Dicaprylyl Carbonate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436766 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Dicaprylyl Carbonate Market Size

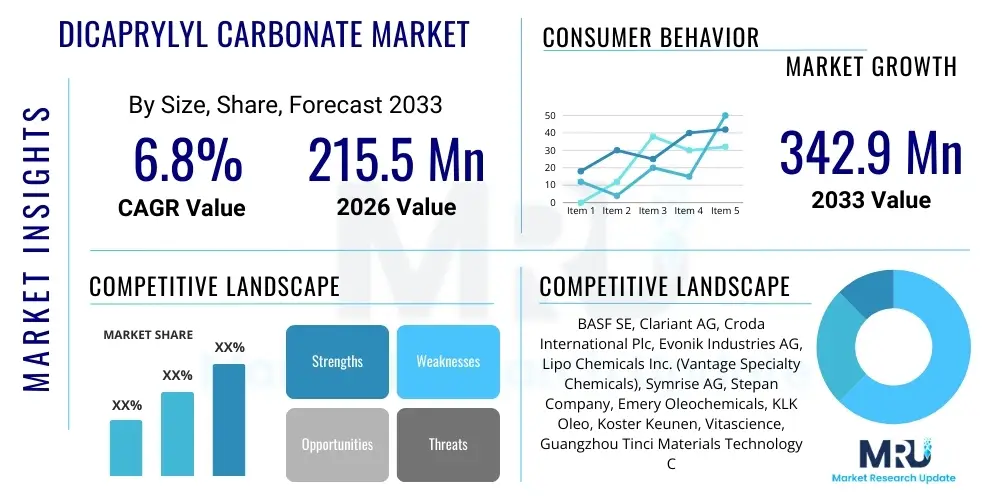

The Dicaprylyl Carbonate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 215.5 Million in 2026 and is projected to reach USD 342.9 Million by the end of the forecast period in 2033.

Dicaprylyl Carbonate Market introduction

Dicaprylyl Carbonate (DCC) is a highly valued emollient and spreading agent derived primarily from vegetable oils, notably coconut oil, and subsequently processed through reaction with dimethyl carbonate. This ester is characterized by its exceptional sensory profile, offering a non-greasy, dry, and light skin feel, making it an ideal alternative to silicones and mineral oils in high-end cosmetic formulations. The substance is chemically stable, clear, odorless, and easily biodegradable, aligning perfectly with the increasing consumer demand for sustainable and clean-label ingredients within the personal care industry. Its primary function in formulations includes enhancing product spreadability, acting as a solvent for UV filters and fat-soluble vitamins, and improving the aesthetics of emulsions.

Major applications for Dicaprylyl Carbonate span across numerous segments of the cosmetics and personal care sector, including sunscreens, facial moisturizers, body lotions, anti-aging creams, and color cosmetics such as foundations and lip products. In sunscreen formulations, DCC is particularly effective as it aids in the uniform dispersion of inorganic and organic UV filters, ensuring optimal protection factor distribution without leaving a heavy or tacky residue. Furthermore, its inclusion significantly improves the texture and wearability of mineral makeup, offering a smooth application and matte finish that is highly sought after by modern consumers, especially in regions focusing on advanced dermatology and high-performance skincare.

The market is primarily driven by the escalating global shift towards natural and bio-based ingredients, catalyzed by stringent regulatory pressures against traditional petroleum-derived compounds and increasing consumer awareness regarding ingredient sourcing. The perceived benefits of DCC, such as its excellent compatibility with various active ingredients, its ability to reduce the greasiness associated with high oil-content formulations, and its role as a skin conditioning agent, solidify its position as a preferred raw material. These drivers are further amplified by continuous innovation in cosmetic delivery systems and the rising prevalence of multifunctional cosmetic products that necessitate versatile and high-performance emollients.

Dicaprylyl Carbonate Market Executive Summary

The Dicaprylyl Carbonate market is exhibiting robust growth, fundamentally propelled by critical business trends focusing on sustainability, green chemistry, and the premiumization of cosmetic formulations globally. Key industry players are aggressively investing in expanding their production capacities and refining synthesis methods to ensure compliance with strict environmental standards, particularly regarding the sourcing of bio-based raw materials. The shift from synthetic alternatives to naturally derived emollients represents a major pivot point for the industry, driving competitive strategies centered on supply chain transparency and certification standards, such as COSMOS and Ecocert, which are increasingly demanded by B2B buyers and end consumers alike. Furthermore, strategic collaborations between raw material suppliers and major cosmetic manufacturers are essential for co-developing novel product applications that leverage the unique sensory properties of DCC in advanced skin care and hair care systems.

Regional trends indicate that the Asia Pacific (APAC) region, spearheaded by dynamic markets like China, Japan, and India, constitutes the fastest-growing segment, largely due to rapid urbanization, rising disposable incomes, and the cultural emphasis on skincare routines (e.g., K-beauty and J-beauty trends). This region's demand is focused heavily on high SPF sun care products and advanced anti-pollution formulations, where the non-greasy nature of DCC is highly beneficial. Conversely, North America and Europe, representing mature markets, show strong demand driven by regulatory adherence (REACH regulations in Europe influencing ingredient choices) and a pronounced preference for premium, ethical, and vegan cosmetic ingredients. European demand particularly emphasizes sustainable sourcing and low carbon footprint production, pressuring suppliers to continuously optimize their manufacturing processes for efficiency and minimal environmental impact.

Segment trends demonstrate a significant reliance on the application segment, with sun care products and facial moisturizers being the predominant consumers of DCC, given its superior solvent and spreading characteristics. From a grade perspective, the high-purity cosmetic grade of Dicaprylyl Carbonate commands a premium, driven by its consistent quality required for sensitive skin formulations and pharmaceutical-grade excipients. Emerging segments, such as natural and organic cosmetics, are accelerating the demand for certified bio-based DCC. The market structure remains moderately consolidated, with a few large multinational chemical companies dominating production, although specialized small and medium enterprises (SMEs) focusing on green chemistry innovations are steadily gaining market share through niche product offerings and superior sustainability profiles.

AI Impact Analysis on Dicaprylyl Carbonate Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Dicaprylyl Carbonate market frequently revolve around its role in optimizing R&D cycles, improving supply chain resilience, and predicting consumer ingredient preferences. Users are keen to understand how AI can accelerate the discovery of more efficient and sustainable synthesis routes for DCC, potentially reducing energy consumption and waste during production. There is also significant user concern about how machine learning algorithms are being deployed by major cosmetic houses to predict which emollients and excipients, like DCC, will trend next, thereby influencing inventory management and future product formulation strategies. Furthermore, questions address the potential for AI-driven quality control, ensuring consistent purity and performance across large batches of DCC, which is critical for specialized applications.

The implementation of AI and machine learning (ML) is fundamentally transforming the manufacturing and utilization landscape of Dicaprylyl Carbonate by enabling predictive analytics across the value chain. In chemical manufacturing, AI-powered process optimization tools can monitor reaction conditions in real-time, adjusting parameters to maximize yield and purity while minimizing unwanted byproducts, leading to lower operating costs and enhanced sustainability. These systems are crucial for maintaining the delicate balance required in esterification processes used to synthesize DCC. Simultaneously, on the formulation side, ML models are analyzing vast datasets of sensory attributes, consumer reviews, and physicochemical data to rapidly prototype new cosmetic formulations, identifying optimal combinations of DCC with other active ingredients to achieve specific textural and performance characteristics that resonate with targeted demographics.

Moreover, AI is playing an increasing role in proactive supply chain risk management. Given that the raw materials for bio-based DCC often originate from agriculture (e.g., coconut/palm kernel oil derivatives), which are susceptible to climatic variations and geopolitical instability, AI algorithms are used to forecast potential supply bottlenecks, predict commodity price fluctuations, and recommend alternative sourcing strategies. This proactive capability ensures a stable and reliable supply of Dicaprylyl Carbonate for major downstream manufacturers, mitigating risks associated with ingredient scarcity and price volatility. This integration of digital intelligence ensures that the market remains responsive to both environmental challenges and rapidly evolving consumer expectations for clean and consistent ingredients.

- AI optimizes DCC synthesis processes, enhancing yield and reducing energy consumption through real-time monitoring.

- Machine Learning (ML) accelerates cosmetic formulation R&D by predicting optimal ingredient combinations and sensory profiles involving DCC.

- AI-driven supply chain platforms forecast raw material availability (e.g., coconut oil derivatives), ensuring supply resilience and stable pricing.

- Predictive analytics aids key cosmetic brands in anticipating future consumer demand for specific clean-label emollients like Dicaprylyl Carbonate.

- Automated quality control systems utilize computer vision and data analytics to verify the purity and consistency of manufactured DCC batches.

DRO & Impact Forces Of Dicaprylyl Carbonate Market

The dynamic forces shaping the Dicaprylyl Carbonate market are centered around stringent regulatory oversight and accelerating demand for green chemistry alternatives, coupled with underlying technological limitations and economic pressures. Key drivers include the overwhelming consumer preference for high-performance, non-comedogenic emollients, especially those perceived as natural or naturally derived substitutes for traditional silicone oils, which are facing increasing environmental scrutiny. The versatility of DCC across multiple product formats—from light moisturizers to heavy sunscreens—ensures broad market appeal. However, restraints manifest primarily as the high initial cost of bio-based feedstock materials and potential price volatility linked to agricultural commodities. Furthermore, the synthesis process, while refined, still requires specific catalytic systems and energy input, presenting an ongoing challenge for manufacturers aiming for zero-carbon production.

Opportunities within the market are substantial, largely residing in geographical expansion into emerging economies where personal care product penetration is rapidly increasing, and in segment diversification, particularly the booming market for men's grooming and specialized hair care products. Developing advanced, high-purity grades of Dicaprylyl Carbonate tailored for sensitive skin care and pediatric dermatology presents a lucrative avenue for specialized manufacturers. The ongoing technological push towards enzymatic esterification and solvent-free synthesis methods represents a significant opportunity to lower production costs and improve the environmental footprint, thereby resolving some current restraints. Strategic positioning as a key component in novel, encapsulated delivery systems for complex actives also promises increased market valuation and application scope.

The impact forces influencing the market trajectory are multi-layered, driven notably by shifts in consumer psychology favoring transparency and ingredient ethics, alongside competitive pressures forcing innovation. Regulatory changes, such as phase-outs of certain high-chain silicone compounds in regions like the European Union, create mandatory substitution demand, strongly benefiting DCC. The competitive rivalry among chemical suppliers necessitates continuous product differentiation based on sustainability certifications (e.g., RSPO certification for palm derivatives) and technical support capabilities provided to formulators. Ultimately, the market growth is heavily dependent on sustained investment in R&D to maintain DCC's cost-effectiveness and performance superiority compared to alternative synthetic esters and natural oils, ensuring its dominance in the premium emollient category.

Segmentation Analysis

The Dicaprylyl Carbonate market is comprehensively segmented primarily based on application type, function within formulations, and the regional geography governing consumption and production patterns. Understanding these segments is crucial for strategic market positioning, as distinct end-use industries exhibit varying demands concerning purity, volume, and supply chain requirements. The segmentation by function, such as emollient versus solvent or spreading agent, dictates the concentration and grade required by manufacturers. Meanwhile, segmentation by application, including specialized segments like baby care versus mainstream sun care, allows suppliers to tailor their technical support and product offerings effectively to meet the specific safety and performance standards of each category.

- By Application:

- Sun Care Products

- Facial and Body Moisturizers

- Anti-Aging and Specialized Treatments

- Color Cosmetics (Foundations, Lipsticks)

- Hair Care Products (Shampoos, Conditioners)

- Baby Care Products

- By Function:

- Emollient and Skin Conditioner

- Solvent and Dispersing Agent (for UV filters and pigments)

- Spreading Agent

- Silicone Replacement/Alternative

- By Source:

- Natural/Bio-based (Derived from vegetable oils)

- Synthetic/Petrochemical-based (Minority share, declining)

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Dicaprylyl Carbonate Market

The Dicaprylyl Carbonate value chain begins with the upstream sourcing and processing of raw materials, primarily focusing on vegetable oils such as coconut oil or palm kernel oil, which yield the required caprylic alcohol and capric acid derivatives. This stage is characterized by high sensitivity to agricultural commodity price fluctuations, necessitating robust sourcing strategies and often requiring sustainability certifications, such as those from the Roundtable on Sustainable Palm Oil (RSPO). Following the extraction and purification of these fatty alcohols, they are reacted with a carbonating agent, typically dimethyl carbonate (DMC), in a specialized esterification process, marking the crucial manufacturing stage. The success of this upstream activity depends heavily on efficient chemical synthesis, catalyst management, and stringent quality control protocols to produce high-purity cosmetic-grade DCC, which is free from impurities and residues.

The midstream involves the distribution and marketing of the finished Dicaprylyl Carbonate product. Distribution channels are bifurcated into direct sales, where large multinational chemical companies supply directly to Tier 1 cosmetic manufacturers (e.g., L’Oréal, Estée Lauder), and indirect sales through specialized chemical distributors and agents. Distributors play a vital role in servicing smaller cosmetic brands and providing technical assistance regarding formulation compatibility and regulatory compliance, particularly across disparate international markets. Effective inventory management and specialized warehousing are necessary to maintain product quality and ensure timely delivery, particularly to regions with fast-moving consumer goods (FMCG) production hubs like APAC.

The downstream segment encompasses the final formulation and end-use application of DCC within the personal care industry. Cosmetic manufacturers are the principal consumers, integrating DCC into complex formulations such as anhydrous sunscreens, high-end serums, and moisturizing creams, leveraging its sensory benefits and solvent properties. The selection and procurement of DCC are often guided by regulatory compliance in the target market and the specific textural claims the finished product intends to make (e.g., "dry-touch," "silicone-free"). The final stage involves marketing and sales to the end consumers, where the presence of clean, bio-derived ingredients like Dicaprylyl Carbonate often acts as a key marketing differentiator, highlighting the connection between upstream sourcing and consumer perception of product quality and ethics.

Dicaprylyl Carbonate Market Potential Customers

The primary and most significant potential customers for Dicaprylyl Carbonate are global and regional manufacturers within the cosmetics and personal care sector. These businesses, ranging from large multinational corporations specializing in mass-market brands to boutique firms focusing on niche, organic, or professional skincare, utilize DCC as a foundational component in their formulation matrix. Specifically, companies focusing on high-SPF chemical and mineral sunscreens represent a major buying segment, given DCC's effectiveness in dissolving and stabilizing UV filters while providing the desirable light skin feel demanded by consumers. Additionally, manufacturers of premium anti-aging creams and facial serums frequently use DCC due to its ability to improve the spreadability of highly concentrated active ingredients without imparting greasiness.

A rapidly expanding customer base includes manufacturers specializing in 'clean beauty' and certified natural/organic personal care products. These customers prioritize sourcing certified bio-based Dicaprylyl Carbonate that meets strict criteria for naturality, biodegradability, and ethical sourcing, aligning with consumer demand for transparency. Furthermore, the specialized segment of color cosmetics—particularly foundations, concealers, and BB creams—represents significant potential, as DCC provides a smooth, non-oily carrier for pigments, improving wear time and finish. The purchasing decisions of these potential customers are highly influenced by factors beyond price, including sensory evaluation data, supplier certification (e.g., ECOCERT/COSMOS approval), and the consistency of the ingredient's quality and supply chain resilience.

Beyond the traditional cosmetic sector, there is emerging potential in adjacent industries, specifically in certain dermatological and pharmaceutical applications. DCC can function as an inert excipient or carrier oil for topical drug delivery systems, particularly those requiring enhanced skin penetration and reduced systemic exposure. This niche segment, while currently smaller in volume compared to cosmetics, demands the highest purity grades and stringent regulatory documentation, offering high-value contracts. Overall, the diversified applications across sun care, facial care, hair care, and color cosmetics establish a robust and varied end-user profile characterized by a strong emphasis on formulation innovation and ingredient performance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 215.5 Million |

| Market Forecast in 2033 | USD 342.9 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Clariant AG, Croda International Plc, Evonik Industries AG, Lipo Chemicals Inc. (Vantage Specialty Chemicals), Symrise AG, Stepan Company, Emery Oleochemicals, KLK Oleo, Koster Keunen, Vitascience, Guangzhou Tinci Materials Technology Co., Ltd., Sensient Technologies Corporation, Gattefossé, Sonneborn LLC, Berg + Schmidt GmbH & Co. KG, Phoenix Chemical, Inc., Dow Inc., Lonza Group, Wacker Chemie AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dicaprylyl Carbonate Market Key Technology Landscape

The technology landscape for the Dicaprylyl Carbonate market is predominantly defined by advancements in esterification chemistry, aiming for greener, more efficient, and solvent-free production methods. The conventional synthesis involves the transesterification of fatty alcohols (derived from caprylic acid) using phosgene derivatives or dimethyl carbonate (DMC). Current technological focus is placed on enhancing the catalytic systems used in the reaction with DMC, moving towards heterogeneous catalysts that are easily recyclable, minimize waste generation, and reduce the reaction temperature and pressure requirements. This push for advanced catalysis directly addresses both the cost-efficiency demands of manufacturers and the strict environmental standards imposed by global regulatory bodies, specifically regarding solvent emissions and energy consumption, leading to a more favorable life cycle assessment for the resulting product.

Furthermore, process intensification technologies, including continuous flow chemistry and microreactor technology, are emerging as key enablers for next-generation DCC production. These technologies offer superior control over reaction kinetics, ensuring higher purity and tighter molecular weight distribution, which is crucial for high-end cosmetic applications where consistency is paramount. Continuous flow reactors allow for safer handling of raw materials, better heat management, and significantly reduced reaction times compared to traditional batch processes. Adopting these advanced chemical engineering techniques provides a competitive advantage to firms capable of large-scale production while maintaining the rigorous quality specifications required by global personal care brands looking for reliable, high-performing emollients.

Beyond synthesis, technological innovation extends to purification and formulation science. Advanced distillation and filtration techniques, such as molecular distillation and membrane filtration, are employed to remove residual catalysts, unreacted starting materials, and potential odor-causing trace elements, ensuring the final DCC product is ultra-pure and sensory-neutral. In formulation, nanotechnologies and advanced encapsulation systems are utilizing DCC as a key non-polar solvent within delivery vehicles to enhance the dermal penetration and stability of sensitive active ingredients, such as vitamins and retinoids. This technological integration positions Dicaprylyl Carbonate not merely as a carrier, but as an integral performance enhancer in sophisticated cosmetic matrices, expanding its functional versatility and market value beyond simple emollience.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the market and is projected to exhibit the highest CAGR during the forecast period. This growth is driven by massive consumption in key markets like China, Japan, and South Korea, which lead global trends in advanced skincare and cosmetics. The rising middle class, coupled with a strong cultural emphasis on intensive beauty routines and sun protection (leading to high demand for sunscreens where DCC excels), fuels market expansion. Regulatory landscapes in this region are rapidly maturing, encouraging the adoption of high-performance, safe ingredients, further benefiting DCC.

- Europe: Europe is a mature but highly dynamic market, characterized by stringent environmental regulations, particularly the European Union's focus on phasing out specific silicones and microplastics (like certain D-series cyclics), creating mandatory substitution demand for bio-derived alternatives such as DCC. Consumer preferences here strongly favor COSMOS and Ecocert certified natural ingredients, pushing manufacturers to prioritize sustainable sourcing and transparent supply chains. Germany, France, and the UK are major consumption hubs, focusing on high-end, ethical, and organic cosmetic lines.

- North America: North America represents a substantial market share, driven by a high awareness of skin health, robust anti-aging product consumption, and a significant movement toward "clean beauty" formulations. U.S. consumer demand for non-greasy, fast-absorbing products, especially in daily moisturizers and broad-spectrum sunscreens, ensures sustained high demand for Dicaprylyl Carbonate. Innovation is rapid, often centering around multifunctional products that utilize DCC to enhance stability and sensory appeal, frequently serving as an approved excipient in Over-the-Counter (OTC) sun protection products.

- Latin America (LATAM): The LATAM market, notably Brazil and Mexico, is expanding rapidly due to improving economic conditions and increased consumer spending on personal grooming products. Brazil, in particular, has a high consumption rate for hair care and sun care products. The market here is price-sensitive but increasingly values high-quality, regionally sourced ingredients, although the supply chain often relies heavily on imports of specialty chemicals like DCC, presenting logistical challenges and opportunities for regional distribution networks.

- Middle East and Africa (MEA): The MEA market shows promising, albeit localized, growth, largely concentrated in the UAE and Saudi Arabia, driven by high disposable incomes and a preference for luxury personal care and fragrance products. DCC is valued here for its ability to function as an excellent carrier oil for complex fragrance components and its light feel suitable for use in warmer climates. Local production capacity for advanced emollients remains limited, making it primarily an import-driven market, focused on meeting the demands of modern retail cosmetic giants entering the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dicaprylyl Carbonate Market.- BASF SE

- Clariant AG

- Croda International Plc

- Evonik Industries AG

- Lipo Chemicals Inc. (Vantage Specialty Chemicals)

- Symrise AG

- Stepan Company

- Emery Oleochemicals

- KLK Oleo

- Koster Keunen

- Vitascience

- Guangzhou Tinci Materials Technology Co., Ltd.

- Sensient Technologies Corporation

- Gattefossé

- Sonneborn LLC

- Berg + Schmidt GmbH & Co. KG

- Phoenix Chemical, Inc.

- Dow Inc.

- Lonza Group

- Wacker Chemie AG

Frequently Asked Questions

Analyze common user questions about the Dicaprylyl Carbonate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Dicaprylyl Carbonate primarily used for in cosmetic formulations?

Dicaprylyl Carbonate is primarily used as a high-performance emollient, spreading agent, and solvent in cosmetic formulations. It provides a highly sought-after non-greasy, dry-touch finish, making it an excellent alternative to silicones and mineral oils in sunscreens, moisturizers, and color cosmetics. It aids in the efficient dispersion of pigments and UV filters.

Is Dicaprylyl Carbonate considered a clean or natural ingredient?

Yes, Dicaprylyl Carbonate is widely accepted as a clean-label ingredient. It is typically derived from renewable, plant-based sources, such as coconut or palm kernel oil, through green chemistry processes. Many grades are certified by organizations like COSMOS and ECOCERT, supporting its classification as a natural and highly biodegradable component.

How does the regulatory environment impact the Dicaprylyl Carbonate market?

The regulatory environment strongly favors Dicaprylyl Carbonate, especially in Europe and North America, as regulations tighten concerning traditional synthetic emollients like certain silicones. This regulatory pressure mandates ingredient substitution, positioning DCC as a preferred, compliant, and sustainable alternative for major cosmetic manufacturers globally.

What are the key drivers of growth in the Dicaprylyl Carbonate market?

The key drivers include the accelerating consumer demand for natural, ethical, and high-performance beauty products; the critical need for silicone replacement ingredients offering comparable sensory benefits; and the continuous expansion of the global sun care and anti-aging segments, both of which rely heavily on DCC for optimal formulation aesthetics.

Which geographical region holds the largest potential for Dicaprylyl Carbonate market expansion?

The Asia Pacific (APAC) region, driven by markets like China and South Korea, offers the largest potential for expansion. This is due to rapid growth in disposable incomes, a cultural emphasis on multi-step skincare routines, and intense demand for innovative, light-feel sunscreen and specialized cosmetic formulations that utilize DCC.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager