Diesel Fuel Water Separator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433770 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Diesel Fuel Water Separator Market Size

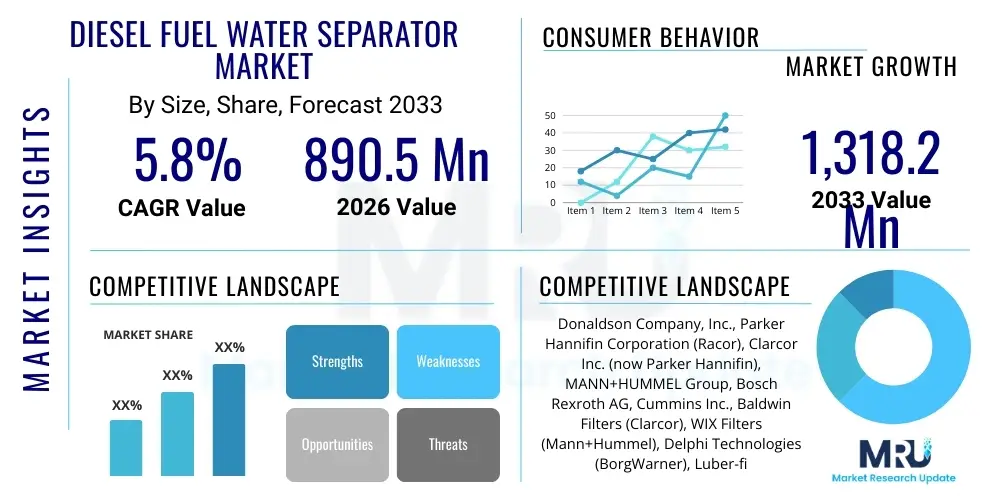

The Diesel Fuel Water Water Separator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $890.5 Million USD in 2026 and is projected to reach $1,318.2 Million USD by the end of the forecast period in 2033.

Diesel Fuel Water Separator Market introduction

The Diesel Fuel Water Separator Market encompasses filtration systems crucial for maintaining the integrity and performance of diesel engines across various industrial and transportation sectors. These devices are specifically engineered to efficiently remove free water, emulsified water, and particulate contamination from diesel fuel before it reaches the sensitive injection components. The necessity for these separators stems directly from the hygroscopic nature of modern diesel fuels, especially bio-diesel blends (B-series fuels), which are highly susceptible to water ingress through condensation, transportation, and storage processes. Contaminated fuel can lead to severe operational issues, including corrosion, microbial growth (diesel bug), premature wear of injectors and pumps, and ultimately, catastrophic engine failure. Therefore, the implementation of robust fuel water separation technology is non-negotiable for fleet operators and equipment owners seeking to optimize uptime and reduce maintenance expenditure, particularly in high-demand operational environments like commercial trucking, marine propulsion, power generation, and heavy construction equipment.

Diesel Fuel Water Separators operate primarily on the principles of coalescence and centrifugal force, often integrated with advanced filtration media, such as synthetic layered fabrics or Aquabloc filters, to achieve superior separation efficiency down to small micron levels. The major applications of these separators span the entire diesel ecosystem, ranging from OEM installation in new vehicles and machinery to aftermarket upgrades and retrofits. Key application segments include heavy-duty Class 8 trucks, agricultural tractors, mining haulers, marine vessels (both commercial and recreational), and stationary diesel generators utilized in data centers, hospitals, and remote sites. The benefits derived from deploying these advanced separation systems are multifaceted; they directly extend the lifespan of costly engine components, significantly improve fuel efficiency by ensuring optimal combustion, and critically, help engines comply with increasingly stringent global emission standards, such as EPA Tier regulations and Euro VI. The driving factors behind the market expansion are inherently linked to the global growth in commercial transportation and construction, the increasing adoption of ultra-low sulfur diesel (ULSD) which requires finer filtration, and the rising consumer demand for engine longevity and reliability.

Furthermore, the evolution of engine technology, particularly the shift towards high-pressure common rail (HPCR) injection systems, has intensified the requirement for ultra-clean fuel. HPCR systems operate at extremely high pressures (up to 30,000 psi or more) and utilize components with micro-tolerances, making them exceptionally vulnerable to damage from water droplets and abrasive particulates. A single micron of water or grit can cause pitting, erosion, and seizure of these precision components. Consequently, manufacturers are continuously innovating, developing two-stage or multi-stage separation systems that incorporate heating elements (for cold weather operation) and integrated sensors to detect water accumulation proactively. This technological advancement, coupled with the mandatory need for reliability in critical infrastructure powered by diesel—such as emergency backup power and maritime transport—ensures sustained market growth and high replacement demand, positioning diesel fuel water separators as essential protective mechanisms within the modern internal combustion engine infrastructure.

Diesel Fuel Water Separator Market Executive Summary

The global Diesel Fuel Water Separator Market is characterized by robust growth, primarily propelled by stringent environmental regulations mandating cleaner diesel operations and the widespread integration of sensitive High-Pressure Common Rail (HPCR) injection systems in new engine designs. Business trends indicate a strong focus on filter media innovation, including the move towards hydrophobic and multi-layered synthetic media to enhance water rejection capabilities and extend service intervals, addressing the industry demand for reduced operational costs and increased uptime. Regional trends highlight the Asia Pacific (APAC) region, particularly China and India, as the fastest-growing market due to massive investments in infrastructure development, rapid urbanization, and corresponding expansion of commercial vehicle fleets and construction equipment. North America and Europe remain mature markets but demonstrate sustained demand driven by strict fleet maintenance protocols and the continuous replacement cycle of heavy machinery. Segment trends reveal that the coalescing filter type dominates the market due to its high efficiency and reliability, while the application segment is heavily weighted towards the automotive and transportation sector, reflecting the sheer volume of diesel usage in commercial trucking and passenger vehicles globally. Furthermore, the OEM channel is experiencing growth as engine manufacturers increasingly integrate sophisticated filtration solutions as standard equipment to protect warranties and ensure compliance with modern fuel quality standards.

AI Impact Analysis on Diesel Fuel Water Separator Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Diesel Fuel Water Separator Market often center on predictive maintenance, operational efficiency improvements, and the integration of smart filtration systems. Common user questions probe whether AI can predict fuel quality degradation, optimize filter replacement schedules based on real-time operational parameters, or automate the water draining process in separators. The prevailing theme is the shift from reactive maintenance (replacing filters based on fixed mileage) to proactive, condition-based monitoring. Users express expectations that AI-driven analytics, processing data from integrated fuel sensors (monitoring differential pressure, water content, and temperature), will significantly reduce unexpected breakdowns and minimize waste by maximizing the useful life of filtration media. Conversely, concerns include the high initial cost of integrating AI-ready sensor arrays and the complexity of ensuring data connectivity and security across diverse, often remote, fleet environments. This analysis suggests AI will revolutionize fuel management by offering superior diagnostic capabilities and enabling highly precise operational adjustments, transitioning the separator from a passive component into an active, intelligent subsystem of the engine management unit.

- AI-driven Predictive Maintenance: Utilizing machine learning algorithms to analyze sensor data (pressure drop, water level) to accurately forecast filter clogging and component failure, enabling just-in-time replacement and reducing inventory costs.

- Optimized Drain Schedules: AI systems can analyze ambient humidity, fuel consumption patterns, and operational geography to autonomously determine the optimal frequency for draining accumulated water, preventing saturation and potential contamination incidents.

- Enhanced Efficiency Monitoring: Real-time correlation of fuel consumption with filtration system health allows operators to identify and rectify efficiency losses attributable to partially clogged or suboptimal separators.

- Supply Chain and Inventory Optimization: AI can forecast regional demand for specific filter types based on fleet demographics, climate conditions, and regulatory changes, optimizing manufacturer production and distributor inventory levels.

- Automated Diagnostic Reporting: AI generates concise, actionable reports for fleet managers, prioritizing maintenance tasks based on severity and potential impact on asset uptime, improving overall fleet management efficiency.

- Integration with Telematics: Seamless integration of separator data streams with broader vehicle telematics platforms enhances holistic engine health monitoring and remote diagnostics capabilities.

DRO & Impact Forces Of Diesel Fuel Water Separator Market

The dynamics of the Diesel Fuel Water Separator market are dictated by a powerful interplay of regulatory drivers, operational constraints, and technological opportunities, collectively shaping the investment and innovation landscape. Key drivers primarily revolve around the necessity to comply with strict global emission standards (such as Euro VI, EPA 2010, and Tier 4/5 off-road standards), which necessitate the use of highly sensitive High-Pressure Common Rail (HPCR) fuel injection systems. These systems demand exceptionally clean fuel, making water separation an indispensable protective measure. Furthermore, the mandatory introduction and increasing penetration of biofuel blends (B5, B20, etc.) significantly contribute to market growth, as these hydroscopic fuels attract and hold water more readily than traditional diesel, accelerating the need for high-performance separators capable of handling emulsified water efficiently. The persistent industry demand for enhanced engine durability and minimized downtime across sectors like logistics, mining, and power generation acts as a continuous commercial driver, compelling fleet owners to invest in superior separation technologies as a form of operational insurance against expensive component failures.

However, the market faces significant restraints that temper its growth trajectory. The most pronounced restraint is the initial high cost associated with advanced, multi-stage separation systems, which can deter cost-sensitive end-users in developing economies or smaller fleet operations from adopting premium products. Additionally, the proliferation of counterfeit or sub-standard replacement filters in the aftermarket poses a dual threat: it undercuts the pricing power of legitimate manufacturers and, more critically, compromises engine protection, leading to customer dissatisfaction and skepticism regarding the overall reliability of separation technology. Another constraint involves serviceability challenges; replacing and properly priming advanced filter cartridges requires specific technical knowledge, and improper servicing can lead to air ingress or inadequate filtration, which acts as a barrier to user adoption in regions with low technical expertise. Furthermore, the global long-term transition towards electric vehicles (EVs) and alternative fuels, while currently limited to specific segments, represents a structural restraint on the overall expansion of the diesel-reliant component market over the extreme long term.

Opportunities within the market center on technological innovation and strategic geographical expansion. There is a substantial opportunity in developing smart filtration systems integrated with Internet of Things (IoT) sensors, offering real-time monitoring and predictive maintenance capabilities, which aligns perfectly with the trend toward digitalization in fleet management. Manufacturers can capitalize on the robust replacement market by offering long-life, modular separators compatible with multiple engine platforms, reducing complexity for distributors and service providers. Geographically, untapped potential lies in expanding the OEM presence in emerging economies, particularly across Asia and Africa, where massive infrastructure projects are fueling rapid diesel engine deployment in construction and transportation. The industry also has an opportunity to focus R&D on mitigating the challenges posed by severe weather conditions, developing self-heating or chemically-enhanced separators that prevent fuel gelling and maintain high separation efficiency even in extreme cold, thus offering specialized, high-value solutions to regional market needs. Ultimately, the impact forces of regulation and technology push the market toward higher quality and smarter separation systems, ensuring sustained moderate to high growth.

Segmentation Analysis

The Diesel Fuel Water Separator Market segmentation provides a granular view of product penetration across diverse applications, technologies, and flow capacities, enabling manufacturers and suppliers to tailor their offerings effectively. The primary dimensions for market breakdown include the type of product (such as primary, secondary, and integrated systems), the filtration media employed (paper, synthetic, or glass fiber), the application sector (automotive, marine, industrial), and the flow rate capacity (crucial for matching the separator to engine size). Analyzing these segments reveals shifting consumer preferences toward synthetic media, driven by its superior water rejection properties and longer service intervals compared to traditional cellulose filters. Moreover, the integrated system segment, combining pre-filtration, water separation, and fine particulate filtration into a single unit, is gaining traction, particularly among Original Equipment Manufacturers (OEMs) seeking compact and efficient solutions that minimize engine bay complexity and ensure optimal protection.

Understanding the market by application segment is critical, as the operating conditions and regulatory requirements vary significantly. For instance, the marine segment demands highly corrosion-resistant materials and robust continuous monitoring systems due to the harsh operating environment (saltwater exposure and continuous high-load operation). In contrast, the automotive segment, dominated by heavy-duty trucks, emphasizes longevity and ease of serviceability to minimize vehicle downtime. The industrial application segment, including power generation sets and mining equipment, often requires separators with very high flow rates and robust construction to handle contaminated fuel supplies typically encountered in remote locations. This granular segmentation allows market participants to identify lucrative niches and allocate R&D resources toward developing specialized components that meet the specific performance and durability thresholds required by each unique end-user category, maximizing market penetration across the entire diesel landscape.

The structure of the global segmentation also reflects the technological maturity of different regions. In highly regulated markets like North America and Europe, there is a distinct preference for high-efficiency, multi-stage separators equipped with advanced sensors for proactive maintenance. Conversely, in developing regions, the demand for cost-effective, easily maintainable primary separation units remains substantial. Manufacturers strategically manage their product portfolios to address this dichotomy, offering premium, technology-rich solutions to meet stringent regulatory needs while providing reliable, economical options for general industrial use. This dual-market strategy ensures comprehensive coverage, facilitating steady volume growth and maintaining profitability across the broad spectrum of diesel engine requirements globally, regardless of immediate regulatory or economic pressures.

- By Product Type:

- Primary Separators (Pre-filters)

- Secondary Separators

- Integrated Separation Systems (Filter/Separator Combos)

- By Application:

- Automotive (Heavy-Duty Trucks, Light Commercial Vehicles, Buses)

- Marine (Commercial Shipping, Recreational Boats)

- Construction and Mining Equipment (Excavators, Loaders, Haulers)

- Agriculture Equipment (Tractors, Harvesters)

- Industrial (Power Generation Sets, Pumps, Compressors)

- By Media Type:

- Cellulose Media

- Synthetic Media (Non-woven, Multi-layered)

- Coalescing Media

- Glass Fiber Media

- By Flow Rate Capacity:

- Low Flow (Below 50 GPH/190 LPH)

- Medium Flow (50 - 150 GPH/190 - 570 LPH)

- High Flow (Above 150 GPH/570 LPH)

- By Sales Channel:

- OEM (Original Equipment Manufacturer)

- Aftermarket (Replacement and Service)

Value Chain Analysis For Diesel Fuel Water Separator Market

The value chain for the Diesel Fuel Water Separator Market initiates with the sourcing and processing of raw materials, primarily specialized filtration media (cellulose, synthetic polymers, glass fibers), metal or plastic housings, seals, and sensor components. The upstream segment is dominated by specialized chemical and materials companies that develop proprietary media formulations essential for high-efficiency water and particulate removal. Critical upstream challenges include maintaining a consistent supply of high-grade raw materials and managing volatile commodity prices, particularly for metal alloys used in housing construction and the specialized chemical treatments applied to filter media to enhance hydrophobic properties. The performance of the final product is highly dependent on the quality and consistency of these input materials, necessitating strong supplier relationships and rigorous quality control protocols at the material sourcing stage to ensure filter durability and efficiency.

The core manufacturing and assembly stage involves the proprietary design and fabrication of the separation units, including the pleating and assembly of the filter element, molding of the housing, and integration of specialized components like pumps, heaters, and electronic sensors. Manufacturers invest heavily in intellectual property related to media geometry and flow dynamics to maximize separation efficiency while minimizing pressure drop across the system, ensuring optimal engine performance. The distribution channel is bifurcated into direct sales to Original Equipment Manufacturers (OEMs) and indirect sales to the aftermarket. Direct sales require close collaboration with engine designers to custom-fit units, secure long-term contracts, and manage just-in-time inventory. This channel typically commands higher volume stability and predictable revenue streams, positioning manufacturers as strategic partners in the engine development process.

The downstream activities involve distribution, sales, and end-user support. The aftermarket relies heavily on a robust network of independent distributors, authorized service centers, and specialized parts retailers to ensure timely availability of replacement cartridges and repair kits. Effective distribution in the aftermarket requires significant logistical expertise due to the diverse geographical spread of diesel equipment and the urgent nature of replacement demand (driven by unexpected filter clogging or routine maintenance cycles). Both direct (OEM) and indirect (Aftermarket) channels are critical for market success. The aftermarket, while fragmented, offers higher profit margins on replacement elements, making robust branding and dealer training essential for capturing value post-sale. Overall value creation hinges on technological leadership in filtration media and operational excellence in global logistics to service both the factory floor and the roadside service bay efficiently.

Diesel Fuel Water Separator Market Potential Customers

The primary consumers and end-users of Diesel Fuel Water Separators span every sector reliant on diesel power for locomotion, construction, or static energy generation. The most substantial segment consists of global fleet operators, specifically those managing heavy-duty commercial vehicles, including long-haul trucking companies, regional logistics providers, and municipal transport authorities. These customers represent a massive, recurring revenue stream for aftermarket replacement filters, as their operational demands necessitate strict adherence to preventative maintenance schedules. Furthermore, the Original Equipment Manufacturer (OEM) segment, comprising major diesel engine and vehicle builders (e.g., Daimler, Volvo, Cummins, Caterpillar), are critical, high-volume purchasers of integrated systems for factory installation, driven by requirements to meet warranty commitments and engine performance specifications.

Beyond the automotive sector, the construction and mining industries are high-value consumers, purchasing robust, high-flow rate separators designed to operate reliably in extremely dusty, dirty, and high-vibration environments, where fuel quality is often variable and poor. Companies operating large fleets of excavators, bulldozers, haul trucks, and drilling rigs prioritize durability and extended service intervals above all else, making them prime targets for premium, heavy-duty filtration solutions. Similarly, the marine industry, encompassing everything from commercial container ships and fishing trawlers to recreational yachts, constitutes a specialized customer base. Marine applications demand separators resistant to saltwater corrosion and often require certifications from classification societies (like Lloyd's Register or ABS), focusing on continuous, high-volume filtration capacity under critical, non-stop operation where failure is catastrophic.

Finally, the industrial and power generation sectors form a crucial customer base, particularly generators used for emergency backup power in hospitals, data centers, telecommunications infrastructure, and utility substations. For these applications, the separator acts as a safeguard against failure during critical moments, prioritizing reliability over cost. Customers in this segment require separators with long shelf life, immediate readiness, and often integrated heating elements for cold-weather operation. Service providers who maintain these stationary power assets are also significant buyers in the aftermarket. Targeting these diverse segments requires manufacturers to offer a tailored product portfolio that addresses unique requirements for flow capacity, material resilience, and regulatory compliance specific to each industry's operational demands and fuel quality challenges.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $890.5 Million USD |

| Market Forecast in 2033 | $1,318.2 Million USD |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Donaldson Company, Inc., Parker Hannifin Corporation (Racor), Clarcor Inc. (now Parker Hannifin), MANN+HUMMEL Group, Bosch Rexroth AG, Cummins Inc., Baldwin Filters (Clarcor), WIX Filters (Mann+Hummel), Delphi Technologies (BorgWarner), Luber-finer, Hengst Filtration, Fleetguard, MAHLE GmbH, Separ Filter, Alco Filters, SKF Group, UFI Filters, Schroeder Industries, Stanadyne, Sogefi Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Diesel Fuel Water Separator Market Key Technology Landscape

The technological landscape of the Diesel Fuel Water Separator Market is shifting rapidly towards higher efficiency, integrated systems, and smart functionality, primarily driven by the need to protect sophisticated High-Pressure Common Rail (HPCR) injection systems. The core innovation lies in filtration media development. Traditional cellulose media is being increasingly supplanted by advanced synthetic and composite media, such as multi-layered polymer fabrics and treated glass fibers. These newer materials offer significantly enhanced water separation efficiency, often achieving 98% or higher water removal rates and particulate filtration down to 2-5 microns. The synthetic media is engineered with high porosity and hydrophobic properties, allowing fuel to pass through while effectively coalescing and repelling water droplets, thereby extending the filter service life and reducing the frequency of maintenance intervention, a critical factor for minimizing fleet downtime.

Another major technological advancement is the integration of electronic monitoring systems and associated heating elements. Modern separators are frequently equipped with Water-In-Fuel (WIF) sensors that provide real-time alerts to the engine control unit (ECU), allowing immediate intervention before significant water damage occurs. Additionally, electrically heated separators (EHS) are becoming standard equipment, particularly in cold climate regions. These heaters ensure that the fuel temperature remains above its cloud point, preventing the formation of wax crystals and maintaining optimal fuel viscosity, which is essential for ensuring effective separation and preventing performance degradation during winter operation. The combination of WIF sensors and EHS contributes directly to AEO performance by providing generative engines with structured data points related to operational efficiency and reliability in varying conditions.

Furthermore, the industry is witnessing a strong trend towards modular and self-priming systems. Modular designs allow for easier and quicker replacement of the filter element without requiring specialized tools, simplifying maintenance procedures for fleet mechanics and reducing the risk of contamination during servicing. Self-priming electric pumps integrated into the separator unit eliminate the manual process of priming the fuel system after a filter change, greatly improving service efficiency and reducing the likelihood of air locks that can lead to engine starting failures. These technological refinements—focused on media performance, electronic intelligence, and ease of use—are central to defining the competitive edge in the modern Diesel Fuel Water Separator Market and are critical for meeting the increasingly demanding requirements of global engine manufacturers.

Regional Highlights

- Asia Pacific (APAC)

The Asia Pacific region currently holds the largest market share and is projected to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This rapid expansion is fundamentally driven by unprecedented infrastructural investment, particularly in developing economies such as China, India, and Southeast Asian nations. These countries are experiencing massive growth in commercial road transport, construction, and mining activities, leading to a continuous surge in demand for diesel-powered machinery. Furthermore, regulatory tightening, especially in China (implementing China VI standards) and India (adopting Bharat Stage VI norms), is forcing engine manufacturers to utilize sophisticated HPCR systems, thereby making high-efficiency fuel water separators mandatory for compliance and component protection. The region's inherent challenge with variable fuel quality also significantly boosts the adoption rate of advanced separators in the aftermarket.

The dense population and urbanization trends in APAC translate into a high volume of vehicles and equipment requiring maintenance, fueling the aftermarket segment substantially. Local manufacturing capacity is also expanding, with global players establishing production facilities within the region to capitalize on lower operational costs and better serve regional OEM partners. However, the presence of numerous local, low-cost manufacturers creates pricing pressure, demanding innovative cost-management strategies from international players. The diverse operational conditions, ranging from extreme heat in the Middle East section of the region to high humidity across Southeast Asia, necessitate a varied product portfolio, including separators with robust heat dissipation and high corrosion resistance, ensuring that customized solutions are critical for maximizing market penetration across the varied sub-regions within APAC.

- North America (NA)

North America represents a mature yet highly valuable market segment characterized by stringent environmental regulations, particularly the Environmental Protection Agency (EPA) standards, which have necessitated the ubiquitous use of high-efficiency fuel injection systems. The region's demand is driven primarily by the colossal heavy-duty trucking industry, which relies on maximum uptime and demands best-in-class filtration technologies to protect expensive engine assets. Key market drivers include the ongoing replacement cycle of aging fleets and the consistent implementation of highly advanced diesel engines that rely on ultra-clean fuel. OEM sales are robust, as major engine manufacturers like Cummins and PACCAR integrate premium separators as standard components to ensure adherence to warranty requirements and meet expected durability standards.

The North American market is highly receptive to technological advancements, displaying strong adoption rates for smart filtration systems, IoT-enabled sensors, and predictive maintenance technologies. This preference for integrated, high-tech solutions provides a strong competitive advantage to manufacturers investing in R&D and digital integration capabilities. Furthermore, the agricultural and construction sectors, particularly in the US and Canada, demand heavy-duty separators capable of handling large volumes of fuel under rugged conditions. The market structure is dominated by a few large, established global players who compete intensely based on filter media technology, brand reputation, and the strength of their nationwide distribution networks, particularly in the aftermarket segment where rapid parts availability is paramount to fleet operations.

- Europe

The European market for Diesel Fuel Water Separators is highly influenced by the stringent Euro VI emission standards and a strong corporate emphasis on sustainability and operational efficiency. Europe was an early adopter of advanced common rail technology, leading to an entrenched demand for high-performance filtration solutions. The market exhibits steady growth, fueled by both OEM installations in new vehicles and the substantial replacement demand generated by the continent's large fleet of commercial vehicles, passenger cars (historically high diesel penetration), and off-road machinery utilized in industrial applications. European manufacturers often prioritize compact, lightweight, and highly serviceable filtration modules that align with sophisticated engine bay designs and strict maintenance protocols enforced by leasing and fleet management companies.

A distinctive feature of the European market is the significant adoption of specialized solutions tailored for bio-diesel and synthetic diesel (HVO), which often present unique separation challenges. Consequently, there is high demand for separators optimized for compatibility with these alternative fuels and for integrated heating systems to manage cold-weather operation across Northern and Eastern Europe. Germany, France, and the UK are key markets, characterized by high quality expectations and a willingness to invest in premium products that offer measurable lifecycle cost savings and operational reliability. Strategic opportunities exist in integrating separators with broader vehicle health monitoring systems, leveraging the strong presence of sophisticated telematics providers across the continent to offer value-added digital services to fleet customers.

- Latin America and Middle East & Africa (LAMEA)

The LAMEA region represents a market with significant potential, though growth is often hampered by economic volatility and highly variable fuel quality. In Latin America, growth is tied to infrastructure development in Brazil and Mexico, driving demand for heavy equipment and commercial vehicles. Here, separators are critical for mitigating the risks associated with often inferior or highly contaminated fuel sources, making robust, multi-stage separation an essential protective measure. The focus is typically on durability and cost-effectiveness, with a preference for easily maintained primary filtration systems that can handle large volumes of contamination without excessive maintenance complexity.

The Middle East and Africa (MEA) market is dominated by demand from oil & gas extraction, mining, and power generation sectors, particularly for large, high-capacity stationary and mobile diesel generators. In this region, extreme operational temperatures and dusty environments necessitate separators built with enhanced material resilience and high flow rates. The growth in Africa is linked to increasing investment in infrastructure and transport corridors, although political instability and logistical challenges in distribution networks present operational complexities. However, the high economic value placed on uptime in critical applications like power generation makes quality fuel water separation a non-negotiable component, providing a steady demand base for specialized and heavy-duty filtration products across the MEA sub-regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Diesel Fuel Water Separator Market.- Donaldson Company, Inc.

- Parker Hannifin Corporation (Racor)

- MANN+HUMMEL Group

- Bosch Rexroth AG

- Cummins Inc. (Fleetguard)

- Baldwin Filters (Clarcor)

- WIX Filters (Mann+Hummel)

- Delphi Technologies (BorgWarner)

- Luber-finer

- Hengst Filtration

- MAHLE GmbH

- Separ Filter

- Alco Filters

- SKF Group

- UFI Filters

- Schroeder Industries

- Stanadyne

- Sogefi Group

- ZF Friedrichshafen AG

- Doosan Infracore

Frequently Asked Questions

Analyze common user questions about the Diesel Fuel Water Separator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a diesel fuel water separator?

The primary function is to remove free and emulsified water, along with particulate contaminants, from diesel fuel before it enters the engine's sensitive injection system. This prevents corrosion, microbial growth, and wear, thereby protecting costly components like injectors and high-pressure pumps.

Why are water separators more critical with modern diesel engines?

Modern diesel engines utilize High-Pressure Common Rail (HPCR) injection systems which operate at extremely high pressures and have microscopic component tolerances. Water and minute contaminants can rapidly destroy these precision components, making highly efficient water separation essential for engine reliability and warranty adherence.

What is the difference between an OEM and Aftermarket fuel water separator?

OEM (Original Equipment Manufacturer) separators are installed directly by the engine builder and are often integrated into the engine design. Aftermarket separators are replacement units or upgrade kits purchased after the initial sale, crucial for routine maintenance and filter element replacement throughout the vehicle’s lifecycle.

How does the adoption of biofuel blends impact the demand for separators?

Biofuel blends (like B20) are highly hydroscopic, meaning they absorb and hold water more easily than standard diesel. This increased susceptibility to water contamination drives higher demand for advanced, multi-stage separators equipped with enhanced coalescing media to efficiently handle emulsified water.

What role does IoT and AI play in future fuel water separators?

IoT sensors integrated into separators monitor parameters like pressure drop and water level in real-time. AI utilizes this data to facilitate predictive maintenance, accurately forecasting when a filter replacement is required or when water draining is necessary, optimizing fleet efficiency and preventing unexpected engine failure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager