Digital Music Distribution Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435194 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Digital Music Distribution Service Market Size

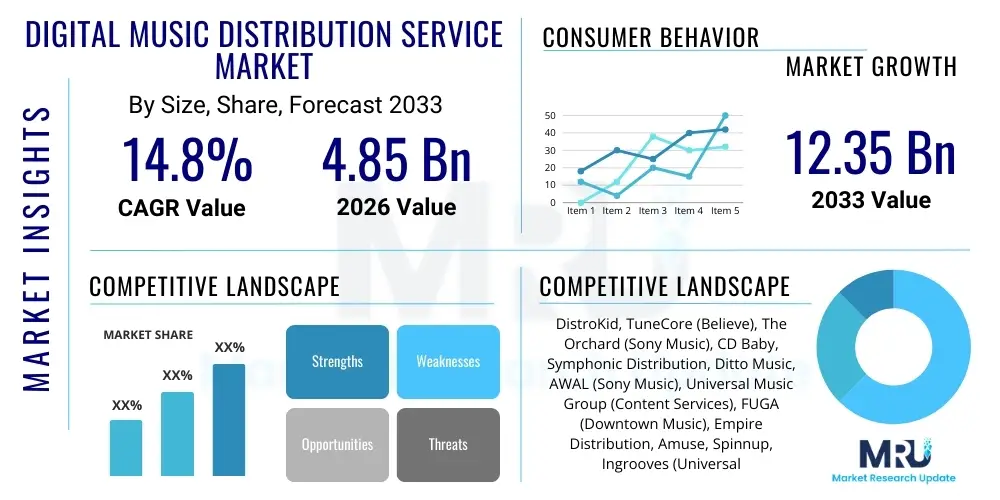

The Digital Music Distribution Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.8% between 2026 and 2033. The market is estimated at USD 4.85 Billion in 2026 and is projected to reach USD 12.35 Billion by the end of the forecast period in 2033.

Digital Music Distribution Service Market introduction

The Digital Music Distribution Service Market encompasses the technological infrastructure and business models facilitating the delivery of musical content from rights holders (artists, labels, publishers) to consumers through digital channels, primarily streaming platforms, digital download stores, and synchronization licensing outlets. This market is fundamentally driven by the global transition away from physical media and the pervasive consumer demand for on-demand, ubiquitous access to vast music libraries. Distribution services act as critical intermediaries, handling the complex tasks of metadata management, digital fingerprinting, royalty calculation, and cross-platform delivery, making them indispensable for both major record labels seeking operational efficiency and independent artists striving for global reach.

The core product offerings within this ecosystem revolve around aggregation services, which compile, format, and upload music files and associated intellectual property rights information to hundreds of Digital Service Providers (DSPs) worldwide. Major applications include direct streaming monetization (ad-supported and subscription), neighboring rights management, and ensuring global content security through sophisticated anti-piracy measures. The primary benefit derived by rights holders is streamlined market access and efficient global royalty collection, which historically required complex, multi-territorial licensing agreements. Distribution platforms democratize access, enabling millions of tracks to enter the market annually, driving hyper-competition and consumer choice.

Key driving factors accelerating market expansion include the sustained, double-digit growth in global streaming subscriptions, particularly in emerging economies across Asia Pacific and Latin America, where mobile internet penetration is soaring. Furthermore, the rise of independent artists and the creator economy heavily relies on these accessible distribution channels, bypassing traditional gatekeepers and fostering innovation in genre and format. Technological advancements, such as the implementation of blockchain for enhanced royalty transparency and the integration of sophisticated analytics tools for marketing optimization, further solidify the foundational role of digital distribution services in the modern music industry value chain.

Digital Music Distribution Service Market Executive Summary

The Digital Music Distribution Service Market is characterized by robust business trends, including intense competition among aggregators focusing on value-added services such as advanced analytics, marketing tools, and simplified licensing frameworks. A significant trend involves vertical integration, where distribution platforms are increasingly offering adjacent services like publishing administration and neighboring rights collection, aiming to capture a larger share of the artist’s revenue stack. Consolidation is evident, with major media conglomerates acquiring smaller, technologically agile distributors to enhance their catalogue ingestion capabilities and expand their reach into the independent artist segment. This strategic activity underscores the importance of scaling operations to manage the immense volume of content generated globally.

Regionally, the market dynamics show divergence. North America and Europe remain mature markets dominated by subscription revenues, focusing on high-fidelity audio (Hi-Fi) distribution and advanced playlist curation algorithms. In contrast, the Asia Pacific (APAC) region stands out for its exponential growth potential, driven by first-time smartphone adopters and a preference for localized content and tiered pricing models. Latin America also exhibits high potential, characterized by the rapid adoption of ad-supported streaming and mobile-first distribution strategies. These regional trends necessitate distribution platforms to offer highly customized localization strategies, including multi-currency payment processing and support for diverse local DSPs.

Segment trends highlight the critical role of the independent artist segment, which is increasingly utilizing direct-to-platform distribution models offering higher royalty splits and greater data control. Technology integration remains paramount, with blockchain technology beginning to transition from conceptual proof-of-concept to practical application in transparent rights management, particularly concerning complex intellectual property arrangements involving multiple writers and publishers. The prevailing segment momentum is shifting toward platform interoperability and the delivery of comprehensive enterprise solutions for mid-sized record labels seeking cost-effective and scalable global distribution infrastructure.

AI Impact Analysis on Digital Music Distribution Service Market

User inquiries regarding the impact of Artificial Intelligence (AI) on digital music distribution services frequently center on efficiency, ethical concerns, and creative displacement. Common questions investigate how AI-driven tools streamline metadata generation and copyright clearance, whether personalized recommendation engines driven by machine learning genuinely impact consumption patterns, and, critically, how distribution platforms will handle the influx of music generated entirely or partially by AI, particularly concerning ownership and royalty attribution. Users express expectations that AI will significantly lower the barrier to entry for content creation (e.g., AI mastering), but simultaneously raise concerns about content saturation and the potential devaluation of human-created art. The overarching theme is the need for distribution infrastructure to rapidly adapt to synthetic content while maintaining integrity and fair compensation models.

The immediate impact of AI is visible in operational optimization, where algorithms are employed to automate crucial, high-volume tasks. AI systems analyze vast datasets to predict market reception for specific genres or artists, enabling distribution platforms to offer sophisticated marketing campaign guidance. Furthermore, AI enhances content identification and anti-piracy efforts by rapidly scanning and comparing new uploads against existing copyrighted material with precision far exceeding manual review processes. This ensures compliance with licensing agreements and protects the revenue streams of rights holders, serving as a proactive defense mechanism against unauthorized distribution and fraudulent streaming activity.

Looking forward, AI is set to redefine the content ingestion and catalog management processes. AI-powered tools are automating the creation of descriptive metadata, optimizing keywords for search discovery on DSPs, and even generating multiple versions of audio files optimized for different playback environments (e.g., podcasts, gaming, high-res streaming). However, this rapid technological integration mandates robust policy updates within distribution agreements to clearly define the royalty structure and intellectual property rights for content where AI plays a substantial role in composition, performance, or mastering, thus shaping the regulatory landscape for future digital distribution services.

- Automated Metadata Tagging and Categorization for improved discovery.

- Enhanced Content Identification and Anti-Piracy Systems using acoustic fingerprinting.

- Personalized Playlist Curation Algorithms driving consumer consumption.

- AI-Driven Market Forecasting and Trend Prediction for strategic distribution planning.

- Streamlining Royalty Processing and Dispute Resolution using smart contracts and AI auditing.

- Facilitation of Synthetic Music Distribution and establishing guidelines for AI-generated content ownership.

DRO & Impact Forces Of Digital Music Distribution Service Market

The Digital Music Distribution Service Market is primarily driven by the exponential global increase in streaming consumption and the parallel growth of the independent artist ecosystem, which requires scalable and accessible publishing tools. Restraints largely center on the complexity of global licensing and synchronization rights, coupled with ongoing debates regarding the fairness and transparency of royalty payments to artists, particularly concerning micropayments per stream. Opportunities are vast, focused on leveraging blockchain technology to enhance transparency and efficiency in royalty distribution, alongside significant market penetration opportunities in previously underserved developing regions. These dynamics interact with powerful external forces, including the bargaining power of major Digital Service Providers (DSPs), which dictates distribution terms, and the increasing regulatory scrutiny aimed at ensuring equitable compensation across the value chain.

Key drivers include the infrastructure improvements in global mobile networks, making high-quality audio streaming accessible even in remote areas. The cultural shift towards consumption-based media rather than ownership has cemented subscription models as the primary revenue generator. Conversely, a major restraining factor is the ongoing fragmentation of digital rights management, especially across varied international jurisdictions, which creates operational hurdles for distributors trying to ensure global compliance and efficient monetization. Furthermore, the sheer volume of content being uploaded daily creates a supply-side glut, making effective discoverability a significant challenge that distribution platforms must address to provide value to their clientele.

Impact forces are multifaceted. The intense bargaining power of buyers—the DSPs like Spotify, Apple Music, and Amazon—sets the effective pricing structure for distribution services and dictates the technical specifications for content delivery. The bargaining power of suppliers, predominantly the major record labels and large publishers, influences the non-negotiable terms for catalog distribution and minimum guarantee requirements, particularly in licensed platforms. The threat of new entrants remains relatively high in the low-cost aggregation segment, but the threat of substitutes is low, as consumers are unlikely to revert to physical media. However, the rapidly evolving regulatory environment, particularly concerning digital copyright and data privacy (like GDPR), imposes substantial compliance costs, acting as an environmental pressure shaping market operations.

Segmentation Analysis

The Digital Music Distribution Service market is comprehensively segmented based on the type of service offered, the end-user demographic, and the primary channel of distribution utilized. Service segmentation distinguishes between core distribution (upload and ingestion) and value-added services (licensing, analytics, marketing). End-user segmentation recognizes the vastly different needs and financial capabilities of major labels versus independent artists and DIY musicians. Analyzing these segments provides strategic clarity on where growth is concentrated and where niche specialization is emerging, particularly as technology enables platforms to offer highly tailored packages to specific types of content creators.

- By Service Type:

- Content Aggregation and Delivery (Core Distribution)

- Rights Management and Publishing Administration

- Digital Marketing and Promotion Services

- Royalty Collection and Reporting Services

- Synchronization Licensing Services

- By End-User:

- Major Record Labels (Tier 1)

- Independent Record Labels (Tier 2/3)

- Independent Artists and DIY Musicians

- Music Publishers and Rights Holders

- Production Music Libraries

- By Distribution Channel:

- Digital Streaming Platforms (DSPs - Subscription and Ad-Supported)

- Digital Download Stores (e.g., iTunes, Bandcamp)

- Synchronization Licensing Marketplaces (Film, TV, Gaming)

- Social Media and User-Generated Content Platforms (e.g., TikTok, YouTube)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Digital Music Distribution Service Market

The value chain in the Digital Music Distribution Service Market begins upstream with the creators and rights holders—the artists, songwriters, producers, and publishers—who originate the musical intellectual property. These entities require efficient mechanisms to transform their master recordings and compositions into monetizable digital assets. The upstream phase is characterized by recording, mixing, mastering, and the crucial establishment of sound recording and publishing rights metadata. Technological innovation in this segment focuses on AI-assisted mastering and simplified intellectual property registration, reducing the initial cost and complexity for independent creators entering the market.

The midstream is dominated by the Digital Music Distribution Service providers (aggregators). These companies are responsible for converting the master files into the proprietary formats required by various downstream Digital Service Providers (DSPs), attaching standardized metadata (using identifiers like ISRC and ISWC), and managing the licensing clearance required for global distribution. Distribution channels are predominantly indirect, routing content through these aggregators to DSPs, but a trend toward direct-to-DSP submissions exists for very large rights holders. The core value added at this stage is global reach, efficiency, and accurate royalty tracking across complex global territories and consumption models (e.g., pro-rata vs. user-centric payment models).

The downstream component involves the vast network of consumption platforms—Spotify, Apple Music, YouTube, Tencent Music, and synchronization licensees (such as film and game studios). These DSPs pay royalties back to the distributors based on consumption data, which the distributors then filter, calculate, and remit to the rights holders. The final customers are the global music consumers who pay via subscriptions or tolerate advertisements. Direct distribution, while possible, lacks the logistical scale and technical integration offered by major aggregators, making the indirect channel the dominant pathway for mass market access and efficient royalty settlement across hundreds of storefronts.

Digital Music Distribution Service Market Potential Customers

The primary customers for Digital Music Distribution Services are diverse entities holding commercial rights to musical works, ranging from multinational corporations to individual content creators. The largest and most demanding customer segment comprises the Major Record Labels (Universal Music Group, Sony Music Entertainment, Warner Music Group) and large independent labels. These customers require enterprise-level distribution solutions characterized by extremely high volume capacity, sophisticated security protocols, advanced analytics integration, and dedicated account management to handle massive catalogs and complex international licensing portfolios.

A rapidly expanding segment of critical importance consists of independent artists and Do-It-Yourself (DIY) musicians. These creators prioritize ease of use, low upfront cost, high royalty splits, and educational resources regarding music business practices. Distribution platforms cater to this segment by offering user-friendly interfaces, tiered pricing models (including freemium options), and integration with social media platforms for direct marketing. Their primary purchasing criteria focus heavily on transparency regarding royalty processing and the speed of content delivery to major streaming sites.

Beyond traditional labels and artists, potential customers also include Music Publishers seeking efficient mechanisms to manage and monetize the compositional rights of songwriters globally, often utilizing distribution platforms for synchronization licensing clearances. Additionally, Production Music Libraries, which license instrumental tracks for commercial use, rely on these services to organize, metadata-tag, and securely deliver their extensive catalogs to synchronization buyers across film, television, advertising, and video game industries, highlighting the market's reach beyond mere consumer streaming.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.85 Billion |

| Market Forecast in 2033 | USD 12.35 Billion |

| Growth Rate | 14.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DistroKid, TuneCore (Believe), The Orchard (Sony Music), CD Baby, Symphonic Distribution, Ditto Music, AWAL (Sony Music), Universal Music Group (Content Services), FUGA (Downtown Music), Empire Distribution, Amuse, Spinnup, Ingrooves (Universal Music Group), Level Music, ReverbNation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Digital Music Distribution Service Market Key Technology Landscape

The technology underpinning the Digital Music Distribution Service Market is rapidly evolving, driven by the need for scalability, transparency, and advanced data processing. Central to this landscape are robust Content Management Systems (CMS) capable of handling petabytes of audio files and complex associated metadata across multiple territories and languages. Key technological advancements include the deployment of sophisticated server architectures designed for continuous uptime and rapid global file delivery, ensuring that new releases are simultaneously available on hundreds of DSPs at designated times, often down to the minute. Furthermore, enhanced digital fingerprinting technologies are essential for proactive content monitoring and preventing unauthorized usage across user-generated content platforms, protecting the intellectual property of rights holders globally.

The integration of Distributed Ledger Technology (DLT), commonly known as Blockchain, represents a pivotal technological shift. While still maturing, Blockchain offers the potential for unprecedented transparency in royalty tracking and disbursement. By recording every stream transaction and corresponding rights ownership on an immutable ledger, distribution platforms can streamline complex royalty calculations involving multiple stakeholders (artists, writers, publishers, labels), significantly reducing administrative overhead and disputes. This technology addresses one of the market's most significant pain points: the perception of opaque and slow royalty payments, positioning platforms that successfully integrate DLT for a strong competitive advantage in the future.

In addition to core distribution infrastructure, advanced analytics and machine learning tools form a crucial part of the technology landscape. Distribution services are leveraging big data processing capabilities to provide rights holders with granular, real-time insights into consumer behavior, geographical consumption patterns, and playlist penetration. This includes predictive modeling used for optimal release timing and targeted advertising placement. Furthermore, high-resolution audio codecs (like FLAC and MQA) are becoming standard requirements, compelling distributors to upgrade their ingestion and storage capabilities to support high-fidelity distribution tiers increasingly demanded by premium streaming subscribers, ensuring technological parity with the evolving consumer electronics landscape.

Regional Highlights

The global Digital Music Distribution Service Market exhibits distinct regional consumption and distribution patterns that necessitate customized strategic approaches from service providers. Market maturity, mobile penetration, and regulatory environments significantly shape regional growth trajectories and revenue generation opportunities.

- North America (NA): Represents the most mature market, characterized by high subscription penetration rates and dominance of major US-based DSPs. Revenue generation is high, driven by premium subscriptions and high Average Revenue Per User (ARPU). Distribution service focus here is on advanced data analytics, high-fidelity audio support, and sophisticated synchronization licensing operations. The region serves as a primary hub for global music marketing strategies.

- Europe: A highly competitive market with strong regulatory influence, particularly concerning digital copyright laws (e.g., EU Copyright Directive). The region is a vital hub for independent distribution networks and specialized neighboring rights collection. Market growth is stable, emphasizing legislative compliance and innovation in user-centric payment models (UCPM) within certain territories.

- Asia Pacific (APAC): The fastest-growing region globally, driven by massive populations, increasing smartphone usage, and the rise of local streaming giants (e.g., Tencent Music, Gaana). Growth is concentrated in emerging economies like India, Indonesia, and China. Distributors must prioritize localization, integration with local payment gateways, and tiered, often ad-supported, subscription models to capture market share.

- Latin America (LATAM): Exhibits rapid digitalization and high consumption of mobile-first streaming, often characterized by ad-supported or freemium tiers. Key markets like Brazil and Mexico present substantial growth opportunities, favoring distribution services that offer low-latency delivery and cater to genre-specific local music trends, such as Reggaeton and Latin Pop.

- Middle East & Africa (MEA): Emerging market characterized by strong mobile-only access and the nascent development of formal streaming ecosystems. Distribution efforts focus on establishing robust infrastructure, managing geopolitical complexities, and addressing lower banking penetration rates through innovative localized payment methods.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Digital Music Distribution Service Market.- DistroKid

- TuneCore (A division of Believe)

- The Orchard (A wholly-owned subsidiary of Sony Music)

- CD Baby

- Symphonic Distribution

- Ditto Music

- AWAL (Acquired by Sony Music)

- FUGA (A subsidiary of Downtown Music)

- Universal Music Group (Global Content Services)

- Ingrooves (A subsidiary of Universal Music Group)

- Empire Distribution

- Amuse

- OneRPM

- Spinnup (Universal Music Group)

- Level Music (Owned by Warner Music Group)

- ReverbNation

- iMusician Digital

- Stem

- MondoTunes

Frequently Asked Questions

Analyze common user questions about the Digital Music Distribution Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a Digital Music Distributor?

A Digital Music Distributor serves as the critical intermediary, aggregating musical content, managing complex metadata and intellectual property rights, and delivering the files to hundreds of global Digital Service Providers (DSPs) like Spotify and Apple Music, ensuring efficient royalty collection and reporting for the rights holder.

How does blockchain technology impact music distribution royalties?

Blockchain technology promises to enhance royalty transparency by creating an immutable, distributed ledger of consumption and ownership rights. This reduces reliance on centralized accounting systems, potentially accelerating payment processing and minimizing disputes among artists, publishers, and distributors.

What are the key differences between distribution models for independent artists versus major labels?

Independent artists typically use low-cost or freemium aggregators focused on simplicity and high percentage royalty splits (Direct-to-Artist model). Major labels utilize sophisticated enterprise distribution solutions offering dedicated infrastructure, high-volume capacity, complex catalog management, and priority technical support through subsidiaries like The Orchard or Ingrooves.

Which geographic region is experiencing the fastest growth in digital music distribution?

The Asia Pacific (APAC) region, driven by explosive growth in mobile internet penetration and rising middle-class consumption in key markets like China and India, is currently exhibiting the highest Compound Annual Growth Rate (CAGR) for digital music consumption and subsequent distribution services.

How do Digital Distribution Services ensure content security and prevent piracy?

Distribution services employ advanced digital fingerprinting and acoustic monitoring technologies to track unauthorized usage across streaming and User-Generated Content (UGC) platforms (like YouTube). They enforce strict content ID policies and integrate with anti-piracy databases to ensure only authorized versions of music are monetized.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager