Digital Mapping Cameras Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433155 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Digital Mapping Cameras Market Size

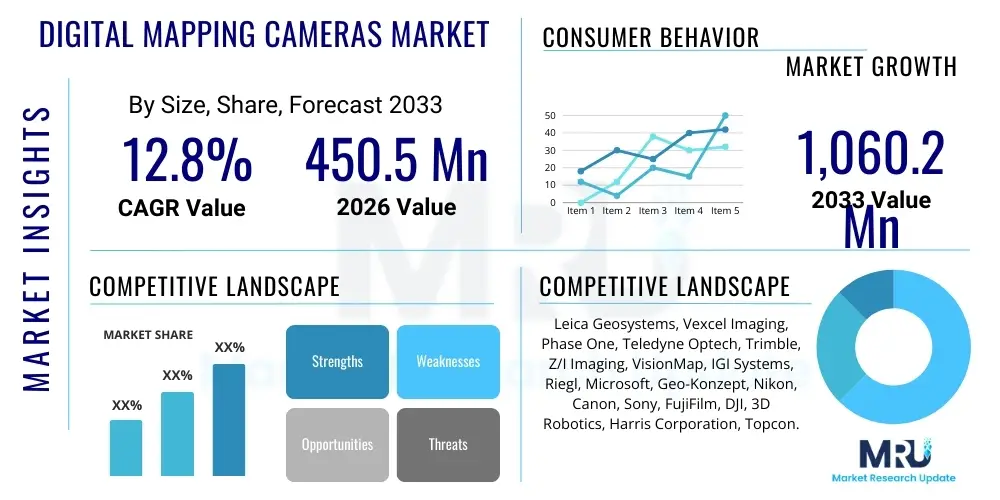

The Digital Mapping Cameras Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 1,060.2 Million by the end of the forecast period in 2033.

Digital Mapping Cameras Market introduction

The Digital Mapping Cameras (DMC) Market encompasses highly specialized imaging systems designed for high-precision geospatial data collection. These cameras utilize advanced sensor technology, often employing large format charge-coupled device (CCD) or complementary metal-oxide-semiconductor (CMOS) arrays, to capture detailed aerial, terrestrial, or underwater imagery. Unlike standard photographic equipment, DMCs are rigorously calibrated, ensuring geometric accuracy crucial for photogrammetry and remote sensing applications. Key components include navigation sensors (GPS/IMU), specialized optics, and high-speed data storage systems, integrating seamlessly into aircraft, drones (UAVs), and ground vehicles to produce orthorectified imagery and 3D models.

Major applications of these high-resolution systems span across infrastructure development, natural resource management, and security sectors. In civil engineering, DMCs are indispensable for large-scale infrastructure monitoring and accurate volume calculations. Furthermore, their utility in urban planning involves creating detailed digital twin representations of metropolitan areas, facilitating smarter city initiatives. The primary benefit derived from DMCs is the rapid acquisition of accurate, high-fidelity spatial data over vast areas, significantly reducing the time and cost associated with traditional ground surveying methods, thereby increasing project efficiency and reliability in complex environments.

Market growth is predominantly driven by the escalating demand for accurate geographic information systems (GIS) data required for smart city development and autonomous vehicle navigation systems. The proliferation of low-cost, high-performance unmanned aerial vehicles (UAVs) capable of carrying professional-grade DMCs has democratized access to high-resolution mapping, driving adoption among smaller enterprises and developing economies. Additionally, regulatory changes supporting the use of geospatial technologies in monitoring climate change impact and managing disaster response efforts further contribute substantial momentum to the expansion of the Digital Mapping Cameras Market globally, positioning this technology as fundamental to modern spatial intelligence.

Digital Mapping Cameras Market Executive Summary

The Digital Mapping Cameras Market is experiencing robust acceleration driven by technological convergence, particularly the integration of advanced sensors and high-accuracy inertial measurement units (IMU) directly into camera systems. Current business trends indicate a strong shift towards subscription-based models for data processing and cloud integration of photogrammetric workflows, moving vendors beyond mere hardware sales into comprehensive data service provision. Companies are focusing heavily on developing lightweight, high-resolution cameras tailored specifically for deployment on small-to-medium UAV platforms, which reduces operational costs and expands the addressable market beyond traditional governmental and large-scale surveying firms. This transition is accelerating consolidation, with major players acquiring specialized software firms to offer end-to-end solutions from image capture to final 3D model generation.

Regionally, North America and Europe maintain dominance, characterized by early adoption of precision agriculture, extensive infrastructure mapping requirements, and robust defense spending focused on ISR (Intelligence, Surveillance, and Reconnaissance) capabilities. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market segment, fueled by massive ongoing urbanization projects in countries like China, India, and Southeast Asia. These governments are prioritizing the creation of detailed digital maps for infrastructure expansion, land records digitization, and disaster mitigation planning, translating into substantial procurement opportunities for advanced mapping camera systems. Regulatory easing regarding drone flight restrictions in various APAC nations is further facilitating market penetration.

Segment trends reveal that the Aerial Platform segment, particularly UAV-based systems, holds the largest market share and is expected to exhibit the highest CAGR due to flexibility and cost-effectiveness. In terms of application, Surveying and Mapping remains the cornerstone, but the adoption of DMCs in Urban Planning and Environmental Monitoring is showing exponential growth as city authorities seek to leverage high-fidelity imagery for managing complex municipal services and ensuring sustainable development. The demand for Large Format Digital Mapping Cameras, offering superior coverage and efficiency for governmental projects, continues to drive revenue in the high-end spectrum, while smaller, medium-format cameras dominate the rapidly expanding commercial drone mapping sector.

AI Impact Analysis on Digital Mapping Cameras Market

Common user questions regarding AI's impact on Digital Mapping Cameras primarily revolve around how AI enhances the utility and efficiency of the captured imagery, rather than affecting the physical camera hardware itself. Users frequently inquire about AI's role in automating feature extraction (e.g., identifying buildings, roads, vegetation) from vast datasets, minimizing the need for manual interpretation. There is significant interest in AI algorithms that improve image quality post-capture, such as automatic geometric correction, seamless orthomosaic generation, and cloud removal. Furthermore, queries often focus on the potential for real-time processing capabilities enabled by edge AI computing within the data capture platform, specifically asking if DMCs will incorporate integrated AI modules to classify objects instantly during the flight mission.

The analysis indicates that AI's key influence lies in transforming raw photographic data into actionable geospatial intelligence at unprecedented speeds. Machine learning algorithms, particularly Deep Learning for image segmentation and classification, are dramatically reducing the post-processing bottlenecks that previously characterized photogrammetric workflows. This shift enhances the overall value proposition of DMCs; the camera becomes not just a data collection device but the source for an intelligent data pipeline. This automation ensures faster turnaround times for critical mapping projects, such as rapid damage assessment following natural disasters, where timely information is paramount. The integration of AI tools is moving from specialized post-processing software to becoming an expected feature within comprehensive mapping solutions.

The expectation among advanced users is that future DMC systems will leverage AI to optimize mission planning dynamically based on environmental factors or specific mapping objectives, such as optimizing flight paths to minimize overlap while ensuring complete coverage and consistent image quality. Concerns, however, sometimes center on data security and the computational resources required to run complex AI models. As AI continues to evolve, the distinction between high-end digital mapping cameras and standard remote sensing devices will increasingly be defined by the level of embedded computational intelligence dedicated to quality control, automated processing, and feature extraction, making the output immediately valuable to GIS professionals and urban planners.

- AI-powered automated feature extraction accelerates processing of imagery, identifying objects like infrastructure and vegetation instantly.

- Deep learning algorithms enhance image quality and accuracy through automatic orthorectification and geometric correction.

- Real-time image classification using onboard Edge AI allows for immediate operational decisions during data collection missions.

- AI optimization of sensor settings and mission planning improves data capture efficiency, minimizing data redundancy.

- Predictive maintenance models based on AI ensure the longevity and reliability of expensive DMC sensor arrays.

DRO & Impact Forces Of Digital Mapping Cameras Market

The Digital Mapping Cameras Market is primarily driven by the escalating global need for highly precise spatial data across multiple governmental and commercial sectors, coupled with significant technological advancements that have made these systems more accessible and efficient. The deployment flexibility offered by UAV platforms, which can carry medium-format DMCs, is a major driver, drastically reducing the cost barrier associated with traditional fixed-wing aerial surveys. Furthermore, government mandates for digitization of land records, strict enforcement of zoning regulations, and the proactive requirement for disaster preparedness and response planning are continuously boosting demand. Opportunities are substantial in developing economies where large-scale infrastructure projects, such as smart road networks and extensive utility expansion, necessitate comprehensive and reliable mapping data.

However, the market faces inherent restraints, most notably the high initial investment cost associated with high-end, large-format digital mapping cameras, their specialized calibration requirements, and the necessity for highly trained personnel to operate both the sensor and the sophisticated post-processing software. Regulatory hurdles concerning airspace restrictions, particularly limitations on drone flight heights, locations (e.g., near airports or critical infrastructure), and the visual line of sight (VLOS) requirements in many jurisdictions, significantly impede the widespread and unrestricted deployment of these aerial mapping solutions. These restrictions necessitate complex permitting processes and often limit the scope of commercial operations, acting as a frictional force against market growth.

The primary opportunity lies in the convergence of mapping technology with Building Information Modeling (BIM) and digital twin initiatives, creating a sustained demand for updated, highly detailed 3D reality meshes derived from DMC data. Additionally, the development of smaller, lighter, and more robust multispectral and hyperspectral DMCs is opening up lucrative niches in precision agriculture and environmental monitoring, allowing for detailed analysis of crop health and ecological shifts. Impact forces are currently dominated by the rapid pace of sensor technology improvements (e.g., increased pixel resolution and reduced noise), which continuously lowers the barrier to entry for high-quality data capture, forcing established manufacturers to innovate rapidly in both hardware and integrated software solutions to maintain a competitive edge and address evolving user expectations.

Segmentation Analysis

The Digital Mapping Cameras Market is systematically segmented based on various technical and functional characteristics, allowing for detailed analysis of market dynamics tailored to specific operational requirements. The segmentation structure provides clarity on demand patterns across different end-use environments and technological specifications. Key segments include categorization by the platform utilized for deployment (Aerial, Ground, Underwater), which dictates camera ruggedness and size; by the application area (Surveying, Urban Planning, GIS), reflecting the end-purpose of the data; and by resolution, influencing the level of detail and coverage efficiency. Understanding these segments is crucial for manufacturers to tailor product development and market penetration strategies effectively.

The segmentation by platform highlights a significant market divergence between high-cost, fixed-wing/helicopter-mounted cameras (Aerial) favored by government and large survey organizations, and the rapidly growing UAV/Drone segment, which caters to commercial and smaller-scale mapping needs due to its agility and lower operational cost. Meanwhile, resolution segmentation dictates performance capabilities, with High-Resolution cameras being essential for applications requiring sub-centimeter accuracy, such as façade mapping and highly detailed infrastructure inspection, whereas medium resolution suffices for regional land use planning and preliminary surveys.

Further analysis of the Application segment reveals that while fundamental Surveying and Mapping dominate, segments like Disaster Management and Emergency Response are exhibiting accelerated demand, requiring rapid deployment and processing capabilities, thus influencing the design of future DMC systems toward robustness and speed. The complexity of modern mapping requirements necessitates a modular approach from vendors, offering specialized lenses, sensor types (e.g., RGB, NIR, Thermal), and integrated positioning systems customized for each specific segmented application environment.

- By Platform:

- Aerial (Fixed-wing, Helicopter, UAV/Drone)

- Ground-based (Mobile Mapping Systems)

- Underwater/Marine

- By Application:

- Surveying & Mapping

- GIS Data Acquisition

- Urban Planning & Development

- Disaster Management & Emergency Response

- Environmental Monitoring & Conservation

- By Resolution:

- High Resolution (Above 100 MP)

- Medium Resolution (50 MP to 100 MP)

- Low Resolution (Below 50 MP)

- By Format:

- Large Format

- Medium Format

- Small Format

Value Chain Analysis For Digital Mapping Cameras Market

The value chain for the Digital Mapping Cameras Market begins with the upstream suppliers, which constitute specialized manufacturers of critical components. This includes providers of high-precision optics (lenses and filters), sophisticated image sensors (CMOS/CCD arrays, often supplied by companies like Sony or Teledyne), and highly accurate Inertial Measurement Units (IMU) and Global Navigation Satellite System (GNSS) receivers. The technical complexity and strict quality control required for these components mean that the upstream segment is concentrated and exerts significant influence over the final product quality and cost. Strategic partnerships with sensor manufacturers are crucial for DMC producers to ensure access to the latest, highest-resolution sensor technologies.

The midstream involves the core manufacturing, integration, and calibration of the DMC systems. This stage is dominated by specialized photogrammetry hardware manufacturers (e.g., Vexcel Imaging, Leica Geosystems). They integrate the sensors, optics, and navigation systems into a robust, geometrically sound system. Calibration, which certifies the camera’s geometric accuracy, is a high-value activity unique to this market segment. Once manufactured, the distribution channel is predominantly indirect, utilizing specialized regional distributors and authorized resellers who possess the technical expertise to install, integrate, and provide post-sales support for complex aerial and mobile mapping solutions to end-users such as government agencies or large-scale survey contractors.

The downstream segment involves the data acquisition services and subsequent data processing. Data acquisition is often performed by specialized surveying companies or internal departments within government entities (e.g., defense or transportation). The captured data then moves into the processing stage, which is handled either by proprietary software provided by the camera manufacturer or by third-party photogrammetric software solutions. Direct sales typically occur only for very large governmental contracts or highly customized systems, whereas indirect distribution through Value-Added Resellers (VARs) allows manufacturers to reach a broader base of small to medium-sized commercial mapping firms globally. VARs often bundle the camera hardware with installation services, training, and essential processing software licenses.

Digital Mapping Cameras Market Potential Customers

The primary customers and end-users of Digital Mapping Cameras are diverse, encompassing both public sector entities and private commercial enterprises whose operations fundamentally rely on accurate, high-resolution geospatial intelligence. Governmental bodies constitute the largest customer base, including national mapping agencies, defense and intelligence organizations requiring reconnaissance and surveillance data, and ministries responsible for transportation, infrastructure development, and natural resource management. These entities typically procure high-end, large-format aerial systems necessary for state-level mapping, cadastral surveys, and complex environmental monitoring programs, driven by regulatory mandates and national security imperatives.

In the private sector, the potential customers are highly concentrated within specialized domains. Leading among these are large engineering, procurement, and construction (EPC) firms that require centimeter-level accuracy for infrastructure planning, construction site monitoring, and volumetric calculations. Utilities and telecommunication companies utilize DMCs mounted on ground vehicles or drones for asset inventory, power line inspection, and right-of-way management. Furthermore, the burgeoning field of precision agriculture represents a growing market segment, with farmers and agricultural service providers adopting multispectral DMCs on UAVs for detailed crop health analysis and optimizing resource deployment across vast farmlands, seeking to maximize yields efficiently.

A rapidly emerging customer segment includes providers of digital twin and smart city solutions. These companies require continuous, updated, high-fidelity imagery to create and maintain living 3D models of urban environments for planning, simulation, and emergency response purposes. Media and entertainment production houses also constitute niche but significant customers, using high-resolution DMCs for creating realistic digital environments for films and video games. Overall, any organization whose strategic decision-making process is improved by detailed, georeferenced visual data is a potential customer, emphasizing the widespread applicability of these sophisticated imaging systems across the modern digital economy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 1,060.2 Million |

| Growth Rate | CAGR 12.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Leica Geosystems, Vexcel Imaging, Phase One, Teledyne Optech, Trimble, Z/I Imaging, VisionMap, IGI Systems, Riegl, Microsoft, Geo-Konzept, Nikon, Canon, Sony, FujiFilm, DJI, 3D Robotics, Harris Corporation, Topcon. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Digital Mapping Cameras Market Key Technology Landscape

The technological landscape of the Digital Mapping Cameras Market is rapidly advancing, fundamentally driven by improvements in sensor technology and tighter integration with positioning systems. The shift from older CCD technology to high-resolution CMOS sensors is prevalent, offering superior dynamic range, higher frame rates, and reduced power consumption, which is critical for drone-based deployment. Large format digital sensors, featuring up to hundreds of megapixels, are becoming the standard for high-altitude aerial survey operations, allowing fewer flight lines, thereby significantly increasing efficiency and reducing operational expenses for covering large areas. Furthermore, manufacturers are increasingly incorporating multispectral and hyperspectral capabilities into DMCs, moving beyond standard RGB imaging to capture data useful for environmental assessment and specialized agricultural applications.

A cornerstone technology is the tight integration of sophisticated Inertial Measurement Units (IMU) and dual-frequency GNSS receivers directly into the camera system. This direct georeferencing capability eliminates the need for extensive ground control points, dramatically simplifying field operations and improving the speed and accuracy of the resulting geospatial products. Advanced processing techniques such as Block Adjustment with robust error models are integrated into accompanying software suites to handle minor geometric distortions. This technological sophistication means that the camera system is now a cohesive unit designed not just to capture light, but to capture precisely positioned spatial data.

The future technology landscape is heavily invested in further miniaturization and computational power. Edge computing is emerging as a vital trend, allowing DMCs to perform basic image processing, compression, and quality checks in real-time, reducing data transfer volumes and accelerating the workflow from field to office. Furthermore, advancements in specialized lenses designed to maintain minimal distortion across large format sensors are crucial, ensuring geometric fidelity remains paramount. Finally, the development of modular camera systems that can seamlessly switch between different sensor types (e.g., LiDAR, RGB, Thermal) on the same platform offers flexibility and maximizes the utility of the hardware investment for end-users operating across varied mapping environments.

Regional Highlights

North America currently holds the largest share in the Digital Mapping Cameras Market, primarily attributed to the mature defense and geospatial intelligence sectors and the rapid adoption of advanced mapping technologies across various civilian applications. The region benefits from substantial investments in infrastructure monitoring, strict regulatory requirements for construction mapping, and the pervasive use of GIS data by federal and state agencies. The United States and Canada are leading in the deployment of UAV-based mapping solutions for commercial surveying and real estate development, driving demand for medium-format, high-precision camera systems. The presence of major industry players and key technology developers in this region ensures continuous innovation and rapid market uptake of new DMC models and integrated processing software solutions, solidifying its market leadership through the forecast period.

Europe represents a highly competitive and technologically advanced market, characterized by stringent environmental regulations and a strong emphasis on sustainable urban planning. Countries like Germany, France, and the UK are heavy investors in large-format aerial mapping for creating and maintaining high-resolution digital elevation models and national orthophoto datasets. The European Space Agency and various national initiatives promote geospatial data usage, bolstering the demand for reliable, accurate DMCs. The region is witnessing significant growth in ground-based mobile mapping systems utilizing DMCs for detailed street-level data collection necessary for autonomous vehicle development and detailed infrastructure asset management, particularly within dense urban corridors.

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally, propelled by unprecedented levels of urbanization, massive government investment in new infrastructure (e.g., China's Belt and Road Initiative, India's smart city projects), and the urgent need to digitize vast swaths of poorly mapped territories. While price sensitivity remains a factor, the sheer scale of mapping projects required for land management, disaster recovery, and telecommunications expansion ensures immense long-term demand. Furthermore, the increasing liberalization of drone regulations in countries like Japan and Australia is accelerating the adoption of professional-grade UAV mapping, creating substantial new revenue streams for vendors offering cost-effective and efficient medium-format DMC solutions tailored to regional operational challenges.

- North America: Dominant market share due to mature defense spending, high penetration of GIS technology, and early adoption of commercial UAV mapping services, especially in infrastructure and energy sectors.

- Europe: Strong focus on detailed urban mapping, high adoption of mobile mapping systems for autonomous driving data collection, and strict adherence to environmental monitoring standards driving demand for multispectral systems.

- Asia Pacific (APAC): Highest CAGR expected, driven by massive government-led infrastructure development, rapid urbanization, and significant investments in land registration digitization projects across China, India, and Southeast Asia.

- Latin America: Emerging market growth supported by resource exploration (mining, oil and gas) and agricultural expansion, creating demand for aerial survey services and associated digital mapping cameras.

- Middle East and Africa (MEA): Growth centered around large-scale construction projects in the GCC states (e.g., Saudi Arabia’s NEOM project) and increasing need for security and surveillance applications utilizing high-resolution aerial imagery.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Digital Mapping Cameras Market.- Leica Geosystems (Hexagon AB)

- Vexcel Imaging GmbH

- Phase One A/S

- Teledyne Optech (Teledyne Technologies)

- Trimble Inc.

- Z/I Imaging

- VisionMap Ltd.

- IGI Systems GmbH

- Riegl Laser Measurement Systems GmbH

- Microsoft (through its aerial mapping assets)

- Geo-Konzept GmbH

- Nikon Corporation

- Canon Inc.

- Sony Corporation

- FujiFilm Holdings Corporation

- DJI Innovations (targeting the prosumer/commercial drone segment)

- 3D Robotics (3DR)

- Harris Corporation

- Topcon Corporation

- Geodetics Inc.

Frequently Asked Questions

Analyze common user questions about the Digital Mapping Cameras market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a Digital Mapping Camera (DMC) and a standard commercial digital camera?

DMCs are differentiated by their rigorous geometric calibration, specialized lens systems designed for minimal distortion, and tight integration with high-accuracy GNSS/IMU systems for direct georeferencing, ensuring the capture of spatially precise data suitable for professional photogrammetry and 3D modeling, unlike standard consumer cameras.

How is the adoption of Unmanned Aerial Vehicles (UAVs) impacting the DMC Market?

UAVs are democratizing high-resolution mapping by providing a cost-effective and flexible platform for deploying medium-format DMCs. This has expanded the market beyond large governmental surveys to include smaller commercial surveying firms, driving demand for lighter, compact, and highly integrated camera systems.

What are the key drivers for high-resolution large-format DMCs?

The primary drivers are large-scale national mapping projects, cadastral surveys, and the creation of detailed digital orthophoto mosaics by government agencies. Large format cameras maximize coverage efficiency and minimize flight time, delivering superior data quality required for these large-scale foundational mapping efforts.

Which technological trend is most critical for the future growth of the DMC Market?

The integration of advanced AI/Machine Learning capabilities for automated data processing and feature extraction is most critical. This technology significantly reduces the time from data capture to actionable intelligence, increasing the operational efficiency and economic viability of DMC deployments across all applications.

What is the projected Compound Annual Growth Rate (CAGR) for the Digital Mapping Cameras Market?

The Digital Mapping Cameras Market is projected to grow at a robust CAGR of 12.8% during the forecast period from 2026 to 2033, driven by infrastructure spending and increasing global demand for geospatial information systems (GIS) data.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager