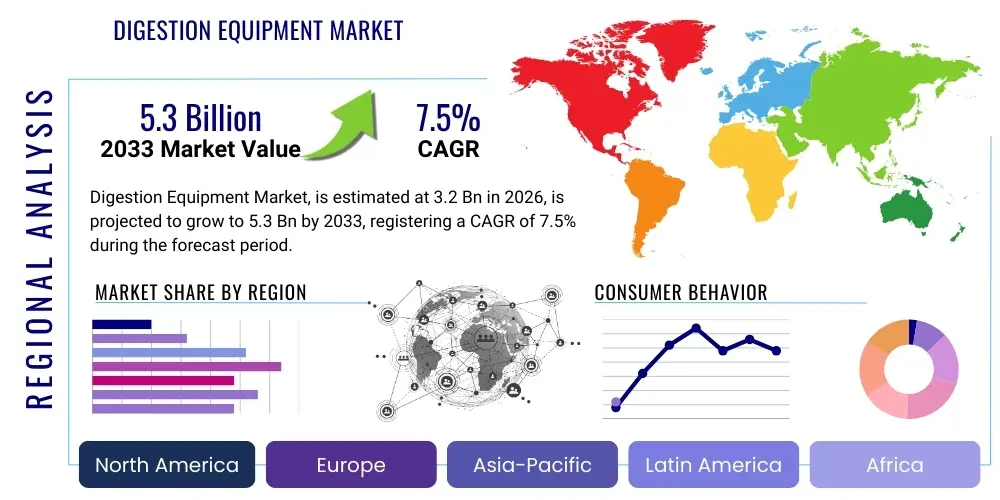

Digestion Equipment Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439594 | Date : Jan, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Digestion Equipment Market Size

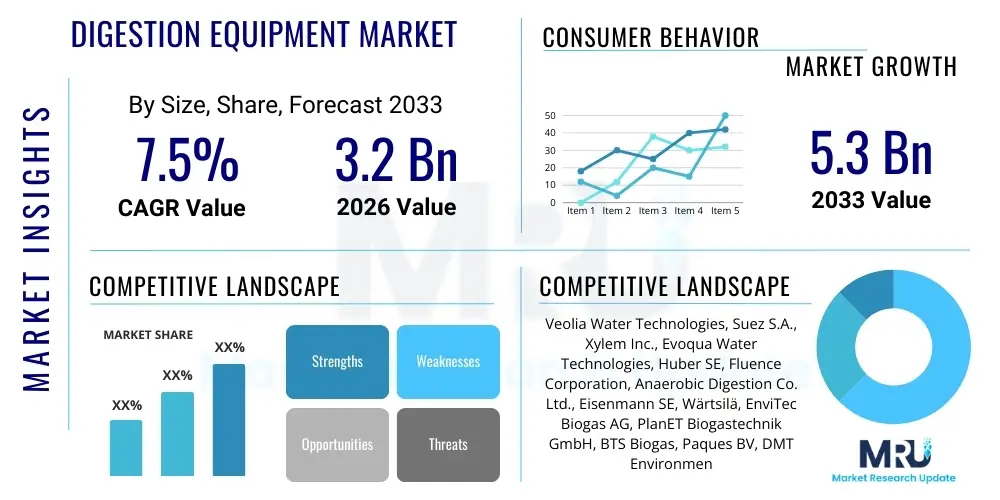

The Digestion Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 3.2 Billion in 2026 and is projected to reach USD 5.3 Billion by the end of the forecast period in 2033. This robust growth is primarily driven by an escalating global focus on sustainable waste management practices, stringent environmental regulations pertaining to industrial and municipal wastewater treatment, and the increasing demand for renewable energy sources such as biogas. The market's expansion is further fueled by technological advancements in digester designs, improved efficiency of anaerobic digestion processes, and the integration of smart monitoring and control systems, which enhance operational performance and resource recovery. Investments in upgrading existing infrastructure and developing new facilities, particularly in rapidly industrializing regions, are also significant contributors to this projected market trajectory, underscoring the vital role of digestion equipment in the circular economy.

Digestion Equipment Market introduction

The Digestion Equipment Market encompasses a broad range of technologies and machinery designed to facilitate the biological or chemical decomposition of organic matter, primarily for waste treatment, resource recovery, and energy generation. This market includes various types of digesters, such as anaerobic digesters, aerobic digesters, and thermal hydrolysis systems, alongside associated auxiliary equipment like pumps, mixers, heat exchangers, gas handling systems, and dewatering units. These systems are crucial for managing diverse organic waste streams, including municipal sewage sludge, industrial wastewater, agricultural waste, and food waste, transforming them into valuable byproducts like biogas, biofertilizers, and treated effluent. The inherent versatility and environmental benefits of these systems make them indispensable across multiple sectors, addressing critical challenges related to pollution, waste disposal, and energy security, thereby positioning digestion equipment as a cornerstone of sustainable development initiatives globally.

Major applications of digestion equipment span municipal wastewater treatment plants, industrial facilities (such as food and beverage processing, pharmaceuticals, and pulp and paper), agricultural operations, and dedicated biogas plants. In municipal settings, they are vital for processing sewage sludge to reduce volume, stabilize solids, and produce biogas for energy. Industrial applications leverage digestion for treating high-strength organic effluents, minimizing discharge costs, and recovering valuable resources. Agricultural sectors utilize these systems to manage animal manure and crop residues, mitigate greenhouse gas emissions, and generate renewable energy. The overarching benefits include significant waste volume reduction, nutrient recovery, pathogen destruction, odor control, and the production of clean energy (biogas) and nutrient-rich digestate, which can be used as a soil amendment. These advantages collectively contribute to a more sustainable and resource-efficient economy, enhancing environmental protection and fostering energy independence across various scales of operation, from small-scale farm digesters to large centralized waste management facilities.

The market's growth is predominantly driven by an confluence of factors, including increasingly stringent environmental regulations worldwide aimed at reducing pollution and promoting waste valorization. The rising global demand for renewable energy, particularly biogas derived from organic waste, serves as a powerful economic incentive for adopting digestion technologies. Furthermore, growing populations and rapid urbanization lead to increased generation of municipal and industrial waste, necessitating efficient and sustainable treatment solutions. Technological advancements, such as enhanced reactor designs, optimized process controls, and more efficient material handling systems, are continuously improving the performance and cost-effectiveness of digestion equipment, making it a more attractive investment. Moreover, favorable government policies and subsidies supporting renewable energy projects and waste-to-energy initiatives further stimulate market expansion. Public awareness regarding environmental sustainability and the circular economy concept also plays a crucial role in advocating for the widespread adoption of digestion technologies, influencing policy decisions and corporate sustainability strategies globally.

Digestion Equipment Market Executive Summary

The Digestion Equipment Market is experiencing substantial momentum, propelled by robust business trends centered around sustainability, resource efficiency, and the circular economy. Key business drivers include escalating capital expenditure in wastewater treatment infrastructure upgrades, particularly in developing economies, and the widespread adoption of waste-to-energy solutions. Enterprises are increasingly investing in advanced digestion technologies to comply with stricter environmental mandates, reduce operational costs associated with waste disposal, and capitalize on the revenue potential from biogas and biofertilizers. Strategic partnerships between technology providers, engineering firms, and end-users are fostering innovation and accelerating market penetration, leading to the development of more integrated and intelligent digestion systems. Furthermore, the market is characterized by a strong emphasis on automation and digital transformation, with the integration of IoT sensors, data analytics, and AI-driven predictive maintenance enhancing the efficiency and reliability of digestion plants, making these solutions more attractive to a wider range of industrial and municipal clients seeking optimized performance and long-term value.

Regional trends indicate a diverse landscape of growth and adoption. North America and Europe are mature markets, distinguished by stringent environmental regulations, well-established waste management infrastructure, and significant investments in upgrading existing facilities to improve efficiency and comply with advanced standards for nutrient removal and biogas utilization. These regions also lead in technological innovation and are early adopters of cutting-edge digestion solutions. The Asia Pacific region is emerging as a dominant growth hub, driven by rapid urbanization, industrialization, and a burgeoning population, which collectively generate enormous volumes of organic waste. Governments in countries like China and India are heavily investing in new wastewater treatment plants and promoting waste-to-energy projects, creating substantial opportunities for digestion equipment manufacturers. Latin America, the Middle East, and Africa are also showing promising growth, albeit from a smaller base, spurred by improving economic conditions, increased environmental awareness, and the need for basic sanitation infrastructure, alongside nascent renewable energy initiatives that favor biogas production from agricultural and municipal wastes, positioning these regions for accelerated future development.

Segmentation trends highlight a shift towards more specialized and high-efficiency digestion solutions tailored to specific waste streams and operational requirements. The anaerobic digestion segment continues to dominate due to its proven efficacy in biogas production and waste stabilization, with a growing emphasis on co-digestion of multiple waste types to maximize methane yield. Within aerobic digestion, innovations are focused on energy-efficient aeration systems and advanced controls for nutrient removal. Furthermore, the market is seeing increased adoption of thermal hydrolysis pre-treatment systems, which significantly enhance the efficiency and capacity of subsequent anaerobic digestion processes, thereby improving overall plant performance and reducing sludge volume. End-user segments, particularly municipal wastewater treatment and industrial applications (especially food and beverage, and agriculture), remain key drivers, with a noticeable trend towards larger-scale, integrated facilities capable of handling diverse and complex organic loads. The demand for compact, modular, and containerized digestion solutions is also rising, catering to smaller-scale operations and remote locations requiring flexible and scalable waste treatment options, indicating a diversified market responding to varied client needs and operational contexts.

AI Impact Analysis on Digestion Equipment Market

Common user questions regarding AI's impact on the Digestion Equipment Market frequently revolve around how artificial intelligence can enhance operational efficiency, optimize performance, reduce costs, and improve the reliability and safety of digestion plants. Users are keen to understand the practical applications of AI in real-time process monitoring, predictive maintenance of critical equipment, intelligent automation of complex biological processes, and the optimization of biogas yield and quality. There is also significant interest in AI's role in data analysis for informed decision-making, its potential to address challenges such as process instability and variable waste feedstock composition, and ultimately, how AI integration can contribute to more sustainable and economically viable waste-to-energy solutions. The overarching expectation is that AI will transform digestion operations from reactive to proactive, leading to substantial improvements across the entire value chain.

- AI-driven predictive maintenance: AI algorithms analyze sensor data from pumps, mixers, and other components to predict equipment failures before they occur, reducing downtime and maintenance costs.

- Real-time process optimization: AI models continuously monitor parameters like temperature, pH, and volatile fatty acids, adjusting operational settings to maximize biogas production and process stability.

- Enhanced feedstock management: AI can analyze the composition of incoming waste streams, optimizing mixing ratios for co-digestion and improving overall digester performance.

- Automated fault detection and diagnosis: AI systems quickly identify anomalies and diagnose operational issues, enabling operators to respond rapidly and prevent process upsets.

- Improved energy efficiency: AI optimizes aeration systems in aerobic digesters and heat exchange in anaerobic systems, minimizing energy consumption while maintaining optimal conditions.

- Advanced data analytics and reporting: AI tools provide deeper insights into plant performance, generating comprehensive reports for regulatory compliance and operational improvements.

- Decision support systems: AI assists operators and plant managers in making data-driven decisions regarding process adjustments, resource allocation, and long-term planning.

- Safety and risk management: AI can monitor hazardous conditions and predict potential safety risks, enabling proactive measures to protect personnel and equipment.

- Resource recovery maximization: AI optimizes nutrient recovery processes, enhancing the quality and value of digestate for agricultural use.

- Reduced operational variability: AI helps to stabilize digester performance against fluctuations in feedstock quality and environmental conditions, ensuring consistent output.

DRO & Impact Forces Of Digestion Equipment Market

The Digestion Equipment Market is significantly influenced by a dynamic interplay of drivers, restraints, opportunities, and broader impact forces that shape its growth trajectory and technological evolution. Key drivers include the global imperative for sustainable waste management, driven by increasing waste generation rates and the scarcity of landfill space, pushing municipalities and industries towards advanced treatment solutions. Simultaneously, stringent environmental regulations enforcing stricter limits on pollutant discharge and promoting resource recovery mandate the adoption of efficient digestion technologies. The rising demand for renewable energy, particularly biogas, provides a strong economic incentive, transforming waste from a liability into a valuable energy source. Furthermore, advancements in digestion technology, such as improved pre-treatment methods, enhanced reactor designs, and the integration of smart controls, are boosting efficiency and cost-effectiveness, making these solutions more attractive to a wider range of end-users. These factors collectively create a robust environment for sustained market expansion, emphasizing the critical role of digestion equipment in addressing pressing global environmental and energy challenges.

However, the market also faces considerable restraints that temper its growth. The high initial capital investment required for digestion equipment and plant construction remains a significant barrier, particularly for smaller municipalities and businesses with limited financial resources. Complex operational management, often requiring specialized technical expertise for optimal performance and troubleshooting, can deter potential adopters. Furthermore, the variability in feedstock quality and quantity poses operational challenges, impacting digester stability and biogas output, which can lead to unpredictable returns on investment. Regulatory complexities, including inconsistent policy frameworks and permitting processes across different regions, can also hinder project development and market entry. Public perception issues, such as concerns over odor or land use for digestion facilities, can occasionally lead to community opposition, further delaying or blocking projects. These restraints necessitate innovative financing models, robust technical support, and effective public engagement strategies to mitigate their impact and ensure broader market penetration.

Despite these challenges, numerous opportunities are poised to propel the market forward. The growing emphasis on the circular economy and nutrient recovery presents a substantial opportunity for digestate valorization, transforming it from a waste product into a valuable biofertilizer, thus creating additional revenue streams. Emerging economies, particularly in Asia Pacific and Latin America, offer immense untapped potential due to rapid urbanization, industrial growth, and underdeveloped waste treatment infrastructure, creating a significant demand for new digestion facilities. The increasing adoption of co-digestion, where multiple organic waste streams are processed together, enhances biogas yield and improves economic viability, unlocking new markets. Furthermore, technological innovation in areas such as advanced sensor technologies, artificial intelligence for process optimization, and modular digester designs are expanding the applicability and accessibility of digestion solutions to diverse scales and contexts. The ongoing global pursuit of energy independence and climate change mitigation also continues to drive investments in renewable energy technologies, including biogas from digestion, positioning the market for long-term sustainable growth and diversification. Impact forces, such as global climate agreements, energy security concerns, and evolving waste management policies, exert significant pressure on industries and governments to adopt and scale digestion technologies, ensuring continued relevance and investment in this crucial sector.

Segmentation Analysis

The Digestion Equipment Market is characterized by a multifaceted segmentation based on type, application, end-user, and capacity, each offering distinct insights into market dynamics and growth opportunities. This granular analysis is crucial for understanding specific demand patterns, technological preferences, and regional adoption rates. The types of digestion equipment, such as anaerobic and aerobic systems, cater to different process requirements and desired outputs, with anaerobic systems prominently focused on biogas production and aerobic systems on effluent quality. Applications span a wide array of waste streams, from municipal sludge to complex industrial effluents and agricultural residues, each demanding specialized equipment configurations. End-users range from large municipal entities to diverse industrial sectors and agricultural producers, each having unique operational scales and regulatory compliance needs. Finally, capacity segmentation reflects the varying scales of projects, from small-scale on-farm digesters to large centralized waste treatment facilities. This comprehensive segmentation provides a detailed landscape of the market, highlighting the diverse solutions required to address the global organic waste management challenge effectively and sustainably.

- By Type

- Anaerobic Digesters

- Wet Anaerobic Digestion

- Dry Anaerobic Digestion

- High-Solids Anaerobic Digestion

- Low-Solids Anaerobic Digestion

- Aerobic Digesters

- Conventional Aerobic Digestion

- Extended Aeration

- Sequencing Batch Reactors (SBR)

- Thermal Hydrolysis Pre-treatment Systems

- Composting Equipment

- Other Digestion Technologies (e.g., Enzymatic Digestion)

- Anaerobic Digesters

- By Application

- Municipal Wastewater Sludge

- Industrial Wastewater (Food & Beverage, Pulp & Paper, Chemical, Pharmaceutical)

- Agricultural Waste (Manure, Crop Residues)

- Food Waste

- Bio-Solids

- Solid Organic Waste

- Mixed Organic Waste

- By End-User

- Municipal

- Industrial (Food & Beverage, Chemical, Pharmaceutical, Textile, etc.)

- Agricultural

- Commercial

- Energy & Biogas Production Facilities

- Waste Management Companies

- By Capacity

- Small-Scale (e.g., <1,000 m³ reactor volume)

- Medium-Scale (e.g., 1,000-10,000 m³ reactor volume)

- Large-Scale (e.g., >10,000 m³ reactor volume)

- By Component

- Digester Tanks

- Pumps and Mixers

- Heat Exchangers

- Gas Handling Systems (Storage, Upgrading)

- Dewatering Equipment

- Control and Monitoring Systems

- Pre-treatment Units (Shredders, Screens)

Value Chain Analysis For Digestion Equipment Market

The value chain for the Digestion Equipment Market is a complex and interconnected network, beginning with upstream activities involving the sourcing of raw materials and the manufacturing of specialized components, extending through the core processes of equipment fabrication, integration, and installation, and culminating in downstream services related to plant operation, maintenance, and product distribution. Upstream, the market relies heavily on suppliers of high-grade steel, plastics, and various chemical compounds for digester tanks and associated infrastructure, alongside manufacturers of precision components such as pumps, mixers, sensors, heat exchangers, and gas purification units. Innovation at this stage often focuses on developing more durable, efficient, and corrosion-resistant materials and components, which directly impact the longevity and performance of digestion systems. Strong supplier relationships and quality control are paramount to ensure the reliability and safety of the final assembled equipment. This foundational segment sets the stage for the quality and efficiency of the entire digestion ecosystem, making robust supply chain management a critical success factor.

Downstream activities are equally critical, encompassing the installation, commissioning, operation, and maintenance of digestion facilities, as well as the distribution and utilization of the valuable byproducts such as biogas and digestate. Installation services require specialized engineering expertise to ensure proper site preparation, system integration, and adherence to local regulations. Post-installation, operators are responsible for managing the complex biological processes, monitoring performance, and troubleshooting issues, often supported by remote monitoring and automation technologies. Maintenance services, including routine checks, repairs, and spare parts supply, are essential for ensuring the long-term operational efficiency and asset longevity. Furthermore, the downstream value extends to the off-takers of biogas, which can be used for electricity generation, heat production, vehicle fuel (biomethane), or injected into natural gas grids. The digestate, a nutrient-rich organic fertilizer, is distributed to agricultural end-users, closing the loop in the circular economy. The efficiency and reliability of these downstream processes directly influence the economic viability and environmental impact of digestion projects, necessitating comprehensive support and robust off-take agreements.

Distribution channels for digestion equipment are diverse, encompassing both direct and indirect models. Direct sales are common for large-scale, complex projects, where equipment manufacturers engage directly with municipal clients, large industrial corporations, or specialized waste-to-energy developers. This approach allows for customized solutions, direct technical support, and closer client relationships. Indirect channels involve a network of distributors, agents, and engineering, procurement, and construction (EPC) firms, particularly for smaller to medium-sized projects or in regions where local presence is crucial. EPC firms often play a pivotal role, integrating equipment from various manufacturers into a complete, operational plant, providing turnkey solutions. Original Equipment Manufacturers (OEMs) may also partner with system integrators to offer comprehensive solutions that include installation and ongoing support. The choice of distribution channel often depends on the project's scale, geographical location, regulatory environment, and the manufacturer's strategic objectives. Effective channel management, including training, technical support, and marketing efforts, is vital for expanding market reach and ensuring widespread adoption of digestion technologies across various customer segments and geographic regions.

Digestion Equipment Market Potential Customers

The Digestion Equipment Market serves a diverse and expanding base of potential customers, all of whom share a common need for efficient and sustainable organic waste management, resource recovery, and often, renewable energy generation. The primary end-users or buyers of digestion equipment are typically large institutional bodies and industrial enterprises facing significant organic waste streams and stringent environmental compliance requirements. Municipalities represent a cornerstone of this customer base, driving demand for equipment in their wastewater treatment plants to manage sewage sludge, reduce landfill volumes, and mitigate environmental pollution. As urban populations grow, the volume of municipal waste escalates, making advanced digestion solutions indispensable for public health and environmental protection. These municipal entities are often driven by regulatory mandates, public health concerns, and the potential for cost savings through waste valorization and energy production.

Industrial sectors, particularly those with high organic wastewater discharge or significant volumes of solid organic waste, constitute another major segment of potential customers. This includes the food and beverage industry, which generates substantial quantities of processing waste; the pulp and paper industry with its organic-rich effluents; and the pharmaceutical and chemical sectors, which require specialized treatment for complex organic compounds. Agricultural operations, ranging from large-scale livestock farms to agrifood processing facilities, are increasingly adopting digestion equipment to manage animal manure, crop residues, and food processing byproducts, thereby reducing greenhouse gas emissions, producing biofertilizers, and generating on-site renewable energy. These industrial and agricultural clients are motivated by a combination of factors: stringent effluent discharge regulations, rising waste disposal costs, corporate sustainability goals, and the economic benefits derived from biogas production and nutrient recovery, leading to both environmental compliance and operational efficiency improvements.

Beyond these traditional segments, new customer groups are emerging, driven by evolving market dynamics. Independent power producers and specialized biogas plant operators are significant buyers, focusing on large-scale renewable energy generation from diverse organic feedstocks. Waste management companies are investing in digestion facilities to diversify their service offerings, enhance resource recovery from collected municipal solid waste, and create value from organic fractions. Furthermore, commercial establishments such as large hotels, restaurants, and shopping centers are exploring smaller-scale, localized digestion solutions for their food waste management. The growth of circular economy initiatives and decentralized energy production models also fosters demand from various stakeholders seeking to integrate waste-to-resource strategies into their operations. This expanding customer landscape underscores the versatility and increasing importance of digestion technologies across various economic sectors, reflecting a global shift towards more sustainable and resource-efficient practices, creating a broad and resilient market for digestion equipment providers worldwide.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.2 Billion |

| Market Forecast in 2033 | USD 5.3 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Veolia Water Technologies, Suez S.A., Xylem Inc., Evoqua Water Technologies, Huber SE, Fluence Corporation, Anaerobic Digestion Co. Ltd., Eisenmann SE, Wärtsilä, EnviTec Biogas AG, PlanET Biogastechnik GmbH, BTS Biogas, Paques BV, DMT Environmental Technology, Strabag Umwelttechnik GmbH, AT-Biogas GmbH, Biothane, Kumac, Pentair, Cambi AS. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Digestion Equipment Market Key Technology Landscape

The Digestion Equipment Market is characterized by a rapidly evolving technological landscape, driven by the continuous pursuit of enhanced efficiency, reduced operational costs, and improved resource recovery from organic waste streams. Central to this evolution are advancements in reactor design, which include specialized configurations such as continuously stirred tank reactors (CSTRs), plug-flow digesters, upflow anaerobic sludge blanket (UASB) reactors, and advanced hybrid systems. These designs are optimized for specific waste characteristics and operational goals, offering benefits like increased throughput, better mixing, and superior solid retention times. Alongside these, pre-treatment technologies are gaining significant traction, particularly thermal hydrolysis, which uses high temperature and pressure to break down complex organic matter, thereby enhancing the biodegradability of sludge, increasing biogas yield, and improving dewaterability. Other pre-treatment methods like mechanical disintegration, ultrasonic treatment, and chemical pre-treatment also play a crucial role in optimizing digestion processes by preparing the feedstock for more efficient microbial action, ensuring a more stable and productive digester environment.

Another pivotal area of technological innovation lies in the integration of advanced control and monitoring systems, often incorporating sophisticated sensor technologies, the Internet of Things (IoT), and Supervisory Control and Data Acquisition (SCADA) systems. These technologies enable real-time tracking of critical process parameters such as pH, temperature, volatile fatty acids, alkalinity, and gas composition, allowing for dynamic adjustments to optimize performance and prevent process upsets. Predictive analytics, often powered by artificial intelligence and machine learning algorithms, are increasingly being deployed to forecast equipment failures, anticipate changes in feedstock quality, and optimize biogas production based on complex data patterns. This shift towards smart, data-driven operation minimizes human error, reduces operational variability, and maximizes overall plant efficiency. The development of more robust and reliable sensors, capable of operating in harsh digester environments, is also crucial for accurate data collection and effective process management, contributing significantly to the stability and output of digestion facilities.

Furthermore, post-digestion technologies are receiving considerable attention to enhance the value proposition of digested products. This includes advanced biogas upgrading systems, such as membrane separation, pressure swing adsorption (PSA), and water scrubbing, which purify biogas into biomethane (renewable natural gas) suitable for injection into gas grids or use as vehicle fuel. Efficient digestate separation and nutrient recovery technologies, like ammonia stripping, struvite precipitation, and various dewatering techniques, are transforming digestate into a high-value biofertilizer product, rich in nitrogen, phosphorus, and potassium. This not only mitigates potential environmental impacts from digestate disposal but also creates additional revenue streams for plant operators, aligning with circular economy principles. Innovations in modular and compact digestion systems are also catering to smaller-scale applications and decentralized waste management, offering scalable and flexible solutions that reduce construction time and capital costs. These ongoing technological advancements collectively enhance the economic viability and environmental sustainability of digestion processes, driving continuous growth and expansion in the market.

Regional Highlights

- North America: This region is characterized by mature environmental regulations and a strong emphasis on wastewater treatment upgrades and renewable energy initiatives. The United States and Canada are significant contributors, driven by federal and state-level mandates for nutrient removal, sludge stabilization, and biogas utilization. Significant investments in aging infrastructure modernization and the adoption of advanced digestion technologies, including thermal hydrolysis, are prevalent. The increasing focus on food waste diversion from landfills also provides a growing market for digestion equipment, particularly for co-digestion facilities. High awareness of energy independence and sustainability further propels the adoption of biogas-to-energy projects.

- Europe: Europe stands as a frontrunner in the Digestion Equipment Market, particularly due to its robust circular economy framework, ambitious renewable energy targets, and extensive network of biogas plants. Countries like Germany, France, Italy, and the UK are leaders in anaerobic digestion, driven by supportive feed-in tariffs and environmental policies that incentivize organic waste recycling and biogas production. The region demonstrates high technological sophistication, with strong research and development in digester optimization, nutrient recovery, and biomethane upgrading. Strict EU directives on waste management and landfill reduction continue to fuel steady growth and innovation in the sector, emphasizing both energy recovery and the production of high-quality biofertilizers.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market for digestion equipment, primarily fueled by rapid industrialization, urbanization, and a burgeoning population leading to vast increases in waste generation. Countries such as China, India, Japan, and South Korea are making significant investments in new wastewater treatment facilities and waste-to-energy projects to address severe environmental pollution and escalating energy demands. Government initiatives, subsidies, and stringent environmental protection laws are key drivers. The region offers immense untapped potential, with a strong focus on both municipal and industrial waste treatment, as well as agricultural waste valorization, representing a vast opportunity for market players.

- Latin America: This region is experiencing a gradual but steady growth in the digestion equipment market, driven by increasing environmental awareness, improving economic conditions, and the urgent need for enhanced sanitation infrastructure. Countries like Brazil, Mexico, and Argentina are investing in municipal wastewater treatment plants and exploring biogas potential from agricultural waste and landfills. While facing challenges such as inconsistent regulatory frameworks and limited funding, the region presents growing opportunities, particularly in rural areas for decentralized waste management and energy solutions, and in urban centers for large-scale municipal projects.

- Middle East and Africa (MEA): The MEA market for digestion equipment is in its nascent stages but shows significant potential, propelled by rapid economic diversification, increasing population, and growing awareness of water scarcity and sustainable waste management. Investments in infrastructure development, particularly in GCC countries and South Africa, are creating demand for advanced wastewater treatment and waste-to-energy solutions. While the market faces hurdles like water scarcity issues impacting feedstock availability and technological adoption, the region's strong solar energy potential and the need for new energy sources can foster synergies with biogas production from digestion processes, offering long-term growth prospects as environmental regulations strengthen and economic conditions improve.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Digestion Equipment Market.- Veolia Water Technologies

- Suez S.A.

- Xylem Inc.

- Evoqua Water Technologies

- Huber SE

- Fluence Corporation

- Anaerobic Digestion Co. Ltd.

- Eisenmann SE

- Wärtsilä

- EnviTec Biogas AG

- PlanET Biogastechnik GmbH

- BTS Biogas

- Paques BV

- DMT Environmental Technology

- Strabag Umwelttechnik GmbH

- AT-Biogas GmbH

- Biothane

- Kumac

- Pentair

- Cambi AS

Frequently Asked Questions

What is the projected growth rate for the Digestion Equipment Market?

The Digestion Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033, driven by increasing waste generation and demand for renewable energy.

What are the primary drivers for the Digestion Equipment Market's expansion?

Key drivers include stringent environmental regulations, global focus on sustainable waste management, rising demand for renewable energy (biogas), and continuous technological advancements in digestion processes and equipment design.

Which regions are leading in the adoption of digestion equipment?

Europe and North America are mature markets with high adoption due to strong regulations and infrastructure, while Asia Pacific is emerging as the fastest-growing region due to rapid urbanization and industrialization.

How is AI impacting the Digestion Equipment Market?

AI is enhancing the market by enabling predictive maintenance, real-time process optimization, automated fault detection, and improved feedstock management, leading to greater efficiency, stability, and cost reduction in digestion plants.

What are the main types of digestion equipment available in the market?

The market primarily offers anaerobic digesters (for biogas production) and aerobic digesters (for waste stabilization), alongside thermal hydrolysis pre-treatment systems and various auxiliary components, tailored for diverse organic waste streams.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager