Digital Caliper Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432269 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Digital Caliper Market Size

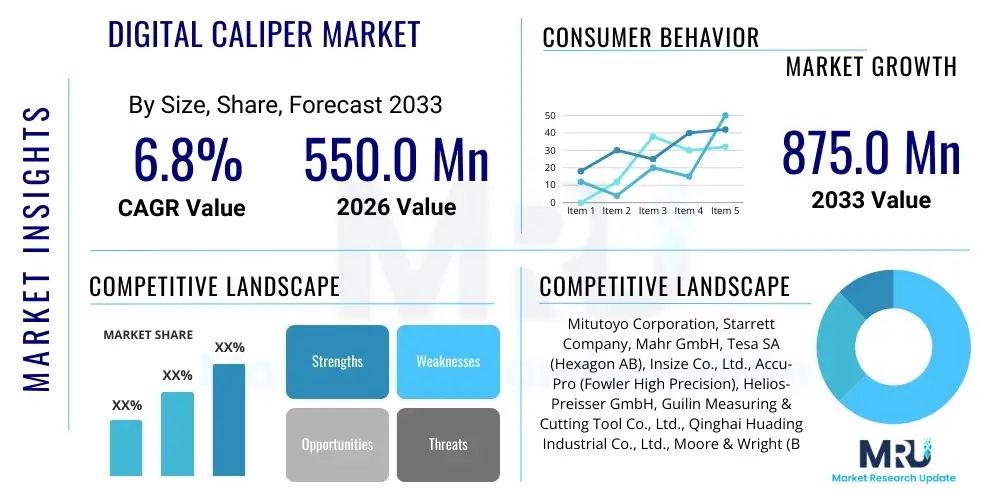

The Digital Caliper Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 550.0 million in 2026 and is projected to reach USD 875.0 million by the end of the forecast period in 2033.

Digital Caliper Market introduction

The Digital Caliper Market encompasses the global trade and utilization of precision measuring instruments designed for highly accurate linear measurements, including internal, external, depth, and step dimensions. These instruments utilize advanced electronic sensors and digital displays to provide readings, offering superior resolution, repeatability, and ease of use compared to traditional vernier or dial calipers. The product represents a critical component of quality control and dimensional metrology across various industrial sectors. Modern digital calipers often feature data output capabilities, enabling seamless integration with statistical process control (SPC) systems and computer-aided quality assurance (CAQ) platforms, significantly enhancing efficiency in high-throughput manufacturing environments.

Major applications for digital calipers span key manufacturing sectors such as automotive, aerospace, machinery fabrication, medical device manufacturing, and precision engineering shops. In the automotive industry, they are indispensable for checking component tolerances, wear dimensions, and assembly clearances. Similarly, in aerospace, where material stresses and dimensional integrity are paramount, digital calipers ensure components adhere to stringent quality standards. The primary benefits driving their adoption include reduced measurement error due to digital readouts, faster measurement cycles, the capability for origin memory, and the ease of switching between metric and imperial systems. These operational advantages position digital calipers as standard equipment in modern industrial metrology laboratories and production floors globally.

The market growth is fundamentally driven by the escalating demand for high-precision manufacturing, particularly in complex industries like electric vehicle production and advanced semiconductor fabrication, which mandate extremely tight tolerances. Furthermore, the global proliferation of Industry 4.0 initiatives encourages the integration of smart measuring tools capable of data connectivity and real-time monitoring. The shift from manual quality assurance methods to automated and digitized metrology workflows further accelerates the replacement rate of older, less capable measuring tools, fueling the sustained expansion of the Digital Caliper Market throughout the forecast period.

Digital Caliper Market Executive Summary

The Digital Caliper Market is characterized by robust growth, primarily propelled by global manufacturing digitization trends and the increasing complexity of engineered components, which necessitate superior measurement accuracy and data integration capabilities. Business trends highlight a strong focus on developing wireless and IoT-enabled digital calipers that can communicate measurement data directly to enterprise resource planning (ERP) or quality management systems (QMS), minimizing manual data entry errors and optimizing statistical process control (SPC). Key manufacturers are investing heavily in improving IP ratings (e.g., IP67 for coolant resistance) and battery longevity to enhance reliability in harsh industrial settings. Furthermore, competitive pressures are driving innovation in display technology, moving towards high-contrast, easily readable screens, and ergonomically designed instruments that reduce operator fatigue, leading to a higher overall productivity rate.

Regionally, the Asia Pacific (APAC) stands as the dominant and fastest-growing market, driven by massive investments in manufacturing infrastructure, particularly in countries like China, India, and South Korea, which serve as global hubs for electronics, automotive components, and machinery production. North America and Europe maintain stable growth, characterized by strong demand for high-end, premium-segment calipers that emphasize connectivity and superior calibration stability for use in demanding industries like aerospace and defense. Emerging economies in Latin America and MEA are increasingly adopting digital instruments as their industrial bases mature and prioritize international quality standards compliance. The varying regional adoption rates reflect differences in industrial maturity and regulatory environments, with developed regions focusing on technological upgrades and developing regions focusing on basic digitization.

Segment trends reveal that the wireless connectivity segment is experiencing the most significant uptake, reflecting the industrial migration toward smart factories and fully connected manufacturing ecosystems. By application, the Automotive and Aerospace sectors remain the largest consumers due to strict regulatory compliance and the critical nature of dimensional inspection in these fields. However, the specialized purpose caliper segment, including instruments designed for specific measurements such as tube wall thickness or brake disc inspection, is growing rapidly as customization provides efficiency gains over general-purpose tools. Material science advancements, particularly the use of advanced composites in caliper construction to reduce weight while maintaining rigidity, also influence purchasing decisions across all end-user segments seeking enhanced portability and durability in demanding shop-floor environments.

AI Impact Analysis on Digital Caliper Market

User queries regarding AI's impact on digital calipers commonly revolve around how artificial intelligence and machine learning (ML) can enhance measurement accuracy, automate inspection processes, and facilitate predictive maintenance of the instruments themselves. Users express concerns about the complexity of integrating AI algorithms into existing quality assurance infrastructure and the requisite data governance frameworks needed to handle vast amounts of metrological data generated by connected tools. Key expectations include the ability of AI to detect subtle measurement deviations beyond human perception, analyze trends in component wear based on collected caliper data, and autonomously optimize calibration schedules. The overall theme is a desire for smart, self-correcting metrology systems that leverage AI for enhanced decision-making rather than simple data recording.

The immediate impact of AI is not in replacing the physical caliper, but in revolutionizing the data processing layer above it. AI/ML algorithms are being deployed to analyze large datasets generated by thousands of measurements taken by digital calipers in a production run. This analysis can rapidly identify correlations between dimensional variation and specific machine tool settings, environmental factors, or material batches, leading to proactive quality adjustments. This shift transforms the digital caliper from a passive data capture tool into an active sensor contributing to real-time process optimization and closed-loop manufacturing control, drastically reducing scrap rates and improving overall operational efficiency in complex machining operations.

Furthermore, AI-driven software is becoming crucial for advanced metrology labs utilizing digital calipers for complex geometric dimensioning and tolerancing (GD&T) checks. While calipers provide fundamental linear measurements, integrating their output with AI allows for contextual validation against established GD&T standards and the creation of automated reporting features that highlight non-conforming characteristics with greater speed and reliability than traditional statistical software. This application enhances the interpretative power of the measurement data, ensuring that shop-floor operators and quality engineers derive maximum value from their digital caliper investments, thereby reinforcing the overall market value proposition of high-end, data-enabled instruments.

- AI-driven anomaly detection in measurement datasets, identifying subtle patterns indicative of impending tool wear or process drift.

- Machine learning algorithms optimizing Statistical Process Control (SPC) by dynamically adjusting control limits based on historical caliper data variability.

- Predictive maintenance schedules for calipers and associated jigs, forecasted using operational hours and environmental data captured by smart instruments.

- Enhanced quality reporting through natural language processing (NLP) of measurement notes and automated summarization of inspection results.

- Integration with computer vision systems for automated position confirmation, ensuring the caliper is correctly oriented before data capture.

- AI facilitating the fusion of data from calipers with other metrology instruments (CMMs, micrometers) for holistic dimensional analysis.

- Development of self-calibrating or self-correcting measurement routines guided by embedded adaptive algorithms.

- Improved traceability through blockchain-enabled data logging validated and indexed by AI systems.

DRO & Impact Forces Of Digital Caliper Market

The Digital Caliper Market dynamics are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO). Key drivers include the global push towards precision manufacturing across high-value sectors such as aerospace and electric vehicles, coupled with the mandatory adoption of digital metrology tools under various international quality standards like ISO 9001. The rising penetration of Industry 4.0 principles necessitates measuring instruments capable of real-time data output, positioning smart digital calipers equipped with wireless connectivity as indispensable assets. Furthermore, the inherent human error reduction provided by clear digital readouts, compared to the ambiguity of vernier scales, significantly accelerates operational efficiency and overall product quality assurance. These combined forces create a strong, sustainable tailwind for market expansion.

However, the market faces several restraining forces that moderate growth. Primary among these is the higher initial capital expenditure required for premium digital calipers compared to conventional mechanical alternatives, which can deter small and medium-sized enterprises (SMEs) with limited operational budgets, particularly in developing economies. Additionally, while digital instruments offer high precision, they are inherently reliant on battery power and sensitive electronic components, making them susceptible to downtime and demanding more rigorous environmental protection (e.g., against dust, coolant, and electromagnetic interference). The complexity associated with integrating wireless data streams into heterogeneous plant networks also poses a technical hurdle for less technologically mature companies, requiring specialized IT infrastructure and training for effective utilization.

Opportunities for future growth are significant and center on technological evolution and market penetration into untapped sectors. The convergence of Digital Calipers with IoT technology presents a major opportunity for vendors to offer integrated solutions that include cloud-based data storage, predictive analytics services, and remote calibration monitoring. The expansion of manufacturing bases in emerging Asia Pacific and Latin American countries, driven by global supply chain diversification, provides new geographical markets for penetration. Finally, the development of specialized calipers for niche applications, such as those tailored for additive manufacturing (3D printing) quality control or micro-measurement in semiconductor fabrication, opens premium market segments that prioritize application-specific precision and durability, ensuring sustained revenue growth across the forecast horizon.

Segmentation Analysis

The Digital Caliper Market is systematically segmented based on Type, Display Technology, Connectivity, Application, and Distribution Channel, allowing for granular analysis of demand patterns and technological adoption across various industrial landscapes. Understanding these segmentations is crucial for manufacturers to tailor product development strategies and for distributors to optimize inventory and targeting efforts. The market exhibits distinct growth trajectories within these segments; for instance, while general-purpose standard calipers maintain the largest volume share, the specialized and high-connectivity segments are rapidly increasing in terms of revenue growth due to their higher average selling prices and utility in advanced manufacturing environments. Analyzing the intersection of segments, such as IP-rated, wireless-enabled standard calipers used in the automotive sector, provides critical insights into high-growth niches.

Segmentation by Display Technology is particularly relevant as modern manufacturers increasingly seek OLED or high-contrast LCD screens for improved readability in varying shop-floor lighting conditions, directly influencing operator efficiency and reducing potential reading errors. The differentiation between basic data hold features and advanced data output capabilities (connectivity segment) highlights the divergence between price-sensitive buyers needing basic dimensional checks and quality-driven buyers requiring seamless integration with their entire metrology workflow. This segmentation structure reflects the market's maturity, where end-users no longer view the digital caliper as a mere measuring tool but as a critical component of their digitized quality ecosystem, demanding features far beyond simple linear measurement.

- Type:

- Standard Digital Calipers

- Special Purpose Digital Calipers (e.g., Inside Groove, Depth, Pipe Thickness)

- Display Technology:

- LCD (Liquid Crystal Display)

- OLED (Organic Light-Emitting Diode)

- Connectivity:

- Non-Connected (Basic Digital Output)

- Wired Connectivity (USB, RS232)

- Wireless Connectivity (Bluetooth, WLAN)

- Application/End-User Industry:

- Automotive Industry

- Aerospace and Defense

- Machinery and Equipment Manufacturing

- Medical Devices and Healthcare

- Electronics and Semiconductors

- General Fabrication and Workshops

- Protection Rating:

- Standard Protection (IP40/IP54)

- High Protection (IP67)

Value Chain Analysis For Digital Caliper Market

The value chain for the Digital Caliper Market begins with upstream activities involving the sourcing of highly specialized raw materials and electronic components. Raw material suppliers provide high-grade stainless steel or advanced composite materials crucial for the caliper body, ensuring stability, corrosion resistance, and thermal expansion minimalization. Crucially, upstream component suppliers provide the complex linear encoders (capacitive or inductive), microprocessors, batteries, and display modules (LCD/OLED), which dictate the caliper's accuracy and functionality. Expertise in precision machining and cleanroom assembly is vital in this stage to ensure the core measurement system maintains the necessary sub-micron level precision required for high-accuracy metrology instruments. The efficiency and quality of the upstream supply significantly impact the final product's performance specifications and cost structure.

Midstream activities involve the design, assembly, and rigorous calibration of the final product. Manufacturers focus on product design innovation, integrating ergonomic features, advanced connectivity modules (e.g., proprietary wireless systems), and developing specialized application-specific jaws and measuring faces. Manufacturing processes are highly controlled, incorporating automated assembly and extensive quality checks, including temperature and humidity control during the setting of the measurement scales. Calibration is a bottleneck and a crucial value-adding step, often involving multiple stages of comparison against national metrology standards to ensure instrument traceability and certified accuracy. These manufacturing efficiencies determine time-to-market and the overall quality perception among professional end-users who prioritize reliability.

Downstream distribution channels are bifurcated into direct sales and indirect channels. Direct distribution is common for high-volume orders to large OEMs in the automotive and aerospace sectors, allowing manufacturers to maintain tight control over customer relationships and provide specialized technical support and training. Indirect channels, which form the majority of sales transactions, involve a global network of authorized distributors, industrial suppliers, and e-commerce platforms. These intermediaries play a vital role in local market penetration, inventory management, and providing immediate access to replacement parts and calibration services for smaller workshops and independent quality control laboratories. The trend toward sophisticated e-commerce platforms is optimizing the indirect channel, providing better product comparison tools and expedited logistics, thus streamlining the procurement process for professional buyers globally.

Digital Caliper Market Potential Customers

The primary end-users, or potential customers, of the Digital Caliper Market are diverse industrial entities heavily involved in manufacturing processes that require strict adherence to dimensional tolerances and high standards of quality assurance. These buyers encompass every stage of the production cycle, from initial prototyping and tool setup verification to final component inspection and maintenance checks. Specifically, large original equipment manufacturers (OEMs) across the automotive, aerospace, and heavy machinery sectors represent substantial buyers, often requiring large volumes of networked, high-IP-rated calipers for consistent use on demanding production lines and in specialized metrology laboratories where instruments must interface seamlessly with sophisticated quality systems.

In addition to large-scale manufacturers, the market targets small and medium-sized enterprises (SMEs), including independent machine shops, precision component fabricators, and specialized tool and die makers. While these customers often purchase fewer units, their cumulative demand for robust, reliable, and cost-effective digital instruments is a core pillar of the market. Furthermore, technical educational institutions, vocational training centers, and government research laboratories are consistent customers, integrating digital calipers into their curricula and R&D activities to train future technicians and conduct fundamental dimensional research. These institutions often require instruments with specific features that facilitate instruction and long-term durability in varied learning environments.

The expanding medical device and semiconductor industries represent particularly high-growth potential customer segments. Medical device manufacturers, constrained by stringent FDA and equivalent regulatory body standards, require ultra-high accuracy and certified instruments for validating miniature components used in surgical implants and diagnostic equipment. Similarly, the electronics and semiconductor sectors, dealing with increasingly miniaturized components, demand specialized digital calipers capable of non-contact or low-force measurements on delicate parts. As manufacturing complexity increases globally, any industry reliant on dimensional accuracy for function, safety, or regulatory compliance remains a core potential customer for advanced digital caliper technologies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550.0 Million |

| Market Forecast in 2033 | USD 875.0 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mitutoyo Corporation, Starrett Company, Mahr GmbH, Tesa SA (Hexagon AB), Insize Co., Ltd., Accu-Pro (Fowler High Precision), Helios-Preisser GmbH, Guilin Measuring & Cutting Tool Co., Ltd., Qinghai Huading Industrial Co., Ltd., Moore & Wright (Baty International), CDI (Snap-on Incorporated), Sylvac S.A., Feinmess Suhl GmbH, Shenzhen Sanhuan Precision Tool Co., Ltd., PCE Instruments. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Digital Caliper Market Key Technology Landscape

The technology landscape of the Digital Caliper Market is dominated by the evolution of highly accurate displacement measurement systems and advancements in data handling capabilities. The core technology remains the precision scale system, primarily capacitive or inductive encoders, which convert linear movement into a digital signal. Capacitive systems are widely used due to their low power consumption and cost-effectiveness, although inductive systems are preferred in high-end, harsh environment applications (IP67 certified) for their superior resistance to coolant, dirt, and electromagnetic noise. Recent technological focus has shifted significantly toward enhancing the digital interface, utilizing advanced microprocessors for faster data refresh rates and improved measurement stability, alongside the integration of highly durable, high-contrast OLED displays for superior readability under varying industrial lighting conditions, minimizing operator fatigue and reading errors.

A major technological frontier is the widespread adoption of wireless communication standards, primarily Bluetooth Low Energy (BLE), optimized for industrial environments. This connectivity allows digital calipers to transmit measurement data instantly and accurately to networked quality management software (QMS) and Statistical Process Control (SPC) databases, facilitating real-time quality monitoring and reducing manual transcription errors, a common pitfall in traditional metrology. Manufacturers are developing proprietary communication protocols that ensure secure, reliable, and high-speed data transmission over larger distances within a manufacturing plant. This focus on seamless data integration supports the broader Industry 4.0 paradigm, where every measuring device functions as a smart sensor contributing to comprehensive factory digitization and automation efforts, driving demand for technologically advanced models capable of robust network communication.

Further innovation is concentrated on battery life optimization and the development of specialized ergonomic features and material science applications. Improved power management techniques extend the operational lifespan of the caliper, reducing maintenance intervals. Material advancements include the use of advanced carbon fiber composites in specialized calipers, reducing weight for large measurements while maintaining dimensional stability and rigidity, which is critical in aerospace applications. Furthermore, the incorporation of embedded memory and advanced features like dynamic tolerance indicators directly on the caliper display aids in immediate go/no-go decisions on the shop floor, streamlining inspection workflows and substantially improving the throughput of quality checks compared to older generation instruments that required external computer interfacing for complex tolerance analysis.

Regional Highlights

- Asia Pacific (APAC) Dominance and Growth: APAC is the largest and fastest-growing market, primarily fueled by the massive concentration of global manufacturing operations, particularly in China, Japan, South Korea, and India. The region's robust electronics, automotive, and general machinery sectors drive extremely high demand for precision measuring tools. Government initiatives promoting high-tech manufacturing and quality standards compliance, coupled with the competitive need for efficient production, accelerate the adoption of advanced digital and networked calipers over older mechanical variants. The sheer volume of manufacturing output ensures APAC remains the core revenue generator.

- North America Market Maturity and High Value: The North American market is characterized by maturity and a strong focus on high-specification, premium digital calipers. Demand is heavily concentrated in the aerospace and defense, high-end automotive (electric vehicles), and specialized medical device manufacturing sectors, which mandate the highest levels of accuracy, traceability, and robust data connectivity. Manufacturers in this region prioritize wireless-enabled tools that seamlessly integrate with complex enterprise quality systems and maintain strict adherence to regulatory standards (e.g., NIST traceability), often driving higher average selling prices compared to global averages.

- Europe's Emphasis on Quality and Automation: Europe represents a significant market, driven by the strong presence of the German machinery industry and precision engineering sectors across the continent. European users place a high value on reliability, longevity, and adherence to established European metrology standards. The region leads in adopting fully automated or semi-automated inspection processes, driving demand for digital calipers equipped with advanced data output features (e.g., proprietary wireless systems compliant with European frequency standards) that support sophisticated factory automation initiatives and Industry 4.0 adoption rates across all industrial segments.

- Latin America's Emerging Industrialization: The Latin American market, while smaller, is exhibiting consistent growth linked to increasing foreign investment in automotive assembly plants and infrastructure projects, particularly in Brazil and Mexico. The adoption of digital calipers is driven by the need to upgrade domestic quality control practices to meet international export standards. Price sensitivity remains a factor, but the shift towards digital tools is clear, primarily targeting standard digital calipers that offer reliability and ease of use in new or modernizing industrial facilities across the region.

- Middle East & Africa (MEA) Infrastructure Development: The MEA market shows promising potential, largely driven by large-scale infrastructure projects, expansion of the oil and gas precision equipment sector, and regional diversification efforts away from resource extraction. Countries like the UAE and Saudi Arabia are investing in high-tech manufacturing and defense industries, requiring professional-grade metrology tools. Market growth is expected to accelerate as industrialization broadens, increasing the necessity for standardized dimensional measurement tools that ensure quality compliance in newly established production facilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Digital Caliper Market.- Mitutoyo Corporation

- Starrett Company

- Mahr GmbH

- Tesa SA (Hexagon AB)

- Insize Co., Ltd.

- Accu-Pro (Fowler High Precision)

- Helios-Preisser GmbH

- Guilin Measuring & Cutting Tool Co., Ltd.

- Qinghai Huading Industrial Co., Ltd.

- Moore & Wright (Baty International)

- CDI (Snap-on Incorporated)

- Sylvac S.A.

- Feinmess Suhl GmbH

- Shenzhen Sanhuan Precision Tool Co., Ltd.

- PCE Instruments

- Shandong Shida Measuring Tools Co., Ltd.

- Kroeplin GmbH

- Asimeto

- Trimos S.A.

- iGaging

Frequently Asked Questions

Analyze common user questions about the Digital Caliper market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the key difference between capacitive and inductive digital calipers?

Capacitive digital calipers are generally more cost-effective and consume less power, using changes in electrical capacitance to measure displacement. Inductive digital calipers, often found in premium, high-protection (IP67) models, use magnetic induction principles, offering superior resistance to coolant, dirt, and electromagnetic interference, making them ideal for harsh shop-floor environments.

How is Industry 4.0 influencing the purchase of new digital calipers?

Industry 4.0 mandates instruments capable of real-time data exchange. This trend is driving demand for wireless-enabled digital calipers (Bluetooth/WLAN) that automatically feed measurement results into Statistical Process Control (SPC) software or cloud-based Quality Management Systems, minimizing transcription errors and supporting automated manufacturing decision-making.

Which region currently dominates the global Digital Caliper Market in terms of revenue?

The Asia Pacific (APAC) region currently dominates the Digital Caliper Market revenue share. This is due to its high volume of manufacturing output, extensive industrial base across electronics and automotive sectors, and increasing investment in quality control infrastructure across countries like China, Japan, and South Korea.

What are the primary factors restraining the market growth for digital calipers?

The primary restraints include the relatively high initial acquisition cost compared to traditional mechanical calipers, which affects budget-conscious SMEs, and the need for frequent battery replacement and protection of sensitive electronics against the harsh conditions often present on factory floors.

Are there specialized digital calipers for niche applications, and how do they differ?

Yes, specialized digital calipers are designed for niche applications such as measuring brake disc thickness, external grooves, tube wall thickness, or gear tooth measurements. They differ from standard calipers by featuring application-specific jaws, measuring faces, and modified frames tailored for geometries that standard tools cannot accurately or efficiently measure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager