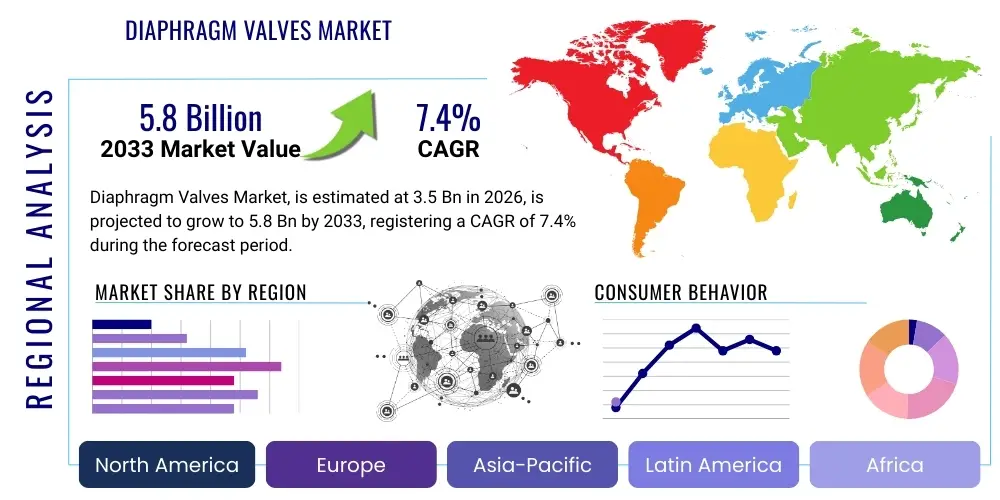

Diaphragm Valves Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440375 | Date : Jan, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Diaphragm Valves Market Size

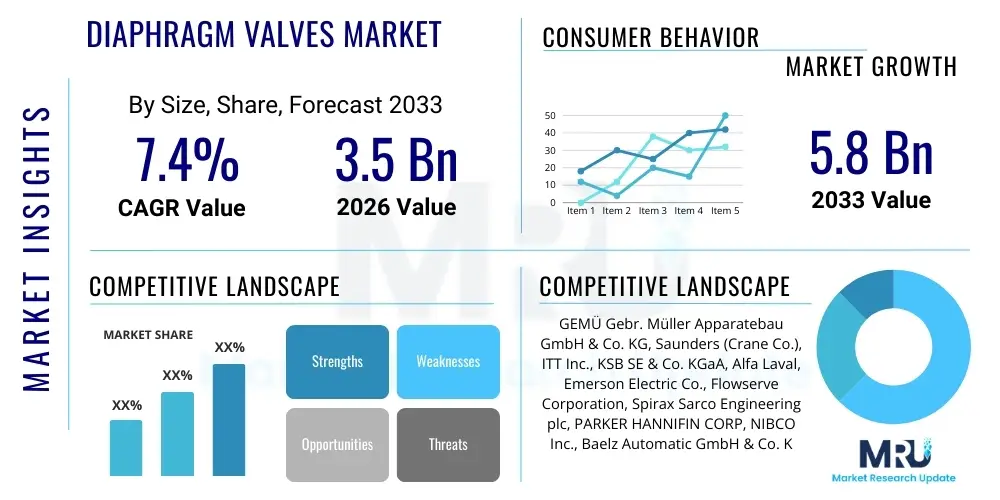

The Diaphragm Valves Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.4% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.8 Billion by the end of the forecast period in 2033.

Diaphragm Valves Market introduction

Diaphragm valves represent a critical class of quarter-turn valves extensively utilized across various industrial sectors for regulating and controlling fluid flow. Their fundamental design incorporates a flexible diaphragm, typically made from elastomeric materials, plastics, or specialty alloys, which is pressed against a weir or a seat by a compressor to provide a hermetic seal. This unique operational mechanism isolates the valve's bonnet assembly and internal components from the process fluid, making them exceptionally suitable for handling corrosive, abrasive, viscous, or slurry media, as well as maintaining hygienic conditions in sensitive applications. The hermetic seal provided by the diaphragm eliminates potential leak paths, prevents contamination of the fluid, and protects the operating mechanism from the fluid's properties, thereby extending valve life and enhancing operational safety. These valves are highly valued for their ability to offer precise flow control, tight shut-off capabilities, and minimal pressure drop when fully open, contributing to energy efficiency and process optimization in numerous industrial settings. Their robust construction and adaptable material configurations allow them to perform reliably in environments demanding high purity, chemical resistance, and ease of maintenance, solidifying their indispensable role in modern fluid handling systems. The market's consistent growth is primarily propelled by their inherent benefits in critical applications, coupled with ongoing advancements in material science and manufacturing processes that expand their functional envelope.

Diaphragm Valves Market Executive Summary

The Diaphragm Valves Market is characterized by dynamic business trends driven by increasing industrial automation, stringent regulatory compliance, and a heightened focus on process efficiency and purity across various sectors. Mergers and acquisitions continue to reshape the competitive landscape, as larger players seek to consolidate market share, expand product portfolios, and acquire specialized technologies, leading to both intensified competition and strategic collaborations. Furthermore, a discernible trend towards digitalization and the integration of smart technologies, such as sensors and IoT-enabled monitoring systems, is transforming the operational capabilities of diaphragm valves, enabling predictive maintenance and real-time performance optimization. Supply chain resilience has also emerged as a critical consideration, with manufacturers diversifying sourcing and optimizing logistics to mitigate global disruptions and ensure consistent material availability for production. The market's regional trends indicate robust growth in Asia Pacific, propelled by rapid industrialization, burgeoning pharmaceutical manufacturing, and significant investments in water and wastewater infrastructure across countries like China, India, and Southeast Asian nations. North America and Europe, while representing mature markets, demonstrate steady demand driven by strict environmental regulations, pharmaceutical R&D, and the modernization of existing industrial facilities, emphasizing high-purity and safety-critical applications. Latin America, the Middle East, and Africa are experiencing emergent growth, fueled by investments in chemical processing, mining, and expanding municipal water treatment projects, albeit with varying paces and market penetration levels. Across segments, sanitary and aseptic diaphragm valves are witnessing accelerated demand due to the rigorous standards in the pharmaceutical, biotechnology, and food & beverage industries, necessitating materials and designs that prevent bacterial growth and cross-contamination. Manually operated valves retain a significant share for cost-effectiveness in less critical applications, while actuated valves, particularly pneumatically and electrically operated types, are gaining traction due to their compatibility with automated control systems, offering enhanced precision and remote operational capabilities. The ongoing evolution in material science is also enabling the development of valves suitable for increasingly aggressive media and extreme operating conditions, broadening the market's application spectrum and contributing significantly to its sustained expansion.

AI Impact Analysis on Diaphragm Valves Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Diaphragm Valves Market frequently center on how AI can enhance operational efficiency, predictive maintenance, and product innovation within the manufacturing and application domains of these critical components. Common concerns revolve around the potential for AI to optimize valve performance, extend lifespan, and reduce downtime through intelligent monitoring and diagnostics. Users are keen to understand how AI might integrate with existing industrial control systems to create "smart valves" that can autonomously respond to process variations or identify impending failures, thereby transitioning from reactive to proactive maintenance strategies. Furthermore, questions often arise about AI's role in streamlining supply chains for diaphragm valve components, improving quality control during manufacturing, and accelerating the design process for new, more resilient, and application-specific valve configurations. The overarching expectation is that AI will introduce unprecedented levels of precision, reliability, and cost-effectiveness across the entire lifecycle of diaphragm valves, from their conceptualization and production to their deployment and end-of-life management in complex industrial environments.

- AI-driven predictive maintenance algorithms analyze sensor data from diaphragm valves to anticipate potential failures, significantly reducing unplanned downtime and optimizing maintenance schedules.

- Integration of AI in manufacturing processes enhances quality control by detecting microscopic defects and inconsistencies in materials or assembly, ensuring higher product reliability and consistency.

- AI algorithms assist in optimizing the design of new diaphragm valve geometries and material compositions, simulating performance under extreme conditions to accelerate R&D and improve valve efficiency.

- Supply chain management benefits from AI through demand forecasting, inventory optimization, and intelligent logistics, ensuring timely availability of components and finished valves, reducing lead times.

- Smart diaphragm valves equipped with AI-powered diagnostics can provide real-time operational insights, allowing for automated adjustments and proactive problem-solving without human intervention.

- AI-enabled vision systems can automate inspection processes for diaphragm valves, identifying anomalies with greater accuracy and speed than manual methods, particularly for high-volume production.

- Enhanced energy efficiency can be achieved by AI systems optimizing valve actuation and flow control parameters based on real-time process requirements, minimizing power consumption.

- AI supports the development of digital twins for diaphragm valves, enabling virtual testing and simulation of various operational scenarios, reducing the need for costly physical prototypes.

DRO & Impact Forces Of Diaphragm Valves Market

The Diaphragm Valves Market is propelled by a confluence of robust drivers, notably the increasing demand for stringent hygienic and aseptic processing conditions in the pharmaceutical, biotechnology, and food and beverage industries. These sectors necessitate valves that offer complete isolation of process fluids from the environment and the valve's operating mechanism, precisely what diaphragm valves provide, thereby minimizing contamination risks and complying with rigorous regulatory standards such as FDA and cGMP. Furthermore, the burgeoning expansion of chemical processing plants, water and wastewater treatment facilities, and mining operations globally fuels demand for diaphragm valves due to their exceptional corrosion and abrasion resistance, making them ideal for handling aggressive and slurry media. The continuous push towards industrial automation and the integration of smart manufacturing principles also acts as a significant driver, as modern facilities increasingly adopt actuated diaphragm valves that can be remotely controlled and integrated into sophisticated process control systems, enhancing operational efficiency and safety. These factors collectively underscore the critical role diaphragm valves play in maintaining product integrity, ensuring environmental protection, and optimizing operational workflows across diverse industrial landscapes.

Despite these significant drivers, the Diaphragm Valves Market faces several restraints that could impede its growth trajectory. The relatively higher initial cost of diaphragm valves, particularly those made from specialized materials or featuring advanced actuation systems, can be a barrier for some small to medium-sized enterprises (SMEs) or in projects with tight budgetary constraints, leading them to opt for less expensive alternative valve types. Additionally, the complexity associated with their maintenance and diaphragm replacement, which requires specialized skills and adherence to specific procedures to maintain sterility and sealing integrity, can be a deterrent for end-users seeking simpler, lower-maintenance solutions. The limitations regarding temperature and pressure ranges, especially for elastomeric diaphragms, restrict their applicability in extreme operating conditions where other valve types might be more suitable. Moreover, the inherent design of some diaphragm valves may lead to higher pressure drop in certain applications compared to full-bore ball valves, which can impact process efficiency. The strong competition from alternative valve technologies, such as ball valves, butterfly valves, and gate valves, each offering distinct advantages in specific applications, further presents a restraint, compelling diaphragm valve manufacturers to continuously innovate and demonstrate superior value proposition to maintain their competitive edge.

The market presents substantial opportunities for innovation and expansion, particularly through the development of advanced diaphragm materials that can withstand even harsher chemical environments, higher temperatures, and pressures, thereby broadening the application scope of these valves. Emerging markets in Asia Pacific, Latin America, and Africa offer significant untapped potential, driven by rapid industrialization, urbanization, and increasing investments in critical infrastructure projects, including water management, chemical processing, and healthcare facilities. The growing trend towards modular processing skids and compact system designs creates a demand for smaller, more integrated diaphragm valve solutions. Furthermore, the integration of sensors, IoT capabilities, and diagnostic tools into diaphragm valves represents a key opportunity for developing "smart valves" that offer predictive maintenance, real-time performance monitoring, and enhanced process control, aligning with Industry 4.0 initiatives. These technological advancements, combined with strategic regional market penetration, are poised to unlock new revenue streams and applications, ensuring sustained growth for the diaphragm valves market. Impact forces within the market are primarily shaped by the bargaining power of buyers, who demand high performance, reliability, and competitive pricing, alongside the bargaining power of suppliers, particularly those providing specialized elastomers and exotic alloys for diaphragms. The threat of new entrants, while mitigated by high capital investment and technical expertise requirements, necessitates continuous innovation from incumbents. The threat of substitutes from other valve types remains a constant force, pushing manufacturers to highlight the unique benefits of diaphragm valves. Finally, intense competitive rivalry among established players drives product differentiation, technological advancements, and strategic pricing, influencing market dynamics significantly.

Segmentation Analysis

The Diaphragm Valves Market is meticulously segmented based on various critical parameters, enabling a detailed understanding of its diverse applications, operational characteristics, and material considerations across different industrial landscapes. This multi-faceted segmentation allows market participants to identify specific niches, tailor product development strategies, and target precise end-user requirements, reflecting the specialized nature of fluid control systems. The primary segmentation criteria include the valve type, which distinguishes between the internal geometry and flow characteristics, the mode of operation, indicating how the valve is actuated, the material of construction, which dictates its chemical compatibility and pressure/temperature limits, and the end-use industry, representing the major sectors where these valves are predominantly deployed. Each segment exhibits unique growth drivers and market dynamics, contributing to the overall complexity and opportunity within the diaphragm valves ecosystem. Understanding these segments is crucial for strategic planning, market penetration, and competitive positioning within this specialized industrial component sector.

- By Type: This segmentation focuses on the internal design and flow path characteristics of the diaphragm valve, which dictate its suitability for various fluid types and applications.

- Weir Type: Characterized by a raised weir or saddle in the flow path, against which the diaphragm seals. This design is highly effective for throttling and on-off service, offering good shut-off capabilities and commonly used in general industrial and chemical applications.

- Straight-through Type: Features a full-bore, unobstructed flow path when fully open, making it ideal for viscous fluids, slurries, and applications requiring minimal pressure drop and easy pigging. The diaphragm seals against the bottom of the body.

- Full Bore Type: A variant of the straight-through type designed for maximum flow capacity and minimal turbulence, often used in critical hygienic applications where cleanliness and unimpeded flow are paramount.

- Sanitary/Aseptic Type: Specifically designed to meet stringent cleanliness and sterility requirements, featuring crevice-free interiors, polished surfaces, and materials compliant with pharmaceutical and food-grade standards, crucial for biopharmaceutical and food & beverage industries.

- By Operation: This segment categorizes valves based on the mechanism employed to actuate the diaphragm, influencing their suitability for manual control, remote operation, or automated processes.

- Manual: Operated via a handwheel, lever, or gear, requiring direct human intervention. Cost-effective for less frequent operations or where power sources are unavailable.

- Actuated: Operated by an external power source, enabling remote control and integration into automated systems.

- Pneumatic: Utilizes compressed air to move the diaphragm, offering fast response times and robust performance, widely used in automated process control.

- Electric: Employs an electric motor to actuate the diaphragm, providing precise control, often used where compressed air is unavailable or for intricate flow regulation.

- Hydraulic: Uses hydraulic fluid pressure for actuation, suitable for applications requiring very high force or precise positioning, though less common for standard diaphragm valves.

- By Material: This segmentation considers the materials used for the valve body and diaphragm, which are crucial for determining chemical compatibility, temperature/pressure ratings, and durability against abrasive media.

- Cast Iron: Economical and widely used for general industrial applications with non-corrosive fluids.

- Ductile Iron: Offers improved strength and ductility compared to cast iron, suitable for higher pressure applications.

- Stainless Steel: Provides excellent corrosion resistance and strength, essential for chemical, pharmaceutical, and food & beverage industries.

- Plastics (PVC, CPVC, PP, PVDF): Chosen for their superior chemical resistance to aggressive media at lower temperatures and pressures, common in water treatment and chemical processing.

- Exotic Alloys: Materials like Hastelloy, Monel, or Titanium are used for highly corrosive or high-temperature applications where standard materials fail to perform.

- Elastomers (EPDM, PTFE, Viton, Butyl): The most common diaphragm materials, selected based on fluid compatibility, temperature, and flexibility requirements, forming the primary seal.

- By End-Use Industry: This segment categorizes the market based on the primary sectors that utilize diaphragm valves, reflecting specific industry requirements and market demand drivers.

- Pharmaceuticals & Biotechnology: Demands high purity, aseptic conditions, and materials compliant with strict regulations for drug manufacturing, vaccine production, and sterile processing.

- Food & Beverage: Requires hygienic designs, non-toxic materials, and ease of cleaning to prevent contamination in food processing, dairy, and beverage production.

- Water & Wastewater Treatment: Utilizes diaphragm valves for handling various water qualities, from raw water to treated effluent, where corrosion and abrasion resistance are crucial.

- Chemicals: Needs valves capable of handling a wide range of corrosive and aggressive chemicals, requiring specialized body and diaphragm materials.

- Mining & Metals: Employs diaphragm valves for handling abrasive slurries and corrosive mining chemicals, demanding robust construction and wear resistance.

- Power Generation: Used in various auxiliary systems, including water treatment for boilers, flue gas desulfurization, and chemical injection systems, requiring durability and reliability.

- Semiconductor: Crucial for ultra-high purity fluid handling in microchip manufacturing, where even trace contamination can ruin products, demanding advanced sanitary designs.

- Others: Includes pulp & paper, textiles, general manufacturing, and specialized OEM applications, each with unique fluid handling requirements.

Value Chain Analysis For Diaphragm Valves Market

The value chain for the Diaphragm Valves Market is a complex and interconnected network encompassing multiple stages, from the sourcing of raw materials to the final distribution and after-sales support to end-users. At the upstream end, the chain begins with the extraction and processing of fundamental raw materials such as various metals (e.g., cast iron, ductile iron, stainless steel, exotic alloys), polymers (e.g., PVC, CPVC, PP, PVDF), and elastomers (e.g., EPDM, PTFE, Viton). These materials are supplied by a diverse group of specialized manufacturers to component producers who then fabricate critical valve parts like bodies, bonnets, diaphragms, and actuators. The quality and availability of these raw materials and components are paramount, as they directly impact the performance, durability, and cost-effectiveness of the final diaphragm valve. Strong relationships with reliable upstream suppliers are crucial for ensuring a consistent supply of high-grade materials that meet stringent industry standards and specifications, especially for applications demanding chemical resistance, high purity, or specific temperature and pressure ratings, thereby forming the foundational layer of the value chain's integrity.

Moving further down the value chain, the manufacturing stage involves the assembly of these components, precision machining, finishing, and rigorous testing to produce a complete diaphragm valve. This stage also includes specialized processes such as lining the valve body with corrosion-resistant materials or molding complex diaphragm shapes from advanced elastomers. Once manufactured, these valves enter the distribution phase, which is critical for reaching a diverse global customer base. The distribution channels can be broadly categorized into direct and indirect methods. Direct sales involve manufacturers selling directly to large industrial clients, original equipment manufacturers (OEMs), or large-scale project contractors, often for bespoke solutions or bulk orders, allowing for closer customer relationships and direct feedback. This approach offers greater control over pricing and customer service, fostering long-term strategic partnerships with key accounts, especially in highly specialized or high-purity applications where technical expertise and direct support are highly valued by end-users seeking custom configurations and specific compliance guarantees.

Conversely, indirect distribution channels are highly prevalent and involve a network of independent distributors, wholesalers, and specialized industrial suppliers who stock and resell diaphragm valves to a broader range of end-users, including smaller businesses and those requiring off-the-shelf solutions. These indirect channels often provide value-added services such as local inventory, technical support, installation services, and after-sales maintenance, thereby extending the manufacturer's reach into geographically dispersed markets. E-commerce platforms and online marketplaces are also emerging as significant indirect channels, offering greater accessibility and convenience for procurement. Effective management of both direct and indirect channels is essential for maximizing market penetration and catering to the varied purchasing preferences and requirements of different customer segments. The downstream segment of the value chain concludes with the deployment of diaphragm valves in various end-use industries, followed by essential after-sales support, including maintenance, spare parts supply (especially diaphragms), and technical troubleshooting. This comprehensive value chain highlights the intricate interplay of material sourcing, manufacturing precision, efficient distribution, and ongoing customer support that collectively determine market success and end-user satisfaction within the Diaphragm Valves Market.

Diaphragm Valves Market Potential Customers

The potential customer base for diaphragm valves is exceptionally diverse, spanning a wide array of industrial sectors that require precise, reliable, and contamination-free fluid handling solutions. At the forefront are industries with stringent hygiene and purity requirements, making them primary end-users. The pharmaceutical and biotechnology industries represent a critical segment, with companies involved in drug manufacturing, vaccine production, bioprocessing, and research & development relying heavily on aseptic and sanitary diaphragm valves to prevent cross-contamination, maintain product integrity, and comply with strict regulatory guidelines such as FDA and cGMP. These customers prioritize valves made from biocompatible materials, featuring smooth, crevice-free designs and verifiable sterility, ensuring that the critical processes involving highly sensitive and valuable media are managed with utmost precision and safety. Similarly, the food & beverage sector, including dairies, breweries, beverage production, and processed food manufacturers, constitutes a significant customer segment. These businesses demand valves that meet food-grade standards, are easy to clean (CIP/SIP compatible), and prevent microbial growth, thereby ensuring product safety and quality across their production lines.

Beyond the hygiene-sensitive industries, the chemical processing industry represents another substantial customer segment. Companies engaged in the production of bulk chemicals, specialty chemicals, petrochemicals, and fine chemicals require diaphragm valves for handling corrosive acids, bases, solvents, and other aggressive media. These customers seek valves constructed from highly resistant materials like PTFE-lined bodies, exotic alloys, or plastic bodies with appropriate diaphragm materials to withstand chemical attack, prevent leaks, and ensure operational safety in hazardous environments. The water and wastewater treatment sector is also a major consumer, utilizing diaphragm valves in municipal water treatment plants, industrial effluent treatment facilities, and desalination plants. These applications require valves that can handle raw water, treated water, and various chemical additives used in the treatment process, often involving abrasive solids and corrosive chemicals. Reliability, resistance to clogging, and ease of maintenance are key considerations for these customers, who often operate large-scale, continuous flow systems where valve failure can lead to significant operational disruptions and environmental impact.

Furthermore, the mining and metals industry forms a vital customer group, especially for applications involving abrasive slurries, corrosive reagents, and high-pressure fluid transfer in mineral processing, tailings management, and hydrometallurgy. Diaphragm valves, particularly those with robust body linings and wear-resistant diaphragms, are favored for their ability to handle such challenging media while minimizing wear and tear. The power generation sector, encompassing thermal, nuclear, and renewable energy plants, uses diaphragm valves in auxiliary systems such as boiler feedwater treatment, cooling water circuits, and chemical dosing systems, where reliable shut-off and flow control are essential. Emerging niche markets include the semiconductor industry, demanding ultra-high purity valves for microchip fabrication, and pulp & paper mills, where valves must withstand corrosive pulping liquors and abrasive slurries. Overall, the common thread among these diverse potential customers is a critical need for valves that offer superior fluid isolation, contamination prevention, corrosion/abrasion resistance, and precise flow control, making diaphragm valves an indispensable component in their respective industrial processes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.8 Billion |

| Growth Rate | 7.4% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GEMÜ Gebr. Müller Apparatebau GmbH & Co. KG, Saunders (Crane Co.), ITT Inc., KSB SE & Co. KGaA, Alfa Laval, Emerson Electric Co., Flowserve Corporation, Spirax Sarco Engineering plc, PARKER HANNIFIN CORP, NIBCO Inc., Baelz Automatic GmbH & Co. KG, Valtorc International, Bray International, Inc., Watts Water Technologies, Inc., Granzow A/S, Pentair plc, Apollo Valves, SSP Fittings Corp, Velan Inc., Metso Outotec |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Diaphragm Valves Market Key Technology Landscape

The technology landscape for the Diaphragm Valves Market is continuously evolving, driven by the imperative to enhance performance, extend durability, improve safety, and meet increasingly stringent industry standards. A significant area of advancement lies in material science, with ongoing research and development focused on creating next-generation diaphragm materials that offer superior chemical resistance, higher temperature and pressure ratings, and extended flex life. Innovations include advanced elastomers with enhanced resilience, specialized fluoropolymers like modified PTFE for more aggressive media, and multi-layer diaphragms that combine the chemical inertness of one material with the mechanical strength and flexibility of another. These material breakthroughs are crucial for expanding the applicability of diaphragm valves into more challenging and extreme operational environments, ensuring long-term reliability and reducing the frequency of maintenance, thereby addressing a key operational concern for many end-users and improving overall process uptime and cost-effectiveness in diverse industrial applications.

Another pivotal technological trend is the increasing integration of automation and smart features into diaphragm valve designs, aligning with the principles of Industry 4.0. This includes the development of sophisticated actuators (pneumatic and electric) that offer precise control, faster response times, and diagnostic capabilities. Many modern diaphragm valves are equipped with position feedback sensors, limit switches, and intelligent control interfaces that allow for seamless integration with Distributed Control Systems (DCS) and Programmable Logic Controllers (PLC). The incorporation of Industrial Internet of Things (IIoT) sensors enables real-time monitoring of valve performance parameters such as open/closed status, temperature, pressure, and even diaphragm health. This data can be transmitted wirelessly to central monitoring systems, facilitating predictive maintenance strategies, identifying potential issues before they escalate, and optimizing process efficiency through data-driven insights. The shift towards smart, connected valves represents a significant leap from traditional mechanical components to intelligent assets that contribute actively to plant-wide operational intelligence.

Furthermore, manufacturing technologies are also advancing, with a growing emphasis on precision engineering, modular design, and additive manufacturing techniques. Precision machining ensures tighter tolerances and improved sealing capabilities, particularly critical for aseptic applications. Modular designs allow for greater customization and easier replacement of components, reducing lead times and maintenance complexity. While not yet widespread for primary valve components, additive manufacturing (3D printing) holds promise for prototyping complex valve geometries, producing specialized or intricate parts, and potentially reducing material waste in the future. Surface finishing technologies, such as electro-polishing for stainless steel bodies, are becoming standard for sanitary valves to achieve ultra-smooth surfaces that inhibit bacterial growth and facilitate thorough cleaning. Diagnostic tools and software are also being developed to assist in troubleshooting and optimizing valve performance, empowering maintenance teams with better insights. Collectively, these technological advancements are transforming diaphragm valves from simple flow control devices into highly sophisticated, intelligent, and resilient components essential for modern industrial processes, enhancing both their functional capabilities and their economic value proposition.

Regional Highlights

- North America: This region represents a mature yet robust market for diaphragm valves, driven by stringent regulatory frameworks in the pharmaceutical and biotechnology sectors, continuous investments in water and wastewater infrastructure upgrades, and a strong demand for process automation in chemical industries. The market here emphasizes high-performance, quality-certified valves, with a growing adoption of smart valve technologies for enhanced efficiency and compliance.

- Europe: Similar to North America, Europe is a well-established market characterized by strong environmental regulations and a high concentration of pharmaceutical and food & beverage manufacturing facilities. Countries like Germany, France, and the UK are key contributors, focusing on energy efficiency, sustainable industrial practices, and advanced materials for chemical processing, driving demand for specialized and high-purity diaphragm valves.

- Asia Pacific (APAC): APAC is the fastest-growing market, propelled by rapid industrialization, massive infrastructure development, and burgeoning manufacturing sectors, particularly in China, India, and Southeast Asian countries. Significant investments in chemical processing, pharmaceuticals, water treatment, and power generation are fueling an exponential demand for diaphragm valves, encompassing both cost-effective general-purpose valves and high-purity specialized variants.

- Latin America: This region exhibits emergent growth, primarily driven by expanding mining operations, increasing investments in water management projects, and a growing chemical industry in countries like Brazil and Mexico. The market here is characterized by a demand for robust, reliable valves that can withstand challenging environmental conditions and corrosive media, with a gradual shift towards more sophisticated solutions.

- Middle East and Africa (MEA): The MEA region presents considerable growth potential, spurred by heavy investments in oil and gas, petrochemicals, water desalination plants, and developing manufacturing capabilities. Countries in the GCC region are leading the charge, demanding durable diaphragm valves for handling aggressive chemicals and ensuring operational integrity in critical infrastructure projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Diaphragm Valves Market.- GEMÜ Gebr. Müller Apparatebau GmbH & Co. KG

- Saunders (Crane Co.)

- ITT Inc.

- KSB SE & Co. KGaA

- Alfa Laval

- Emerson Electric Co.

- Flowserve Corporation

- Spirax Sarco Engineering plc

- PARKER HANNIFIN CORP

- NIBCO Inc.

- Baelz Automatic GmbH & Co. KG

- Valtorc International

- Bray International, Inc.

- Watts Water Technologies, Inc.

- Granzow A/S

- Pentair plc

- Apollo Valves

- SSP Fittings Corp

- Velan Inc.

- Metso Outotec

Frequently Asked Questions

What are the primary advantages of using diaphragm valves over other valve types?

Diaphragm valves offer superior fluid isolation, preventing contamination and leakage due to their hermetic seal, making them ideal for corrosive, abrasive, viscous, or high-purity media. They also provide excellent throttling capabilities, minimal pressure drop, and easy maintenance with simple diaphragm replacement.

Which industries are the largest consumers of diaphragm valves?

The largest consumers are industries with stringent hygiene and chemical resistance requirements, including pharmaceuticals & biotechnology, food & beverage, water & wastewater treatment, and the chemical processing industry.

How do advancements in material science impact the diaphragm valves market?

Advancements in material science enable the development of diaphragms and valve bodies that can withstand more aggressive chemicals, higher temperatures, and pressures, expanding the application scope of diaphragm valves and enhancing their durability and reliability.

What role does automation play in the evolution of diaphragm valves?

Automation integration through pneumatic or electric actuators allows for remote control, precise flow regulation, and seamless integration with industrial control systems, improving operational efficiency, safety, and enabling predictive maintenance capabilities.

What are the main types of diaphragm valves available in the market?

The main types include weir type for general throttling and on-off service, and straight-through or full-bore types for viscous fluids and slurries, ensuring minimal pressure drop and easy cleaning, with sanitary/aseptic variants for high-purity applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Health Diaphragm Valves Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Diaphragm Valves Market Size Report By Type (Weir, Straightway), By Application (Chemical, Food & Beverages, Water Treatment, Power, Pharmaceutical, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Health Diaphragm Valves Market Statistics 2025 Analysis By Application (Food Industry, Pharmaceutical Industry, Biotechnology), By Type (Manual, Pneumatic, Electric, Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Lined Diaphragm Valves Market Statistics 2025 Analysis By Application (Chemical Industry, Pharmaceutical Industry), By Type (PFA Lined, PTFE Lined, FEP Lined), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Diaphragm Valves Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Weir, Straight-way), By Application (Chemical, Food and Beverage, Water Treatment, Power, Pharmaceutical, Other End-user Verticals), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager