Digital Finance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431571 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Digital Finance Market Size

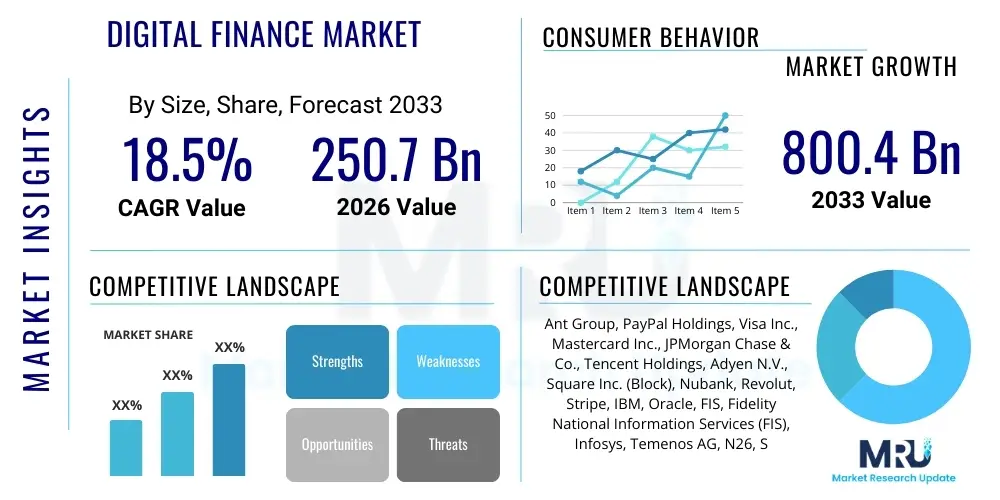

The Digital Finance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 250.7 Billion in 2026 and is projected to reach USD 800.4 Billion by the end of the forecast period in 2033.

Digital Finance Market introduction

The Digital Finance Market encompasses all financial services delivered through digital channels, primarily leveraging internet-enabled devices, mobile technology, and advanced software platforms. This broad ecosystem includes online banking, mobile payment systems, blockchain-based financing (DeFi), InsurTech, RegTech, and personalized wealth management applications. Digital finance solutions are fundamentally driven by the need for greater efficiency, lower transaction costs, enhanced accessibility for underserved populations, and improved customer experience compared to traditional physical banking infrastructure. The core product offering revolves around real-time transaction processing, automated underwriting, secure data exchange, and algorithmic risk assessment, replacing manual, paper-intensive processes.

Major applications of digital finance span retail consumer services, corporate treasury management, cross-border payments, and investment banking operations. In the retail sector, applications include peer-to-peer (P2P) lending, robo-advisory services, and instant consumer credit evaluation. For enterprises, digital finance facilitates supply chain financing, automated compliance monitoring, and integration of enterprise resource planning (ERP) systems with payment gateways. Key benefits driving the massive adoption include global reach, 24/7 availability of services, increased transparency through ledger technologies, and sophisticated fraud detection capabilities enabled by machine learning algorithms, thus modernizing the entire financial landscape.

Several driving factors contribute to the market's robust expansion. Foremost among these is the escalating penetration of smartphones and widespread access to high-speed internet across emerging economies, enabling financial inclusion for vast populations previously excluded from formal banking. Furthermore, supportive regulatory environments, particularly the introduction of open banking initiatives (like PSD2 in Europe), mandate data sharing and encourage collaboration between traditional banks and FinTech disruptors. Finally, changing consumer preferences, favoring convenience, personalization, and seamless digital interactions, pressure established financial institutions to accelerate their digital transformation efforts, thereby continually fueling innovation and market growth.

Digital Finance Market Executive Summary

The Digital Finance Market is experiencing unprecedented dynamism, characterized by rapid technological integration and shifting competitive landscapes. Business trends are dominated by strategic mergers and acquisitions between established banking giants and agile FinTech startups, alongside heavy corporate investments in cloud computing infrastructure to handle massive transaction volumes and data analytics. A pivotal trend is the move toward embedded finance, where financial services are seamlessly integrated into non-financial platforms, such as e-commerce checkouts or automotive purchasing processes, blurring the lines between traditional industry sectors. Moreover, the focus on decentralized finance (DeFi) continues to mature, although regulatory clarity remains a critical factor for mainstream institutional adoption, driving cautious but persistent exploration of blockchain utilities beyond cryptocurrency trading.

Regionally, the market exhibits divergent maturity levels and growth trajectories. North America and Europe currently dominate in terms of market value, primarily due to advanced regulatory frameworks (like GDPR and Open Banking) and high consumer adoption of sophisticated digital wealth and banking services. However, the Asia Pacific (APAC) region, led by China and India, is projected to demonstrate the fastest growth rate. This accelerated growth is fueled by an enormous unbanked population leveraging mobile payments (e.g., UPI, Alipay, WeChat Pay) and a thriving local FinTech startup scene receiving substantial venture capital funding. Latin America and MEA are focused on leveraging digital solutions to tackle hyperinflation and lack of formal financial access, making mobile money and cross-border remittance platforms critical growth segments.

Segmentation trends indicate that digital payments remain the largest revenue generator, driven by the global shift away from cash transactions. Within payments, real-time settlement platforms and Buy Now, Pay Later (BNPL) models are showing explosive growth, appealing particularly to younger demographics. The banking segment, specifically neo-banks and challenger banks, is capturing market share by offering superior user interfaces and lower fee structures. Furthermore, the rising imperative for regulatory compliance and risk management has propelled the RegTech segment, focusing on AI-driven monitoring and automated reporting tools. Security and fraud prevention, powered by biometric authentication and advanced encryption techniques, are increasingly becoming non-negotiable features across all major service categories, driving investment across the entire value chain.

AI Impact Analysis on Digital Finance Market

User inquiries concerning AI's influence in the Digital Finance Market frequently revolve around ethical concerns related to algorithmic bias, the potential for widespread job displacement within traditional banking roles, and the security implications of utilizing sophisticated AI models for fraud detection and risk management. Users are keenly interested in understanding how AI can personalize financial advice, automate compliance (RegTech applications), and revolutionize credit scoring for individuals with thin file histories. A recurring theme is the expectation that AI will deliver hyper-efficient, 24/7 customer service through advanced chatbots and virtual assistants, significantly lowering operational costs for financial institutions while simultaneously demanding higher levels of data privacy and explainability in decision-making processes (Explainable AI - XAI).

- AI drives hyper-personalization of financial products and services, utilizing machine learning to analyze spending habits and financial goals.

- Automation of regulatory compliance and reporting through RegTech solutions, reducing human error and ensuring real-time monitoring of transactions.

- Enhanced algorithmic trading strategies and portfolio optimization, providing high-frequency execution and dynamic risk management in investment banking.

- Revolutionary fraud detection capabilities, employing neural networks to identify subtle anomalies and patterns indicative of sophisticated cyber threats and illicit activities.

- Credit scoring and loan underwriting transformation, allowing institutions to assess risk for historically underserved populations using alternative data sources.

- Implementation of advanced conversational AI (chatbots and virtual assistants) for seamless, instant customer support and operational efficiency improvement.

- Development of sophisticated robo-advisors that manage investment portfolios with minimal human intervention, democratizing wealth management services.

DRO & Impact Forces Of Digital Finance Market

The Digital Finance Market is shaped by a powerful interplay of accelerating drivers (D), necessary restraints (R), transformative opportunities (O), and pervasive impact forces. Key drivers include the global push for financial inclusion, mass adoption of mobile internet, and favorable regulatory shifts like Open Banking, which mandates data portability and encourages competitive service development. Restraints primarily involve significant cybersecurity risks and the threat of sophisticated data breaches, complex and fragmented international regulatory frameworks (especially concerning crypto assets), and the inherent challenge of integrating legacy IT infrastructure within established financial institutions with modern, agile cloud-native systems. Opportunities are centered around the expansion of embedded finance into non-financial sectors, the maturation of decentralized finance (DeFi) protocols, and the application of Artificial Intelligence (AI) to transform operational efficiency and risk modeling, particularly in emerging economies where financial services penetration is low.

Impact forces are those structural changes that permanently alter the market dynamics and competitive equilibrium. The regulatory impact force is profound, as governments worldwide grapple with defining standards for digital assets and cross-border digital taxation, directly influencing market entry barriers and operational compliance costs. Technological acceleration, particularly in quantum computing and advanced cryptography, is an escalating force that promises exponential performance gains but also poses potential security risks if not managed proactively. Societal impact forces, driven by increasing consumer demand for transparency, environmental, social, and governance (ESG) compliant investment products, and ethical use of data, are forcing financial players to adopt responsible digital practices, redefining brand value and customer loyalty in the digital age.

Segmentation Analysis

The Digital Finance Market is primarily segmented across three main axes: Component, Technology, and Application, each revealing specific high-growth areas and investment priorities. The Component segmentation distinguishes between Software/Platforms (including core banking systems, payment gateways, and analytical tools) and Services (encompassing consulting, integration, and managed security services). Technology segmentation is critical, highlighting the shift toward enabling technologies such as Blockchain, Cloud Computing, and advanced Biometrics, which underpin the market’s innovation pipeline. Finally, the Application dimension illustrates how digital finance is penetrating various sectors, including traditional banking (retail and commercial), investment management, insurance (InsurTech), and unique P2P lending models, providing a comprehensive view of revenue streams and end-user adoption patterns across diverse financial activities.

- By Component:

- Solution (Platform, Software, APIs)

- Services (Professional Services, Managed Services, System Integration)

- By Technology:

- Artificial Intelligence (AI) & Machine Learning (ML)

- Blockchain

- Cloud Computing

- Big Data & Analytics

- Biometrics and Identity Management

- By Application/Service Model:

- Digital Payments (Mobile Wallets, POS Solutions, Remittances)

- Digital Banking (Neo-banks, Online Lending, Credit Scoring)

- Wealth Management (Robo-Advisory, Portfolio Management Software)

- Insurance (InsurTech)

- Regulatory Technology (RegTech) and Cybersecurity

- By End-User:

- Retail Customers

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

- Financial Institutions (Banks, Credit Unions)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Digital Finance Market

The value chain for the Digital Finance Market is highly complex, involving multiple stages from infrastructure provision to final customer interaction, differentiating it significantly from traditional linear financial models. Upstream activities are dominated by technology providers, including specialized software developers, cloud infrastructure vendors (AWS, Azure, Google Cloud), and data analytics firms that supply the foundational technology stack necessary for processing, securing, and analyzing financial data. The quality and scalability of these upstream components directly impact the agility and reliability of downstream services. Investment in cutting-edge cryptography and low-latency processing infrastructure is a significant determinant of competitive advantage at this stage.

Midstream activities involve core financial service providers—traditional banks undergoing digital transformation, dedicated FinTech firms, and specialized InsurTech/RegTech companies. These entities integrate the upstream technology into proprietary or licensed platforms to create tangible financial products, such as mobile banking applications, automated trading systems, and KYC/AML verification software. This stage is heavily characterized by data utilization, where raw information is transformed into actionable insights for risk assessment, product customization, and regulatory compliance. Partnerships between banks and FinTechs (Bank-as-a-Service models) are crucial here, speeding time-to-market for innovative products and utilizing combined technological strengths.

Downstream activities focus on distribution and customer engagement. Distribution channels are predominantly direct (through proprietary websites, dedicated mobile apps, and APIs integrated into third-party platforms for embedded finance). Indirect channels, such as authorized financial advisors utilizing proprietary wealth management software or referral networks between e-commerce platforms and payment providers, also play a significant role. The final stage is the end-user interaction, where customer experience, security assurances, and real-time support define the perceived value of the digital finance offering. Continuous iteration based on user feedback and A/B testing of interfaces are essential downstream requirements to maintain user adoption and reduce churn in this competitive environment.

Digital Finance Market Potential Customers

Potential customers for the Digital Finance Market span a highly diverse spectrum, reflecting the pervasive nature of digitized financial services across economic activities. The largest segment remains the retail customer base, which demands convenient, low-cost access to transactional banking, payments (mobile wallets), personal credit, and simplified investment solutions (robo-advisors). This segment places a premium on user experience (UX), security, and seamless integration with daily activities. Geographically, emerging economies represent immense potential among the previously unbanked and underbanked populations, where mobile-first solutions are the primary gateway to formal financial services, bypassing traditional branch infrastructure entirely.

The corporate sector represents the next critical customer segment, bifurcated into Large Enterprises and Small and Medium-sized Enterprises (SMEs). Large enterprises are major buyers of sophisticated digital treasury management systems, cross-border payment platforms, supply chain financing solutions, and advanced RegTech tools necessary for complex, multi-jurisdictional compliance. SMEs, conversely, seek accessible, scalable, and affordable digital solutions for operational finance, including cloud-based accounting software integrated with payroll and invoicing features, specialized digital lending products, and tailored fraud prevention tools that do not require massive in-house IT investment. Both large and small businesses are increasingly leveraging embedded finance solutions to streamline their own customer interactions and payments.

A third, specialized customer segment includes other Financial Institutions (FIs), such as regional banks, credit unions, and insurance companies. These entities often act as buyers of digital finance components (like proprietary APIs, white-label banking software, or advanced AI-driven risk models) to enhance their existing service offerings without building technology from scratch. These B2B customers prioritize stability, regulatory adherence, and the ease of integration with legacy systems. As the ecosystem matures, governments and regulatory bodies also emerge as critical customers for RegTech and SupTech (Supervisory Technology) solutions to improve oversight, enhance real-time data collection, and ensure systemic stability across the increasingly complex digital financial infrastructure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 250.7 Billion |

| Market Forecast in 2033 | USD 800.4 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ant Group, PayPal Holdings, Visa Inc., Mastercard Inc., JPMorgan Chase & Co., Tencent Holdings, Adyen N.V., Square Inc. (Block), Nubank, Revolut, Stripe, IBM, Oracle, FIS, Fidelity National Information Services (FIS), Infosys, Temenos AG, N26, SoFi, Coinbase. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Digital Finance Market Key Technology Landscape

The technological landscape of the Digital Finance Market is rapidly evolving, defined by convergence and specialization across several core domains designed to enhance security, efficiency, and customer engagement. Cloud computing serves as the foundational infrastructure, enabling financial institutions to scale services rapidly, handle fluctuating transaction loads, and reduce operational expenditure (OpEx) by moving away from proprietary on-premise data centers. The adoption of both public and hybrid cloud models is prevalent, although regulatory scrutiny requires specialized compliance protocols for financial data stored in multi-tenant environments. Furthermore, Application Programming Interfaces (APIs) are central to the Open Banking movement, acting as the middleware that allows seamless, permissioned data exchange between banks and third-party FinTech developers, fostering innovation through system interoperability.

Artificial Intelligence (AI) and Machine Learning (ML) represent a critical pillar of technological advancement, driving transformation across multiple functional areas. In risk management, ML algorithms provide sophisticated credit scoring models that utilize non-traditional data points, improving accuracy and speed of lending decisions. For customer service, natural language processing (NLP) powers highly intelligent chatbots and virtual agents capable of resolving complex financial queries 24/7, significantly reducing the burden on human support staff. Furthermore, deep learning techniques are paramount in preventing financial crime, analyzing vast data streams in real-time to detect anomalous transaction patterns indicative of money laundering or advanced synthetic identity fraud, a capability far exceeding traditional rule-based systems.

Blockchain technology, extending beyond cryptocurrencies, is cementing its role in streamlining complex back-office operations, particularly in cross-border payments, trade finance, and supply chain tracking. Distributed Ledger Technology (DLT) offers immutable record-keeping and enhanced transparency, reducing the need for multiple intermediaries and accelerating settlement times from days to seconds in some pilot programs. Finally, Biometrics and advanced identity management systems, including facial recognition, voice recognition, and fingerprint scanning, are becoming standard features for authentication across mobile banking apps. This move enhances security by replacing susceptible password-based authentication, directly addressing consumer concerns about account takeover and protecting the integrity of digital transactions across diverse devices and geographical locations, thereby strengthening the overall trust framework essential for widespread digital finance adoption.

Regional Highlights

Regional dynamics illustrate a complex pattern of market maturity, technological adoption rates, and regulatory responsiveness, crucial for understanding global growth trajectories.

- North America: This region, particularly the United States, holds a significant market share characterized by substantial venture capital investment in FinTech (especially in WealthTech, Payments, and Crypto infrastructure). Adoption rates are high for advanced digital services like robo-advisory and sophisticated B2B payment solutions. The market is highly competitive, driven by incumbent financial giants accelerating digital transformation and new entrants offering innovative, niche products. Focus areas include AI-driven credit risk modeling and securing digital asset platforms, responding to increasing institutional interest in blockchain technology.

- Europe: Europe is defined by its progressive regulatory environment, spearheaded by Open Banking (PSD2). This has fostered a strong challenger bank (neo-bank) ecosystem (e.g., Revolut, N26) and robust RegTech sector. The emphasis here is on interoperability and consumer data protection (GDPR compliance). Key growth is seen in instant cross-border payments within the SEPA zone and the rapid deployment of embedded finance services across various consumer applications, making seamless integration a key competitive differentiator.

- Asia Pacific (APAC): APAC is the fastest-growing region, driven by immense population size, high mobile penetration, and the presence of massive digital ecosystems (e.g., China's Ant Group, India's UPI). Growth is predominantly fueled by mobile payments and financial inclusion initiatives targeting vast underserved populations. Regulatory environments vary significantly, but markets like Singapore and Hong Kong act as innovation hubs, leading in blockchain adoption for trade finance and central bank digital currency (CBDC) explorations.

- Latin America (LATAM): The LATAM market exhibits strong demand for digital finance solutions to combat historically high inflation rates and low levels of traditional bank penetration. Mobile banking and challenger banks (like Nubank) have been highly successful in disrupting the status quo. Remittance services and digital lending platforms, designed for rapid assessment in high-volatility economic climates, are key growth drivers, relying heavily on stable, scalable cloud infrastructure.

- Middle East and Africa (MEA): This region is heavily focused on mobile money and instant payment systems, particularly in Africa, addressing the critical need for basic financial services and reliable cross-border transactions. In the Middle East, high disposable incomes and government-backed digital transformation visions (like Saudi Vision 2030) are driving investment in sophisticated FinTech hubs, focusing on personalized wealth management and InsurTech platforms compliant with Islamic finance principles.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Digital Finance Market.- Ant Group

- PayPal Holdings Inc.

- Visa Inc.

- Mastercard Inc.

- JPMorgan Chase & Co.

- Tencent Holdings Ltd.

- Adyen N.V.

- Square Inc. (Block)

- Nubank

- Revolut Ltd.

- Stripe Inc.

- International Business Machines Corporation (IBM)

- Oracle Corporation

- Fidelity National Information Services (FIS)

- Fidelity Investments

- Infosys Ltd.

- Temenos AG

- N26 GmbH

- SoFi Technologies Inc.

- Coinbase Global Inc.

- Baidu (Du Xiaoman Financial)

- Klarna Bank AB

- Goldman Sachs Group Inc. (Marcus)

- Amazon Web Services (AWS)

- Google LLC (Google Pay)

- Microsoft Corporation

- Wipro Limited

- Tata Consultancy Services (TCS)

- Accenture PLC

Frequently Asked Questions

Analyze common user questions about the Digital Finance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving force behind the growth of the Digital Finance Market?

The primary driver is the accelerating penetration of mobile technology and internet access worldwide, particularly in emerging economies, coupled with regulatory shifts like Open Banking that promote innovation and competition among service providers.

How is Decentralized Finance (DeFi) currently impacting traditional Digital Finance services?

DeFi introduces alternative protocols for lending, trading, and asset management based on blockchain, challenging centralized financial intermediaries. While still niche, DeFi drives innovation in security, transparency, and tokenization, prompting traditional institutions to explore DLT for back-office efficiencies.

What are the most significant risks associated with the expansion of Digital Finance?

The most significant risks include sophisticated cybersecurity threats, data privacy violations, and the potential for increased financial fraud. Regulatory uncertainty regarding digital assets and cross-border data governance also poses major challenges to sustainable market growth.

Which technology is most crucial for improving security and customer verification in Digital Finance?

Biometric authentication (such as facial and voice recognition) and advanced cryptography are the most crucial technologies for enhancing security, enabling secure, password-less access, and mitigating risks associated with identity theft and account takeovers across mobile platforms.

How does the concept of embedded finance reshape consumer financial services?

Embedded finance integrates financial services (like lending or payments) directly into non-financial platforms (e.g., e-commerce, mobility apps) at the point of need. This approach offers unparalleled convenience, creating seamless user journeys and driving significant market share away from traditional, standalone banking applications.

What role do RegTech solutions play in the Digital Finance ecosystem?

RegTech (Regulatory Technology) solutions utilize AI, ML, and big data to automate and streamline regulatory compliance processes, KYC/AML checks, and risk reporting. They significantly reduce operational costs and ensure financial institutions adhere to complex, real-time mandates efficiently and accurately.

Is cloud computing essential for modern digital banking operations?

Yes, cloud computing is essential. It provides the necessary scalability, elastic infrastructure, high availability, and disaster recovery capabilities required to handle massive, fluctuating volumes of real-time transactions and customer data characteristic of modern digital banking and payment systems.

Which geographical region is anticipated to experience the highest growth rate?

The Asia Pacific (APAC) region is anticipated to experience the highest growth rate, primarily due to massive market penetration opportunities driven by mobile-first strategies, rapid urbanization, and government initiatives aimed at broad financial inclusion.

What is the competitive dynamic between incumbent banks and FinTech startups?

The dynamic is shifting from pure competition to increased collaboration. Many incumbent banks are acquiring FinTechs or forming strategic partnerships to leverage their agile technology and speed-to-market, while FinTechs often rely on banks for regulatory licenses and deep customer trust.

What impact does hyper-personalization have on consumer engagement?

Hyper-personalization, powered by AI/ML analysis of user data, allows digital finance providers to offer tailored advice, relevant product suggestions, and dynamic fee structures. This targeted approach significantly improves customer retention, satisfaction, and the lifetime value of the customer relationship.

How are SMEs leveraging digital finance solutions compared to large enterprises?

SMEs primarily leverage digital finance for affordable, cloud-based tools for cash flow management, automated invoicing, and rapid access to alternative digital lending options, whereas large enterprises focus more on complex treasury management, supply chain finance, and integrated global payment platforms.

Explain the significance of API integration in the Digital Finance Market.

API integration is the backbone of interoperability, allowing different financial software systems and third-party developers to communicate securely. It is crucial for Open Banking, embedded finance, and creating modular, interconnected services that enhance the overall ecosystem efficiency.

What is the distinction between a traditional bank and a neo-bank (challenger bank)?

A neo-bank operates exclusively online, typically without physical branches, offering a streamlined, mobile-first user experience and often lower fees. Traditional banks, even when digitized, maintain a physical presence and integrate digital services into legacy infrastructure, often resulting in slower innovation cycles.

How does the focus on ESG (Environmental, Social, and Governance) affect digital finance product development?

ESG principles are increasingly influencing digital finance by driving the creation of sustainable investment screening tools, green lending products, and transparent platforms that allow investors to track the social and environmental impact of their portfolios, aligning with consumer ethical demands.

What are the key functions of AI in mitigating financial crime?

AI, through machine learning and anomaly detection models, analyzes millions of transactions in real-time to identify unusual patterns, quickly flag potential money laundering activities (AML), identify synthetic identity fraud, and dynamically adjust risk scores, moving beyond static rules-based systems.

Why is data integrity a critical concern for the Digital Finance Market?

Data integrity is critical because digital finance relies entirely on accurate, trustworthy data for risk assessment, regulatory compliance, and transaction settlement. Any compromise in data integrity can lead to catastrophic financial losses, regulatory penalties, and significant loss of consumer trust.

How do emerging markets benefit specifically from mobile money solutions?

Mobile money solutions in emerging markets provide essential financial access (payments, savings, credit) to populations lacking traditional bank accounts and physical infrastructure. They lower transaction costs, facilitate remittances, and provide a secure digital entry point for financial inclusion.

What are the primary segments driving market revenue growth in the near term?

Digital Payments, particularly mobile wallets and Buy Now, Pay Later (BNPL) models, and the adoption of core banking software solutions by traditional financial institutions undergoing necessary digital transformation are the primary revenue drivers in the immediate forecast period.

What is the role of Big Data analytics in wealth management?

Big Data analytics enables wealth managers to process vast quantities of market data, economic indicators, and client behavior profiles to create more precise risk models, optimize algorithmic trading strategies, and deliver highly customized, automated robo-advisory services to diverse client segments.

How are regulators adapting to the rapid pace of digital finance innovation?

Regulators are increasingly adopting innovation-friendly approaches, such as establishing regulatory sandboxes, developing specific frameworks for digital assets (e.g., MiCA in Europe), and implementing SupTech tools to improve their own supervisory capabilities and ensure market stability without stifling necessary technological progress.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager