Digital Audio and Video Decoder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434431 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Digital Audio and Video Decoder Market Size

The Digital Audio and Video Decoder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 8.7 Billion by the end of the forecast period in 2033.

Digital Audio and Video Decoder Market introduction

The Digital Audio and Video Decoder Market encompasses the specialized hardware and software components essential for converting compressed digital audiovisual data streams back into uncompressed formats suitable for display and playback. These decoders are foundational elements in the modern digital ecosystem, enabling the consumption of high-definition content across diverse platforms, ranging from consumer electronics to professional broadcast infrastructure. Key applications include decoding highly efficient compression standards such as MPEG, H.264, and the newer HEVC (H.265) and AV1 codecs, which are critical for delivering seamless 4K and 8K streaming experiences while minimizing bandwidth consumption.

The primary benefit derived from advanced digital decoders lies in their ability to handle complex computational tasks efficiently, often through dedicated hardware acceleration, ensuring low latency and high-quality output. The technological evolution is driven by the perpetual increase in content resolution and complexity, demanding decoders that offer improved power efficiency and throughput. The proliferation of Over-The-Top (OTT) streaming services, coupled with the global transition to high-resolution standards like Ultra HD (UHD), serves as a major accelerator for market growth. These factors necessitate continuous innovation in semiconductor design and algorithmic optimization to support next-generation media delivery protocols.

The market landscape is characterized by intense competition among semiconductor manufacturers and intellectual property (IP) core providers who are continuously striving to integrate support for emerging codecs and sophisticated processing capabilities directly into System-on-Chips (SoCs). Major applications span smart televisions, set-top boxes, personal computers, smartphones, automotive infotainment systems, and professional video processing equipment used in broadcasting and surveillance. The continuous convergence of media consumption across fixed and mobile devices reinforces the crucial role of versatile, high-performance decoding solutions in maintaining quality user experience and optimizing network resource utilization globally.

Digital Audio and Video Decoder Market Executive Summary

The Digital Audio and Video Decoder Market is experiencing robust expansion fueled by several interdependent global business trends, most notably the widespread adoption of 4K resolution and the nascent deployment of 8K technologies across consumer and professional domains. Business trends highlight a strong shift toward hybrid decoding solutions, combining specialized hardware blocks for demanding tasks with flexible software frameworks for adapting to evolving codec standards and proprietary encryption methods. Strategic alliances between semiconductor firms and major content distributors are becoming critical to ensuring hardware compatibility and optimizing end-to-end media delivery pipelines. The market is also heavily influenced by the accelerating shift of traditional broadcast models towards internet protocol (IP) delivery and cloud-based processing.

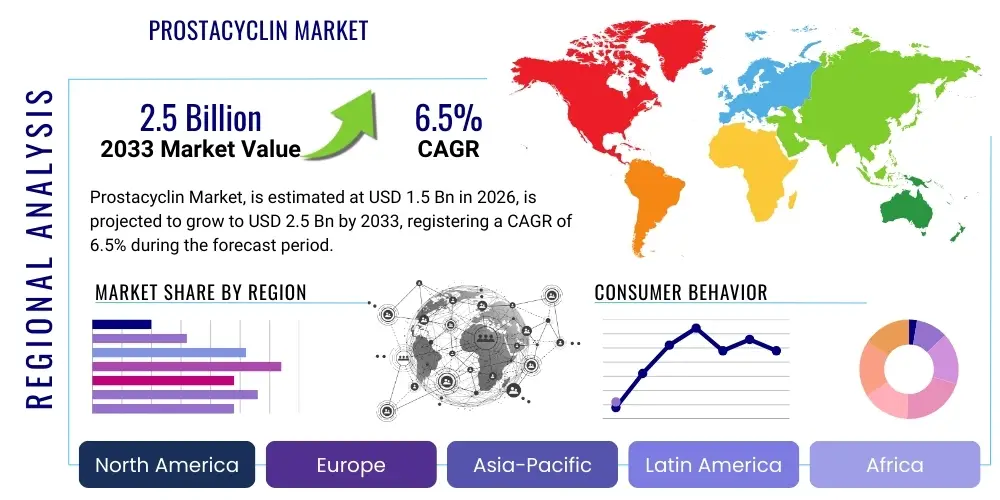

Regionally, Asia Pacific (APAC) stands out as a high-growth area, driven by massive manufacturing capabilities for consumer electronics, rapid internet penetration, and a substantial, digitally engaged population demanding localized and high-quality streaming content. North America and Europe maintain technological leadership, particularly in the development and implementation of next-generation codecs (like AV1) and low-latency decoding for interactive applications such as cloud gaming and virtual reality (VR). Regulatory trends related to spectrum allocation and standardized digital television broadcasting continue to shape the regional demand for specific decoding chipsets, particularly in emerging economies undergoing digital transformation.

Segment-wise, hardware decoders, primarily embedded within high-performance SoCs, command the largest market share due to their superior efficiency in handling high bit rates required by Ultra HD content. However, the software decoder segment is growing rapidly, driven by the flexibility required in personal computing, mobile platforms, and the increasing reliance on cloud-based transcoding services, which utilize software-optimized decoding algorithms. The application segment focused on Consumer Electronics remains dominant, but the Automotive sector, with its increasing requirement for advanced infotainment, sensor processing, and high-resolution displays, represents one of the fastest-growing application areas, demanding resilient and thermally efficient decoding solutions tailored for harsh operating environments.

AI Impact Analysis on Digital Audio and Video Decoder Market

User queries regarding AI’s influence on the Digital Audio and Video Decoder Market frequently center on concerns about computational overhead, the potential for AI to optimize legacy codecs, and the feasibility of achieving superior visual quality without proportional increases in bitrate or power consumption. Analysis indicates a strong user expectation that AI will primarily be used for two critical functions: intelligent pre-processing and post-processing (such as super-resolution and noise reduction) to enhance decoded image quality, and optimizing the decoding process itself through dynamic resource allocation and power management. Key themes include the integration of neural networks to predict motion vectors, enhance compression efficiency beyond conventional standards, and enable personalized stream adjustments based on viewing context and network conditions. There is also significant interest in how AI can facilitate the adoption of complex, computationally intensive codecs like AV1 by managing hardware utilization effectively.

- AI algorithms enable perceptually optimized video coding, adjusting compression dynamically based on human visual system limitations.

- Machine learning is utilized for artifact reduction (denoising, deblocking) during the post-decoding phase, significantly improving perceived video quality.

- AI facilitates intelligent bitrate adaptation and resource scheduling, optimizing power consumption in portable decoding devices (e.g., smartphones and tablets).

- Neural network-based super-resolution techniques allow decoders to upscale standard or high-definition content to 4K/8K displays with enhanced detail.

- AI assists in predicting complex motion in next-generation codecs, potentially accelerating hardware decoding paths and reducing latency.

- Enhanced security and content fingerprinting capabilities are being integrated using AI to prevent illegal redistribution of decoded premium content.

DRO & Impact Forces Of Digital Audio and Video Decoder Market

The Digital Audio and Video Decoder Market dynamics are governed by a complex interplay of drivers, restraints, and opportunities, collectively forming the impact forces shaping its trajectory. The dominant driver is the unrelenting global demand for high-resolution content, spurred by the expansion of OTT platforms and the availability of 4K/8K display panels at increasingly accessible price points. This driver forces continuous innovation toward more efficient compression algorithms (like HEVC and AV1) that require dedicated, powerful decoding hardware. Simultaneously, the proliferation of connected devices (IoT and smart home ecosystems) requires robust decoding capabilities at the edge, moving processing power closer to the consumer and driving miniaturization and power efficiency in decoder SoCs. The requirement for immersive experiences, including VR, AR, and cloud gaming, further accelerates the need for ultra-low latency and high-throughput decoding solutions.

Restraints primarily revolve around the high initial investment required for adopting new codec standards and the pervasive challenge of intellectual property (IP) complexities associated with licensed codecs such as H.264 and HEVC, which can inflate component costs and slow down widespread implementation. Furthermore, the rapid obsolescence of decoding hardware due to continually evolving standards poses a significant hurdle for consumer electronics manufacturers. The computational intensity and inherent power demands of decoding extremely high-resolution video streams (8K at high frame rates) also present thermal and power management challenges, particularly in passive or small-form-factor devices.

Opportunities are abundant in emerging technological frontiers, specifically the integration of decoding capabilities within automotive grade systems for autonomous driving visualization and advanced passenger entertainment. Moreover, the increasing adoption of open, royalty-free codecs like AV1 creates a strong market opportunity for hardware vendors who can provide early, optimized, and competitive solutions, bypassing traditional IP licensing barriers. Edge computing and the deployment of 5G networks facilitate distributed video processing, allowing decoders to operate within various network nodes, unlocking new enterprise applications in surveillance, healthcare, and industrial inspection. These factors, alongside the continuous push towards higher dynamic range (HDR) and wider color gamut (WCG) standards, ensure a sustained growth trajectory for specialized decoding solutions.

Segmentation Analysis

The Digital Audio and Video Decoder Market is fundamentally segmented based on the implementation method, the underlying technology or codec utilized, and the diverse applications across various end-user industries. Understanding these segments is crucial for strategic planning, as market needs vary significantly between hardware-centric consumer devices and flexible, software-based professional solutions. The distinction between hardware and software decoding solutions often defines the performance envelope, with dedicated hardware offering superior efficiency for fixed applications, while software solutions offer adaptability critical for rapidly changing environments like cloud services and mobile platforms. The increasing computational power of general-purpose processors is narrowing the performance gap in certain contexts, particularly for lower-resolution streams, but high-end UHD streams still necessitate specialized silicon.

- By Type:

- Hardware Decoders (Dedicated ASICs, FPGA implementations)

- Software Decoders (Library implementations running on CPUs/GPUs)

- Hybrid Decoders (Combining dedicated hardware blocks with programmable elements)

- By Technology (Codec Standard):

- MPEG (MPEG-2, MPEG-4)

- H.264 (AVC)

- H.265 (HEVC)

- AV1

- VP9

- Others (e.g., VC-1, proprietary codecs)

- By Application/End-User:

- Consumer Electronics (Smart TVs, Streaming Sticks, Set-Top Boxes, Smartphones)

- Broadcast & Telecommunications

- Automotive Infotainment and ADAS

- Gaming Consoles and PC Gaming

- Medical Imaging Systems

- Defense and Surveillance

Value Chain Analysis For Digital Audio and Video Decoder Market

The value chain for the Digital Audio and Video Decoder Market is complex, beginning with upstream semiconductor and IP core providers who develop the foundational decoder algorithms and silicon architectures. Upstream activities involve intensive R&D to optimize codec implementation for power efficiency and speed, resulting in proprietary intellectual property (IP) blocks that are licensed or sold directly to chip manufacturers. Companies like ARM, Synopsys, and specialized video IP vendors play a critical role here, providing reusable and customizable cores that form the heart of decoder SoCs. These cores are then fabricated by major semiconductor foundries, transforming designs into physical integrated circuits.

Moving downstream, the fabricated chipsets are integrated by Original Equipment Manufacturers (OEMs), who produce the final consumer electronics, broadcasting equipment, and automotive systems. This stage involves rigorous testing, integration with other system components (like display drivers and audio processors), and software/firmware development to ensure interoperability. Distribution channels are varied, encompassing direct sales for large enterprise clients (broadcasters, surveillance firms) and a vast indirect network for consumer electronics, utilizing distributors, retailers, and e-commerce platforms. The efficiency of this downstream distribution is critical, especially for high-volume consumer goods where rapid time-to-market is essential for competitive advantage.

The distinction between direct and indirect distribution channels is particularly pronounced in this market. Direct channels typically handle large volume transactions for B2B applications, ensuring deep technical support and customized solutions for industrial and professional users, such as integrating bespoke decoders into high-end medical imaging equipment. Conversely, indirect channels manage the mass market sales of products like smart TVs and set-top boxes, where cost efficiency, widespread geographical reach, and established retail partnerships are paramount. Software decoders often utilize a purely digital distribution model, leveraging licensing agreements and downloadable libraries, bypassing traditional physical logistics entirely.

Digital Audio and Video Decoder Market Potential Customers

The potential customer base for Digital Audio and Video Decoder technology is extremely broad, encompassing any entity involved in the creation, transmission, storage, or consumption of digital audiovisual content. The primary end-users are large-scale consumer electronics manufacturers who embed these decoders into billions of devices annually, including global leaders in smart TV production, mobile phone fabrication, and gaming console development. These buyers prioritize cost-effectiveness, power efficiency, and certification compliance with international standards and streaming platform specifications. They often procure decoder IP or pre-integrated SoCs directly from tier-one semiconductor vendors.

Another major category includes telecommunication and broadcast infrastructure providers. These customers require enterprise-grade decoders for transcoders, headend equipment, and specialized network appliances used to manage content streams across satellite, cable, and IP networks. Their primary requirements are high throughput, extreme reliability (24/7 operation), and density, often favoring rack-mounted solutions with extensive redundancy features. Furthermore, specialized industry sectors, such as medical (for diagnostic imaging displays), defense (for real-time surveillance feeds), and automotive (for advanced driver-assistance systems and internal displays), represent smaller but highly lucrative segments demanding decoders that meet stringent performance, regulatory, and environmental robustness standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 8.7 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Broadcom Inc., Qualcomm Incorporated, Texas Instruments, Intel Corporation, NVIDIA Corporation, Renesas Electronics Corporation, STMicroelectronics, NXP Semiconductors, MediaTek Inc., Lattice Semiconductor, Analog Devices, Inc., Realtek Semiconductor Corp., Imagination Technologies, Amlogic, S.p.A., Cirrus Logic, Inc., ON Semiconductor, Sony Corporation (Semiconductors), Samsung Electronics (System LSI), Xilinx (now AMD), Synaptics Incorporated. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Digital Audio and Video Decoder Market Key Technology Landscape

The technology landscape of the Digital Audio and Video Decoder Market is defined by intense innovation centered around three core pillars: achieving maximum compression efficiency, reducing power consumption, and ensuring ultra-low latency. Currently, the most critical technologies involve hardware acceleration for High Efficiency Video Coding (HEVC/H.265) and AOMedia Video 1 (AV1). HEVC remains dominant in many premium content distribution networks due to its established ecosystem and significant efficiency improvements over its predecessor, H.264. However, AV1, an open and royalty-free codec, is rapidly gaining traction, particularly among major streaming platforms like Netflix and YouTube, necessitating the rapid development of cost-effective hardware decoders capable of handling its computational complexity. The market is moving toward flexible decoding architectures that can efficiently handle multiple codecs and easily integrate firmware updates to address evolving standards.

The integration of decoding functions into highly specialized System-on-Chips (SoCs) is a primary technology trend. These SoCs incorporate dedicated hard-wired decoder blocks that execute the highly repetitive, mathematically intensive parts of the decoding process (such as inverse transformation and motion compensation) with minimal power usage. Furthermore, advanced semiconductor fabrication processes, such as 7nm and 5nm nodes, are essential for packing the required computational density into small, thermally manageable chips, particularly for mobile and smart TV applications. Parallel processing techniques, utilizing multi-core processor designs and dedicated Graphical Processing Units (GPUs) alongside the dedicated decoding hardware, are commonly employed to manage the high data rates associated with 4K HDR and 8K video streams, ensuring a smooth and artifact-free viewing experience even under heavy system load.

Beyond core compression technologies, the landscape also includes proprietary technologies focusing on quality enhancement and post-processing. High Dynamic Range (HDR) decoding (supporting standards like HDR10+, Dolby Vision, and HLG) requires complex tone mapping algorithms that must be executed in real-time by the decoder pipeline. Audio decoding, while often less computationally demanding than video, is seeing advancements with object-based audio codecs (e.g., Dolby Atmos, DTS:X) that require specialized spatial processing capabilities integrated alongside the video decoding chain. This convergence demands that modern decoder solutions are highly integrated multimedia engines rather than simple video translators, capable of synchronizing complex audio and visual streams precisely for an immersive consumer experience.

Regional Highlights

Geographical market dynamics reveal significant disparities in terms of technological adoption and market maturity, heavily influenced by regional infrastructure, regulatory environment, and consumer purchasing power. North America holds a substantial market share, primarily due to the presence of major content creators, leading streaming service providers, and semiconductor innovation hubs. The region is characterized by early and aggressive adoption of new standards, including 4K UHD streaming and HDR technologies, alongside significant investment in cloud-based video infrastructure, driving demand for high-throughput enterprise decoding solutions.

Asia Pacific (APAC) represents the fastest-growing region globally, fueled by two core factors: the massive manufacturing base for consumer electronics (particularly China, South Korea, and Japan) and the rapid digitalization of media consumption across populous emerging economies like India and Southeast Asia. The transition from standard definition to high definition, and increasingly to 4K, driven by competitive pricing of smart devices and expanding 5G networks, is a major factor. This region demands cost-optimized decoding solutions for mass-market devices, contributing significantly to the high-volume segment of hardware decoders.

Europe demonstrates a strong demand pattern driven by strict broadcast standards and public service broadcasting mandates, necessitating reliable and compliant decoding equipment for traditional DVB infrastructure, although IP delivery is rapidly increasing. Latin America and the Middle East & Africa (MEA) are emerging markets, where growth is currently linked to the expansion of digital terrestrial television (DTT) and the initial deployment of localized streaming services. These regions often prioritize solutions that balance decoding capability with bandwidth efficiency, leading to sustained demand for optimized HEVC and H.264 decoders.

- North America: Leading market share driven by strong OTT consumption, high disposable income, and dominance in cloud gaming and content creation ecosystems.

- Asia Pacific (APAC): Highest growth rate due to vast manufacturing capabilities, rapid 4K TV adoption, and deployment of 5G infrastructure in countries like China and India.

- Europe: Mature market focusing on compliance with advanced broadcasting standards (DVB-T2/S2) and strong adoption of personalized streaming services.

- Latin America (LATAM): Growth driven by governmental initiatives for digital switchovers and increasing penetration of affordable smart devices.

- Middle East & Africa (MEA): Emerging market focused on infrastructure build-out and demand for satellite and localized streaming content.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Digital Audio and Video Decoder Market.- Broadcom Inc.

- Qualcomm Incorporated

- Texas Instruments

- Intel Corporation

- NVIDIA Corporation

- Renesas Electronics Corporation

- STMicroelectronics

- NXP Semiconductors

- MediaTek Inc.

- Lattice Semiconductor

- Analog Devices, Inc.

- Realtek Semiconductor Corp.

- Imagination Technologies

- Amlogic, S.p.A.

- Cirrus Logic, Inc.

- ON Semiconductor

- Sony Corporation (Semiconductors)

- Samsung Electronics (System LSI)

- Xilinx (now AMD)

- Synaptics Incorporated

Frequently Asked Questions

Analyze common user questions about the Digital Audio and Video Decoder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the adoption of HEVC and AV1 codecs in the market?

The primary driver is the necessity for greater compression efficiency to support 4K and 8K Ultra HD content delivery without overwhelming network bandwidth. HEVC offers significant improvement over H.264, while AV1, being royalty-free, is gaining momentum due to strong backing from major streaming providers seeking to reduce licensing costs.

How does the shift towards 8K resolution impact decoder hardware design?

8K resolution dramatically increases the required computational throughput and memory bandwidth. This necessitates more powerful, dedicated hardware decoders (ASICs) optimized for parallel processing, requiring advanced semiconductor nodes (like 5nm or smaller) to maintain acceptable power consumption and thermal performance in consumer devices.

What are the main advantages of using dedicated hardware decoders over software decoders?

Hardware decoders offer superior power efficiency and predictable performance, particularly for high-resolution content (4K/8K) and high bitrates, by offloading intensive tasks from the main CPU. This is critical for mobile devices, smart TVs, and battery-operated equipment where thermal management and energy conservation are paramount.

Which application segment shows the strongest future growth potential for digital decoders?

While Consumer Electronics remains the largest segment, the Automotive sector (infotainment, ADAS visualization, and sensor data processing) exhibits the strongest future growth potential. Automotive applications require high reliability and increasing complexity in video processing, driven by the shift toward advanced in-car entertainment and autonomous vehicle technology.

How is Artificial Intelligence (AI) being integrated into modern video decoding pipelines?

AI is integrated primarily for post-processing and enhancement functions, such as super-resolution upscaling, noise reduction, and intelligent artifact removal to improve perceived image quality. Additionally, AI optimizes resource allocation within hybrid decoders to maximize energy efficiency and throughput dynamically.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager