Dichlorobenzoic Acid Isomers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433533 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Dichlorobenzoic Acid Isomers Market Size

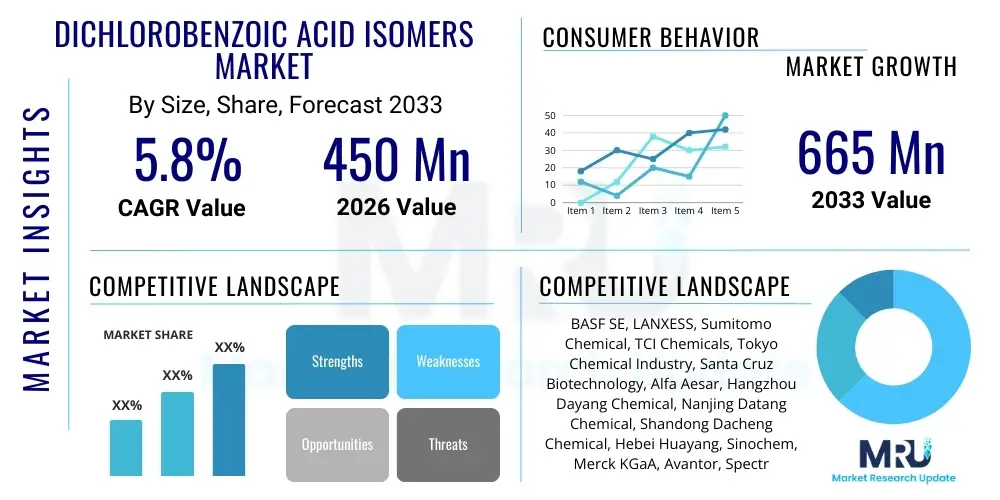

The Dichlorobenzoic Acid Isomers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 665 Million by the end of the forecast period in 2033.

Dichlorobenzoic Acid Isomers Market introduction

Dichlorobenzoic Acid (DCBA) isomers, including 2,4-DCBA, 3,4-DCBA, and 2,3-DCBA, are crucial intermediates in various industrial synthesis processes. These organic compounds are characterized by a benzene ring substituted with two chlorine atoms and a carboxylic acid group, resulting in distinct chemical properties and reactivity profiles depending on the position of the substituents. The versatility of these isomers makes them indispensable building blocks, particularly in the production of herbicides, fungicides, dyes, and pharmaceutical active ingredients. The market growth is fundamentally linked to the expansion of the agricultural sector globally, which heavily relies on DCBA derivatives for crop protection chemicals, ensuring sustained demand across various geographic regions.

The primary applications of Dichlorobenzoic Acid Isomers span across agrochemicals and specialty chemicals. In the agrochemical industry, DCBA serves as a precursor for developing high-efficacy herbicides, such as Dicamba, which is essential for broadleaf weed control. The increasing global focus on maximizing crop yields and enhancing food security directly drives the consumption of these intermediates. Furthermore, the pharmaceutical sector utilizes DCBA isomers in the synthesis of complex organic molecules, including certain anti-inflammatory drugs and other therapeutic agents, leveraging their specific functional groups for structural diversity in drug discovery pipelines. This dual demand from high-volume agricultural applications and high-value pharmaceutical manufacturing stabilizes the market landscape.

Key market drivers include rigorous research and development in specialty chemicals, leading to new applications and improved production efficiencies. Regulatory changes regarding specific pesticide usage, while sometimes posing challenges, also prompt innovation toward safer and more effective DCBA-based chemistries. The benefits associated with DCBA, such as their stability and predictable reactivity, make them preferred starting materials. However, environmental concerns and stringent registration processes in developed economies necessitate continuous process optimization and investment in sustainable manufacturing practices to maintain market relevance and ensure compliance with evolving global standards.

Dichlorobenzoic Acid Isomers Market Executive Summary

The Dichlorobenzoic Acid Isomers market is characterized by steady growth, primarily driven by robust demand from the agricultural sector in emerging economies and persistent innovation in specialty chemical synthesis within developed regions. Business trends indicate a strong focus on capacity expansion, particularly in the Asia Pacific region, to cater to the escalating need for agrochemicals and intermediates. Key players are investing in vertical integration to secure raw material supply and optimize cost structures, while also navigating complex global supply chain disruptions through strategic sourcing and regional manufacturing diversification. Furthermore, there is a clear trend toward high-purity DCBA production tailored for pharmaceutical and high-end electronics applications, commanding premium pricing and higher margins.

Regionally, Asia Pacific (APAC) dominates the market, largely due to the massive agricultural base in countries like China and India, coupled with the presence of major chemical manufacturing hubs offering competitive production costs. North America and Europe maintain significant market shares, characterized by advanced pharmaceutical manufacturing, stringent quality standards, and a focus on innovative, low-toxicity agrochemical formulations derived from DCBA isomers. Regulatory environments significantly shape regional trends; for instance, European markets prioritize environmentally friendly synthesis routes, whereas North American markets emphasize large-scale, cost-effective production for major herbicide lines. The Middle East and Africa (MEA) and Latin America show promising growth trajectories, fueled by expanding agriculture and increasing foreign direct investment in chemical production capabilities.

Segment trends reveal that the 2,4-Dichlorobenzoic Acid (2,4-DCBA) segment holds the largest share due to its established use in the production of key herbicides and dyes. However, the 3,4-Dichlorobenzoic Acid (3,4-DCBA) segment is anticipated to exhibit the fastest growth rate, driven by its increasing adoption in the synthesis of specialized pharmaceutical compounds and advanced polymer additives requiring specific chemical structures. Application-wise, the Agrochemicals segment remains the largest consumer, but the Pharmaceutical & Fine Chemicals segment is crucial for driving revenue growth and technological advancement, pushing manufacturers toward higher grades of purity and consistency across all isomer types.

AI Impact Analysis on Dichlorobenzoic Acid Isomers Market

User inquiries regarding AI's influence on the Dichlorobenzoic Acid Isomers market center primarily around optimizing complex chemical synthesis pathways, predicting reaction yields, and enhancing quality control. Common concerns revolve around how AI can accelerate R&D for novel DCBA derivatives used in next-generation herbicides or pharmaceuticals, and its role in improving process efficiency to reduce waste and energy consumption in capital-intensive chemical plants. Users are keen to understand if AI-driven predictive maintenance can minimize costly downtime and if machine learning models can accurately forecast raw material price volatility, directly impacting manufacturing costs and profitability across the supply chain. The overarching expectation is that AI will streamline the often lengthy and resource-intensive R&D and manufacturing cycle associated with specialty chemical intermediates.

- Optimization of Synthesis Routes: AI algorithms can rapidly screen millions of potential reaction parameters to identify optimal conditions for DCBA isomer production, leading to higher yields and reduced byproducts.

- Predictive Quality Control: Machine learning models analyze real-time spectroscopic data from manufacturing batches, predicting deviations in purity and concentration before they affect the final product quality.

- Supply Chain Forecasting: AI tools analyze geopolitical data, commodity prices, and logistics constraints to provide accurate forecasts for key precursors (like chlorine and toluene derivatives), ensuring efficient procurement strategies.

- Accelerated Material Discovery: AI assists chemists in modeling the interaction of DCBA derivatives with target biological systems (e.g., weeds or disease pathways), speeding up the discovery of more potent and selective agrochemicals or drug candidates.

- Energy and Waste Reduction: Implementation of AI-driven process control systems allows for precise modulation of reactor temperature and pressure, minimizing energy usage and reducing the generation of environmentally regulated chemical waste streams.

DRO & Impact Forces Of Dichlorobenzoic Acid Isomers Market

The Dichlorobenzoic Acid Isomers market is governed by a dynamic interplay of Drivers, Restraints, and Opportunities, collectively forming significant Impact Forces. Key drivers include the persistent global demand for crop protection chemicals, especially in high-growth agricultural regions, which mandates a steady supply of DCBA-based intermediates. Simultaneously, the expanding pharmaceutical industry utilizes DCBA as a complex structural unit, further boosting demand for high-purity grades. Restraints predominantly involve stringent environmental regulations concerning hazardous chemical handling and waste disposal associated with chlorination processes. Furthermore, the volatility in raw material pricing, particularly petroleum derivatives and chlorine, poses significant cost pressures, limiting profit margins for manufacturers operating in highly competitive segments.

Opportunities for market expansion are abundant, centered on developing novel, sustainable manufacturing techniques, such as continuous flow chemistry, which reduces batch time and enhances safety. The emergence of specialized applications in advanced materials, such as high-performance plastics and specialized coatings, provides new, high-value avenues outside traditional agrochemicals. Strategic alliances between manufacturers and end-users (e.g., major pharmaceutical companies) ensure dedicated supply agreements and facilitate joint R&D efforts for custom DCBA derivatives. Successful navigation of these opportunities requires substantial investment in R&D and compliance infrastructure to meet evolving global standards for chemical safety and environmental stewardship.

The cumulative Impact Forces dictate the market trajectory. High regulatory scrutiny acts as a barrier to entry, favoring established manufacturers with robust compliance records and scale advantages. However, the consistent underlying demand from essential sectors—agriculture and healthcare—provides resilience against economic downturns. Technology adoption, particularly in process automation and purification, serves as a crucial impact force, allowing leading companies to differentiate their products based on purity and consistency, crucial for sensitive end-use applications like pharmaceuticals. The ability to manage input cost volatility through backward integration or long-term supplier contracts determines long-term profitability and market positioning.

Segmentation Analysis

The Dichlorobenzoic Acid Isomers market is comprehensively segmented based on the type of isomer, the grade of the product, and its primary end-use application. Understanding these segments is vital for strategic market positioning, as each isomer possesses distinct chemical reactivity that dictates its suitability for specific industrial applications. The segmentation by isomer type (2,4-DCBA, 3,4-DCBA, others) is critical because it reflects the diverse demands arising from herbicide production, where 2,4-DCBA is dominant, versus specialized pharmaceutical synthesis, which may require less common isomers like 3,5-DCBA or 2,3-DCBA for specific chemical structures.

Segmentation by grade—technical grade versus high-purity grade—highlights the bifurcation of demand. Technical grade DCBA is widely used in bulk chemical manufacturing, especially for agrochemical intermediates and dyes, where cost efficiency is paramount. Conversely, high-purity grade DCBA, characterized by minimal impurities and high assay concentrations, commands a premium price and is essential for the pharmaceutical, life sciences, and advanced electronics industries, where even trace impurities can compromise product integrity or regulatory compliance. This grade segmentation allows manufacturers to tailor production processes and pricing strategies based on stringent end-user requirements.

Application-based segmentation confirms the market's reliance on the Agrochemicals sector for volume consumption, followed by Pharmaceuticals, Dyes & Pigments, and other specialty chemical manufacturing. The differential growth rates across these application segments influence future investment decisions; while Agrochemicals provide stability, the faster growth projected for Pharmaceuticals underscores the shift toward high-value, low-volume opportunities requiring greater technical expertise and quality assurance. This detailed segmentation analysis enables accurate forecasting and targeted marketing efforts within the complex landscape of specialty chemical intermediates.

- By Isomer Type:

- 2,4-Dichlorobenzoic Acid (2,4-DCBA)

- 3,4-Dichlorobenzoic Acid (3,4-DCBA)

- 2,3-Dichlorobenzoic Acid (2,3-DCBA)

- Others (including 3,5-DCBA and 2,5-DCBA)

- By Grade:

- Technical Grade

- High Purity/Pharmaceutical Grade

- By Application:

- Agrochemicals (Herbicides, Fungicides, Insecticides)

- Pharmaceuticals and Fine Chemicals

- Dyes and Pigments

- Polymer Additives and Resins

- Others (Research and Specialty Synthesis)

Value Chain Analysis For Dichlorobenzoic Acid Isomers Market

The value chain for Dichlorobenzoic Acid Isomers begins with the upstream segment, encompassing the sourcing and preparation of essential raw materials. Key precursors include toluene derivatives (which are halogenated to form chlorotoluenes), chlorine gas, and catalysts. The cost and availability of these upstream petrochemical and industrial gas inputs significantly influence the final product price and production efficiency. Manufacturers engaged in backward integration gain a competitive advantage by controlling the cost and quality of early-stage intermediates. High capital expenditure is required for the complex chlorination and oxidation processes necessary to convert precursors into the various DCBA isomers, placing the initial manufacturing stage as a high-value creation point.

The midstream process involves the complex chemical synthesis, purification, and formulation of the DCBA isomers. This stage demands stringent quality control, especially for high-purity grades required by pharmaceutical clients. Differentiation occurs here through patented synthesis technologies, optimized separation techniques (like crystallization or chromatography), and compliance with global regulatory standards (e.g., REACH, EPA guidelines). Distribution channels are bifurcated: Direct sales dominate large-volume technical grade transactions, often involving long-term supply agreements with major agrochemical formulators. Indirect channels, involving specialized chemical distributors and regional agents, handle smaller batches, high-purity grades, and penetration into niche markets and research institutions.

The downstream analysis focuses on the end-use applications, where DCBA isomers are utilized as key building blocks. Major agrochemical companies convert DCBA into final herbicide formulations, while pharmaceutical companies integrate them into Active Pharmaceutical Ingredients (APIs). The profitability in the downstream segment is tied to the efficacy and market acceptance of the final products. The relationship between the DCBA manufacturer and the downstream consumer is critical; collaboration often ensures that the DCBA intermediate meets specific purity and particle size requirements, driving product innovation and market penetration. Effective logistics and inventory management across both direct and indirect channels are essential to maintain responsiveness to fluctuating demand from agricultural planting cycles and pharmaceutical R&D pipelines.

Dichlorobenzoic Acid Isomers Market Potential Customers

The primary customer base for Dichlorobenzoic Acid Isomers is concentrated within sectors reliant on complex organic synthesis, predominantly the global Agrochemicals industry. Large multinational chemical companies and regional formulators that produce herbicides (such as Dicamba derivatives) and fungicides represent the highest volume buyers. These customers require technical grade DCBA in bulk quantities with consistent specifications and competitive pricing, often secured through annual contracts. Their purchasing decisions are driven by the scale of agricultural production in their target markets and the regulatory approval status of DCBA-derived pesticides.

A second major segment comprises Pharmaceutical and Fine Chemical manufacturers. These customers require high-purity or pharmaceutical grade DCBA isomers (often 3,4-DCBA or niche isomers) for the synthesis of complex APIs and specialized intermediates. Purchasing criteria here are extremely stringent, focusing intensely on batch-to-batch consistency, adherence to pharmacopeial standards (USP, EP), robust documentation, and supply chain reliability. This group represents high-value customers, even if their volume demand is lower than the agrochemical sector, due to the premium prices associated with high-purity material and the necessity of validated supplier relationships.

Additional potential customers include manufacturers in the Dyes and Pigments industry, where DCBA isomers are used to create certain colorants, and specialized polymer and resin producers who utilize DCBA derivatives as functional additives. Furthermore, independent contract research organizations (CROs) and academic institutions form a smaller, but strategically important, customer base, purchasing specialty isomers and research-grade materials for new molecule discovery and chemical process development. Targeting these diverse segments requires a differentiated sales approach, ranging from bulk commodity sales to technical consultation and custom synthesis services for niche requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 665 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, LANXESS, Sumitomo Chemical, TCI Chemicals, Tokyo Chemical Industry, Santa Cruz Biotechnology, Alfa Aesar, Hangzhou Dayang Chemical, Nanjing Datang Chemical, Shandong Dacheng Chemical, Hebei Huayang, Sinochem, Merck KGaA, Avantor, Spectrum Chemical, Synthon Chemicals, Kowa Company Ltd., Aarti Industries Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dichlorobenzoic Acid Isomers Market Key Technology Landscape

The Dichlorobenzoic Acid Isomers market relies on several established chemical processes, predominantly involving the oxidation of dichlorotoluene intermediates. The key technological challenge lies in achieving high selectivity for a specific isomer (e.g., 2,4-DCBA over 3,4-DCBA) while minimizing energy consumption and managing the corrosive nature of the reactants and intermediates. Traditional batch processing methods, involving high-temperature liquid-phase oxidation, are common but are increasingly being supplemented or replaced by advanced catalytic oxidation technologies. Research focuses on developing heterogeneous catalysts that offer higher conversion rates, improved selectivity, and easier separation from the reaction mixture, thereby reducing downstream purification costs and environmental impact. Furthermore, technologies enabling the recycling and reuse of solvents and catalysts are crucial for achieving cost efficiencies and meeting circular economy objectives.

Process intensification and purification technologies represent the next frontier in the DCBA production landscape, particularly for high-purity pharmaceutical grades. Continuous flow chemistry (CFC) is gaining traction, replacing large batch reactors with compact systems that allow for precise control over exothermic reactions, leading to safer operations and higher throughput. CFC minimizes residence time variability, which is critical for ensuring batch-to-batch consistency. In terms of purification, advanced separation techniques such as fractional crystallization, supercritical fluid extraction, and membrane filtration are being implemented to achieve the extremely low impurity levels (often parts per million or less) demanded by the pharmaceutical industry. Investment in these purification capabilities is a major factor differentiating premium producers from bulk technical-grade suppliers.

Digitalization and automation are also reshaping the technological landscape. Implementation of advanced sensor technology, coupled with real-time data analytics, allows operators to monitor reaction kinetics and product quality continuously. This shift towards Industry 4.0 principles enables predictive maintenance, optimizes resource allocation, and facilitates dynamic process adjustments, particularly crucial in handling complex, multi-stage synthesis reactions involving chlorinated compounds. Furthermore, green chemistry initiatives are driving the development of synthesis routes that avoid highly hazardous reagents or solvents, pushing manufacturers to explore bio-catalysis or mild electrochemical methods, although these technologies are still in earlier stages of commercial viability compared to established chemical routes.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market volume due to robust and expanding agricultural sectors in China and India, coupled with large-scale, cost-effective chemical manufacturing capabilities. APAC serves as a major global exporter of DCBA intermediates, benefiting from lower operating costs and strong government support for the chemical industry.

- North America: A high-value market characterized by advanced R&D and sophisticated demand from both the patented agrochemical industry (especially for herbicide synthesis) and the pharmaceutical sector. Strict environmental regulations necessitate continuous investment in process improvement and high-purity product manufacturing.

- Europe: Highly regulated market focused on innovation, sustainability, and high-quality pharmaceutical intermediates. Growth is driven by the European Union's strong pharmaceutical manufacturing base and stringent requirements under REACH legislation, promoting cleaner production technologies and certified supply chains.

- Latin America (LATAM): Exhibits rapid growth potential, primarily driven by the expansion of large-scale commercial farming in Brazil and Argentina, increasing the regional demand for DCBA-based herbicides to maximize crop yields of soybeans and corn.

- Middle East and Africa (MEA): A nascent market segment, where growth is projected due to increasing investment in local agricultural development initiatives and gradual industrial diversification away from oil and gas, leading to localized specialty chemical production opportunities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dichlorobenzoic Acid Isomers Market.- BASF SE

- LANXESS

- Sumitomo Chemical

- TCI Chemicals (Tokyo Chemical Industry)

- Merck KGaA

- Santa Cruz Biotechnology

- Alfa Aesar (Thermo Fisher Scientific)

- Hangzhou Dayang Chemical

- Nanjing Datang Chemical

- Shandong Dacheng Chemical

- Hebei Huayang

- Sinochem

- Avantor

- Spectrum Chemical

- Synthon Chemicals GmbH & Co. KG

- Aarti Industries Ltd.

- Jubilant Life Sciences Ltd.

- Kowa Company Ltd.

- Pestech India Pvt. Ltd.

- Wako Pure Chemical Industries, Ltd.

Frequently Asked Questions

Analyze common user questions about the Dichlorobenzoic Acid Isomers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Dichlorobenzoic Acid Isomers?

The primary driver is the robust and expanding global demand for agrochemicals, particularly high-efficacy herbicides derived from 2,4-DCBA, which are essential for maximizing yields in large-scale commercial agriculture worldwide.

Which Dichlorobenzoic Acid isomer holds the largest market share by volume?

2,4-Dichlorobenzoic Acid (2,4-DCBA) holds the largest market share by volume, predominantly due to its extensive use as a critical intermediate in the production of established and widely used herbicides globally.

How do regulatory environments impact the pricing and manufacturing of DCBA?

Stringent regulations, such as REACH in Europe, necessitate significant investment in sophisticated waste treatment and compliance verification, raising operational costs and favoring manufacturers capable of producing high-purity, environmentally compliant products.

What role does 3,4-DCBA play in the pharmaceutical industry?

3,4-DCBA is a vital building block used in the high-value synthesis of Active Pharmaceutical Ingredients (APIs) and fine chemical intermediates, often required for complex organic synthesis pathways due to its specific substituent positioning.

Which region is expected to demonstrate the fastest growth rate in the DCBA market?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, fueled by expanding agricultural activities, increasing investments in domestic chemical production, and competitive manufacturing costs that support global export volumes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager