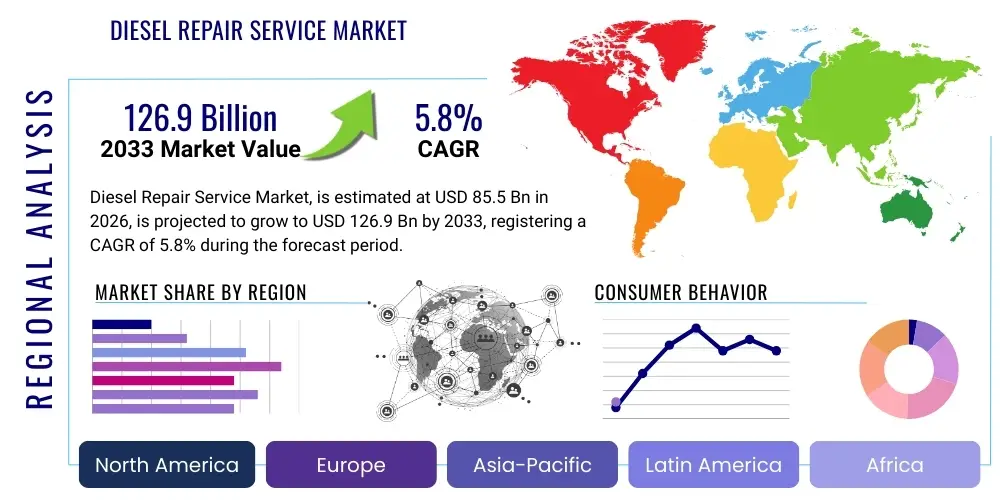

Diesel Repair Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436974 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Diesel Repair Service Market Size

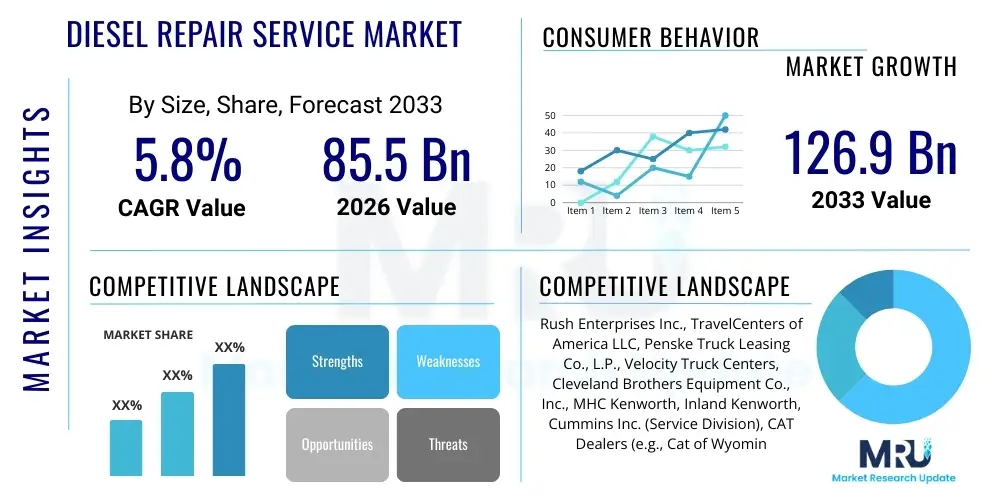

The Diesel Repair Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 85.5 Billion in 2026 and is projected to reach USD 126.9 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the enduring dominance of diesel powertrains in heavy-duty commercial transport, long-haul logistics, and various off-highway applications, despite increasing regulatory pressures favoring electrification in certain segments. The longevity and robustness of diesel engines necessitate specialized maintenance and repair cycles, ensuring a sustained demand for professional service providers capable of handling complex engine architecture and sophisticated emission control systems, which are becoming increasingly integrated and difficult to service without specialized tools and certified expertise.

Market growth is further supported by the global aging fleet size, particularly in emerging economies where vehicle replacement cycles are significantly longer. As diesel engines accumulate mileage and operational hours, the incidence of major component failures—such as turbocharger malfunctions, fuel injector degradation, and DPF (Diesel Particulate Filter) system failures—rises proportionally, creating a constant revenue stream for the aftermarket repair sector. Furthermore, the adoption of advanced telematics and predictive maintenance schedules by major fleet operators is shifting the service paradigm from reactive fixes to proactive, scheduled repairs, thereby stabilizing demand and optimizing service center workflow, contributing positively to the overall market valuation projection through 2033.

Diesel Repair Service Market introduction

The Diesel Repair Service Market encompasses all maintenance, diagnostic, and repair activities dedicated to diesel engines and associated systems, including commercial vehicles (Class 4 to 8 trucks), buses, marine vessels, heavy construction equipment, agricultural machinery, and stationary power generation units. This market involves highly specialized technical expertise required to service high-pressure common rail (HPCR) fuel systems, complex turbocharging setups, and intricate exhaust gas recirculation (EGR) and selective catalytic reduction (SCR) emissions control technologies mandated by stringent environmental regulations worldwide. The primary product offering within this market is the provision of labor, diagnostics, specialized tooling, and replacement parts aimed at restoring operational efficiency, ensuring compliance with emission standards, and maximizing the operational uptime for diesel asset owners. Major applications span across transportation logistics, infrastructural development, resource extraction, and agriculture, sectors that fundamentally rely on the reliable performance and torque capabilities inherent to the diesel engine platform.

Key benefits derived from professional diesel repair services include enhanced fuel economy achieved through precision tuning, prolonged engine life resulting from scheduled preventative maintenance, reduced total cost of ownership (TCO) for large fleets, and guaranteed adherence to environmental compliance mandates, which is increasingly critical for cross-border operations. The driving factors propelling this market include the sustained growth in global freight volumes necessitating greater fleet utilization, the rising complexity of engine electronics demanding specialized diagnostic tools, and governmental regulations, particularly in North America and Europe, which necessitate frequent servicing and repair of emissions-related components like DPFs and SCR systems. Furthermore, the increasing integration of telematics and IoT devices into commercial vehicles allows for sophisticated remote monitoring and failure prediction, thereby channeling maintenance demand into certified repair facilities capable of processing and acting upon real-time operational data.

The service sector is highly fragmented, ranging from independent local garages specializing in specific engine manufacturers to large, authorized dealer networks and specialized heavy-duty repair chains. The crucial nature of diesel assets to the global economy ensures inelastic demand for rapid and effective repair solutions, as downtime translates directly into substantial financial losses for fleet operators and construction firms. Therefore, speed of service, availability of genuine or certified aftermarket parts, and the specialization of technical staff remain paramount differentiators in this competitive landscape. As technological evolution introduces hybrid and alternative fuel vehicles, the repair industry is concurrently adapting, integrating skills to handle both traditional diesel mechanics and associated electrical components or advanced diagnostics, solidifying the market’s necessity for the foreseeable future, especially considering the multi-decade lifespan of heavy-duty assets currently in operation.

Diesel Repair Service Market Executive Summary

The Diesel Repair Service Market is currently characterized by robust business trends driven primarily by digitalization and consolidation. Major repair service providers are aggressively investing in advanced diagnostic software, cloud-based fleet management platforms, and integrated Enterprise Resource Planning (ERP) systems to enhance service efficiency, streamline parts inventory management, and offer superior customer engagement through real-time repair status updates. Furthermore, there is a discernible trend towards professional specialization, where independent shops are focusing on specific engine types (e.g., Cummins, Detroit Diesel, PACCAR) or service niches (e.g., transmission rebuilds, exhaust aftertreatment system repair), allowing them to deliver greater expertise than generalist maintenance facilities. Business growth is increasingly achieved through strategic acquisitions and franchise expansion, enabling regional players to achieve economies of scale and standardize service quality across broader geographical footprints, effectively addressing the widespread shortage of highly skilled diesel technicians through centralized training programs.

Regional trends indicate that North America maintains the largest market share due to its massive heavy-duty trucking industry and stringent EPA emissions standards (Tier 4 Final), which necessitate complex and recurring aftertreatment system maintenance. Asia Pacific (APAC), particularly China and India, represents the fastest-growing market, propelled by rapid industrialization, massive infrastructure projects, and the expanding need for efficient freight transport. In APAC, the market dynamic is heavily influenced by aging fleets and lower average technology adoption rates compared to Western markets, leading to high demand for preventative maintenance and engine overhaul services. Europe, constrained by stricter regulations favoring electrification in urban transport, still shows strong demand for high-quality diesel repair services in the long-haul sector and specialized machinery segments, often focusing on high-precision electronic diagnostics and manufacturer-certified processes to meet Euro VI compliance requirements.

Segmentation trends highlight that the commercial fleet segment (Class 8 trucks) dominates the revenue landscape due to the sheer volume and critical nature of these assets, commanding premium services to minimize downtime. Regarding component segmentation, engine repair and maintenance (including cylinder head servicing, piston replacement, and complete overhauls) consistently generate the highest revenue, closely followed by fuel systems (injector and pump replacement) and emissions control maintenance. The growth trajectory for emissions system repair is particularly steep, driven by regulatory non-compliance issues and the inherent sensitivity of components like DPFs to varying fuel quality and operating conditions. Maintenance contracts and extended service agreements are increasingly favored by large fleet owners, shifting revenue models towards predictable, recurring service income, enhancing stability across the overall market structure.

AI Impact Analysis on Diesel Repair Service Market

User inquiries regarding the integration of Artificial Intelligence (AI) in the Diesel Repair Service Market commonly revolve around themes of predictive maintenance efficacy, the displacement of manual diagnostic skills, and the optimization of service center operations. Users frequently question how AI algorithms can accurately predict complex mechanical failures, particularly in highly variable operating environments, and whether this technology will primarily benefit large authorized dealers or become accessible to independent repair shops. There is also significant interest in the potential of AI to automate diagnostic procedures, thereby reducing labor time and human error, juxtaposed with concerns about the high initial investment cost and the necessity for technicians to evolve their skills from mechanical expertise to data interpretation and software management. The key expectation is that AI will transform reactive repair work into proactive asset management, making fleets more reliable and operationally efficient, while the main concern remains the accessibility and seamless integration of these sophisticated tools into existing repair workflows.

- AI-driven Predictive Diagnostics: Algorithms analyze sensor data (telematics, vibration, temperature) to anticipate component failure likelihood days or weeks in advance, optimizing scheduling.

- Service Optimization: AI tools manage repair bay assignments, technician scheduling based on required expertise, and parts inventory forecasts, minimizing vehicle turnaround time.

- Automated Troubleshooting: Machine learning models assist technicians by analyzing symptom patterns across vast databases of historical repairs, suggesting the most probable causes and optimal repair procedures.

- Enhanced Training and Simulation: AI-powered training modules provide realistic simulations of complex failures, accelerating technician skill development and minimizing errors during actual repairs.

- Warranty and Claim Management: AI automates the processing of warranty claims by instantly verifying failure modes against maintenance history and standard operating conditions, speeding up financial settlements.

- Supply Chain Resilience: AI algorithms predict parts demand based on fleet utilization and repair forecasts, optimizing warehouse stock levels and mitigating potential supply chain disruptions.

- Quality Control: Computer vision systems powered by AI are used for automated inspection of rebuilt components, ensuring high-quality standards before reinstallation.

DRO & Impact Forces Of Diesel Repair Service Market

The market for Diesel Repair Services is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities, which collectively constitute the critical Impact Forces determining its future trajectory. A primary driver is the essential role of diesel engines in heavy-duty logistics and industrial applications globally, where current alternatives often lack the necessary power density and infrastructure support to achieve immediate replacement. Furthermore, increasingly complex engine designs, necessitated by stringent emissions regulations like EPA 2010 and Euro VI, require mandatory specialization, specialized tools, and frequent updates to service protocols, creating a structural need for professional repair centers. These complex systems, particularly those involving exhaust aftertreatment (SCR and DPF), are prone to issues requiring specialized diagnostic and cleaning services, thereby sustaining high demand within the aftermarket service sector.

However, the market faces significant restraints, most notably the persistent and growing shortage of skilled diesel mechanics and technicians capable of working on modern electronic engines and their interconnected systems. The perception of the trade and the rigorous demands of continuous training deter new entrants, escalating labor costs for service providers and potentially limiting service capacity. Another major restraint is the looming threat and long-term uncertainty posed by global decarbonization efforts and the rapid development and deployment of battery-electric and hydrogen fuel cell alternatives, particularly in medium-duty and local commercial transport segments, which could eventually erode a portion of the diesel repair market, albeit slowly over the next two decades. High investment costs in advanced diagnostic equipment and software licenses for independent repair shops also pose a barrier to entry, favoring larger consolidated entities.

Opportunities for growth are abundant, particularly in embracing digitalization, offering mobile and field service units equipped with advanced telematics integration to reduce downtime significantly. Expanding preventative maintenance contract offerings, leveraging predictive analytics to schedule services, and focusing on specialized services like engine reprogramming or specific component rebuilds (e.g., fuel injectors, turbochargers) represent key avenues for market penetration and margin improvement. Furthermore, the extensive lifespan of existing diesel fleets guarantees demand for comprehensive overhaul and repair services well beyond the forecast period. The synergistic impact forces ultimately favor service providers who invest proactively in technician training, standardize their diagnostic procedures, and effectively utilize data analytics to manage asset health across diverse operational environments, reinforcing the market's resilience against immediate technological displacement.

Segmentation Analysis

The Diesel Repair Service Market is comprehensively segmented based on three primary attributes: the application or vehicle type being serviced, the specific component or system requiring attention, and the service provider type. Analyzing these segments provides a clear understanding of market dynamics, revenue allocation, and areas of highest growth potential. The vehicle type segmentation is crucial as the service requirements and profitability margins vary significantly between heavy-duty commercial vehicles, which demand rapid, high-cost repairs to minimize operational losses, and off-highway equipment, which often requires complex field service due to remote operational locations. Component segmentation is vital for specialization, driving demand for dedicated expertise in areas like advanced fuel injection systems, which are increasingly intricate and expensive to repair or replace, offering higher value capture for specialized providers.

The service provider segmentation reflects the competitive landscape, distinguishing between highly regulated and often premium-priced dealer services, which typically guarantee genuine parts and manufacturer-specific diagnostic updates, and independent workshops or national chains, which compete aggressively on labor rates and turnaround time, frequently utilizing certified aftermarket parts. Furthermore, within the component segment, the differentiation between engine, transmission, and aftertreatment system repairs is critical, with aftertreatment (EGR, DPF, SCR) projected to show the highest CAGR due to regulatory necessity and inherent operational sensitivity, leading to frequent service needs. Understanding these cross-segment interactions allows market participants to tailor their investment strategies, focusing on specialized training or geographical expansion where specific segmentation demands are highest, particularly in rapidly industrializing regions where heavy equipment use is accelerating.

- By Vehicle Type

- Heavy-Duty Commercial Vehicles (Class 8 Trucks, Buses)

- Medium-Duty Commercial Vehicles (Class 4-7 Trucks)

- Off-Highway Equipment (Construction, Agriculture, Mining)

- Marine Vessels and Power Generation Units

- By Component

- Engine System Repair (Cylinder head, Overhaul, Turbochargers)

- Fuel System Repair (Injectors, Pumps, Common Rail)

- Transmission and Drivetrain Repair

- Exhaust Aftertreatment System (DPF, SCR, EGR, Sensors)

- Electrical and Electronic Systems (ECUs, Wiring, Diagnostics)

- Brake and Suspension Systems

- By Service Provider Type

- Authorized Dealerships and Original Equipment Manufacturers (OEM) Service Centers

- Independent Repair Shops (IRS)

- Fleet Maintenance Garages (In-House Services)

- National and Regional Repair Chains

Value Chain Analysis For Diesel Repair Service Market

The Value Chain for the Diesel Repair Service Market begins with the Upstream Analysis, which is centered on the suppliers of necessary components, diagnostic software, specialized tools, and technical training. Key upstream contributors include Original Equipment Manufacturers (OEMs) who supply proprietary parts and diagnostic interfaces, as well as independent aftermarket parts manufacturers (IAMs) who offer cost-effective alternatives. The quality and availability of these parts, especially advanced fuel injection components and sophisticated sensors required for modern engines, directly impact the service provider's ability to execute high-quality repairs quickly. Furthermore, specialized diagnostic software developers and providers of technical certification programs form a crucial link in the upstream chain, ensuring that the service sector possesses the necessary intellectual capital to address increasingly complex vehicle technologies, making supplier relationships for technical data and training paramount for maintaining competitive service capabilities.

The midstream segment is occupied by the diverse array of Service Providers, encompassing authorized dealers, independent workshops, and large fleet in-house garages, where the actual repair and maintenance activities take place. This stage is characterized by high operational complexity involving diagnostics, component replacement, rebuilding, calibration, and final road testing, demanding significant capital investment in specialized lifts, heavy equipment tools, and advanced software licenses. Efficiency in this stage is determined by skilled labor availability, optimized workflow management, and inventory control. The distribution channel plays a critical role here; Direct channels often involve large fleet operators sourcing parts directly from OEMs or certified distributors and performing work internally, while Indirect channels rely on independent shops obtaining parts through regional wholesale distributors or specialized parts retailers, impacting service lead times and pricing structures significantly.

Downstream Analysis focuses on the End-Users—primarily commercial fleet operators, construction companies, agricultural enterprises, and individual truck owners—who seek reliable, timely, and cost-effective repair solutions to minimize costly operational downtime. The quality and trustworthiness of the repair service directly influence customer retention and market reputation. Key downstream activities include contract negotiation, service relationship management, and the provision of warranties and follow-up support. The long-term viability of service providers is increasingly linked to their ability to integrate with the customer’s fleet management systems, offering proactive service scheduling and detailed performance reporting (AEO/GEO focus: linking repair data back to asset health monitoring), creating a continuous cycle of service demand rather than relying solely on breakdown repairs, thereby solidifying the value proposition across the entire chain from parts manufacturing to asset reliability.

Diesel Repair Service Market Potential Customers

Potential customers for the Diesel Repair Service Market are predominantly large-scale commercial entities whose core operations are intrinsically reliant on the continuous and reliable performance of heavy-duty diesel equipment. The largest segment of end-users is the commercial trucking and logistics sector, encompassing national and international freight carriers (LTL and FTL), courier services, and local distribution companies. For these buyers, engine failure or even minor component malfunction directly translates to missed delivery schedules and substantial financial penalties, making rapid repair, comprehensive preventative maintenance contracts, and 24/7 emergency service paramount considerations when selecting a service partner. Reliability, geographic coverage, and demonstrated expertise in complex emissions systems are non-negotiable requirements for securing high-value fleet maintenance contracts with these critical customers.

The second major cohort comprises off-highway equipment operators, including construction firms, mining operations, and agricultural businesses. These users operate highly specialized machinery (excavators, bulldozers, combines, drill rigs) often in remote or extremely harsh environments, necessitating robust and mobile field repair services. Downtime in these industries is exceptionally costly—for example, a non-operational combine during harvest season—driving demand for highly specialized technicians trained in hydraulics, heavy-duty powertrains, and engine diagnostics specific to manufacturers like Caterpillar, Komatsu, and John Deere. Their purchasing decisions are heavily influenced by the service provider's ability to mobilize quickly, minimize travel time, and carry comprehensive diagnostic and repair capabilities directly to the operational site, thereby avoiding expensive transportation of failed machinery.

Additionally, municipal and government entities, including public transit authorities (diesel buses) and utility service departments, represent stable and high-volume customers. These organizations typically operate fixed fleets and require highly regulated, scheduled maintenance contracts focused on safety compliance and longevity. Finally, individual owner-operators of heavy trucks and specialized equipment form a crucial segment, prioritizing competitive pricing, transparency in repair procedures, and the personal trust established with the servicing facility. Tailoring service offerings, whether through fixed-rate preventative packages for fleets or transparent, flexible repair options for owner-operators, is essential for maximizing market penetration across this diverse customer base, recognizing that all potential customers share a fundamental need for minimized operational disruption caused by mechanical failures.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 85.5 Billion |

| Market Forecast in 2033 | USD 126.9 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rush Enterprises Inc., TravelCenters of America LLC, Penske Truck Leasing Co., L.P., Velocity Truck Centers, Cleveland Brothers Equipment Co., Inc., MHC Kenworth, Inland Kenworth, Cummins Inc. (Service Division), CAT Dealers (e.g., Cat of Wyoming), Daimler Truck North America Service, Volvo Trucks Service, FMI Truck Repair, Taylor & Martin Inc., Transervice Logistics Inc., Dorman Products Inc. (Aftermarket Support), Love's Travel Stops & Country Stores, TBC Corporation (Commercial Service), First Class Truck and Auto Service, Empire Truck & Trailer, Truck Centers, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Diesel Repair Service Market Key Technology Landscape

The Diesel Repair Service Market is undergoing a rapid technological transformation, primarily driven by the increasing integration of sophisticated electronic control units (ECUs) and advanced telematics into modern diesel powertrains. The key technology landscape is centered around diagnostic hardware and software platforms that enable technicians to communicate with the vehicle's intricate computer network. Modern diesel engines are regulated by complex algorithms controlling fuel injection timing, turbo boost, and emission parameters (e.g., DEF dosing in SCR systems). Consequently, high-fidelity proprietary diagnostic tools (like those from Cummins Insite, PACCAR ESA, or specialized multibrand interfaces) are mandatory for accurate fault isolation, parameter adjustments, and mandatory software updates, effectively shifting the necessary skillset from purely mechanical repair to advanced electronic systems troubleshooting and reprogramming. The ability to efficiently interpret the thousands of fault codes and sensor readings generated by these systems defines the capability of a modern diesel repair facility.

A second crucial technological area is the deployment of predictive maintenance solutions leveraging IoT and Big Data analytics. Commercial fleets are increasingly equipped with sophisticated telematics devices that continuously stream real-time operational data (engine load, component temperatures, fuel pressure, oil analysis) to cloud-based platforms. These platforms utilize machine learning models to identify anomalies indicative of impending failure, allowing service providers to schedule proactive maintenance before catastrophic breakdown occurs. This predictive capability minimizes unscheduled downtime—the single largest cost factor for fleet operators—and necessitates service centers to adopt integrated software suites that can process telematics data and automatically generate optimized repair work orders. The implementation of augmented reality (AR) tools is also emerging, assisting technicians in complex component disassembly and assembly procedures through overlay visualizations and step-by-step guidance, especially useful for training new mechanics on highly complex engines.

Furthermore, technology focused on emissions control maintenance represents a significant subset of the landscape. This includes specialized DPF cleaning equipment, highly calibrated exhaust gas analysis tools, and precise calibration rigs for fuel injectors and high-pressure pumps (HPCR systems). As emissions standards tighten globally, the technology required to service these components becomes more specialized and mandatory. For instance, testing HPCR injectors requires equipment capable of simulating real-world pressures exceeding 30,000 psi, demanding substantial investment. The successful repair provider must constantly evaluate and adopt certified technologies related to fluid analysis (oil, coolant, DEF quality testing), digital job tracking (paperless workflow systems), and specialized tooling required for materials sensitive to high temperatures and pressures inherent in modern diesel combustion and aftertreatment processes, ensuring regulatory compliance and maximizing engine efficiency for the end-user.

Regional Highlights

North America, comprising the United States and Canada, represents the largest and most mature market for diesel repair services globally. This dominance is attributable to the vast size of the commercial freight industry, which relies heavily on Class 8 heavy-duty trucks powered predominantly by diesel. Strict environmental regulations imposed by the EPA (e.g., requiring complex SCR and DPF systems) ensure a continuous, high-value demand for specialized emissions system maintenance and repair, often involving expensive component replacements and specialized cleaning processes. The North American market is characterized by a high degree of technological integration, with fleet operators widely adopting advanced telematics and predictive maintenance schedules, driving demand towards service centers capable of seamless data integration and AI-assisted diagnostics. Furthermore, the immense scale of agricultural and construction sectors contributes substantially to the demand for specialized off-highway diesel repair, frequently requiring remote, mobile service solutions due to vast geographical distances. Market players here focus intensively on technician recruitment, standardized certification, and efficient parts supply chains to minimize the punitive costs associated with truck downtime.

Europe exhibits a highly regulated but resilient diesel repair market, defined by the stringent Euro VI emissions standards and a strong push towards electric mobility, particularly in urban centers. While electrification challenges diesel viability in medium-duty urban delivery, the long-haul trucking, specialized logistics, and heavy industrial machinery sectors maintain a robust demand for high-quality diesel services. The European market emphasizes precision diagnostics, original equipment parts usage, and manufacturer-certified repair processes to ensure absolute compliance with technical inspection requirements. Germany, France, and the UK lead in terms of service complexity and volume, with a strong presence of authorized dealer networks offering specialized servicing for specific brands (e.g., Daimler, Volvo, MAN). The regional trend is towards highly specialized, digitally enabled service shops focused on calibration, advanced fuel system repair, and expert management of complex electronic failures, sustaining high average repair costs due to technical complexity and high labor rates.

Asia Pacific (APAC) is the fastest-growing market globally, driven by massive infrastructural investment, urbanization, and the exponential expansion of cross-border logistics, especially in China, India, and Southeast Asian nations. The APAC region is characterized by immense fleet volumes, longer vehicle lifecycles, and diverse regulatory landscapes. While some regions are rapidly adopting modern diesel engine technologies, a significant portion of the operating fleet still consists of older, mechanically injected engines, creating bifurcated demand for both basic overhaul services and highly advanced electronic diagnostics. Rapid fleet growth and variable fuel quality in many APAC countries lead to accelerated wear and higher incidence of fuel system-related issues, generating continuous service demand. The market opportunity lies in establishing professional, standardized repair chains capable of providing reliable, certified services that can manage both mechanical complexities and the growing prevalence of electronic systems, addressing the previously high fragmentation of independent, often informal, service providers.

Latin America (LATAM) and the Middle East and Africa (MEA) present high-potential markets characterized by challenging operating conditions, reliance on heavy transport for resource extraction, and often less stringent or inconsistently enforced emissions regulations. In LATAM, countries like Brazil and Mexico drive demand through large agricultural and mining sectors, requiring rugged, reliable repair services, often with an emphasis on component rebuilding to manage costs. The MEA region, heavily influenced by oil and gas operations and expansive infrastructure projects, demands robust service support for construction equipment and heavy haulage vehicles. The service market here often suffers from a shortage of readily available genuine parts and specialized training, creating a unique opportunity for global repair chains to enter and establish standardized service platforms, particularly focusing on optimizing fleet longevity and fuel efficiency given the volatile nature of operating costs in these regions. Demand for highly durable mechanical repairs and foundational preventative maintenance services remains strong, contrasting with the advanced electronic demands seen in North America and Europe.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Diesel Repair Service Market.- Rush Enterprises Inc.

- TravelCenters of America LLC

- Penske Truck Leasing Co., L.P.

- Velocity Truck Centers

- Cleveland Brothers Equipment Co., Inc. (CAT Dealer)

- MHC Kenworth

- Inland Kenworth

- Cummins Inc. (Service Division)

- Daimler Truck North America Service

- Volvo Trucks Service

- Love's Travel Stops & Country Stores

- Pilot Company (Pilot Flying J Truck Service)

- Transervice Logistics Inc.

- First Class Truck and Auto Service

- TBC Corporation (Commercial Service)

- Hino Motors Sales U.S.A., Inc. (Service Network)

- Ryder System, Inc.

- Wrench Group LLC

- Diesel Experts (Specialized Independent)

- Truck Centers, Inc.

Frequently Asked Questions

Analyze common user questions about the Diesel Repair Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Diesel Repair Service Market?

Market growth is primarily driven by the sustained use of diesel engines in heavy-duty logistics, increasing operational complexity of modern emission control systems (SCR, DPF), and the global need for timely preventative maintenance to maximize fleet uptime and ensure regulatory compliance.

How is the shortage of skilled diesel technicians affecting the market?

The scarcity of specialized technicians increases labor costs, extends repair turnaround times, and forces service providers to invest heavily in training and technology, making the efficient utilization of existing skilled labor a critical competitive advantage.

What impact does telematics and predictive maintenance have on diesel repair services?

Telematics integration shifts the industry from reactive breakdown repair to proactive, predictive maintenance schedules. This optimization improves fleet reliability, reduces unscheduled downtime for customers, and allows repair shops to better manage parts inventory and workflow efficiency.

Which geographical region holds the largest market share for diesel repair services?

North America currently holds the largest market share, attributed to its extensive heavy-duty commercial trucking sector, significant industrial activity, and mandatory adherence to complex and expensive EPA emissions standards requiring specialized and recurring maintenance services.

What are the key technological advancements transforming diesel repair diagnostics?

The key advancements include AI-powered diagnostic software that analyzes sensor data for failure prediction, cloud-based fleet management integration, and the mandatory use of specialized OEM and multi-brand electronic diagnostic tools required for sophisticated engine ECU and emissions system calibration.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager