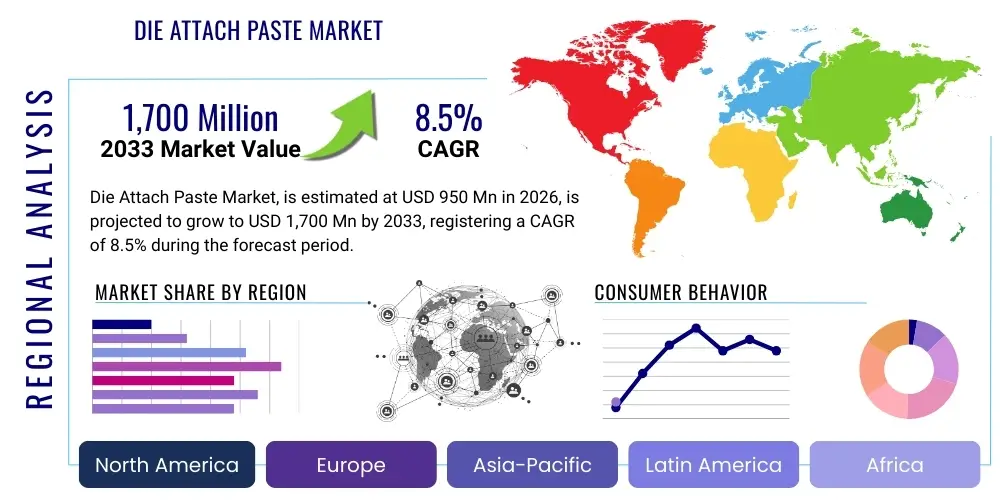

Die Attach Paste Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435166 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Die Attach Paste Market Size

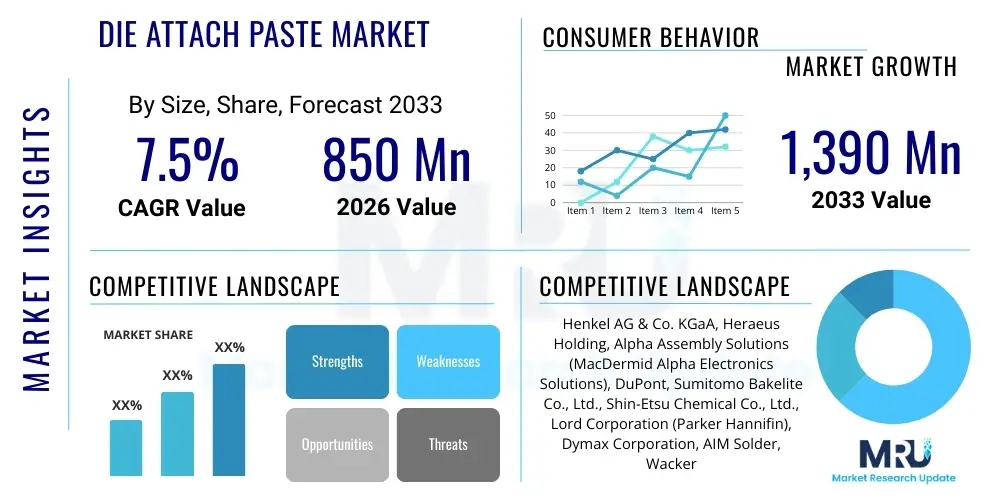

The Die Attach Paste Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,390 Million by the end of the forecast period in 2033.

Die Attach Paste Market introduction

The Die Attach Paste Market encompasses specialized polymeric or metallic materials used to bond semiconductor chips (dies) securely onto substrates, leadframes, or packages within electronic devices. These materials are critical components in semiconductor packaging, serving not only to mechanically anchor the chip but also to provide necessary thermal and electrical pathways for reliable device operation. The fundamental requirement for die attach pastes is high thermal conductivity to efficiently dissipate heat generated by the semiconductor, especially in high-power applications, combined with low stress characteristics to prevent damage to delicate silicon structures during manufacturing and thermal cycling. The quality and performance of the die attach material directly influence the overall reliability, lifespan, and efficiency of modern electronic systems, including advanced consumer electronics, automotive power modules, and complex data center infrastructure.

Product descriptions within this market range widely, from traditional epoxy-based pastes, which offer excellent mechanical stability and cost-effectiveness, to advanced silver-sintering pastes and specialized non-conductive films (NCFs) or conductive films (ACFs) required for heterogeneous integration and complex 3D packaging architectures. Major applications driving demand include high-brightness LEDs (HB-LEDs), which mandate superior thermal management, power devices used in electric vehicles (EVs) and industrial motor controls, where robust bonding and high-temperature tolerance are non-negotiable, and high-performance computing (HPC) processors. The continuous miniaturization of electronic devices and the increasing power density of ICs necessitate a shift towards materials that can handle extreme thermal loads and high-frequency operation with minimal degradation over time, spurring significant research and development investments in novel material compositions, including nano-filled composites.

The primary benefits offered by high-performance die attach pastes include enhanced thermal dissipation, leading to improved device performance and longevity; superior electrical conductivity for high-speed signal transmission; and reduced package stress, minimizing warpage and delamination risks. Key driving factors include the massive proliferation of 5G infrastructure, demanding high-speed and thermally efficient RF power amplifiers; the accelerating transition towards electric vehicles, requiring reliable insulated-gate bipolar transistor (IGBT) and MOSFET modules; and the unprecedented growth in data centers and AI accelerators, which utilize highly integrated chip packages. These macroeconomic and technological trends collectively ensure sustained, robust demand for specialized and high-reliability die attach solutions capable of meeting the stringent requirements of next-generation semiconductor technologies.

Die Attach Paste Market Executive Summary

The Die Attach Paste market is experiencing a significant uplift, primarily fueled by robust growth in the automotive electronics sector, particularly the rapid adoption of electric vehicles and associated charging infrastructure, alongside explosive demand from high-performance computing (HPC) and artificial intelligence (AI) applications. Current business trends indicate a strong shift away from traditional epoxy materials towards advanced, high-reliability interconnects such as silver-sintering pastes, which offer significantly higher thermal conductivity and operational temperatures, critical for SiC and GaN power devices. Furthermore, technological innovation in packaging, specifically the migration toward fan-out wafer level packaging (FOWLP) and system-in-package (SiP) structures, is creating new opportunities for specialized film-based attach solutions, necessitating close collaboration between material suppliers and semiconductor foundries to co-develop compatible processes and chemistries.

Regionally, the Asia Pacific (APAC) continues to dominate the market landscape, driven by the massive concentration of semiconductor manufacturing, assembly, and testing (OSAT) facilities located in countries like China, Taiwan, South Korea, and Japan. APAC acts as the primary consumption hub, benefitting from governmental support for domestic semiconductor production and being the global epicenter for consumer electronics manufacturing. North America and Europe, while smaller in volume, represent key centers for high-value innovation, particularly in aerospace, defense, and premium automotive applications, driving the demand for ultra-high-reliability materials. Investment trends are increasingly focused on diversifying supply chains and enhancing production capacity outside of traditional hubs, a geopolitical risk mitigation strategy influencing near-term capital expenditure in new material development and regional manufacturing expansion.

Segmentation trends reveal that the electrically conductive segment maintains market leadership, given its necessity in most semiconductor applications, although the thermally conductive segment is projected to exhibit the fastest growth rate, fueled primarily by the urgent need for superior heat management in new generations of processors and power electronics. In terms of material type, the silver-filled epoxy sub-segment remains pervasive due to its balance of performance and cost, but the non-epoxy polymeric materials, particularly those optimized for low-stress packaging, are gaining traction rapidly. The increasing complexity of advanced packaging technologies is forcing material manufacturers to develop tailored solutions that offer tunable properties, enabling simultaneous optimization for mechanical stability, low outgassing, and long-term environmental durability under extreme operating conditions, thereby driving product differentiation across all major segments.

AI Impact Analysis on Die Attach Paste Market

User queries regarding the impact of Artificial Intelligence (AI) on the Die Attach Paste market primarily revolve around how the increasing demand for high-performance AI accelerators and specialized chipsets influences material requirements, particularly concerning thermal management and high-density integration. Users frequently inquire about whether traditional die attach materials can sustain the intense heat generated by large AI models, the expected lifespan of pastes under continuous high load in data centers, and the role of novel materials like silver sintering in enabling the next generation of AI hardware. A core concern is the expected shift in performance specifications: how much higher thermal conductivity is needed, and what new mechanical properties are essential for vertically stacked or tightly packed heterogeneous integrated circuits (HICs) necessary for efficient AI processing, pushing material science to its limits in terms of stress absorption and reliability.

The impact of AI hardware acceleration is profoundly reshaping the Die Attach Paste market by mandating significantly higher thermal budgets and increasing complexity in packaging architectures. AI servers rely on massive parallel processing units, such as GPUs and specialized TPUs/NPUs, which generate unprecedented levels of heat flux. This necessitates a fundamental pivot from conventional eutectic or epoxy pastes to advanced thermal interface materials (TIMs) and die attach solutions with exceptionally high thermal conductivity (exceeding 150 W/mK). The demand for materials capable of managing these thermomechanical stresses is directly linked to the burgeoning AI training and inference market, which demands continuous 24/7 operation reliability. Furthermore, the push towards 2.5D and 3D stacking technologies, often using silicon interposers or chiplets for AI processors, requires die attach solutions that maintain low bond line thickness (BLT) and exhibit superior control over dimensional stability during the curing process, ensuring precise alignment of micro-bumps and through-silicon vias (TSVs).

The indirect impact stems from the AI-driven optimization of material formulation and manufacturing processes itself. Machine learning algorithms are increasingly utilized by material science companies to predict material performance characteristics, optimize filler dispersion within the paste matrix, and rapidly screen candidate formulations, reducing development cycles. This allows manufacturers to quickly respond to the highly dynamic needs of AI chip developers. The need for precise, repeatable dispensing and curing processes for advanced packaging, particularly in high-volume manufacturing of AI components, is also driving the adoption of AI-enabled quality control and robotic dispensing systems, ensuring uniform bond line thickness and defect minimization, which directly affects the overall reliability of high-cost AI processors and server modules.

- AI demands superior thermal dissipation, driving rapid adoption of Silver Sintering Paste (SSP).

- Increased complexity in AI chip packaging (2.5D/3D integration) requires pastes with ultra-low stress and tight bond line thickness control.

- AI accelerates R&D cycles through ML-driven material performance prediction and formulation optimization.

- High power density in AI accelerators increases demand for robust, high-reliability die attach solutions capable of enduring extreme thermal cycling.

- Enhanced automation and quality control (QC) in manufacturing, driven by AI vision systems, ensure precision needed for complex AI chip assembly.

DRO & Impact Forces Of Die Attach Paste Market

The Die Attach Paste Market is shaped by a confluence of powerful drivers, structural restraints, and emerging opportunities, which collectively determine its growth trajectory and competitive intensity. Primary drivers include the aggressive expansion of the electric vehicle (EV) market, which mandates high-power, high-temperature SiC and GaN power modules requiring advanced sintering pastes for optimal thermal management and reliability. Simultaneously, the global roll-out of 5G networks and the exponential growth of data center infrastructure, fueled by cloud computing and AI, are creating sustained demand for high-performance semiconductor packages that rely on advanced die attach solutions to manage extreme heat flux. These technological shifts are imposing increasingly stringent performance specifications on materials, pushing innovation toward higher thermal conductivity and greater operational stability across wider temperature ranges, creating significant market momentum.

Restraints primarily revolve around the high development cost and complexity associated with advanced material formulation, particularly nano-filled conductive materials and sintering pastes, which require specialized manufacturing environments and complex intellectual property portfolios. Furthermore, the stringent quality and reliability testing required, especially for automotive (AEC-Q100/200) and aerospace applications, represents a significant barrier to entry for new players and adds lead time to product commercialization. Another critical restraint is the continuous trend toward miniaturization, which decreases the allowable bond line thickness (BLT), making precise dispensing and void-free bonding increasingly challenging in high-volume manufacturing, thereby limiting yield rates for specialized packages and maintaining price sensitivity in commodity segments where epoxy alternatives remain viable, despite lower performance.

Opportunities in the market are abundant, centered on the widespread adoption of advanced packaging technologies such as heterogeneous integration, chiplet architectures, and advanced fan-out wafer-level packaging (FOWLP), all of which require customized and specialized attach materials beyond standard offerings. The growing emphasis on sustainable electronics also presents an opportunity for manufacturers to develop halogen-free and environmentally friendly paste formulations that meet green manufacturing mandates without compromising performance. Impact forces, therefore, are weighted heavily towards technological mandates stemming from high-growth end-user segments like EVs and AI, which prioritize performance and reliability over cost, creating a strong pull for premium, high-margin die attach solutions. The competitive landscape is characterized by intense R&D activity, focused on developing the next generation of materials that can withstand operating temperatures exceeding 250°C and offering fatigue resistance under extreme thermal cycling conditions.

Segmentation Analysis

The Die Attach Paste Market is rigorously segmented based on material composition, performance characteristics, application scope, and physical form factor, reflecting the diverse and specialized requirements of the semiconductor industry. The segmentation by material is crucial, differentiating between traditional epoxy-based pastes, which dominate volume markets due to their cost-effectiveness and good mechanical properties, and emerging high-performance materials like silver sintering paste and specialized polyimide-based compositions. Segmentation by conductivity further divides the market into electrically conductive (essential for most ICs and power devices) and electrically non-conductive (used in sensor applications or where insulation is required, like flip-chip underfill substitutes), with thermal conductivity being a major defining metric across all categories, especially for high-power devices.

Application segmentation remains a significant driver of material choice and specification. Major applications include power devices (IGBTs, MOSFETs), LEDs (where heat dissipation is paramount), RF and microwave devices (demanding low loss and high-frequency stability), and consumer electronics (requiring low cost and high throughput). The application profile dictates crucial parameters such as required thermal resistance, maximum operating temperature, die size compatibility, and volume manufacturing feasibility. For instance, automotive applications necessitate extreme reliability testing and resistance to harsh environments, pushing the market toward specialized high-reliability materials, whereas mass-market consumer devices prioritize lower cost per unit and manufacturability.

Furthermore, segmentation by form factor, including liquid paste dispensed via jetting or printing, and pre-formed die attach films (DAFs), provides differentiation based on the manufacturing process and packaging geometry. Die attach films are gaining popularity in high-volume, thin packaging applications, offering precise thickness control and reduced process complexity, while liquid pastes remain the dominant form for large die and high-power applications where maximum void-free coverage and tailored bond lines are required. Understanding these segment dynamics is crucial for market participants, as specialization in high-growth niches, such as sintering pastes for SiC power modules, often yields higher margins and stronger competitive positioning than competing in saturated commodity segments.

- By Material Type:

- Epoxy (Silver-filled, Non-conductive)

- Non-Epoxy Polymeric (Silicones, Polyimides, Cyanate Esters)

- Sintering Paste (Silver, Copper)

- Eutectic/Metallic Alloys

- By Type of Conductivity:

- Electrically Conductive

- Electrically Non-Conductive

- By Application:

- Power Devices (IGBTs, MOSFETs)

- High Brightness LEDs (HB-LEDs)

- RF & Microwave Devices

- Memory Chips

- CMOS Image Sensors

- Microprocessors/ASICs

- Others (Defense, Aerospace)

- By Form Factor:

- Paste (Liquid/Dispensable)

- Film (Die Attach Film - DAF)

Value Chain Analysis For Die Attach Paste Market

The value chain for the Die Attach Paste market begins upstream with the sourcing of specialized raw materials, encompassing the synthesis of base polymers (e.g., epoxy resins, silicones, polyimides) and the procurement of high-purity functional fillers, predominantly metallic powders like silver, copper, and specialized ceramic compounds (e.g., boron nitride, aluminum nitride). The quality and cost of these raw materials, especially ultra-fine silver powder required for high-conductivity and sintering pastes, significantly influence the final product’s performance and pricing structure. Suppliers in this phase are highly specialized chemical and metallurgy companies that must ensure strict control over particle size distribution, purity, and surface chemistry, as these properties directly affect the thermal and rheological characteristics of the final paste product. Maintaining resilient sourcing strategies, especially concerning precious metals, is a critical challenge for profitability in the highly competitive upstream segment.

The midstream involves the core activities of formulation, compounding, and manufacturing, where material suppliers blend and homogenize the polymers and fillers under stringent cleanroom conditions to produce the final die attach paste or film. This stage requires significant investment in advanced mixing equipment, quality control infrastructure, and intellectual property related to rheology modification and long-term stability enhancement (e.g., shelf life). Distribution channels for die attach pastes are typically bifurcated into direct sales to large, integrated device manufacturers (IDMs) and major outsourced semiconductor assembly and test (OSAT) providers, and indirect sales through specialized technical distributors who offer localized technical support and inventory management to smaller or regional customers. Effective technical support is paramount in this market, as the proper application and curing of the paste are highly process-dependent and crucial for achieving optimal package performance.

Downstream analysis focuses on the end-users: semiconductor manufacturers, OSAT companies, and specialized module assemblers (particularly in automotive and LED industries). These customers integrate the paste into their packaging lines, using highly automated equipment for dispensing, die placement, and subsequent curing/sintering processes. The demand for Die Attach Paste is derived from the production volume of electronic devices, making the market highly sensitive to cycles in the electronics and automotive industries. Direct engagement with these end-users is essential for material suppliers to understand emerging packaging needs, such as requirements for ultra-thin bond lines in advanced fan-out packaging or the need for lead-free, high-temperature solutions for automotive power modules, ensuring that R&D efforts are aligned with industry technological roadmaps and application-specific constraints.

Die Attach Paste Market Potential Customers

The primary consumers and potential customers of Die Attach Paste are fundamentally linked to the global semiconductor manufacturing ecosystem, spanning across original equipment manufacturers (OEMs) with internal packaging capabilities and, more significantly, outsourced semiconductor assembly and test (OSAT) service providers. OSAT companies represent a colossal customer base due to their function as the centralized service providers for packaging and testing chips for numerous fabless and integrated device manufacturers globally. Major OSAT firms such as ASE Group, Amkor Technology, and JCET Group are critical high-volume buyers, as they process millions of wafers annually across diverse packaging types, requiring vast quantities of standardized and specialized die attach materials tailored to different customer specifications and regulatory environments, particularly those serving automotive and medical sectors.

Beyond the core OSAT segment, significant purchasing power resides within Integrated Device Manufacturers (IDMs) who maintain their own in-house packaging lines, including major players like Intel, Samsung, and Texas Instruments. These companies often require highly proprietary or customized paste formulations that are optimized for their specific chip architectures (e.g., CPU, GPU, memory) and advanced proprietary packaging processes. These customers prioritize performance specifications, process compatibility, and long-term supply assurance over marginal cost savings, leading to high-value, long-term supply contracts for advanced materials like high-purity silver sintering pastes essential for their premium, high-reliability products, such as server processors and high-performance memory modules.

Finally, specialized vertical integrators, particularly in the Power Electronics and LED manufacturing sectors, form a crucial segment of potential buyers. Companies manufacturing power modules for electric vehicles (e.g., Infineon, Fuji Electric, Bosch) are highly discerning customers for thermal management solutions, driving the highest demand for silver sintering paste due to its unmatched thermal and mechanical reliability under extreme temperature cycling. Similarly, High-Brightness LED manufacturers require materials that maximize light output efficiency and product lifespan by minimizing junction temperature. Targeting these specialized customers requires material suppliers to provide extensive technical validation, comprehensive reliability data, and a deep understanding of thermal stress analysis specific to the power cycling demands of the final application.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,390 Million |

| Growth Rate | CAGR 7.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Henkel AG & Co. KGaA, Heraeus Holding, Alpha Assembly Solutions (MacDermid Alpha Electronics Solutions), DuPont, Sumitomo Bakelite Co., Ltd., Shin-Etsu Chemical Co., Ltd., Lord Corporation (Parker Hannifin), Dymax Corporation, AIM Solder, Wacker Chemie AG, BASF SE, Nagase & Co., Ltd., Delo Industrial Adhesives, Indium Corporation, Kyocera Corporation, TSRC Corporation, Mitsubishi Materials Corporation, Remondis SE & Co. KG, Sanyu Rec Co., Ltd., Zymet Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Die Attach Paste Market Key Technology Landscape

The Die Attach Paste market is undergoing rapid technological evolution, moving away from traditional solder and standard epoxy toward highly specialized advanced polymeric and metallic bonding solutions necessary for high-performance semiconductor devices. The most disruptive technological shift is the increasing adoption of Silver Sintering Paste (SSP) technology, especially for high-power applications involving Silicon Carbide (SiC) and Gallium Nitride (GaN) devices found in electric vehicles and renewable energy infrastructure. Sintering involves pressing and heating the paste to form a dense, metallic bond at relatively lower temperatures than traditional soldering, resulting in extremely high thermal conductivity (often exceeding 150 W/mK) and excellent mechanical stability across wide operating temperature ranges, addressing the critical thermal dissipation challenges posed by next-generation wide-bandgap semiconductors. This technology requires specialized process equipment, including high-pressure sintering tools and inert atmospheres, representing a significant capital expenditure but delivering unparalleled performance.

Another crucial technological development involves advanced polymeric formulations designed for low-stress packaging and heterogeneous integration. As chiplets and 3D stacking become standard practice, the need for materials that exhibit low coefficient of thermal expansion (CTE) and low modulus of elasticity—essential for minimizing stress transfer between components—has escalated. Manufacturers are developing non-epoxy polymeric materials, such as specialized silicones and cyanate ester formulations, which offer flexibility and cushioning capabilities, preventing warpage and cracking in multi-die packages and large-area substrates. Furthermore, the drive towards thinner, higher-density packaging has spurred innovation in Die Attach Films (DAFs), which provide precise bond line thickness (BLT) control down to the micrometer level and simplify the manufacturing process by eliminating dispensing steps. Modern DAFs are increasingly being formulated to incorporate advanced thermal or electrical fillers, blurring the line between traditional pastes and film-based solutions.

Process technology refinement also plays a critical role in the landscape, focusing on improving dispensing accuracy and ensuring void-free bonding. Advanced dispensing techniques, including jetting and enhanced screen printing methods, are constantly being refined to handle the increasing complexity and miniaturization of bond areas, particularly for flip-chip applications and fine-pitch interconnection. Automation, utilizing high-precision robotics and real-time vision systems, is essential to achieve the sub-micron accuracy required in high-volume production. Future advancements are expected in hybrid materials that combine the mechanical benefits of polymers with the thermal performance of metallic fillers, potentially leading to fully printable, low-temperature curing conductive inks or pastes compatible with flexible substrates, thereby expanding the market reach into emerging areas like wearable technology and IoT sensors that prioritize flexibility and low processing heat.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market for Die Attach Paste, primarily due to the vast presence of semiconductor manufacturing giants, including integrated device manufacturers (IDMs) and the world’s largest outsourced semiconductor assembly and test (OSAT) service providers located in China, Taiwan, South Korea, and Japan. The region accounts for the majority of global consumer electronics, memory, and increasingly, automotive semiconductor production, creating massive, sustained demand for both high-volume epoxy pastes and advanced sintering materials. Government investments in domestic semiconductor self-sufficiency (e.g., China's Made in China 2025 initiative) continue to fuel capacity expansion and technological adoption, particularly in advanced packaging techniques.

- North America: North America is a major innovation hub, driving demand for premium, high-reliability Die Attach Paste, especially for high-performance computing (HPC), AI accelerators, military, and aerospace applications. While manufacturing volume is lower compared to APAC, the average selling price (ASP) of materials sold here is significantly higher, reflecting the demand for specialized, highly tested, and certified pastes capable of meeting stringent specifications for durability and thermal management in cutting-edge technologies. The concentration of leading chip design companies and foundries specializing in advanced packaging strongly influences R&D direction globally.

- Europe: The European market is characterized by strong demand from the automotive sector, driven by the rapid electrification transition and robust industrial automation segment. Europe is a global leader in power electronics manufacturing (SiC/GaN), especially in Germany and Scandinavia, creating a powerful pull for high-end silver sintering and robust high-temperature pastes. Regulatory pressure for environmentally compliant materials (e.g., REACH compliance) also shapes the European market, favoring suppliers capable of providing high-performance, halogen-free, and sustainable paste formulations.

- Latin America & Middle East and Africa (MEA): These regions represent emerging markets with smaller current market shares but significant long-term growth potential, particularly in telecommunications infrastructure (5G rollout), defense, and localized electronics assembly. While volume production remains limited, the growth in data center development and localized automotive assembly operations, particularly in Mexico and Brazil, is expected to steadily increase the demand for imported die attach materials and related assembly consumables throughout the forecast period.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Die Attach Paste Market.- Henkel AG & Co. KGaA

- Heraeus Holding

- Alpha Assembly Solutions (MacDermid Alpha Electronics Solutions)

- DuPont

- Sumitomo Bakelite Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- Lord Corporation (Parker Hannifin)

- Dymax Corporation

- AIM Solder

- Wacker Chemie AG

- BASF SE

- Nagase & Co., Ltd.

- Delo Industrial Adhesives

- Indium Corporation

- Kyocera Corporation

- TSRC Corporation

- Mitsubishi Materials Corporation

- Remondis SE & Co. KG

- Sanyu Rec Co., Ltd.

- Zymet Inc.

Frequently Asked Questions

Analyze common user questions about the Die Attach Paste market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for high-performance die attach pastes?

The surging demand for power devices, specifically Silicon Carbide (SiC) and Gallium Nitride (GaN) modules used in electric vehicles (EVs) and 5G infrastructure, is the primary driver. These applications require pastes with superior thermal conductivity (like silver sintering paste) to manage extremely high heat flux and ensure long-term reliability under severe thermal cycling.

How does the shift towards advanced packaging influence die attach material selection?

Advanced packaging technologies, such as 2.5D/3D integration and chiplet architectures, necessitate die attach materials with ultra-low stress characteristics and precise bond line thickness (BLT) control. This drives the demand for specialized Die Attach Films (DAFs) and low-modulus polymeric pastes designed to minimize warpage and maintain dimensional stability during complex assembly processes.

Which material segment is projected to grow the fastest in the forecast period?

The Silver Sintering Paste (SSP) segment is projected to exhibit the fastest growth. SSP provides unmatched thermal performance and reliability compared to traditional epoxies or solders, making it the material of choice for next-generation automotive power electronics and high-performance server processors, which operate at high junction temperatures.

What are the main alternatives to standard epoxy die attach pastes?

Key alternatives include highly reliable metallic bonding materials such as Silver Sintering Paste, specialized non-epoxy polymers (like silicones and polyimides) used for their low-stress properties, and pre-formed Die Attach Films (DAFs), which simplify processing and provide excellent control over bond line thickness in high-volume applications.

Why is the Asia Pacific region dominant in the Die Attach Paste market?

APAC dominates due to the massive concentration of the global semiconductor supply chain, including major outsourced semiconductor assembly and test (OSAT) facilities and high-volume manufacturing hubs for consumer electronics and memory chips, centered in countries like China, Taiwan, South Korea, and Japan, driving the majority of global material consumption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Semi-Sintering Die Attach Paste Market Statistics 2025 Analysis By Application (Consumer Electronics, Automotive, Date Center), By Type (LOCTITE ABLESTIK ABP 8068TA, LOCTITE ABLESTIK ABP 8068TB), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Die Attach Paste Market Statistics 2025 Analysis By Application (SMT Assembly, Semiconductor Packaging, Automotive, Medical), By Type (No-Clean Pastes, Rosin Based Pastes, Water Soluble Pastes), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager