Digital Dosing Pump Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438507 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Digital Dosing Pump Market Size

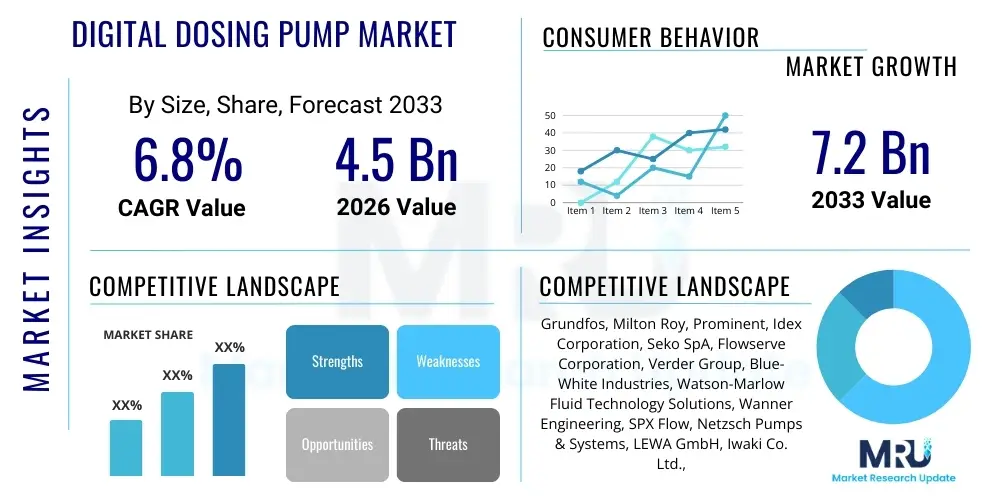

The Digital Dosing Pump Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Digital Dosing Pump Market introduction

Digital dosing pumps, often referred to as smart metering pumps, represent a significant advancement over traditional mechanically driven pumps. These devices utilize microprocessors and advanced electronic controls to achieve highly accurate and precise chemical injection across various industrial and municipal applications. Unlike analog pumps, digital pumps allow operators to input precise flow rates and control parameters via a digital interface, ensuring optimal chemical consumption and operational efficiency. The integration of advanced features such as remote monitoring, data logging, and automatic flow compensation makes them indispensable in processes requiring strict adherence to quality and environmental standards, particularly in water treatment and complex chemical processing.

The primary application sectors leveraging digital dosing pump technology include water and wastewater management, where precise pH balancing and disinfection are critical, and the chemical industry, which demands accurate mixing and dispensing of corrosive or viscous fluids. Additionally, the pharmaceutical and food & beverage industries rely on these pumps for sterile and highly consistent ingredient dosing. The core benefit derived from utilizing digital dosing technology is enhanced reliability and reduced maintenance burden due to the elimination of complex mechanical linkages, coupled with substantial cost savings through optimized chemical usage and minimizing over-dosing.

Key driving factors accelerating market penetration include stringent global environmental regulations mandating better water quality management and industrial discharge standards. Furthermore, the increasing adoption of automation and Industrial Internet of Things (IIoT) technologies within manufacturing plants is creating a favorable ecosystem for integrating smart dosing solutions. The inherent need for operational transparency, predictive maintenance capabilities, and high precision in specialized manufacturing processes cements the digital dosing pump's position as a critical component in modern fluid control systems.

Digital Dosing Pump Market Executive Summary

The global Digital Dosing Pump Market is characterized by robust growth fueled by the convergence of industrial automation and escalating regulatory pressures concerning environmental safety and process efficiency. Business trends indicate a strong shift towards pumps equipped with advanced connectivity features, enabling real-time diagnostics and integration with centralized control systems (SCADA). Manufacturers are heavily investing in developing compact, modular units that offer flexibility in installation and higher material compatibility for handling challenging chemicals. This technological evolution is driving demand, particularly in sectors where process uptime and minimization of chemical waste are paramount, leading to competitive pricing strategies focused on total cost of ownership rather than initial procurement cost.

Regionally, Asia Pacific is positioned as the fastest-growing market, driven by rapid industrialization, massive infrastructure projects related to water and sanitation in countries like China and India, and increasing awareness regarding process automation benefits. North America and Europe, while mature, exhibit high adoption rates due to strict governmental mandates on industrial effluent treatment and the widespread modernization of existing water utilities. These established regions prioritize energy efficiency and integration capabilities, demanding pumps that comply with complex network protocols and contribute to overall smart facility management systems.

Segment trends highlight the dominance of the water and wastewater treatment application segment, which utilizes digital dosing pumps extensively for flocculation, chlorination, and nutrient removal processes. Technologically, the solenoid-driven pump segment retains a large market share due to its cost-effectiveness and precise low-volume dispensing capabilities, yet the motor-driven segment, particularly those utilizing stepper motor technology, is gaining momentum due to its capability to handle high flow rates and viscous fluids with superior accuracy and durability, catering specifically to the heavy chemical and oil & gas industries.

AI Impact Analysis on Digital Dosing Pump Market

Analysis of common user questions reveals significant interest in how Artificial Intelligence can transition dosing pump operations from reactive maintenance schedules to predictive, optimized systems. Users frequently inquire about the feasibility of AI algorithms analyzing historical dosing data and environmental sensor feedback (e.g., pH, conductivity) to dynamically adjust pump outputs, thus preventing costly over-dosing or under-dosing events. Key concerns revolve around the complexity and cost of integrating AI-powered control systems with legacy infrastructure and ensuring data security for sensitive process parameters. Expectations are high regarding AI's ability to minimize human error, automate calibration routines, and ultimately guarantee process stability and regulatory compliance with unparalleled precision.

The application of AI and Machine Learning (ML) is fundamentally transforming the operational paradigm of digital dosing pumps, moving beyond simple programmed control. AI models can process multivariate data streams—including temperature, pressure, chemical concentration, and flow rate deviations—to identify subtle shifts in system equilibrium. This capability allows the AI to predict component failure months in advance, triggering condition-based maintenance alerts, thereby drastically reducing unplanned downtime and optimizing inventory management for spare parts.

Furthermore, AI facilitates highly sophisticated chemical optimization. Instead of relying on static process setpoints, ML algorithms can continuously learn the unique hydraulic characteristics and chemical demand curves of a specific industrial process. For example, in cooling tower water treatment, an AI system can adjust biocide and scale inhibitor injection based on real-time microbiological activity and water evaporation rates, ensuring maximum efficacy while minimizing environmental impact and chemical procurement costs. This level of dynamic optimization is unreachable using traditional PID controllers.

The integration of deep learning techniques into the firmware of high-end digital dosing pumps is also enabling self-calibration and fault diagnosis. These smart pumps can automatically detect anomalies in their motor current, pulsation patterns, or valve response times, comparing them against millions of operational cycles stored in a cloud database. This self-awareness reduces the need for frequent manual verification and significantly extends the mean time between failures, positioning the digital dosing pump not just as a mechanical device, but as an integral, intelligent node within a broader process control ecosystem.

- Implementation of predictive maintenance schedules based on real-time operational data analysis.

- Dynamic, closed-loop control of chemical dosage rates optimized by ML algorithms for enhanced efficiency.

- Automated calibration and self-correction mechanisms reducing operational drift and human intervention.

- Improved anomaly detection, identifying equipment wear or process disturbances before critical failure occurs.

- Integration with Digital Twins for simulation and optimization of chemical injection scenarios.

DRO & Impact Forces Of Digital Dosing Pump Market

The Digital Dosing Pump Market dynamics are strongly shaped by compelling drivers rooted in regulatory requirements and operational imperatives, counterbalanced by inherent market restraints related to capital expenditure and technical complexity. The primary driver is the global mandate for higher efficiency in water treatment and manufacturing, driven by legislation such as the European Union's Water Framework Directive and stringent EPA standards in North America, which necessitate precise chemical metering to meet discharge limits. Concurrently, the increasing focus on sustainable practices and resource conservation pushes industrial users towards digital solutions that minimize chemical wastage. These drivers create an undeniable force towards adoption, particularly in large-scale infrastructure projects and high-value manufacturing sectors.

However, the market faces significant restraints, notably the high initial investment required for sophisticated digital pumping systems compared to conventional analog pumps. Furthermore, integrating these advanced systems, which often require complex networking and specialized software for remote control and data analytics, poses a challenge, particularly for Small and Medium Enterprises (SMEs) lacking extensive technical infrastructure or skilled personnel for maintenance and operation. Another constraint relates to material compatibility; ensuring that the pump head materials can withstand the high corrosivity of diverse chemicals across all application temperatures and pressures remains a critical design limitation that dictates pump lifespan and reliability.

Opportunities in this market are abundant, primarily revolving around the untapped potential of smart industrialization and the expansion of monitoring capabilities through IoT connectivity. The emergence of affordable sensor technology combined with secure cloud platforms presents an opportunity for manufacturers to offer Dosing-as-a-Service (DaaS) models, lowering the entry barrier for smaller entities. Additionally, developing highly specialized digital pumps tailored for niche, high-growth sectors such as green hydrogen production and advanced semiconductor manufacturing, which require ultra-high purity and precision dosing, offers lucrative avenues for future expansion and product differentiation, mitigating the impact of existing restraints.

The impact forces influencing the market trajectory are primarily technological innovation, where advancements in solenoid and stepper motor technology drive greater accuracy and turndown ratios, coupled with environmental forces pushing sustainability. Economic forces dictate the pace of industrial capital expenditure, while political and regulatory forces directly influence mandatory compliance standards. The net effect is a strong, sustained pull towards high-precision digital solutions, marginally slowed by economic volatility affecting industrial investment cycles.

Segmentation Analysis

The Digital Dosing Pump Market is comprehensively segmented based on technology, application, and end-user, providing a granular view of demand across various industrial ecosystems. Understanding these segmentations is critical for manufacturers to tailor product development, marketing strategies, and distribution channels effectively. The core differentiation lies in the pumping mechanism—solenoid versus motor-driven—which dictates the flow capacity, pressure handling capabilities, and overall accuracy suitable for specific industrial requirements. The solenoid segment typically serves low-flow, high-precision needs, whereas motor-driven pumps (including hydraulic and mechanical diaphragm variants) are deployed for high-volume, high-pressure applications common in heavy industries.

Application segmentation reveals the diverse utility of these pumps, ranging from essential services like municipal water purification to specialized manufacturing processes within the chemical and pharmaceutical industries. The water and wastewater treatment segment dominates due to the universal necessity for chemical coagulation, disinfection, and pH correction worldwide. However, specialized sectors, such as oil and gas (for corrosion inhibition and chemical injection) and power generation (for boiler water treatment), represent critical high-value segments demanding extremely robust and reliable digital solutions capable of operating in harsh environments.

From an end-user perspective, the market is broadly divided into industrial (further sub-segmented into various manufacturing and resource extraction sectors), municipal (covering public water and sewage treatment facilities), and commercial sectors (including smaller institutional or building management systems). The industrial end-user segment is the largest revenue generator, driven by the vast scale and complexity of chemical processes within large manufacturing plants. Future growth is anticipated to be heavily influenced by infrastructural spending in the municipal sector, particularly in emerging economies focused on modernizing outdated utility infrastructure.

- By Technology:

- Solenoid Driven

- Motor Driven (Stepping Motor, Hydraulic, Mechanical)

- Pneumatic Driven

- By Application:

- Water & Wastewater Treatment

- Oil & Gas

- Chemical Processing

- Pharmaceuticals & Biotechnology

- Food & Beverage

- Pulp & Paper

- Power Generation

- By End-User:

- Industrial (Manufacturing, Mining, etc.)

- Municipal (Public Utilities)

- Commercial (Institutional, Pool & Spa)

Value Chain Analysis For Digital Dosing Pump Market

The value chain for the Digital Dosing Pump Market begins with upstream activities focused on securing high-quality raw materials, particularly specialized engineering plastics (like PTFE, PVDF), corrosion-resistant alloys (e.g., Hastelloy, Stainless Steel), and sophisticated electronic components (microprocessors, stepper motors, and sensors). Upstream suppliers are critical as the precision and chemical compatibility of the final pump heavily rely on the quality and certification of these specialized inputs. Intense R&D is situated early in the chain, focusing on fluid dynamics modeling, material science breakthroughs, and software development for advanced control algorithms, ensuring the pumps offer high turndown ratios and long-term chemical resilience.

Midstream activities involve core manufacturing, assembly, and rigorous quality assurance. This stage focuses on precision machining of pump heads, integration of complex electronic control boards, and calibration testing. Digital dosing pump manufacturers often operate specialized assembly lines requiring high levels of cleanliness and automation to maintain precision tolerances. The trend towards modular design and standardization is evident here, aiming to simplify assembly and inventory management, while also incorporating advanced firmware capabilities such as IoT compatibility and cybersecurity features.

Downstream distribution channels are crucial for market reach and customer service. Distribution is typically handled through a hybrid model involving direct sales for large, complex industrial projects (e.g., major chemical plants or municipal contracts) and indirect channels utilizing specialized regional distributors, technical integrators, and system houses for standard sales and after-market support. Specialized integrators play a vital role in providing local expertise for installation, system commissioning, and ongoing maintenance. Given the technical nature of the product, robust after-sales support, including spare parts availability and technical training, significantly impacts customer satisfaction and repeat business.

Digital Dosing Pump Market Potential Customers

The potential customer base for digital dosing pumps is vast and highly diversified, spanning nearly all industrial and utility sectors where precise fluid management and chemical control are mandatory. The largest group of buyers resides within the water and wastewater treatment sector, encompassing both municipal entities managing public water supplies and industrial facilities responsible for treating their effluent before discharge. These customers purchase pumps primarily for disinfection (chlorination), pH adjustment, coagulation, and sludge conditioning, prioritizing reliability, compliance reporting capabilities, and resistance to harsh oxidizing agents.

Another significant segment comprises the heavy industrial users, specifically the chemical processing and oil & gas industries. Chemical plants require digital dosing pumps for continuous proportional blending, catalyst injection, and transfer of hazardous materials where any inaccuracy can lead to batch failure or safety hazards. Similarly, the oil and gas sector uses these pumps extensively for injecting corrosion inhibitors, demulsifiers, and scale inhibitors into pipelines and production systems, necessitating pumps designed for high pressure and extreme environmental conditions. For these customers, robustness, high turndown ratios, and remote diagnostic features are essential purchasing criteria.

Furthermore, the high-tech and specialized manufacturing sectors, including pharmaceuticals, biotechnology, and electronics, represent premium potential customers. These industries demand ultra-high precision, often measured in microliters, and require certified pumps adhering to stringent regulations (like FDA compliance or hygienic standards). For instance, pharmaceutical companies use digital dosing pumps for formulation mixing and sterile media transfer, where traceability and validation of every dose are non-negotiable requirements, driving demand for pumps with comprehensive data logging and validation protocols.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Grundfos, Milton Roy, Prominent, Idex Corporation, Seko SpA, Flowserve Corporation, Verder Group, Blue-White Industries, Watson-Marlow Fluid Technology Solutions, Wanner Engineering, SPX Flow, Netzsch Pumps & Systems, LEWA GmbH, Iwaki Co. Ltd., Ingersoll Rand, Injecta S.r.l., Lutz-Jesco GmbH, EMEC S.r.l., Alldos, Aquionics |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Digital Dosing Pump Market Key Technology Landscape

The technological landscape of the Digital Dosing Pump Market is primarily defined by continuous advancements in microprocessor control, motor efficiency, and communication protocols. A key technological shift involves the transition from simple analog control to sophisticated microcontroller-based systems that enable digital flow adjustment, remote diagnostics, and enhanced turndown ratios (the range between maximum and minimum flow rates). Modern digital dosing pumps leverage high-resolution displays and intuitive software interfaces, allowing operators to monitor performance parameters, set precise dosage limits, and access detailed data logging capabilities essential for regulatory compliance and process optimization.

Central to digital dosing accuracy is the evolution of drive mechanisms. Solenoid-driven pumps are increasingly incorporating optimized electromagnetics and advanced valve designs to improve chemical priming and stroke repeatability, especially at very low flow rates. More significantly, motor-driven pumps are migrating towards stepper motor and servo motor technologies, which provide unprecedented control over stroke speed and length independently. This allows for nearly pulsation-free flow and eliminates the need for mechanical adjustment knobs, significantly enhancing the precision and stability required for sensitive chemical processes, while also reducing energy consumption compared to older AC motor variants.

Furthermore, the integration of Industrial Internet of Things (IIoT) capabilities is reshaping the market. New generations of digital dosing pumps are equipped with standardized communication modules (e.g., Modbus, EtherNet/IP, Profibus) enabling seamless integration into factory-wide automation networks. This connectivity facilitates centralized monitoring, allows for over-the-air firmware updates, and supports advanced data analysis, which is foundational for predictive maintenance and AI-driven optimization strategies. The focus is now on creating a 'smart pump' that communicates its health status, chemical inventory levels, and dosage compliance directly to the control room or cloud platform, thereby minimizing manual checks and improving overall plant reliability.

Regional Highlights

The global demand profile for digital dosing pumps is highly diverse, reflecting varying levels of industrial development, regulatory enforcement, and infrastructure investment across major geographic regions. Each region presents a unique set of market drivers and competitive challenges, compelling manufacturers to adapt their product offerings, sales strategies, and service models to local requirements. Understanding these regional differences is paramount for effective market penetration and sustaining global growth.

North America (U.S., Canada, Mexico) is a mature market characterized by stringent environmental regulations, particularly concerning drinking water quality and industrial discharge limits enforced by the EPA. This regulatory framework necessitates high-precision dosing equipment for compliance. The region demonstrates a high rate of technology adoption, driven by established infrastructure and a strong focus on automation and labor cost reduction. Customers here prioritize smart features, including IIoT connectivity, NEMA-rated enclosures, and robust support services. The oil and gas sector and the pharmaceutical industry represent major revenue streams, demanding durable, high-pressure pumps and highly validated hygienic pumps, respectively. Market growth is sustained through the continuous modernization of aging municipal water treatment facilities and ongoing expansion in advanced manufacturing sectors.

Europe (Germany, UK, France, Italy) maintains a strong presence, driven by comprehensive water quality directives (such as the Water Framework Directive) and a powerful commitment to energy efficiency (A++ standards). European industries, particularly chemical manufacturing and food & beverage, demand highly reliable, certified dosing equipment. Germany, with its strong engineering base, acts as a technological hub, driving innovations in pump efficiency and smart control algorithms. The emphasis in Europe is on sustainability, energy consumption metrics, and the seamless integration of dosing solutions within complex, highly automated industrial environments. Regulatory standardization across the EU single market facilitates cross-border sales, but compliance with region-specific certifications remains crucial.

Asia Pacific (APAC) (China, India, Japan, South Korea) is the undisputed growth engine for the digital dosing pump market. This rapid expansion is fueled by massive infrastructure development, explosive industrialization, and rapidly improving regulatory enforcement concerning pollution control. Countries like China and India are investing heavily in municipal water and wastewater treatment plants to meet the demands of fast-growing urban populations. While price sensitivity remains higher in some sub-regions compared to North America or Europe, the overall volume demand, coupled with the increasing adoption of higher-end precision manufacturing (e.g., semiconductors in South Korea and Taiwan), makes APAC a priority focus area for global pump manufacturers. The need for basic, reliable digital pumps for general industrial use coexists with the demand for highly sophisticated systems in specialized manufacturing zones.

Latin America (LATAM) and Middle East & Africa (MEA) represent emerging markets with high long-term potential. In LATAM, growth is uneven but promising, driven by urbanization and ongoing investment in mining and municipal water infrastructure (e.g., Brazil, Chile). MEA, particularly the GCC countries, shows strong demand derived from major oil and gas projects requiring chemical injection and large-scale desalination plants essential for regional water security. These regions face unique challenges, including harsh climate conditions and logistical complexities, requiring pumps optimized for robustness, extreme temperature tolerance, and reliable operation in remote settings. Government initiatives focusing on water scarcity solutions, especially in drought-prone areas, accelerate the adoption of precise dosing technologies in water re-use and treatment facilities.

- North America: Leads in technology adoption and regulatory-driven demand, particularly in oil & gas and pharmaceuticals.

- Europe: Focuses on energy efficiency, precision in chemical manufacturing, and adherence to strict EU environmental directives.

- Asia Pacific (APAC): Fastest growing region, driven by massive infrastructure expansion and industrialization, especially in water utilities.

- Latin America and MEA: Emerging high-growth markets, driven by mining, oil & gas production, and crucial desalination projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Digital Dosing Pump Market.- Grundfos

- Milton Roy

- Prominent

- Idex Corporation

- Seko SpA

- Flowserve Corporation

- Verder Group

- Blue-White Industries

- Watson-Marlow Fluid Technology Solutions

- Wanner Engineering

- SPX Flow

- Netzsch Pumps & Systems

- LEWA GmbH

- Iwaki Co. Ltd.

- Ingersoll Rand

- Injecta S.r.l.

- Lutz-Jesco GmbH

- EMEC S.r.l.

- Alldos

- Aquionics

Frequently Asked Questions

Analyze common user questions about the Digital Dosing Pump market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of digital dosing pumps over traditional mechanical pumps?

Digital dosing pumps offer superior accuracy, higher turndown ratios, integrated flow monitoring, and advanced connectivity (IIoT), leading to optimized chemical consumption, reduced operational costs, and simplified compliance reporting compared to analog mechanical counterparts.

Which application segment holds the largest share in the Digital Dosing Pump Market?

The Water and Wastewater Treatment segment dominates the market share, driven by global mandates for disinfection, pH correction, and coagulation processes required in both municipal utilities and industrial effluent treatment facilities worldwide.

How is Artificial Intelligence (AI) influencing the future of dosing pump operations?

AI is enabling predictive maintenance by analyzing pump data to forecast failures, optimizing chemical dosage dynamically based on real-time process conditions, and automating calibration routines, ensuring unparalleled precision and reliability in fluid control systems.

What is the main restraint impacting the widespread adoption of digital dosing pumps?

The primary restraint is the higher initial capital investment required for sophisticated digital pumping systems and the associated complexity of integrating advanced networking and control software into existing legacy industrial infrastructure.

Which technology segment is expected to show the fastest growth rate in the forecast period?

The Motor Driven technology segment, particularly those utilizing advanced stepper and servo motors, is anticipated to exhibit the fastest growth, driven by demand for high-volume, high-pressure, and low-pulsation capabilities required by the chemical and oil & gas industries.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager