Diatomaceous Earth Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433918 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Diatomaceous Earth Market Size

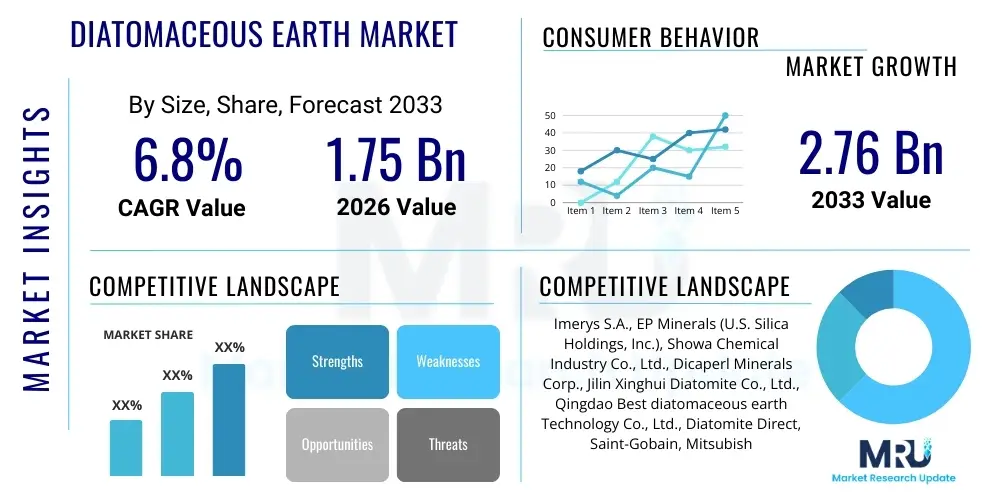

The Diatomaceous Earth Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.75 Billion in 2026 and is projected to reach USD 2.76 Billion by the end of the forecast period in 2033. This growth trajectory is significantly influenced by the expanding applications across various end-use industries, particularly filtration and agriculture, where the unique properties of diatomaceous earth offer cost-effective and environmentally friendly solutions.

The consistent demand for highly efficient filtration media in the food and beverage industry, coupled with stringent environmental regulations requiring effective wastewater treatment, acts as a primary catalyst for market expansion. Furthermore, the rising awareness regarding natural and organic pest control methods in farming and household settings is fueling the consumption of high-purity DE products. The market size calculation incorporates revenues derived from sales of both natural and calcined DE across industrial, commercial, and agricultural sectors globally, taking into account price fluctuations related to mining, processing, and transportation logistics. The forecast also factors in the increasing substitution of synthetic filter aids with natural mineral alternatives.

Diatomaceous Earth Market introduction

Diatomaceous Earth (DE), also known as diatomite or kieselgur, is a naturally occurring, soft, siliceous sedimentary rock composed primarily of the fossilized remains of microscopic single-celled algae called diatoms. This fine, white powder is characterized by its high silica content, porosity, low density, and high surface area, attributes that make it invaluable across a wide spectrum of industrial applications. The inherent chemical inertness and abrasive nature further enhance its utility in areas ranging from structural fillers to advanced insulation materials. The market encompasses various grades of DE, including natural, calcined, and flux-calcined, each tailored for specific performance requirements regarding flow rate, particle size distribution, and permeability.

Major applications of diatomaceous earth span critical sectors such as filtration, where it is extensively used as a filter aid in brewing, wine production, and water purification due to its high purity and microporous structure that efficiently traps suspended solids. In agriculture, DE functions as a natural insecticide and anti-caking agent for feed grain storage, providing organic pest control without reliance on chemical toxins. Industrially, it serves as a functional filler in paints, plastics, paper, and rubber, improving product durability, strength, and matte finishing. Furthermore, its insulating properties make it useful in construction materials and refractory applications requiring high heat resistance, offering thermal efficiency in high-temperature settings.

The market is driven by several key factors, notably the growing preference for natural and non-toxic additives, the increasing global consumption of processed beverages requiring high-standard filtration, and continuous technological advancements in processing techniques to enhance product performance and purity. These benefits, combined with its relatively low cost compared to synthetic alternatives, solidify DE’s position as a crucial industrial mineral worldwide. However, the market growth is moderately constrained by health concerns related to crystalline silica exposure, necessitating strict occupational safety standards and dust control measures during handling and processing activities, especially for high-grade calcined products.

Diatomaceous Earth Market Executive Summary

The Diatomaceous Earth Market is exhibiting robust expansion driven primarily by surging demand in the food and beverage filtration sector, particularly in emerging economies experiencing rapid industrialization and modernization of beverage processing facilities. Business trends indicate a strong shift towards flux-calcined and high-purity grades, necessitated by increasing quality control requirements in pharmaceuticals and specialized industrial catalyst applications. Strategic mergers, acquisitions, and expansions focused on securing high-quality mining reserves and optimizing supply chain logistics are prevalent among major market players, aiming to consolidate regional influence and achieve economies of scale. Furthermore, investment in sustainable mining practices and efficient drying technologies represents a crucial competitive differentiator in the current market landscape, allowing firms to meet stringent environmental standards.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, largely due to burgeoning agricultural demand, rapid urbanization necessitating enhanced water treatment infrastructure, and the expansion of the regional manufacturing base. China and India are central to this growth, fueled by both internal consumption and export-oriented processing industries. North America and Europe maintain significant market shares, characterized by mature filtration markets and high adoption rates of DE in specialized industrial applications, although growth here is generally slower but stable, focusing on advanced processing and regulatory compliance regarding silica content. These developed regions lead innovation in specialized DE derivatives.

Segment trends reveal that the filter media application segment dominates the market in terms of value, owing to its high volume usage and continuous consumption rate in liquid processing industries requiring precise clarification. However, the agricultural application segment, particularly for natural insecticide and soil conditioning, is projected to register the highest CAGR, reflective of the global movement towards organic and sustainable farming practices that seek alternatives to chemical pesticides. By product type, the natural diatomaceous earth segment holds a large volume share due to its direct use in agriculture and lower processing costs, while the calcined and flux-calcined segments command higher price points due to the added value of enhanced porosity and flow characteristics required for high-grade industrial filtration and complex separation tasks.

AI Impact Analysis on Diatomaceous Earth Market

User queries regarding AI in the Diatomaceous Earth sector commonly revolve around optimizing mining efficiency, enhancing purity analysis during processing, and predicting demand fluctuations based on end-user industry trends (e.g., beverage production cycles, seasonal agricultural needs). Key themes include the implementation of predictive maintenance for heavy mining machinery, utilizing machine learning algorithms for real-time quality control checks in filter media manufacturing, and deploying AI-powered logistics solutions to manage the complex distribution of bulk mineral products globally. Concerns often focus on the required capital expenditure for AI integration and the need for specialized training for technical staff, particularly in managing sophisticated sorting and classification systems designed to differentiate various grades of DE based on particle morphology and chemical composition.

The integration of Artificial Intelligence and advanced analytics is set to revolutionize operational efficiencies within the Diatomaceous Earth value chain, primarily impacting upstream activities like geological exploration and resource management. AI models can analyze geophysical data and satellite imagery to identify high-purity DE reserves more accurately, reducing exploration costs and risks. Furthermore, in processing plants, AI-driven optical sorting systems can instantly differentiate mineral grades based on microscopic characteristics, significantly improving product consistency and reducing waste. This precision engineering enabled by AI ensures that the output meets stringent specifications required by pharmaceutical and specialized chemical industries, thereby enhancing market competitiveness through superior product quality control.

In downstream applications, particularly demand forecasting and inventory management, AI algorithms analyze historical sales data, macroeconomic indicators, and consumption patterns in key industries (like brewing and water treatment) to generate highly accurate demand predictions. This capability allows manufacturers to optimize production schedules, minimize storage costs, and ensure just-in-time delivery to large industrial consumers. Overall, AI’s influence is shifting the industry towards more data-driven decision-making, promising substantial reductions in operational expenditure and elevating the overall quality and traceability of Diatomaceous Earth products across the global supply chain, ensuring resilience against market volatility and supply shocks.

- AI optimizes geological surveying for high-purity DE deposits, reducing exploration time.

- Machine learning improves real-time quality control and automated grade classification during high-volume processing.

- Predictive maintenance minimizes unexpected downtime of heavy mining and milling equipment, maximizing output.

- AI-powered logistics enhance supply chain efficiency, optimize route planning, and reduce transportation costs for bulk goods.

- Advanced analytics forecast end-user demand (e.g., seasonal filtration needs) accurately, minimizing inventory holding costs.

- Robotics integrated with AI facilitates automated, contamination-free packaging and palletizing processes for specialized grades.

DRO & Impact Forces Of Diatomaceous Earth Market

The Diatomaceous Earth Market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities. Primary drivers include the robust expansion of the global food and beverage industry, which relies heavily on DE for clarification and filtration, and the escalating shift towards sustainable agriculture where natural DE serves as a highly effective, non-chemical pest control agent. The increasing stringency of global water quality standards also necessitates the use of high-performance filter aids, thereby bolstering demand across municipal and industrial water treatment sectors. These fundamental, non-cyclical demands provide a strong baseline for continuous market growth.

Conversely, the market faces significant restraints, notably the regulatory scrutiny and health hazards associated with exposure to crystalline silica dust, which is a byproduct of high-temperature processing (calcination). This necessitates substantial investment in advanced dust mitigation technologies, specialized occupational training, and changes in product handling procedures, driving up operational costs. Furthermore, competition from alternative filtration and filler materials, such as perlite, cellulose, and synthetic silicates, presents a continuous challenge to market share, forcing DE producers to maintain strict cost controls and continuously improve product performance metrics to retain competitiveness.

Opportunities for market growth are vast, particularly through the development of specialized, high-performance DE products tailored for novel applications, such as high-temperature insulation materials, advanced catalyst carriers in chemical synthesis, and specialized functional fillers for high-end polymers requiring lightweight and high-strength characteristics. Geographical expansion into untapped emerging markets in Africa and Latin America, where industrialization is accelerating and water treatment infrastructure is rapidly evolving, offers substantial potential for bulk and general-purpose DE consumption. Moreover, continuous research and development efforts focused on surface modification of DE particles to improve performance characteristics, such as higher flow rates and reduced leachability, are key to future success and premium pricing strategies within the specialized industrial segment. The impact forces are thus heavily driven by environmental legislation, consumer demands for organic products, and material science advancements.

Segmentation Analysis

The Diatomaceous Earth Market segmentation provides a granular view of consumption patterns and market dynamics based on product type, application, and end-use industry. Analyzing these segments helps stakeholders understand specific growth pockets and tailor their production and marketing strategies accordingly. The market is primarily divided based on the level of processing applied to the raw diatomite, differentiating between natural, calcined, and flux-calcined grades, each possessing distinct properties optimized for particular industrial requirements, especially regarding filtration speed and clarity. Understanding these grades is essential as their price points and application areas vary widely.

The robust filtration segment, encompassing liquids like beer, wine, edible oils, and pharmaceuticals, traditionally commands the largest revenue share due to the continuous high-volume usage characteristic of processing industries that rely on repeated filtration cycles. Conversely, the agriculture segment, driven by the shift towards organic farming and the need for safe, effective natural insecticides, is projected to experience the fastest growth rate, propelled by strong regulatory support for non-chemical pest control. Geographic segmentation reveals significant differences, with developed regions prioritizing high-purity specialized applications while emerging markets prioritize cost-effective bulk industrial and agricultural usage, reflecting varying levels of industrial maturity.

- By Type: Natural Diatomaceous Earth (Amorphous Silica), Calcined Diatomaceous Earth (Heat-treated), Flux-Calcined Diatomaceous Earth (Treated with fluxing agents).

- By Application: Filter Aids (Beverage Filtration, Oil Purification, Water Treatment, Chemical Processing), Functional Fillers (Paints and Coatings, Plastics, Paper, Rubber), Absorbents (Spill Cleanup, Pet Litter), Insecticides and Pesticides, Catalyst Carriers, Abrasives and Polishing Agents.

- By End-Use Industry: Food and Beverage (Brewing, Wine, Juice), Agriculture (Pest Control, Soil Conditioner, Feed Additives), Chemicals and Pharmaceuticals, Water Treatment and Environmental Management, Construction and Refractories, Oil and Gas (Drilling Mud).

Value Chain Analysis For Diatomaceous Earth Market

The value chain for the Diatomaceous Earth market begins with extensive upstream analysis focused on geological exploration, mining, and beneficiation of raw diatomite deposits. Mining operations, often open-pit, are critical and highly dependent on the quality and accessibility of the reserves, particularly deposits yielding low levels of crystalline silica and high purity amorphous silica. Energy-intensive processing, including drying, milling, and specialized heat treatment (calcination), transforms the raw mineral into various marketable grades, requiring substantial investment in advanced processing technology to maintain high-quality standards and minimize dust emissions, which is a major operational cost factor.

Downstream analysis involves the complex logistics of distributing the finished product, which is often bulky, powdery, and requires careful handling to prevent segregation, contamination, or product loss due to dusting. Distribution channels are highly varied, ranging from direct sales to large-scale industrial consumers (like major breweries or chemical manufacturers) to indirect sales through regional distributors, specialized chemical suppliers, and agricultural retail networks. Direct distribution is crucial for high-volume contracts and customized product requirements, ensuring tight quality control and dedicated technical support for industrial clients requiring precise filtration metrics.

The market relies heavily on a hybrid distribution model. Indirect channels play a vital role in reaching dispersed smaller users, such as individual farmers or local water treatment plants, providing accessibility and local inventory management. Effective value chain management focuses on optimizing energy consumption during calcination, controlling freight costs for bulk material, and establishing strong relationships with end-use technical consultants to ensure the correct grade of DE is applied for specific filtration or filler challenges. Innovation in packaging to reduce material breakage, improve shelf stability, and facilitate automated handling at the customer site is also a key differentiator in the later stages of the value chain, adding value beyond the basic mineral commodity.

Diatomaceous Earth Market Potential Customers

The potential customer base for Diatomaceous Earth is exceptionally broad, reflecting the mineral's multi-functional utility across diverse industrial and consumer sectors. Primary buyers include major players in the food and beverage processing industry, such as breweries, wineries, juice manufacturers, and edible oil refineries, who rely on DE as a critical, high-efficiency filter aid to achieve clarity and stability in their final products. These customers require continuous, high-volume supply of consistent quality, typically requesting calcined or flux-calcined grades for optimal flow characteristics and filtration performance in demanding liquid processing environments, often procured under long-term supply agreements.

Another significant segment comprises agricultural end-users, including commercial farms, organic growers, greenhouse operators, and livestock feed producers. These buyers utilize natural, uncalcined DE primarily for its non-toxic insecticide properties against stored grain pests and external parasites, as well as an anti-caking agent in animal feed. This segment is characterized by seasonal demand fluctuations and a strong preference for certified organic products, making supply chain transparency and regulatory compliance with organic standards essential for manufacturers targeting this robust, high-growth market segment.

Furthermore, specialized industrial customers form a crucial part of the market, including manufacturers of paints, coatings, plastics, and specialized chemicals, who purchase DE as a functional filler to enhance physical properties such as abrasion resistance, matte finish, fire retardancy, and lightweighting. Water treatment facilities, particularly municipal and industrial wastewater plants utilizing pre-coat filtration systems, also represent key buyers. Targeting these varied segments requires a highly diversified sales strategy, specialized product lines, and robust technical support tailored to specific end-user performance metrics, ranging from filtration speed to chemical compatibility and safety certifications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.75 Billion |

| Market Forecast in 2033 | USD 2.76 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Imerys S.A., EP Minerals (U.S. Silica Holdings, Inc.), Showa Chemical Industry Co., Ltd., Dicaperl Minerals Corp., Jilin Xinghui Diatomite Co., Ltd., Qingdao Best diatomaceous earth Technology Co., Ltd., Diatomite Direct, Saint-Gobain, Mitsubishi Kakoki Kaisha, Ltd., American Diatomite, Dicalite Management Group, EaglePicher Minerals LLC, Ashapura Group, CECA (Arkema Group), Sibelco, Reade Advanced Materials, Luoding Diatomite Co., Ltd., Changbai Mountain Diatomite, Kinetico Incorporated, Min-Tech. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Diatomaceous Earth Market Key Technology Landscape

The technological landscape in the Diatomaceous Earth market is dominated by advancements aimed at enhancing product purity, optimizing particle size distribution, and improving processing efficiency, particularly in energy-intensive steps like calcination and drying. Key technologies include sophisticated air classification systems used post-milling to achieve precise particle separation, ensuring consistent permeability and flow rates essential for high-performance filter aids. Modern processing plants utilize advanced fluid bed dryers and rotary kilns equipped with automated temperature control to minimize energy consumption while achieving the desired level of calcination, which critically determines the final product's physical and chemical characteristics, notably the conversion rate of amorphous silica to crystalline forms.

Furthermore, technology is rapidly evolving in the area of surface modification and functionalization of DE particles. Techniques such as coating DE with organic polymers or chemically treating the surface are being explored to improve its performance as a functional filler, enhancing compatibility with various polymer matrices or reducing dusting potential, which directly addresses occupational health concerns related to airborne silica. Research focuses on creating high-flux filter aids that offer superior efficiency with minimal pre-coat requirements, reducing operational complexity for end-users in the beverage and pharmaceutical industries. This focus on value-added processing drives innovation and allows premium pricing for specialized, high-performance grades.

In the mining sector, the adoption of satellite mapping and advanced geological modeling software assists in precise resource extraction, minimizing overburden and maximizing the yield of high-grade raw material. Automation and robotics are also increasingly used in quality testing labs to perform rapid analysis of silica content, moisture level, and particle morphology, ensuring strict adherence to international standards like Food Chemicals Codex (FCC) specifications. The implementation of IoT sensors within production lines facilitates real-time monitoring and predictive maintenance, contributing to lower operational costs and enhanced reliability across the entire manufacturing footprint, ensuring product consistency from mine to end-user application.

Regional Highlights

The regional analysis reveals distinct market maturity levels and growth trajectories influenced by local regulatory environments, industrial output, and agricultural practices. Market dynamics are highly heterogeneous, requiring tailored strategies for each major geography.

- North America (U.S. and Canada): Characterized by a mature industrial base and high demand for specialized, high-purity DE in high-end applications such as pharmaceutical filtration and specialized catalyst carriers. Stringent environmental regulations drive the market for advanced water treatment applications. The region is a key consumer of natural DE for domestic and commercial pest control, reflecting high organic consumer demand and a robust regulatory framework favoring certified natural products.

- Europe (Germany, UK, France, Italy): Driven by rigorous food and beverage quality standards and a strong emphasis on sustainability. Europe utilizes calcined DE extensively for brewing and wine production, adhering to strict purity requirements. The focus on reducing chemical usage in agriculture provides substantial momentum for the natural insecticide segment, supported by favorable EU regulations concerning biopesticides and organic farming subsidies.

- Asia Pacific (China, India, Japan, South Korea): The fastest-growing region, fueled by rapid industrialization, increasing investment in municipal water infrastructure, and the massive scale of agricultural activities. China is both a major producer and consumer, particularly in the construction, filler, and regional filtration applications. The surging middle-class population drives processed food and beverage consumption, escalating the demand for filtration aids significantly.

- Latin America (Brazil, Mexico): Exhibits strong growth potential, primarily driven by expanding agricultural exports (where DE is used for post-harvest protection and anti-caking) and growing investment in infrastructure projects, including municipal water and wastewater treatment facilities. Economic volatility and logistics challenges remain factors, but the underlying demand for basic filtration and agricultural solutions is robust, especially in the expanding beverage sector.

- Middle East and Africa (MEA): Growth is linked to substantial infrastructure spending, particularly in the Oil and Gas sector (where DE is used in drilling muds and well cementing operations) and ongoing development of regional water desalination and purification projects. Adoption of modern farming techniques in key agricultural hubs also contributes to stable, albeit emerging, market growth for DE products, often imported from established global suppliers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Diatomaceous Earth Market.- Imerys S.A.

- EP Minerals (U.S. Silica Holdings, Inc.)

- Showa Chemical Industry Co., Ltd.

- Dicaperl Minerals Corp.

- Jilin Xinghui Diatomite Co., Ltd.

- Qingdao Best diatomaceous earth Technology Co., Ltd.

- Diatomite Direct

- Saint-Gobain

- Mitsubishi Kakoki Kaisha, Ltd.

- American Diatomite

- Dicalite Management Group

- EaglePicher Minerals LLC

- Ashapura Group

- CECA (Arkema Group)

- Sibelco

- Reade Advanced Materials

- Luoding Diatomite Co., Ltd.

- Changbai Mountain Diatomite

- Kinetico Incorporated

- Min-Tech

Frequently Asked Questions

Analyze common user questions about the Diatomaceous Earth market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Diatomaceous Earth Market?

The primary driver is the exponentially increasing global demand for effective, high-purity filtration media in the expanding food and beverage industry, particularly for clarifying beer, wine, and fruit juices. Additionally, the rapid shift towards organic and sustainable agricultural practices fuels demand for natural Diatomaceous Earth as a safe, non-chemical insecticide and soil conditioner, supported by consumer health trends worldwide.

What are the main differences between natural, calcined, and flux-calcined Diatomaceous Earth grades?

Natural DE is raw, untreated material consisting primarily of amorphous silica, suitable for agriculture and absorbents. Calcined DE is heat-treated (up to 1000°C) to increase permeability and hardness, making it ideal for standard industrial filtration. Flux-calcined DE is processed at even higher temperatures with a fluxing agent, resulting in much higher flow rates, lower density, and the partial conversion of amorphous silica to crystalline silica, required for high-speed industrial clarification.

What is the largest application segment for Diatomaceous Earth globally?

The filtration segment, particularly filter aids for liquid processing in the food and beverage industry (including brewing, soft drinks, and edible oils), consistently represents the largest application segment by value and volume. Its unique micro-porous structure and high surface area provide superior efficiency in removing microscopic impurities and achieving required product clarity, making it indispensable in high-volume production.

Are there health concerns associated with handling Diatomaceous Earth, particularly relating to silica dust?

Yes, occupational health concerns primarily relate to the exposure to fine crystalline silica dust, which is present predominantly in high-temperature processed (calcined and flux-calcined) grades. Inhalation of crystalline silica can pose respiratory hazards. Therefore, manufacturers must adhere strictly to occupational safety standards, utilize dust suppression techniques, and ensure proper training and protective equipment for workers and end-users handling these specific grades.

Which geographical region exhibits the fastest growth rate for Diatomaceous Earth consumption and why?

The Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR). This growth is attributed to rapid urbanization, massive infrastructural development (boosting construction and water treatment demand), industrial expansion, and the rising consumer class increasing demand for filtered beverages and processed foods across countries like China, India, and Southeast Asian nations.

The detailed technical characteristics of Diatomaceous Earth, particularly its micro-porosity and controlled particle size distribution, are central to its market dominance in filter aid applications. Continuous innovation is focused on enhancing these physical attributes. For instance, manufacturers are investing heavily in advanced milling and sizing equipment, such as air classifiers and hydrocyclones, to achieve tighter specifications in particle distribution. This precision is vital for end-users in specialized sectors like pharmaceutical manufacturing, where filtration consistency directly impacts product efficacy and regulatory compliance. The market's competitive landscape is defined not only by the cost of raw materials but increasingly by the technological capability to produce ultra-pure, customized DE grades with certified low heavy metal content.

The environmental sustainability aspect is becoming a significant purchasing criterion for industrial buyers, prompting producers to showcase their commitment to responsible mining practices and reduced energy consumption during processing. As a natural, abundant mineral, DE benefits from a positive perception compared to synthetic alternatives. However, managing the crystalline silica content remains a core operational challenge, necessitating continuous monitoring and investment in closed-system processing technologies to ensure worker safety and product integrity. The future growth of the market is intrinsically linked to the ability of producers to meet both the high-performance demands of modern industrial processes and the escalating standards for environmental and health safety, requiring substantial R&D expenditure.

Market consolidation remains a trend, particularly among global leaders who seek to secure diverse, high-quality deposits across different geographies. This strategic vertical integration ensures supply stability and allows companies to cater efficiently to global supply contracts across various continents, mitigating risks associated with single-source supply. Furthermore, the development of value-added products, such as DE modified for use as a high-performance catalyst support in specialized chemical reactions or as a reinforcing agent in advanced composites, opens up new revenue streams and diversifies the market beyond traditional filtration roles. These specialized, smaller-volume applications often command premium pricing, contributing significantly to overall market value growth despite representing a smaller share of the total volume sold.

The agricultural segment's growth is strongly influenced by global consumer trends prioritizing organic produce and minimizing chemical pesticide residues. Diatomaceous Earth offers a mechanical mode of action against insects, which prevents the development of chemical resistance—a major concern in conventional pest management programs. This inherent advantage makes DE a favored tool for integrated pest management (IPM) programs worldwide. Manufacturers are focusing on developing fine, lightweight DE powders optimized for efficient dusting and dispersion in farming environments while ensuring minimal impact on beneficial insects and pollinators. Education and outreach to agricultural cooperatives and farming associations are crucial marketing strategies in this segment to maximize adoption rates and ensure correct application techniques.

In the construction sector, DE serves a crucial role as a pozzolanic admixture in cement and concrete, enhancing strength and durability while reducing permeability and mitigating the risk of alkali-silica reaction (ASR). The utilization of DE in this capacity helps mitigate the environmental impact of concrete production by replacing a portion of the energy-intensive Portland cement. This application segment is particularly sensitive to global construction activity and regulatory pushes for greener building materials, especially in industrialized nations. As urbanization continues globally, especially in APAC and MEA, the demand for DE as a construction additive is expected to witness steady, volume-based growth, supplementing its existing applications in specialized insulation materials designed for high-heat environments like furnaces and kilns.

The competitive landscape of the Diatomaceous Earth market is fragmented yet features a few dominant players controlling major global production facilities and high-quality reserves. Competition is intense, focusing heavily on product consistency, cost-effectiveness, and the ability to provide rigorous technical support tailored to the specific needs of filtration engineers. Smaller, regional players often thrive by focusing on local deposits, specialized product niches (e.g., specific pet litter or non-food grade absorbents), or offering superior logistics to regional agricultural customers. Price competition is particularly noticeable in high-volume, standard-grade industrial applications, necessitating continuous operational excellence and cost optimization in mining and milling processes to maintain profitability in a commoditized environment.

Regulatory adherence remains a paramount concern across all geographic markets. Compliance with standards set by bodies like the FDA (U.S. Food and Drug Administration) for food contact applications, EFSA (European Food Safety Authority), and EPA (Environmental Protection Agency) for agricultural uses dictates market access and product formulation. Investment in robust quality assurance systems, including ISO certifications and rigorous testing protocols for heavy metals, microbial contamination, and residual moisture, is non-negotiable for companies seeking to supply the pharmaceutical and high-end food filtration sectors. Future regulatory trends, potentially increasing scrutiny on dust exposure in occupational settings, will continue to shape processing technology choices and facility design, pushing for innovation in dust mitigation.

Technological advancement is also being directed toward maximizing resource utilization. The industry is actively exploring methods to process lower-grade diatomite deposits that were previously deemed uneconomical. Techniques such as froth flotation or gravity separation are being refined to upgrade impure raw materials, thereby extending the economic lifespan of existing mines and reducing the reliance on limited, ultra-high-purity reserves. This shift towards efficient resource management aligns with broader sustainability goals and ensures a more resilient long-term supply chain for this vital industrial mineral. The successful implementation of these beneficiation technologies is crucial for meeting the rising global volume demand projected through 2033 without compromising quality.

The strategic importance of R&D in developing highly specialized applications cannot be overstated. For example, the creation of micro-scale and nano-scale silica particles derived from Diatomaceous Earth offers opportunities in advanced functional coatings, drug delivery systems, and specialized electronic materials, areas that are currently in nascent stages but possess immense potential for high-margin revenue growth. These high-technology applications require fundamentally different processing methods, often involving chemical treatments and precise particle engineering at the nanoscale, demanding substantial scientific investment. Companies positioned to successfully translate these research findings into commercial products will secure a strong competitive edge in the evolving mineral market landscape, moving beyond bulk commodities.

Investment in digitalization across the supply chain, moving beyond just AI in mining, involves implementing Enterprise Resource Planning (ERP) systems optimized for mineral logistics and bulk material handling. These systems integrate order management, inventory tracking, production scheduling, and regulatory reporting, providing essential end-to-end visibility. Enhanced transparency is crucial, especially when dealing with international distribution and varying customs requirements for mineral exports. The ability to quickly and accurately trace specific product batches, particularly for certified food-grade and pharmaceutical-grade DE, enhances consumer trust and ensures rapid response capabilities in the event of quality deviations or recalls, minimizing financial and reputational damage.

The inherent limitations of transportation costs for a high-volume, relatively low-value commodity like DE necessitate strategic location planning for both mines and processing plants. Establishing regional processing hubs near major consumption centers (e.g., key brewing regions or high-yield agricultural belts) reduces long-haul freight expenses, thereby significantly enhancing cost competitiveness, particularly against imported material. Furthermore, optimizing packaging—moving from traditional multi-ply bags to bulk storage and specialized containers—can reduce handling costs, minimize product loss or contamination during transit, and improve safety standards, adding tangible value to the downstream supply chain process for major industrial users.

Addressing the restraint related to crystalline silica exposure requires continuous product modification. Producers are actively marketing and developing products with inherently low crystalline silica content, often achieved through careful selection of raw materials and avoiding high-temperature processing where applicable. For applications where calcination is essential for performance, manufacturers are developing engineered DE products that minimize dusting through granulation, pelletization, or specialized coating agents. These safety-focused product enhancements demonstrate commitment to worker health and provide a distinct marketing advantage over competitors utilizing older, less controlled processing methodologies, particularly when targeting markets with stringent OSHA standards.

In summary, the Diatomaceous Earth Market is poised for sustained growth, driven by fundamental needs in liquid purification and sustainable agriculture across diverse global markets. While facing challenges related to health regulations and intense competition from synthetic materials, the strategic focus on high-purity specialized grades, enhanced processing technology (including AI integration), and effective management of the complex global supply chain will dictate market leadership through the forecast period. The market remains resilient due to the mineral's irreplaceable functional properties across multiple critical industrial applications worldwide, ensuring a robust future for high-quality diatomite producers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Diatomaceous Earth Market Size Report By Type (Anhydrous substance, Baked Product, Flux Calcined), By Application (Filter Aids, Fillers, Absorbents, Construction materials, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Hot Tub Filters Market Statistics 2025 Analysis By Application (Residential, Commercial), By Type (Cartridge Style Filters, Sand Filters, Ceramic Filters, Diatomaceous Earth Filters), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Spa Filter Cartridges Market Statistics 2025 Analysis By Application (Residential, Commercial), By Type (Cartridge Style Filters, Sand Filters, Ceramic Filters, Diatomaceous Earth Filters), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager