Digital Mortgage Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433027 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Digital Mortgage Software Market Size

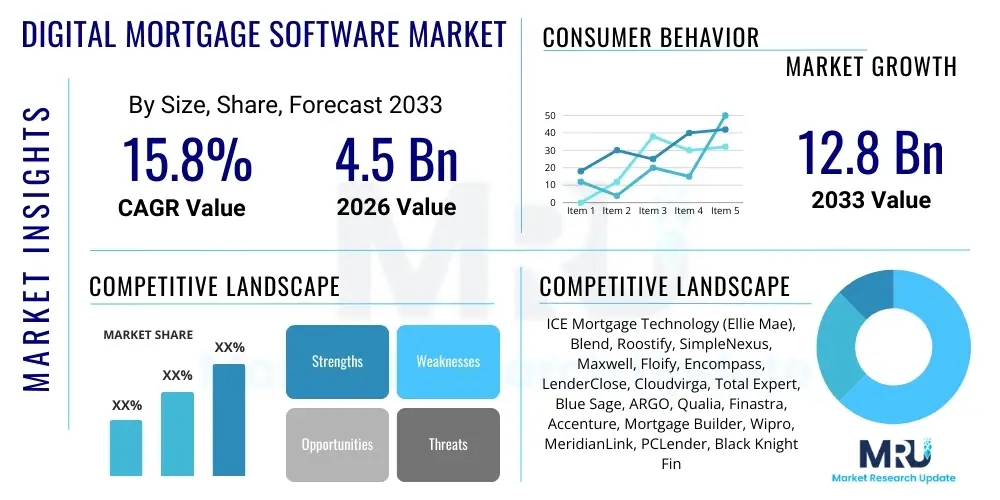

The Digital Mortgage Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 12.8 Billion by the end of the forecast period in 2033.

Digital Mortgage Software Market introduction

The Digital Mortgage Software Market encompasses specialized technological solutions designed to automate, streamline, and integrate various stages of the mortgage lifecycle, spanning origination, processing, underwriting, closing, and servicing. These platforms replace traditional paper-based methods with digital workflows, enhancing efficiency, improving data accuracy, and significantly reducing the time required for loan approval and closing. Key products include Loan Origination Systems (LOS), Customer Relationship Management (CRM) tools tailored for lenders, document management systems, and proprietary algorithms for automated underwriting. The core benefit of adopting these systems lies in providing a superior, transparent, and faster experience for both lenders and borrowers, which is essential in today's demanding financial services landscape. The software facilitates compliance adherence by automatically tracking regulatory changes and ensuring all documentation meets stringent governmental standards, thereby mitigating legal and financial risks for institutions.

Major applications of digital mortgage software are predominantly found within large commercial banks, regional credit unions, specialized non-bank mortgage lenders, and independent brokerage firms. These solutions are pivotal in addressing market demands for rapid service delivery and personalized customer journeys. The inherent capabilities of these systems, such as secure data exchange, integration with third-party verification services (e.g., income, assets, credit), and real-time communication portals, drive their robust adoption across global financial markets. Furthermore, the push towards remote operations, accelerated by geopolitical and health crises, cemented the necessity for fully digital closing and remote notarization capabilities, further expanding the software's functional scope and market penetration.

The market is primarily driven by the compelling need for cost reduction in loan processing, coupled with increasing regulatory pressure favoring data transparency and standardized digital procedures. Technological advancements, particularly in cloud computing and Application Programming Interface (API) integration, enable sophisticated interoperability between various financial technologies (FinTech) stacks, making holistic digital transformation achievable for diverse institutional sizes. Consumer demand for intuitive, mobile-first applications that simplify complex financial transactions also acts as a powerful catalyst, forcing traditional lenders to upgrade their legacy systems to remain competitive against agile, technology-focused disruptors. This combination of efficiency, compliance, and enhanced user experience forms the fundamental underpinning of the market’s rapid growth trajectory.

Digital Mortgage Software Market Executive Summary

Current business trends indicate a strong migration of large financial institutions towards comprehensive, end-to-end digital mortgage platforms rather than siloed point solutions. This strategic shift is aimed at achieving maximum operational efficiency and minimizing data fragmentation across departments. Mergers and acquisitions remain a persistent trend, with major technology providers acquiring niche software firms specializing in areas like e-closing, remote online notarization (RON), or advanced data analytics, consolidating market share and expanding product breadth. Furthermore, vendors are increasingly focusing on embedding sophisticated AI and machine learning capabilities into their underwriting and risk assessment modules to automate decision-making and reduce manual review errors, signaling a crucial evolution in risk management practices within the sector. The shift to subscription-based, Software as a Service (SaaS) models continues to dominate deployment preferences due to lower upfront capital expenditure and greater scalability, appealing especially to smaller and mid-sized lending institutions seeking rapid digital enablement.

Geographically, North America currently holds the dominant market share, driven by a highly mature and competitive mortgage landscape in the United States, favorable government policies promoting digital signatures and electronic records, and high levels of technological infrastructure readiness among lenders. However, the Asia Pacific (APAC) region, particularly emerging economies like India and China, is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to rapid urbanization, increasing consumer wealth, and governmental initiatives aimed at digitizing bureaucratic processes and financial inclusion. European markets are characterized by strong but fragmented adoption, heavily influenced by diverse national regulatory frameworks (such as GDPR compliance requirements), necessitating highly customizable software solutions capable of navigating varied data privacy laws and housing market specifics across member states.

Segment trends reveal that the Cloud-based deployment model is growing significantly faster than the traditional on-premise solutions, primarily driven by scalability, accessibility, and lower maintenance burdens. Within the component segment, the services category (including professional integration, consultation, and managed services) is experiencing accelerating growth, reflecting the complex implementation needs of large institutions transitioning away from legacy systems. From an end-user perspective, non-bank mortgage lenders and FinTech disruptors are demonstrating the most aggressive adoption rates, utilizing these platforms to gain a crucial competitive advantage in speed and efficiency against established, traditional banking entities. Origination software remains the foundational segment, but servicing software is gaining traction as lenders realize the importance of digitizing post-closing customer interactions and portfolio management for long-term profitability.

AI Impact Analysis on Digital Mortgage Software Market

User queries regarding the integration of Artificial Intelligence (AI) in the Digital Mortgage Software Market center primarily on three areas: automation capabilities, predictive accuracy in underwriting, and regulatory compliance risks associated with algorithmic bias. Common questions revolve around how AI can drastically reduce loan processing time (e.g., "Can AI complete underwriting in minutes?"), the reliability of machine learning models in identifying fraudulent applications, and the ethical implications of using complex algorithms to make life-changing financial decisions ("How do we ensure AI underwriting is fair and non-discriminatory?"). There is a strong expectation that AI will deliver superior fraud detection, instant verification of documents, and highly personalized loan product recommendations, but this is tempered by concerns about data security, algorithm explainability (XAI), and the potential for job displacement among loan officers and processors. Users are seeking clarity on the ROI of implementing sophisticated AI solutions and the necessary infrastructure upgrades required to support advanced cognitive capabilities within existing Loan Origination Systems (LOS).

The pervasive impact of AI is transforming the operational backbone of digital mortgage lending. AI-driven tools are fundamentally altering how creditworthiness is assessed, moving beyond traditional FICO scores to incorporate alternative data sources and sophisticated risk modeling, enabling lenders to service previously underserved market segments while maintaining rigorous risk control. Furthermore, AI significantly streamlines the document collection and verification process through Natural Language Processing (NLP) and Optical Character Recognition (OCR), allowing systems to instantly parse bank statements, tax documents, and pay stubs, dramatically reducing the potential for human error and accelerating the overall application timeline. This shift from manual document review to automated data extraction is not merely an efficiency gain; it is a foundational change in data handling and compliance verification, making mortgage operations fundamentally more scalable and accurate.

While the benefits are profound, the integration of AI introduces complex governance challenges, particularly concerning regulatory scrutiny. Ensuring that AI models comply with Fair Lending laws (like the Equal Credit Opportunity Act) requires rigorous testing for bias across demographics and geography. Vendors are responding by developing more transparent and auditable AI models (Explainable AI or XAI) that provide clear rationales for lending decisions, thereby helping financial institutions meet stringent compliance requirements. The strategic imperative is clear: lenders must adopt AI not just for speed, but as a critical tool for maintaining regulatory integrity in a rapidly evolving digital environment. Successful implementation requires a careful balance between leveraging automation benefits and maintaining human oversight for complex edge cases and ethical validation.

- Instantaneous Document Verification and Processing via NLP and OCR.

- Enhanced Predictive Analytics for Default Risk Assessment and Pricing Optimization.

- Automation of Complex Underwriting Tasks, Reducing Turnaround Time (T/A).

- Improved Fraud Detection through Behavioral Analysis and Anomaly Identification.

- Development of Explainable AI (XAI) to ensure compliance with Fair Lending Regulations.

- Personalized Product Recommendations based on Borrower's financial profile and goals.

- Chatbots and Virtual Assistants providing 24/7 borrower support and pre-qualification screening.

DRO & Impact Forces Of Digital Mortgage Software Market

The Digital Mortgage Software Market growth is robustly driven by the imperative for operational efficiency, regulatory compliance mandates, and heightened consumer expectations for faster, more transparent loan processes. However, this expansion is constrained by significant challenges, notably the substantial initial investment required for system migration and integration with legacy platforms, and pervasive concerns regarding data security and privacy compliance in handling highly sensitive financial information. Opportunities are emerging primarily from the underserved market segments globally, the increasing adoption of cloud infrastructure allowing for scalability, and the continuous development of AI-driven tools for enhanced risk modeling and automation. These diverse forces—drivers, restraints, and opportunities—interact dynamically, forming a complex landscape where technological innovation must constantly address compliance risks and infrastructure limitations to maintain market momentum.

The primary driver is the accelerating shift towards a paperless environment necessitated by cost pressures; manual processes are expensive, time-consuming, and prone to error. Digital software minimizes these overheads while drastically improving the customer experience, which is a key competitive differentiator. Conversely, a major restraint is the regulatory patchwork across global jurisdictions. For instance, the differing legal acceptance of e-signatures, e-notes, and Remote Online Notarization (RON) across US states and international borders creates complexity for software vendors aiming for universal solutions. Financial institutions are often hesitant to overhaul functional, albeit outdated, legacy systems (known as 'sunk cost fallacy'), perceiving the migration risk as outweighing the immediate benefits, thus slowing down comprehensive market penetration.

The impact forces are fundamentally shaping market structure and growth trajectory. The internal impact force of digitalization (improving internal workflows and efficiency) is met by the external impact force of changing customer behavior (demand for mobile-first, transparent services). This dual pressure necessitates continuous innovation. Regulatory impact forces, particularly post-2008 financial crisis regulations that favor robust audit trails and data integrity, accelerate the need for modern compliance-centric software. The greatest opportunity lies in leveraging blockchain technology for secure, transparent transaction record-keeping (digital ledger technology), which promises to revolutionize property title management and secondary market securitization, creating new revenue streams for vendors capable of integrating these cutting-edge capabilities into their existing platforms.

Segmentation Analysis

The Digital Mortgage Software Market is systematically segmented based on Component, Deployment Type, and End-User, providing a granular view of market dynamics and adoption patterns across different institutional types and operational preferences. Component segmentation differentiates between the core Software platforms (such as Loan Origination Systems, servicing software, and e-closing tools) and the critical Services segment (including implementation, consulting, maintenance, and support services necessary for effective deployment and integration into existing infrastructure). Deployment segmentation highlights the critical difference between legacy On-premise installations, favored by institutions with strict internal security requirements, and the rapidly dominant Cloud-based model, which offers unmatched scalability and lower total cost of ownership (TCO).

End-user segmentation clearly defines the primary consumers of these specialized solutions: Banks and Credit Unions, which require robust, high-volume, highly compliant systems; specialized Mortgage Lenders (both depository and non-depository), which prioritize speed and agility in their competitive offerings; and Mortgage Brokerages, which often require highly integrative, plug-and-play solutions to manage diverse relationships with multiple wholesale lenders. Each segment presents unique technological requirements; for instance, large banks prioritize regulatory stability and seamless integration with core banking systems, while independent mortgage lenders focus heavily on front-end borrower experience optimization to capture market share through faster service delivery.

Understanding these segmentations is vital for both vendors and investors. The shift towards cloud deployment and the increasing demand for outsourced services (especially managed services) indicate that future growth will be concentrated in vendor offerings that prioritize flexibility, scalability, and specialized expertise in complex system integrations. Furthermore, while traditional banking remains the largest end-user group by volume, the fastest growth is projected from the non-bank mortgage lender segment, which is increasingly adopting sophisticated digital tools to challenge the dominance of established financial institutions by optimizing every touchpoint of the lending cycle, from initial application to post-closing servicing.

- By Component:

- Software (Loan Origination Systems, Loan Servicing Systems, E-Closing Systems, Document Management)

- Services (Professional Services, Managed Services, Consulting Services, Implementation & Integration)

- By Deployment Type:

- On-premise

- Cloud (SaaS)

- By End-User:

- Banks and Credit Unions

- Mortgage Lenders (Depository & Non-Depository)

- Mortgage Brokerages and Intermediaries

Value Chain Analysis For Digital Mortgage Software Market

The value chain for Digital Mortgage Software begins with the upstream activities centered on core technology development, encompassing intellectual property creation, platform architecture design, and the continuous enhancement of algorithms for underwriting and compliance. This stage involves significant investment in R&D, focusing on emerging technologies like AI/ML, blockchain integration, and robust cybersecurity protocols. Key upstream stakeholders include software engineers, data scientists, and FinTech specialists who define the functional and non-functional requirements of the platforms. The successful execution of this stage requires deep domain expertise in financial regulations and real estate market dynamics to ensure the software is relevant, compliant, and performs optimally in complex lending environments.

Midstream activities involve the development, sales, implementation, and integration of the software solutions. This is where vendors transform proprietary technology into deployable products tailored for specific client needs (e.g., configuring an LOS for a large bank vs. a regional lender). The distribution channel plays a crucial role; direct sales teams handle major institutional clients, offering customized enterprise contracts, while indirect channels, such as specialized system integrators or authorized resellers, often service smaller lenders and brokerages. The complexity of integrating these platforms with existing core banking systems or legacy data warehouses mandates a high degree of technical professional services, making the midstream service component a significant value driver.

The downstream segment focuses on the usage, maintenance, and ongoing support of the software by end-users. This stage includes continuous technical support, regular software updates for security and new feature deployment, and managed services that allow lenders to outsource IT infrastructure management. The value generated downstream is derived from the efficiency gains, reduced operational costs, and improved regulatory compliance experienced by the mortgage institutions. The ultimate downstream beneficiary is the borrower, who receives a faster, more transparent, and generally superior borrowing experience. The iterative feedback loop between end-users and software developers ensures continuous product improvement, solidifying the long-term relationship and recurring revenue model (SaaS) that dominates the modern digital mortgage software value chain.

Digital Mortgage Software Market Potential Customers

Potential customers for Digital Mortgage Software solutions are defined broadly as any institution involved in the origination, servicing, or securitization of residential and commercial mortgages, spanning a wide range from massive multinational banks to small, independent brokers. The most significant segment of the market consists of traditional financial institutions—large national and regional commercial banks, and credit unions—which require sophisticated, high-volume systems capable of processing millions of loans annually while adhering to rigorous stress testing and compliance requirements. These entities are primarily focused on system stability, enterprise-level security features, and seamless integration with their existing core banking software, viewing digital tools as an essential component of competitive survival.

A rapidly growing segment comprises non-depository mortgage lenders (NDMLs) and specialized FinTech lending companies. These organizations operate with less regulatory overhead than traditional banks, allowing them to prioritize speed, agility, and technology-driven efficiency. NDMLs are aggressive adopters of cloud-based, best-of-breed solutions, often utilizing advanced analytics and AI for optimized marketing and rapid underwriting. Their need centers on flexibility and rapid deployment, allowing them to scale quickly based on market fluctuations without the maintenance burden of on-premise infrastructure.

Furthermore, independent mortgage brokerages and servicing firms represent another critical customer group. Brokerages require highly versatile platforms that can interact seamlessly with multiple wholesale lenders and manage a diverse pipeline of loan products, often prioritizing strong CRM functionality and easy third-party data integration. Mortgage servicing firms, focusing on the post-closing management of loan portfolios (e.g., payment processing, escrow management, default management), are increasingly adopting digital platforms to enhance customer retention, improve communication, and ensure compliance with stringent servicing regulations. The trend towards centralized, digital servicing is driven by the need for transparency and efficiency throughout the entire loan lifecycle, benefiting all players in the secondary mortgage market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 12.8 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ICE Mortgage Technology (Ellie Mae), Blend, Roostify, SimpleNexus, Maxwell, Floify, Encompass, LenderClose, Cloudvirga, Total Expert, Blue Sage, ARGO, Qualia, Finastra, Accenture, Mortgage Builder, Wipro, MeridianLink, PCLender, Black Knight Financial Services. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Digital Mortgage Software Market Key Technology Landscape

The technological landscape of the Digital Mortgage Software Market is rapidly evolving, moving beyond simple workflow automation to embrace sophisticated cognitive and distributed ledger technologies. A foundational pillar of this landscape is the widespread adoption of cloud computing platforms (such as AWS and Azure) to deliver robust Software as a Service (SaaS) solutions. SaaS deployment is crucial because it provides instant scalability, high availability, and facilitates continuous, rapid updates essential for maintaining regulatory compliance in dynamic financial environments. Furthermore, modern platforms rely heavily on Application Programming Interfaces (APIs) to ensure seamless integration with critical external services, including credit reporting bureaus, property valuation tools, title companies, and payroll verification systems, creating a unified and interoperable ecosystem that maximizes data flow efficiency.

Artificial Intelligence (AI) and Machine Learning (ML) constitute the most impactful technology layer currently being implemented. These technologies are applied across the entire mortgage lifecycle, specifically targeting automated underwriting, fraud detection, and predictive modeling for loan defaults. NLP and OCR technologies are utilized to interpret and structure unstructured data from documents, drastically accelerating the processing of loan files. Simultaneously, advanced data analytics and business intelligence (BI) tools are integrated to provide lenders with real-time insights into pipeline performance, operational bottlenecks, and compliance metrics, empowering data-driven decision-making and optimization of marketing strategies for targeted borrower engagement.

Looking forward, blockchain and Distributed Ledger Technology (DLT) are poised to revolutionize the post-closing segments, particularly title management and the secondary mortgage market. DLT promises immutable, secure, and transparent record-keeping for property deeds and loan ownership, potentially reducing the cost and time associated with closing and transferring assets. The increasing focus on cybersecurity, specifically enhanced encryption methods (e.g., homomorphic encryption for secure data sharing) and multi-factor authentication, is also a constant necessity. As digital solutions proliferate, the market demands that technology providers not only streamline processes but also maintain the highest standards of data integrity and protection against evolving cyber threats, cementing security as a core non-negotiable technological requirement.

Regional Highlights

North America, particularly the United States, dominates the global Digital Mortgage Software market share due to its technologically mature financial sector, high consumer adoption of digital banking services, and a competitive lending environment that rewards rapid process efficiency. The large volume of mortgage originations and the complexity of regulatory requirements (e.g., TILA-RESPA Integrated Disclosure Rule or TRID) drive significant institutional investment in specialized compliance-focused software solutions. Furthermore, the US market benefits from widespread legal acceptance of digital closing practices, including e-notes and Remote Online Notarization (RON), which further accelerates the demand for robust end-to-end digital platforms capable of managing fully paperless transactions from application to closing. Canada also contributes strongly, demonstrating a high degree of integration between major banks and digital platforms.

Europe represents a highly fragmented yet increasingly important market. Adoption rates vary significantly across countries, influenced heavily by national regulatory bodies and diverse property laws. The UK, Nordics, and Germany are leaders in adopting sophisticated digital solutions, driven by strong FinTech ecosystems and favorable government digital transformation agendas. However, the need for software systems to be locally customized to adhere to individual nation-state regulations—such as varied consumer protection laws and highly specific data privacy compliance mandates (GDPR)—presents unique challenges. The focus in Europe is currently on digitizing the pre-approval and origination stages, with significant efforts underway to standardize e-documentation across the European Union.

Asia Pacific (APAC) is projected to be the fastest-growing region, fueled by massive untapped potential in emerging economies. Countries like India, China, and Australia are experiencing rapid digitization, driven by urbanization, expanding middle classes, and government initiatives promoting financial inclusion through technology. While infrastructure readiness remains variable, the lack of deeply entrenched legacy systems in many areas allows for leapfrog adoption directly to cloud-based, mobile-first solutions. Latin America and the Middle East & Africa (MEA) are nascent markets where digital transformation is being driven primarily by regional FinTech hubs seeking to bypass slow, manual governmental processes, focusing initial efforts on basic workflow automation and mobile application access to financial services.

- North America (Dominant Market): High concentration of FinTech innovation, aggressive adoption of AI/ML in underwriting, driven by complex regulation and competitive pressure among major lenders.

- Asia Pacific (Fastest Growth): Rapid digital penetration in emerging markets (India, China), favorable governmental policies supporting digital finance, strong growth in cloud-based solutions bypassing legacy infrastructure.

- Europe (Fragmented Maturity): High adoption in the UK and Nordics; growth constrained by complex, varied national regulations and need for GDPR compliance; focus on standardizing e-mortgage infrastructure.

- Latin America & MEA (Emerging Potential): Driven by mobile-first strategies and the need for efficiency in high-growth, underdeveloped mortgage markets; focus on basic origination and servicing automation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Digital Mortgage Software Market.- ICE Mortgage Technology (Ellie Mae)

- Blend

- Roostify

- SimpleNexus

- Maxwell

- Floify

- Encompass (Black Knight Financial Services)

- LenderClose

- Cloudvirga

- Total Expert

- Blue Sage

- ARGO

- Qualia

- Finastra

- Accenture

- Mortgage Builder

- Wipro

- MeridianLink

- PCLender

- Black Knight Financial Services

Frequently Asked Questions

Analyze common user questions about the Digital Mortgage Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Digital Mortgage Software Market?

The Digital Mortgage Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033, driven primarily by increasing demand for operational efficiency and regulatory compliance across financial institutions globally.

Which component segment holds the largest share in the digital mortgage software market?

The Software component segment, specifically Loan Origination Systems (LOS), currently holds the largest market share, as it forms the indispensable foundation for managing and automating the complex initial stages of the mortgage lifecycle, though the services segment is accelerating rapidly.

How does AI impact the underwriting process in digital mortgage lending?

AI significantly impacts underwriting by enabling instant document verification using NLP/OCR, enhancing fraud detection, and utilizing sophisticated machine learning models for predictive risk assessment, thereby accelerating decision-making and improving accuracy while maintaining compliance.

What is the preferred deployment type for new digital mortgage software adoption?

Cloud-based (SaaS) deployment is the preferred and fastest-growing type, offering lenders superior scalability, lower Total Cost of Ownership (TCO), faster deployment cycles, and continuous updating capabilities, especially appealing to non-bank lenders and regional institutions.

What are the primary restraints affecting the growth of the Digital Mortgage Software Market?

The primary restraints include the high initial capital investment required for migrating large financial institutions from legacy systems, the complexity of integrating diverse software solutions, and ongoing concerns regarding data security and navigating fragmented international regulatory compliance frameworks.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager