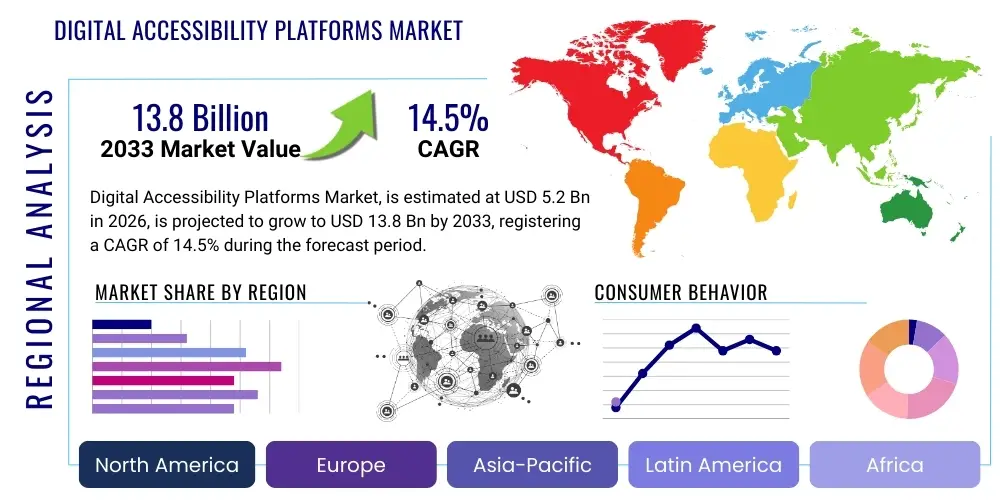

Digital Accessibility Platforms Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436784 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Digital Accessibility Platforms Market Size

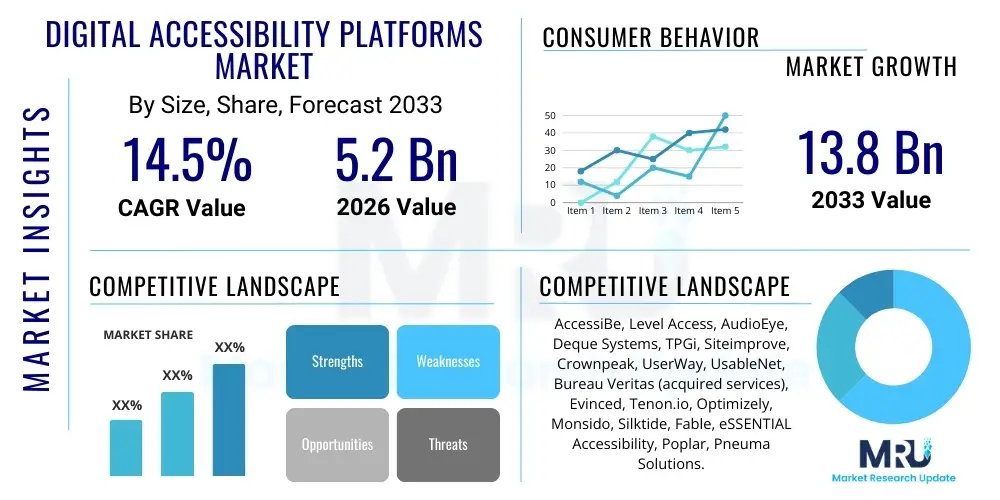

The Digital Accessibility Platforms Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033. The market is estimated at $5.2 Billion in 2026 and is projected to reach $13.8 Billion by the end of the forecast period in 2033.

Digital Accessibility Platforms Market introduction

The Digital Accessibility Platforms Market encompasses sophisticated software solutions and integrated services designed to help organizations ensure that their digital content—including websites, mobile applications, documents, and multimedia—is fully usable by people with disabilities, aligning strictly with global regulatory standards like the Web Content Accessibility Guidelines (WCAG) and Section 508 of the Rehabilitation Act. These platforms provide tools for automated audits, real-time monitoring, remediation guidance, and performance reporting, allowing companies to mitigate legal risks associated with non-compliance and adhere to ethical business practices emphasizing inclusivity. The primary goal is to foster a truly inclusive digital ecosystem, bridging the gap for individuals using assistive technologies such as screen readers, voice recognition software, and specialized input devices.

Product offerings within this domain are highly diversified, ranging from simple overlay widgets offering minor front-end adjustments to comprehensive enterprise-level solutions integrating deep scanning and automated code remediation capabilities into Continuous Integration/Continuous Deployment (CI/CD) pipelines. Major applications span e-commerce, banking and financial services (BFSI), government portals, education, and healthcare, where access to critical information and transactional functionality is paramount. The increasing dependency on digital channels across all sectors means that accessibility is no longer a niche concern but a fundamental requirement for market participation and brand reputation management. Adoption is being driven heavily by a combination of punitive legislation enforcement and a growing corporate commitment to Environmental, Social, and Governance (ESG) criteria.

Key driving factors accelerating market expansion include the proliferation of accessibility-related lawsuits globally, particularly in North America, which necessitates proactive compliance measures. Furthermore, the rising global prevalence of chronic conditions and aging populations, which often result in temporary or permanent impairments, expands the necessity for digitally accessible services. The benefits of deploying these platforms are multifaceted, covering reduced legal exposure, expanded market reach to include an estimated one billion people globally with disabilities, improved Search Engine Optimization (SEO) due to better website structure, and enhanced brand loyalty stemming from demonstrated social responsibility. The integration of artificial intelligence (AI) and machine learning (ML) for sophisticated remediation suggestions is setting a new benchmark for platform effectiveness.

Digital Accessibility Platforms Market Executive Summary

The Digital Accessibility Platforms Market is experiencing robust growth fueled by mandatory regulatory frameworks, particularly the expansion and enforcement of WCAG standards (currently WCAG 2.1 and anticipated WCAG 2.2/3.0 adoption), transforming accessibility from an optional feature into a core operational necessity. Business trends indicate a strong shift toward integrated, subscription-based Software as a Service (SaaS) models that offer continuous monitoring rather than one-off audits, providing enterprises with real-time compliance dashboards and automated remediation tools. Large enterprises are driving demand for comprehensive, scalable platforms capable of handling thousands of digital assets, while Small and Medium-sized Enterprises (SMEs) are often utilizing simpler, quick-deployment overlay solutions or managed services. The market structure is moderately fragmented, with intense competition centered on the efficacy of AI-driven remediation tools and the depth of technical expertise offered through accompanying professional services.

Regionally, North America maintains market dominance due to stringent regulatory pressures, including the Americans with Disabilities Act (ADA) and specific state laws, leading to a high volume of accessibility litigation and subsequent high demand for compliance solutions. Europe is rapidly catching up, driven by the implementation of the European Accessibility Act (EAA), which harmonizes accessibility requirements across member states for numerous products and services, creating significant mandatory demand across the EU single market. The Asia Pacific (APAC) region is poised for substantial future growth as key economies, such as Japan and Australia, tighten their domestic accessibility laws and as multinational corporations operating there impose their global compliance standards. The readiness and sophistication of platforms addressing diverse language and cultural contexts will be crucial for success in APAC.

In terms of segmentation, the Component segment is seeing services grow faster than software, reflecting the complexity of remediation tasks that require expert human intervention alongside automated tools, especially for highly complex or bespoke web applications. By Deployment, the cloud-based model is overwhelmingly preferred due to its scalability, lower upfront costs, and ease of continuous updates essential for keeping pace with evolving standards like WCAG. Within Industry Verticals, BFSI and Government remain the largest adopters due to the critical nature of their services and high regulatory scrutiny, while the Retail and E-commerce segment is showing the fastest adoption rate, necessitated by high-traffic websites and frequent consumer litigation aimed at transactional platforms. The shift towards mobile accessibility platforms is also accelerating, mirroring the general move towards mobile-first digital strategies.

AI Impact Analysis on Digital Accessibility Platforms Market

Common user inquiries regarding AI's influence in the Digital Accessibility Platforms Market primarily revolve around the extent of automation possible, concerns about potential "false compliance" generated by overly simplistic AI tools, the ethical implications of relying on machine learning for sensitive accommodation needs, and the cost-efficiency compared to human auditing. Users are seeking clarity on whether AI can truly address complex, context-dependent accessibility issues, such as those related to dynamic content or complex navigational paths, or if it remains primarily useful only for basic technical compliance checks like alternative text generation or contrast ratios. There is significant interest in AI's role in predictive analytics—identifying potential non-compliance risks before deployment—and ensuring that AI models are trained on diverse user experiences to avoid perpetuating accessibility gaps.

The integration of Artificial Intelligence and Machine Learning (ML) is fundamentally reshaping the landscape of digital accessibility platforms, moving them beyond simple static scans to sophisticated, real-time remediation engines. AI algorithms are now deployed to automatically analyze source code, identify violations of WCAG standards with high precision, and, crucially, suggest or implement automated fixes for common errors such as missing alt text for images, incorrect color contrast, or inadequate keyboard focus indicators. This automation significantly reduces the time and cost associated with manual audits and expert remediation, accelerating the compliance lifecycle. However, the market must address the ongoing challenge that while AI excels at technical adherence, human auditors remain essential for validating complex logical accessibility and ensuring the best user experience for all assistive technologies.

Moreover, AI is playing a pivotal role in advanced user personalization and adaptive interfaces. Platforms utilizing ML can analyze a user’s interaction patterns and declared accessibility needs to dynamically adjust the interface—such as text spacing, font sizes, or navigational elements—without requiring explicit user modification of system settings. This capability enhances usability and moves the industry towards AEO-optimized, individualized access. The future impact of AI will focus on leveraging Generative AI (GenAI) to create comprehensive descriptions for complex visual data (e.g., charts, graphs) and to dynamically generate accessible versions of legacy documents, substantially reducing the backlog of remediation work for large organizations. Ethical AI governance standards are simultaneously emerging to ensure these tools promote genuine inclusion rather than merely legal compliance.

- AI enables automated detection and preliminary remediation of up to 70% of common WCAG violations (e.g., color contrast, focus order, missing attributes).

- Machine Learning (ML) enhances content tagging accuracy, particularly for image descriptions, significantly lowering the burden on human content creators.

- AI-driven predictive analytics identify high-risk code segments during development, integrating accessibility testing into DevOps pipelines.

- Generative AI is increasingly used for converting complex, inaccessible media (like video transcripts or data visualizations) into fully accessible formats.

- Concerns persist regarding "false compliance," where automated fixes address technical rules but fail to ensure functional accessibility for actual users with complex needs.

- AI platforms offer adaptive personalization layers, modifying UI elements based on individual user profiles or detected assistive technology.

DRO & Impact Forces Of Digital Accessibility Platforms Market

The Digital Accessibility Platforms Market is powerfully shaped by converging Drivers, Restraints, and Opportunities, which collectively determine the momentum and direction of sector growth. The dominant Driver is the intensified global regulatory environment, characterized by increasingly specific and punitive accessibility mandates (e.g., ADA litigation, EAA, Section 508 updates), forcing organizations to adopt comprehensive platform solutions to manage risk and avoid massive fines or costly lawsuits. This is complemented by the growing realization of the commercial advantage of inclusivity, where reaching the vast market segment of individuals with disabilities translates directly into increased revenue and positive brand perception. Conversely, the primary Restraint is the high cost and complexity of integrating enterprise-grade accessibility platforms into existing, often legacy, IT infrastructures, coupled with the shortage of skilled professionals required to execute necessary human remediation and maintain compliance across diverse digital assets.

Opportunities for expansion are primarily concentrated in the penetration of emerging markets and the specialization of platforms to address specific industry needs, particularly healthcare (ensuring access to medical records) and education (accommodating diverse learning styles). The largest growth vector lies in leveraging advanced technologies: the ongoing evolution of AI/ML for deeper, context-aware automated remediation, and the development of platforms specifically tailored for mobile apps and immersive technologies (AR/VR). Furthermore, the push towards establishing standardized accessibility metrics beyond basic WCAG pass/fail scores, focusing on genuine user experience (UX) outcomes, creates opportunities for innovative platform features that measure and report on functional accessibility. These advanced metrics are expected to become key differentiators in the competitive landscape.

The Impact Forces governing this market center heavily on political and legal pressures. The threat of legal action acts as the strongest immediate impact force, compelling rapid compliance adoption, often prioritizing risk aversion over technological perfection. Societal impact, driven by advocacy groups and heightened public awareness regarding digital exclusion, is another critical force, influencing corporate ESG strategies and budget allocation towards accessibility initiatives. Technological obsolescence poses a moderate impact force; platforms must constantly update to comply with evolving web standards (HTML5, CSS3, JavaScript frameworks) and new assistive technologies. These combined forces ensure sustained, high demand for robust, continuous accessibility management solutions, cementing the market’s necessity rather than viewing it as a discretionary IT expenditure.

Segmentation Analysis

The Digital Accessibility Platforms Market is comprehensively segmented based on various technical and operational parameters, providing a detailed view of adoption patterns across different enterprises and application domains. Key segmentation dimensions include Component type (Software vs. Services), Deployment model (Cloud vs. On-Premise), Organization Size (SMEs vs. Large Enterprises), and the specific Industry Vertical being served. This granular analysis is crucial for vendors to tailor their offerings, addressing the specific needs of large organizations requiring scalable, integrated solutions for hundreds of sites versus SMEs that often prioritize ease of deployment and lower subscription costs, frequently opting for managed services to offset a lack of internal expertise. The fastest growing segments are typically those related to compliance services and cloud-based platforms, reflecting the market’s preference for flexibility and outsourced expertise.

The segmentation by Component highlights the interdependence of software and services. While platform software forms the technological core, the complexity of achieving and maintaining full WCAG 2.1 AA compliance means that professional services—including expert auditing, remediation consulting, training, and legal compliance advisories—are indispensable. In many cases, the services segment generates higher revenue, as organizations often lack the necessary internal knowledge base to leverage sophisticated software tools effectively without expert guidance. This dynamic suggests that platforms that successfully bundle powerful automation tools with robust professional support will secure long-term client relationships and dominate market share. The continuous demand for expert auditing is driven by the reality that automated tools can only reliably detect a fraction of Level A/AA violations, necessitating human validation for critical aspects like content logic and navigational usability.

- By Component:

- Platform/Software (Subscription-based tools for automated scanning, testing, and monitoring)

- Services (Consulting, Auditing, Remediation, Training, Legal Advisory Services)

- By Deployment:

- Cloud (SaaS) (Dominant model due to scalability and continuous updates)

- On-Premise (Preferred by highly regulated sectors like defense or financial services with strict data residency requirements)

- By Organization Size:

- Small and Medium-sized Enterprises (SMEs) (Often rely on overlay widgets or managed services)

- Large Enterprises (Demand comprehensive, integrated, API-driven solutions)

- By Industry Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- Government and Public Sector

- Retail and E-commerce (Fastest growing due to high transaction volume)

- Education (K-12 and Higher Education)

- Healthcare and Life Sciences (Critical necessity for patient information access)

- Technology and Telecommunications

- Media and Entertainment

Value Chain Analysis For Digital Accessibility Platforms Market

The value chain for Digital Accessibility Platforms begins with upstream activities focused on core technology development, including R&D into AI/ML algorithms for automated compliance checks, continuous monitoring tools, and the development of APIs for seamless integration into various Content Management Systems (CMS) and development environments. This stage is dominated by specialized software firms and accessibility experts investing heavily in keeping pace with the rapid evolution of web technologies (e.g., single-page applications, complex JavaScript frameworks) and international standards (e.g., WCAG 2.2). The ability to accurately interpret and translate complex regulatory text into actionable code checks is a critical value differentiator at the upstream level. Strategic partnerships with web development agencies and technology platform providers (like Adobe or Microsoft) are crucial here for early access to new digital ecosystems.

Midstream activities involve the aggregation, packaging, and deployment of the platform. This encompasses tailoring the core software into modular, scalable products for different organization sizes (SME vs. Enterprise), offering various deployment options (primarily cloud-based SaaS), and bundling essential features such as customized reporting, multi-lingual support, and user training materials. The efficient provision of robust professional services—auditing and remediation consulting—is often the most valuable part of the midstream value proposition, as it directly addresses the client's biggest pain point: achieving functional, not just technical, compliance. The pricing strategy for subscription licenses and service retainers significantly influences market penetration at this stage.

Downstream analysis focuses on distribution channels and end-user engagement. Direct distribution via dedicated sales teams is common for large enterprise contracts, providing high-touch consultative selling necessary for complex integration projects. Indirect channels include partnerships with IT consultancies, digital agencies, and Managed Service Providers (MSPs) who recommend and implement the platform as part of broader digital transformation or regulatory compliance projects. These partners provide local market reach and specialized integration expertise. Successful distribution relies on effective training of these partners and continuous technical support, ensuring the platform’s value proposition is clearly communicated to the diverse range of end-users/buyers, including CIOs, Chief Legal Officers, Marketing Executives, and Development Teams, all of whom have different priorities regarding implementation and compliance.

Digital Accessibility Platforms Market Potential Customers

The primary customers for Digital Accessibility Platforms are any organizations that maintain a public-facing website, mobile application, or internal digital infrastructure subject to regulatory oversight or market scrutiny regarding inclusion. End-users span multiple functional areas within an organization: Chief Information Officers (CIOs) and IT departments prioritize seamless integration, security, and scalability; Chief Legal Officers (CLOs) and Compliance teams focus exclusively on risk mitigation, litigation avoidance, and maintaining evidence trails of compliance efforts; Marketing and Brand Managers leverage accessibility as a crucial component of ESG reporting and brand reputation building; and Development/UX teams require tools that simplify the remediation process and integrate easily into Agile development cycles. Any organization with high digital traffic, high transactional value, or strict legal mandates represents a core potential customer, irrespective of industry.

Specifically, Large Enterprises across the BFSI, Government, and Retail sectors constitute the most valuable customer segment, characterized by high spending capacity and an urgent need for solutions managing vast, complex digital ecosystems subject to constant regulatory updates. BFSI entities require accessibility for critical functions like online banking and loan applications, while Government bodies must ensure equitable access to essential public services and information mandated by law. Retail giants, particularly those engaged in high-volume e-commerce, are highly susceptible to demand letters and lawsuits, making proactive platform investment a cost-effective measure. These large buyers typically demand comprehensive platforms capable of handling multiple domains, offering advanced AI features, and providing dedicated professional services for strategic compliance road mapping.

The secondary, but rapidly growing, customer base consists of SMEs and educational institutions. SMEs are increasingly targeted by legal actions, yet often lack the resources for internal expertise, making them ideal candidates for simplified, cost-effective cloud-based solutions or fully managed services. Higher education institutions, driven by internal equity mandates and federal funding requirements, must ensure all online courses, learning management systems (LMS), and administrative portals are accessible to students and faculty, creating specialized demand for platforms that handle dynamic educational content effectively. The key sales motion for these segments often revolves around demonstrating the immediate reduction in legal risk alongside the simplification of technical compliance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.2 Billion |

| Market Forecast in 2033 | $13.8 Billion |

| Growth Rate | 14.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AccessiBe, Level Access, AudioEye, Deque Systems, TPGi, Siteimprove, Crownpeak, UserWay, UsableNet, Bureau Veritas (acquired services), Evinced, Tenon.io, Optimizely, Monsido, Silktide, Fable, eSSENTIAL Accessibility, Poplar, Pneuma Solutions. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Digital Accessibility Platforms Market Key Technology Landscape

The technological core of the Digital Accessibility Platforms Market revolves around advanced software engineering utilizing techniques like Document Object Model (DOM) analysis, sophisticated parsing algorithms, and dynamic content inspection capabilities designed to evaluate digital assets against hundreds of WCAG success criteria. Key technologies include proprietary scanning engines optimized for modern web frameworks such as React, Angular, and Vue.js, which traditionally pose challenges for static accessibility checkers. Furthermore, API integration capabilities are mandatory, allowing platforms to seamlessly connect with common enterprise tools like Jira for bug tracking, various CMS systems (e.g., WordPress, Drupal), and CI/CD pipelines, facilitating shift-left testing where accessibility concerns are addressed early in the development lifecycle rather than after deployment. The effectiveness of these platforms is often measured by their ability to accurately identify violations while minimizing false positives, a critical factor for adoption by development teams.

A significant trend shaping the technological landscape is the rapid adoption of Artificial Intelligence (AI) and Machine Learning (ML). AI-driven features are increasingly used for automated image description generation (alt text), identifying complex structural errors in documents (PDF accessibility), and providing context-sensitive suggestions for remediation that are often beyond the scope of traditional rules-based engines. These ML models are trained on large datasets of compliant and non-compliant code samples, enabling them to handle ambiguity and complexity inherent in human language and dynamic interfaces. This technological specialization is moving the market towards fully managed, predictive compliance models where the platform not only reports problems but also autonomously suggests code snippets or uses Generative AI to rewrite non-compliant elements, saving significant developer time and reducing reliance on external consultants for basic fixes.

Furthermore, accessibility platforms are focusing heavily on enhancing user testing technologies, moving beyond simple static checks. Tools now include features for simulating various forms of impairment (e.g., color blindness filters, motion sensitivity simulation) and conducting automated compatibility checks with leading assistive technologies (e.g., NVDA, JAWS, VoiceOver). Robust reporting and dashboard features are standard, utilizing technologies for data visualization and complex aggregation to provide clear, prioritized compliance scores tailored to different organizational stakeholders—legal teams need risk metrics, while development teams need technical remediation specifics. The integration of mobile accessibility testing kits (Android and iOS native apps) and continuous monitoring architectures are essential technical components for capturing real-time compliance status across all digital touchpoints, recognizing the increasing prevalence of mobile accessibility issues.

Regional Highlights

- North America (Dominance and Litigation Driver): North America holds the largest market share, predominantly driven by the United States due to the aggressive enforcement of the Americans with Disabilities Act (ADA Title III) in the context of digital services. The region experiences thousands of accessibility-related lawsuits annually, creating a high-pressure environment where compliance platforms are viewed as essential litigation mitigation tools. High technology adoption rates, the presence of major global corporations, and significant expenditure on digital infrastructure ensure continuous, high demand for sophisticated enterprise-level accessibility solutions and specialized legal compliance services. Canada’s commitment to new federal accessibility legislation also contributes substantially to regional growth, mirroring the US trend toward mandated digital inclusion.

- Europe (Regulatory Catalyst - European Accessibility Act): Europe is the fastest-growing market segment, poised for substantial revenue increases following the mandatory implementation deadlines of the European Accessibility Act (EAA), which requires a vast range of digital products and services to comply with WCAG standards. This legislative shift is transitioning accessibility from a voluntary measure to a legal necessity across all EU member states, impacting e-commerce, banking, telecommunications, and transport sectors. Demand centers around platforms offering multi-lingual support and localized compliance expertise, particularly in the run-up to and immediately following regulatory deadlines, driving significant investment in cloud-based deployment models for rapid scale-up.

- Asia Pacific (Emerging Growth and Digitalization): The APAC region, though currently trailing North America and Europe, represents immense future potential driven by rapid digitalization, massive online populations, and tightening regulatory focus in key economies like Australia, Japan, and India. While enforcement varies, multinational companies operating in the region are importing global compliance standards, thereby increasing local demand. The complexity of language localization and diverse digital infrastructures necessitates flexible platform solutions. Growth is highly concentrated in financial services and government modernization projects seeking to emulate Western accessibility benchmarks to achieve socio-economic inclusion objectives.

- Latin America (Increasing Policy and Awareness): Latin America is characterized by nascent but growing accessibility awareness, supported by progressive disability rights legislation in countries such as Brazil and Mexico. The market growth here is slower but steady, primarily driven by government initiatives to improve public sector service accessibility and gradual adoption by large regional banks and telecom companies seeking to adhere to international standards. Cost-sensitivity remains a factor, often leading to the adoption of simpler, budget-friendly platforms or reliance on open-source solutions, although enterprise adoption is accelerating as foreign investment requires higher compliance standards.

- Middle East and Africa (Infrastructure Development and Smart City Initiatives): The MEA market is developing, with growth focused primarily in Gulf Cooperation Council (GCC) countries investing heavily in "Smart City" and national digital transformation initiatives (e.g., Saudi Vision 2030, UAE's digital strategy). These initiatives frequently incorporate digital accessibility mandates from inception to ensure inclusive public services. Healthcare and government sectors are the leading adopters, although the overall market size remains smaller, reflecting infrastructure maturity levels and concentrated spending patterns on high-end integrated solutions for major government projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Digital Accessibility Platforms Market.- AccessiBe

- Level Access

- AudioEye

- Deque Systems

- TPGi (Vispero)

- Siteimprove

- Crownpeak

- UserWay

- UsableNet

- Bureau Veritas (acquired services)

- Evinced

- Tenon.io

- Optimizely

- Monsido

- Silktide

- Fable

- eSSENTIAL Accessibility

- Poplar

- Pneuma Solutions

- SensusAccess (Aarhus University)

Frequently Asked Questions

Analyze common user questions about the Digital Accessibility Platforms market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary regulatory drivers for adopting Digital Accessibility Platforms?

The primary regulatory drivers are global mandates, chiefly the Web Content Accessibility Guidelines (WCAG), the U.S. Americans with Disabilities Act (ADA), the European Accessibility Act (EAA), and Section 508 in the U.S. federal sector. These laws necessitate platform adoption to mitigate significant legal risk and fines associated with non-compliance.

How do AI and Machine Learning technologies benefit Digital Accessibility Platforms?

AI and ML enhance platforms by providing automated detection and real-time, context-aware remediation for common WCAG violations, such as generating accurate alternative text for images and optimizing focus indicators. This automation significantly reduces the reliance on costly, slow manual auditing and speeds up compliance cycles.

Is a cloud-based (SaaS) deployment model preferred over on-premise solutions?

Yes, the cloud-based SaaS model is overwhelmingly preferred across the market. It offers critical benefits including scalability, lower initial investment, ease of continuous updates (essential for meeting evolving WCAG standards), and simplified integration into modern development pipelines (DevOps/CI/CD).

What is the main challenge faced by organizations seeking full compliance?

The main challenge is bridging the gap between automated technical compliance (which platforms excel at) and functional accessibility. Automated tools cannot reliably detect complex, context-dependent usability issues, requiring organizations to invest in expensive professional human auditing services alongside platform software.

Which industry vertical is showing the fastest growth in platform adoption?

The Retail and E-commerce industry vertical is exhibiting the fastest growth in platform adoption. This is driven by high transactional volumes, frequent website changes, and an increased susceptibility to accessibility lawsuits targeting consumer-facing online shopping experiences.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager