Diazo Film Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432589 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Diazo Film Market Size

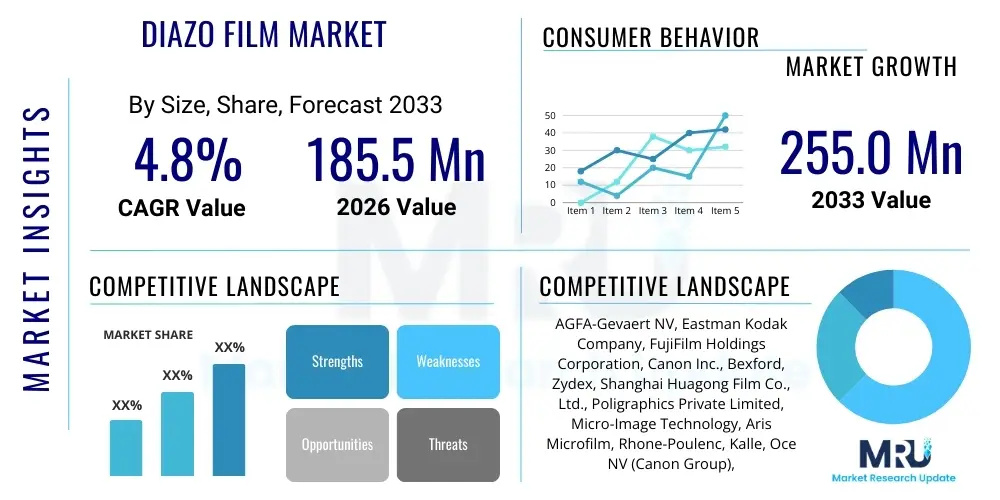

The Diazo Film Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 185.5 Million in 2026 and is projected to reach USD 255.0 Million by the end of the forecast period in 2033.

Diazo Film Market introduction

The Diazo Film Market encompasses the production, distribution, and consumption of specialized films utilized primarily for duplicating images, archival storage, and creating phototools for specific industrial applications. Diazo film, also known as diazochrome film, operates on the principle of diazonium salt photochemistry. When exposed to ultraviolet (UV) light, these salts decompose, and the unexposed areas, when subsequently developed using ammonia vapor or moist heat, form stable azo dyes, creating a direct positive copy of the original document or image. This characteristic makes it valuable in situations demanding high-resolution, low-cost duplication without the need for traditional silver-halide photography processes.

Key applications of Diazo film historically included engineering blueprints, micrographics (microfilm and microfiche), and cartography. While the advent of advanced digital imaging technologies has significantly reduced its use in general office environments and mainstream graphic arts, Diazo film retains a crucial role in specialized sectors. Its ability to produce copies with excellent archival longevity, coupled with relatively low processing costs and system simplicity, ensures its sustained demand in libraries, government archives, and specialized manufacturing environments where legacy systems or stringent regulatory requirements necessitate physical documentation preservation. The market dynamic is characterized by stability in niche applications rather than aggressive expansion.

Driving factors for the sustained market include the irreplaceable demand for archival quality in government and historical document preservation, particularly for microfiche and aperture cards used in engineering legacy systems. Furthermore, in certain electronic manufacturing processes, Diazo films are used as phototooling masks due to their specific optical properties and precise dimensional stability. The primary benefit remains the cost-effective production of durable, high-contrast, direct-positive copies, catering to industries where document integrity over decades is paramount.

Diazo Film Market Executive Summary

The Diazo Film Market demonstrates a steady growth trajectory driven primarily by resilience in specialized end-use sectors, counteracting the broader decline caused by digital substitution. Business trends highlight a consolidation among key manufacturers focusing on improving film durability, thermal stability, and optimizing ammonia-free development systems to comply with evolving environmental regulations. Strategic partnerships are crucial for maintaining efficient global distribution networks, especially catering to specialized technical printing and micrographic service bureaus that form the core consumer base. Manufacturers are investing minimally in radical innovation, prioritizing supply chain robustness and consistency in established product formulations that meet stringent archival standards, ensuring long-term product availability for legacy systems.

Regionally, North America and Europe continue to dominate the market, largely due to high demand from institutional archives, major governmental documentation centers, and established industrial engineering sectors relying on aperture cards and large-format Diazo prints. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, albeit from a smaller base, fueled by rapid industrialization, increasing governmental documentation requirements, and the gradual adoption of specialized micrographic solutions for preserving crucial historical and technical data across emerging economies. Investment in developing regions often focuses on modernizing existing archival infrastructure, thereby sustaining the need for Diazo film materials and processing equipment.

Segment trends indicate that the Microfilm and Microfiche segment holds the largest market share, directly linked to archival and documentation preservation requirements across finance, insurance, and government sectors. Conversely, the Industrial Printing segment, though smaller, exhibits robust stability, driven by specific technical requirements in printed circuit board (PCB) manufacturing and specialized drafting processes where Diazo film’s dimensional stability is indispensable. Continuous technological improvements focus on enhancing the resolution and density characteristics of Diazo films to meet evolving precision demands in industrial phototooling, while product simplification remains a goal for user-friendly archival applications.

AI Impact Analysis on Diazo Film Market

User inquiries regarding AI's influence on the Diazo Film Market frequently center on whether intelligent automation will render physical preservation obsolete or if AI tools can enhance the usability of existing Diazo archives. Key concerns revolve around the perceived obsolescence risk, the integration feasibility of AI-driven digitization processes, and the optimization potential for Diazo manufacturing logistics. Users seek to understand if Machine Learning (ML) models can efficiently catalog, index, and retrieve data from vast Diazo microfilm collections, thus extending the functional lifespan of these physical assets. Conversely, there is apprehension that AI-powered digital twins and automated digital drafting systems will fundamentally eliminate the need for physical Diazo blueprints in engineering and construction industries.

The consensus emerging from this analysis is that AI does not directly displace Diazo film production but significantly influences the downstream handling and utilization of Diazo-based records. AI-driven solutions are crucial in high-speed, high-accuracy digitization projects, employing computer vision and optical character recognition (OCR) to convert microform images into searchable, structured data. This integration increases the accessibility and economic value of legacy Diazo archives, slowing their inevitable replacement. Furthermore, predictive maintenance algorithms, a core application of industrial AI, can optimize the complex chemical processes involved in Diazo film manufacturing and coating, ensuring quality control and minimizing waste, thereby providing subtle efficiency gains rather than revolutionary change. The primary transformative effect lies in managing the immense volume of data previously stored only on Diazo media.

- AI accelerates the digitization of Diazo microform, enhancing data accessibility.

- Machine Learning (ML) improves OCR and indexing accuracy for archival content retrieval.

- AI tools in engineering drafting reduce the long-term need for new physical Diazo blueprints.

- Predictive maintenance optimizes Diazo film coating and chemical process consistency.

- AI helps in managing inventory and predicting demand for niche archival products.

- Automated quality control systems use computer vision to inspect film defects during production.

DRO & Impact Forces Of Diazo Film Market

The Diazo Film Market is governed by a complex interplay of Drivers, Restraints, and Opportunities. Key drivers include the mandatory requirements for long-term document preservation in governmental and financial sectors, where the longevity and regulatory acceptance of microfilm remain unparalleled. The established infrastructure and relatively low unit cost of Diazo reproduction, especially for legacy systems and large-format architectural drawings, further support sustained demand. However, the market faces significant restraints, primarily the pervasive substitution by advanced digital imaging and storage technologies which offer superior retrieval speed, storage density, and environmental friendliness. The reliance on ammonia for development in traditional systems poses environmental and occupational health challenges, necessitating investment in less reactive, often more costly, alternative thermal development methods.

Opportunities in the market center around innovation in thermal Diazo film technology (ammonia-free processing), catering to environmentally conscious clients and smaller laboratories. Furthermore, expanding applications in specialized industrial phototooling, particularly within the electronics sector where specific Diazo properties are valuable for precision masking, represent a stable growth avenue. The market benefits from the "impact forces" derived from the technological lock-in effect, where the massive existing base of micrographic equipment and archives necessitates the continued purchase of compatible Diazo consumables, stabilizing revenue for core manufacturers. External forces such as stringent data retention laws in critical infrastructure sectors also provide an underlying layer of demand resilience.

The impact forces are predominantly internal and regulatory. Archival standards bodies and governmental regulations defining acceptable long-term storage formats (e.g., ANSI, ISO standards for micrographics) exert significant positive influence, effectively locking in demand for media like Diazo film which meets these benchmarks. Conversely, the market is restrained by the lack of significant entry of new, disruptive technologies within the Diazo segment itself, relying instead on incremental improvements. The environmental push toward "green" chemistry acts as both a restraint (due to ammonia handling) and an opportunity (for thermal film development), forcing manufacturers to adapt operational procedures and product formulation to maintain market relevance.

Segmentation Analysis

The Diazo Film Market is comprehensively segmented based on product type, end-use application, and development method, allowing for a granular understanding of consumer needs and market dynamics. Segmentation by product type primarily distinguishes between Diazo Microfilm, used for archival storage, and Diazo Technical Film, employed for drafting and specialized industrial phototooling. Application segmentation reveals critical areas of demand, with Government & Archival Institutions forming the backbone of the market due to their massive preservation needs, followed by Engineering & Construction, and specialized Electronics Manufacturing. Understanding these segments is crucial as demand stability varies significantly; archival segments are driven by regulatory compliance and historical needs, while industrial segments are sensitive to manufacturing cycle volatility.

- By Product Type:

- Diazo Microfilm (Roll Film, Microfiche, Aperture Cards)

- Diazo Technical Film (Drafting/Blueprints, Specialized Phototools)

- By Development Method:

- Wet Development (Ammonia-based)

- Thermal Development (Heat-based/Ammonia-free)

- By Film Base Material:

- Polyester (PET)

- Acetate

- By Application:

- Government & Archival Institutions (Libraries, Historical Societies)

- Engineering & Construction (CAD/Drafting Backup)

- Electronics Manufacturing (Phototooling Masks)

- Finance & Insurance (Record Keeping)

Value Chain Analysis For Diazo Film Market

The value chain for the Diazo Film Market commences with upstream analysis, focusing on the sourcing and supply of raw materials, which are highly specialized. This includes the manufacturing of high-quality, dimensionally stable base films, predominantly polyester (PET) or sometimes acetate, and the synthesis of light-sensitive diazonium salts and associated chemical couplers necessary for image formation. This stage requires significant chemical expertise and specialized coating facilities, often involving highly concentrated raw material suppliers due to the niche nature of the product. Upstream cost fluctuations in petrochemical derivatives (for the film base) and specialized chemicals are key determinants of overall product pricing and margin stability.

The midstream phase involves the core manufacturing process: coating the film base with the diazo sensitizer solution, slitting the material into required formats (rolls, sheets, aperture card stock), and meticulous quality control to ensure uniform sensitivity and absence of defects. This step is capital-intensive, requiring clean-room conditions and precision machinery. Downstream activities involve packaging and distribution. The distribution channel is characterized by a mix of direct sales to large governmental procurement entities and indirect distribution through specialized micrographic equipment dealers, technical printing supply companies, and archival service bureaus. These distributors often provide complementary services such as processing equipment maintenance and technical support, playing a crucial role in reaching the highly specialized end-user base.

Direct channels are typically reserved for large volume contracts with institutional clients, ensuring consistent supply and negotiated pricing. Indirect channels are vital for penetrating smaller engineering firms and archives that rely on local expertise and integrated solutions. The efficiency of this downstream segment relies heavily on maintaining a trained network capable of handling specialized chemical products and supporting the necessary development equipment (both wet and thermal developers). The expertise required in handling and utilizing Diazo film materials and equipment dictates that the distribution network must possess technical competence, differentiating it from commodity product distribution models.

Diazo Film Market Potential Customers

Potential customers for the Diazo Film Market are predominantly institutions and technical organizations with stringent long-term data retention mandates and requirements for durable, non-digital backup solutions. The primary end-users are government agencies, including national archives, municipal records offices, and military departments, which rely on microfilm and microfiche to store documents permanently, often exceeding 50 to 100 years, a feat difficult to guarantee with contemporary digital storage media subject to rapid technological obsolescence and format migration challenges. These institutions prioritize regulatory compliance and archival quality over modern digital convenience.

The second major consumer group consists of large engineering, architectural, and construction firms, particularly those involved in long-term infrastructure projects or managing extensive historical technical documentation. These companies utilize Diazo film for aperture cards and large-format copies of blueprints, ensuring that mission-critical technical drawings are accessible even without specialized digital infrastructure. Furthermore, organizations in the finance and insurance sectors often use Diazo microfiche for legally mandated record-keeping of transactional data, valuing the tamper-proof nature and verifiable authenticity inherent in physical film records.

Lastly, specialized electronics manufacturers and graphic arts studios constitute a smaller but technologically crucial customer base. They leverage the dimensional stability and high resolution of Diazo technical films to create precision phototools necessary for manufacturing printed circuit boards (PCBs), specialized instrumentation scales, or high-accuracy optical masters. This segment requires the highest quality film products tailored for specific exposure and processing parameters, sustaining a niche market focused entirely on performance characteristics rather than archival volume.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 185.5 Million |

| Market Forecast in 2033 | USD 255.0 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AGFA-Gevaert NV, Eastman Kodak Company, FujiFilm Holdings Corporation, Canon Inc., Bexford, Zydex, Shanghai Huagong Film Co., Ltd., Poligraphics Private Limited, Micro-Image Technology, Aris Microfilm, Rhone-Poulenc, Kalle, Oce NV (Canon Group), Mitsubishi Imaging (MPM), MacDermid Alpha Electronics Solutions, Tetenal, Imation Corp., 3M Company, Konica Minolta, EIKOSHA Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Diazo Film Market Key Technology Landscape

The technological landscape of the Diazo Film Market, while mature, focuses on continuous refinement rather than revolutionary breakthroughs, primarily targeting consistency, longevity, and environmental performance. The core technology centers on the photo-sensitive coating process, where precise control over the mixture of diazonium salts, stabilizers, and couplers is paramount to achieving desired contrast and resolution characteristics. Key advancements are concentrated in maximizing D-max (maximum density) for high-contrast images, critical for sharp reproduction of fine lines and archival clarity. Furthermore, manufacturers dedicate research to enhancing the film base's dimensional stability, particularly important for technical and engineering films where minimal thermal expansion or contraction is essential for accuracy in phototooling and large-format printing applications.

A significant technological trajectory involves the shift from traditional wet (ammonia) development to thermal development systems. Wet development, while cost-effective for large volumes, requires specialized ventilation and handling due to the use of hazardous ammonia vapor. Thermal Diazo technology utilizes heat to activate the coupling process, resulting in an odor-free, "dry" development system that is environmentally friendlier and more suitable for smaller decentralized operations. This ammonia-free technology requires specialized sensitizer formulations that remain stable until activated by heat, representing a critical area of ongoing material science refinement and offering a competitive edge for manufacturers catering to modern workplace safety standards.

Other technological developments focus on integrating Diazo media into hybrid digital-archival workflows. This includes optimizing film chemistry for compatibility with high-speed, high-resolution scanners (microfilm scanners), enabling efficient conversion to digital formats for easier access while retaining the film as the permanent master record. The development of advanced anti-static coatings and scratch-resistant surfaces is also essential for maintaining film integrity during repeated handling and scanning operations. Ultimately, the technology landscape prioritizes reliability and compatibility with legacy equipment and modern digitization requirements, ensuring the material remains a viable component of long-term data preservation strategies.

Regional Highlights

The global Diazo Film Market exhibits distinct consumption patterns across major geographical regions, influenced by economic development, regulatory environments, and the maturity of archival infrastructure.

- North America: This region maintains a significant market share, driven by extensive government archives (federal, state, and local), large institutional libraries, and a mature defense and aerospace engineering sector that utilizes aperture cards for technical data. Demand is stable, characterized by strict adherence to archival standards and a high prevalence of legacy micrographic systems requiring consistent consumable supply. The market here is highly quality-sensitive.

- Europe: Similar to North America, Europe is a cornerstone of the Diazo market, primarily due to rigorous historical preservation mandates, especially in countries like Germany, France, and the UK. The European market shows a higher propensity towards adopting thermal (ammonia-free) Diazo systems due to stringent environmental and occupational safety regulations, spurring innovation in development technologies.

- Asia Pacific (APAC): APAC is anticipated to demonstrate the fastest growth rate. This growth is spurred by rapid industrialization in countries like China, India, and South Korea, leading to increasing volumes of technical documentation and a growing governmental focus on formalizing and modernizing national archives. While initially adopting lower-cost solutions, the demand for high-quality archival and specialized technical film is escalating.

- Latin America (LATAM): The LATAM market is relatively smaller but stable, driven primarily by government records management and large corporate financial archives seeking long-term, secure document storage solutions amidst varying levels of digital infrastructure reliability. Price sensitivity is higher in this region, influencing procurement towards cost-effective options.

- Middle East and Africa (MEA): Demand in MEA is highly localized, often centered around petroleum/resource engineering projects requiring documentation backup and governmental bodies investing in establishing formal national archives. Growth is steady but dependent on public sector investment in infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Diazo Film Market.- AGFA-Gevaert NV

- Eastman Kodak Company

- FujiFilm Holdings Corporation

- Canon Inc. (Oce N.V.)

- Bexford

- Zydex

- Shanghai Huagong Film Co., Ltd.

- Poligraphics Private Limited

- Micro-Image Technology

- Aris Microfilm

- Kalle Infotec (now part of a larger chemical conglomerate)

- Mitsubishi Imaging (MPM)

- MacDermid Alpha Electronics Solutions

- Tetenal

- Imation Corp.

- 3M Company

- Konica Minolta

- EIKOSHA Co., Ltd.

- General Microfilm Company

- Realist Inc.

Frequently Asked Questions

Analyze common user questions about the Diazo Film market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Diazo film and traditional silver-halide film?

Diazo film is a non-silver duplicating material that uses diazonium salts sensitive to UV light, providing direct positive copies cheaply and easily without complex wet processing required by silver-halide film. Diazo films are primarily used for duplication and archival copies, while silver-halide films serve as original capture media.

Is the Diazo Film Market declining due to the widespread adoption of digital scanning and storage?

While digital substitution has reduced general use, the Diazo market maintains stability in niche areas. It is sustained by mandatory archival requirements (longevity exceeds digital guarantees) and specialized industrial applications where its unique dimensional stability and low production cost for duplicates are irreplaceable.

What are the environmental concerns associated with Diazo film development?

Traditional Diazo films rely on wet development using ammonia vapor, which poses occupational health and environmental disposal challenges. To mitigate this, manufacturers are increasingly developing and promoting thermal Diazo films, which use heat activation and are entirely ammonia-free, aligning with current sustainability trends.

Which geographical region exhibits the highest growth potential for Diazo film consumption?

The Asia Pacific (APAC) region is projected to show the highest growth rate. This is due to rapid infrastructure development, increased industrial activity requiring technical documentation backup, and rising governmental investments in formal, long-term national archival solutions.

How is Diazo film utilized in modern electronics manufacturing?

In electronics manufacturing, specifically for Printed Circuit Boards (PCBs), high-resolution Diazo technical films are utilized as phototools or masking materials. Their precise dimensional stability is critical for accurately transferring complex circuit patterns during the photolithography process.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager