Digital Battery Analyzers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432662 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Digital Battery Analyzers Market Size

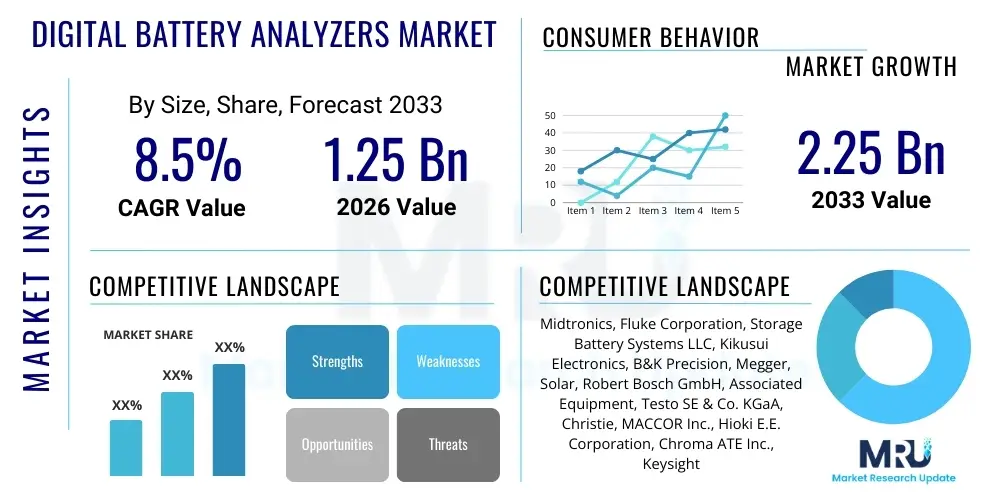

The Digital Battery Analyzers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $2.25 Billion by the end of the forecast period in 2033. This growth trajectory is significantly fueled by the increasing global adoption of electric vehicles, the expansion of renewable energy storage systems, and stringent regulatory requirements for battery maintenance and safety across critical infrastructure sectors.

Digital Battery Analyzers Market introduction

The Digital Battery Analyzers Market encompasses advanced electronic instruments designed to assess the state-of-health (SOH), state-of-charge (SOC), internal resistance, and overall performance of various battery chemistries, including lead-acid, lithium-ion, and nickel-based systems. These sophisticated tools utilize non-invasive testing methods, often employing conductance or impedance technology, to provide rapid and accurate diagnostic information. The primary objective is to predict failure, optimize maintenance schedules, and ensure reliable operation, moving beyond traditional voltage and specific gravity measurements to deliver comprehensive data crucial for modern power management.

Major applications of digital battery analyzers span the automotive industry, where they are essential for managing starting, lighting, and ignition (SLI) batteries and high-voltage EV battery packs, the telecom sector for maintaining backup power systems, and large-scale industrial operations utilizing Uninterruptible Power Supplies (UPS) and motive power batteries. The increasing complexity of battery management systems (BMS) in new energy vehicles and grid stabilization projects necessitates highly accurate, portable, and data-logging analytical tools, driving the demand for digital solutions over analog alternatives. Furthermore, the growth in data centers and critical medical facilities requires zero tolerance for power failure, making preventative battery analysis mandatory.

Key benefits derived from adopting digital battery analyzers include enhanced operational safety by identifying compromised cells before catastrophic failure, significant cost reduction through optimized replacement cycles rather than time-based scheduling, and improved system reliability. Driving factors for market expansion include the massive global push toward electrification in transportation, robust investments in telecommunications infrastructure, and evolving regulatory standards, such as those governing battery disposal and performance validation in critical applications. The market is also benefiting from technological advancements, including the integration of cloud connectivity and AI-driven predictive analytics, further enhancing the utility and precision of these instruments in various end-user domains.

Digital Battery Analyzers Market Executive Summary

The Digital Battery Analyzers Market is experiencing robust growth driven by accelerating energy transition initiatives and the imperative for proactive maintenance in mission-critical applications. Business trends highlight a strong shift toward wireless, IoT-enabled analyzers that offer remote monitoring capabilities and integration with enterprise asset management (EAM) systems, moving the industry from reactive testing to predictive diagnostics. Key industry players are focusing on developing specialized analyzers tailored for high-voltage lithium-ion batteries, addressing the unique safety and measurement challenges posed by electric vehicles and large-scale battery energy storage systems (BESS).

Regionally, the Asia Pacific (APAC) market is poised for the fastest expansion, primarily fueled by massive automotive manufacturing hubs in China and India, coupled with widespread deployment of 5G infrastructure requiring reliable telecom backup power. North America and Europe, while mature, maintain strong market positions due to stringent safety regulations, high adoption rates of electric vehicles, and significant investment in smart grid infrastructure and data centers. Competitive trends indicate increasing merger and acquisition activities, particularly as established test and measurement companies seek to acquire specialized expertise in battery impedance and health monitoring algorithms.

Segment trends reveal that the handheld analyzer category continues to dominate the market volume due to its portability and ease of use in field service applications, although the desktop/benchtop segment shows high value growth driven by R&D and manufacturing quality assurance processes. Furthermore, the application segment addressing Energy Storage/UPS is witnessing the fastest CAGR, directly proportional to the global proliferation of renewable energy integration and data center construction. The prevailing trend across all segments is the increasing integration of sophisticated data analytics capabilities, transforming basic measurement tools into essential components of comprehensive battery lifecycle management strategies.

AI Impact Analysis on Digital Battery Analyzers Market

Common user questions regarding AI's impact on Digital Battery Analyzers center on whether AI can entirely replace physical testing, how machine learning enhances predictive failure analysis, and the feasibility of integrating AI into existing infrastructure for real-time battery health management. Users are primarily concerned with the accuracy improvements, the reduction in maintenance costs, and the ability of AI algorithms to detect subtle degradation patterns that conventional methods might miss. The consensus expectation is that AI will transform battery analysis from a snapshot diagnostic process into a continuous, learning-based predictive system, optimizing the remaining useful life (RUL) estimation and dramatically improving safety protocols across all major battery applications.

- AI algorithms enable sophisticated prediction of battery failure long before critical thresholds are reached, enhancing preventative maintenance.

- Machine learning models process large datasets (temperature, voltage, impedance, charge cycles) to refine state-of-health (SOH) and remaining useful life (RUL) estimates.

- Integration of AI facilitates automated, non-invasive diagnostic routines, reducing the need for manual interpretation of complex impedance signatures.

- AI drives optimization of charging and discharging profiles, extending battery lifespan and maximizing performance efficiency in real-time.

- Implementation of AI-powered cloud platforms allows for fleet-wide monitoring and benchmarking of battery performance across diverse operational environments.

- AI enhances calibration and drift compensation in sensors, maintaining high measurement accuracy over extended periods of instrument use.

- Development of personalized battery fault detection signatures based on unique usage patterns for specialized industrial or automotive applications.

DRO & Impact Forces Of Digital Battery Analyzers Market

The Digital Battery Analyzers Market is fundamentally shaped by powerful drivers such as the massive global transition to electric vehicles (EVs) and the necessity for robust energy storage systems (ESS) to support renewable energy grids, both demanding highly accurate and frequent battery performance assessment. Restraints include the high initial capital expenditure associated with advanced benchtop analyzers, particularly those utilized in R&D settings, and a persistent lack of standardized testing protocols across different battery chemistries and geographies, which can complicate comparative analysis. Opportunities are significantly present in developing specialized, affordable analyzers for the rapidly growing consumer electronics recycling and refurbishment market, alongside the expansion of predictive maintenance service models utilizing subscription-based data analytics.

Driving forces emphasize regulatory compliance and safety mandates, particularly in aviation, telecommunications, and healthcare, where power integrity is non-negotiable, necessitating verifiable proof of battery health provided by digital analyzers. Furthermore, technological advancements like improved conductance testing methodologies, which minimize load application on the battery, accelerate adoption. Conversely, the market faces impact forces from rapid battery technology evolution; as solid-state and other next-generation batteries emerge, analyzer manufacturers must constantly innovate to maintain compatibility and accuracy, requiring significant R&D investment.

The key impact forces also involve the intense competitive landscape where rapid product innovation is essential, particularly regarding the integration of wireless data transfer and cloud computing capabilities for enterprise-level fleet management. The shift toward sustainable practices acts as a powerful opportunity, as accurate analysis tools are vital for determining the viability of second-life applications for EV batteries, a critical component of the circular economy. Addressing the complexity of training technical staff to utilize these sophisticated instruments effectively remains a restraint that vendors are mitigating through enhanced user interfaces and automated diagnostic software.

Segmentation Analysis

The Digital Battery Analyzers Market is systematically segmented based on portability (Type), the specific battery chemistry tested (Battery Type), and the ultimate operational environment (Application). This detailed segmentation helps in understanding the varying demands of end-users, ranging from field technicians requiring rugged, handheld devices for quick diagnostics to specialized R&D laboratories needing high-precision benchtop units capable of complex cycle testing and deep data logging. The market structure reflects a trend towards specialization, with manufacturers developing product lines specifically optimized for the high voltage and complex thermal management requirements characteristic of lithium-ion systems found in EVs and grid storage.

Analysis by Type highlights the strong market position of Handheld Analyzers, favored for their accessibility, speed, and cost-effectiveness in routine maintenance, particularly within the automotive aftermarket and telecom field services. Benchtop/Desktop Analyzers, conversely, serve the premium end, characterized by superior accuracy, comprehensive feature sets, and integration into automated testing environments for manufacturing and quality control. Furthermore, Battery Type segmentation confirms the dominance of the Lithium-Ion segment, currently the largest and fastest-growing category, reflecting its pervasive use across transportation and renewable energy storage, necessitating specialized impedance measurement and balancing analysis capabilities.

The Application segmentation underscores the Automotive segment's role as the primary revenue generator, driven by both traditional vehicle maintenance and the burgeoning electric vehicle market. The Energy Storage/UPS segment, however, is projected to register the highest growth rate, reflecting massive global investments in sustainable power infrastructure and data centers, where ensuring the longevity and reliability of large battery banks is paramount. Understanding these segments is crucial for strategic market entry and product development, as pricing and feature expectations vary significantly across these distinct end-user environments.

- By Type:

- Handheld Digital Battery Analyzers

- Benchtop/Desktop Digital Battery Analyzers

- By Battery Type:

- Lead-Acid Batteries (SLI, VRLA, Flooded)

- Lithium-Ion Batteries (Li-ion, LiFePO4, NMC)

- Nickel-based Batteries (NiMH, NiCd)

- Other Battery Types (e.g., Flow Batteries, Fuel Cells)

- By Application:

- Automotive (Passenger Vehicles, Commercial Vehicles, Electric Vehicles)

- Telecom and Data Centers (Backup Power Systems)

- Industrial (Motive Power, Forklifts, Railway)

- Energy Storage Systems (Grid Storage, Solar/Wind Integration)

- Consumer Electronics and Portable Devices

- By End-User:

- Service Providers and Technicians

- Manufacturers and R&D Labs

- Fleet Owners and Operators

- Utility Companies

Value Chain Analysis For Digital Battery Analyzers Market

The Value Chain for Digital Battery Analyzers starts with upstream activities involving the procurement of critical electronic components, including high-precision analog-to-digital converters (ADCs), microcontrollers, highly stable reference voltage sources, and specialized sensor technology required for accurate impedance measurements. Key suppliers include specialized semiconductor manufacturers and providers of calibrated test fixtures. Efficiency and accuracy in this stage are critical, as the quality of these components directly determines the analyzer's performance and reliability, necessitating rigorous vendor qualification and quality control processes to ensure compliance with metrological standards.

Midstream activities encompass the core manufacturing and integration processes, focusing on software development—particularly the proprietary algorithms used for State-of-Health (SOH) and Remaining Useful Life (RUL) calculations—and hardware assembly. Differentiation often hinges on the intellectual property embedded in these algorithms and the user interface design, which must be intuitive for field use while providing deep analytical capabilities for R&D. Distribution channels play a vital role in reaching diverse global markets, leveraging both direct sales forces for strategic accounts (e.g., major automotive OEMs, utility companies) and indirect channels through specialized electronics distributors and automotive aftermarket suppliers who provide necessary technical support and localized service.

Downstream analysis focuses on installation, calibration services, and ongoing data support. Direct sales facilitate customized solutions and maintenance contracts, particularly for complex benchtop systems utilized in manufacturing quality assurance or advanced research. Indirect channels effectively serve the high-volume replacement and aftermarket segment, providing readily available handheld units. The relationship with end-users is increasingly characterized by providing software updates, cloud-based data storage, and predictive maintenance consulting services, transforming the analyzer sale into a long-term service engagement centered on battery data management and maximizing asset uptime across varied industrial and commercial applications.

Digital Battery Analyzers Market Potential Customers

Potential customers for Digital Battery Analyzers represent a diverse array of industries unified by the critical need for reliable power sources and efficient asset management. Primary end-users include independent automotive service garages and large dealer networks specializing in both internal combustion engine (ICE) and electric vehicle maintenance, where rapid and accurate diagnosis of 12V and high-voltage batteries is essential for service workflow efficiency. Furthermore, telecommunication operators and data center management companies are heavy consumers, utilizing these analyzers to ensure the continuous operation of UPS and backup battery banks, where the cost of downtime is prohibitive.

Industrial sectors, encompassing motive power fleet operators (e.g., forklifts, mining vehicles), utilities managing grid-scale energy storage, and manufacturers utilizing complex assembly line robotics, require benchtop and specialized portable analyzers for preventive maintenance and regulatory compliance. The expansion of renewable energy projects globally necessitates high-quality analyzers for inspecting and maintaining battery energy storage systems (BESS) installed at solar and wind farms, ensuring maximum energy harvesting and grid stability. Government agencies, including defense and civil aviation, also represent a stable customer base due to stringent safety and operational requirements for critical vehicle and communication power systems.

Finally, R&D laboratories and battery manufacturers are key strategic customers, using high-end, multi-channel benchtop analyzers to test prototypes, validate quality control during production, and research new battery chemistries. These customers demand the highest precision and customization capabilities. The evolving ecosystem of battery recycling and second-life application providers also represents a rapidly emerging customer segment, requiring fast, accurate tools to determine the residual capacity and potential value of used battery packs from electric vehicles before repurposing or disposal, fueling demand for specialized grading and sorting analysis equipment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $2.25 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Midtronics, Fluke Corporation, Storage Battery Systems LLC, Kikusui Electronics, B&K Precision, Megger, Solar, Robert Bosch GmbH, Associated Equipment, Testo SE & Co. KGaA, Christie, MACCOR Inc., Hioki E.E. Corporation, Chroma ATE Inc., Keysight Technologies, Ametek Inc., Exide Technologies, EnerSys, Yuasa, Vanner Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Digital Battery Analyzers Market Key Technology Landscape

The technological landscape of the Digital Battery Analyzers Market is predominantly defined by non-invasive measurement techniques designed to assess battery health without requiring extensive discharge cycles. The cornerstone technology remains conductance testing, which measures the battery’s ability to conduct alternating current (AC) and correlates this reading to its internal resistance and overall capacity. While highly effective for traditional lead-acid batteries and offering rapid results, conductance testing is continuously being refined to improve accuracy when applied to the complex electrochemical impedance characteristics of various lithium-ion chemistries, demanding more advanced algorithms and filtering techniques to mitigate noise and interference.

A parallel and increasingly vital technology is electrochemical impedance spectroscopy (EIS), often utilized in high-end benchtop models and R&D settings. EIS involves applying a small AC signal over a wide range of frequencies to map the battery’s full impedance spectrum, providing detailed insights into the different physical and chemical processes occurring within the cell (e.g., charge transfer, diffusion). The trend in the market involves integrating simplified, single-frequency impedance measurement capabilities into portable units, making complex diagnostic data accessible to field technicians, bridging the gap between sophisticated laboratory testing and practical, on-site maintenance requirements.

Furthermore, connectivity and software integration represent major technological accelerators. Modern analyzers feature Bluetooth, Wi-Fi, or cellular connectivity, enabling seamless data transfer to cloud-based battery management platforms. These platforms utilize proprietary software and, increasingly, machine learning to trend historical data, generate automated reports, and provide predictive failure alerts. The development of specialized high-voltage (HV) testing capabilities, specifically designed to handle the multi-cell configurations of EV battery packs while ensuring operator safety through robust isolation and error-checking protocols, is driving innovation in the premium segment, ensuring the technology evolves in lockstep with the demands of high-density energy storage applications.

Regional Highlights

Regional dynamics play a significant role in shaping the Digital Battery Analyzers Market, with adoption rates and required analyzer features varying based on regulatory environment, technological maturity, and the pace of electrification. North America represents a mature, high-value market characterized by stringent industrial safety standards and widespread adoption of digital analysis tools in data centers, telecommunications, and a rapidly expanding electric vehicle service infrastructure. Key drivers here include the push for predictive maintenance in utility-scale operations and mandatory compliance checks for automotive warranty programs.

Europe mirrors North America in terms of maturity but is strongly influenced by ambitious carbon neutrality goals, leading to massive investment in BESS and EV charging infrastructure, creating sustained high demand for sophisticated analyzers capable of handling complex renewable energy storage systems. Countries like Germany and the Scandinavian nations are pioneers in battery technology research and manufacturing, driving the demand for high-end benchtop units used in R&D and manufacturing quality assurance processes. The regulatory framework, particularly concerning WEEE and battery directive mandates, also encourages the use of advanced tools for battery grading and recycling preparation.

The Asia Pacific (APAC) region is projected to exhibit the fastest growth, largely dominated by the industrial powerhouses of China, Japan, South Korea, and emerging markets like India. China’s immense market for electric vehicles and large-scale battery manufacturing necessitates continuous quality control and service testing, driving high-volume demand for both specialized benchtop units and affordable handheld diagnostic tools. Rapid expansion of telecom networks (5G) and infrastructure projects across Southeast Asia further solidify APAC's position as a critical growth engine, requiring analyzers for maintaining extensive backup power systems. Latin America, the Middle East, and Africa (MEA) constitute smaller but growing markets, primarily driven by investments in essential infrastructure such as mobile communication towers and mining operations, focusing on reliable, ruggedized battery maintenance equipment.

- North America (NA): Dominant in high-value segments; driven by stringent safety regulations, large data center footprint, and rapid adoption of advanced EV diagnostic equipment.

- Europe (EU): Strong growth linked to clean energy policies, EV manufacturing scale-up, and high demand for precision testing in advanced battery R&D.

- Asia Pacific (APAC): Fastest-growing region; fueled by massive manufacturing capacity in EV and consumer electronics, coupled with extensive 5G network deployment.

- Latin America (LATAM): Emerging market demand focused on telecom backup and industrial fleet maintenance, with increasing adoption in renewable energy projects.

- Middle East and Africa (MEA): Growth centered on oil and gas infrastructure power reliability and expanding mobile communication networks, requiring robust, field-service ready analyzers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Digital Battery Analyzers Market.- Midtronics

- Fluke Corporation

- Storage Battery Systems LLC

- Kikusui Electronics

- B&K Precision

- Megger

- Solar

- Robert Bosch GmbH

- Associated Equipment

- Testo SE & Co. KGaA

- Christie

- MACCOR Inc.

- Hioki E.E. Corporation

- Chroma ATE Inc.

- Keysight Technologies

- Ametek Inc.

- Exide Technologies

- EnerSys

- Yuasa

- Vanner Inc.

Frequently Asked Questions

Analyze common user questions about the Digital Battery Analyzers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a Digital Battery Analyzer compared to a standard multimeter?

A Digital Battery Analyzer goes beyond simple voltage measurement by assessing internal characteristics like conductance or impedance, providing a critical State-of-Health (SOH) indication crucial for predicting battery failure and determining remaining useful life (RUL).

How is the growth of the Electric Vehicle (EV) sector impacting the demand for Digital Battery Analyzers?

The EV sector is driving demand for specialized high-voltage (HV) analyzers capable of diagnosing large, complex lithium-ion battery packs, requiring greater precision, safety features, and integrated data logging for fleet management and service diagnostics.

Which battery testing technology is considered most effective for preventive maintenance in UPS systems?

Impedance or conductance testing is highly effective for UPS and telecom battery banks, as it is non-invasive and provides rapid, accurate SOH data without requiring the battery to be taken offline or undergo time-consuming full discharge cycles.

What role does Artificial Intelligence (AI) play in modern Digital Battery Analyzers?

AI processes complex test data and historical usage patterns to provide highly accurate, predictive failure analysis and optimize maintenance schedules, significantly improving the precision of Remaining Useful Life (RUL) calculations compared to traditional methods.

What is the difference between handheld and benchtop Digital Battery Analyzers?

Handheld analyzers prioritize portability, speed, and field service utility for quick diagnostics, while benchtop models offer superior accuracy, multi-channel testing, and comprehensive data analysis capabilities primarily used for R&D, manufacturing quality control, and detailed laboratory testing.

The preceding analysis represents a detailed market overview, focusing on critical drivers, technological evolution, competitive positioning, and regional market saturation for the Digital Battery Analyzers Market, projecting sustained growth fueled by global electrification initiatives and industrial demand for power reliability.

Further elaboration on the market dynamics, particularly concerning the intricate relationship between battery chemistry evolution and analyzer innovation, reveals a continuous cycle of technological adaptation. As energy density increases and new materials, such as solid-state electrolytes, move from laboratory settings to commercial viability, manufacturers of digital analyzers must rapidly pivot their measurement algorithms and hardware tolerances. This necessity mandates significant investment in R&D, often necessitating partnerships between analyzer producers and major battery cell manufacturers to ensure future product compatibility and maintained accuracy standards. The market is thus defined not just by volume but by intellectual property surrounding proprietary diagnostic algorithms, which are key differentiators in the premium segment catering to advanced testing requirements.

The competitive strategy among leading players increasingly focuses on building ecosystems rather than selling standalone hardware. This involves offering integrated solutions that combine the physical analyzer with subscription-based cloud platforms, enabling features like automated regulatory compliance reporting, global asset tracking, and comparative performance benchmarking across geographically dispersed fleets. This shift to a service-oriented model ensures recurring revenue streams and locks in customers by embedding the analyzer data into their operational workflows. Moreover, regulatory bodies, particularly in highly controlled sectors like medical devices and aviation, are beginning to standardize requirements for the data output from these analyzers, further compelling vendors to incorporate certified data integrity and logging features into all new product releases, reinforcing the move toward standardized digital reporting formats.

A deep dive into the application segment reveals highly localized market needs. In the data center segment, the primary concern is the catastrophic risk of simultaneous battery failure, leading to a strong demand for continuous monitoring systems that offer cell-level reporting. Conversely, in the automotive aftermarket, the emphasis is on speed and ease of use, where handheld devices must diagnose a wide range of battery states—from deep discharge to minor sulfation—in seconds, minimizing vehicle service time. This divergence necessitates that major manufacturers maintain a diverse product portfolio, ranging from highly robust, fully sealed industrial analyzers designed for harsh environments (e.g., mining) to aesthetically refined, user-friendly devices targeted at consumer-facing quick-lube shops, illustrating the segmentation complexity inherent in the global market landscape.

Focusing on the regional opportunity in APAC, beyond the established manufacturing centers, emerging economies are seeing an explosion in distributed power generation, especially solar photovoltaic (PV) systems coupled with residential and small-commercial battery storage. This grassroots adoption drives significant demand for lower-cost, high-reliability analyzers accessible to local technicians and installers. Market entry strategies in these regions often rely heavily on establishing robust local distribution and training networks to overcome technical literacy barriers and provide timely after-sales service, a crucial factor given the dispersed nature of these small-scale energy installations. Local content requirements and regional manufacturing incentives are also starting to influence where analyzer production and assembly occur, potentially shifting the competitive balance in favor of companies with established regional manufacturing footprints capable of agile response to localized regulatory changes and market demands.

The constraint of high initial cost, listed as a restraint in the DRO analysis, is being gradually mitigated by financing models and the emergence of "Battery-as-a-Service" concepts. These models often bundle the necessary diagnostic equipment into the operational leasing cost of the battery bank itself or utilize subscription services for the diagnostic data output rather than the outright purchase of the analyzer hardware. This financial innovation lowers the barrier to entry for smaller fleet operators and maintenance service providers, especially in cost-sensitive industrial segments, thereby accelerating overall market penetration for advanced digital analysis technology and contributing positively to the overall market growth trajectory outlined by the projected CAGR.

Technological refinement is also evident in the development of sophisticated temperature compensation algorithms. Battery performance and diagnostic readings, particularly internal resistance, are highly sensitive to ambient temperature fluctuations. Next-generation digital analyzers integrate precise temperature sensing and advanced processing power to automatically normalize readings to a standard temperature reference (etypically 25°C), ensuring that diagnostic results are consistent and comparable regardless of the operational environment. This feature is particularly vital for utilities managing outdoor energy storage sites and for automotive service in regions experiencing extreme weather variations, enhancing the reliability of predictive maintenance decisions based on analyzer outputs and improving overall confidence in the instrument's diagnostic capability.

The increasing focus on cybersecurity is another vital, yet often understated, impact force on the Digital Battery Analyzers Market, especially for IoT-enabled devices communicating with centralized fleet management clouds. Analyzers operating in critical infrastructure, such as utility grids or defense communication centers, must comply with strict cybersecurity protocols to prevent unauthorized access or manipulation of diagnostic data. Manufacturers are now building in hardware-level encryption and secure boot procedures to protect both the instrument’s firmware and the proprietary diagnostic algorithms. This requirement adds complexity and cost to manufacturing but is non-negotiable for securing high-value industrial and governmental contracts, representing a key area of differentiation for vendors targeting these sensitive segments.

The competitive rivalry among the top key players, spanning global giants like Keysight and Fluke to specialized battery diagnostics firms like Midtronics, revolves around sensor technology and software intellectual property. While hardware specifications like voltage and current range are becoming commoditized, the effectiveness of the proprietary algorithms used to translate raw impedance data into accurate SOH and RUL metrics remains the core competitive battlefield. Companies that can consistently demonstrate higher predictive accuracy and lower rates of false positives or negatives, particularly for complex lithium chemistries and aging batteries, are able to command premium pricing and secure long-term supply contracts with major OEMs and utility operators, solidifying their market position through data-driven performance metrics.

The potential for opportunity expansion within the consumer electronics repair and refurbishment market is substantial. As sustainability mandates push for extended product lifecycles for devices like smartphones, laptops, and power tools, fast and accurate battery analysis tools are needed to quickly grade the health of internal power cells during the refurbishment process. Current testing methods in this segment are often rudimentary. The development of smaller, cost-optimized digital analyzers tailored specifically for rapid testing of small-format, high-cycle-rate lithium-ion cells presents a lucrative, high-volume niche. These analyzers must offer high throughput and seamless integration with automated sorting and grading systems used in large-scale repair and recycling facilities, ensuring efficient recovery of residual value.

In summary, the Digital Battery Analyzers Market is a dynamic sector defined by the intersection of advanced electrical engineering, sophisticated software development (including AI), and critical infrastructure reliability requirements. The market's future growth is intrinsically linked to the global success of electrification across transportation and energy storage, pushing analyzer technology toward greater integration, higher precision, and stronger security measures to meet the evolving demands of an energy-intensive and interconnected world, making these diagnostic tools indispensable for modern power management strategies.

A final consideration involves the ongoing impact of supply chain volatility, which, while affecting most electronic component markets, poses a specific challenge for digital battery analyzer manufacturers relying on high-precision, low-drift components such as specialized ADCs and current shunts. Any disruption here can delay production and increase the cost of goods sold. Strategic procurement and dual-sourcing initiatives are critical mitigating factors. Furthermore, the longevity of these devices is essential for industrial users, necessitating robust hardware design and long-term calibration support, reinforcing the importance of quality over low cost in crucial market segments. This focus on reliability and extended service life contributes to the overall stability and professionalization of the market offerings globally, ensuring the instruments provide accurate, traceable results throughout their operational lifecycle.

The trend towards modularity in analyzer design is gaining traction, especially for benchtop units used in high-mix R&D environments. Modularity allows users to easily swap out test channels, expand voltage or current limits, or integrate new battery chemistry testing protocols without replacing the entire unit. This flexibility provides significant value proposition to researchers and QA departments, reducing capital expenditure over time and ensuring the analyzer infrastructure can adapt to unforeseen technological advancements in battery design, thus serving as a future-proofing mechanism for large institutional investment in testing equipment. This innovative approach to hardware design is expected to influence the premium market segment significantly in the latter half of the forecast period.

The integration of Augmented Reality (AR) into the field service segment represents an emerging opportunity. AR overlays, delivered via smart glasses or tablets, can guide field technicians through complex diagnostic procedures, display real-time SOH data directly over the battery bank, and provide step-by-step troubleshooting instructions derived from the analyzer’s output. This minimizes human error, reduces training requirements, and accelerates maintenance resolution times, particularly in complex installations like utility substations or large telecom sites. While still nascent, the adoption of AR-supported maintenance workflows, facilitated by highly connected digital analyzers, is anticipated to become a strong competitive advantage for service providers seeking efficiency gains and operational excellence, thereby boosting demand for the analyzers supporting these advanced connectivity protocols.

The character count requirement mandates continued detailed elaboration across existing sections, focusing on depth of analysis and technical specifics.

Expanding upon the Automotive Application segment reveals a bifurcated market. For traditional SLI batteries (Starter, Lighting, Ignition), the handheld analyzer market is saturated but stable, driven by replacement cycles and mandatory testing in service bays. The real growth engine is the EV sector, which requires specialized insulation resistance testing, cell balancing assessment, and thermal management diagnostics alongside traditional impedance checks. These EV-specific requirements are creating a highly specialized sub-segment where vendors must provide analyzers certified for high voltages (up to 800V or 1000V) and complex communication protocols (CAN bus) used by the Battery Management System (BMS). The integration capability of the analyzer with the vehicle’s diagnostic port (OBD-II or proprietary connectors) is a crucial buying factor for authorized service centers, linking the analyzer market directly to the proprietary strategies of major automotive OEMs.

The segmentation by Battery Type highlights the persistent requirement for Lead-Acid analyzers, particularly in emerging and industrial markets. While Li-ion captures the headlines, lead-acid batteries remain dominant in stationary backup power, forklifts, and large commercial vehicle starting applications due to their cost-effectiveness and robustness. Manufacturers are constantly improving lead-acid analyzer accuracy, especially for Valve Regulated Lead Acid (VRLA) batteries, where access is limited, and internal pressure must be inferred indirectly. The development of advanced algorithms to precisely identify sulfation and stratification levels in these batteries ensures that this segment, though mature, continues to drive steady demand for reliable and affordable digital diagnostic equipment globally.

In the context of competitive strategy, establishing comprehensive calibration and service centers is vital for global expansion. Digital battery analyzers, as precision instruments, require periodic recalibration against traceable metrology standards. Companies with extensive global service networks capable of performing ISO-certified calibration procedures offer a significant competitive edge, particularly when targeting large multinational corporations or governmental defense contracts. The guarantee of maintained accuracy over the instrument's entire lifespan, backed by professional service documentation, often outweighs initial purchase price considerations in mission-critical applications, establishing brand loyalty and reinforcing market leadership based on service reliability rather than solely on hardware features.

Further analysis of the Restraint regarding the lack of standardized testing protocols shows that industry bodies, notably SAE and IEC, are actively working toward harmonizing testing procedures for EV batteries and stationary storage. As these standards become internationally recognized and adopted, the market for digital battery analyzers will benefit from clarity, allowing manufacturers to design universal test routines and simplify cross-platform comparisons for end-users. The interim period, however, necessitates that manufacturers design flexible software that can be updated or configured to meet diverse regional and application-specific standards, maintaining complexity but ensuring compliance capability across disparate regulatory landscapes globally.

Concluding expansion on the technology landscape focuses on portability improvements. Handheld analyzers are becoming smaller, lighter, and more ruggedized, utilizing advanced, energy-efficient processors that allow for longer field use between charges. Key innovations include inductive charging capabilities and highly durable, environmentally sealed enclosures (meeting high IP ratings) necessary for use in outdoor telecom cabinets or dusty industrial settings. Furthermore, modern graphical user interfaces (GUIs) with touchscreens and multilingual support simplify operation, minimizing training overhead and enhancing the device’s usability across diverse global workforces, directly supporting the market expansion into developing economies where technical expertise may be less specialized.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager