Digital Dealer Platform Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432554 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Digital Dealer Platform Market Size

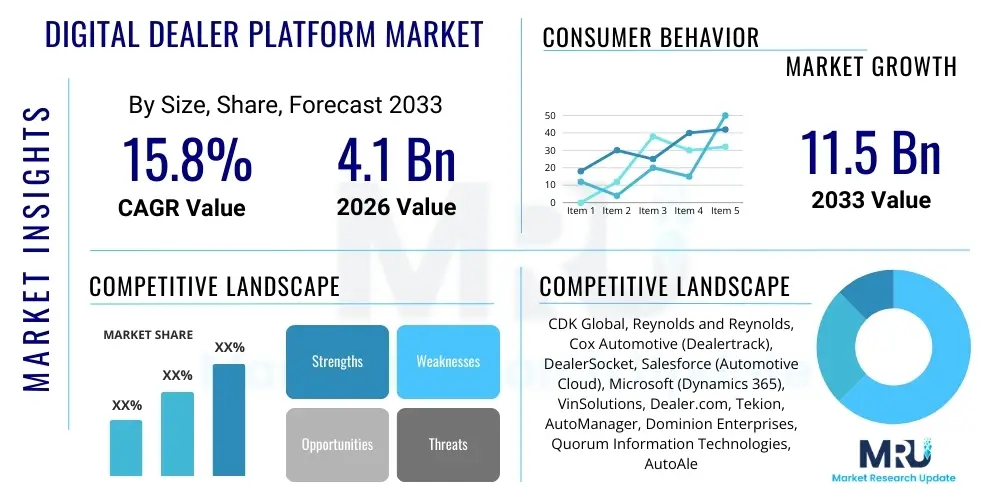

The Digital Dealer Platform Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 11.5 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily driven by the accelerating digitalization of automotive retail processes, consumer demand for seamless omnichannel experiences, and the necessity for dealerships to optimize operational efficiency and manage complex inventory streams in real-time. The shift from traditional sales models to integrated digital ecosystems, encompassing lead management, financing, and service scheduling, fundamentally underpins this expansion.

The valuation reflects a significant investment spike in cloud-based solutions and advanced data analytics capabilities, crucial for transforming how dealers interact with prospective buyers. Market growth is further amplified by small and medium-sized dealerships recognizing the competitive imperative of adopting advanced platform technologies to maintain market relevance and improve Customer Lifetime Value (CLV). Geographically, mature automotive markets in North America and Europe currently dominate the revenue share, though emerging markets in Asia Pacific are expected to witness the highest incremental growth due to rapid urbanization and increasing consumer affluence supporting vehicle purchases.

Digital Dealer Platform Market introduction

The Digital Dealer Platform Market encompasses sophisticated software solutions and integrated ecosystems designed specifically for automotive dealerships to manage core business operations across the entire customer journey, from initial inquiry to vehicle maintenance. These platforms serve as the central nervous system for dealerships, consolidating data and functionalities previously spread across disparate systems, including Customer Relationship Management (CRM), Dealer Management Systems (DMS), inventory synchronization tools, digital retailing interfaces, and integrated financing modules. The primary objective of these platforms is to facilitate an end-to-end, seamless, and personalized car buying experience, catering to the modern consumer's preference for researching, initiating, and often concluding vehicle transactions online.

Major applications of Digital Dealer Platforms include streamlined inventory management across multiple physical and digital locations, advanced lead generation and nurturing via digital marketing tools, efficient workflow automation for sales and service departments, and enhanced data analytics for predictive demand forecasting and personalized customer engagement strategies. The integrated nature of these platforms significantly reduces operational friction, improves data accuracy, and ensures compliance with increasingly stringent regional data privacy regulations. Furthermore, they are pivotal in optimizing used car valuation and trade-in processes through rapid, data-driven assessment tools, accelerating the sales cycle and maximizing profitability per transaction.

Key driving factors propelling the market include the irreversible trend towards automotive e-commerce, where consumers expect full transaction transparency and remote capabilities; the necessity for competitive differentiation through superior customer service; and the pressure on dealerships to achieve economies of scale by automating repetitive administrative tasks. The platforms deliver significant benefits such as increased sales conversion rates, reduced operating costs, improved employee productivity, and a quantifiable boost in customer satisfaction scores, making them indispensable investments for modern automotive retail enterprises aiming for sustainable growth and operational resilience in a volatile economic landscape.

Digital Dealer Platform Market Executive Summary

The Digital Dealer Platform Market is characterized by intense innovation driven by business trends prioritizing omnichannel integration and hyper-personalization of the automotive purchasing process. Current business trends indicate a strong move toward platform consolidation, where dealerships prefer unified solutions offering modules for marketing, sales, F&I (Finance and Insurance), and after-sales service, rather than managing multiple single-function vendors. This consolidation is pushing solution providers to enhance their API ecosystems and integrate advanced analytics engines capable of deriving actionable insights from vast amounts of consumer behavior and inventory data. Significant investment is being channeled into refining the digital showroom experience, leveraging high-fidelity visuals and virtual reality (VR) tours to bridge the physical and digital retailing gaps effectively. Furthermore, the rising popularity of subscription-based vehicle ownership models is necessitating platform updates to manage recurring revenue streams and complex fleet logistics efficiently.

Regionally, North America maintains its leadership due to high technological readiness, stringent regulatory environments encouraging digital transparency, and significant early adoption of cloud-based DMS and CRM systems among large dealer groups. Europe, characterized by diverse national markets and high consumer expectation regarding data privacy (GDPR), shows strong growth in platforms specializing in secure, transparent transaction processing and compliance management. Asia Pacific (APAC) is emerging as the fastest-growing region, fueled by massive market volumes in China and India, escalating smartphone penetration rates among consumers, and government initiatives promoting digitalization in the retail sector. Investments in localized content and language support are critical success factors for vendors operating across the diverse APAC landscape.

Segment trends highlight the dominance of cloud-based deployment models due to their scalability, lower Total Cost of Ownership (TCO), and rapid implementation cycles compared to legacy on-premise systems. Functionality-wise, the Digital Retailing segment is witnessing explosive growth as dealers race to offer end-to-end digital transaction capabilities, including remote documentation signing and home delivery scheduling. Large dealer groups (Enterprise segment) represent the highest revenue capture, demanding highly customized, integrated solutions, while Small and Medium Dealers (SMDs) are increasingly adopting modular, Software-as-a-Service (SaaS) offerings that provide essential functionality without prohibitive capital expenditure, thus democratizing access to high-end digital tools.

AI Impact Analysis on Digital Dealer Platform Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Digital Dealer Platform Market frequently revolve around optimizing customer interaction, improving predictive analytics accuracy, and enhancing operational efficiency. Common user questions include: "How can AI personalize the car buying journey better than current systems?", "What role does Machine Learning play in dynamic pricing and inventory forecasting?", "Will AI automate sales roles, and how can platforms ensure lead quality using AI?", and "What are the ethical implications of using AI in automotive financing and recommendation engines?" Based on these themes, key user concerns center on the tangible return on investment (ROI) from AI implementation, the complexity of integrating advanced algorithms into existing DMS/CRM infrastructure, and ensuring that AI-driven personalization respects customer data privacy while delivering meaningful, relevant vehicle recommendations and service reminders. Expectations are high regarding AI's ability to drive significant competitive advantages, particularly in areas requiring complex data analysis, such as identifying fraud risks and predicting vehicle servicing needs before component failure.

AI is fundamentally transforming the DDP market by embedding intelligence into every module, moving beyond basic automation to true predictive and prescriptive capabilities. AI-powered chatbots and virtual sales assistants handle initial qualification and repetitive inquiries 24/7, freeing up human staff for complex sales negotiations. Machine learning models analyze historical sales data, web traffic patterns, and external economic indicators to provide dynamic pricing recommendations, ensuring inventory competitiveness and maximizing margin potential. Furthermore, sophisticated algorithms are used for enhanced F&I product recommendations tailored precisely to individual buyer risk profiles and historical preferences, improving both penetration rates and compliance adherence. This shift elevates the platform from a management tool to a strategic intelligence hub, offering dealers unprecedented foresight into market shifts and consumer demands.

- AI-driven Predictive Maintenance: Utilizing vehicle telematics data to forecast component failures, scheduling proactive service appointments, and optimizing service bay utilization.

- Hyper-Personalized Customer Journey Mapping: Employing ML to analyze behavior across digital touchpoints (website, social media, email) and deliver tailored content, financing options, and vehicle recommendations in real-time.

- Intelligent Lead Scoring and Routing: Using complex algorithms to assess the likelihood of conversion for each lead, automatically prioritizing high-value prospects and routing them to the most appropriate sales agent.

- Dynamic Inventory Optimization: ML models constantly adjust stocking levels, trade-in valuations, and transfer strategies based on local market demand signals and regional sales velocity data.

- Natural Language Processing (NLP) in Communication: Enhancing customer communication analysis from emails and chat logs to extract sentiment, identify pain points, and provide immediate, relevant automated responses.

DRO & Impact Forces Of Digital Dealer Platform Market

The Digital Dealer Platform Market is shaped by a powerful confluence of drivers and restraining factors, alongside compelling opportunities that dictate its future growth trajectory. The principal drivers include the pervasive consumer shift toward conducting vehicle research and purchasing transactions online, demanding end-to-end digital retailing capabilities from dealerships. Furthermore, the intense competitive pressure within the automotive retail landscape mandates the adoption of advanced platforms to reduce operational inefficiencies, streamline complex regulatory compliance procedures, and gain a holistic, data-driven view of the customer lifecycle. The rapid expansion of connected vehicle technology also acts as a major driver, generating vast amounts of data that DDPs must integrate and analyze to enable proactive service offerings and personalized marketing.

Conversely, significant restraints hinder market acceleration, most notably the high initial implementation costs and the complexity associated with integrating new digital platforms with often outdated legacy Dealer Management Systems (DMS) still operational in many smaller dealerships. Concerns regarding data security and privacy remain paramount, particularly in regions with strict regulations, requiring vendors to invest heavily in robust cybersecurity measures, which increases the overall platform cost. Furthermore, resistance to technological change among long-tenured dealership staff and the associated steep learning curve often necessitate substantial training investments, presenting a practical barrier to rapid, large-scale adoption, particularly among independent dealers.

Opportunities for market growth are abundant, primarily revolving around the expansion of AI and Machine Learning capabilities to unlock deeper predictive insights for inventory management, financing risk assessment, and customer churn reduction. The untapped potential in the used car market, requiring sophisticated digital platforms for rapid valuation, certification, and listing across multiple channels, presents a substantial revenue stream. Additionally, the proliferation of electric vehicles (EVs) and hybrid models necessitates specialized platform features for managing battery health data, charging infrastructure integration, and unique maintenance schedules, offering DDP providers a fertile area for product differentiation and specialized segment growth, particularly in emerging economies where EV adoption is projected to soar dramatically post-2025.

Segmentation Analysis

The Digital Dealer Platform Market is meticulously segmented based on Deployment Model, Application, and Dealer Size, reflecting the diverse operational needs and technological maturity across the global automotive retail industry. Understanding these segmentations is critical for vendors to tailor their offerings, pricing structures, and go-to-market strategies effectively. The deployment split between Cloud-based (SaaS) and On-premise solutions highlights the ongoing migration away from traditional server-dependent infrastructure, favoring the flexibility and scalability offered by the cloud. Application segmentation reveals the crucial functional areas where dealers seek immediate digital transformation benefits, ranging from core ERP functions (DMS) to strategic customer engagement tools (CRM/Marketing) and vital financial services (F&I). Finally, segmentation by dealer size determines the necessary complexity, integration depth, and pricing models required, distinguishing the needs of massive multinational dealer groups from those of independent or small regional dealerships.

Cloud-based solutions dominate the growth trajectory due to lower upfront capital requirements and the ability to receive continuous, seamless software updates, ensuring compliance and access to the latest security protocols and feature enhancements. Within the application segment, the rise of true digital retailing modules, enabling customers to complete the entire transaction—including valuation, credit checks, and documentation—online, is generating the largest revenue contribution growth. For dealer size, the large dealer group segment drives the highest overall value, often requiring comprehensive, highly integrated platforms that can manage complex multi-franchise, multi-location operations, while the small and medium dealer segment is characterized by rapid adoption rates of simplified, affordable subscription-based platforms that streamline essential operations like inventory syndication and basic lead management, offering scalability as their businesses grow.

- By Deployment Model:

- Cloud-based (SaaS)

- On-premise

- By Application:

- Dealer Management System (DMS)

- Customer Relationship Management (CRM)

- Digital Retailing and Marketing

- Inventory Management

- Finance and Insurance (F&I)

- Service and Parts Management

- By Dealer Size:

- Small and Medium Dealers (SMDs)

- Large Dealer Groups and Enterprises

Value Chain Analysis For Digital Dealer Platform Market

The value chain for the Digital Dealer Platform Market commences with Upstream Activities involving software development and intellectual property creation, where technology providers focus on R&D for AI, cloud architecture, data security, and specialized automotive retail APIs. This stage requires significant investment in data scientists, cloud engineers, and automotive domain experts to build robust, scalable, and compliant software modules. Key upstream components include core database infrastructure, advanced analytics engines, and third-party integrations with vehicle manufacturers' data feeds (OEM systems) and major financial institutions for real-time credit application processing. Strategic alliances and partnerships at this stage are crucial for vendors to acquire specialized technologies, such as advanced fraud detection algorithms or sophisticated geospatial mapping tools necessary for logistics management.

Moving through the value chain, the Midstream involves the crucial activities of platform integration, customization, and implementation. Given the variability in dealership operations and legacy systems, professional services related to configuring the platform—including data migration from old DMS systems, workflow optimization, and employee training—represent a significant portion of the total project value. Distribution channels are generally categorized into Direct and Indirect methods. Direct distribution involves platform vendors selling and servicing the software directly to large dealer groups, offering highly customized enterprise contracts and dedicated support teams. Indirect distribution relies heavily on channel partners, Value-Added Resellers (VARs), and system integrators who market modular solutions, particularly to the SMD segment, often bundling the software with local support and specialized hardware if required.

The Downstream segment focuses on deployment, ongoing support, and continuous feature enhancement. Post-implementation support, including managed services, help desk assistance, and software updates (especially critical for compliance and security patches), ensures customer satisfaction and high renewal rates. The effectiveness of the DDP is directly tied to the quality of the technical support and the vendor's ability to quickly adapt the platform to evolving market demands, such as new vehicle models, regulatory shifts, or emerging digital marketing channels. This phase emphasizes high availability, rapid response times, and proactive monitoring to ensure the platform remains the reliable operational backbone of the dealership, maximizing the dealer's ongoing ROI from the technology investment.

Digital Dealer Platform Market Potential Customers

The primary End-Users or Buyers of Digital Dealer Platforms are diverse entities within the automotive ecosystem, centrally encompassing franchised new vehicle dealerships and large, independent used vehicle superstores. These entities require comprehensive platforms to manage their high-volume sales processes, extensive inventory portfolios, and complex customer service schedules. Franchised dealerships, often representing multiple Original Equipment Manufacturers (OEMs), specifically require platforms that can integrate seamlessly with proprietary OEM interfaces for parts ordering, warranty claims processing, and vehicle recall tracking, necessitating specialized compliance modules within the DDP suite. Their purchasing decisions are driven by the need for operational synergy between their sales, F&I, and service departments.

A second significant customer segment includes large automotive dealer groups and enterprise chains operating across multiple regions or countries. These customers demand highly scalable, centralized DDP solutions that offer consolidated reporting, standardized operational protocols across all locations, and specialized tools for inter-dealership inventory transfers and centralized marketing campaign management. For these enterprise clients, features like robust multi-currency and multi-language support, alongside sophisticated security architecture, are non-negotiable requirements. The procurement cycle for this segment is typically longer, involving complex RFP processes and proof-of-concept stages to ensure the platform meets their extensive, customized needs.

Finally, niche segments such as specialized commercial fleet operators, rental car agencies managing large fleets, and even large service and parts distributors are emerging as potential customers. Although their needs are less focused on consumer sales transactions, they require DDP elements like advanced inventory tracking, automated fleet maintenance scheduling, and sophisticated parts management modules to optimize their asset utilization and minimize vehicle downtime. The increasing sophistication of the DDP market is enabling vendors to create specialized, modular solutions that cater to the unique logistics and lifecycle management requirements of these B2B-focused end-users, expanding the overall addressable market beyond traditional consumer dealerships and offering substantial growth opportunities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 11.5 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CDK Global, Reynolds and Reynolds, Cox Automotive (Dealertrack), DealerSocket, Salesforce (Automotive Cloud), Microsoft (Dynamics 365), VinSolutions, Dealer.com, Tekion, AutoManager, Dominion Enterprises, Quorum Information Technologies, AutoAlert, Dealer Inspire, Snap-on Business Solutions, Xtime, PureCars, Serti, Autosoft, NetLook |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Digital Dealer Platform Market Key Technology Landscape

The technological backbone of the Digital Dealer Platform Market is rapidly evolving, moving away from monolithic, proprietary software toward flexible, API-driven, and highly scalable cloud architectures. Core technology involves the widespread adoption of multi-tenant, microservices-based cloud platforms (primarily AWS, Azure, and Google Cloud Platform) which enable vendors to offer Software-as-a-Service (SaaS) models with superior uptime and faster deployment cycles. Critical technological requirements include robust data integration frameworks that utilize standardized APIs (such as those for Vehicle Identification Number – VIN decoding and OEM data synchronization) to ensure seamless flow of information between a dealership’s internal systems and external market data sources, including third-party listing sites and consumer credit bureaus. This shift facilitates real-time data synchronization, which is paramount for maintaining accurate inventory listings and instant F&I approval processes.

A second major technological trend is the deep integration of Artificial Intelligence (AI) and Machine Learning (ML) across all platform modules. Key AI implementations include natural language processing (NLP) for advanced sentiment analysis of customer communications, predictive modeling for demand forecasting, and computer vision technologies deployed for automated vehicle photography processing and damage assessment during trade-in evaluations. Furthermore, the adoption of blockchain technology is beginning to gain traction, particularly in applications related to secure digital document transfer, verifiable vehicle history reports, and transparent financing contracts, offering enhanced security and reducing the potential for fraud, though its implementation remains nascent compared to established cloud and AI technologies.

Crucially, the user interface (UI) and user experience (UX) are being prioritized through the implementation of responsive design frameworks and mobile-first development strategies, ensuring that dealer staff can manage operations seamlessly whether they are on a desktop in the finance office or utilizing a tablet on the lot. Security remains foundational, relying on technologies such as multi-factor authentication (MFA), continuous penetration testing, and compliance-focused data encryption (both in transit and at rest) to protect sensitive consumer financial data and proprietary dealership operational information from escalating cyber threats, guaranteeing adherence to global standards like ISO 27001 and regional mandates like CCPA and GDPR.

Regional Highlights

- North America (NA): Dominates the global market share primarily due to the presence of large, technologically advanced dealer groups, high consumer expectation for digital transaction capabilities, and early, widespread adoption of integrated DMS and CRM platforms. The U.S. market is characterized by intense competition among platform providers, rapid deployment of full digital retailing solutions, and significant investment in AI-driven tools for lead generation and dynamic pricing optimization. Strict state-level regulatory variations necessitate highly flexible and compliant platform architecture, driving innovation in secure digital contracting and remote transaction processing. Canada also represents a mature market with high penetration rates for established DDP vendors.

- Europe: Exhibits strong growth, driven by stringent regulatory frameworks, particularly GDPR, which mandates high standards for data privacy and consent management, pushing platforms to innovate in secure data handling. The market is fragmented due to diverse national languages and regulatory environments, meaning vendors often need to provide localized and modular solutions. Key growth areas include the UK, Germany, and France, where the push toward vehicle electrification (EVs) is creating demand for platforms capable of managing new sales models (agency model) and specific EV service requirements. Cloud adoption is accelerating, especially among medium-sized independent dealers seeking efficiency gains.

- Asia Pacific (APAC): Positioned as the fastest-growing region, fueled by the massive expansion of the automotive sector in countries like China, India, and Southeast Asia, coupled with high mobile and internet penetration. The market is characterized by a "leapfrog" effect, often skipping intermediary technologies and directly adopting advanced cloud-based solutions. Demand is high for platforms that can manage complex logistics in densely populated urban centers, support multi-language interfaces, and integrate with local digital payment ecosystems. OEM captive finance companies and large national dealer chains are the primary revenue drivers, investing heavily to standardize disparate operations across vast geographic areas and capitalize on surging middle-class consumer demand.

- Latin America (LATAM): Showing steady, though moderated, growth, concentrated mainly in major economies like Brazil and Mexico. Market adoption is motivated by the need to combat operational inefficiencies and mitigate high administrative costs. Challenges include economic volatility, less standardized market data, and connectivity issues in remote areas. Platforms succeeding here typically offer robust, offline capabilities and focus on core functionalities such as inventory control and financial management, aiming to improve transparency and reduce risk in complex financing environments.

- Middle East and Africa (MEA): Emerging market with high potential, particularly in the GCC (Gulf Cooperation Council) countries due to high per capita income and luxury vehicle consumption. Growth is driven by strategic governmental visions focused on smart city development and technological modernization. Dealer groups in Saudi Arabia and the UAE are investing in high-end DDP solutions to deliver premium, seamless customer experiences that match global standards, focusing particularly on digital retailing for high-value transactions and leveraging platforms for sophisticated regional marketing campaigns targeting affluent demographics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Digital Dealer Platform Market. These entities are actively investing in cloud technologies, AI, and comprehensive digital retailing tools to maintain market dominance and drive industry transformation. Their strategies involve aggressive M&A activity, strategic partnerships with third-party data providers, and continuous feature updates to enhance platform integration capabilities and expand geographical reach.- CDK Global LLC

- Reynolds and Reynolds Company

- Cox Automotive (Dealertrack, VinSolutions, Dealer.com)

- DealerSocket (now part of Solera)

- Tekion Corp.

- Salesforce (Automotive Cloud Solutions)

- Dominion Enterprises

- Quorum Information Technologies Inc.

- AutoManager

- Snap-on Business Solutions (Mitchell 1)

- AutoAlert

- Dealer Inspire

- Xtime (A Cox Automotive Brand)

- Serti

- Autosoft

- Wilde Tools

- PureCars

- NetLook

- Wipfli LLP (Consulting services with platform focus)

- Microsoft (Dynamics 365 for Automotive Retail)

Frequently Asked Questions

Analyze common user questions about the Digital Dealer Platform market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a DMS and a comprehensive Digital Dealer Platform (DDP)?

The Dealer Management System (DMS) historically focuses on core internal operational tasks like accounting, parts inventory, and payroll. A comprehensive Digital Dealer Platform (DDP) is an integrated ecosystem that incorporates the DMS functions while adding customer-facing digital retailing, advanced CRM, AI-driven marketing, and omnichannel engagement tools to manage the entire modern customer journey seamlessly, bridging the gap between online and in-store operations.

How is AI impacting the profitability of automotive dealerships using these platforms?

AI significantly impacts profitability by optimizing pricing strategies (dynamic pricing based on real-time market data), improving lead conversion rates through intelligent scoring and automated follow-up, and reducing operational costs via predictive service scheduling and workflow automation. AI ensures resources are allocated to the most valuable opportunities, directly boosting gross margins and improving overall operational efficiency.

What are the key integration challenges when implementing a new Digital Dealer Platform?

Key challenges include migrating complex historical data from outdated legacy systems (DMS/CRM), ensuring seamless API connectivity with third-party services (OEMs, lenders, advertising channels), and managing organizational change resistance among long-term staff, necessitating intensive training and robust post-implementation support to achieve high user adoption and data integrity.

Which deployment model, cloud or on-premise, is dominating market growth?

Cloud-based (SaaS) deployment is rapidly dominating market growth. Cloud models offer superior scalability, lower initial capital expenditure, continuous automated updates (crucial for security and feature parity), and enhanced accessibility, which appeals particularly to Small and Medium Dealers (SMDs) and large dealer groups seeking centralized management across disparate geographical locations.

What role does the Digital Dealer Platform play in supporting Electric Vehicle (EV) sales and service?

DDPs are evolving to support EV requirements by integrating specialized modules for managing battery health diagnostics, optimizing service workflows tailored to less frequent but highly specialized EV maintenance needs, and facilitating compliance with new agency sales models often favored by EV manufacturers, ensuring the platform remains future-proofed against industry shifts.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager