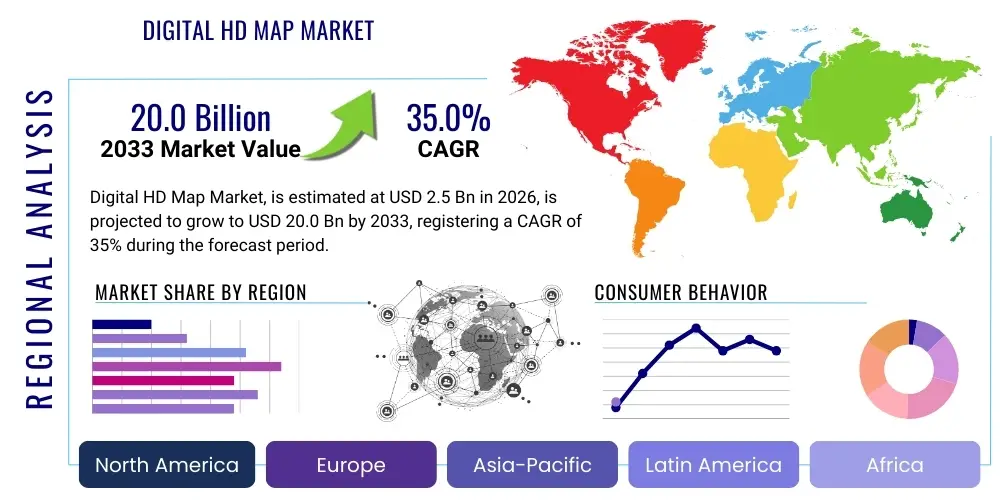

Digital HD Map Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436734 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Digital HD Map Market Size

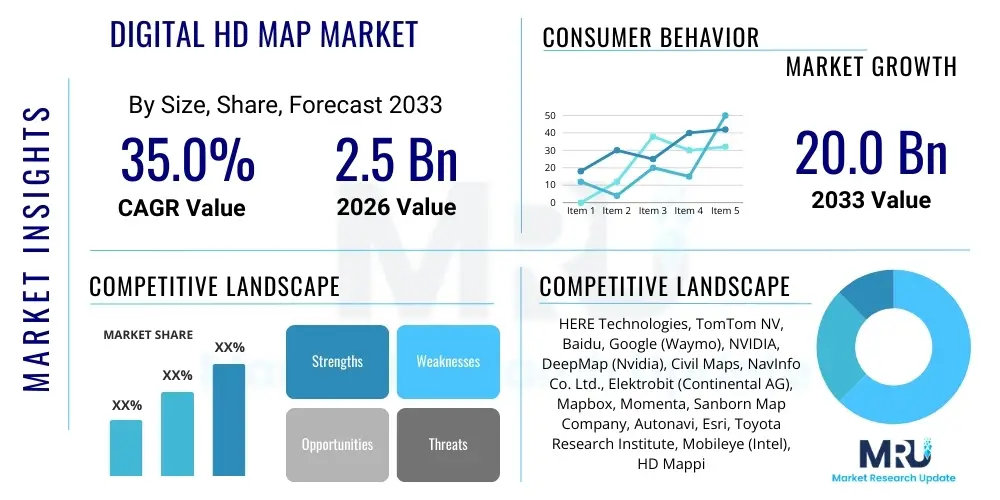

The Digital HD Map Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 35.0% between 2026 and 2033. The market is estimated at $2.5 Billion in 2026 and is projected to reach $20.0 Billion by the end of the forecast period in 2033.

Digital HD Map Market introduction

The Digital HD Map Market encompasses the creation, maintenance, and deployment of highly precise, centimeter-accurate geospatial datasets used primarily by Advanced Driver Assistance Systems (ADAS) and fully Autonomous Vehicles (AVs). Unlike traditional navigation maps, HD maps provide crucial lane-level detail, road geometry, signage, landmarks, and infrastructure attributes necessary for vehicle localization and path planning, especially in complex urban environments. These specialized maps serve as a critical component in ensuring the safety, reliability, and efficiency of self-driving technology, bridging the gap between vehicle perception and long-range prediction capabilities.

Major applications of Digital HD Maps span across various transportation and logistics sectors, including passenger autonomous vehicles (robotaxis, privately owned cars), commercial fleet operations (trucking, delivery vans), and railway systems requiring precise positional data. The primary benefits of implementing HD maps include improved vehicle localization resilience, enhanced situational awareness for the driving system, reduced computational load on real-time perception sensors by providing static context, and enabling smoother, more human-like driving maneuvers. These maps are foundational for SAE Levels 3, 4, and 5 automation, supporting features like lane keeping, automated highway driving, and complex intersection navigation.

Driving factors fueling the rapid expansion of this market are deeply rooted in the global automotive industry's massive investment in autonomous driving technology, coupled with supportive regulatory environments in key regions like North America, Europe, and Asia Pacific that are testing and permitting autonomous vehicle deployment. Furthermore, the decreasing cost and increased adoption of sensor technologies such as LiDAR, high-resolution cameras, and sophisticated Inertial Measurement Units (IMUs) are enhancing the fidelity and speed of map creation and updates. The demand for safer, more efficient transportation systems, alongside the competitive push among tech giants and automotive OEMs to commercialize Level 4 autonomy, continues to accelerate market growth, making HD maps a mandatory component of the future mobility ecosystem.

Digital HD Map Market Executive Summary

The Digital HD Map Market is characterized by intense technological competition and strategic alliances between established mapping companies, automotive OEMs, and specialized sensor providers. Current business trends indicate a significant shift towards dynamic map layers, emphasizing real-time updates derived from crowdsourced data—often termed the "fleet as a sensor" approach—to ensure maps accurately reflect temporary changes like construction zones or accident debris. Regionally, North America and Europe currently dominate due to early adoption, extensive road networks, and high concentrations of autonomous vehicle testing; however, Asia Pacific, particularly China and South Korea, is poised for explosive growth driven by supportive government policies and large-scale smart city initiatives. Segment trends show that the application segment is highly skewed towards Level 4 (L4) automation in robotaxis and commercial trucking, demanding the highest map resolution and real-time reliability, while the data source segment is migrating rapidly from dedicated mapping vehicles towards hybrid models utilizing consumer vehicle data and deep learning algorithms for feature extraction and verification.

Key strategic challenges revolve around standardizing map formats, ensuring interoperability across different vehicle platforms, and managing the extremely high computational and data storage requirements associated with maintaining global, centimeter-level precision maps. The transition from static, survey-based mapping to living, dynamic maps requires substantial infrastructure investment, driving consolidation and partnerships across the value chain. For instance, partnerships between leading LiDAR manufacturers and mapping providers are crucial for developing robust map creation pipelines. The primary opportunity lies in expanding map coverage beyond primary highways into complex, unmapped urban areas and leveraging HD map data beyond autonomous driving, such as in specialized drone navigation, advanced robotics, and highly accurate geospatial data services for infrastructure planning and maintenance.

Technological advancement, especially in edge computing and 5G connectivity, is critical for enabling instantaneous map updates, which is essential for ensuring vehicle safety and minimizing latency during decision-making. The increasing complexity of map data requires sophisticated AI models not only for processing raw sensor inputs but also for predicting changes and prioritizing dynamic elements. Stakeholders must focus on developing scalable, cost-effective methods for global map maintenance, addressing concerns about data privacy, security, and regulatory compliance associated with collecting and aggregating high-fidelity, real-time positional data from millions of vehicles, thus solidifying the market's trajectory towards dynamic, subscription-based services rather than static product sales.

AI Impact Analysis on Digital HD Map Market

User inquiries concerning the impact of Artificial Intelligence (AI) on the Digital HD Map Market commonly center on efficiency, scalability, and the shift from manual to automated mapping processes. Key user questions frequently ask: "How does AI make HD maps cheaper and faster to update?", "Can AI handle the variability of crowdsourced sensor data?", and "Will AI reduce the need for expensive LiDAR mapping vehicles?" The underlying concern is whether the market can transition to a globally scalable, cost-effective model without compromising the safety-critical precision required by autonomous vehicles. Users are primarily seeking assurance that AI can automate feature extraction (road signs, lane markers, barriers), perform sensor fusion optimally across heterogeneous data sources (camera, radar, LiDAR), and facilitate real-time anomaly detection and verification within the map layer, ensuring the generated maps are trustworthy and universally deployable across diverse environmental conditions and geographies.

AI’s influence is transformative, moving HD map generation away from labor-intensive, dedicated mapping fleets towards scalable, machine-learning-driven pipelines. AI algorithms, particularly deep learning models like Convolutional Neural Networks (CNNs) and Recurrent Neural Networks (RNNs), are now fundamental in automating critical mapping tasks. This includes the automated recognition, classification, and segmentation of road features from raw sensor data, significantly accelerating the initial map creation phase. Furthermore, machine learning is essential for solving the localization problem by allowing the autonomous vehicle to accurately match real-time sensor inputs to the stored HD map features, even under poor weather or lighting conditions, thereby improving system robustness and redundancy.

The most profound impact of AI is seen in the dynamic maintenance layer. AI tools process vast streams of crowdsourced data from consumer vehicles—identifying discrepancies, filtering noise, and validating potential changes (e.g., temporary lane closures or new traffic patterns). Predictive AI models are increasingly being used to infer real-time road conditions and project environmental changes onto the map, ensuring the map acts as a living digital twin of the infrastructure. This capability shifts the operational expenditure of mapping from periodic, expensive surveys to continuous, automated verification cycles, which is critical for achieving Level 4 and Level 5 automation reliability. Consequently, AI is not just an optimization tool but the core technology enabling the economic viability and operational safety of the entire Digital HD Map ecosystem.

- AI-Powered Feature Extraction: Deep learning models automate the identification and classification of static and dynamic road features (signs, traffic lights, road markings) from raw sensor data (camera, LiDAR point clouds), drastically reducing manual labeling time and costs.

- Sensor Fusion Optimization: AI algorithms efficiently combine and reconcile data inconsistencies across disparate sensor modalities (e.g., fusing camera-derived semantic data with LiDAR-derived geometric data) to create a unified, robust map representation.

- Crowdsourced Data Validation: Machine learning models filter noise, detect anomalies, and verify map changes submitted by fleets, ensuring only accurate and persistent updates are integrated into the master map layer in real-time.

- Automated Map Localization: AI improves the vehicle's ability to localize itself against the HD map features, ensuring high precision even when GPS signals are weak or unavailable, crucial for functional safety.

- Predictive Maintenance: AI algorithms analyze historical traffic and change patterns to predict potential infrastructure modifications or temporary road hazards, enhancing the map's proactive utility for path planning.

DRO & Impact Forces Of Digital HD Map Market

The Digital HD Map Market is shaped by a powerful interplay of technological advancements and demanding application requirements, encapsulated by its Drivers, Restraints, and Opportunities (DRO). Key drivers include the overwhelming global demand for autonomous driving safety and reliability, which mandates the use of centimeter-level localization systems, making HD maps indispensable for Level 3 and above vehicles. Significant investments from automotive OEMs and technology firms into fully autonomous solutions necessitate robust mapping infrastructure. Conversely, major restraints involve the prohibitively high cost associated with initial map creation and continuous maintenance, especially across expansive, diverse geographies. Furthermore, the lack of standardized global map formats and protocols creates interoperability challenges among different manufacturers, slowing widespread adoption and increasing complexity for developers. The most impactful forces relate to the regulatory environment and technological maturity, where successful deployments rely heavily on clear legal frameworks governing data collection and safety standards for autonomous navigation systems.

Opportunities in this market are vast, centering primarily on leveraging the massive influx of consumer vehicle data for crowdsourced mapping, which drastically lowers operational expenditure over time. Expanding the utility of HD maps beyond autonomous vehicles—into areas like drone delivery navigation, smart infrastructure management (V2X communication), and highly specialized logistics optimization—presents lucrative diversification paths. Developing sophisticated AI and machine learning techniques to automate the dynamic updating process is crucial, allowing maps to evolve in real-time, matching temporary road conditions and changes. Strategic partnerships between telecom providers (for 5G rollout), sensor manufacturers (for better input data), and established mapping firms are accelerating the maturation of comprehensive dynamic mapping platforms. Overcoming the initial investment barrier through scalable, AI-driven solutions is the primary lever for converting market potential into commercial success.

The key impact forces driving market structure include competitive pressure to achieve the first widely adopted, scalable mapping standard and the inherent complexity of data governance. Data privacy and security regulations (such as GDPR and similar regional policies) exert significant pressure on how real-time vehicle data is collected, aggregated, and anonymized for mapping purposes, forcing companies to develop sophisticated compliance frameworks. Technological forces, particularly the rapid improvements in low-cost sensors and the deployment of 5G networks, are reducing latency and improving data throughput, making truly dynamic mapping feasible. Furthermore, the need for functional safety validation requires HD maps to be classified as safety-critical components, leading to rigorous certification processes that favor providers with established, robust verification methodologies, ultimately shaping the landscape toward fewer, highly reliable providers.

Segmentation Analysis

The Digital HD Map Market segmentation provides a granular view of the market structure, categorizing demand based on the specific requirements of autonomous systems, the technological methods employed for data collection, and the different layers of map content required. Key segments include the application type (autonomous passenger vehicles, commercial vehicles), the component (software, hardware, services), the content type (road network data, localization data, semantic data), and the level of automation (L3, L4, L5). Understanding these segments is crucial for stakeholders to tailor their product offerings, focusing on the highly demanding L4 and L5 segments, which require the most comprehensive and frequently updated map data. The primary demand driver across all segments remains the core necessity of providing a reliable, redundant layer of positional information to support vehicle perception and decision-making systems, differentiating market focus between high-volume consumer adoption and high-value commercial deployment.

Within the technology and content segmentation, the market is currently seeing a strong preference for hybrid data collection methods that merge high-fidelity survey data (using dedicated LiDAR and surveying equipment) with continuous crowdsourced data from standard vehicle cameras and IMUs. This hybrid approach allows providers to achieve detailed initial mapping while maintaining economic viability for global, continuous updates. Content-wise, localization layers (which include features like pole positions and highly accurate road geometry) are the most valuable component, as they directly facilitate the vehicle's ability to precisely position itself within centimeters, a prerequisite for safe autonomous operation. This stratification highlights the specialized nature of HD map development, requiring expertise in geospatial data management, computer vision, and real-time data processing, creating distinct competitive landscapes within each category.

The service segment is rapidly transitioning towards subscription-based models, reflecting the critical need for constant map maintenance and real-time delivery of dynamic information. Automotive OEMs prefer models that offer continuous updates and seamless integration with their proprietary autonomous driving stacks, moving away from one-time map purchases. This preference ensures that vehicle safety is maintained throughout the vehicle lifecycle. Geographically, while initial adoption focused on developed regions (North America, Europe), emerging markets, particularly in APAC, are expected to rapidly scale adoption, driven by large-scale government investment in smart infrastructure and mobility-as-a-service (MaaS) initiatives, necessitating adaptable and locally compliant mapping solutions across all major segments.

- By Component:

- Software (Map Engine, Update Algorithms, Localization Software)

- Hardware (LiDAR Sensors, High-Resolution Cameras, GPS/IMU Units used for mapping)

- Services (Mapping and Data Collection Services, Maintenance and Update Services, Consulting)

- By Solution Type:

- Mapping Solutions

- Localization Solutions

- Real-Time Dynamic Layer Solutions

- By Vehicle Autonomy Level:

- Level 3 (Conditional Automation)

- Level 4 (High Automation)

- Level 5 (Full Automation)

- By End-User Application:

- Autonomous Passenger Vehicles

- Commercial Vehicles (Trucking, Logistics, Delivery)

- Others (Robotics, Defense, Rail)

- By Data Source/Mapping Method:

- LiDAR/Dedicated Mapping Vehicles

- Crowdsourced Data (Cameras, Radar, Telematics)

- Satellite and Aerial Imagery

Value Chain Analysis For Digital HD Map Market

The Digital HD Map market value chain is intricate, spanning from raw data acquisition to final deployment in vehicle navigation stacks. The upstream segment involves the collection of raw geospatial data, typically utilizing highly sophisticated and expensive sensor hardware like mobile LiDAR, high-resolution cameras, and Differential GPS/IMU systems mounted on dedicated mapping vehicles, increasingly supplemented by satellite imagery and crowdsourced data from consumer fleets. Key upstream activities focus on high-precision surveying, sensor calibration, and initial data cleansing. Strategic partnerships are critical here, linking sensor manufacturers (hardware providers) with raw data aggregators and initial data processing specialists. The quality and resolution of the upstream data fundamentally determine the accuracy and reliability of the final HD map product, making data acquisition a high-cost and high-barrier-to-entry phase.

The midstream phase is where the core value addition occurs, transforming terabytes of raw point clouds and images into structured, usable HD map layers. This involves extensive data processing, feature extraction (often heavily reliant on AI and deep learning algorithms), data fusion, and the creation of various map layers—including the precise localization layer (geometric road structure) and the semantic layer (road signs, traffic rules). Map providers then employ proprietary software engines for continuous maintenance, validation, and updating of these maps, crucial for addressing temporary road changes. The midstream involves both proprietary software development for mapping algorithms and the rigorous quality control necessary for safety-critical automotive applications. Distribution channels, both direct and indirect, play a pivotal role in delivering these highly structured maps.

Downstream analysis focuses on the integration and utilization of HD maps by the end-users, primarily automotive OEMs and Tier 1 suppliers developing autonomous driving stacks. Direct distribution often involves map providers licensing their data directly to OEMs for integration into the vehicle's onboard computer and navigation system, often via secure cloud APIs enabling over-the-air (OTA) updates. Indirect channels include licensing the data to system integrators or specialized middleware providers who package the map data with other autonomous driving components before selling to the OEM. Upstream costs related to LiDAR data collection and downstream requirements for real-time OTA updates drive the economic model toward subscription-based software services, where continuous map updates (a service) rather than the static map itself (a product) constitute the primary revenue source, demanding robust and secure communication infrastructures.

Digital HD Map Market Potential Customers

Potential customers for Digital HD Maps are predominantly concentrated within the automotive and technology sectors that are actively pursuing automation and advanced mobility solutions. The primary end-users are global Automotive Original Equipment Manufacturers (OEMs), including companies like General Motors, Ford, BMW, Mercedes-Benz, and Tesla, who require precise maps to enable their Level 3 and Level 4 autonomous vehicle offerings. These OEMs integrate the HD map data directly into their vehicle’s electronic control unit (ECU) for sophisticated path planning and localization. Tier 1 automotive suppliers, such as Continental, Bosch, and Aptiv, who develop complete ADAS and AV computing platforms, are also significant buyers, often acting as intermediaries integrating map data into standardized hardware and software solutions that are then sold to multiple vehicle manufacturers.

Beyond traditional automotive players, technology companies specializing in Mobility-as-a-Service (MaaS) and robotaxi operations represent a rapidly expanding customer segment. Companies like Waymo, Cruise, and various ride-hailing services require high-definition maps for operational redundancy and safety in their self-driving fleets, particularly in restricted operating domains (geofenced areas). For these customers, the dynamism and accuracy of the map are paramount, as operational failures directly impact revenue and safety records. Furthermore, commercial fleet operators, especially long-haul trucking companies and logistics providers exploring platooning and highway automation, are increasingly adopting HD maps to enhance fuel efficiency and driver safety, marking a high-growth segment driven by commercial optimization rather than consumer adoption.

Secondary, yet significant, potential customers include government agencies and infrastructure planners interested in leveraging high-fidelity geospatial data for smart city planning, traffic management optimization, and infrastructure maintenance. Drone and specialized robotics manufacturers, particularly those operating in controlled environments or requiring highly accurate navigation in complex 3D space, also represent a niche market for HD map providers. The common requirement across all potential buyers is a need for map data that is not just spatially accurate but also continuously updated, robust against varying environmental conditions, and certified to meet stringent safety and reliability standards crucial for integrating into mission-critical systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.5 Billion |

| Market Forecast in 2033 | $20.0 Billion |

| Growth Rate | 35.0% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | HERE Technologies, TomTom NV, Baidu, Google (Waymo), NVIDIA, DeepMap (Nvidia), Civil Maps, NavInfo Co. Ltd., Elektrobit (Continental AG), Mapbox, Momenta, Sanborn Map Company, Autonavi, Esri, Toyota Research Institute, Mobileye (Intel), HD Mapping Technologies, Velodyne Lidar, Ibeo Automotive Systems, Quanergy Systems |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Digital HD Map Market Key Technology Landscape

The technological landscape of the Digital HD Map market is rapidly evolving, driven by the need for higher precision, faster update cycles, and scalable data processing. The foundation of this technology lies in highly accurate geospatial data collection techniques, primarily relying on Mobile Mapping Systems (MMS) equipped with high-resolution LiDAR sensors and advanced camera arrays. These systems capture precise 3D point clouds and rich visual data, which form the geometric backbone of the HD map. However, the reliance on expensive dedicated mapping fleets is being rapidly offset by the adoption of crowdsourcing technologies, where millions of consumer vehicles act as sensors, transmitting anonymized, low-cost sensor data back to the central processing engine. This hybrid data collection model ensures both the initial high fidelity and the continuous dynamic maintenance required for autonomous safety.

Central to processing this massive influx of data is the advanced application of Artificial Intelligence and Machine Learning, specifically in computer vision and deep learning. AI is employed for automated feature recognition (identifying road signs, traffic lights, and curbs), semantic segmentation of road elements, and, critically, for sensor fusion. Sensor fusion algorithms reconcile data discrepancies between various inputs (LiDAR, camera, radar, IMU) to construct a coherent, reliable map layer. This automation significantly reduces the labor involved in map production and verification. Furthermore, specialized algorithms are used for localization, enabling the autonomous vehicle to match its current sensor inputs against the stored map features in real-time with centimeter-level accuracy, a function often referred to as 'relocalization' or 'map matching'.

Connectivity infrastructure, particularly the rollout of 5G networks and V2X (Vehicle-to-Everything) communication standards, represents the key enabler for dynamic map updates. HD maps are shifting towards a highly dynamic data structure, where the map includes not only static features but also a real-time layer reflecting temporary conditions like weather, construction, or traffic incidents. Utilizing 5G's low latency and high bandwidth capabilities allows map providers to instantly push essential safety-critical updates to vehicles on the road, transforming the map from a static asset into a crucial component of the vehicle's real-time operational stack. The ongoing development of standardized map formats, such as the Sensor Independent Positioning (SIP) standard or variations of the OpenDRIVE format, is crucial for fostering interoperability and accelerating market adoption across global OEM bases.

Regional Highlights

Regional dynamics heavily influence the Digital HD Map Market, reflecting variances in regulatory environments, infrastructure maturity, and the pace of autonomous vehicle deployment. Each major region contributes distinctively to market demand and technological innovation.

- North America: This region is a market leader, characterized by early and aggressive investment in autonomous technology, driven by major tech companies (e.g., Waymo, Cruise) and established automotive giants. High adoption rates of Level 4 testing and commercial robotaxi services in metropolitan areas like Phoenix and San Francisco necessitate extensive HD map coverage. Favorable regulatory environments in several states (e.g., California, Arizona) and substantial investment in mapping sensor technology (LiDAR, high-end cameras) ensure North America remains a dominant hub for R&D and commercial deployment, focused heavily on crowdsourced data collection and real-time map dynamism.

- Europe: Europe represents a highly valuable market segment, propelled by stringent safety regulations (NCAP updates mandating advanced ADAS features) and significant government support for intelligent transportation systems. Countries like Germany, France, and the UK are major testing grounds for L3 highway pilot systems. The market here places a strong emphasis on interoperability and standardization, exemplified by efforts among key local players and cross-border initiatives. The density of road networks and varied environmental conditions necessitate highly robust and versatile HD map solutions capable of seamless cross-border operation.

- Asia Pacific (APAC): APAC is projected to exhibit the highest growth rate during the forecast period. This explosive growth is driven primarily by China and South Korea, fueled by massive government investments in smart cities, 5G deployment, and aggressive domestic autonomous vehicle targets. China's market is unique, characterized by proprietary mapping standards and regulatory requirements mandating local map providers (like Baidu and NavInfo). The rapid deployment of MaaS platforms and the scale of potential vehicle adoption make APAC the key battleground for volume scaling, demanding cost-effective, high-coverage mapping solutions adaptable to complex, high-density urban infrastructure.

- Latin America, Middle East, and Africa (MEA): These regions are emerging markets for HD maps, with adoption concentrated in specific government-backed smart city projects (e.g., NEOM in Saudi Arabia) and pilot autonomous transportation initiatives. While infrastructure development for wide-scale consumer AV deployment is still nascent, the commercial vehicle segment (mining, ports, logistics) provides an initial, high-value demand for restricted-domain, high-precision mapping solutions. Market penetration is expected to increase steadily as infrastructure and regulatory frameworks mature, particularly in industrialized nations within the GCC and South Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Digital HD Map Market.- HERE Technologies

- TomTom NV

- Baidu

- Google (Waymo)

- NVIDIA

- DeepMap (Nvidia)

- Civil Maps

- NavInfo Co. Ltd.

- Elektrobit (Continental AG)

- Mapbox

- Momenta

- Sanborn Map Company

- Autonavi

- Esri

- Toyota Research Institute

- Mobileye (Intel)

- HD Mapping Technologies

- Velodyne Lidar

- Ibeo Automotive Systems

- Quanergy Systems

Frequently Asked Questions

Analyze common user questions about the Digital HD Map market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a Digital HD Map and a standard GPS navigation map?

Digital HD Maps provide centimeter-level positional accuracy and detailed, semantic information (lane geometry, road signs, curbs) crucial for L3-L5 autonomous vehicle localization and path planning, whereas standard GPS maps offer meter-level accuracy primarily for human navigation.

How do HD Maps handle real-time changes in road conditions, such as construction zones?

HD Maps utilize a dynamic layer that is constantly updated in real-time via crowdsourced data from vehicle fleets and V2X communication. AI models process this data to detect, verify, and broadcast temporary changes, ensuring the map remains current for safety-critical operations.

Which sensor technology is most critical for the initial creation of highly accurate HD Maps?

LiDAR (Light Detection and Ranging) technology is currently the most critical sensor for initial HD map creation, as it generates highly dense and geometrically accurate 3D point clouds essential for establishing the centimeter-level base layer of the map.

Is the Digital HD Map market moving toward a standardized format for global use?

Yes, while standardization is an ongoing challenge, industry bodies and key players are actively developing open standards, such as the OpenDRIVE format and proprietary interfaces like NDS, aiming for greater interoperability to streamline integration across different autonomous vehicle platforms worldwide.

What are the biggest challenges related to the scalability of HD map deployment?

The main challenges are the high capital cost required for initial global data acquisition, the complexity of maintaining real-time accuracy across vast geographies, and navigating fragmented regulatory landscapes regarding data ownership and privacy.

Do HD Maps replace a vehicle's onboard perception system entirely?

No. HD Maps act as a critical redundancy and context layer, providing prior knowledge of the road structure and static features. They complement, rather than replace, the vehicle's real-time perception system (cameras, radar, onboard LiDAR) which handles immediate dynamic elements and sudden changes.

Which regions are leading in the commercial deployment and adoption of HD Maps?

North America and Europe currently lead in commercial deployment and Level 3 and 4 testing. However, the Asia Pacific region, particularly China, is projected to lead future growth due to massive state investments in smart city infrastructure and domestic AV fleet expansion.

How does AI contribute to reducing the operational cost of HD map maintenance?

AI significantly reduces maintenance costs by automating the validation and integration of crowdsourced data, filtering sensor noise, and automatically extracting features, thereby minimizing the reliance on expensive manual verification and dedicated mapping sweeps.

What role does 5G connectivity play in the Digital HD Map ecosystem?

5G connectivity is vital for enabling ultra-low latency, high-bandwidth communication, which is necessary for the rapid, real-time distribution of safety-critical map updates and dynamic layer information to autonomous vehicle fleets.

Are mapping companies primarily focusing on static or dynamic map content?

The market focus is rapidly shifting toward dynamic map content, which integrates static road geometry with real-time variables like traffic, weather effects, and temporary obstructions, enabling safer and more informed decision-making for L4 and L5 systems.

What is the expected average growth rate (CAGR) for the HD Map Market?

The Digital HD Map Market is anticipated to experience robust growth, projected at approximately 35.0% CAGR between 2026 and 2033, driven by the commercialization of autonomous vehicle technology globally.

Who are the major end-users outside of traditional automotive manufacturers?

Major non-automotive end-users include Mobility-as-a-Service (MaaS) providers like robotaxi companies, commercial trucking and logistics fleets utilizing automated transport, and smart city infrastructure planners seeking high-fidelity geospatial data.

What is semantic data in the context of HD maps?

Semantic data refers to the context and meaning attributed to road features, such as identifying a sign as a 'stop sign', classifying a lane as 'exit only', or marking a curb as 'mountable,' which is essential for the autonomous vehicle's decision-making logic.

How does the 'fleet as a sensor' concept impact HD map creation?

The 'fleet as a sensor' concept utilizes existing consumer and commercial vehicles equipped with basic sensors (cameras, GPS) to continuously collect and transmit data, providing a cost-effective, scalable method for real-time map maintenance and validating updates globally.

What are the key components included in an HD Map solution?

Key components include the initial high-resolution mapping data (geometric layer), the localization software engine within the vehicle, and continuous maintenance and update services delivered via cloud infrastructure.

Do Digital HD Maps pose cybersecurity risks?

Yes, due to their safety-critical nature and reliance on continuous over-the-air (OTA) updates, HD maps are vulnerable to cybersecurity threats. Secure encryption, robust authentication protocols, and integrity checks are essential to prevent unauthorized data manipulation or hacking.

How does the market address the issue of varying regulatory compliance across different countries?

Map providers must develop highly adaptable mapping platforms capable of supporting localized semantic data (e.g., traffic law differences) and adhering to distinct regional privacy and data sovereignty regulations, often requiring local partnerships in markets like China.

What role do Tier 1 suppliers play in the HD Map value chain?

Tier 1 suppliers integrate map data licensed from providers into their broader autonomous driving hardware and software platforms, often serving as the crucial technical link between the map developers and the final vehicle OEM integrators.

What is the projected market size of the Digital HD Map Market by 2033?

The Digital HD Map Market is projected to reach an estimated value of $20.0 Billion by the end of the forecast period in 2033, reflecting substantial growth driven by mass production of L4 autonomous vehicles.

Why is centimeter-level precision necessary for autonomous vehicles?

Centimeter-level precision is essential because it allows the autonomous vehicle to accurately localize itself within its lane, differentiate between adjacent road features, and perform complex maneuvers (like merging or narrow passage navigation) safely and reliably.

How are initial mapping costs being mitigated by technology advancements?

Initial mapping costs are mitigated through advancements in high-efficiency data processing using AI, the integration of lower-cost sensor fusion techniques (combining camera and radar with LiDAR), and leveraging widespread crowdsourced data contributions.

What is a key opportunity for HD Map technology outside of on-road vehicles?

A key opportunity lies in specialized navigation applications such as drone delivery services, industrial robotics operating in constrained environments, and geospatial data services for highly precise infrastructure modeling and maintenance.

How do mapping companies ensure the safety integrity of the map data?

Safety integrity is ensured through rigorous automated verification and validation processes, redundancy checks across multiple data sources, compliance with safety standards (e.g., ISO 26262), and secure transmission protocols to prevent data corruption.

Which segment of the market demands the highest resolution and update frequency?

The Level 4 (L4) and Level 5 (L5) autonomous vehicle segment, particularly for robotaxi operations and commercial trucking, demands the absolute highest resolution, real-time update frequency, and operational redundancy due to the absence of a required human driver.

What is the primary role of the HD map localization layer?

The localization layer provides the vehicle with a precise geometric fingerprint of the road environment, allowing the vehicle to accurately determine its exact position and orientation (pose estimation) within the map's coordinate system.

What impact does telematics data have on HD mapping?

Telematics data provides valuable supplementary information regarding vehicle speed, braking patterns, and route choices, which helps in identifying common traffic flows, speed limits, and areas requiring high-priority map detail or dynamic updates.

How does the market define 'dynamic layer' data?

'Dynamic layer' data refers to non-permanent, rapidly changing information overlaid onto the static map base, including real-time traffic flow, temporary construction zones, weather conditions affecting visibility, and recent accident alerts.

Are traditional GPS mapping providers involved in the HD Map Market?

Yes, traditional providers like HERE Technologies and TomTom have heavily invested in and transformed their operations to develop and specialize in high-definition mapping required for autonomous driving, leveraging their existing geospatial expertise and customer base.

What is the significance of the Base Year 2025 in this market report?

The Base Year 2025 represents the current state of market development and valuation, providing the definitive reference point from which future growth projections and CAGR calculations for the forecast period (2026-2033) are derived.

How are different levels of vehicle automation (L3, L4, L5) addressed by map content?

L3 systems require regional, high-fidelity maps mainly for highway piloting, while L4 and L5 systems demand continuous, comprehensive, and highly dynamic mapping for full operational design domains (ODDs), including complex urban environments and diverse driving scenarios.

Why is the relationship between map providers and sensor manufacturers strategically important?

The relationship is critical because the quality of the HD map is directly dependent on the fidelity and type of sensor data collected. Strategic collaboration ensures the map architecture is optimized for integration with the latest sensor hardware and data formats.

What distinguishes semantic data extraction from geometric data extraction in mapping?

Geometric extraction focuses on the precise physical location and shape (e.g., lane line coordinates), while semantic extraction focuses on assigning meaning and rules to those physical objects (e.g., lane line is solid white, indicating no passing).

Is there a trend towards consolidation among market players in the HD Map sector?

Yes, significant consolidation and strategic acquisitions are occurring, as evidenced by large tech firms (like Nvidia, Intel) acquiring specialized HD mapping startups (e.g., DeepMap, Mobileye) to integrate key mapping capabilities directly into their autonomous driving stacks.

What is the projected market size in 2026 for the Digital HD Map Market?

The Digital HD Map Market size is estimated at $2.5 Billion in 2026, marking the beginning of the period characterized by the accelerating commercial rollout of L3 and L4 systems.

How do HD map services typically generate revenue?

Revenue generation is primarily shifting towards subscription-based licensing models, where automotive OEMs and mobility providers pay recurring fees for continuous access to map data, necessary updates, and specialized software services.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager