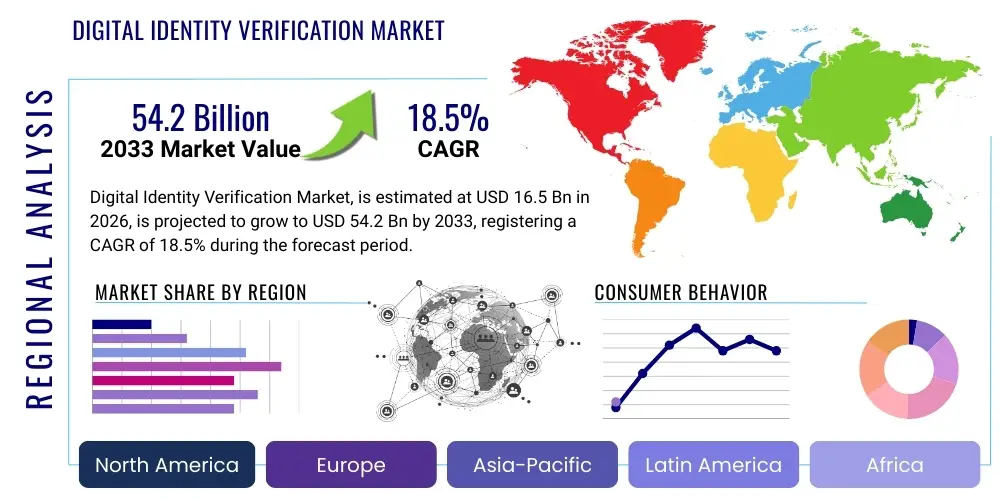

Digital Identity Verification Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436183 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Digital Identity Verification Market Size

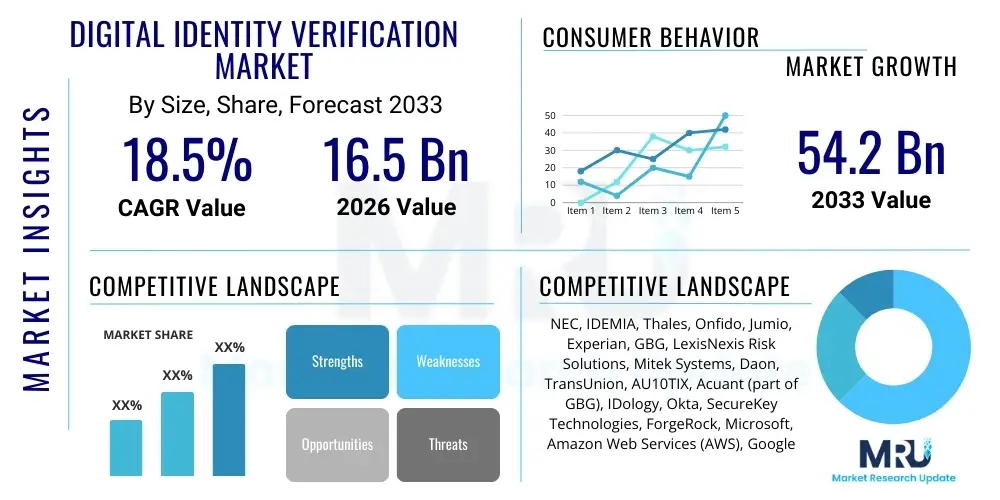

The Digital Identity Verification Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 16.5 Billion in 2026 and is projected to reach USD 54.2 Billion by the end of the forecast period in 2033.

Digital Identity Verification Market introduction

The Digital Identity Verification Market encompasses the technologies and services designed to confirm the real-world identity of an individual or entity during online interactions, primarily to mitigate fraud, comply with regulatory mandates such as Know Your Customer (KYC) and Anti-Money Laundering (AML), and enhance overall security for digital transactions. This verification process typically involves validating government-issued documents, matching biometric data, or utilizing knowledge-based authentication methods across various digital channels. The core objective is to establish trust in a non-face-to-face environment, crucial for the expansive growth of e-commerce, digital finance, and government services globally. The market offers solutions ranging from basic automated document checks to complex, multi-layered identity proofing orchestration platforms.

The primary products within this market are segmented by solution type, including biometric verification (such as facial recognition and fingerprint scanning), automated document verification (checking passports and driving licenses for authenticity), and non-document-centric methods like identity scoring, behavioral biometrics, and knowledge-based authentication. Major applications span across highly regulated industries like Banking, Financial Services, and Insurance (BFSI), telecommunications, government, healthcare, and retail, all of which require robust mechanisms for customer onboarding, age verification, and transaction authorization. The widespread adoption of remote services, accelerated by global events, has cemented the necessity of reliable digital ID systems for both convenience and compliance.

The profound benefits derived from adopting comprehensive digital identity solutions include significantly reduced onboarding friction, lower operational costs associated with manual verification processes, and markedly improved fraud prevention rates, which directly translate into enhanced customer trust and minimized financial losses. Key driving factors propelling market expansion include increasingly stringent global regulatory landscapes (e.g., GDPR, PSD2, FATF guidelines), the escalating sophistication of identity theft and synthetic identity fraud schemes, and the mass consumer shift toward mobile-centric interactions and digital-only service providers. Furthermore, the push for true digital transformation across public and private sectors, emphasizing seamless yet secure access to services, fundamentally underpins the market's robust growth trajectory over the forecast period.

Digital Identity Verification Market Executive Summary

The Digital Identity Verification Market is experiencing accelerated growth, fueled primarily by a critical shift in global business trends toward fully remote and digital customer onboarding processes, eliminating the need for physical presence. This move is driven by consumer demand for instantaneous service access and mandatory compliance requirements, particularly in the BFSI sector, where the fight against financial crime necessitates continuous, sophisticated identity proofing mechanisms. A major trend involves the integration of advanced Artificial Intelligence (AI) and Machine Learning (ML) algorithms to enhance the accuracy of biometric matching, detect deepfakes, and instantly analyze the authenticity of physical documents submitted digitally. Companies are investing heavily in identity orchestration platforms that combine multiple verification methods (biometrics, device data, document analysis) into a single, seamless workflow, reducing customer dropout rates while maintaining high security standards.

Regionally, North America and Europe currently dominate the market share due to established digital infrastructure, early regulatory adoption (like GDPR and PSD2), and a mature market of technology providers. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), driven by massive populations rapidly transitioning to mobile-first banking and digital governance initiatives, especially in developing economies like India and Southeast Asia. Regulatory frameworks focused on digital citizen identification (e.g., India's Aadhaar) and financial inclusion efforts are massive accelerators in APAC. The Middle East and Africa (MEA) are also showing strong uptake, often leaping past legacy systems directly into advanced digital ID solutions to modernize government services and combat cross-border fraud.

Segment trends highlight the dominance of Biometric Verification solutions, particularly facial recognition coupled with passive or active liveness detection, due to their superior accuracy and user convenience compared to traditional methods. Within the end-user landscape, the BFSI segment remains the largest consumer of these technologies, utilizing them extensively for account opening, credit application processing, and secure transaction authentication. Furthermore, the Cloud Deployment model is rapidly overtaking on-premise solutions, offering scalability, lower total cost of ownership (TCO), and flexibility necessary for global organizations that need to quickly adapt to evolving international regulatory standards. Managed services are also seeing significant demand, as many organizations prefer outsourcing complex compliance and verification workflows to specialized third-party providers.

AI Impact Analysis on Digital Identity Verification Market

Common user and market questions regarding AI's influence center on its ability to transcend human verification limitations, asking: Can AI detect sophisticated synthetic identities and deepfake attacks effectively? How quickly and accurately can machine learning process identity documents from hundreds of jurisdictions? What are the biases inherent in biometric AI, and how do providers ensure fairness and regulatory compliance? And ultimately, how does AI-driven fraud detection move from reactive to predictive analysis? The synthesis of these queries confirms that the key themes revolve around enhanced fraud detection sophistication, improved operational efficiency through automation (reducing manual review time), and navigating the ethical and privacy challenges associated with processing sensitive biometric data at scale. Users expect AI not just to verify identity but to provide real-time risk scoring and adaptive authentication.

- AI significantly enhances fraud detection capabilities by analyzing patterns and anomalies in identity documents, metadata, and user behavior that are too subtle for human review.

- Machine Learning algorithms power advanced biometric analysis, enabling high-accuracy facial recognition, fingerprint matching, and highly reliable liveness detection against sophisticated spoofing attempts (e.g., deepfakes or 3D masks).

- AI improves operational efficiency by automating the processing and cross-validation of identity documents, reducing customer onboarding time from days to mere seconds, which drastically lowers customer abandonment rates.

- Predictive analytics, driven by AI, allows identity verification systems to assign real-time risk scores to transactions and new accounts based on historical fraud data, facilitating adaptive authentication strategies.

- Natural Language Processing (NLP) within AI systems assists in processing documentation and identity attributes across diverse languages and formats, broadening global verification capabilities.

- The use of AI introduces challenges related to data privacy, algorithmic bias, and compliance, necessitating explainable AI (XAI) models to ensure transparency and regulatory adherence, particularly in sensitive governmental and financial applications.

DRO & Impact Forces Of Digital Identity Verification Market

The Digital Identity Verification Market is strongly influenced by a robust combination of compelling drivers, necessary restraints, and significant long-term opportunities, all coalescing to form powerful impact forces. The primary drivers are the massive global acceleration of digital transformation, which mandates remote identity proofing for service access, coupled with the exponential increase in the financial losses attributed to identity theft, synthetic identities, and account takeover fraud. Furthermore, global regulatory bodies are continually tightening KYC and AML requirements, pushing organizations to adopt real-time, high-assurance digital verification methods to avoid crippling fines. These drivers create an immediate and non-negotiable demand across nearly all regulated sectors.

However, the market faces notable restraints. Foremost among these is the growing public concern and legal scrutiny over data privacy and security, especially related to the storage and processing of biometric information, which can deter adoption among privacy-conscious consumers. The high initial implementation cost associated with integrating complex, multi-layered identity verification platforms, particularly for small and medium-sized enterprises (SMEs), also poses a significant barrier. Additionally, the lack of globally harmonized regulatory standards complicates international verification processes, forcing vendors to build highly customized, region-specific solutions, increasing complexity and cost.

Opportunities for market expansion are abundant, particularly in emerging areas like decentralized identity (DID) frameworks, leveraging blockchain technology to grant users greater control over their verifiable credentials. The integration of identity verification into the growing Metaverse and Web3 ecosystems presents new frontiers for secure, digital interaction. Furthermore, the untapped potential in sectors such as P2P lending, gig economy platforms, and supply chain verification represents substantial greenfield expansion for market players. The overarching impact forces—regulatory pressure, technological innovation (AI/ML), and the constant threat of sophisticated cybercrime—ensure that the need for robust digital identity verification systems will remain critical and consistently drive investment throughout the forecast period.

Segmentation Analysis

The Digital Identity Verification market is highly fragmented and analyzed across several critical dimensions, enabling organizations to select solutions tailored to their specific risk appetite, regulatory environment, and operational workflow requirements. The primary segmentation layers focus on the technological solution being deployed (biometrics versus document-centric), the type of service offered (professional consultation versus continuous managed verification), the deployment model (cloud-based for agility or on-premise for high security), and the distinct industry vertical being served, reflecting varied compliance needs across sectors like BFSI, Government, and Telecom. This multi-layered structure ensures that analysis captures the diverse procurement strategies of global enterprises.

- By Solution Type:

- Biometric Verification (Facial Recognition, Fingerprint/Palm Vein Recognition, Voice Recognition, Iris Recognition, Behavioral Biometrics)

- Document Verification (Automated Document Analysis, Manual Review, Digital Proofing)

- Knowledge-Based Verification (KBA)

- Non-Document Centric Verification (Database Checks, Identity Scoring)

- Identity Proofing and Orchestration Platforms

- By Service:

- Professional Services (Consulting, Integration, Training, Support)

- Managed Services (Outsourced Identity Lifecycle Management, Continuous Monitoring)

- By Deployment Type:

- On-Premise

- Cloud-Based (SaaS model predominant)

- By End-User Industry:

- Banking, Financial Services, and Insurance (BFSI)

- Government and Defense (e-Government Services, Border Control, Citizen ID)

- Telecommunications

- Retail and E-commerce

- Healthcare

- Energy and Utility

- Other Verticals (Travel, Gaming, Education)

- By Organization Size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

Value Chain Analysis For Digital Identity Verification Market

The value chain for the Digital Identity Verification Market begins with core technology providers who specialize in developing sophisticated algorithms for biometric capture, AI-driven document analysis, and underlying cryptographic security mechanisms. This upstream segment is highly competitive and capital-intensive, focusing on continuous R&D to improve liveness detection and minimize verification latency. These foundational technology components are then passed to specialized platform and solution developers, who integrate these distinct capabilities into holistic identity orchestration platforms that offer a unified API for easy deployment across various end-user applications. This stage focuses on scalability, user experience, and regulatory compliance features necessary for cross-border operations.

Midstream activities involve implementation, integration, and service provision. System integrators and professional service firms play a crucial role in customizing platforms to fit an organization’s legacy infrastructure and specific compliance needs (e.g., integrating verification processes into existing CRM or core banking systems). Furthermore, many vendors offer managed services, taking on the direct responsibility of monitoring, reviewing complex cases, and ensuring continuous regulatory adherence for their clients. This outsourcing approach is highly attractive to companies seeking operational efficiencies and guaranteed compliance without building large internal security teams. Distribution channels are predominantly direct sales to large enterprises and government entities, particularly for bespoke, on-premise solutions, alongside a rapidly growing reliance on indirect channels.

The downstream flow involves the distribution channel, which utilizes both direct sales forces and a robust network of indirect partners, including resellers, cloud marketplace providers (like AWS and Azure), and technology partners specializing in adjacent fields (e.g., fraud management or cybersecurity). Cloud deployment, specifically the Software-as-a-Service (SaaS) model, has become the dominant distribution channel, facilitating rapid global deployment and simplifying updates. End-users (e.g., major banks, government agencies) complete the value chain, applying the verified identity data to various applications such as customer onboarding, secure access control, transaction validation, and risk management. The efficiency of the entire chain is heavily dependent on the seamless data exchange between the foundational technology providers and the ultimate service application layers.

Digital Identity Verification Market Potential Customers

The primary and most lucrative customer segment for digital identity verification solutions remains the Banking, Financial Services, and Insurance (BFSI) sector. Financial institutions are legally obligated to perform rigorous KYC checks to prevent money laundering and terrorist financing, making high-assurance identity verification a non-negotiable operational cost. Potential customers in this sector include traditional commercial banks seeking to modernize their digital account opening processes, FinTech start-ups requiring rapid yet compliant remote onboarding, and insurance providers verifying claims applicants and policyholders. Their need centers on reducing fraud losses from synthetic identity creation while simultaneously delivering a near-instantaneous, frictionless customer experience to maintain competitiveness.

Another immensely significant customer segment is Government and Public Services. National, state, and local governments require solutions for e-governance initiatives, citizen identity programs, secure border control, and the efficient distribution of social benefits and essential services. These agencies require scalable solutions that can handle extremely large volumes of data, often across diverse demographics, prioritizing data sovereignty and long-term storage security. The move towards decentralized digital IDs and verifiable credentials is a major purchasing driver in this sector, aiming to enhance citizen privacy while improving service delivery efficiency and integrity.

Beyond these highly regulated sectors, the Telecommunications and Retail/E-commerce industries represent rapidly expanding potential customer bases. Telecom companies need robust verification to prevent SIM card swap fraud and illegal contract sign-ups, which is crucial as 5G deployment accelerates the number of connected devices. E-commerce and retail customers need solutions for age verification (for restricted goods), payment fraud prevention, and account creation security, particularly as cross-border shopping and alternative payment methods grow. These customers seek verification services that are easily integrated into their existing consumer-facing mobile applications and websites, emphasizing speed and minimizing disruption to the customer journey.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 16.5 Billion |

| Market Forecast in 2033 | USD 54.2 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | NEC, IDEMIA, Thales, Onfido, Jumio, Experian, GBG, LexisNexis Risk Solutions, Mitek Systems, Daon, TransUnion, AU10TIX, Acuant (part of GBG), IDology, Okta, SecureKey Technologies, ForgeRock, Microsoft, Amazon Web Services (AWS), Google |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Digital Identity Verification Market Key Technology Landscape

The technology landscape of the Digital Identity Verification Market is characterized by the convergence of advanced computing techniques, primarily Artificial Intelligence (AI) and Machine Learning (ML), with sophisticated hardware and cryptographic security protocols. Biometric technologies, particularly facial recognition coupled with passive liveness detection, form the cornerstone of modern verification, offering the highest level of assurance and user convenience. ML models are continuously trained on massive datasets of legitimate and fraudulent documents and faces to detect anomalies, deepfakes, and synthetic identity markers in real time. This technological sophistication allows systems to perform rapid cross-validation of identity attributes against trusted databases, device signals, and behavioral patterns, moving beyond simple static data checks.

Document verification technologies rely heavily on computer vision and optical character recognition (OCR) enhanced by AI to instantly read, classify, and authenticate identity documents from thousands of global issuers. Key innovations include utilizing advanced spectral analysis and machine learning to verify minute security features (like holograms, microprint, and UV patterns) without human intervention. Furthermore, the development of identity orchestration layers represents a critical technological advancement. These platforms are designed to seamlessly integrate various verification technologies (biometrics, document checks, database lookups) into a single, adaptive workflow. This ensures that the system can automatically pivot authentication methods based on the risk profile of the transaction or the specific regulatory requirement of the geographic location, maximizing both security and user conversion rates.

Looking ahead, emerging technologies such as Decentralized Identity (DID), leveraging blockchain and Self-Sovereign Identity (SSI) principles, are gaining traction. DID frameworks aim to shift control of identity credentials from centralized authorities or third-party vendors back to the individual, enhancing privacy and security by minimizing the amount of personal data shared during verification. Although still nascent in widespread enterprise adoption, SSI platforms are positioned to disrupt traditional verification models by facilitating reusable, verifiable digital credentials. Concurrently, behavioral biometrics—analyzing typing speed, mouse movements, and navigation patterns—are becoming integrated layers, providing continuous, passive authentication post-onboarding, drastically reducing the risk of account takeover (ATO) fraud without impacting the user experience.

Regional Highlights

- North America: This region holds the largest market share, driven by a mature technological infrastructure, high rates of digital service adoption, and a massive financial services sector that is aggressively combating sophisticated identity fraud. The US and Canada are home to many leading identity verification solution providers, and regulatory pressure, particularly concerning data breach prevention, fuels continuous investment in high-assurance identity solutions. Early adoption of advanced biometrics and orchestration platforms is standard practice here.

- Europe: Characterized by stringent data protection laws (GDPR) and complex regulatory environments (eIDAS, PSD2), Europe is highly focused on achieving regulatory compliance while ensuring data portability and consumer consent. The strong push toward pan-European digital identity systems drives market demand. The market is highly competitive, emphasizing secure, consent-based verification methods that support digital single market initiatives and secure cross-border transactions.

- Asia Pacific (APAC): APAC is the fastest-growing market, primarily fueled by the massive governmental push for digital citizen IDs (e.g., India, Singapore), rapid financial inclusion efforts, and a vast, mobile-first population moving swiftly from traditional to digital banking. High incidence of mobile device use, coupled with developing regulatory frameworks, necessitates scalable, cost-effective biometric and document verification solutions tailored to diverse local language and document formats.

- Latin America (LATAM): Growth in LATAM is driven by significant efforts to modernize banking sectors and combat high rates of financial fraud and lack of official identification among segments of the population. Countries like Brazil and Mexico are seeing strong adoption of facial recognition and identity database checks to secure remote transactions and improve access to formal financial services. The focus is often on robust fraud prevention capabilities due to high risk environments.

- Middle East and Africa (MEA): This region is characterized by large-scale government digitalization projects and smart city initiatives, particularly in the GCC countries, which require high-security digital ID systems for citizen services and infrastructure access. Adoption is increasing rapidly, often skipping older technologies entirely and moving directly to advanced cloud-based biometric and identity management solutions to secure fast-growing digital economies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Digital Identity Verification Market.- NEC

- IDEMIA

- Thales

- Onfido

- Jumio

- Experian

- GBG

- LexisNexis Risk Solutions

- Mitek Systems

- Daon

- TransUnion

- AU10TIX

- Acuant (now part of GBG)

- IDology

- Okta

- SecureKey Technologies

- ForgeRock

- Microsoft

- Amazon Web Services (AWS)

Frequently Asked Questions

Analyze common user questions about the Digital Identity Verification market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Digital Identity Verification and why is it essential?

Digital Identity Verification is the process of confirming a person’s real-world identity remotely using digital tools to prevent fraud and ensure compliance (KYC/AML). It is essential because it builds trust in non-face-to-face online environments, secures digital transactions, and enables mandatory regulatory adherence for financial and governmental services.

Which technologies are driving the highest growth in the Digital Identity Verification market?

Biometric technologies, specifically AI-powered facial recognition with liveness detection, are the primary growth drivers. Additionally, sophisticated document authentication using Machine Learning and specialized identity orchestration platforms, which integrate multiple verification methods, are seeing massive investment and adoption.

What is the role of AI in detecting synthetic identity fraud?

AI plays a critical role by analyzing vast datasets and behavioral patterns to identify anomalies characteristic of synthetic identities—identities fabricated using a combination of real and fake data. AI models can correlate verification data points across multiple systems to flag high-risk accounts that traditional verification methods might miss.

How does the Digital Identity Verification market comply with GDPR and privacy regulations?

Compliance is achieved by prioritizing consent, data minimization, and secure cryptographic storage. Leading solutions are adopting privacy-enhancing technologies, like zero-knowledge proofs and decentralized identity frameworks, to verify credentials without requiring access to or permanent storage of sensitive personal data, adhering strictly to global data protection laws.

Which industry segment is the largest user of Digital Identity Verification solutions?

The Banking, Financial Services, and Insurance (BFSI) segment is the largest end-user, accounting for the highest market share. This is due to stringent global KYC and AML regulatory mandates, the high monetary risk associated with financial transactions, and the need for seamless digital onboarding of customers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager