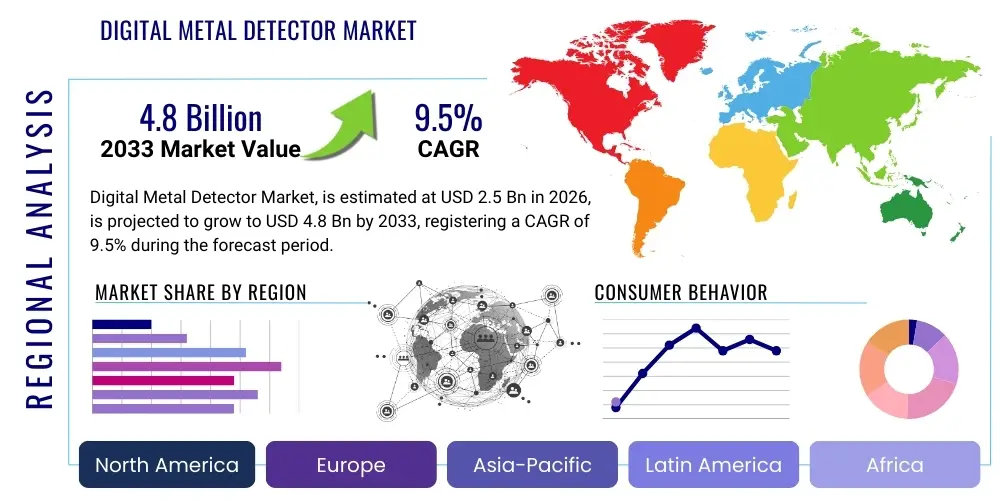

Digital Metal Detector Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437927 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Digital Metal Detector Market Size

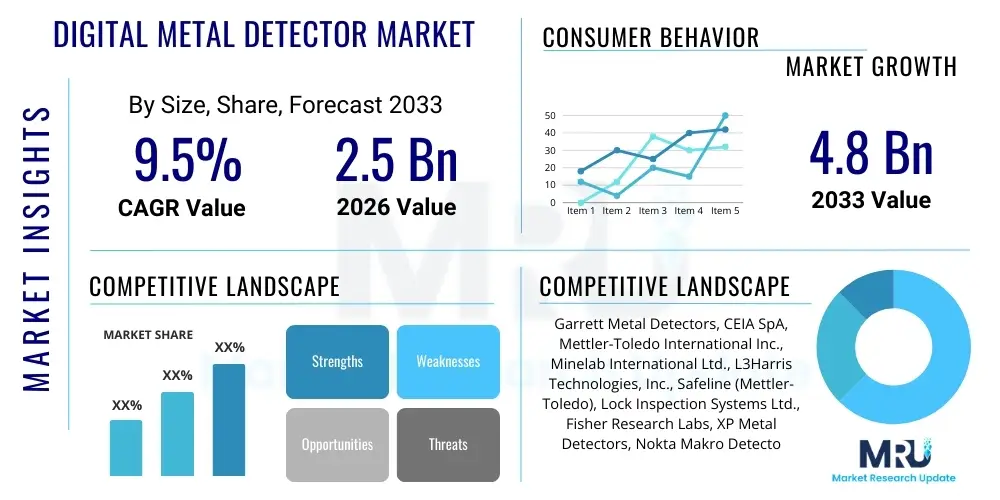

The Digital Metal Detector Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 4.8 Billion by the end of the forecast period in 2033.

Digital Metal Detector Market introduction

The Digital Metal Detector Market encompasses advanced electronic devices designed to locate metallic objects buried underground, concealed within products, or hidden on individuals. Unlike their analog predecessors, digital detectors utilize microprocessors, sophisticated software algorithms, and digital signal processing (DSP) to enhance sensitivity, accuracy, and discrimination capabilities. These devices convert analog signals received from the search coil into digital data, allowing for precise filtering of unwanted targets (such as iron mineralization or trash) and superior identification of desired metals. This digital transformation has led to significant improvements in operational efficiency, particularly in challenging environments where high mineral content interferes with traditional technology. The primary function remains the same—security screening, industrial quality control, and recreational searching—but the user experience and reliability are vastly improved.

The core product offering includes various types, such as walk-through detectors used in airports and public safety, handheld devices for localized security checks, and industrial detectors integrated into manufacturing lines (e.g., food and pharmaceuticals) to ensure product purity. Major applications span critical infrastructure protection, border security, resource exploration (mining), and consumer electronics recycling. The inherent benefits of digital metal detectors, such as improved target ID stability, automatic ground balancing, and the ability to save user profiles and settings, are driving widespread adoption across regulated industries. Furthermore, the integration of connectivity features, including Bluetooth and Wi-Fi, allows for remote monitoring, data logging, and software updates, transforming these detectors into interconnected smart devices capable of complex data analysis and threat assessment.

Driving factors for this market expansion include stringent global security regulations mandating the use of advanced screening technology in high-traffic areas, increasing quality control standards in manufacturing sectors (especially food and beverage safety), and technological advancements that make detectors lighter, more ergonomic, and highly sensitive to minute traces of metal. The continuous threat landscape requiring robust perimeter and access control systems further fuels demand. Additionally, the growing popularity of treasure hunting and recreational metal detecting, fueled by improved consumer-grade digital models that offer professional features at accessible price points, contributes significantly to market growth. These devices provide rapid detection and classification, minimizing false alarms and maximizing throughput in high-volume screening operations.

Digital Metal Detector Market Executive Summary

The Digital Metal Detector Market is experiencing robust growth driven by converging trends in regulatory compliance, industrial automation, and advancements in sensor fusion technology. Business trends indicate a strong push toward subscription-based models for software updates and predictive maintenance, particularly in high-security and industrial sectors where uptime is critical. Key manufacturers are focusing on miniaturization, enhanced battery life, and the development of multi-frequency capabilities to improve detection depth and target separation in complex environments. Geographically, North America and Europe maintain dominance due to established security infrastructure and stringent food safety laws, while the Asia Pacific region is emerging as the fastest-growing market, propelled by rapid infrastructure development and increasing investments in public safety and counter-terrorism measures. Competitive strategies center around intellectual property, particularly algorithms designed for advanced clutter rejection and threat signature identification.

Regional trends highlight differing adoption rates based on local regulatory frameworks. In developed economies, the focus is shifting from basic detection to intelligent screening, incorporating features like AI-powered threat recognition and biometric integration for streamlined processes. Conversely, in developing regions, the initial adoption is driven primarily by infrastructure projects (airports, metros) and commodity inspection in mining and agriculture. Segmentation trends reveal that the industrial metal detection segment, particularly equipment used for HACCP compliance in food processing, is growing rapidly due to zero-tolerance policies for foreign object contamination. Furthermore, the security segment is pivoting towards networked, centralized management systems that allow security personnel to monitor dozens of devices simultaneously from a single console, improving situational awareness across large venues or interconnected transit hubs.

Overall, the market trajectory is highly dependent on continuous innovation in digital signal processing (DSP) and sensor technology. Companies achieving superior performance in highly mineralized ground or offering highly customized, portable solutions for specific niche applications (e.g., humanitarian demining) are expected to gain significant market share. The consolidation of smaller, specialized technology providers by larger conglomerates seeking to acquire advanced AI/ML detection algorithms is a noticeable merger and acquisition trend. The primary challenge remains balancing high sensitivity required for safety with the need to minimize nuisance alarms, a problem increasingly addressed through sophisticated digital filtering and improved electromagnetic immunity in the latest generation of products.

AI Impact Analysis on Digital Metal Detector Market

User questions regarding the impact of Artificial Intelligence (AI) on the Digital Metal Detector Market frequently revolve around improved threat identification, reduction of false positives, and autonomous operation. Users are keen to understand how AI algorithms enhance the ability of detectors to differentiate between benign objects (keys, coins) and legitimate threats (weapons, prohibited materials) without slowing down throughput. A common concern is the training data required for these AI models—specifically, how diverse the data sets are across various metal types and concealment methods. Expectations are high for predictive maintenance capabilities, where AI analyzes detector performance data to anticipate component failure before operational disruption occurs. Furthermore, users inquire about the ethical implications and data privacy associated with AI-enabled surveillance and screening systems, particularly in public spaces.

The integration of AI, machine learning (ML), and deep learning techniques is fundamentally transforming the accuracy and operational scope of digital metal detection. AI enables detectors to learn from vast amounts of screening data, identifying complex patterns and generating high-confidence alerts, dramatically reducing the reliance on human interpretation and enhancing decision support. In industrial settings, AI-powered detectors can analyze product flow dynamics, ambient noise, and environmental factors in real-time to adjust sensitivity and filtering thresholds automatically, leading to fewer production stoppages caused by erroneous detections. This capability not only improves product quality assurance but also increases overall manufacturing efficiency, making the technology a critical component of Industry 4.0 initiatives focused on smart factories and quality automation.

For security applications, AI models can classify detected objects based on geometry, material density, and electromagnetic signature, moving beyond simple binary "metal/no-metal" identification. This advanced classification allows security personnel to focus immediate attention on objects categorized as high-risk, thereby accelerating screening processes while maintaining high security standards. This represents a significant shift from traditional threshold-based detection systems to sophisticated pattern-recognition engines. As AI models become more computationally efficient, they are increasingly being deployed at the edge (within the detector hardware itself), ensuring rapid processing and reduced latency, which is essential for high-volume environments like mass transit hubs and large event venues.

- AI-driven classification significantly reduces false alarm rates by distinguishing between benign and threatening metallic items based on signature analysis.

- Machine Learning (ML) optimizes ground balance and mineralization rejection algorithms, improving performance in geologically complex areas for mining and archaeology.

- AI enables predictive maintenance of industrial inspection systems, forecasting sensor drift or coil degradation before failure, maximizing uptime.

- Deep learning models enhance threat recognition in security screening by analyzing the shape and density of concealed objects within complex body scanner data.

- Autonomous calibration and real-time environmental adaptation are facilitated by AI, ensuring consistent detection performance regardless of fluctuating ambient conditions.

- AI integration supports centralized security management systems by aggregating and interpreting data from multiple networked detectors to identify systemic vulnerabilities or patterns.

- Generative AI tools assist in simulating complex detection scenarios for training security staff and optimizing detector placement layouts.

DRO & Impact Forces Of Digital Metal Detector Market

The market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), significantly influenced by pervasive impact forces such as stringent global regulatory environments and rapid technological obsolescence. The primary driver is the escalating global focus on security and counter-terrorism measures, necessitating high-throughput, non-intrusive screening technologies at critical access points. This is coupled with non-negotiable compliance requirements across the food, pharmaceutical, and textile industries, where digital metal detectors are essential for preventing product contamination and costly recalls. Restraints primarily involve the high initial capital expenditure required for advanced digital systems and the technical challenges associated with detecting non-ferrous, low-density metallic threats in high electromagnetic interference (EMI) settings. Opportunities are vast in developing customized, lightweight systems for remote resource exploration and in expanding integrated solutions that combine metal detection with other sensors (e.g., X-ray, millimeter wave) for holistic threat assessment, positioning the market for sustained, technology-led expansion.

Impact forces exert constant pressure on market players. Regulatory impact is perhaps the most significant, with organizations like the Transportation Security Administration (TSA) and the FDA continually updating standards, compelling manufacturers to innovate quickly to meet new certification requirements, such as enhanced sensitivity to smaller, modern threat components. Technological change acts as a force that simultaneously drives growth and creates competitive risks; while digital signal processing (DSP) and multi-frequency technology offer superior performance, they also hasten the retirement of older equipment, demanding significant R&D investment from vendors. Economic fluctuations, particularly in the mining and construction sectors, can temporarily depress demand for high-end geophysical detectors, demonstrating the market's sensitivity to global commodity cycles and capital investment priorities in major infrastructure projects. Furthermore, the rising cost of complex semiconductor components, critical for advanced digital algorithms, also affects the final product pricing and market accessibility.

The market’s resilience is rooted in the essential nature of its application areas—security and quality control are non-discretionary spending categories for governments and regulated industries. Therefore, while restraints like integration complexity (especially in legacy industrial setups) and the persistent issue of ground mineralization interference exist, they are being aggressively countered by R&D focused on advanced filtering algorithms and adaptive detection modes. The environmental imperative for recycling critical raw materials presents a burgeoning opportunity, requiring specialized digital sorting metal detectors in waste management facilities. The overall impact forces compel the industry towards solutions that offer superior precision, enhanced connectivity (IoT integration), and simplified user interfaces, ensuring that the return on investment justifies the high implementation costs.

Segmentation Analysis

The Digital Metal Detector Market is comprehensively segmented based on technology, product type, end-user industry, and operational frequency. Technological segmentation differentiates between Pulse Induction (PI), Very Low Frequency (VLF), and Multi-Frequency (MF) systems, reflecting their suitability for various environments and target types. Product types include walk-through detectors essential for large-scale security screening, handheld detectors used for specific item inspections, and industrial conveyor belt systems designed for automated quality control. The largest end-user segments are Security & Public Safety, which dominates the market share due to critical infrastructure protection needs, and the Food & Packaging industry, driven by global safety regulations. Operational frequency segmentation is crucial as it determines the penetration depth and sensitivity to specific metal types, allowing for highly customized solutions for diverse applications ranging from deep relic hunting to high-speed pharmaceutical inspection.

- By Technology:

- Digital Signal Processing (DSP)

- Very Low Frequency (VLF)

- Pulse Induction (PI)

- Multi-Frequency (Simultaneous and Selectable)

- By Product Type:

- Walk-Through Metal Detectors (WTMD)

- Handheld Metal Detectors (HHMD)

- Industrial Metal Detectors (Conveyor, Pipeline, Gravity Feed)

- Ground Search/Hobby Detectors

- Underwater Detectors

- By End-User:

- Security & Public Safety (Airports, Government Buildings, Events)

- Food & Packaging

- Pharmaceutical & Chemical

- Mining & Geology

- Consumer/Recreational

- Textile & Apparel

- By Frequency:

- Single Frequency

- Multi-Frequency

- By Component:

- Sensors/Coils

- Control Units/Processors

- Software & Algorithms

- Displays & Interfaces

Value Chain Analysis For Digital Metal Detector Market

The value chain for the Digital Metal Detector Market begins with sophisticated upstream activities focused heavily on R&D and component sourcing. Upstream analysis involves the procurement of high-performance microprocessors, specialized coils (ferrite and non-ferrite materials), digital signal processors, and advanced semiconductor components necessary for executing complex detection algorithms. The core intellectual property lies in developing proprietary software algorithms for superior target discrimination and noise reduction. Key suppliers are often specialized electronics manufacturers and sensor technology firms providing custom-designed printed circuit boards (PCBs) and analog-to-digital converters (ADCs). The quality and reliability of these sourced components directly dictate the final detector's performance metrics, such as depth penetration and operational speed, making strategic supplier partnerships critical for maintaining a competitive edge in product innovation and cost efficiency.

The midstream phase focuses on manufacturing, assembly, software integration, and rigorous testing, including electromagnetic compatibility (EMC) tests and field validation under diverse environmental conditions. Manufacturers must maintain high cleanliness standards, especially for detectors intended for the food and pharmaceutical industries (HACCP compliance). Downstream analysis addresses distribution and deployment. Due to the diverse applications, distribution channels are highly segmented. High-end industrial and security detectors are primarily sold through direct sales teams or highly specialized systems integrators who offer installation, calibration, and maintenance services. This direct involvement is necessary because these systems often require customization and integration with existing security or manufacturing infrastructure.

Conversely, recreational and entry-level handheld detectors are often distributed through indirect channels, including e-commerce platforms, specialized hobby stores, and large electronic retail chains. The after-sales service component, including software updates (crucial for digital systems), calibration services, and spare parts supply (coils, batteries), constitutes a significant revenue stream and acts as a key differentiator. The choice between direct and indirect distribution heavily depends on the complexity of the product and the required level of technical support and ongoing certification demanded by the end-user industry, ensuring that highly regulated sectors prefer vendor-supported direct channels for accountability and quality assurance.

Digital Metal Detector Market Potential Customers

Potential customers for digital metal detectors are broadly categorized into three major sectors: governmental security entities, regulated industrial manufacturers, and individual consumers/hobbyists. Governmental end-users, encompassing entities such as airport authorities, national defense agencies, correctional facilities, and customs and border protection, constitute the largest segment. Their demand is driven by regulatory mandates and the necessity for robust, high-throughput screening solutions that minimize human error and integrate seamlessly with centralized command systems. Procurement decisions in this segment prioritize reliability, certification (e.g., ECAC standards), and advanced features like networking capabilities and AI-enhanced threat assessment.

The second critical customer group is the regulated industrial sector, primarily manufacturers in the food and beverage, pharmaceutical, and textile industries. For these customers, digital metal detectors are not just screening devices but essential quality control tools mandated by international standards (e.g., ISO 22000, FDA regulations). These buyers require highly sensitive, robust, and hygienic industrial detectors (often stainless steel) capable of operating continuously in harsh production environments while providing detailed audit trails and validation data. Their buying decision is based on detection sensitivity, operational speed, ease of cleaning, and compliance documentation, with a strong preference for systems offering remote diagnostic capabilities and minimized total cost of ownership (TCO).

The final significant segment comprises professional and amateur metal detecting enthusiasts. This consumer market seeks advanced digital features like multi-frequency operation, precise target ID mapping, light weight, and sophisticated ground cancellation features for finding relics, coins, and gold nuggets. The purchasing decision here is driven by performance specifications (depth and discrimination), ergonomics, brand reputation, and community reviews. The growing digitization of consumer models, offering GPS integration and data logging capabilities, continues to attract younger, technologically savvy hobbyists, expanding the accessible market base for manufacturers focusing on consumer electronics standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 4.8 Billion |

| Growth Rate | CAGR 9.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Garrett Metal Detectors, CEIA SpA, Mettler-Toledo International Inc., Minelab International Ltd., L3Harris Technologies, Inc., Safeline (Mettler-Toledo), Lock Inspection Systems Ltd., Fisher Research Labs, XP Metal Detectors, Nokta Makro Detectors, Eriez Manufacturing Co., Cassel Inspection GmbH, ZKTeco, Anschutz, and Detector Electronics Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Digital Metal Detector Market Key Technology Landscape

The technology landscape of the Digital Metal Detector Market is dominated by advancements in Digital Signal Processing (DSP), multi-frequency operation, and the incorporation of sensor fusion. DSP is the foundational technology, allowing raw analog signals from the search coil to be converted into digital data, enabling complex filtering algorithms to effectively distinguish target metals from ground mineralization (clutter) and electromagnetic interference (EMI). The precision of modern DSP chips allows detectors to achieve significantly higher levels of target discrimination and depth penetration compared to older analog models. Manufacturers continuously upgrade their DSP firmware to enhance detection performance and introduce new capabilities, often delivered via over-the-air software updates, reflecting a trend towards software-defined detection capabilities.

Multi-frequency technology is rapidly becoming the industry standard, offering a critical advantage over single-frequency systems. Detectors utilizing simultaneous multi-frequency transmission can analyze how a target responds across a wide spectrum of frequencies instantly. Low frequencies penetrate deeper, while high frequencies are more sensitive to smaller or less conductive metals. By processing these responses concurrently, multi-frequency devices provide superior target identification (Target ID) accuracy and enhanced detection sensitivity across diverse environments, particularly in areas with highly variable soil conditions or complex product matrices in industrial applications. This technology significantly improves the probability of detection (POD) while minimizing the probability of false alarms (PFA).

Furthermore, the integration of advanced technologies such as Artificial Intelligence (AI) and Machine Learning (ML) algorithms is defining the next generation of digital detectors. AI is used to refine detection algorithms, allowing the system to learn and adapt to specific operational environments automatically, reducing the need for constant manual calibration. Sensor fusion is also gaining traction, particularly in security screening, where metal detection data is combined with outputs from complementary technologies (such as passive millimeter wave imaging or X-ray scanners). This fusion creates a more comprehensive threat profile, enabling highly accurate, integrated security assessments that address modern, multi-material threats more effectively than standalone systems, driving demand for technologically sophisticated, integrated security solutions.

Regional Highlights

- North America: This region holds a leading position in the Digital Metal Detector Market, driven by the most stringent security regulations globally (TSA, CATSA) and massive public and private investment in critical infrastructure protection (CIP). The U.S. and Canada are early adopters of advanced WTMD and HHMD technologies incorporating AI for enhanced threat assessment at airports, government facilities, and schools. Furthermore, the recreational and gold prospecting market in the Western U.S. and Alaska fuels demand for high-end consumer digital detectors, ensuring continued market leadership in innovation and deployment volumes.

- Europe: Europe represents a highly mature market characterized by rigorous food safety and pharmaceutical manufacturing standards (HACCP, GMP). This drives high demand for precision industrial metal detection systems, particularly in Germany, the UK, and Italy. Security spending remains elevated across the continent due to persistent counter-terrorism concerns, leading to large-scale modernization projects for public transport and stadium security, often prioritizing networked, centrally managed detection systems compliant with European Civil Aviation Conference (ECAC) mandates.

- Asia Pacific (APAC): APAC is poised for the fastest growth, propelled by rapidly increasing infrastructure development, urbanization, and rising industrialization, particularly in China, India, and Southeast Asian countries. The massive buildout of new airports, metro systems, and modern manufacturing facilities creates immense demand for both security and industrial inspection equipment. Government initiatives focusing on border security and trade commodity inspection also contribute substantially, although market fragmentation and price sensitivity remain key considerations for vendors operating in this diverse region.

- Latin America (LATAM): Growth in LATAM is closely linked to commodities and mining operations in countries like Chile, Brazil, and Peru. Digital metal detectors are crucial here for mineral exploration, quality control in extraction processes, and asset protection. While security expenditures are rising, market adoption is often hampered by fluctuating economic conditions and delays in regulatory standardization, leading to a focus on cost-effective, durable equipment suitable for remote, rugged environments.

- Middle East and Africa (MEA): The MEA region exhibits strong demand driven by heavy investment in critical infrastructure, major construction projects (e.g., in the GCC states), and high-level security needs associated with large-scale pilgrimage and major events (e.g., FIFA World Cup). These regions prioritize state-of-the-art security technology, often purchasing the highest-specification WTMDs and integrated screening solutions, while the African market shows burgeoning growth related to humanitarian demining efforts and industrial quality control in emerging manufacturing hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Digital Metal Detector Market.- Garrett Metal Detectors

- CEIA SpA

- Mettler-Toledo International Inc.

- Minelab International Ltd.

- L3Harris Technologies, Inc.

- Safeline (Mettler-Toledo)

- Lock Inspection Systems Ltd.

- Fisher Research Labs

- XP Metal Detectors

- Nokta Makro Detectors

- Eriez Manufacturing Co.

- Cassel Inspection GmbH

- ZKTeco

- Anschutz

- Detector Electronics Corporation

- S+S Separation and Sorting Technology GmbH

- Rapiscan Systems

- Bruker Corporation

- Daihan Scientific Co., Ltd.

- Thermo Fisher Scientific

Frequently Asked Questions

Analyze common user questions about the Digital Metal Detector market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of a digital metal detector over an analog model?

The primary advantage is the use of Digital Signal Processing (DSP) and advanced algorithms, which allow digital detectors to analyze, filter, and interpret signals with higher precision. This results in superior discrimination between target metals and environmental noise (like ground mineralization), leading to fewer false alarms and greater detection depth and stability.

How is AI transforming security screening applications within this market?

AI is transforming security screening by enabling advanced threat recognition. Machine learning models analyze complex signal patterns to classify detected objects based on geometry and density, moving beyond simple metal detection. This significantly enhances throughput and reduces the rate of false positives in high-volume security checkpoints.

Which end-user segment is experiencing the fastest growth in digital metal detector adoption?

The Food and Packaging industry segment is exhibiting rapid growth. This is driven by increasingly stringent global food safety standards (HACCP compliance) and zero-tolerance policies regarding foreign metallic contaminants, necessitating the use of highly sensitive and reliable industrial digital inspection systems throughout the production line.

What are the key benefits of multi-frequency technology in modern digital detectors?

Multi-frequency technology allows detectors to operate and analyze targets across several frequencies simultaneously. This provides superior target ID accuracy, greater depth penetration, and enhanced performance in highly mineralized or cluttered ground conditions, making the detector versatile across various application environments.

What geographical region is expected to lead market expansion over the forecast period?

The Asia Pacific (APAC) region is projected to demonstrate the fastest market expansion. This growth is fueled by massive investments in new infrastructure (airports, metros), rapid industrialization, and the increasing adoption of modern quality control and public safety technologies across major economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager