Digital Collections Management System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437304 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Digital Collections Management System Market Size

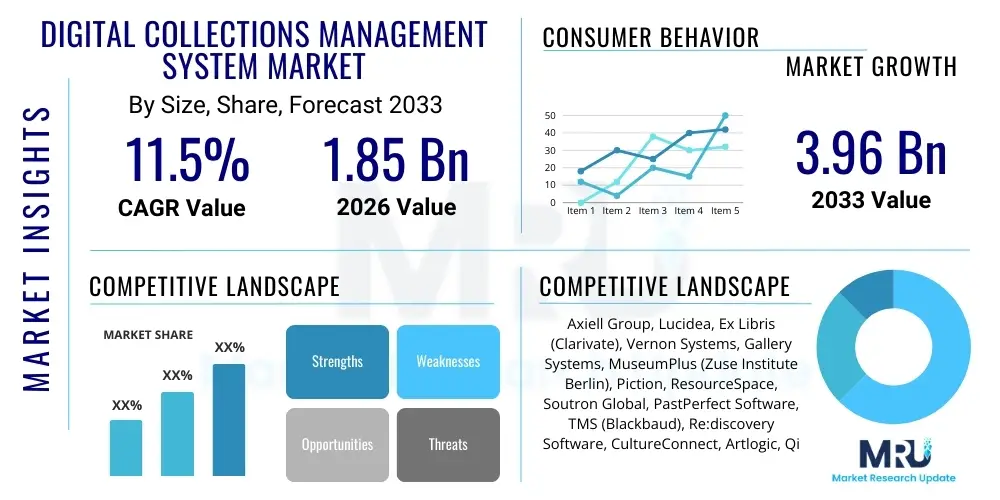

The Digital Collections Management System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at $1.85 Billion in 2026 and is projected to reach $3.96 Billion by the end of the forecast period in 2033. This significant expansion is driven primarily by the escalating need for cultural heritage institutions—such as museums, libraries, and archives—to digitize, preserve, and provide global access to their extensive collections, moving beyond traditional physical management constraints toward scalable digital platforms.

Market size determination is complex, integrating revenue streams from software licenses, cloud subscriptions, implementation services, and ongoing maintenance contracts across various institutional tiers. The transition from legacy, in-house systems to robust, cloud-native solutions offering enhanced interoperability and security is a major factor inflating market valuation. Furthermore, increased government funding and private sector investment in cultural preservation and digital scholarship programs worldwide are solidifying the growth trajectory, particularly in high-growth regions like Asia Pacific and specialized vertical markets such as media archiving and corporate historical records management.

Digital Collections Management System Market introduction

The Digital Collections Management System (DCMS) Market encompasses specialized software solutions designed to manage, catalog, preserve, and provide access to digital assets and intellectual property held by institutions. These systems are pivotal for cultural heritage organizations, educational bodies, and corporations needing structured control over vast amounts of digital data, including digitized physical artifacts, born-digital content, media files, manuscripts, and research materials. The core functionality centers around metadata creation, preservation workflow management, rights management, and public access portals, ensuring long-term accessibility and integrity of invaluable digital collections.

Key applications of DCMS span across museum artifact cataloging, library special collections digitization, archival document preservation, and scientific data management. The systems offer numerous benefits, including enhanced collection visibility, streamlined operational efficiency for curators and researchers, improved data security, and compliance with international standards like Dublin Core and CIDOC CRM. DCMS tools facilitate collaborative research and global outreach, transforming static collections into dynamic, searchable digital resources accessible via the internet, thereby fulfilling mandates for public education and scholarly engagement.

Driving factors for this market include the global imperative for digital transformation across all sectors, the rapid proliferation of high-resolution digital media requiring specialized storage and indexing, and the need for disaster recovery planning and digital preservation strategies against technological obsolescence. Regulatory pressures regarding data provenance and intellectual property rights also compel institutions to adopt sophisticated DCMS platforms. Conversely, advancements in cloud computing infrastructure have lowered the barrier to entry, enabling smaller institutions to access enterprise-grade collection management capabilities.

Digital Collections Management System Market Executive Summary

The Digital Collections Management System Market is undergoing rapid transformation, characterized by aggressive cloud migration and the integration of advanced technologies like Artificial Intelligence (AI) for automated metadata tagging and content analysis. Business trends emphasize modular, platform-as-a-service (PaaS) offerings that allow institutions to tailor functionality, integrating DCMS with existing enterprise resource planning (ERP) systems and discovery services. The competitive landscape is consolidating, with major vendors acquiring niche players to expand their technological portfolios, particularly in preservation services and specialized media management tools. Key investment areas include enhancing user experience, developing robust APIs for third-party integration, and improving scalability to handle petabytes of data efficiently, reflecting a shift toward solutions that support holistic digital stewardship.

Regionally, North America and Europe maintain dominance due to established cultural infrastructure, high technological adoption rates, and significant government funding for digitalization initiatives, especially concerning national heritage archives. However, the Asia Pacific (APAC) region is poised for the fastest growth, propelled by massive government-led projects in countries like China and India focused on modernizing national libraries and museums, coupled with increasing disposable incomes allowing private educational institutions to invest heavily in digital infrastructure. The Middle East and Africa (MEA) are also emerging, spurred by large-scale projects in nations seeking to establish cultural landmarks and research hubs, necessitating advanced systems for managing newly acquired or excavated collections.

Segment trends reveal a pronounced shift towards cloud-based deployment models, favored for their lower total cost of ownership (TCO), faster deployment, and inherent scalability required for managing exponentially growing collections. Software and platform components retain the largest market share, driven by demand for core cataloging and rights management features, while the services segment, including consulting, implementation, and digitization services, exhibits robust growth due to the complex nature of data migration and system customization. End-user demand is strongest from museums and academic libraries, which require feature-rich systems capable of handling diverse media types, complex object hierarchies, and sophisticated public access features, influencing vendors to prioritize interoperability with online learning platforms and virtual exhibition tools.

AI Impact Analysis on Digital Collections Management System Market

User inquiries regarding the integration of Artificial Intelligence (AI) into Digital Collections Management Systems primarily focus on automation efficiency, enhanced accessibility, and ethical implications. Common questions revolve around how AI can automatically generate rich metadata for previously uncataloged items, the accuracy of computer vision in identifying objects and patterns within visual collections, and the potential for Natural Language Processing (NLP) to unlock insights from vast textual archives like manuscripts and historical correspondence. Users are keen to understand the return on investment (ROI) associated with AI implementation, specifically quantifying the time savings realized by minimizing manual data entry and curation tasks. Furthermore, a significant concern centers on the ethical governance of AI—ensuring algorithmic bias does not skew classification, and maintaining data provenance and integrity when automated systems make descriptive judgments.

The consensus expectation is that AI will fundamentally transform curatorial workflows, shifting human effort from tedious, repetitive cataloging to higher-level interpretation and scholarly engagement. Institutions anticipate using AI-driven recommendation engines to personalize user experiences on public portals, making collections more relevant and discoverable to diverse audiences. Specific interest lies in predictive preservation analytics, where machine learning models forecast the degradation rate of digital assets or identify bottlenecks in digital storage infrastructure, thereby allowing proactive intervention. This adoption of AI is not merely a technological upgrade but a strategic move to handle the exponential growth of digital content while simultaneously enhancing the intellectual depth and discoverability of institutional holdings.

However, the implementation of AI requires substantial investment in computational infrastructure and specialized expertise, leading to user concerns about cost barriers and vendor lock-in. Institutions need DCMS vendors to provide transparent, explainable AI (XAI) features to ensure curators maintain oversight and control over automated decisions. The successful integration of AI is seen as critical for institutions aiming to be leaders in digital scholarship, demanding systems that are flexible enough to incorporate new AI models quickly while adhering to stringent data security and cultural sensitivity standards required when managing historically significant or culturally sensitive materials.

- Automated Metadata Tagging: AI accelerates cataloging by using computer vision (for images/objects) and NLP (for text) to generate descriptive metadata, significantly reducing manual labor.

- Enhanced Search and Discovery: Machine learning improves search relevance and enables semantic searching, allowing users to find connections and concepts rather than just keywords.

- Predictive Preservation: AI models analyze usage patterns, file integrity, and storage health to predict risks and prioritize digital preservation actions efficiently.

- Rights Management Automation: AI assists in identifying copyrighted material or restricted access items by analyzing visual and textual content against rights databases.

- Content Transcription and Recognition: AI facilitates the transcription of historical audio, video, and handwritten documents, making previously inaccessible formats searchable.

- Personalized User Experiences: Recommendation engines driven by AI suggest related collections or research paths to public portal users, increasing engagement.

- Workflow Optimization: AI streamlines internal processes, such as digital asset ingestion, normalization, and quality control, ensuring compliance with institutional standards.

DRO & Impact Forces Of Digital Collections Management System Market

The Digital Collections Management System market is profoundly shaped by a combination of technological drivers, structural restraints, and strategic opportunities. The primary driver is the accelerating volume of global digital content—both born-digital and digitized legacy materials—which mandates scalable and robust management solutions. Alongside this, strong governmental mandates and international standards for cultural heritage preservation, coupled with increasing public and academic demand for open access to information, necessitate the adoption of sophisticated DCMS. The structural restraint primarily involves the significant initial investment required for sophisticated DCMS implementation, including data migration from legacy systems and the requisite training of specialized personnel, which often creates budgetary hurdles for smaller and mid-sized institutions. Furthermore, the complexity of standardizing diverse metadata schemas across different types of collections (e.g., historical artifacts vs. biological samples) poses a significant technological challenge.

Key opportunities within this landscape lie in the expansion of cloud-based services, which democratize access to high-end collection management capabilities by offering pay-as-you-go models and reducing the need for extensive on-premise IT infrastructure. Another major opportunity is the integration of immersive technologies, such as Virtual Reality (VR) and Augmented Reality (AR), enabling institutions to create engaging virtual exhibitions directly leveraging the data managed by the DCMS, thereby monetizing digital assets and increasing public outreach. Impact forces driving market evolution include the accelerating pace of technological obsolescence, pushing institutions towards flexible, service-oriented platforms, and the increasing global awareness of provenance and ethical data stewardship, necessitating systems with transparent tracking and robust rights management functionalities. The global pandemic also served as a catalyst, forcing institutions to prioritize digital access and remote curatorial capabilities, accelerating cloud adoption.

The overall impact forces dictate that successful DCMS vendors must prioritize security, scalability, and seamless integration capabilities. The market favors solutions that can handle heterogeneous data types (3D models, high-resolution media, structured data) within a unified platform. Restraints such as data privacy concerns and varying international regulations regarding data sovereignty necessitate highly localized and compliant software solutions, pushing vendors toward regional specialization. The market's future growth hinges on overcoming implementation complexity through simplified user interfaces and standardized API integration, making advanced digital stewardship tools accessible to a broader range of cultural and corporate institutions globally.

- Drivers: Exponential growth of digital assets; Global mandates for cultural heritage preservation; High demand for public digital access; Advancements in cloud computing infrastructure.

- Restraints: High initial implementation costs and long data migration timelines; Complexity of integrating disparate legacy systems; Lack of standardized metadata practices across sectors; Budgetary constraints in public sector institutions.

- Opportunity: Expanding demand for subscription-based cloud DCMS platforms; Integration with AI/ML for automated curation; Development of AR/VR exhibition tools leveraging collection data; Targeting corporate archives and media management verticals.

- Impact Forces: Rapid technological changes demanding frequent system updates; Increasing need for robust cybersecurity and data integrity features; Regulatory requirements (e.g., GDPR) affecting data storage and access; Competitive pressure leading to functional convergence (cataloging, preservation, and access in one platform).

Segmentation Analysis

The Digital Collections Management System market is comprehensively segmented based on deployment model, component type, application (end-user), and region. This segmentation provides a granular view of market dynamics, revealing preferred technological architectures and specific end-user requirements that drive vendor strategy. The transition away from traditional on-premise installations toward scalable, secure cloud platforms marks the most significant architectural trend, primarily driven by the need to manage constantly increasing data volumes without substantial internal IT investment. The component segmentation highlights the duality of the market, where core software functionality generates the largest immediate revenue, but specialized services—including consultation, customization, and ongoing preservation management—are increasingly critical for long-term customer retention and value.

The application segment clearly delineates market needs, with museums requiring advanced visual asset management, complex object hierarchies, and public engagement tools, while archives demand granular version control, legal hold capabilities, and detailed provenance tracking. Academic libraries focus heavily on interoperability with learning management systems and support for varied scholarly resources. Understanding these nuanced demands allows DCMS vendors to develop tailored solutions, often leveraging modular design to cater to the specific requirements of cultural, educational, and governmental institutions. The increasing sophistication of digital media management is also creating a viable niche in the corporate sector, targeting marketing assets, product histories, and proprietary research data.

Geographically, market growth is heavily skewed towards regions with advanced digital infrastructure and strong cultural investment, though emerging markets are rapidly closing the gap through targeted national digitalization efforts. The analysis confirms that investment decisions are often tied to institutional size, with large national institutions favoring custom enterprise solutions (often hybrid cloud), while smaller local organizations increasingly rely on specialized, accessible Software-as-a-Service (SaaS) models. This diverse demand structure necessitates a flexible go-to-market strategy that addresses scalability, integration capabilities, and TCO across all segments.

- By Deployment:

- On-Premise

- Cloud (SaaS, PaaS)

- Hybrid

- By Component:

- Software/Platform (Core CMS, Cataloging Tools, Search Engines)

- Services (Implementation, Consulting, Training, Maintenance, Digitization Services)

- By Application (End-User):

- Museums and Galleries

- Libraries (Academic, Public, Special)

- Archives and Records Centers (Governmental and Corporate)

- Educational Institutions (Universities and K-12)

- Media and Entertainment

- Historical Societies and Foundations

- By Pricing Model:

- Subscription-Based (SaaS)

- Perpetual License

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Digital Collections Management System Market

The value chain for the Digital Collections Management System market begins with the upstream activities centered around core software development and technology provision. This stage involves the creation of robust database architectures, development of metadata management tools, integration of international standards (such as IIIF for image delivery), and the engineering of scalable cloud environments. Key upstream players include specialized software developers, open-source community contributors, and infrastructure providers (e.g., AWS, Azure) crucial for hosting cloud-native DCMS solutions. R&D focuses heavily on incorporating AI/ML functionalities for automated indexing and enhancing user experience through modern web interfaces and mobile access capabilities, requiring continuous investment in specialized software engineering talent.

The mid-stream activities primarily involve solution integration, customization, and deployment. This is often handled by System Integrators (SIs), specialized consulting firms, or the DCMS vendors themselves. Given the unique and complex nature of collection data, successful deployment requires deep domain expertise to map institutional workflows to system features, ensuring data integrity during migration from legacy formats. Training and post-implementation support are vital services at this stage, focusing on empowering curatorial staff and IT teams to manage the system effectively. The mid-stream process also includes the labor-intensive physical digitization services required to convert analog collections into digital assets suitable for ingestion into the DCMS.

Downstream analysis focuses on the distribution channels and the final consumption by end-users. Distribution is characterized by a mix of direct sales (especially for large governmental or national institutions requiring complex, custom contracts) and indirect channels through channel partners, resellers, and regional service providers who offer localized support and language capabilities. Direct distribution allows vendors to maintain greater control over pricing and customer relationships, while indirect channels provide market reach, especially in geographically dispersed or emerging regions. The ultimate value delivery is realized when end-users—museums, libraries, and archives—successfully leverage the DCMS to manage their collections, disseminate knowledge globally, and ensure long-term digital preservation, thereby fulfilling their core mandates for accessibility and stewardship.

Digital Collections Management System Market Potential Customers

The potential customer base for Digital Collections Management Systems is highly diverse, spanning public, private, and non-profit organizations that possess significant quantities of cultural, historical, scientific, or proprietary digital assets. The most prominent end-users are large cultural heritage institutions, including national libraries, major academic research centers, and globally recognized museums and galleries, which require enterprise-level, highly customizable systems to manage complex data structures and millions of items. These organizations prioritize features such as multilingual support, adherence to strict international preservation standards (OAIS, TRAC), and capabilities for high-volume public web traffic via integrated discovery layers. Their purchasing decisions are often long-term strategic investments, heavily influenced by vendor reputation, longevity, and commitment to future-proofing technology.

The second major cohort includes smaller regional museums, local historical societies, and community colleges. These customers often possess tighter budgets and fewer specialized IT staff, making them ideal targets for scalable, user-friendly, SaaS-based DCMS solutions that minimize infrastructure maintenance and implementation overhead. For this segment, ease of use, robust technical support, and affordability through subscription models are primary purchasing criteria. Furthermore, specialized institutions like zoological and botanical gardens, geological surveys, and scientific research labs also constitute significant potential customers, requiring DCMS solutions tailored to manage scientific data, specimen records, and associated metadata, often necessitating integration with GIS mapping or laboratory information management systems (LIMS).

An expanding segment includes corporate archives and media companies. Corporations, particularly those with long histories (e.g., automotive manufacturers, financial institutions, media studios), are increasingly realizing the intellectual and branding value locked within their historical product designs, advertising campaigns, and proprietary documents. They seek DCMS platforms primarily for intellectual property protection, internal knowledge management, and brand heritage marketing, focusing on features like secure access control, rapid internal search, and digital rights management (DRM) integration. The media and entertainment industry utilizes DCMS (often rebranded as Media Asset Management or MAM systems) to catalog high-resolution film, audio, and production files, highlighting the market convergence between traditional collections management and enterprise content management systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.85 Billion |

| Market Forecast in 2033 | $3.96 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Axiell Group, Lucidea, Ex Libris (Clarivate), Vernon Systems, Gallery Systems, MuseumPlus (Zuse Institute Berlin), Piction, ResourceSpace, Soutron Global, PastPerfect Software, TMS (Blackbaud), Re:discovery Software, CultureConnect, Artlogic, Qi, NetXposure, Adlib Information Systems, Archivum, Preservica, Arkivum. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Digital Collections Management System Market Key Technology Landscape

The Digital Collections Management System (DCMS) market relies heavily on a sophisticated technological stack centered around scalable database technologies, modern web architectures, and advanced data processing capabilities. Key technologies include microservices architectures, which enable modular, flexible system design, allowing institutions to selectively deploy features such as cataloging, preservation modules, or public access portals without overhauling the entire system. Cloud-native development using platforms like Kubernetes and Docker ensures rapid deployment, high availability, and elastic scalability necessary to handle fluctuating user loads and rapidly growing storage requirements. Furthermore, adherence to standardized data exchange protocols, particularly the use of APIs (Application Programming Interfaces), is fundamental for ensuring seamless interoperability with institutional ERP systems, external discovery services, and specialized third-party tools like GIS systems and 3D visualization software, avoiding the creation of data silos.

Metadata management remains the technological core, requiring systems that support complex, hierarchical metadata standards (MARC, Dublin Core, LIDO, EAD, CIDOC CRM) and sophisticated versioning control to track changes to collection records over time. Crucially, digital preservation technologies, including the implementation of the Open Archival Information System (OAIS) reference model and tools for checksum verification and format migration, are non-negotiable for long-term stewardship. The adoption of the International Image Interoperability Framework (IIIF) has become a market standard, revolutionizing how high-resolution images and deep-zoom capabilities are delivered to researchers globally, enabling standardized viewing and comparative analysis across different institutional collections.

Emerging technologies significantly impacting the landscape include Artificial Intelligence (AI) and Machine Learning (ML). Specifically, computer vision algorithms are increasingly used for automated object recognition and indexing of visual materials, while Natural Language Processing (NLP) is applied to extract entities and themes from unstructured text documents, significantly accelerating the cataloging process. Blockchain technology is also being explored by vendors to offer immutable proof of provenance and rights management for high-value digital assets, addressing growing concerns about intellectual property security and authenticity. Vendors that successfully integrate these advanced technologies into user-friendly, configurable interfaces will capture a larger share of the enterprise market, offering competitive advantages beyond basic cataloging functionalities.

Regional Highlights

The Digital Collections Management System market exhibits distinct growth patterns and maturity levels across different global regions, largely correlating with existing cultural heritage investment and technological infrastructure readiness. North America, driven by the United States and Canada, represents the most mature market, characterized by high adoption rates in major museums, prestigious university libraries, and government archives like the Library of Congress and the National Archives. This region sees heavy investment in cutting-edge preservation technologies, large-scale cloud migration projects, and the early adoption of AI for complex digital humanities research. The demand here is focused on advanced features such as sophisticated digital rights management (DRM) and integration with academic discovery services, maintaining its position as the largest revenue generator.

Europe holds a substantial market share, buoyed by strong public funding for culture and rigorous data sovereignty regulations, such as GDPR. Countries like the UK, Germany, and France lead in large-scale national digitalization projects (e.g., Europeana), focusing on robust long-term preservation and open-access mandates. The European market often favors highly customizable systems that comply with diverse national cultural standards and multilingual requirements. The recent emphasis has been on hybrid solutions, balancing cloud scalability with the security and compliance requirements of government-held sensitive historical data, fostering a competitive environment among both local and international DCMS providers.

Asia Pacific (APAC) is projected to be the fastest-growing region, fueled by large-scale national infrastructure modernization projects in emerging economies. Countries such as China, Japan, and South Korea are making significant investments in digitizing vast cultural and historical records, driven by government policy aimed at education and cultural tourism. The market demand in APAC is characterized by the need for scalable solutions that can manage non-Latin character sets and handle extremely high data volumes, focusing heavily on implementation services and training. Latin America and the Middle East & Africa (MEA) are emerging, with growth concentrated in wealthy nations (e.g., UAE, Saudi Arabia) establishing world-class cultural institutions and universities. These regions show a preference for modular, turnkey cloud solutions that can be rapidly deployed to manage newly established collections, often bypassing legacy system dependency.

- North America: Market leader; High investment in AI and cloud DCMS; Focus on advanced DRM and academic integration; Dominance by major commercial vendors.

- Europe: Strong regulatory environment (GDPR); High governmental funding for preservation; Focus on multilingual support and adherence to European cultural standards; Significant adoption of hybrid cloud models.

- Asia Pacific (APAC): Fastest growth rate; Driven by national digitalization initiatives (China, India); High demand for implementation services and solutions supporting large-scale data ingestion and local language scripts.

- Latin America (LATAM): Emerging market; Growing institutional interest in affordable SaaS solutions; Focus on initial digitization projects and basic collections management needs.

- Middle East and Africa (MEA): Growth centered around cultural development and educational hub creation; Preference for modular, rapidly deployable cloud systems; Opportunities in specialized archival projects related to regional history.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Digital Collections Management System Market.- Axiell Group (Axiell Collections, Axiell EMu)

- Lucidea (Argus, Inmagic DB/TextWorks)

- Ex Libris (Clarivate) (Rosetta, Alma D)

- Vernon Systems (Vernon CMS)

- Gallery Systems (The Museum System - TMS)

- MuseumPlus (Zuse Institute Berlin)

- Piction (Piction Digital Asset Management)

- ResourceSpace

- Soutron Global

- PastPerfect Software

- Re:discovery Software (re:discovery Proficio)

- CultureConnect

- Artlogic

- Qi (Quria)

- NetXposure

- Adlib Information Systems

- Archivum

- Preservica

- Arkivum

- Blackbaud (through TMS systems)

Frequently Asked Questions

Analyze common user questions about the Digital Collections Management System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between DCMS and standard DAM (Digital Asset Management) systems?

DCMS (Digital Collections Management Systems) are specifically engineered for the complex needs of cultural institutions, focusing on detailed hierarchical metadata (like provenance and object history), international preservation standards (OAIS, TRAC), complex rights management for non-commercial use, and integrating public access/discovery layers. Standard DAM systems are typically focused on marketing, media production, and commercial workflow efficiency, lacking the deep curatorial and preservation functionalities essential for long-term cultural stewardship.

Which deployment model—Cloud or On-Premise—is dominating the DCMS market and why?

The Cloud deployment model (SaaS/PaaS) is rapidly dominating the DCMS market. Cloud solutions offer superior scalability to manage exponential data growth, reduce the initial capital expenditure and ongoing IT overhead for institutions, and facilitate collaborative remote access for curatorial staff. While On-Premise systems are still used by large government archives with strict data sovereignty requirements, the flexibility and disaster recovery capabilities of the cloud make it the preferred choice for new deployments.

How is AI specifically improving curatorial workflows in Digital Collections Management?

AI primarily enhances curatorial workflows through automation. Machine Learning and Computer Vision are used for automated metadata tagging, object recognition in images, and transcription of handwritten or audio/video content. This automation dramatically accelerates the cataloging backlog, allowing human curators to redirect their focus from tedious data entry to high-value scholarly interpretation and engagement with the collection.

What are the key challenges institutions face when migrating to a new DCMS platform?

The main challenges during DCMS migration include the complexity of data cleaning and normalization, especially when dealing with decades of inconsistent legacy metadata; the high cost and time required for comprehensive data transfer; and managing change resistance among long-term staff. Successful migration requires rigorous planning, specialized data mapping services, and comprehensive staff training focused on the new system's operational logic.

What are the critical features DCMS users prioritize for digital preservation and access?

For preservation, users prioritize adherence to the OAIS reference model, automated file format validation, migration pathways to combat technological obsolescence, and robust fixity checking (checksums) to ensure data integrity. For access, critical features include IIIF compliance for high-resolution media delivery, sophisticated semantic search capabilities, strong integration with public-facing discovery platforms, and granular access control for restricted materials, all contributing to efficient and secure scholarly usage.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager