Digging Tools Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431445 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Digging Tools Market Size

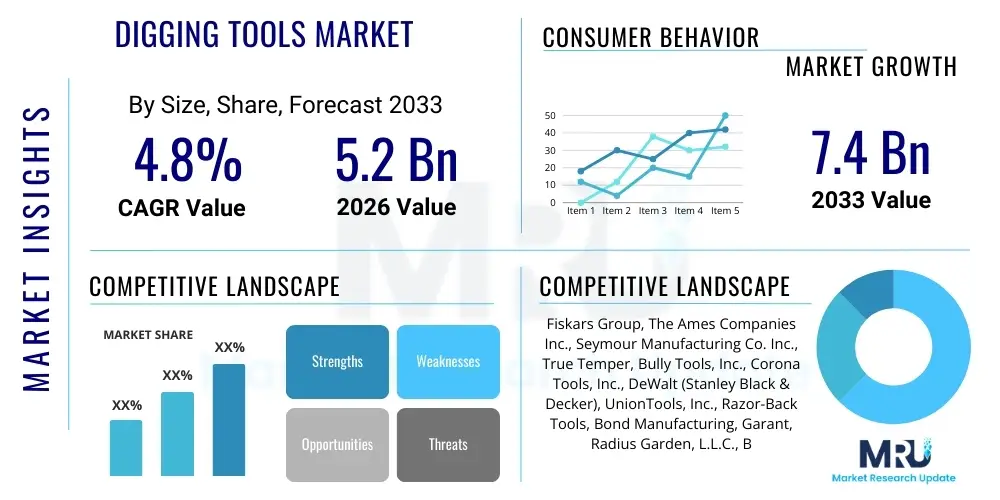

The Digging Tools Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 7.4 Billion by the end of the forecast period in 2033.

The steady expansion of the global construction and infrastructure sector serves as the primary catalyst propelling the market size forward. Digging tools, encompassing traditional items like shovels and spades to advanced mechanized post-hole diggers, are foundational necessities across civil engineering projects, utility installation, and residential development. Furthermore, the increasing global emphasis on sustainable agriculture and large-scale landscaping projects, particularly in rapidly urbanizing regions of Asia Pacific, necessitates high volumes of durable and ergonomically designed manual and semi-automated digging implements. This sustained demand profile, relatively insulated from short-term economic fluctuations due to the necessity of infrastructure maintenance, supports the projected moderate yet consistent CAGR throughout the forecast period.

Market valuation growth is further supported by the technological evolution within the segment, primarily focusing on material science enhancements and ergonomic design principles. Manufacturers are increasingly utilizing composite materials, such as fiberglass and high-tensile steel alloys, to reduce weight, increase durability, and minimize user fatigue, thereby meeting stringent professional contractor requirements for efficiency and worker safety. The transition towards tools optimized for specific tasks, such as trenching or precision gardening, coupled with robust replacement cycles across industrial and agricultural end-users, ensures a continuous revenue stream. While heavy machinery often substitutes manual labor in large-scale excavations, the indispensable role of manual digging tools in precision work, confined spaces, and preparatory tasks maintains their significant market footprint and contributes substantially to the overall market valuation.

Digging Tools Market introduction

The Digging Tools Market encompasses the global trade and utilization of various implements designed for excavating, moving, and manipulating earth and granular materials. These essential tools range from basic manual instruments, such as spades, shovels, trowels, and post-hole diggers, to larger, often mechanically assisted, tools like picks and mattocks used in heavy-duty applications. The core application spectrum is exceptionally broad, spanning large-scale civil construction, residential and commercial landscaping, agricultural tillage and planting, and utilities infrastructure maintenance. Key benefits derived from these tools include cost-effectiveness for small-to-medium tasks, portability, precision in delicate groundwork, and operational viability in areas inaccessible to heavy machinery, making them indispensable across virtually all outdoor earth manipulation activities globally.

Major applications driving market demand include foundational work in residential housing, installation and repair of underground piping and cabling (water, gas, electricity, telecommunications), and extensive use in professional landscaping services for bed preparation and planting. For the agricultural sector, specialized digging tools facilitate crop preparation and harvesting processes that require manual precision, particularly in smallholding and organic farming. The market's robust nature is intrinsically linked to global population growth and urbanization, which necessitate constant development of supporting infrastructure. Driving factors include government investments in public works, heightened consumer interest in gardening and Do-It-Yourself (DIY) home improvement projects, and stringent safety regulations promoting the use of appropriate, high-quality, and ergonomically sound equipment to reduce workplace injuries and improve task efficiency.

The contemporary market is characterized by fierce competition centered not only on price but significantly on material innovation and ergonomic superiority. Manufacturers are investing heavily in research and development to introduce products with enhanced grip technologies, vibration dampening handles, and corrosion-resistant coatings, thereby extending product lifespan and user comfort. The confluence of necessary utility, broad applicability across diverse economic sectors, and continuous refinement in design ensures that the Digging Tools Market remains a staple component of the global hardware and industrial supply chain, reflecting growth patterns closely aligned with global GDP and construction output cycles.

Digging Tools Market Executive Summary

The Digging Tools Market is experiencing steady expansion, driven fundamentally by robust global construction activities and a sustained boom in landscaping and infrastructure maintenance across developing and developed economies. Key business trends indicate a strong focus on premiumization, where end-users, particularly professional contractors, prioritize durability and ergonomic features over mere cost savings, fueling demand for tools manufactured from superior materials like aviation-grade aluminum and specialized carbon steel alloys. This trend has pushed manufacturers toward advanced supply chain optimization and localized production strategies to meet regional quality requirements and environmental standards. Furthermore, digitalization is influencing distribution, with B2B e-commerce platforms and sophisticated inventory management systems becoming crucial components for serving large institutional buyers and dispersed retail channels efficiently.

Regionally, the Asia Pacific (APAC) stands out as the predominant growth engine, primarily fueled by massive infrastructural projects in countries like India and China, alongside rapid urbanization in Southeast Asian nations, requiring vast quantities of basic and specialized digging implements. North America and Europe, while exhibiting slower volume growth, maintain high market maturity and profitability, focusing on replacing existing inventory with higher-margin, specialized, and smart tools catering to stringent occupational safety standards and the burgeoning DIY and gardening enthusiast segments. Segments trends highlight the dominance of the shovel and spade categories due to their universal application, but the fastest growth is observed in specialized tools, such as compact trenching shovels and high-leverage post-hole diggers, designed for niche applications that maximize contractor efficiency and minimize physical exertion.

The trajectory of the market suggests that sustainability and materials science will dictate future competitive positioning. Manufacturers successfully integrating recycled content, deploying circular economy practices in their production cycles, and delivering demonstrable reductions in the carbon footprint of their products will gain significant market share, especially in regions with strict environmental procurement policies. Overall, the market remains foundational, characterized by stable demand and technological incrementalism focused heavily on improving user experience and material resilience, translating into a reliably positive outlook for the forecast period across professional and consumer segments.

AI Impact Analysis on Digging Tools Market

User inquiries regarding the integration of Artificial Intelligence (AI) in the Digging Tools Market primarily revolve around optimizing manufacturing processes, enhancing supply chain resiliency, and developing 'smart' construction equipment that interfaces with basic manual tools. Key concerns include how AI-driven predictive maintenance models can reduce tool failure rates, the potential for AI to streamline logistics from raw material procurement to shelf placement, and the eventual impact of AI-controlled robotics on traditional manual labor tools, specifically in construction site management and safety monitoring. Users are expecting AI not to replace the fundamental tool itself, but rather to optimize its ecosystem—improving material yield through AI-driven design simulation, predicting regional demand spikes based on macroeconomic indicators, and integrating tools with safety wearables to monitor worker exertion and mitigate injury risks, thereby significantly enhancing overall operational efficiency and safety protocols in high-risk environments.

- AI optimizes factory floor efficiency, predicting equipment failures in forging and assembly lines, leading to higher output and consistent quality for digging tools.

- Predictive analytics driven by machine learning algorithms enhance supply chain management, anticipating disruptions and optimizing inventory levels across distribution centers globally.

- AI supports advanced material science by simulating stress points and fatigue failure in new tool designs, ensuring superior ergonomic quality and longevity.

- Integration of basic RFID or IoT sensors (analyzed via AI) allows for fleet management and asset tracking of specialized digging tools on large construction sites, reducing loss and optimizing utilization.

- AI-enabled computer vision systems can monitor construction site movements, ensuring manual digging tools are used according to safety standards and identifying potential hazards in real-time.

- Demand forecasting models utilize AI to process vast datasets (weather patterns, permits issued, commodity prices) to accurately predict market needs for specific types of digging tools.

DRO & Impact Forces Of Digging Tools Market

The dynamics of the Digging Tools Market are dictated by a delicate balance between persistent infrastructure investment (Drivers) and the increasing mechanization of construction tasks (Restraints), opening avenues for innovation in material science and ergonomic design (Opportunity). The primary driver is the unavoidable need for precision earth moving, trenching, and utility access required in confined urban spaces where large machinery is impractical or prohibited. Global population growth necessitates continuous upgrades to sewage, water, and power infrastructure, creating steady foundational demand for reliable manual digging tools. Restraints largely center on escalating labor costs globally, which incentivize construction companies to favor automated or semi-automated heavy equipment for larger projects, thereby limiting the volume potential for purely manual tools. Furthermore, market fragmentation and the presence of low-cost, low-quality imports often depress average selling prices, particularly in consumer segments, challenging premium manufacturers.

Opportunities for market growth are strongly linked to the demand for specialized, high-performance tools, particularly those incorporating superior ergonomic features to comply with modern occupational safety standards. The rise of sophisticated landscaping architecture and precision agriculture requires tools specifically engineered for minimum soil disturbance or maximum leverage. Impact forces indicate that standardization of product quality and safety certifications are becoming non-negotiable, acting as barriers to entry for uncertified manufacturers, while the rising cost volatility of raw materials, particularly steel and composite resins, exerts sustained pressure on manufacturing margins. These forces compel manufacturers to prioritize operational efficiency and vertical integration to maintain competitive pricing without compromising the mandated improvements in durability and user experience.

The market faces external pressures from environmental regulations that favor sustainable materials and manufacturing processes, pushing innovation toward recycled plastics for handles and low-impact metal coatings. The impact force of substitution risk remains constant, especially from compact machinery like mini-excavators; however, the cost-effectiveness and zero-emissions profile of manual tools for small, defined tasks secure their long-term relevance. Therefore, strategic maneuvering in this market requires focusing on segment-specific durability, investing in ergonomic engineering to address labor efficiency concerns, and maintaining robust distribution networks that can service both high-volume industrial clients and widely dispersed retail consumers.

Segmentation Analysis

The Digging Tools Market is comprehensively segmented based on product type, application, material composition, and distribution channel, allowing for granular analysis of demand patterns and strategic allocation of manufacturing resources. Product Type segmentation is crucial, as demand varies significantly between general-purpose tools (shovels, spades) used across all sectors and highly specialized tools (trenching shovels, post-hole augers) primarily catering to utilities and professional contractors. Application analysis provides insight into the primary end-user sectors, with Construction and Landscaping typically commanding the largest market share due to the intensity and scale of earth manipulation required in these industries. Understanding these segment dynamics is paramount for manufacturers to tailor their product lines, distribution strategies, and pricing structures effectively to maximize penetration and profitability across diverse end-user profiles, ranging from large multinational construction firms to individual gardening enthusiasts.

- By Product Type:

- Shovels (Round Point, Square Point, Scoop)

- Spades (Trenching, Border, Digging)

- Trowels and Hand Diggers (Garden Trowels, Transplanters)

- Post Hole Diggers (Manual and Mechanized Augers)

- Picks and Mattocks

- Forks and Rakes (Digging Forks)

- Specialty Tools (Clam Shell Diggers, Root Cutters)

- By Application:

- Construction and Infrastructure Development

- Landscaping and Gardening (Professional and Residential)

- Agriculture (Tillage and Planting)

- Mining and Resource Extraction

- Utility Installation and Maintenance

- By Material:

- Steel and Metal Alloys (Carbon Steel, Stainless Steel)

- Fiberglass and Composite Materials (Handles and Shafts)

- Wood (Ash, Hickory Handles)

- Plastics and Polymers (Grips and Small Components)

- By Distribution Channel:

- Offline Retail (Hardware Stores, Home Improvement Centers)

- Online Retail and E-commerce Platforms

- Direct Sales (B2B to Contractors and Industrial Suppliers)

Value Chain Analysis For Digging Tools Market

The value chain for the Digging Tools Market begins with the highly competitive upstream segment involving the sourcing and processing of raw materials, primarily high-grade steel, various hardwoods (like ash and hickory), and composite resins for handles. Steel procurement is critical, characterized by global commodity price volatility and the necessity for specific alloys that provide maximum strength and durability, requiring manufacturers to maintain robust hedging strategies or long-term contracts with specialized steel mills. Manufacturing processes are complex, involving precision forging, heat treatment, polishing, and ergonomic handle attachment, where quality control and scale efficiencies determine manufacturing cost effectiveness and market competitiveness. The upstream analysis emphasizes the critical reliance on high-quality input suppliers capable of meeting stringent performance specifications required for professional-grade tools, directly impacting the final product's pricing and longevity.

The distribution channel segment acts as the critical bridge between manufacturers and the diverse array of end-users. Direct distribution, predominantly B2B, serves large professional contractors, construction firms, and governmental bodies, allowing for volume sales and bespoke contractual agreements. Indirect channels are segmented into offline retail (large format home improvement stores and specialized hardware shops) and the rapidly expanding online retail segment. Online channels offer unparalleled reach to residential and DIY consumers, requiring sophisticated logistics management but providing opportunities for direct consumer engagement and brand building. The effectiveness of the value chain is highly dependent on managing inventory turnover and ensuring tools meet regional safety standards, facilitating seamless movement from factory floor to end-user, often through complex global logistical networks.

Downstream analysis focuses on the end-user consumption patterns, replacement cycles, and market pull dynamics. Professional users demand tools optimized for daily intensive use, justifying higher price points for superior durability and ergonomic design, whereas consumer demand is often price-sensitive, driven by immediate project needs. The interaction between distribution margins and end-user price sensitivity is constant; maintaining strong relationships with key retailers who provide prime shelf space and promotional visibility is essential. The value chain conclusion emphasizes that success lies not just in manufacturing excellence but in a finely tuned distribution strategy that addresses the unique purchasing habits of industrial, agricultural, and residential consumers while efficiently mitigating raw material price risks.

Digging Tools Market Potential Customers

Potential customers for the Digging Tools Market are highly diversified, encompassing a vast spectrum of professional, commercial, governmental, and individual end-users, reflecting the ubiquitous requirement for earth manipulation across modern societies. The largest consumer cohort consists of professional entities, specifically construction and civil engineering contractors who require large volumes of durable, reliable tools for site preparation, trenching, utility access, and foundational work. This segment focuses heavily on total cost of ownership, prioritizing tools with extended warranties and proven field resilience, leading to significant B2B sales and long-term contracts with major suppliers. Agricultural operators, ranging from large-scale commercial farms utilizing specific digging implements for soil sampling and irrigation work to small-scale organic growers requiring precision hand tools, represent another foundational professional customer base, where seasonal purchasing peaks influence market demand.

The retail and individual consumer segment, driven largely by landscaping, gardening, and Do-It-Yourself (DIY) home improvement projects, forms the most volume-sensitive portion of the market. These customers are primarily served through offline retail centers (Home Depot, Lowes) and e-commerce platforms, demonstrating purchasing decisions influenced by retail pricing, ergonomic features appealing to casual users, and branding visibility. Government and municipal organizations, including public works departments, parks and recreation management, and utility companies, constitute a reliable, high-specification customer group. These entities adhere to strict procurement standards, demanding tools that comply with occupational health and safety regulations and often specifying specialized, non-conductive, or high-visibility tools for enhanced safety during infrastructure repair and maintenance operations.

Furthermore, specialized industrial sectors, such as mining and resource extraction, utilize heavy-duty digging tools for preparatory work, geological sampling, and maintaining operational access routes, requiring tools built to withstand extremely harsh environmental conditions. The diversity of these end-users necessitates that manufacturers maintain a multifaceted product portfolio, ensuring that basic, cost-effective tools are available for the DIY market, while high-tensile, ergonomically certified, and often contract-specific tools are supplied to meet the rigorous demands of professional and governmental procurement cycles, ensuring broad market coverage and sustained revenue generation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 7.4 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fiskars Group, The Ames Companies Inc., Seymour Manufacturing Co. Inc., True Temper, Bully Tools, Inc., Corona Tools, Inc., DeWalt (Stanley Black & Decker), UnionTools, Inc., Razor-Back Tools, Bond Manufacturing, Garant, Radius Garden, L.L.C., Bahco (Snap-on), Spear & Jackson, Tekton, Inc., Husqvarna Group, Ken-Tool, Kobalt (Lowe's), Craftsman (Stanley Black & Decker), Anvil Tooling. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Digging Tools Market Key Technology Landscape

The technological landscape of the Digging Tools Market, while traditionally reliant on basic mechanical principles, is currently undergoing significant transformation driven by advancements in material science and ergonomic engineering. The shift away from traditional wood and basic carbon steel is notable, with leading manufacturers focusing on high-performance alloys, such as boron steel and heat-treated manganese steel, which offer superior resistance to bending, abrasion, and premature wear, significantly extending the tool's service life, particularly under rigorous professional use conditions. Handle technology is a major area of innovation, with the widespread adoption of pultruded fiberglass, which provides exceptional strength-to-weight ratios and natural insulation properties, alongside specialized polymer grips designed to absorb vibration and prevent blistering, thereby minimizing musculoskeletal strain on the user—a critical compliance factor in regulated labor markets.

Furthermore, surface treatment and coating technologies represent a key technological battleground. Advanced powder coating and epoxy treatments are now standard, offering superior resistance to rust and corrosion, vital for tools frequently exposed to harsh chemicals, wet soil, or coastal environments. Some premium manufacturers are integrating micro-textured blade surfaces to reduce friction during soil penetration, enhancing digging efficiency and reducing the physical effort required. While the integration of complex electronics is limited in purely manual tools, the technological footprint is growing through IoT and telematics incorporation into larger, semi-manual tools (like mechanized post-hole diggers) for asset tracking, remote diagnostics, and preventative maintenance scheduling, ensuring optimal fleet utilization for large contractors.

Ultimately, the core of technological advancement in this sector lies in optimizing the human-tool interface. This includes computer-aided design (CAD) simulation for optimizing blade curvature and angle to maximize soil displacement efficiency, and rigorous laboratory testing to ensure compliance with global fatigue standards (ISO, ANSI). The ongoing pursuit of lighter, stronger, and more resilient materials that also align with sustainability objectives—such as the use of recycled or sustainably sourced components—defines the cutting edge of technological development in this indispensable, yet often overlooked, segment of the global hardware market, ensuring the tools are safer, more durable, and increasingly efficient for the end-user.

Regional Highlights

The regional market dynamics for digging tools reflect a strong correlation with infrastructural spending, construction growth rates, and agricultural practices specific to each major geographic zone. Asia Pacific (APAC) currently dominates the market both in terms of volume and growth potential. This dominance is primarily attributed to rapid urbanization, massive government investment in utility infrastructure (road networks, telecommunications, sewage systems), and continued expansion of residential and commercial real estate, particularly in populous countries such as China, India, and Indonesia. The sheer scale of construction projects, coupled with a large agricultural sector reliant on manual labor and basic implements, drives colossal demand across all product segments. Manufacturers strategically focus on establishing localized production facilities in APAC to mitigate logistical costs and capitalize on highly competitive market pricing and immediate delivery capabilities required by regional contractors.

North America (NA), representing a mature market, is characterized by high demand for premium, specialized, and ergonomically advanced digging tools. Growth here is primarily driven by rigorous replacement cycles, stringent occupational safety regulations that necessitate investments in high-quality tools to reduce worker injury, and a significant, robust DIY and professional landscaping segment. The US and Canada market prioritizes tools with composite handles and superior steel alloys, commanding higher average selling prices compared to tools sold in price-sensitive developing markets. The market structure in NA is heavily influenced by large retail chains and robust B2B distribution networks, demanding exceptional supply chain reliability and promotional support from manufacturers.

Europe mirrors North America in its focus on quality and specialization, with an added layer of emphasis on sustainability and adherence to EU directives regarding materials and manufacturing processes. Western European countries exhibit high demand for precision gardening and landscaping tools, aligning with dense urban planning and a culture of extensive residential gardening. Conversely, Eastern Europe shows strong growth related to ongoing modernization of aging infrastructure and new commercial development. Latin America (LATAM) and the Middle East & Africa (MEA) represent high-potential, yet often volatile, growth markets. LATAM demand is tied to commodity price cycles affecting mining and agricultural sectors, while MEA growth is powered by large-scale oil and gas infrastructure projects and ambitious civil development plans in the GCC states, requiring specialized, heavy-duty tools capable of handling challenging desert and rocky terrains.

- Asia Pacific (APAC): Highest volume market, driven by urbanization, large-scale infrastructure projects (e.g., Belt and Road Initiative), and a large, traditional agricultural sector. Focus on competitive pricing and volume distribution.

- North America (NA): Mature market focused on premiumization, ergonomics, and high-quality specialized tools. Demand supported by strong DIY culture and replacement cycles in professional construction.

- Europe: Emphasis on sustainable manufacturing, adherence to strict safety standards, and high demand for precision gardening and specialized utility tools. Growth steady, focused on efficiency and durability.

- Latin America (LATAM): Market volatility linked to economic cycles; significant demand generated by agricultural expansion and critical mining operations requiring robust implements.

- Middle East and Africa (MEA): Growth stimulated by large state-funded construction and resource extraction projects (oil, gas, minerals). Demand skewed toward heavy-duty, climate-resistant tools.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Digging Tools Market.- Fiskars Group

- The Ames Companies Inc.

- Seymour Manufacturing Co. Inc.

- True Temper

- Bully Tools, Inc.

- Corona Tools, Inc.

- DeWalt (Stanley Black & Decker)

- UnionTools, Inc.

- Razor-Back Tools

- Bond Manufacturing

- Garant

- Radius Garden, L.L.C.

- Bahco (Snap-on)

- Spear & Jackson

- Tekton, Inc.

- Husqvarna Group

- Ken-Tool

- Kobalt (Lowe's)

- Craftsman (Stanley Black & Decker)

- Anvil Tooling

Frequently Asked Questions

Analyze common user questions about the Digging Tools market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Digging Tools Market?

The market is primarily driven by global infrastructure development, specifically the sustained governmental investment in public works, utility expansion, and ongoing residential and commercial construction worldwide, requiring constant procurement of manual and semi-automated earth-moving implements.

Which material segment holds the highest market share in digging tools?

The Steel and Metal Alloys segment holds the highest market share due to its superior durability and strength, making it the preferred material for professional-grade shovel heads, spades, and picks required in heavy-duty construction and agricultural applications.

How is the adoption of ergonomic design impacting consumer choice in the market?

Ergonomic design is critically impacting consumer choice, particularly among professional contractors in developed markets, who are increasingly willing to pay a premium for tools featuring anti-vibration technology and composite handles to minimize physical strain and comply with occupational safety standards.

Which regional market is projected to exhibit the fastest growth rate?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, fueled by aggressive urbanization strategies, large-scale infrastructure projects in developing nations, and substantial growth in commercial and residential property development.

What role does e-commerce play in the distribution of digging tools?

E-commerce plays a vital role, facilitating direct-to-consumer sales for the DIY and gardening segments, enabling broader market reach for specialized tools, and providing an efficient B2B platform for volume purchases by small to medium-sized contractors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager