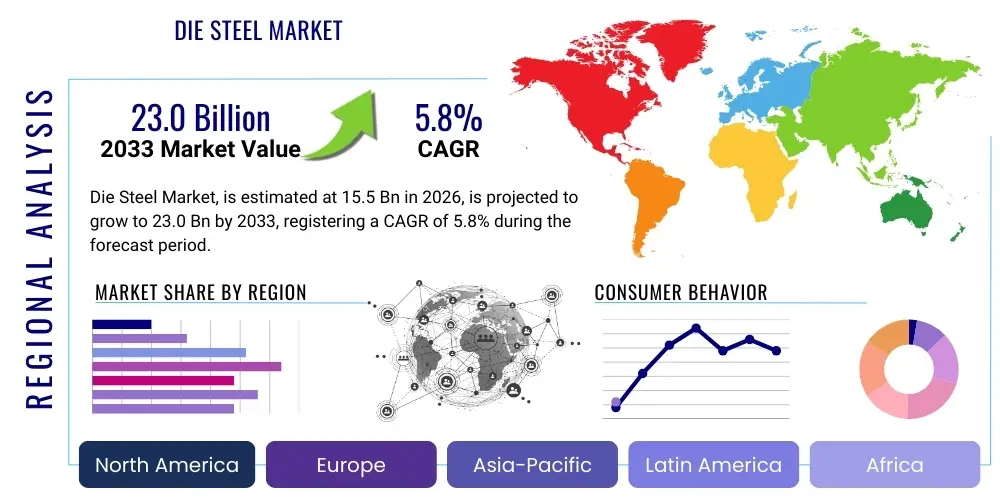

Die Steel Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440422 | Date : Jan, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Die Steel Market Size

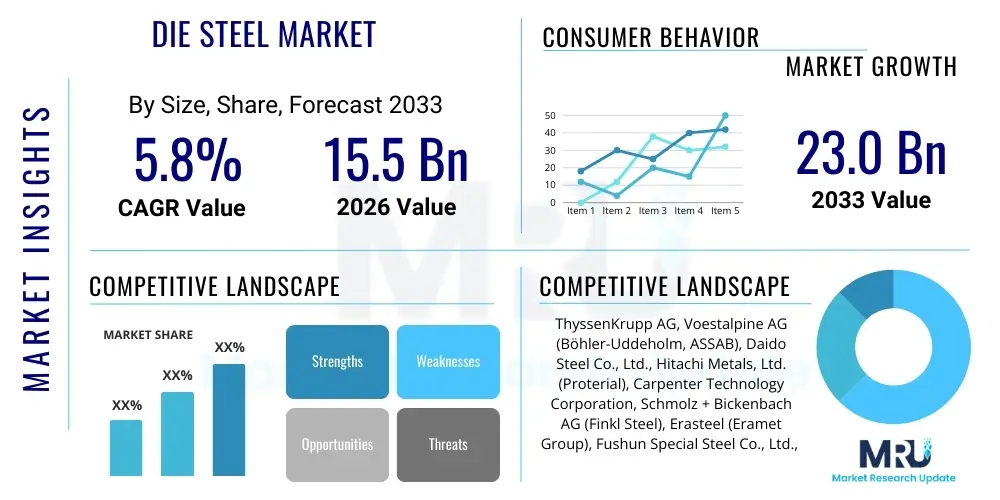

The Die Steel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 23.0 Billion by the end of the forecast period in 2033.

Die Steel Market introduction

The Die Steel Market encompasses the global production, distribution, and consumption of specialized steel alloys primarily designed for the manufacturing of dies, molds, and various tooling applications. These advanced materials are engineered to withstand extreme conditions, including high temperatures, intense pressures, abrasive wear, and repetitive mechanical stress, making them indispensable in critical industrial processes. The intrinsic properties of die steel, such as exceptional hardness, toughness, wear resistance, and thermal stability, are crucial for extending the lifespan and enhancing the performance of tooling components across a diverse range of manufacturing sectors. The market primarily caters to industries that rely on precision manufacturing, mass production, and intricate shaping of materials like metals, plastics, and ceramics, where the integrity and accuracy of the tooling directly impact final product quality and production efficiency.

Die steels are broadly categorized based on their working temperature and application, including hot work die steels, cold work die steels, and plastic mold steels, each optimized for specific operational environments. Hot work die steels, for instance, maintain high strength and hardness at elevated temperatures, making them ideal for forging, extrusion, and die-casting operations. Cold work die steels, conversely, exhibit superior wear resistance and toughness at ambient temperatures, finding extensive use in stamping, punching, and cutting applications. Plastic mold steels offer excellent polishability, corrosion resistance, and dimensional stability, critical for injection molding of intricate plastic components. The market's growth is predominantly driven by the escalating demand for high-quality, high-precision manufactured goods across various industries, coupled with continuous advancements in material science and processing technologies that enable the development of superior die steel grades capable of addressing increasingly stringent performance requirements. The benefits derived from employing advanced die steels include enhanced tool longevity, reduced downtime, improved product quality, and ultimately, significant cost savings in manufacturing operations.

Die Steel Market Executive Summary

The Die Steel Market is experiencing robust expansion, propelled by the relentless evolution of manufacturing processes and the escalating global demand for high-precision components across diverse end-use industries. Key business trends indicate a significant push towards developing advanced die steel grades that offer superior performance characteristics, such as enhanced wear resistance, increased toughness, and improved thermal conductivity, to meet the stringent demands of modern manufacturing. Manufacturers are increasingly investing in research and development to innovate new compositions and heat treatment protocols, aiming to extend tool life, optimize production cycles, and reduce overall operational costs for their clientele. Furthermore, there is a growing emphasis on sustainable manufacturing practices, influencing the development of die steels with improved recyclability and energy efficiency in their production and use. The consolidation of major players and strategic collaborations are also shaping the competitive landscape, fostering technological advancements and broader market reach.

Regionally, the Asia Pacific (APAC) market continues to dominate the die steel landscape, driven by the rapid industrialization, burgeoning automotive sector, and robust growth in electronics and general engineering industries, particularly in China, India, and Southeast Asian countries. Europe and North America, while more mature markets, are characterized by a strong focus on high-value-added applications, technological innovation, and the adoption of premium die steel grades for advanced manufacturing processes such as additive manufacturing. Latin America and the Middle East & Africa regions are also exhibiting steady growth, fueled by infrastructure development, expanding manufacturing bases, and increased foreign investments. From a segmentation perspective, hot work die steels and plastic mold steels are projected to witness significant growth, attributed to the expanding automotive industry and the escalating demand for complex plastic components in consumer electronics and medical devices. The increasing adoption of these specialized steels in tooling for electric vehicle components and lightweight materials further underscores their critical role in shaping future manufacturing paradigms.

AI Impact Analysis on Die Steel Market

The integration of Artificial Intelligence (AI) across industrial sectors is prompting a transformative shift in the Die Steel Market, with common user questions frequently revolving around how AI can enhance material selection, optimize manufacturing processes, and improve predictive maintenance for tooling. Users are keen to understand AI's role in accelerating the discovery of new alloy compositions, predicting performance under extreme conditions, and enabling smarter quality control to reduce defects. There is also significant interest in AI-driven solutions for optimizing heat treatment parameters and machining strategies, which are crucial for achieving the desired properties in die steels. The overarching theme is one of leveraging AI to achieve higher efficiency, superior product quality, reduced material waste, and ultimately, a more intelligent and responsive die steel supply chain, addressing concerns about cost, lead times, and the need for increasingly specialized materials for advanced applications.

AI's analytical capabilities extend beyond process optimization, offering profound implications for material design and lifecycle management of die steel tools. By analyzing vast datasets encompassing material properties, process parameters, and operational performance, AI algorithms can identify subtle correlations and optimal configurations that human analysis might miss. This enables a data-driven approach to developing next-generation die steels tailored for specific applications, significantly reducing the trial-and-error often associated with traditional metallurgical research. Furthermore, AI-powered systems can provide real-time insights into tool wear and performance, facilitating proactive maintenance schedules and minimizing unexpected downtime, which is a major concern for manufacturers reliant on continuous production. The implementation of AI is thus anticipated to elevate the sophistication of die steel manufacturing and application, making the entire ecosystem more agile and efficient.

- AI-Driven Material Design and Discovery: AI algorithms can analyze vast datasets of material properties, chemical compositions, and processing parameters to predict the performance of new die steel alloys. This accelerates the discovery of novel materials with enhanced toughness, wear resistance, and thermal stability, reducing the time and cost associated with traditional experimental methods. For example, machine learning models can simulate the effects of alloying elements on microstructure and mechanical properties, guiding metallurgists toward optimal formulations.

- Predictive Maintenance for Dies and Molds: AI-powered sensors and analytics can monitor the operational conditions of dies and molds in real-time, detecting subtle anomalies in temperature, vibration, or force. This allows for accurate prediction of potential tool failure or wear progression, enabling proactive maintenance scheduling and reducing unexpected downtime. Such systems contribute significantly to extending the service life of expensive tooling and optimizing production efficiency.

- Optimized Manufacturing Processes: AI can fine-tune critical manufacturing steps such as melting, forging, and heat treatment of die steels. Machine learning models can analyze process data to identify optimal parameters for each stage, ensuring consistent material quality, minimizing defects, and improving energy efficiency. This leads to more uniform mechanical properties and reduced batch-to-batch variation in the final die steel product.

- Enhanced Quality Control and Defect Detection: Computer vision and AI algorithms can be deployed for automated inspection of die steel billets and finished products, identifying surface defects, internal flaws, and microstructural inconsistencies with high precision and speed. This significantly improves the accuracy and consistency of quality control compared to manual inspections, ensuring that only high-quality materials proceed to manufacturing.

- Supply Chain Optimization and Demand Forecasting: AI can analyze historical sales data, market trends, and economic indicators to provide more accurate demand forecasts for various grades of die steel. This enables manufacturers and distributors to optimize inventory levels, streamline production schedules, and enhance supply chain responsiveness, ensuring timely delivery and reducing storage costs.

- Robotics and Automation in Processing: AI-driven robotics are increasingly used in handling, machining, and finishing operations for die steels, improving precision, repeatability, and safety. Automated systems can perform complex tasks such as grinding, milling, and polishing with minimal human intervention, contributing to higher productivity and consistent quality in tooling production.

- Customization and Personalization: AI facilitates the customization of die steel solutions by processing specific client requirements, application data, and performance criteria. This allows for the precise tailoring of material properties and geometries, delivering highly specialized dies and molds that meet unique operational challenges and performance demands, driving greater customer satisfaction and market differentiation.

DRO & Impact Forces Of Die Steel Market

The Die Steel Market is significantly influenced by a confluence of driving forces, prominent among which is the escalating demand from the automotive industry, particularly with the global shift towards electric vehicles (EVs) and lightweighting initiatives. The production of intricate EV components, high-strength body parts, and specialized battery casings necessitates advanced die steels capable of handling complex stamping, forging, and molding operations with superior precision and extended tool life. Concurrently, the robust expansion of the general manufacturing and machinery industries, driven by global industrialization and infrastructure development, consistently fuels the demand for durable and high-performance dies and molds. Furthermore, continuous technological advancements in material science and metallurgy enable the development of newer, superior grades of die steels that offer enhanced properties such as improved wear resistance, higher toughness, and better thermal stability, thereby catering to more demanding applications and stimulating market growth. The increasing adoption of advanced manufacturing techniques like additive manufacturing for producing complex tooling also necessitates specialized die steel powders and materials, acting as a crucial driver for innovation and market expansion.

Despite these strong growth drivers, the market faces several restraining factors that could impede its trajectory. The high initial capital investment required for specialized die steel production facilities, coupled with the complex metallurgical processes and stringent quality control standards, poses a significant barrier to entry for new players. Volatility in raw material prices, particularly for alloying elements like chromium, molybdenum, vanadium, and nickel, can directly impact production costs and subsequently affect the pricing and profitability of die steel manufacturers. Environmental regulations concerning energy consumption, emissions, and waste disposal in steel manufacturing also add to operational costs and compliance burdens. Moreover, the long product development cycles for new die steel grades, which involve extensive research, testing, and certification, can slow down the pace of innovation and market penetration. The availability of substitute materials or alternative manufacturing processes, though limited for high-performance applications, also presents a long-term restraint, pushing manufacturers to continuously innovate.

Opportunities within the Die Steel Market are abundant, primarily stemming from the increasing focus on tool life optimization and productivity enhancement in manufacturing sectors worldwide. The growing adoption of Industry 4.0 technologies, including IoT, AI, and advanced analytics, for predictive maintenance and process optimization in tooling, creates new avenues for intelligent die steel solutions. Emerging economies, particularly in Asia Pacific and Latin America, present vast untapped potential due to their burgeoning manufacturing bases and increasing adoption of advanced tooling for domestic production and export. The demand for specialized die steels in niche, high-growth sectors such as medical devices, aerospace, and defense, which require ultra-precision and reliability, also offers lucrative opportunities. Impact forces, therefore, include the ongoing geopolitical shifts influencing trade policies and supply chain resilience, the rapid pace of digitalization in manufacturing, and persistent efforts to achieve sustainable industrial practices. These forces collectively shape the competitive dynamics and future strategic imperatives for die steel producers, urging them to prioritize R&D, supply chain diversification, and customer-centric innovation to capitalize on emerging opportunities and mitigate risks.

Segmentation Analysis

The Die Steel Market is comprehensively segmented based on various critical parameters, providing a detailed understanding of its diverse applications and material types. This segmentation allows for precise market analysis, enabling stakeholders to identify key growth areas and tailor their strategies to specific industry needs. The primary segmentation criteria include the type of die steel, the application it serves, the end-use industry utilizing the product, and the manufacturing process employed for its production. Each segment reflects unique performance requirements and market dynamics, contributing to the overall complexity and specialization of the die steel landscape. Understanding these distinctions is fundamental to grasping the intricate interdependencies within the market and projecting future trends, as demand drivers and technological advancements often vary significantly across these classifications. The market's structural integrity is maintained through this granular approach, ensuring that specific industry demands for durability, precision, and efficiency are met with appropriate material solutions.

- By Type:

- Hot Work Die Steel: Characterized by high resistance to softening at elevated temperatures, exceptional toughness, and good thermal fatigue resistance. Primarily used for applications involving high temperatures and shock, such as forging, extrusion, and die casting dies. Examples include H13, H11.

- Cold Work Die Steel: Known for high hardness, superior wear resistance, and toughness at ambient temperatures. Employed in applications like stamping, blanking, punching, and cutting tools where abrasion and deformation resistance are paramount. Examples include D2, A2, O1.

- Plastic Mold Steel: Offers excellent polishability, corrosion resistance, and good machinability. Essential for injection molding, compression molding, and blow molding of plastic components, especially for producing highly aesthetic and precise parts. Examples include P20, 420 stainless.

- High-Speed Steel (HSS): Possesses very high hardness, wear resistance, and heat resistance, even at high cutting speeds. Primarily used for cutting tools (drills, milling cutters) but also in some die applications requiring extreme wear resistance. Examples include M2, T1.

- Others (e.g., Ultra-High Strength Steels): Includes specialized alloys developed for niche applications demanding unique combinations of properties not covered by standard types, such as advanced powder metallurgy steels or specific tool steels for additive manufacturing.

- By Application:

- Automotive Manufacturing: Dies for stamping body panels, engine components, chassis parts, and forging dies for crankshafts and connecting rods. Critical for lightweighting and complex component production for both traditional and electric vehicles.

- Aerospace & Defense: High-precision dies for forming complex aircraft structural components, turbine blades, and defense equipment parts that require exceptional strength-to-weight ratios and reliability.

- Tool & Die Making: Production of a wide array of tools and molds used across various industries, including injection molds, extrusion dies, progressive dies, and trim dies, fundamental to mass production processes.

- Electronics & Electrical: Dies for manufacturing intricate electronic connectors, semiconductor lead frames, and components for electrical devices, where precision and longevity are vital.

- General Engineering: Dies and tools for manufacturing general machinery parts, gears, bearings, fasteners, and agricultural equipment, requiring robust and durable tooling solutions.

- Medical Devices: Molds for producing intricate medical instruments, surgical tools, and implantable devices where high surface finish, precision, and biocompatibility are often required.

- By End-Use Industry:

- Automotive & Transportation: Encompasses all aspects of vehicle manufacturing, including passenger cars, commercial vehicles, and aerospace components, where die steel is crucial for structural integrity and performance.

- Machinery & Equipment: Includes heavy machinery, industrial equipment, construction equipment, and agricultural machinery, all requiring durable tools for fabrication and assembly.

- Consumer Goods: Production of household appliances, electronics, and various plastic products where injection molding and stamping dies are extensively used.

- Construction: Tools and dies for producing structural steel components, fasteners, and other building materials that demand robust manufacturing processes.

- Energy: Molds and dies for components in the oil & gas, power generation, and renewable energy sectors, where materials must withstand harsh environments and high stresses.

- Medical & Healthcare: Manufacturers of surgical instruments, prosthetic devices, and various medical equipment relying on precision tooling for sterile and functional components.

- By Process:

- Forging: Uses die steel for hammer dies, press dies, and upset dies to shape metal by compressive forces, producing strong and tough components for automotive and aerospace.

- Casting: Die steel is used in permanent molds and die-casting dies for non-ferrous metals, offering high dimensional accuracy and efficient production of complex shapes.

- Powder Metallurgy: Involves the use of die steel for compaction dies and sintering molds, crucial for forming intricate components from metal powders with minimal material waste.

- Additive Manufacturing: Emerging application where specialized die steel powders are used in processes like selective laser melting (SLM) to create complex tooling and functional prototypes, offering design freedom and rapid prototyping capabilities.

Value Chain Analysis For Die Steel Market

The value chain for the Die Steel Market is a complex and multi-stage process, beginning with the extraction and processing of raw materials and culminating in the end-use application of dies and molds. Upstream analysis involves the mining and initial processing of critical alloying elements such as iron ore, chromium, molybdenum, vanadium, nickel, and tungsten. These raw materials are then transported to primary steel producers, where they undergo melting, refining, and alloying processes in electric arc furnaces or induction furnaces to create the specific chemical compositions required for various die steel grades. This stage involves stringent quality control to ensure the purity and precise elemental balance, which are paramount for the final performance characteristics of the die steel. Advanced vacuum melting techniques, such as Vacuum Induction Melting (VIM) and Vacuum Arc Remelting (VAR), are often employed at this stage to achieve superior cleanliness and homogeneity, which directly impacts the toughness and fatigue life of the resultant steel. The efficiency and cost-effectiveness of these initial stages significantly influence the overall competitiveness of the die steel product.

Following the primary steel production, the molten metal is cast into ingots or continuously cast billets. These intermediate products then undergo extensive downstream processing, which includes hot working operations like forging and rolling, aimed at refining the microstructure, eliminating porosity, and enhancing mechanical properties. Subsequent heat treatment processes, such as annealing, hardening, and tempering, are meticulously controlled to achieve the desired hardness, toughness, and dimensional stability of the die steel. These processes are highly specialized and require significant metallurgical expertise and state-of-the-art equipment. The processed die steel is then machined, ground, and polished to produce blanks or near-net shape components that are ready for tool and die makers. This manufacturing phase also involves various finishing operations, including surface treatments like nitriding or PVD coatings, to further enhance wear resistance and improve tool life in specific applications. Quality assurance and testing throughout these downstream stages are critical to guarantee that the die steel meets the demanding performance specifications required for industrial tooling.

Distribution channels for die steel can be both direct and indirect, catering to a diverse customer base. Direct sales typically involve large-volume purchasers, such as major automotive manufacturers, large tool and die shops, or aerospace companies, where direct relationships with die steel producers facilitate customized orders, technical support, and optimized supply chain logistics. These direct channels often include specialized technical sales teams that work closely with clients to recommend appropriate steel grades and provide application-specific solutions. Indirect channels, on the other hand, involve a network of distributors, stockists, and agents who maintain inventories of various die steel grades and provide immediate availability to smaller and medium-sized tool and die manufacturers, general engineering shops, and specialized machining centers. These intermediaries play a crucial role in market penetration, particularly in regions where direct sales may not be economically viable, offering cut-to-size services and localized support. The choice of distribution channel often depends on the customer's size, geographic location, specific requirements, and the complexity of the die steel product, ensuring broad market access and efficient delivery of these critical materials.

Die Steel Market Potential Customers

Potential customers for die steel are predominantly found across a spectrum of manufacturing industries that rely heavily on precision tooling, high-volume production, and intricate component shaping. The largest segment of end-users comprises the automotive industry, encompassing manufacturers of passenger vehicles, commercial vehicles, and automotive components. These companies require vast quantities of die steel for stamping dies (for body panels, chassis components), forging dies (for engine parts, crankshafts, connecting rods), and plastic injection molds (for interior and exterior plastic parts). The ongoing shift towards electric vehicles (EVs) further intensifies demand for die steel suitable for lightweighting solutions and specialized battery component manufacturing, pushing the need for materials with superior strength-to-weight ratios and enhanced fatigue resistance. The aerospace and defense sectors represent another critical customer base, demanding ultra-high-performance die steels for forming complex structural components, turbine blades, and various defense equipment, where reliability, dimensional stability, and extreme temperature performance are non-negotiable.

Beyond the transportation sectors, the general engineering and machinery manufacturing industries constitute a significant segment of potential customers. This includes manufacturers of industrial machinery, construction equipment, agricultural machinery, and various metalworking equipment, all of whom require robust and durable dies for forming, cutting, and shaping metal components. These customers often seek die steels that offer excellent wear resistance and toughness to withstand continuous operation and minimize downtime, which is critical for maintaining productivity in heavy-duty applications. Furthermore, the electronics and electrical industry represents a growing customer segment, particularly for precision plastic mold steels and cold work die steels used in the production of intricate connectors, semiconductor lead frames, and components for consumer electronics. The increasing miniaturization and complexity of electronic devices necessitate tooling with extremely tight tolerances and high surface finishes, driving demand for specialized die steel grades capable of achieving these exacting standards.

Additionally, the medical device industry is emerging as a niche but high-value segment of potential customers for die steel. Manufacturers of surgical instruments, implants, and various medical equipment require molds and dies that meet stringent requirements for precision, surface finish, and often, corrosion resistance and biocompatibility. The demand here is for high-quality plastic mold steels for injection molding of medical-grade plastics and specialized cold work steels for stamping and forming precision components. The consumer goods sector also consistently drives demand for plastic mold steels, used in the production of household appliances, various plastic products, and packaging. These diverse end-users collectively underscore the broad applicability and critical importance of die steel across the global manufacturing landscape, with each segment seeking specific material properties to optimize their unique production challenges and product requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 23.0 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ThyssenKrupp AG, Voestalpine AG (Böhler-Uddeholm, ASSAB), Daido Steel Co., Ltd., Hitachi Metals, Ltd. (Proterial), Carpenter Technology Corporation, Schmolz + Bickenbach AG (Finkl Steel), Erasteel (Eramet Group), Fushun Special Steel Co., Ltd., Nachi-Fujikoshi Corp., Sandvik AB, POSCO, JFE Steel Corporation, Crucible Industries LLC, Kind & Co. Edelstahlwerke GmbH & Co. KG, Nippon Koshuha Steel Co., Ltd., ArcelorMittal S.A., Gerdau S.A., Aichi Steel Corporation, Universal Stainless & Alloy Products, Inc., Longyida Special Steel Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Die Steel Market Key Technology Landscape

The Die Steel Market is continuously evolving through significant technological advancements aimed at enhancing material performance, optimizing manufacturing efficiency, and meeting increasingly stringent application demands. One pivotal area of innovation lies in advanced melting and refining technologies, such as Electroslag Remelting (ESR) and Vacuum Arc Remelting (VAR). These processes are crucial for producing ultra-clean, highly homogeneous die steels with minimal inclusions, leading to superior toughness, fatigue resistance, and isotropic properties. The elimination of defects and segregation through these methods is paramount for high-stress applications in automotive and aerospace. Furthermore, vacuum degassing techniques play a vital role in reducing dissolved gases, further improving the steel's cleanliness and reliability. These metallurgical processes represent the foundational technological capabilities that enable the production of premium die steel grades capable of extended service life under extreme operational conditions, directly impacting tool performance and manufacturing productivity.

Another significant technological driver is the development of sophisticated heat treatment protocols and surface modification techniques. Precise control over hardening, tempering, and annealing cycles is essential to achieve the desired microstructure and mechanical properties in die steels. Innovations in controlled atmosphere furnaces, vacuum heat treatment, and cryo-treatment allow for fine-tuning of hardness, toughness, and dimensional stability, reducing residual stresses and improving wear resistance. Complementary to heat treatment, advanced surface modification technologies like nitriding, carburizing, and various PVD (Physical Vapor Deposition) and CVD (Chemical Vapor Deposition) coatings are widely adopted. These surface treatments significantly enhance the surface hardness, friction reduction, and corrosion resistance of dies and molds without compromising the core toughness of the steel. The synergy between optimized heat treatment and high-performance coatings offers a comprehensive solution for maximizing tool longevity and operational efficiency in demanding applications, thereby reducing maintenance costs and downtime in manufacturing facilities.

The rise of powder metallurgy (PM) and additive manufacturing (AM) technologies is also profoundly reshaping the die steel landscape. Powder metallurgy enables the creation of high-alloyed die steels with finer grain structures, superior homogeneity, and the ability to incorporate higher concentrations of alloying elements than traditional ingot metallurgy. This results in enhanced wear resistance, improved grindability, and better overall performance, particularly for high-speed steels and tool steels. Additive manufacturing, specifically processes like Selective Laser Melting (SLM) and Electron Beam Melting (EBM), is gaining traction for producing complex die inserts and functional tooling with intricate internal cooling channels or customized geometries that are impossible to achieve with conventional manufacturing. This technology offers unprecedented design freedom, rapid prototyping capabilities, and the potential for on-demand production of specialized tooling. While still in its nascent stages for large-scale die steel production, AM represents a transformative technology that promises to revolutionize tool design, manufacturing lead times, and overall operational performance in the coming years, pushing the boundaries of what is achievable with die steel materials.

Regional Highlights

- North America: The North American die steel market is characterized by a strong emphasis on high-performance and high-value-added applications, particularly within the automotive, aerospace, and general engineering sectors. The region benefits from significant investments in advanced manufacturing technologies and robust research and development activities, driving the demand for premium and specialized die steel grades. The automotive industry, with its continuous innovation in electric vehicles and lightweight materials, remains a primary consumer, requiring durable and precise tooling. The presence of stringent quality standards and a focus on operational efficiency further propels the adoption of advanced die steels and associated manufacturing techniques.

- Europe: Europe represents a mature yet highly innovative die steel market, spearheaded by Germany, Italy, and France, which are major hubs for automotive, machinery, and precision tooling industries. The region is at the forefront of implementing Industry 4.0 principles, integrating automation, AI, and data analytics into die manufacturing processes, leading to increased demand for smart materials and optimized tool designs. Strict environmental regulations and a focus on sustainability also drive the development of more energy-efficient production methods and recyclable die steel compositions. European manufacturers often prioritize long tool life, reduced downtime, and high product quality, fueling demand for top-tier die steel solutions.

- Asia Pacific (APAC): The Asia Pacific market is the largest and fastest-growing region for die steel, driven by rapid industrialization, massive manufacturing bases, and burgeoning demand from China, India, Japan, and South Korea. The region's dominant automotive and electronics industries, coupled with significant investments in infrastructure and machinery manufacturing, create an immense appetite for all types of die steel. China, in particular, leads in both production and consumption, with a strong focus on domestic production capabilities and technological advancements. The lower labor costs and expanding middle-class populations further fuel consumption of manufactured goods, thereby consistently stimulating the demand for high-quality dies and molds across the region.

- Latin America: The Latin American die steel market is experiencing steady growth, primarily influenced by the expansion of the automotive sector in countries like Brazil and Mexico, alongside growing investments in infrastructure and general manufacturing. Economic stability and increased foreign direct investment are gradually contributing to the modernization of local industries, leading to higher demand for reliable and efficient tooling materials. While still a developing market compared to APAC or Europe, the region presents significant opportunities for die steel suppliers looking to expand their presence and cater to evolving industrial requirements, particularly as local production capabilities advance and technological adoption increases.

- Middle East and Africa (MEA): The Middle East and Africa region's die steel market is characterized by emerging growth, largely driven by diversification efforts away from oil-dependent economies. Investments in manufacturing, infrastructure development, and the automotive assembly sector in countries like South Africa and Saudi Arabia are increasing the demand for die steels. The region’s market is relatively smaller but offers growth potential as industrialization progresses and local manufacturing capabilities expand. Demand is often met through imports, though local production is gradually increasing, driven by strategic initiatives to bolster industrial self-sufficiency and establish advanced manufacturing hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Die Steel Market.- ThyssenKrupp AG

- Voestalpine AG (Böhler-Uddeholm, ASSAB)

- Daido Steel Co., Ltd.

- Hitachi Metals, Ltd. (Proterial)

- Carpenter Technology Corporation

- Schmolz + Bickenbach AG (Finkl Steel)

- Erasteel (Eramet Group)

- Fushun Special Steel Co., Ltd.

- Nachi-Fujikoshi Corp.

- Sandvik AB

- POSCO

- JFE Steel Corporation

- Crucible Industries LLC

- Kind & Co. Edelstahlwerke GmbH & Co. KG

- Nippon Koshuha Steel Co., Ltd.

- ArcelorMittal S.A.

- Gerdau S.A.

- Aichi Steel Corporation

- Universal Stainless & Alloy Products, Inc.

- Longyida Special Steel Co., Ltd.

Frequently Asked Questions

What is die steel and why is it important in manufacturing?

Die steel refers to a specialized group of high-alloyed steels engineered for creating dies, molds, and other tooling components. Its importance stems from its exceptional properties, including high hardness, superior wear resistance, toughness, and thermal stability, which are crucial for withstanding the extreme conditions of industrial processes like forging, stamping, and injection molding. These properties enable the precise and efficient mass production of complex parts across industries such as automotive, aerospace, and electronics, significantly extending tool life and ensuring consistent product quality.

Which types of die steel are most commonly used and for what applications?

The most common types of die steel include Hot Work Die Steel, used for high-temperature applications like forging and die casting due to its resistance to softening; Cold Work Die Steel, favored for stamping and punching operations at ambient temperatures due to its high wear resistance; and Plastic Mold Steel, essential for injection molding plastic components due to its excellent polishability and corrosion resistance. Each type is specifically formulated and heat-treated to optimize performance for its intended operational environment, ensuring durability and precision in tool applications.

What are the key drivers for growth in the Die Steel Market?

The Die Steel Market's growth is primarily driven by the expanding global automotive industry, particularly the demand for electric vehicles (EVs) and lightweight components, which necessitate advanced tooling. Additionally, robust growth in general manufacturing, machinery production, and electronics sectors worldwide fuels consistent demand for high-performance dies and molds. Continuous advancements in material science and metallurgical technologies, leading to the development of superior die steel grades with enhanced properties, also significantly contribute to market expansion by enabling more efficient and precise manufacturing processes.

How does AI impact the future of die steel manufacturing and application?

AI significantly impacts the die steel market by enhancing material design, optimizing manufacturing processes, and revolutionizing predictive maintenance. AI algorithms can accelerate the discovery of new alloy compositions, predict material performance under various conditions, and fine-tune heat treatment parameters for optimal results. In application, AI-powered systems monitor tool wear in real-time, enabling proactive maintenance and extending tool life, thereby improving efficiency, reducing defects, and creating a more intelligent and responsive die steel supply chain for advanced manufacturing.

Which regions are leading the Die Steel Market and why?

The Asia Pacific (APAC) region currently leads the Die Steel Market, largely due to rapid industrialization, extensive manufacturing bases, and significant demand from the automotive and electronics industries in countries like China, India, and Japan. Europe and North America also remain key markets, characterized by their focus on high-value, high-precision applications, technological innovation, and early adoption of advanced manufacturing techniques such as Industry 4.0. These regions' robust industrial ecosystems and continuous investments in R&D underpin their leadership in the global die steel landscape.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Tool Steel & Die Steel Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Tool Steel/Die Steel Market Statistics 2025 Analysis By Application (Automotive, Shipbuilding, Machinery, Others), By Type (Carbon Tool Steel, Alloy Tool Steel, High Speed Tool Steel), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Tool Steel and Die Steel Market Statistics 2025 Analysis By Application (Automotive, Shipbuilding, Machinery), By Type (Carbon Tool Steel, Alloy Tool Steel, High Speed Tool Steel), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Plastic Molding Die Steel Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (3Cr2Mo, 3Cr2MnNiMo, Others), By Application (OEM, Aftermarket), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Tool Steel Die Steel Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Carbon Tool Steel, Alloy Tool Steel, High Speed Tool Steel), By Application (Automotive, Shipbuilding, Machinery, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager