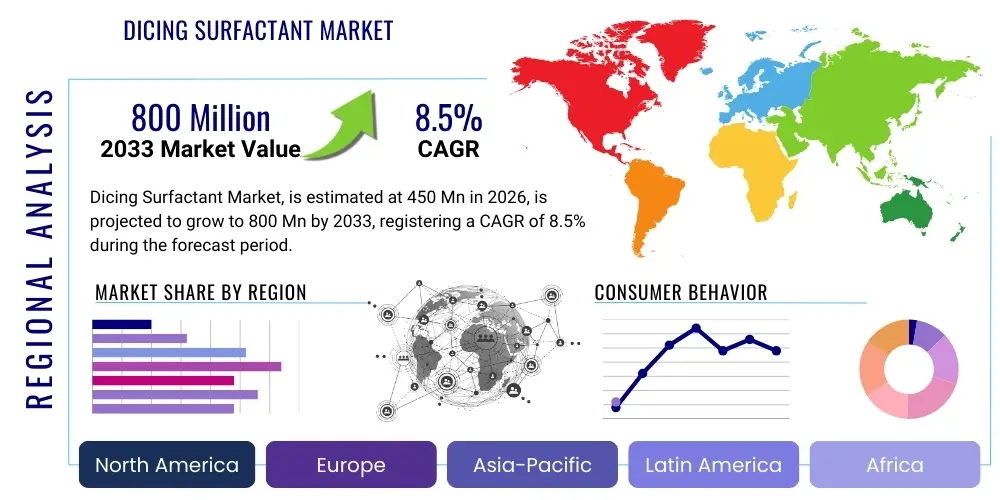

Dicing Surfactant Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439731 | Date : Jan, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Dicing Surfactant Market Size

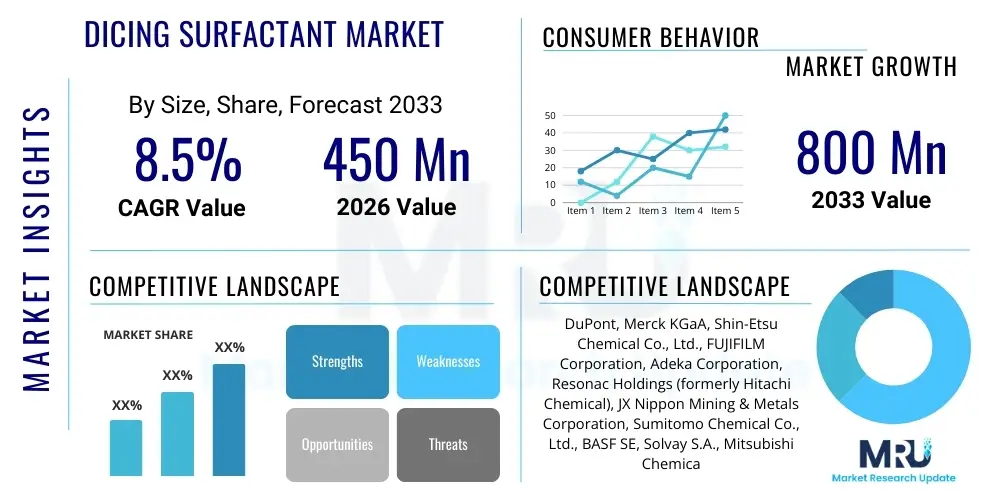

The Dicing Surfactant Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 450 million in 2026 and is projected to reach USD 800 million by the end of the forecast period in 2033.

Dicing Surfactant Market introduction

The dicing surfactant market encompasses specialized chemical formulations critical to the semiconductor manufacturing process, particularly during the intricate wafer dicing stage. These surfactants, or surface-active agents, are meticulously designed to reduce surface tension at the cutting interface, thereby minimizing friction, preventing chip-out, and enhancing the overall precision and quality of the diced wafers. Their application is indispensable for achieving high yields and preserving the integrity of delicate semiconductor devices, micro-electromechanical systems (MEMS), and optoelectronic components, directly impacting the performance and reliability of end products across various industries.

Key products within this market include various chemical classes such as anionic, non-ionic, cationic, and amphoteric surfactants, each selected based on specific dicing material characteristics and process requirements. Major applications span silicon wafer dicing, critical for integrated circuits; sapphire dicing, vital for LED and power electronics; and glass dicing for displays and MEMS. The benefits are profound: reduced kerf loss, superior edge quality, extended dicing blade lifespan, and improved throughput. These advantages are paramount in an industry perpetually striving for miniaturization, higher performance, and cost efficiency in device fabrication.

Driving factors for market expansion are intrinsically linked to the robust growth of the global semiconductor industry, fueled by escalating demand for consumer electronics, advanced computing, artificial intelligence hardware, and the widespread adoption of 5G technology and the Internet of Things (IoT). The continuous innovation in advanced packaging techniques, which necessitates finer pitch and more precise dicing, further accentuates the need for high-performance dicing surfactants. Moreover, the increasing complexity of semiconductor architectures and the advent of novel substrate materials are compelling manufacturers to invest in sophisticated chemical solutions that can address evolving production challenges and maintain competitive edge.

Dicing Surfactant Market Executive Summary

The dicing surfactant market is currently experiencing significant dynamism, characterized by several overarching business trends. Prominent among these is the accelerating pace of consolidation within the specialty chemical sector, as larger entities acquire niche players to broaden their product portfolios and secure supply chains. There is also a pronounced emphasis on research and development, particularly towards creating eco-friendly, biodegradable, and high-performance surfactant formulations that align with stringent environmental regulations and corporate sustainability goals. Furthermore, the market is witnessing increased demand for customized solutions, as semiconductor manufacturers require tailored surfactants optimized for specific materials, dicing equipment, and process parameters to maximize yield and quality for their diverse product lines.

Regionally, the Asia Pacific (APAC) continues to dominate the dicing surfactant market, primarily due to its established position as the global hub for semiconductor manufacturing, encompassing major foundries, assembly and test operations, and a vast ecosystem of electronic component producers. Countries like Taiwan, South Korea, China, and Japan are pivotal, demonstrating robust investment in advanced semiconductor fabrication facilities, which directly translates to substantial demand for dicing surfactants. While North America and Europe contribute significantly through advanced R&D and high-value, specialized applications, their market share in terms of volume is comparatively smaller. Emerging economies within APAC are also showing considerable growth, driven by increasing local electronics manufacturing capabilities and government support for semiconductor self-sufficiency initiatives.

Segmentation trends reveal a sustained shift towards high-performance and specialty dicing surfactants capable of handling new materials such as silicon carbide (SiC) and gallium nitride (GaN), which are critical for power electronics and 5G applications. Non-ionic surfactants, known for their versatility and compatibility with various substrates, continue to hold a substantial share, while amphoteric surfactants are gaining traction due to their enhanced stability and cleaning properties. The application segment for advanced packaging dicing is witnessing particularly strong growth, reflecting the industry's move towards smaller, more powerful, and densely integrated devices. End-user demand from the automotive and telecommunications sectors is also on an upward trajectory, driven by autonomous driving technologies, in-car infotainment systems, and expanding 5G infrastructure, all of which rely heavily on high-quality semiconductor components processed with precision dicing solutions.

AI Impact Analysis on Dicing Surfactant Market

Users frequently inquire about how artificial intelligence (AI) can revolutionize the dicing surfactant market, seeking insights into its potential to optimize chemical formulations, enhance process efficiency, and predict market demands. Common questions revolve around AI's role in accelerating the discovery of novel surfactant chemistries, enabling predictive maintenance for dicing equipment, and improving overall yield through intelligent process control. The core themes coalesce around leveraging AI for greater precision, sustainability, and cost-effectiveness in both the development and application of dicing surfactants, transforming traditional methodologies into data-driven, intelligent operations.

- Smart Formulation and Discovery: AI algorithms can analyze vast datasets of chemical structures and their properties, accelerating the discovery of new, more effective, and environmentally friendly dicing surfactant formulations. This reduces trial-and-error, cutting R&D costs and time-to-market.

- Process Optimization and Control: AI-powered systems can monitor dicing parameters in real-time, adjusting surfactant concentration, flow rates, and other variables to maintain optimal performance, minimize material waste, and improve cut quality, leading to higher yields and reduced operational costs.

- Predictive Maintenance: AI can predict potential failures in dicing equipment by analyzing sensor data, enabling proactive maintenance that extends equipment lifespan, reduces downtime, and ensures consistent application of dicing surfactants.

- Supply Chain Optimization: Machine learning models can forecast demand for specific dicing surfactants based on semiconductor production schedules, market trends, and raw material availability, leading to more efficient inventory management and improved supply chain resilience.

- Quality Assurance: AI-driven vision systems can inspect diced wafers for defects with unparalleled speed and accuracy, identifying issues related to surfactant performance and providing feedback for process adjustments, thereby ensuring stringent quality control.

DRO & Impact Forces Of Dicing Surfactant Market

The dicing surfactant market is propelled by a confluence of robust drivers stemming from the pervasive growth of the semiconductor industry and its continuous pursuit of technological advancement. The relentless demand for smaller, faster, and more powerful electronic devices across consumer electronics, automotive, and telecommunications sectors directly translates to an increased need for high-precision wafer dicing, consequently driving the consumption of specialized surfactants. Furthermore, the burgeoning adoption of advanced packaging technologies like 3D ICs, fan-out wafer-level packaging (FOWLP), and system-in-package (SiP) necessitates ultra-fine dicing processes, requiring superior surfactant performance to maintain yield and integrity. The ongoing transition to wider bandgap materials such as silicon carbide (SiC) and gallium nitride (GaN) for power electronics and RF applications presents unique dicing challenges, creating a strong impetus for the development and adoption of high-performance, specialized dicing surfactants tailored for these novel substrates, thereby acting as a significant market driver.

Despite strong growth drivers, the market faces several notable restraints. High research and development costs associated with developing new surfactant chemistries, especially those tailored for emerging materials and environmentally friendly profiles, pose a significant barrier to entry and innovation. Stringent environmental regulations, particularly regarding the use and disposal of certain chemical compounds, compel manufacturers to invest heavily in compliance and the development of greener alternatives, which can impact profitability and market accessibility. Additionally, volatility in raw material prices, often influenced by geopolitical factors and supply chain disruptions, can lead to unpredictable production costs for surfactant manufacturers, making long-term planning and pricing strategies challenging. The highly specialized nature of the product also means that end-users often have stringent quality and performance requirements, demanding high consistency and reliability which can be difficult and costly to maintain.

Opportunities within the dicing surfactant market are substantial, particularly in the realm of sustainable and custom formulations. The growing emphasis on environmental responsibility and the increasing stringency of regulations are fostering an environment ripe for the development and commercialization of bio-based and readily biodegradable dicing surfactants, presenting a significant competitive advantage for innovators. Moreover, the expanding semiconductor manufacturing capabilities in emerging markets, especially in Southeast Asia and India, offer untapped growth potential for market players looking to diversify their regional footprint. The increasing complexity of wafer designs and the demand for ultra-thin wafers are also creating opportunities for customized surfactant solutions that can address specific process challenges and deliver optimal performance for these intricate applications. Finally, strategic collaborations between chemical suppliers, equipment manufacturers, and semiconductor foundries are emerging as a key opportunity to co-develop integrated dicing solutions, ensuring seamless compatibility and maximized process efficiency. These impact forces shape the strategic landscape, dictating investment priorities and competitive dynamics.

Segmentation Analysis

The dicing surfactant market is comprehensively segmented to provide granular insights into its diverse components, facilitating a detailed understanding of market dynamics, opportunities, and competitive landscapes. This segmentation allows for precise analysis based on various product attributes, application areas, end-user industries, and geographical regions, reflecting the multifaceted nature of demand and supply within the global semiconductor ecosystem. Understanding these segments is crucial for stakeholders to identify high-growth niches, tailor product development strategies, and optimize market entry approaches, ensuring relevance and maximizing commercial success in a rapidly evolving technological environment.

- By Type:

- Anionic Dicing Surfactants

- Non-ionic Dicing Surfactants

- Cationic Dicing Surfactants

- Amphoteric Dicing Surfactants

- Others (e.g., fluorinated surfactants)

- By Application:

- Silicon Wafer Dicing

- Sapphire Wafer Dicing

- Glass Wafer Dicing

- Compound Semiconductor Dicing (e.g., GaAs, SiC, GaN)

- MEMS Dicing

- LED Wafer Dicing

- Advanced Packaging Dicing

- By End-User Industry:

- Semiconductor Manufacturing

- Consumer Electronics

- Automotive

- Telecommunications

- Healthcare

- Industrial

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, Taiwan, India, Southeast Asia, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa (UAE, Saudi Arabia, South Africa, Rest of MEA)

Value Chain Analysis For Dicing Surfactant Market

The value chain for the dicing surfactant market is intricate, beginning with the upstream sourcing of specialized chemical raw materials. This segment involves major chemical producers that supply base chemicals, intermediates, and proprietary compounds necessary for surfactant synthesis. Key raw materials often include ethylene oxide, propylene oxide, fatty alcohols, amines, and various organic acids. The quality, purity, and consistent supply of these upstream components are critical, as they directly influence the performance and stability of the final dicing surfactant products. Strategic relationships with a diversified base of raw material suppliers are therefore essential for dicing surfactant manufacturers to mitigate supply chain risks and ensure cost-effective production, safeguarding against volatility and geopolitical disruptions.

Moving downstream, the value chain encompasses the manufacturing and formulation of the dicing surfactants themselves, followed by their distribution to end-users. Dicing surfactant producers, often specialty chemical companies, invest heavily in R&D to develop optimized formulations that meet stringent performance criteria for specific dicing processes and substrate materials. These companies leverage advanced chemical synthesis techniques and formulation expertise to create products that enhance dicing efficiency, reduce material loss, and improve wafer integrity. Quality control and technical support are paramount at this stage, as precise performance and consistency are critical for semiconductor fabrication. This phase also involves packaging, labeling, and adherence to various regional and international regulatory standards before the products reach the market.

The distribution channel for dicing surfactants typically involves a mix of direct sales and indirect channels. Large, integrated device manufacturers (IDMs) and major semiconductor foundries often engage in direct procurement from surfactant manufacturers, fostering close technical collaboration and customized supply agreements. For smaller fabricators, specialized outsourced semiconductor assembly and test (OSAT) companies, and emerging market players, indirect channels through authorized distributors and specialty chemical suppliers are more common. These distributors provide localized sales, logistics, and technical support, playing a crucial role in market penetration and customer service. The efficiency of these distribution networks is vital for ensuring timely delivery and responsive service, which are critical in the fast-paced semiconductor industry where production lines operate continuously and demand high reliability from all consumables.

Dicing Surfactant Market Potential Customers

The primary potential customers and end-users of dicing surfactants are entities operating within the highly specialized semiconductor and microelectronics manufacturing ecosystem. This includes large-scale integrated device manufacturers (IDMs) that design, manufacture, and sell their own integrated circuits, leveraging dicing surfactants as a critical consumable in their wafer fabrication plants. These IDMs require consistent, high-performance surfactants to maintain rigorous quality control and maximize yield across their diverse product lines, which range from microprocessors and memory chips to specialized sensors. Their procurement strategies often involve long-term contracts and close technical collaboration with surfactant suppliers to ensure product compatibility and process optimization.

Another significant customer segment comprises pure-play semiconductor foundries, which specialize solely in the fabrication of integrated circuits for fabless design companies. These foundries, operating at the forefront of advanced process technologies, require cutting-edge dicing surfactants capable of handling the most delicate and complex wafer designs, including those for advanced nodes and novel materials. Their demand is driven by the collective needs of their numerous clientele, making them large-volume purchasers who prioritize reliability, consistency, and the ability to enhance overall throughput and wafer quality. The increasing trend towards outsourcing fabrication to foundries further solidifies this segment as a crucial market for dicing surfactant suppliers, necessitating strong technical support and a deep understanding of varied fabrication processes.

Beyond traditional silicon-based semiconductor manufacturing, the market extends to manufacturers of micro-electromechanical systems (MEMS), LED devices, power electronics, and advanced packaging solutions. MEMS manufacturers, for instance, require precise dicing for delicate structures used in sensors, accelerometers, and gyroscopes. LED producers utilize dicing surfactants for sapphire and other wide-bandgap substrates. Companies involved in advanced packaging, such as outsourced semiconductor assembly and test (OSAT) providers, are increasingly reliant on high-performance dicing surfactants for intricate processes like wafer thinning and subsequent dicing of stacked dies. These diverse end-users collectively drive the demand for a broad spectrum of dicing surfactant formulations, each tailored to specific material properties, dicing techniques, and performance objectives, underscoring the market's pervasive reach across the modern electronics supply chain.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 800 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DuPont, Merck KGaA, Shin-Etsu Chemical Co., Ltd., FUJIFILM Corporation, Adeka Corporation, Resonac Holdings (formerly Hitachi Chemical), JX Nippon Mining & Metals Corporation, Sumitomo Chemical Co., Ltd., BASF SE, Solvay S.A., Mitsubishi Chemical Corporation, Daikin Industries, Ltd., Brewer Science, Inc., CMC Materials (part of Entegris), Tokuyama Corporation, Stella Chemifa Corporation, Avantor Performance Materials, LLC, SACHEM Inc., Air Products and Chemicals, Inc., Evonik Industries AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dicing Surfactant Market Key Technology Landscape

The technological landscape of the dicing surfactant market is characterized by continuous innovation aimed at enhancing performance, improving environmental profiles, and addressing the evolving demands of advanced semiconductor manufacturing. A primary focus is on the development of advanced formulation techniques that allow for precise control over surfactant properties such as surface tension reduction, wettability, and defoaming capabilities. This includes optimizing the molecular structure of surfactants, incorporating novel functional groups, and utilizing synergistic blends of different surfactant types to achieve superior dicing results for specific materials like ultra-thin silicon wafers, brittle sapphire, or hard compound semiconductors. Nanoparticle dispersion technologies are also emerging, where ultra-fine particles are sometimes integrated into surfactant solutions to provide additional benefits such as improved lubrication or enhanced cooling during the dicing process, leading to reduced kerf loss and better surface quality.

Another critical area of technological advancement is the shift towards more eco-friendly and sustainable surfactant chemistries. This involves the synthesis of bio-based surfactants derived from renewable resources and the development of readily biodegradable formulations that minimize environmental impact without compromising performance. Manufacturers are investing significantly in green chemistry principles to meet increasingly stringent environmental regulations and satisfy the sustainability objectives of their semiconductor industry clients. This focus extends to reducing the use of hazardous substances and developing formulations that are easier to dispose of or recycle, aligning with broader industry trends towards responsible manufacturing and a circular economy. The technological drive here is to deliver high efficiency with minimal ecological footprint.

Furthermore, the integration of dicing surfactants with advanced dicing equipment and process control systems represents a crucial technological frontier. This involves developing surfactants that are specifically designed to perform optimally with laser dicing, plasma dicing, or advanced blade dicing technologies, ensuring seamless compatibility and maximizing the benefits of these sophisticated techniques. Real-time monitoring and feedback systems are being developed to precisely control surfactant delivery and concentration during the dicing process, allowing for dynamic adjustments that optimize performance and prevent issues. This convergence of chemical innovation with process engineering ensures that dicing surfactants remain a vital component in achieving the exacting standards required for next-generation semiconductor devices, demanding a holistic approach to material science and manufacturing technology.

Regional Highlights

- Asia Pacific (APAC): Dominates the global dicing surfactant market due to its robust and expanding semiconductor manufacturing industry, hosting major foundries and outsourced assembly and test (OSAT) facilities. Countries like Taiwan, South Korea, China, and Japan are at the forefront of semiconductor production and innovation, driving significant demand.

- North America: Represents a mature market characterized by advanced R&D, high-value specialty semiconductor manufacturing, and a strong presence of fabless companies and IDMs. Demand is concentrated on high-performance and customized surfactant solutions for leading-edge technologies.

- Europe: A significant market for dicing surfactants, particularly in automotive electronics, industrial applications, and niche high-tech sectors. Germany, France, and the UK are key contributors, with an increasing focus on sustainable and environmentally compliant surfactant formulations.

- Latin America: An emerging market with growing electronics manufacturing activities and increasing foreign investment in semiconductor assembly operations, leading to a gradual rise in demand for dicing surfactants.

- Middle East & Africa (MEA): Currently holds a smaller share but is poised for growth with ongoing efforts to diversify economies and invest in technological infrastructure, potentially fostering increased demand for electronics manufacturing chemicals in the long term.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dicing Surfactant Market.- DuPont

- Merck KGaA

- Shin-Etsu Chemical Co., Ltd.

- FUJIFILM Corporation

- Adeka Corporation

- Resonac Holdings (formerly Hitachi Chemical)

- JX Nippon Mining & Metals Corporation

- Sumitomo Chemical Co., Ltd.

- BASF SE

- Solvay S.A.

- Mitsubishi Chemical Corporation

- Daikin Industries, Ltd.

- Brewer Science, Inc.

- CMC Materials (part of Entegris)

- Tokuyama Corporation

- Stella Chemifa Corporation

- Avantor Performance Materials, LLC

- SACHEM Inc.

- Air Products and Chemicals, Inc.

- Evonik Industries AG

Frequently Asked Questions

Analyze common user questions about the Dicing Surfactant market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a dicing surfactant and why is it essential in semiconductor manufacturing?

A dicing surfactant is a specialized chemical solution used during the wafer dicing process to reduce surface tension, lubricate the cutting interface, and remove debris. It is essential for minimizing chip-out, improving cut quality, extending blade life, and ensuring high yield and integrity of delicate semiconductor devices, particularly in ultra-fine dicing applications.

What are the primary factors driving the growth of the dicing surfactant market?

The market's growth is primarily driven by the expanding global semiconductor industry, increasing demand for miniaturized electronic devices, the adoption of advanced packaging technologies (e.g., 3D ICs), and the rising production of devices utilizing wide-bandgap materials like SiC and GaN, all requiring precise and high-quality dicing.

Which regions are key players in the dicing surfactant market, and why?

The Asia Pacific (APAC) region is the dominant market leader due to its robust semiconductor manufacturing ecosystem, including major foundries in Taiwan, South Korea, China, and Japan. North America and Europe also hold significant shares, focusing on R&D and high-value, specialized semiconductor applications.

What are the main types of dicing surfactants available in the market?

The market primarily features anionic, non-ionic, cationic, and amphoteric dicing surfactants. Each type possesses distinct chemical properties and is selected based on the specific wafer material, dicing method, and desired performance characteristics to optimize the cutting process.

How is environmental sustainability impacting the development of dicing surfactants?

Environmental sustainability is a significant factor, driving R&D towards eco-friendly formulations, including bio-based and biodegradable surfactants. Manufacturers are focused on reducing hazardous chemical use, improving waste management, and adhering to stringent environmental regulations to align with green manufacturing practices in the semiconductor industry.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager