Digital Money Transfer and Remittances Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433050 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Digital Money Transfer and Remittances Market Size

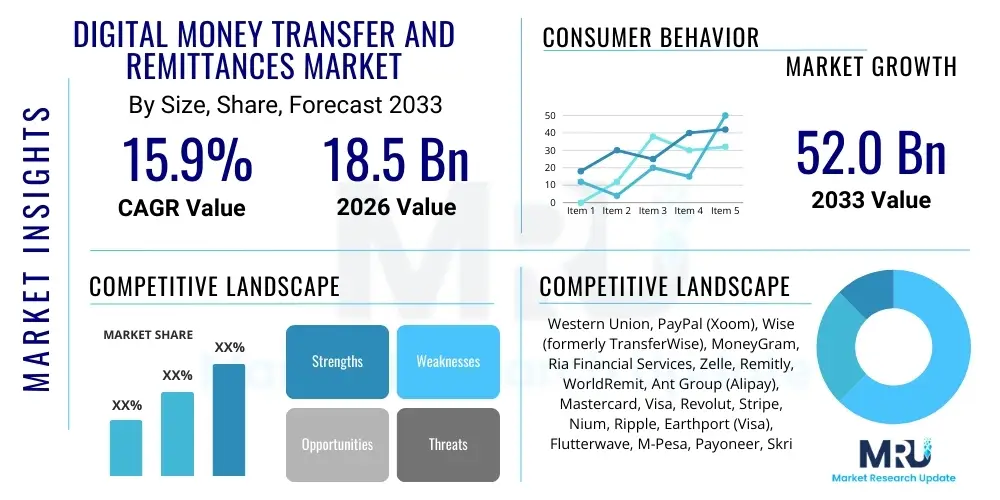

The Digital Money Transfer and Remittances Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.9% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 52.0 Billion by the end of the forecast period in 2033.

Digital Money Transfer and Remittances Market introduction

The Digital Money Transfer and Remittances Market encompasses the ecosystem of digital channels, platforms, and services enabling individuals and businesses to send funds across domestic and international borders electronically. This market primarily revolves around technology-driven solutions that bypass traditional, often slow and expensive, banking systems. Key products include mobile money applications, online remittance platforms, digital wallets, and peer-to-peer (P2P) payment services. These technologies facilitate immediate or near-immediate fund transfers, drastically reducing transaction costs and enhancing user convenience, particularly for migrant workers sending funds back to their home countries, a demographic segment crucial to market growth. The underlying infrastructure often leverages sophisticated security protocols, cloud computing, and application programming interfaces (APIs) to ensure seamless integration and regulatory compliance across varied jurisdictions.

Major applications of digital money transfer services span across consumer-to-consumer (C2C) transfers, business-to-business (B2B) payments, and business-to-consumer (B2C) disbursements, particularly in e-commerce and payroll processing for globally distributed workforces. The primary benefits include superior speed, traceability, transparency in pricing, and accessibility, especially in developing economies where bank penetration is low but mobile connectivity is high. The shift from physical cash agents to digital interfaces has not only streamlined operations for providers but has also provided financial inclusion opportunities for previously unbanked populations. Furthermore, the robust audit trails inherent in digital transactions aid in combating illicit financial activities, aligning with increasing global anti-money laundering (AML) and know-your-customer (KYC) regulations.

Driving factors for sustained market expansion include the exponential rise in smartphone penetration globally, increasing cross-border migration, the expansion of global e-commerce necessitating faster payment settlements, and concerted government and regulatory efforts to promote digital financial services adoption. The COVID-19 pandemic accelerated the shift away from physical transactions, cementing the necessity of reliable digital transfer mechanisms. Competition among fintech startups, established financial institutions, and major technology companies is spurring continuous innovation in service offerings, including multi-currency accounts and instant settlement options, further fueling consumer reliance on digital platforms for their remittance needs.

Digital Money Transfer and Remittances Market Executive Summary

The Digital Money Transfer and Remittances Market is characterized by vigorous competition and rapid technological evolution, underpinned by strong macroeconomic drivers such as global labor migration and the growing digital economy. Business trends highlight a significant move toward embedded finance and API-driven partnerships, where remittance services are integrated directly into e-commerce platforms, social media applications, and enterprise resource planning (ERP) systems. The focus of market leaders is shifting from merely offering low-cost transfers to providing comprehensive cross-border financial services, including foreign exchange management and digital asset handling. Furthermore, regulatory sandboxes and open banking initiatives are fostering innovation, allowing non-traditional players to gain market share by offering highly specialized or hyper-localized digital solutions, pressuring incumbent banks to modernize their outdated correspondent banking networks.

Regionally, Asia Pacific maintains dominance due to high volumes of intra-regional remittances, driven by large migrant worker populations in countries like India, China, and the Philippines, coupled with exceptionally high mobile payment adoption rates. North America and Europe, while representing mature markets, are experiencing growth fueled by the demand for instant, transparent B2B cross-border payment solutions and remittances directed toward emerging markets. Latin America and the Middle East & Africa (MEA) are emerging as high-growth potential regions, spurred by expanding financial inclusion efforts, government-backed digitalization mandates, and the increasing use of stablecoins and decentralized finance (DeFi) protocols to overcome inflation and foreign exchange volatility inherent in traditional systems.

Segment trends underscore the primacy of the mobile application segment due to its accessibility and user-friendly interface. Regarding transaction type, person-to-person (P2P) transfers remain the largest category, but the business-to-business (B2B) segment is exhibiting the fastest growth, primarily driven by small and medium-sized enterprises (SMEs) seeking alternatives to slow and expensive wire transfers for supply chain payments. Furthermore, a crucial trend is the differentiation based on service speed, with 'instant payment' options commanding a premium, highlighting consumer willingness to pay for certainty and immediacy in transaction processing, especially when funds are required urgently in the destination country.

AI Impact Analysis on Digital Money Transfer and Remittances Market

User queries regarding the impact of Artificial Intelligence (AI) on the Digital Money Transfer and Remittances Market frequently center on three core themes: security and fraud detection, operational efficiency and cost reduction, and the future role of human agents in customer service and compliance. Users are highly interested in how AI-powered predictive analytics can identify increasingly sophisticated fraudulent patterns—such as synthetic identity fraud or dynamic transaction anomalies—faster than traditional rule-based systems, thus increasing transaction integrity. Another major area of interest is the potential for AI and Machine Learning (ML) to optimize foreign exchange (FX) rates and dynamically route transactions via the most cost-effective and fastest corridors, thereby maximizing profitability for providers and minimizing costs for consumers. Finally, the role of AI in streamlining regulatory compliance, particularly the automated generation of suspicious activity reports (SARs) and real-time KYC/AML checks, represents a significant focus for compliance officers seeking efficiency gains.

The integration of AI and ML is fundamentally transforming the operating model of digital remittance providers by shifting resources away from manual processing and toward algorithmic decision-making. In compliance, AI tools are capable of monitoring billions of transactions simultaneously, using natural language processing (NLP) to analyze unstructured data from identity documents and public databases, ensuring a higher degree of compliance accuracy and speed than previously achievable. This enhanced compliance capacity is essential for maintaining trust with regulators in a highly scrutinized industry. Furthermore, advanced chatbots and conversational AI are taking over basic customer support functions, resolving common issues like tracking inquiries or updating payment details, freeing up human agents to handle complex exceptions and escalated compliance matters, leading to optimized workforce deployment.

However, the ethical deployment of AI in this sector remains a key concern, particularly regarding bias in credit scoring or transaction monitoring that could disproportionately affect certain demographic groups who rely heavily on remittances. Providers are therefore focused on building explainable AI (XAI) models to ensure transparency and accountability in automated decisions. The ongoing investment in robust cloud infrastructure capable of handling large-scale ML model deployment is critical, as instantaneous decision-making across complex global networks is mandatory. Ultimately, AI’s greatest contribution is enabling hyper-personalization of services, offering tailored financial products based on user remittance history, income patterns, and destination country needs, moving beyond simple transfer execution.

- AI enhances real-time fraud detection and anomaly scoring, drastically reducing financial losses.

- Machine Learning optimizes dynamic foreign exchange rate offerings and liquidity management across corridors.

- Natural Language Processing (NLP) streamlines KYC and AML verification by analyzing complex documentation quickly.

- AI-powered chatbots and virtual assistants handle high-volume customer inquiries, improving service efficiency 24/7.

- Predictive analytics helps forecast remittance flows and liquidity needs, minimizing operational capital risk.

- Algorithmic routing selects the most efficient payment rail (e.g., SWIFT, blockchain, domestic rails) based on cost and speed criteria.

DRO & Impact Forces Of Digital Money Transfer and Remittances Market

The dynamics of the Digital Money Transfer and Remittances Market are shaped by a powerful confluence of drivers, restraints, and opportunities. Key drivers include the ever-increasing volume of global migration, generating consistent remittance flows; the near-ubiquity of mobile technology, which serves as the primary access point for digital services in developing nations; and the continuous pressure from consumers for lower transaction costs and faster settlement times, which traditional banks struggle to meet. These drivers are further amplified by government initiatives worldwide aimed at promoting financial inclusion and reducing reliance on cash, often through preferential regulatory treatment for digital remittance providers. The impact forces are driving structural changes, pushing traditional financial players to adopt digital strategies or risk obsolescence, while simultaneously attracting massive venture capital investment into agile fintech startups focused exclusively on cross-border payments.

Restraints primarily revolve around the complex and highly fragmented global regulatory landscape. Operating in dozens of countries requires compliance with disparate AML, data privacy, and consumer protection laws, which significantly increases compliance costs and operational complexity, particularly for smaller fintech firms. Furthermore, cybersecurity threats and the necessity of robust data encryption are perennial concerns; any major breach can severely undermine consumer trust, which is foundational to the market’s stability. Another restraint is the persistent digital divide and lack of financial literacy in some recipient populations, which necessitates continuous investment in user education and accessible interface design. The need to integrate seamlessly with various legacy payment systems in certain countries also poses a significant technological hurdle.

Opportunities for exponential growth are concentrated in the untapped B2B cross-border payment space, particularly serving SMEs which historically rely on costly bank wires. The adoption of blockchain and distributed ledger technology (DLT) offers a transformative opportunity to achieve truly instant, low-cost settlements by tokenizing assets and eliminating correspondent banking intermediaries. Moreover, geographic expansion into rapidly digitizing regions like Sub-Saharan Africa and Southeast Asia, where mobile money adoption is setting global benchmarks, presents immense potential. The strategic opportunity lies in evolving remittance platforms into comprehensive digital banks offering credit, insurance, and investment products tailored specifically to the needs of migrant workers and their families, thereby capturing a larger share of their lifetime financial value.

The impact forces are fundamentally accelerating the shift from high-cost, high-friction models to low-cost, low-friction, real-time transaction frameworks. This pressure forces consolidation among small players or drives them into strategic alliances with established technology giants to leverage their scale and compliance infrastructure. The primary force driving competition is speed and transparency, making instant settlement a required feature rather than a differentiator. Regulatory impact forces, particularly those relating to global anti-money laundering frameworks and the push for Central Bank Digital Currencies (CBDCs), promise to further standardize and secure cross-border transactions, reducing the operational ambiguity that currently exists.

Segmentation Analysis

The Digital Money Transfer and Remittances Market is comprehensively segmented based on the transfer method utilized, the type of end-user initiating the transaction, and the underlying technology employed for settlement. Analyzing these segments provides strategic insights into consumer preferences and the pace of technological adoption across various demographics. The dominant segment is typically defined by the mobile channel, which leverages the high penetration of smartphones to facilitate P2P transfers. However, growth analysis indicates that the B2B segment, particularly facilitated through API-based corporate solutions, is expanding at the highest CAGR as global supply chains demand more efficient treasury and procurement payment systems than legacy banking structures can offer.

Segmentation by transaction type is critical, differentiating between international cross-border transfers and domestic P2P transfers. While domestic transfers are generally faster and cheaper due to unified regulatory systems, international transfers represent the core value proposition of the remittance market, commanding higher fees but also facing stringent regulatory oversight. Technological segmentation is increasingly relevant, distinguishing between conventional bank transfers relying on SWIFT or ACH, services leveraging blockchain/DLT for near-instant settlement, and proprietary closed-loop networks offered by major fintech players. Understanding the market share distribution across these technology bases helps providers determine optimal infrastructure investment strategies.

- By Transfer Type:

- Domestic Money Transfer

- International Money Transfer (Remittances)

- By End User:

- Personal (Consumer-to-Consumer, C2C)

- Business (Business-to-Business, B2B)

- Business-to-Consumer (B2C)

- By Channel:

- Mobile Applications

- Online Portals (Web-based)

- Agent Locations (Digital Facilitated)

- By Technology:

- Bank-centric (SWIFT, ACH)

- Fintech/Proprietary Platforms

- Distributed Ledger Technology (DLT) / Blockchain

Value Chain Analysis For Digital Money Transfer and Remittances Market

The value chain for digital money transfer and remittances begins with upstream activities focused on technology development, infrastructure provisioning, and initial fund aggregation. Upstream players include core banking solution providers, cloud computing services (AWS, Azure), data analytics firms specializing in transaction monitoring, and secure API providers. These entities build and maintain the secure, scalable technological foundation required for processing high volumes of transactions globally. The initial aggregation phase involves the collection of funds from the sender, which is increasingly done digitally through linking bank accounts, credit cards, or existing digital wallets. Efficiency at the upstream level is paramount, dictating the overall speed and security of the downstream process.

The core of the value chain involves the processing and settlement phase. This midstream activity is dominated by the remittance platforms themselves (e.g., Western Union Digital, PayPal, Wise) which handle crucial functions: foreign exchange conversion, compliance verification (KYC/AML checks), transaction routing, and settlement. The distribution channel dictates the final mile execution. Direct channels involve the transfer of funds directly from the sender's mobile wallet or bank account to the recipient's mobile wallet or bank account, eliminating intermediaries and maximizing efficiency. Indirect channels involve partnerships with local banks, payment processors, or cash pickup agents in the destination country, necessary in regions where digital financial infrastructure is still maturing or where recipients require physical cash.

Downstream activities focus on disbursement and customer engagement. Disbursement involves making the funds accessible to the recipient, whether through direct credit, mobile money payout, or cash pickup via a partner agent network. Customer service and retention, often utilizing AI-powered tools, form a crucial final step. The integration of regulatory bodies throughout the value chain is non-negotiable; compliance and security are embedded at every stage, from the initial identity verification (upstream) to the final reporting of the transaction (downstream). The trend is towards vertical integration, where major players increasingly control both the payment rails (using DLT) and the customer-facing interface, thereby capturing maximum value and ensuring end-to-end control over the service delivery.

Digital Money Transfer and Remittances Market Potential Customers

The primary customer base for the Digital Money Transfer and Remittances Market consists of two major groups: individual consumers and small to medium-sized enterprises (SMEs). For consumers, the dominant segment comprises migrant workers who regularly send money internationally to support their families in their home countries. This segment prioritizes low fees, reliable service, and ease of access, often favoring mobile applications due to their convenience and 24/7 availability. Other individual users include expatriates, students studying abroad, and individuals engaged in international e-commerce purchases or peer-to-peer debt settlement across borders. The critical driver for this cohort is the speed and transparency of the transaction, moving funds from high-income earning countries to developing economies.

The fastest-growing customer segment, however, is the SME market. These businesses require B2B cross-border payment solutions for international procurement, paying suppliers, and managing global payroll. Unlike large multinational corporations that utilize established treasury management systems, SMEs frequently lack dedicated internal resources for complex foreign exchange and international payment management. They are increasingly seeking digital platforms that offer favorable wholesale FX rates, bulk payment processing capabilities, and integrated solutions that can plug directly into their accounting or ERP systems via APIs. This allows them to manage cash flow efficiently and reduce the high operational friction historically associated with global supply chain payments, positioning them as a premium market for specialized fintech providers.

A third significant customer group involves humanitarian organizations, NGOs, and governmental bodies involved in international aid and disaster relief. These entities require highly efficient, transparent, and scalable disbursement solutions to deliver funds directly to beneficiaries in remote or underserved areas. Digital remittance platforms, especially those leveraging mobile money networks, offer the necessary speed and traceability required for accountability and timely delivery of aid, bypassing often corrupt or inefficient local financial infrastructures. Serving these organizations requires robust compliance structures and the capacity for high-volume, low-value disbursements, offering a stable and mission-critical revenue stream for providers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 52.0 Billion |

| Growth Rate | 15.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Western Union, PayPal (Xoom), Wise (formerly TransferWise), MoneyGram, Ria Financial Services, Zelle, Remitly, WorldRemit, Ant Group (Alipay), Mastercard, Visa, Revolut, Stripe, Nium, Ripple, Earthport (Visa), Flutterwave, M-Pesa, Payoneer, Skrill. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Digital Money Transfer and Remittances Market Key Technology Landscape

The technological architecture supporting the digital money transfer market is multifaceted, relying heavily on advancements in mobile computing, cloud infrastructure, and distributed ledger technology (DLT). Mobile applications constitute the primary user interface, requiring robust security measures like multi-factor authentication and biometric verification to protect user data and funds. Underlying these applications, sophisticated cloud-based APIs (Application Programming Interfaces) facilitate seamless integration with local banking systems, card networks, and local mobile money providers globally. The shift to microservices architecture deployed on scalable cloud platforms allows providers to rapidly iterate on new features, manage transaction volumes spikes efficiently, and ensure high uptime, which is critical for continuous cross-border service availability.

Distributed Ledger Technology (DLT), particularly blockchain-based solutions like RippleNet and proprietary stablecoin networks, represents the most disruptive innovation in the settlement layer. DLT offers the promise of immediate, final settlement without the need for traditional nostro/vostro accounts and pre-funding, significantly reducing liquidity risk and counterparty exposure for providers. While adoption is still nascent compared to traditional methods, DLT is rapidly gaining traction, particularly for complex B2B payments and in jurisdictions with weak correspondent banking links. Furthermore, data analytics and AI/ML tools are foundational for continuous operational improvement, powering everything from real-time fraud monitoring and dynamic pricing algorithms to personalized marketing campaigns and compliance reporting.

The technology landscape also includes advancements in instant payment infrastructure, such as Faster Payments (UK), SEPA Instant Credit Transfer (Europe), and UPI (India). Remittance providers strategically leverage these domestic instant payment rails at the destination end to ensure immediate fund access for recipients, drastically improving the speed component of their value proposition. Finally, robust encryption standards (e.g., end-to-end encryption for transactional data) and tokenization protocols are mandatory for maintaining consumer trust and adhering to stringent global data protection regulations like GDPR. Ongoing technological investment is concentrated on enhancing security, achieving faster finality of funds, and reducing the operational cost of managing regulatory compliance across numerous regulatory regimes simultaneously.

Regional Highlights

Regional dynamics play a crucial role in shaping the competitive landscape and growth trajectories of the Digital Money Transfer and Remittances Market, driven by migration patterns, regulatory environments, and mobile penetration rates.

- Asia Pacific (APAC): Dominates the market both in terms of sender and recipient volumes. Key corridors include transfers from Gulf Cooperation Council (GCC) countries and North America into India, China, and the Philippines. High mobile money adoption (especially in Southeast Asia) and supportive regulatory environments focusing on financial inclusion make this region a powerhouse. The regional emphasis is on low-cost, high-volume intra-Asian payments.

- North America: Characterized by high technological maturity and a focus on transparency and advanced fintech solutions. Growth is primarily driven by B2B cross-border payments for SMEs and remittances sent to Latin America and APAC. Regulatory clarity and the adoption of real-time payment systems (like Zelle and impending FedNow) push providers to offer near-instant domestic and outbound services.

- Europe: Highly fragmented but technologically advanced, driven by SEPA Instant Payment mechanisms. The region benefits from strong migrant flows, particularly into the UK, Germany, and France. Competition is fierce among agile neobanks and established fintechs (like Wise and Revolut) focusing on multi-currency accounts and transparent FX pricing for both consumer and SME segments.

- Middle East & Africa (MEA): Exhibits the highest potential CAGR, primarily due to the vast adoption of mobile money platforms (like M-Pesa) in Sub-Saharan Africa and high outflow volumes from major GCC employment hubs (UAE, Saudi Arabia). The challenge lies in infrastructure limitations, but DLT and mobile network operator partnerships are rapidly bridging the gap, making mobile wallets the preferred payout method.

- Latin America: Marked by volatility in local currencies, driving demand for stable, transparent cross-border services. Remittances from the US remain the primary source of flow. High inflation and low bank penetration in several countries are creating a fertile ground for digital solutions, including cryptocurrency and stablecoin transfers, offering consumers a hedge against local economic instability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Digital Money Transfer and Remittances Market.- Western Union Company (WU)

- PayPal Holdings Inc. (Xoom)

- Wise (formerly TransferWise)

- MoneyGram International Inc.

- Ria Financial Services (Euronet Worldwide)

- Remitly Global, Inc.

- WorldRemit Ltd.

- Ant Group (Alipay)

- Mastercard Inc.

- Visa Inc.

- Revolut Ltd.

- Stripe Inc.

- Nium Pte. Ltd.

- Ripple Labs Inc.

- Earthport (acquired by Visa)

- Flutterwave Inc.

- M-Pesa (Vodacom/Safaricom)

- Payoneer Global Inc.

- Skrill (Paysafe Group)

- Zelle (Early Warning Services, LLC)

Frequently Asked Questions

Analyze common user questions about the Digital Money Transfer and Remittances market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are primarily driving the growth of the Digital Money Transfer and Remittances Market?

The primary drivers include the exponential increase in global migration creating consistent remittance demand, widespread adoption of mobile banking and smartphone penetration in developing economies, and regulatory pressure for lower-cost, transparent cross-border payment alternatives to traditional banks. Fintech innovation focusing on instant settlement via proprietary networks or DLT is also a major catalyst.

How is Distributed Ledger Technology (DLT) impacting the speed and cost of remittances?

DLT, exemplified by blockchain solutions, significantly reduces both the speed and cost of remittances by removing the need for traditional correspondent banking relationships. It enables near-instant, 24/7 settlement and reduces liquidity costs by eliminating pre-funding requirements, making cross-border transactions faster and more capital-efficient than legacy systems.

What are the main regulatory challenges faced by digital remittance providers globally?

Providers face complex and disparate compliance challenges, particularly adhering to Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations across numerous jurisdictions. Data localization and privacy laws (such as GDPR) further complicate operations, necessitating substantial continuous investment in global compliance technology and secure data management systems.

Which segment, P2P or B2B, is expected to show the fastest growth rate in the forecast period?

While Person-to-Person (P2P) transfers currently hold the largest volume share, the Business-to-Business (B2B) cross-border payment segment is projected to exhibit the fastest growth rate. This is driven by Small and Medium-sized Enterprises (SMEs) rapidly adopting digital platforms to manage supply chain payments, payroll, and procurement efficiently outside of traditional banking channels.

What is the role of Artificial Intelligence (AI) in maintaining security within the market?

AI plays a critical role in enhancing security by providing real-time, predictive fraud detection. Machine learning models analyze transactional behavior and identify sophisticated anomalies, such as synthetic identity fraud or money laundering patterns, with greater speed and accuracy than conventional rule-based systems, significantly bolstering overall transaction integrity and reducing financial risk.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Digital Money Transfer And Remittances Market Size Report By Type (Domestic Money Transfer and International Money Transfer), By Application (Consumer and Enterprise), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Digital Money Transfer and Remittances Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Domestic Money Transfer, International Money Transfer), By Application (Consumer, Enterprise), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager