continuous capital expenditure on expansion projects, particularly in deep-sea drilling and transportation networks, provides a consistent demand floor for high-specification diaphragm couplings.

Overall, the market is characterized by a high degree of technical sophistication, necessitating specialized manufacturing processes and quality control standards. The primary strategic focus for manufacturers is reducing the lead time for custom-engineered solutions and enhancing product durability to extend service intervals, aligning with the industry's pervasive movement towards maximizing operational uptime. The market is consolidating around manufacturers capable of providing comprehensive technical support and global field services, cementing the transition from component supplier to solution partner, especially for massive, critical rotating equipment installations.

AI Impact Analysis on Diaphragm Coupling Market

Common user questions regarding AI's impact typically center on how artificial intelligence can enhance predictive maintenance protocols, optimize coupling design for specific operational stresses, and streamline manufacturing efficiency. Users are particularly concerned with whether AI integration will lead to a reduction in unexpected coupling failures, thereby maximizing asset uptime, and how sensor data processed by AI algorithms can inform real-time adjustments to operating parameters. The key theme is the shift from scheduled maintenance to condition-based monitoring, where AI analyzes vibration, temperature, and torsional load data patterns generated by proximity sensors embedded near the coupling assembly. Expectations are high that AI will revolutionize coupling lifecycle management, reducing human error in diagnostic processes and prolonging component life through optimized operational regimes that avoid resonance and peak stress conditions. This integration of smart technology with mechanical components signifies a major digitalization trend within the heavy engineering sector.

- AI-driven Predictive Failure Analysis: Utilizing machine learning algorithms to analyze historical performance data and real-time sensor feedback (vibration, temperature) to predict potential diaphragm fatigue or bolt failure weeks in advance, drastically reducing catastrophic failures.

- Optimized Manufacturing Processes: Implementing AI for quality control in diaphragm stamping and assembly, ensuring tighter tolerances and higher consistency in metallic stress characteristics, thereby improving overall fatigue life.

- Digital Twin Modeling: Creation of precise digital representations of the coupling operating within the machinery system, allowing AI to simulate various load scenarios and environmental changes to optimize design parameters before physical prototyping.

- Automated Misalignment Correction Guidance: Providing real-time, data-driven recommendations to field technicians for precise shaft alignment adjustments based on AI analysis of operational vibration signatures, leading to reduced installation-related stress.

- Supply Chain Efficiency: AI modeling optimizing inventory levels for specialized coupling components and predicting regional demand shifts based on global capital expenditure trends in oil & gas and power generation sectors.

- Enhanced Material Selection: Utilizing AI to simulate the performance of novel metallic alloys under extreme torsional and axial stress, accelerating the development of couplings with superior fatigue resistance.

DRO & Impact Forces Of Diaphragm Coupling Market

The dynamics of the Diaphragm Coupling Market are shaped by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and Impact Forces, primarily manifesting as increasing industrial automation and stringent environmental regulations. The core driver is the essential requirement for high-reliability, non-lubricated couplings in critical rotating equipment across industries like power generation and petrochemicals, where equipment failure is prohibitively expensive. However, this market faces restraints such as the relatively high initial cost of engineered metallic couplings compared to elastomeric or gear couplings, and the highly technical expertise required for precise installation and balancing. Opportunities are vast, driven by the emergence of smart manufacturing (Industry 4.0), integrating sensors and IoT capabilities for advanced condition monitoring, and the surging global investment in new energy infrastructure, including hydrogen compression and high-efficiency turbines. The overall impact force emphasizes safety and longevity, pushing manufacturers toward advanced materials science and zero-maintenance designs.

The primary impact forces acting upon the market involve technical standardization and the cyclical nature of capital expenditure in heavy industries. As critical turbomachinery installations demand longer operational periods between maintenance cycles, the pressure on coupling manufacturers to guarantee extended fatigue life intensifies. This has led to widespread adoption of finite element analysis (FEA) and specialized stress testing, making R&D a critical competitive differentiator. Furthermore, the global trend towards energy transition, specifically the build-out of centralized hydrogen and carbon capture infrastructure, presents a burgeoning opportunity for couplings capable of handling novel process fluids and extremely high pressures and speeds associated with these new industrial processes. Manufacturers who can quickly adapt their product lines to meet these emerging technical specifications are poised for significant market share gains.

Market growth is also influenced by macroeconomic factors, including global commodity prices which dictate investment levels in the oil and gas sector, a primary end-user. Restraints, notably the complex manufacturing processes required for precision diaphragms—which involve specialized laser cutting, electron beam welding, and rigorous balancing—contribute to longer lead times and higher production costs, potentially deterring adoption in cost-sensitive, general industrial applications. Successfully navigating this market requires manufacturers to strategically manage supply chain complexities for specialized alloys while simultaneously educating end-users on the total lifecycle cost benefits (reduced downtime and maintenance) that justify the higher initial investment in diaphragm coupling technology.

Segmentation Analysis

The Diaphragm Coupling Market is extensively segmented based on design complexity, material composition, application requirements, and the specific end-use industry utilizing the component. This segmentation reflects the highly engineered nature of the product, which requires customization to meet precise operational parameters such as torque capacity, maximum speed, misalignment tolerance, and environmental resistance. Analyzing these segments provides crucial insight into the shifting demand landscape, indicating a trend toward higher specification, corrosion-resistant couplings utilized in extreme environments like offshore drilling and nuclear power generation. The market structure emphasizes specialized product lines catering distinctly to high-speed turbomachinery versus medium-speed industrial pump applications, reflecting varied pricing strategies and technological complexity across segments.

- By Design Type:

- Single Diaphragm Coupling

- Double Diaphragm Coupling

- By Material:

- Stainless Steel Diaphragms (Standard and High-Strength)

- Alloy Steel Diaphragms (e.g., Maraging Steel)

- Specialty Alloy Diaphragms (e.g., Inconel, Hastelloy)

- Composite Diaphragms (Emerging)

- By Torque Capacity:

- Low Torque Capacity (Below 500 Nm)

- Medium Torque Capacity (500 Nm to 50,000 Nm)

- High Torque Capacity (Above 50,000 Nm)

- By Application Speed:

- High-Speed (>5,000 RPM)

- Medium-Speed (1,000 to 5,000 RPM)

- Low-Speed (<1,000 RPM)

- By End-Use Industry:

- Oil & Gas (Upstream, Midstream, Downstream)

- Power Generation (Thermal, Nuclear, Renewables)

- Chemical and Petrochemical Processing

- Water and Wastewater Treatment

- Aerospace and Marine

- General Industrial Manufacturing (Pumps, Fans, Blowers)

Value Chain Analysis For Diaphragm Coupling Market

The value chain for the Diaphragm Coupling Market begins with the upstream procurement of specialized raw materials, primarily high-strength, fatigue-resistant metallic alloys such as high-grade stainless steels (e.g., 17-4 PH) and exotic nickel alloys like Inconel X-750. This upstream segment is highly critical, as the material quality directly dictates the coupling's performance life and maximum operating envelope. Key suppliers often include specialized metal producers and foundries capable of providing certified aerospace and industrial grade materials. Manufacturing then involves precision processes including CNC machining of hubs, highly specialized laser or waterjet cutting of the diaphragms, and precise electron beam or laser welding to assemble the diaphragm packs. Quality assurance, including dynamic balancing and non-destructive testing (NDT), forms a crucial step before distribution.

The distribution channel is predominantly bifurcated into direct sales for large, custom-engineered turbomachinery couplings and indirect sales through specialized industrial distributors or Original Equipment Manufacturer (OEM) service agreements for standardized, replacement units. Direct channels are typical for high-value contracts with major EPC (Engineering, Procurement, and Construction) firms and large end-users (e.g., national oil companies, major utilities), necessitating extensive technical support and integration expertise. Indirect channels, leveraging regional distributors, provide prompt access to standardized product lines for Maintenance, Repair, and Overhaul (MRO) activities. Effective technical sales engineering support is crucial across both channels due to the technical complexity of proper coupling selection and installation.

Downstream analysis focuses on the installation and long-term service agreements offered to end-users in critical infrastructure sectors. The majority of the coupling lifecycle cost is tied up in the cost of potential downtime, rather than the purchase price, making aftermarket services (field balancing, alignment support, and component replacement stocking) highly profitable and strategically important. Manufacturers are increasingly integrating services like remote condition monitoring and digital diagnostics into their offerings, creating sticky relationships with operators. The efficiency and reliability of the coupling ultimately feeds into the operational profitability of the downstream consumer, whether they are generating power, transporting oil, or producing chemicals, thereby completing the cycle of value creation and reinforcement within the market ecosystem.

Diaphragm Coupling Market Potential Customers

Potential customers for diaphragm couplings are large-scale industrial entities and equipment manufacturers whose operational success hinges on reliable, high-speed power transmission. The primary end-users/buyers are typically categorized by the equipment they operate or manufacture, falling heavily into capital-intensive sectors. These customers prioritize long mean time between failures (MTBF), adherence to rigorous API (American Petroleum Institute) standards, and low operational expenditure related to maintenance. Procurement decisions are often centralized and highly technical, involving multidisciplinary teams including mechanical engineers, procurement specialists, and operations managers, emphasizing factors beyond mere cost, focusing instead on total lifecycle value and guaranteed performance metrics.

Key buying centers are concentrated in EPC contractors responsible for designing and building large plants (e.g., LNG trains, petrochemical complexes) and major OEMs of rotating equipment such as Siemens Energy, GE Turbomachinery, and Mitsubishi Heavy Industries. These customers integrate couplings into their high-value products like gas turbines, centrifugal compressors, and boiler feed pumps. Another significant customer base includes asset owners, such as ExxonMobil, Chevron, Saudi Aramco, and major regional power grid operators, who purchase diaphragm couplings either for new capital projects or as critical replacement components during major equipment overhauls (MRO).

The purchasing cycle is often long, especially for custom, high-torque couplings, involving detailed technical specifications review, engineering consultation, and rigorous compliance checks against standards such as API 671 (Special Purpose Couplings for Refinery Services). The decision-makers within these organizations are deeply sensitive to product lineage, requiring proven track records and comprehensive certifications. Consequently, market penetration strategies must focus on establishing long-term supplier partnerships based on demonstrable reliability and superior technical support, rather than aggressive short-term pricing tactics, appealing directly to the risk-averse nature of critical infrastructure operations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.85 Billion |

| Market Forecast in 2033 | $2.95 Billion |

| Growth Rate | 6.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Metzger Corporation, Altra Industrial Motion (Coupling business), John Crane, KTR Systems GmbH, Rexnord Corporation, SKF, EnDyn, The Timken Company, Ringfeder Power Transmission, Voith Turbo GmbH & Co. KG, Siemens AG, Parker Hannifin Corporation, Sumitomo Heavy Industries, Inc., TB Wood's, Inc., Regal Beloit Corporation, Wuxi Trina International Trade Co., Ltd., ZHY Couplings, Cross Manufacturing Co., Inc., Nabeya Bi-tech Kaisha (NBK), R+W Coupling Technology |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Diaphragm Coupling Market Key Technology Landscape

The technological landscape of the Diaphragm Coupling Market is defined by a continuous push toward higher power density, enhanced flexibility, and superior fatigue resistance, primarily achieved through advancements in materials science and precision engineering. A core technological focus involves the selection and treatment of metallic alloys. High-performance couplings increasingly utilize exotic materials like proprietary Maraging steels or high-nickel alloys (Inconel), which offer exceptional tensile strength and resistance to corrosive media, crucial for operation in refinery and chemical processing environments. Furthermore, advanced surface treatments, such as specialized coatings or cryogenic processing, are being employed to minimize stress concentration points and improve the material's structural homogeneity, effectively extending the lifespan of the flexible diaphragm elements far beyond traditional specifications.

Modern coupling technology heavily relies on sophisticated analytical tools for design validation. Finite Element Analysis (FEA) and Computational Fluid Dynamics (CFD) are indispensable for simulating complex operational stresses, thermal expansion effects, and dynamic balancing requirements under anticipated service conditions. These digital tools allow manufacturers to optimize the diaphragm profile—including the crucial factor of thickness tapering and bolt pattern configuration—to achieve the required flexibility and torsional rigidity simultaneously, minimizing lateral reaction forces on connected equipment bearings. This computational approach ensures that custom-engineered couplings meet stringent industry standards, such as API 671, with a high degree of certainty before physical prototyping begins, significantly accelerating product development cycles and reducing inherent risks associated with high-speed machinery.

The integration of Industry 4.0 principles is rapidly transforming the coupling market, moving these traditionally passive components into the realm of smart machinery. Key technological developments include the embedding of non-contact sensors (e.g., proximity probes, strain gauges) directly into or near the coupling assembly. These sensors provide continuous, high-fidelity data on axial movement, torsional vibration, and temperature profiles, which is then processed by external monitoring systems. The ability to monitor coupling health in real-time allows for sophisticated condition-based maintenance, proactively identifying minor imbalances or early signs of material fatigue. This smart technology integration transforms the coupling from a mere mechanical connector into a vital data source for overall asset performance management, representing the cutting edge of coupling innovation and driving significant competitive advantage for technologically advanced firms.

Regional Highlights

The global demand for diaphragm couplings shows distinct geographical concentrations, highly correlated with industrial output, energy infrastructure development, and maintenance spending across various regions. North America and Europe have historically been mature markets, characterized by high adoption rates in replacement and upgrade cycles within established power generation (thermal and nuclear) and chemical processing sectors. These regions prioritize couplings meeting stringent safety and environmental standards, driving demand for premium, highly durable, and API-compliant products. The focus here is increasingly shifting towards integrating predictive maintenance features and upgrading aging infrastructure with state-of-the-art, high-efficiency coupling technology.

Conversely, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, fueled by unprecedented investments in new capital projects. Countries like China, India, and Southeast Asian nations are rapidly expanding their industrial bases, including massive greenfield projects in petrochemical refining, LNG import terminals, and centralized power plants. This expansion creates a massive initial demand for large, custom-engineered couplings for new rotating equipment. While price sensitivity can be higher in certain APAC sub-markets, the sheer volume of new installations ensures the region's dominance in terms of incremental market value. Furthermore, the burgeoning aerospace and defense manufacturing industries in APAC also contribute to the specialized demand for lighter, higher-speed couplings.

The Middle East and Africa (MEA) region remains a critical market, dominated by the massive capital expenditure cycles of national oil companies and international energy firms focused on upstream extraction and midstream pipeline infrastructure. Given the extreme operating temperatures and highly corrosive environments typical of this region, there is an intense demand for couplings made from specialty alloys like Inconel, offering superior resistance to H2S and high-temperature oxidation. Demand is cyclical, directly tied to oil and gas price stability, but consistently requires high-specification, heavy-duty diaphragm couplings for critical services, ensuring a stable, albeit volatile, revenue stream for market participants focused on high-torque solutions.

- North America: Strong market for API-compliant, replacement couplings; driven by upgrades in refinery and natural gas infrastructure; emphasis on condition monitoring integration.

- Europe: High adoption of standardized and specialized couplings in advanced manufacturing and regulated energy sectors; focused on energy efficiency standards and maintenance reduction.

- Asia Pacific (APAC): Leading growth region driven by large-scale greenfield projects in petrochemicals and power; significant demand volume and increasing focus on localization of manufacturing.

- Middle East & Africa (MEA): High demand for extreme-duty, specialty alloy couplings in oil and gas extraction and transportation; market size dictated by commodity prices and critical infrastructure investment.

- Latin America: Moderate growth fueled by oil exploration (Brazil, Mexico) and mining equipment expansion; often reliant on imports of specialized high-performance couplings.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Diaphragm Coupling Market.- Metzger Corporation

- Altra Industrial Motion (Coupling business)

- John Crane

- KTR Systems GmbH

- Rexnord Corporation

- SKF

- EnDyn

- The Timken Company

- Ringfeder Power Transmission

- Voith Turbo GmbH & Co. KG

- Siemens AG

- Parker Hannifin Corporation

- Sumitomo Heavy Industries, Inc.

- TB Wood's, Inc.

- Regal Beloit Corporation

- Wuxi Trina International Trade Co., Ltd.

- ZHY Couplings

- Cross Manufacturing Co., Inc.

- Nabeya Bi-tech Kaisha (NBK)

- R+W Coupling Technology

Frequently Asked Questions

Analyze common user questions about the Diaphragm Coupling market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of diaphragm couplings over gear couplings?

Diaphragm couplings are non-lubricated, offering zero backlash and requiring minimal maintenance, which significantly reduces operational costs and potential for contamination, particularly critical in high-speed and high-temperature environments. They also exhibit high torsional stiffness for precise torque transmission.

Which industries are the largest consumers of high-performance diaphragm couplings?

The largest consumers are the Oil and Gas industry (especially LNG and pipeline compression) and the Power Generation sector (connecting gas and steam turbines to generators), due to their stringent requirements for high-speed, high-torque, and high-reliability components compliant with standards like API 671.

How is Industry 4.0 influencing the design and maintenance of diaphragm couplings?

Industry 4.0 drives the integration of smart sensors into coupling systems for continuous condition monitoring. This enables AI-powered predictive maintenance, optimizing operational parameters, preventing unscheduled downtime, and extending the coupling's effective service life.

What material advancements are critical for the Diaphragm Coupling Market growth?

Critical advancements involve the use of specialty alloys such as Inconel and high-strength Maraging steels. These materials offer enhanced fatigue resistance, higher yield strength, and superior corrosion resistance, allowing couplings to operate reliably in highly corrosive and high-pressure/temperature applications.

What is the expected CAGR for the Diaphragm Coupling Market between 2026 and 2033?

The Diaphragm Coupling Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.9% during the forecast period, driven by global infrastructure development and increasing demand for specialized, non-lubricated power transmission solutions in heavy industries worldwide.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager