Digital Magazine Publishing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438579 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Digital Magazine Publishing Market Size

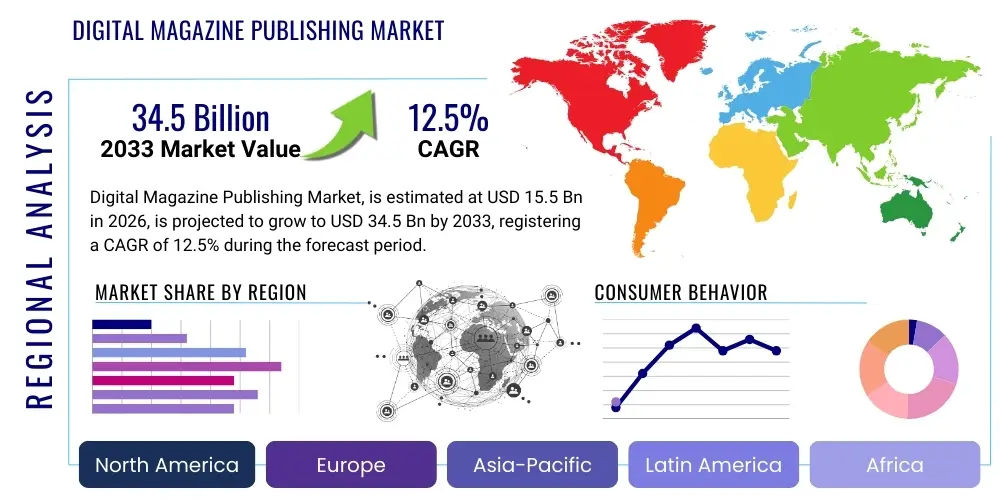

The Digital Magazine Publishing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 34.5 Billion by the end of the forecast period in 2033.

Digital Magazine Publishing Market introduction

The Digital Magazine Publishing Market encompasses the creation, distribution, and monetization of magazine content specifically tailored for digital platforms, including mobile applications, dedicated websites, e-readers, and third-party aggregation services. This industry transition represents a significant shift from traditional print media, leveraging technology to offer enhanced interactivity, multimedia integration, and personalized reading experiences. Products within this market include specialized digital editions (replicas of print magazines), enhanced interactive editions (featuring video, audio, and animations), and native digital content designed exclusively for screen consumption. The core value proposition revolves around instant accessibility, global reach, and reduced environmental impact compared to physical distribution models. Key applications span across consumer lifestyle, business and finance, science and technology, and niche hobbies, catering to diverse global audiences seeking current, high-quality, and engaging information.

Major applications driving market expansion include subscription-based reading models, single-issue purchases through proprietary apps, and integration with dynamic advertising technologies that allow for precise audience targeting. The benefits derived by consumers are manifold, ranging from cost-effectiveness and portability to the immediate updating of content and the ability to archive vast quantities of information digitally. For publishers, the digital shift offers streamlined production processes, lower overhead costs associated with printing and distribution logistics, and powerful data analytics capabilities that provide deep insights into reader behavior and preferences. These insights are crucial for refining content strategy, optimizing pricing tiers, and maximizing advertising revenue potential in a highly competitive media landscape.

Driving factors underpinning the robust growth of this market are primarily the accelerating penetration of high-speed internet, the ubiquitous adoption of smartphones and tablets globally, and the growing consumer comfort with digital payment systems for content consumption. Furthermore, the imperative for publishers to establish direct-to-consumer relationships, circumventing traditional retail channels, fosters innovation in digital delivery systems. The move towards personalized content streams and the development of sophisticated Content Management Systems (CMS) tailored for rich media also contribute significantly to market dynamics, ensuring that digital magazines remain a compelling and engaging alternative to fleeting social media updates and standard web articles.

Digital Magazine Publishing Market Executive Summary

The Digital Magazine Publishing Market is experiencing rapid transformation, marked by a decisive shift toward integrated multimedia experiences and advanced monetization strategies, notably recurring subscription models and programmatic advertising. Current business trends indicate a strong emphasis on leveraging Big Data analytics to understand reader journeys, allowing publishers to create highly personalized content offerings that drive engagement and reduce churn. Publishers are increasingly investing in proprietary technology stacks to ensure seamless cross-platform functionality and superior user interface design, thereby solidifying brand loyalty in a saturated digital environment. Furthermore, strategic mergers and acquisitions among traditional print houses and tech-focused digital platforms are reshaping the competitive landscape, aiming to consolidate market share and integrate complementary technological capabilities for enhanced content delivery and scalability.

Regional trends reveal that North America and Europe currently dominate the market, primarily due to high digital literacy rates, strong consumer spending power on media subscriptions, and the early adoption of advanced mobile reading devices. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by massive increases in smartphone penetration, expanding middle classes with disposable income for digital content, and significant investments in digital infrastructure, particularly in emerging economies like India and China. Latin America and the Middle East & Africa (MEA) are also showing promising acceleration, focusing on mobile-first content strategies tailored to local linguistic and cultural preferences, utilizing localized payment systems to encourage wider subscription uptake.

Segment trends highlight the burgeoning importance of specialized content delivered via dedicated application models, offering richer interactivity compared to simple web-based formats. The segment focused on interactive and enhanced magazines, which incorporate virtual reality (VR) or augmented reality (AR) elements, is witnessing high growth, appealing particularly to younger, digitally native audiences. Monetization segmentation shows a continued reliance on subscription revenue, yet the integration of native content advertising and affiliate marketing within digital editions is providing critical supplementary revenue streams. The Professional and Business segment remains stable, driven by the necessity for timely, curated, and expert information in fields such as technology, healthcare, and finance.

AI Impact Analysis on Digital Magazine Publishing Market

Users frequently inquire about AI's role in content creation efficiency, its potential impact on journalistic integrity, and how machine learning can revolutionize personalized content delivery and advertising optimization within the digital magazine sphere. Key concerns center on whether AI will automate content creation jobs, leading to reduced human oversight, and how sophisticated algorithms can ethically manage and utilize vast amounts of reader data for personalization. Users also express high expectations regarding AI's ability to significantly improve engagement metrics through dynamic layout adjustments, predictive analytics for trending topics, and highly targeted, non-intrusive advertising experiences that enhance rather than disrupt the reading flow. The consensus theme is that AI will move beyond simple automation to become a critical strategic partner in content lifecycle management, from ideation and production workflow optimization to personalized reader engagement and effective monetization.

- AI-driven personalization engines drastically improve user experience by recommending articles based on deep reading habits and behavioral patterns, enhancing retention rates.

- Automated content generation and summarization tools accelerate the drafting process for routine news updates or derivative content, freeing human editors for high-value investigative work.

- Advanced programmatic advertising platforms leverage AI for real-time bidding, optimal ad placement, and precise audience targeting, maximizing yield for publishers.

- Machine learning algorithms analyze subscription churn indicators, allowing publishers to proactively engage at-risk subscribers with tailored offers or specialized content.

- AI facilitates enhanced metadata tagging and semantic search optimization, significantly improving the discoverability of magazine content across search and aggregation platforms.

- Sophisticated natural language processing (NLP) tools assist in content moderation and ensuring brand safety, automatically identifying and flagging inappropriate or plagiarized material.

- Predictive analytics models forecast emerging content trends and reader demand, guiding editorial strategy and resource allocation effectively.

- The implementation of AI assistants enhances accessibility features, such as automated audio descriptions or text-to-speech functionality for visually impaired readers.

DRO & Impact Forces Of Digital Magazine Publishing Market

The Digital Magazine Publishing Market is dynamically shaped by a crucial set of Drivers, Restraints, and Opportunities (DROs), which together constitute the primary impact forces dictating its trajectory. Key drivers include the exponential growth in mobile device usage and consumer willingness to pay for premium, ad-free content, alongside the necessity for publishers to reduce high traditional printing and distribution costs. However, restraints suchide the persistent challenge of content piracy and the intense competition from free online news sources and social media platforms that constantly vie for consumer attention. Opportunities abound in the realm of immersive technologies, such as AR/VR integration, and the expansion into niche interest categories where dedicated, high-quality digital content can command a premium price. These forces mandate that publishers continually innovate their delivery mechanisms and monetization models to remain competitive and profitable in the evolving digital media ecosystem.

The primary impact forces can be synthesized into four categories: technological innovation, consumer behavior shifts, economic pressures, and regulatory environment. Technological innovation, particularly the advancement in mobile app functionality and AI-driven personalization, acts as a strong upward force, continuously enhancing the product offering. Shifts in consumer behavior—specifically the preference for instant access and multimedia content—accelerate the demand for digital formats. Economically, the pressure to reduce overheads strongly pushes publishers toward digital transformation, while the difficulty in achieving scale and recovering R&D costs acts as a restraining force. Finally, evolving data privacy regulations (like GDPR and CCPA) necessitate complex technological compliance, which acts as a moderate restraint but simultaneously creates an opportunity for publishers who can offer highly secure and trustworthy platforms.

The net impact of these forces remains significantly positive, favoring robust market expansion. The long-term sustainability relies heavily on the industry’s ability to standardize anti-piracy measures and successfully diversify revenue away from pure subscription models, integrating dynamic advertising and e-commerce functionalities directly into magazine platforms. Publishers who strategically leverage data analytics to refine paywall strategies—offering metered access or hybrid models—will capture the highest market growth, mitigating the restraints imposed by content saturation and the prevalence of free alternatives.

Segmentation Analysis

The Digital Magazine Publishing Market is structurally segmented across various dimensions, including Content Type, Deployment Model, Revenue Model, and End-User Application, providing granular insights into market dynamics and growth pockets. Content Type segmentation distinguishes between highly interactive, enriched magazines that utilize complex multimedia and simpler replica editions mirroring print layouts. The Deployment Model differentiates between proprietary mobile applications, which offer a controlled, superior reading environment, and web-based platforms, offering broader accessibility. Analyzing these segments helps stakeholders understand where technological investment yields the highest return and how different monetization strategies perform across varied audience demographics and content categories, driving targeted marketing and content development efforts.

- By Content Type:

- Replica Digital Magazines (PDF format, basic e-reader compatibility)

- Enhanced Digital Magazines (Interactive elements, embedded multimedia, animations)

- Native Digital Magazines (Content designed exclusively for digital screens, optimized for mobile)

- By Deployment Model:

- Dedicated Mobile Applications (iOS, Android, proprietary readers)

- Web-Based Platforms (Responsive websites, browser readers)

- Third-Party Aggregators (Apple News, Google Play Newsstand, specialized platforms)

- By Revenue Model:

- Subscription-Based (Monthly, Annual, Premium tiers)

- Advertising-Based (Programmatic, Native Advertising, Sponsored Content)

- Hybrid Models (Subscription + Limited Ads)

- Single-Issue Sales

- By Application/End-User:

- Consumer Lifestyle and Entertainment (Fashion, Travel, Culture)

- Business and Finance (Economic analysis, industry trends)

- Science and Technology (Research, Gadgets, Engineering)

- Education and Academia

- Niche/Special Interest (Hobbies, Health, Arts)

Value Chain Analysis For Digital Magazine Publishing Market

The value chain for Digital Magazine Publishing begins with the upstream processes, primarily focused on high-quality content creation, editorial selection, and securing intellectual property rights. This phase involves writers, journalists, photographers, and specialized domain experts who produce original intellectual property. Unlike print, the upstream supply also heavily integrates technology vendors specializing in advanced Content Management Systems (CMS) and interactive design tools, critical for producing multimedia-rich content ready for digital deployment. Maintaining a robust pipeline of high-caliber, relevant content remains the fundamental requirement for all downstream success. Investment in editorial talent and specialized digital production staff is paramount at this initial stage.

The subsequent midstream and downstream activities involve digital production, distribution, and monetization. Digital production includes formatting content for various screen sizes, embedding interactive features, and ensuring compatibility across operating systems. Distribution utilizes both direct channels—proprietary websites and apps—and indirect channels, relying on global third-party aggregators and digital newsstands like Apple News or Zinio. The distribution phase is heavily reliant on robust Content Delivery Networks (CDNs) to ensure fast, reliable access globally. Monetization, the final stage, encompasses managing subscription billing, optimizing programmatic ad inventory, and executing data analytics to feed back into the upstream content strategy, closing the value loop effectively.

Direct distribution channels offer publishers higher control over user experience, branding, and pricing, leading to better profit margins per subscriber, although requiring significant upfront investment in technology infrastructure. Indirect channels, while taking a cut of the revenue, provide immense reach and access to large established user bases, particularly valuable for smaller or niche publishers seeking immediate exposure. The efficiency of the entire value chain hinges on the seamless integration between the editorial CMS and the final delivery platform, necessitating continuous technology upgrades and strategic partnerships with ad tech firms and analytics providers to maximize revenue yield per user session.

Digital Magazine Publishing Market Potential Customers

The potential customers for the Digital Magazine Publishing Market are broadly segmented into individual consumers seeking high-quality, curated content, and institutional buyers requiring specialized information or large-scale digital subscriptions for their members. Individual consumers typically fall into demographic groups characterized by higher digital literacy, ownership of multiple mobile devices (smartphones, tablets, e-readers), and a propensity to spend on premium digital services, often valuing convenience and mobility over physical ownership. These consumers seek content across leisure, professional development, and specific high-interest hobbies, prioritizing publications that offer interactivity and an uncluttered, ad-free reading experience compared to standard web browsing.

Institutional buyers represent a growing segment, including academic libraries, corporate organizations, and government agencies. Libraries purchase site licenses or institutional subscriptions to provide their patrons or students access to vast archives of high-value research and educational content, prioritizing comprehensive historical access and robust search functionality. Corporations subscribe to business and financial magazines for market intelligence, industry best practices, and competitive analysis for their executives and knowledge workers. This segment places high value on reliability, data accuracy, and the ability to integrate content feeds into internal knowledge management systems, driving demand for specialized B2B digital editions with robust security features.

Furthermore, niche professional groups, such as healthcare practitioners, architects, or specialized engineers, constitute critical potential customers for highly specialized trade digital magazines. These users require timely, peer-reviewed, and deeply technical content essential for professional compliance and continuous education. Publishers targeting these specialized professional groups often utilize membership models or high-tier institutional subscriptions, leveraging the scarcity and necessity of the information to command higher subscription prices and ensuring exceptional content quality and editorial rigor tailored to extremely specific professional requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 34.5 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hearst Communications, Zinio LLC, Adobe Inc., Magzter Inc., Meredith Corporation (Dotdash Meredith), Condé Nast, Axel Springer SE, Future PLC, New York Media LLC, Time Inc. (now parts of Meredith and others), Amazon.com Inc. (Kindle Newsstand), Google LLC, Flipboard Inc., The Economist Group, Bauer Media Group, Forbes Media LLC, TI Media, Rogers Media, Dennis Publishing, Pocketmags (Jylamvo Ltd). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Digital Magazine Publishing Market Key Technology Landscape

The Digital Magazine Publishing market's technological landscape is characterized by platforms focusing on enhanced content creation, seamless delivery, and robust data intelligence. Core technologies involve sophisticated Content Management Systems (CMS) tailored for digital media, capable of handling rich text, embedded video, interactive graphics, and dynamic advertisement placement. Essential to this ecosystem are cross-platform rendering technologies, such as responsive HTML5 frameworks and proprietary app development tools (like Adobe Digital Publishing Suite successors), ensuring that a single content asset can be flawlessly displayed across diverse screen sizes and operating systems. The move toward cloud-based content storage and delivery (CDNs) is critical for managing the high volume of media assets and ensuring global access with minimal latency, significantly enhancing the overall user experience.

Monetization and user engagement technologies form another crucial pillar. Publishers rely heavily on advanced subscription management and billing systems that can handle complex paywall models, free trial offers, and regional pricing variations. Integrated Ad-Tech stacks, encompassing Demand-Side Platforms (DSPs) and Supply-Side Platforms (SSPs), are indispensable for executing programmatic advertising strategies, optimizing impression rates, and ensuring compliance with rapidly evolving privacy standards. Furthermore, the increasing adoption of Augmented Reality (AR) and Virtual Reality (VR) tools allows publishers to create highly immersive experiences, such as virtual tours or interactive product showcases, transforming static articles into engaging, multi-sensory experiences that command higher advertising rates and premium subscription fees.

Data analytics and Artificial Intelligence (AI) represent the leading edge of technological innovation in this sector. Machine learning algorithms are now standard for understanding detailed reader behavior—tracking scroll depth, time spent on interactive elements, and content shared—to inform editorial decisions and predict future preferences. These AI systems power personalization engines that customize content feeds and optimize the user interface layout in real-time for maximum engagement and reduced churn risk. Furthermore, the reliance on secure identity management systems and robust digital rights management (DRM) technologies is non-negotiable, essential for protecting proprietary content from unauthorized sharing and maintaining the integrity of the subscription base across the expansive digital distribution network.

Regional Highlights

- North America: This region maintains market leadership driven by high consumer adoption of mobile technologies, robust infrastructure for high-speed internet, and a strong culture of paying for premium digital content. The US market, in particular, showcases high innovation in subscription modeling and advanced programmatic advertising deployment. Major international publishers headquartered here frequently pioneer new content formats, leveraging the high penetration of iOS and Android devices among affluent consumer bases.

- Europe: Characterized by strong regulatory frameworks, notably GDPR, which influences data handling and advertising strategies. Western European countries like the UK, Germany, and France show significant maturity in digital magazine consumption, with a strong focus on language-specific content and niche professional publications. Growth is accelerated by government initiatives promoting digital literacy and increasing investment in digital education resources.

- Asia Pacific (APAC): The fastest-growing region, APAC is driven by the sheer scale of its mobile-first population, particularly in emerging markets like India, Indonesia, and Southeast Asia. The focus is often on optimizing content for low-bandwidth environments and adapting to diverse local payment ecosystems. Japan and South Korea lead in adopting interactive and multimedia-rich digital content, pushing boundaries in technical delivery and immersive storytelling.

- Latin America (LATAM): Growth is steady, primarily concentrated in major economies such as Brazil and Mexico. The market is highly sensitive to pricing, leading publishers to experiment extensively with hybrid advertising-supported and micro-transaction models. The increasing availability of affordable smartphones and improved digital payment infrastructure are critical growth catalysts.

- Middle East & Africa (MEA): This region is witnessing rapid expansion, particularly in the Gulf Cooperation Council (GCC) nations, fueled by high digital penetration and affluence. Content is often focused on business, luxury lifestyle, and localized cultural narratives. The challenge remains infrastructure variability and the need for localized content creation and culturally sensitive advertising approaches.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Digital Magazine Publishing Market.- Hearst Communications

- Zinio LLC

- Adobe Inc.

- Magzter Inc.

- Meredith Corporation (Dotdash Meredith)

- Condé Nast

- Axel Springer SE

- Future PLC

- New York Media LLC

- Amazon.com Inc. (Kindle Newsstand)

- Google LLC (Google News/Play Newsstand)

- Flipboard Inc.

- The Economist Group

- Bauer Media Group

- Forbes Media LLC

- TI Media

- Rogers Media

- Dennis Publishing

- Pocketmags (Jylamvo Ltd)

- Hubert Burda Media

Frequently Asked Questions

Analyze common user questions about the Digital Magazine Publishing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary revenue driver for the Digital Magazine Publishing Market?

The primary revenue driver is the subscription-based model, which offers recurring, predictable income streams. However, programmatic advertising, leveraging first-party data for precise targeting, is rapidly increasing its contribution, particularly in hybrid revenue models.

How does content piracy impact the sustainability of digital magazine publishers?

Content piracy poses a significant restraint by diverting potential subscribers and eroding intellectual property value. Publishers mitigate this through advanced Digital Rights Management (DRM) technologies, stricter legal enforcement, and offering unique, interactive content that is difficult to replicate illegally.

Which geographical region is expected to show the highest growth rate in this market?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is due to soaring smartphone adoption, expanding digital infrastructure, and a growing middle-class willing to invest in digital media consumption.

What role does Artificial Intelligence (AI) play in enhancing reader engagement?

AI significantly enhances reader engagement through sophisticated personalization engines. These systems analyze reading patterns to recommend tailored content, optimize article layouts in real-time, and streamline search functionality, creating a hyper-relevant user experience.

What are the key technological challenges facing digital magazine publishers?

Key technological challenges include maintaining seamless cross-platform compatibility across fragmented device ecosystems, complying with stringent global data privacy regulations (like GDPR), and continuously innovating delivery mechanisms to compete effectively with video and social media content formats.

The Digital Magazine Publishing Market is poised for sustained, high-velocity growth, fundamentally reshaping how consumers access and interact with periodical content. The shift is irreversible, favoring publishers who prioritize technological integration, data-driven personalization, and diversified monetization strategies. The competition focuses increasingly on delivering immersive, highly interactive digital experiences that justify premium pricing and maintain subscriber loyalty against the backdrop of readily available free information. Future market expansion will heavily rely on the successful implementation of advanced AI tools for content optimization and the strategic expansion into high-growth emerging economies, particularly across the Asia Pacific region, solidifying the transition from traditional media to a fully integrated digital ecosystem.

Successful market navigation requires continuous investment in proprietary Content Management Systems (CMS) capable of handling rich media and generating deep behavioral analytics. Publishers must view their subscription platforms not merely as delivery mechanisms but as robust data collection engines that fuel editorial and advertising decision-making processes. Strategic mergers and partnerships between established publishing houses and technology firms will continue to define the competitive landscape, creating integrated entities with the scale and expertise required to dominate specific content verticals. Furthermore, the move toward environmental sustainability increasingly favors digital formats, reinforcing the long-term viability and growth potential of the entire digital magazine publishing sector globally. This robust growth trajectory is expected to continue well beyond the forecast period, driven by the insatiable global demand for curated, high-quality information available instantly on any device.

The imperative for agility in adapting revenue models is paramount. Pure subscription reliance is becoming increasingly fragile in crowded markets; therefore, the integration of contextually relevant native advertising, affiliate marketing, and e-commerce functionalities directly within the digital magazine environment represents the next phase of monetization maturity. Publishers who successfully transform their digital editions into transactional platforms, offering products or services related to the content consumed, will unlock superior Average Revenue Per User (ARPU). Ultimately, the market favors those organizations that successfully merge journalistic excellence with technological prowess, offering superior user interface design and personalized content journeys that transcend the limitations of legacy print models and general web experiences.

Innovation in content delivery extends to utilizing blockchain technology for rights management and transparent advertising transactions, offering potential solutions to both piracy and trust issues related to programmatic ad spend. While still nascent, these decentralized technologies offer a glimpse into a future where content ownership and consumer data usage are secured and auditable. Furthermore, accessibility standards, driven by global mandates, necessitate the development of highly adaptable digital content that serves diverse needs, including enhanced compatibility with screen readers and voice commands. Publishers who champion these inclusive design practices will not only meet regulatory requirements but also tap into broader audience segments, reinforcing their commitment to widespread content availability and ethical technology deployment within the digital publishing domain.

The convergence of media formats is another critical trend; digital magazines are increasingly blurring the lines with specialized newsletters, short-form video series, and interactive podcasts, transforming the concept of a ‘magazine’ into a continuous stream of curated content accessible through a single branded platform. This holistic approach to content offering necessitates sophisticated unified dashboards for managing multi-format content creation and distribution, moving away from siloed teams and systems. The investment in upskilling editorial and design teams to master interactive storytelling and multimedia production is thus essential, ensuring the digital output remains fresh, engaging, and differentiated from competitors who only offer static PDF replicas of their traditional print counterparts.

The financial success metrics are shifting from simple circulation numbers to granular engagement data, including dwell time, click-through rates on interactive elements, and content completion rates. This focus on deep engagement data mandates sophisticated analytics tools capable of processing real-time feedback and integrating it immediately into A/B testing protocols for layout and content placement. Publishers utilizing these iterative, data-driven optimization loops are demonstrating significantly higher conversion rates for free trials to paid subscriptions. This data-centric operational methodology distinguishes market leaders who view technology as an intrinsic part of the editorial process rather than merely a distribution tool.

In summary, the Digital Magazine Publishing Market is characterized by intense technological evolution and shifting consumer demands for personalized, accessible, and interactive media. Key players are prioritizing AI, cross-platform optimization, and sophisticated data monetization strategies to capture the high growth projected for the next decade. Success hinges on robust technological infrastructure, a commitment to superior user experience, and the strategic agility to continuously adapt revenue models in response to dynamic global market conditions and evolving digital consumption habits.

The continued proliferation of devices with high-resolution displays, particularly large-screen tablets and foldable smartphones, provides the ideal canvas for enhanced digital magazine formats, enabling rich visual narratives and complex interactive infographics. This hardware evolution supports the publishers' push towards visually immersive storytelling. Additionally, the development of secure, single sign-on (SSO) systems across different platforms greatly reduces user friction in the subscription process, a key barrier to entry previously identified. By simplifying access and ensuring continuity of the reading experience, publishers are systematically addressing critical user pain points and encouraging deeper integration of their products into daily consumer routines. The move towards specialized, high-bandwidth applications, often downloaded from platform-specific app stores, allows for offline reading capabilities, which remains a high-value feature, especially for commuters or international travelers, further solidifying the advantage of dedicated app delivery over simple web access.

The regulatory environment is also fostering innovation in regional markets. In jurisdictions where strict competition laws prevent a single entity from dominating content distribution, smaller, specialized digital publishers are finding pathways to profitability through targeted niche content and superior community management. These smaller players often leverage highly efficient, cloud-native publishing platforms, minimizing overheads and allowing rapid deployment of new content verticals in response to fleeting market trends. This fragmentation at the content creation level, coupled with centralized distribution through major global aggregators, creates a healthy tension that drives quality and specialization. The challenge remains in aggregating sufficient audience scale to attract premium programmatic advertising rates, necessitating strategic consortiums or joint ventures for collective ad inventory management across non-competing publications, a trend expected to solidify in the medium term.

The integration of e-commerce capabilities is transforming digital magazines from purely content sources into direct sales channels. Publishers are increasingly integrating 'shop the look' features in fashion magazines or direct links to reviewed products in technology publications, capturing affiliate revenue and positioning the magazine as a trusted intermediary in the purchasing journey. This transition requires sophisticated integration with retail inventory systems and secure payment gateways, adding complexity to the publishing technology stack but offering a high potential return on investment. The successful deployment of these commerce features relies heavily on maintaining user trust and ensuring that product recommendations are genuinely relevant and non-disruptive to the core reading experience, reinforcing the long-standing editorial integrity of the brand. This fusion of content and commerce is particularly successful in lifestyle, travel, and luxury segments, effectively bridging the gap between inspiration and transaction.

Looking ahead, the development of personalized audio editions (text-to-speech utilizing natural-sounding AI voices) and seamless integration with smart home devices (like smart speakers and displays) represent the frontier of accessibility and consumption modality. Publishers recognizing the increasing consumer demand for multi-sensory content consumption are investing heavily in these areas, ensuring their content is not limited to visual screen reading. This diversification of delivery methods broadens the market reach to include visually impaired users, listeners during commutes, or those engaging in parallel activities, significantly expanding the total addressable market. The commitment to ubiquitous content access, regardless of device or user context, is a defining characteristic of market leaders positioning themselves for sustained dominance in the increasingly competitive digital media space.

The need for transparent and verifiable readership metrics is another major trend influencing technological investment. Advertisers demand increasingly sophisticated proof of engagement beyond simple clicks or impressions. Digital magazine platforms are responding by adopting blockchain-based tracking solutions to record immutable readership data, providing advertisers with unprecedented confidence in campaign performance and audience authenticity. This focus on trust and accountability is critical for attracting high-value brand advertising, which commands significantly higher rates than generic performance marketing. Furthermore, publishers are leveraging proprietary zero-party data—information willingly shared by the subscriber during registration or profile setup—to offer advertisers highly exclusive and hyper-targeted advertising inventory, moving beyond basic demographic segmentation to rich behavioral and preference data, creating unique value propositions for brand partners seeking highly engaged audiences within trusted media environments.

The shift towards a specialized workforce skilled in both editorial judgment and technical development (often termed 'news engineers' or 'editorial developers') is transforming organizational structures within leading publishing houses. These hybrid roles are essential for rapidly deploying iterative improvements to the digital product, ensuring the seamless integration of new features, and quickly resolving performance issues unique to digital distribution. This structural adaptation signifies that technology is no longer a supporting function but an integral part of the core content creation and delivery pipeline, crucial for maintaining a competitive edge in product innovation and speed to market. The demand for talent with expertise in AI ethics and data governance is also soaring, reflecting the market’s recognition of the strategic importance of responsible data handling and algorithmic transparency in preserving consumer trust.

Finally, the long-term strategic outlook involves consolidating content platforms to offer 'all-access' passes that bundle multiple magazine titles under a single subscription, often including exclusive archive access or premium virtual events. This strategy, borrowed from major streaming services, significantly increases the perceived value for the consumer and acts as a powerful deterrent against subscription cancellations (churn). By expanding the content universe accessible to a single user, publishers maximize the platform's utility, ensuring continuous engagement across various interest areas and strengthening the overall network effects within their proprietary ecosystem. This bundling approach, supported by robust personalization algorithms that guide users through the extensive catalog, represents a mature stage of digital publishing monetization, maximizing lifetime customer value and stabilizing revenue predictability in a volatile market.

The development cycle for digital magazine applications is increasingly adopting agile and DevOps methodologies, enabling continuous deployment of minor updates and feature enhancements rather than large, disruptive releases. This approach allows publishers to react instantly to user feedback, patch security vulnerabilities rapidly, and maintain a state-of-the-art user experience without prolonged downtime. The ability to iterate quickly is paramount, given the constant evolution of mobile operating systems and device standards. This continuous delivery model reduces the technical debt associated with maintaining legacy platforms and ensures that the platform remains optimized for the latest hardware capabilities, from increased processor speeds to new display aspect ratios, directly impacting user satisfaction and content rendering quality.

Furthermore, the focus on sustainable content monetization involves exploring alternative revenue streams that complement subscriptions and advertising. This includes offering premium market intelligence reports derived from magazine data, hosting exclusive paid webinars featuring editorial staff and industry experts, and selling branded merchandise directly through the platform. These diverse revenue generation methods reduce reliance on any single stream, providing financial resilience against economic downturns or regulatory changes impacting the primary monetization channels. The strategic integration of these ancillary services reinforces the magazine brand’s authority and expertise, deepening the relationship with the audience beyond simple content consumption and transforming the publication into a comprehensive knowledge and community hub.

The market environment also demands heightened attention to cybersecurity, particularly protecting sensitive subscriber data and payment information. Investment in advanced encryption, multi-factor authentication, and specialized security operations centers is now standard practice, driven by both consumer expectation and regulatory mandates. A single data breach can severely damage brand reputation and lead to costly penalties, emphasizing that platform integrity is as critical as content quality. Publishers who proactively invest in secure infrastructure and demonstrate transparency in data handling are better positioned to maintain the trust required to sustain high-value recurring subscription relationships in the highly competitive and sensitive digital media landscape. This rigorous security posture serves as a foundational element for all future digital innovation and growth within the sector.

The global reach of digital magazine publishing has necessitated robust multilingual and localization strategies. Content must not only be translated accurately but also culturally adapted to resonate with diverse international audiences, encompassing everything from measurement units and local holidays to legal and financial reporting standards. Successful global publishers utilize technology that supports rapid localization of interfaces, payment gateways, and content metadata, allowing them to scale quickly into new linguistic markets without rebuilding core infrastructure. This capacity for efficient global deployment is a key differentiator, enabling publishers to tap into the high-growth potential of emerging economies where local-language content often faces less international competition, maximizing the return on investment in original intellectual property.

Finally, the emergence of the "creator economy" is influencing the digital magazine market, with publishers often partnering with independent, high-profile writers and content creators to offer exclusive or premium vertical newsletters that are integrated into the main digital magazine subscription. This collaborative model allows publishers to quickly acquire specialized expertise and tap into existing, loyal fanbases, enhancing the perceived value of the subscription package without the high fixed costs associated with permanent staff expansion. This fluid approach to content sourcing leverages the decentralized nature of digital talent and allows for highly responsive content diversification, ensuring the magazine remains relevant across a rapidly changing spectrum of public interests and consumption trends.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager