Digital Orthodontics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436714 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Digital Orthodontics Market Size

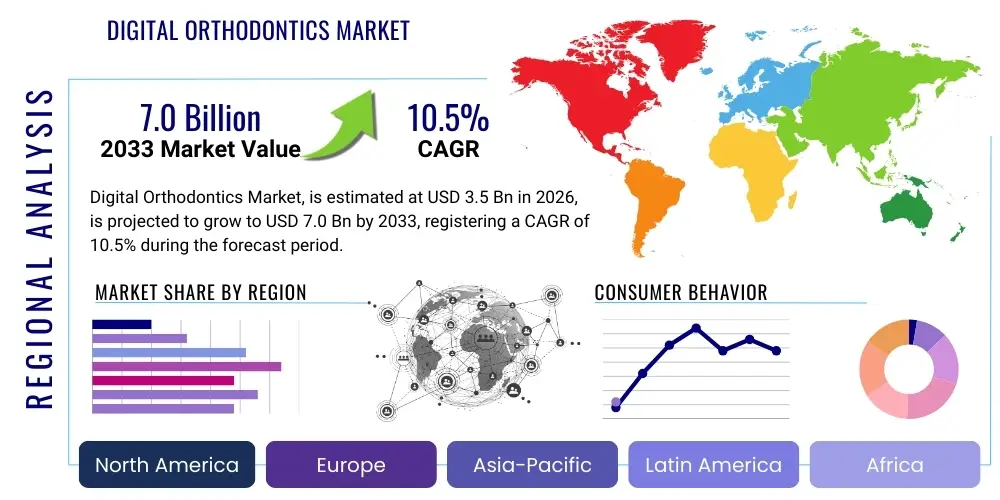

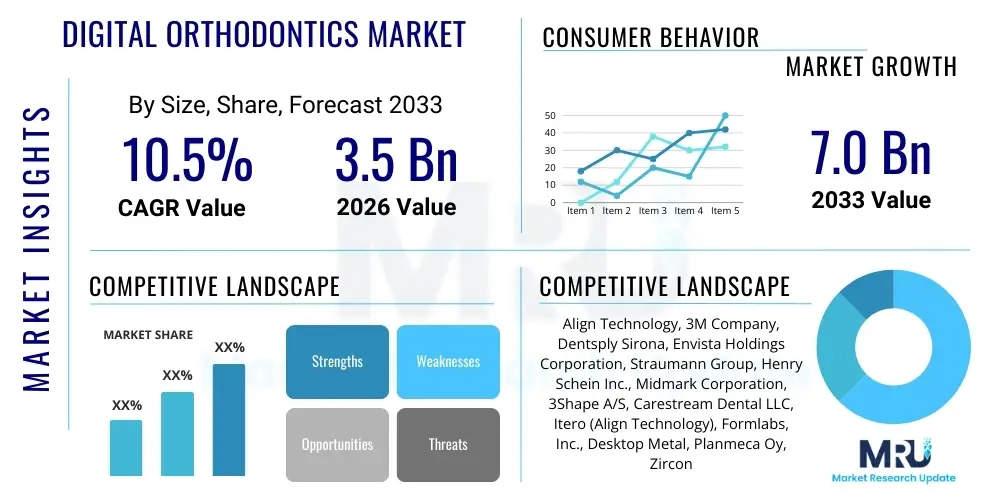

The Digital Orthodontics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 7.0 Billion by the end of the forecast period in 2033.

Digital Orthodontics Market introduction

The Digital Orthodontics Market encompasses the utilization of advanced technological tools, sophisticated software, and specialized hardware designed to streamline and radically enhance every phase of orthodontic care, from initial diagnosis and meticulous treatment planning to the precise fabrication of customized appliances. This comprehensive digital ecosystem integrates high-fidelity intraoral scanners, three-dimensional diagnostic imaging modalities like Cone Beam Computed Tomography (CBCT), advanced Computer-Aided Design and Manufacturing (CAD/CAM) workflows, proprietary treatment planning software, and additive manufacturing technologies, particularly 3D printing. The central purpose of this technology shift is to eliminate the inefficiencies and inaccuracies inherent in traditional analogue methods, such as plaster casts and manual wire bending, by providing precise, highly efficient, and personalized therapeutic routes. The most visible application of this shift is the mass production and customization of clear aligners, alongside the precise manufacturing of custom fixed appliances like brackets and archwires, using indirect bonding techniques.

The core product offerings within this dynamic market range substantially, beginning with state-of-the-art intraoral scanners, such as those employing structured light or confocal imaging, manufactured by market leaders, which serve as the essential entry point for patient data acquisition. This digital data is then processed by sophisticated orthodontic software that utilizes complex algorithms to simulate tooth movement across multiple stages, allowing clinicians to visualize and predict final treatment outcomes with unprecedented accuracy. Major applications of digital orthodontics span the entire spectrum of malocclusion correction, serving both adolescent and increasingly large adult patient populations. The substantial demand from adults for discreet and minimally invasive treatment options has accelerated the dominance of clear aligner therapy. Furthermore, the increasing accessibility and affordability of high-speed, medical-grade 3D printers optimized for specialized orthodontic resins are facilitating a profound organizational change, enabling large dental labs and advanced clinical centers to insource appliance fabrication, thereby realizing substantial operational efficiencies and greater control over the manufacturing timeline and quality.

The benefits derived from fully digitized orthodontic workflows are multi-faceted, providing superior diagnostic clarity and enhanced treatment predictability, stemming from the precise volumetric data provided by CBCT and the micron-level accuracy of surface models generated by intraoral scans. This precision directly translates into improved clinical efficiency, significantly reducing patient chair time and overall treatment duration. Key driving factors underpinning the robust market expansion include the globally rising incidence and awareness of malocclusion, the increasing consumer prioritization of dental aesthetics as a socio-economic necessity, and the widespread adoption of teledentistry platforms that integrate remote monitoring capabilities for digital treatments. Moreover, the substantial strategic investments made by global dental corporations in research, development, and strategic acquisitions—particularly focusing on incorporating Artificial Intelligence (AI) for automated diagnostics and advanced simulation—are continuously pushing the technological envelope and ensuring sustained market momentum. The structural change brought about by the expiration of crucial clear aligner patents is intensifying competition, lowering technology access costs, and accelerating widespread adoption across geographies.

Digital Orthodontics Market Executive Summary

The global Digital Orthodontics Market is characterized by a high degree of innovation and rapid adoption, sustaining robust growth driven by the compelling value proposition of improved clinical outcomes and streamlined practice management. Current business trends emphatically point toward increased vertical integration, a strategy wherein dominant companies seek to control the entire patient journey—from the initial digital scan capture and proprietary software planning to the final mass-scale fabrication of customized devices. This comprehensive control minimizes friction points in the workflow and secures profit margins across the value chain. Leading market competitors are strategically expanding their portfolios through mergers and acquisitions, targeting specialized firms in machine learning, 3D printing hardware, and niche software development, aiming to offer seamless, single-source solutions. A parallel trend involves the critical development and implementation of remote monitoring and virtual consultation tools, which are proving instrumental in managing large caseloads efficiently, enhancing patient communication, ensuring compliance, and ultimately bolstering the profitability of the digital service segment.

Regionally, North America maintains market leadership, driven by high consumer awareness regarding dental aesthetics, strong reimbursement policies, and early adoption of premium technologies like high-fidelity intraoral scanners and advanced simulation software. However, the Asia Pacific (APAC) region is projected to register the fastest CAGR, propelled by expanding middle-class populations with disposable income, increasing access to modern dental care infrastructure, and governmental initiatives supporting digital healthcare adoption in large economies like China and India. Europe also represents a mature market, focusing heavily on regulatory compliance and the integration of digital tools into standard dental practice curricula. Its steady growth is supported by a preference for validated, clinically proven systems and strong regulatory oversight ensuring data privacy and device safety across diverse member states.

Analysis of market segmentation reveals the clear aligner application segment as the primary revenue generator, reflecting the overarching trend of adult patients seeking aesthetic corrections. The technology component segmentation demonstrates rapid innovation cycles focused on orthodontic software, specifically utilizing machine learning techniques for predictive treatment setup and outcome simulation, reducing the time clinicians spend on manual adjustments. Regarding end-users, specialized orthodontic clinics continue to be the foundational segment for high-volume hardware and software purchases. However, a transformative trend involves the escalating adoption of digital diagnostic tools, especially user-friendly intraoral scanners, by General Dental Practitioners (GDPs). This expansion allows GDPs to confidently enter the lucrative realm of simple-to-moderate clear aligner cases, effectively widening the market base beyond traditional specialized orthodontic care and creating new revenue streams for technology providers globally.

AI Impact Analysis on Digital Orthodontics Market

The emergence and integration of Artificial Intelligence (AI) represent a paradigm shift in digital orthodontics, generating significant user inquiry concerning its ability to enhance clinical accuracy, automate time-intensive diagnostic processes, and ultimately improve the feasibility of treatment planning for complex malocclusions. Common user questions probe the reliability of AI algorithms in generating treatment proposals autonomously, the methodologies used by machine learning (ML) to process highly variable anatomical data, and the crucial legal and ethical frameworks surrounding accountability in AI-assisted diagnosis. The thematic synthesis of these inquiries confirms that AI is not merely an incremental improvement but a revolutionary force aimed at significantly reducing clinical variability and human intervention in repetitive tasks. AI’s current demonstrable capabilities encompass rapid, error-free automation of critical diagnostic tasks, such as cephalometric landmark identification, precise optimization of movement sequencing for clear aligner protocols, and enhanced predictive modeling of post-treatment stability and relapse risks. This technological leap fundamentally transitions the discipline toward evidence-based, data-intensive, and hyper-personalized patient care.

Specifically, the application of deep learning neural networks allows AI to analyze vast datasets of successful and unsuccessful orthodontic cases, extracting complex patterns that human clinicians might overlook. This enables the software to suggest highly optimized staging plans for clear aligners, minimizing the need for manual design and iterative adjustments, consequently saving substantial chair time and manufacturing cycles. Furthermore, AI is crucial in integrating disparate data sources, such as fusing 3D surface scans with CBCT volumetric data, creating a holistic digital patient twin. This unified dataset allows for precise analysis of root proximity, bone density, and the presence of any underlying pathology, aspects critical for ensuring biomechanical safety during treatment. The reliability and speed of AI in processing this complex data are paramount, allowing orthodontists to focus their expertise on clinical decision-making rather than data compilation and rudimentary analysis.

Looking ahead, the next phase of AI integration is expected to focus on fully autonomous systems that predict patient compliance levels based on demographic and historical data, and even suggest customized retention protocols to minimize relapse, thereby offering a truly end-to-end intelligent solution. While initial investment and rigorous validation remain ongoing concerns, the long-term cost savings associated with reduced treatment duration, fewer necessary refinements, and minimized complication rates are driving large DSOs and integrated dental technology companies to prioritize AI development. This sustained focus is rapidly establishing AI-powered planning software as a mandatory feature rather than a competitive luxury in the professional digital orthodontics toolbox.

- AI-driven automation of cephalometric and panoramic radiographic analysis, achieving instant and highly repeatable landmark identification and measurement.

- Enhanced predictive modeling utilizing deep learning to simulate complex tooth movements, minimizing mid-course corrections and reducing reliance on manual adjustments in clear aligner therapy.

- Optimization and automated generation of clear aligner staging and tray sequencing based on patient-specific biomechanical thresholds.

- Automated quality control checks for 3D printed appliances and custom brackets, ensuring ultra-high dimensional accuracy and optimized fit before delivery.

- Development of intelligent diagnostic software capable of identifying subtle pathological indicators, such as temporomandibular joint (TMJ) abnormalities, utilizing CBCT data fusion.

- Seamless integration of teledentistry platforms with AI algorithms for continuous remote monitoring, enabling immediate alerts for treatment non-compliance or unexpected movement deviations.

- Personalization and virtual design of custom fixed appliances (brackets and archwires) through algorithms analyzing individual root morphology, bone density, and inter-arch relationships.

- Streamlining and automation of complex administrative tasks, including insurance claim pre-authorization and integrated patient scheduling based on treatment complexity, substantially improving overall clinic operational throughput.

DRO & Impact Forces Of Digital Orthodontics Market

The Digital Orthodontics Market is fundamentally propelled by compelling clinical and economic drivers. The most significant driver is the proven ability of digital systems to provide increased accuracy, substantially reduce the total treatment duration, and deliver aesthetically superior outcomes, specifically through highly personalized clear aligner therapy which depends entirely on 3D technology. These clinical advantages are strongly supported by a significant and growing global consumer demand for aesthetic, comfortable, and discreet treatment options, which places direct pressure on orthodontic providers to adopt high-precision technologies like intraoral scanners. Furthermore, continuous technological advancements, particularly the decreasing cost and improving speed of high-resolution 3D printing and the increasing sophistication of CAD/CAM software, contribute substantially to market acceleration by making digital workflows more accessible to a broader range of practices.

However, several significant restraints challenge universal adoption. The primary impediment remains the substantial initial capital investment required to purchase and install sophisticated digital infrastructure, including high-end intraoral scanners (which can cost tens of thousands of USD) and specialized 3D printing equipment. Coupled with hardware costs are the ongoing expenses associated with mandatory software licensing, maintenance agreements, and technical training, posing a financial hurdle, especially for smaller, independent practices. Furthermore, the inherent complexity and need for integration between different manufacturers' proprietary software platforms often create interoperability issues, requiring specialized technical expertise and training that can delay the seamless adoption of a fully digitized workflow.

Market opportunities are expansive, primarily centering on the massive, untapped potential within emerging economies across Asia Pacific and Latin America, where dental infrastructure is rapidly expanding and patient affluence is growing. Crucially, the expansion of clear aligner manufacturing to general dentists (GDPs) represents a significant new revenue opportunity for technology providers, demanding simplified, intuitive digital tools. Technological innovation also presents key opportunities, including the ongoing development of highly efficient, biocompatible materials for direct 3D printing of appliances, and the integration of emerging visualization technologies like Augmented Reality (AR) and Virtual Reality (VR) for enhanced patient consultation, improving case acceptance rates and overall patient engagement in the treatment process. The market faces moderately high impact forces, characterized by fierce competitive rivalry, particularly following the expiration of major patents in the aligner space, leading to rapid price erosion and continuous pressure for product innovation. Technological substitution risk is high, as digital systems aggressively displace conventional impression materials and analog lab work, fundamentally reshaping the supply chain and clinical practice standards.

Segmentation Analysis

The Digital Orthodontics Market is analyzed across critical dimensions including product type, clinical application, end-user setting, and specific patient demographics, enabling precise targeting and strategic planning for market participants. The segmentation by product meticulously differentiates between tangible hardware assets, such as high-resolution intraoral scanners and additive manufacturing units, dedicated proprietary software solutions essential for diagnostics and treatment planning, and outsourced services, which include remote support and external appliance manufacturing. This structural segmentation allows for detailed analysis of investment trends, highlighting areas where innovation capital is most heavily deployed, typically in software algorithms and advanced scanning technology aimed at improving accuracy and speed.

- By Product:

- Intraoral Scanners (Wired, Wireless, Specialized Color/Texture Mapping Scanners)

- 3D Printers (Stereolithography Apparatus - SLA, Digital Light Processing - DLP, Fused Deposition Modeling - FDM, MultiJet Modeling - MJM)

- Orthodontic Software (Treatment Planning Software, Diagnostic Imaging Software, Practice Management Systems, Cloud-Based Simulation Tools)

- CAD/CAM Systems (Milling Machines, Specialized Abutment/Appliance Manufacturing Units)

- By Application:

- Clear Aligners (Standard, Advanced, In-House Manufactured)

- Customized Brackets and Wires (Lingual, Conventional, Self-Ligating Brackets)

- Retainers (Fixed, Removable, 3D Printed Vacuum-Formed)

- Indirect Bonding Trays and Appliances (Orthognathic Splints, TMD Appliances)

- By End-User:

- Specialized Orthodontic Clinics (Large Group Practices, Single-Doctor Offices)

- Dental Hospitals and Academic Institutions (Research and Training Facilities)

- Dental Service Organizations (DSOs) (Multi-site, standardized corporate entities)

- Commercial Dental Laboratories (High-volume appliance manufacturing)

- By Patient Age Group:

- Adolescents (Ages 10-18, often requiring fixed appliances and early intervention)

- Adults (Ages 18+, driving the demand for aesthetic clear aligners and comprehensive digital treatment)

Value Chain Analysis For Digital Orthodontics Market

The Digital Orthodontics value chain commences with critical upstream activities involving the sourcing of highly specialized raw materials and components. This includes advanced polymer resins and photo-curing materials optimized for medical-grade 3D printing (SLA/DLP), precision optics and high-resolution sensor components for intraoral scanners, and complex proprietary software algorithms developed by specialized technology firms. R&D in this upstream segment is intense, focusing on enhancing material biocompatibility, dimensional stability, and optimizing computational efficiency for real-time scanning and treatment simulation. Successful upstream management secures essential patents and trade secrets related to scanning fidelity and resin performance, establishing key technological barriers to entry.

Midstream processing involves the core manufacturing, assembly, and integration of the final digital products. This stage is dominated by major dental technology conglomerates that produce high-volume intraoral scanners, advanced 3D printers, and integrated CAD/CAM systems. Crucially, the development and rigorous validation of proprietary treatment planning software—often incorporating AI and cloud-based architecture—occurs here. Compliance with stringent global medical device regulations (e.g., ISO, FDA approval, EU MDR) is paramount, necessitating robust quality control protocols. The midstream is characterized by intense competition between manufacturers vying to offer the most open, fastest, and most accurate systems capable of integrating seamlessly into existing clinical IT infrastructures.

The downstream distribution and service delivery segment connects the manufactured goods and software licenses to the end-users. Distribution relies heavily on a dual channel approach: direct sales forces are used for high-value items requiring specialized installation and training (scanners, complex 3D printers), while indirect channels, involving global and regional dental supply dealers, handle software subscriptions and consumables. Service provision is a major value addition, encompassing technical support, software updates, clinical training, and, critically, outsourced manufacturing services for clear aligners, where the technology vendor often acts as the sole manufacturer for their branded system. The rise of vertical integration, particularly by large clear aligner providers, fundamentally compresses this downstream segment by controlling manufacturing in-house, minimizing reliance on independent dental labs for aligner production but increasing dependence on labs for retainer and crown/bridge support.

Digital Orthodontics Market Potential Customers

The primary and most lucrative customer base in the Digital Orthodontics Market consists of specialized orthodontic clinics, ranging from single-chair operations to large multi-site practice groups. These customers represent the highest volume users of all components of the digital workflow, including premium intraoral scanners, advanced treatment planning software, and often, in-house 3D printing capabilities. Their purchasing decisions are primarily driven by the pursuit of clinical excellence, efficiency gains to maximize patient turnover, and the desire to offer the latest aesthetic treatment modalities, making them ideal targets for high-ticket hardware and recurring software subscription models that promise a rapid return on investment through optimized workflow.

A rapidly expanding customer segment includes Dental Service Organizations (DSOs) and large General Dental Practices (GDPs) that are integrating orthodontics, specifically clear aligner therapy, into their comprehensive service offerings. DSOs are highly attractive to vendors because they demand standardized, scalable, and interconnected digital solutions that can be rapidly deployed across a large network of affiliated practices, necessitating enterprise-level software licensing and volume discounts on hardware. GDPs typically adopt foundational digital tools, such as introductory intraoral scanners, to participate in simple cosmetic aligner cases, requiring user-friendly, non-proprietary systems with accessible training modules to minimize their learning curve and initial investment risk.

Finally, academic dental institutions and high-volume hospital-based dental departments constitute a significant, albeit smaller, customer segment. These entities require the most advanced, research-grade digital equipment, including complex CBCT units and cutting-edge simulation software, used primarily for postgraduate education, advanced craniofacial and surgical planning, and long-term clinical research into biomechanics. Their focus is on educational scalability, data research capability, and the integration of highly specialized software that often extends beyond routine orthodontic treatment to encompass maxillofacial surgery and complex interdisciplinary care coordination, requiring vendors capable of providing customized educational and research support packages.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 7.0 Billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Align Technology, 3M Company, Dentsply Sirona, Envista Holdings Corporation, Straumann Group, Henry Schein Inc., Midmark Corporation, 3Shape A/S, Carestream Dental LLC, Itero (Align Technology), Formlabs, Inc., Desktop Metal, Planmeca Oy, Zirconia Dental, G&H Orthodontics, American Orthodontics, ClearCorrect (Straumann Group), TP Orthodontics, Inc., Great Lakes Orthodontics, Inc., Reliance Orthodontic Products, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Digital Orthodontics Market Key Technology Landscape

The foundational technology underpinning the Digital Orthodontics Market is high-precision data acquisition, primarily through advanced intraoral scanning. These scanners employ diverse optical principles, including confocal microscopy, active wavefront sampling, and structured light projection, to capture highly detailed, full-color three-dimensional models of the oral cavity, effectively replacing cumbersome and messy traditional impressions. Key technological innovations in scanning focus on improving scanning speed, reducing the physical size of the wand for enhanced patient comfort, and increasing data fidelity to capture margin lines and soft tissue accurately. Furthermore, the development of open-architecture systems, which allow for seamless export of Standard Tessellation Language (STL) files to any third-party software or manufacturing facility, is critical for promoting interoperability and reducing vendor lock-in, driving mass adoption across various clinical settings globally.

Once the 3D data is acquired, it is processed within sophisticated CAD/CAM and dedicated orthodontic software environments. These platforms utilize advanced computational geometry and biomechanical simulation algorithms to facilitate virtual setup—the precise digital manipulation of teeth from their initial position to the final desired outcome. Crucially, the increasing integration of Artificial Intelligence (AI) and Machine Learning (ML) transforms this planning phase, allowing for automated landmark identification, predictive modeling of root movement, and instantaneous adjustment suggestions based on established clinical success metrics derived from vast patient databases. This software intelligence is integral to the clear aligner ecosystem, dictating the precise staging of tooth movement and the subsequent design of the aligner molds, directly influencing the efficiency and success rate of the treatment protocol.

The third critical pillar is Additive Manufacturing (3D Printing), which converts the digital treatment plan into physical reality. Stereolithography (SLA) and Digital Light Processing (DLP) technologies are the industrial standards for producing the high-resolution master models used for thermoforming clear aligners, or for directly printing indirect bonding trays and custom surgical guides. Recent technological advancements center on the direct 3D printing of the aligners themselves using proprietary medical-grade resins that offer superior clarity, flexibility, and resistance to staining, bypassing the traditional two-step thermoforming process entirely. Furthermore, the development of robust, high-volume production printers capable of running 24/7 with minimal supervision has allowed major manufacturers to scale their aligner production to meet global demand, while simultaneously enabling smaller dental labs to enter the custom appliance market with manageable capital investment.

Regional Highlights

The Digital Orthodontics Market exhibits distinct regional dynamics influenced by economic maturity, healthcare policy, and patient acceptance of aesthetic treatments.

- North America: Market leader due to high healthcare spending, strong presence of key market players (e.g., Align Technology, 3M), and high penetration of clear aligner therapy among adult consumers. High adoption rates are supported by sophisticated dental insurance systems and consumer willingness to invest in aesthetic treatments. The U.S. remains the central hub for R&D and major product launches in scanning and software technology.

- Europe: Characterized by established dental infrastructure and strong governmental focus on healthcare standards. Western European countries (Germany, U.K., France) are mature markets showing high uptake of integrated CAD/CAM solutions. The region emphasizes clinical validation and regulatory compliance (MDR/IVDR), leading to sustained, steady growth driven by the shift from conventional impressions to digital workflows across all practice types.

- Asia Pacific (APAC): Fastest-growing region, powered by rapid urbanization, increasing disposable incomes, and improving access to modern dental technology, particularly in densely populated countries like China, India, and Japan. Expansion is significantly supported by the growing demand for clear aligners and local manufacturing efforts aiming to produce low-cost digital solutions, democratizing access to technology in developing sub-regions.

- Latin America (LATAM): Emerging market where digital adoption is accelerating, especially in Brazil and Mexico. Growth is driven by competitive pricing of entry-level intraoral scanners and increasing investment in local dental education focused on digital techniques. Price sensitivity remains a key factor, favoring solutions that offer a rapid return on investment.

- Middle East and Africa (MEA): A nascent market with growth concentrated in high-income Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia). Digital adoption is primarily limited to specialized high-end clinics and private hospitals serving medical tourism, characterized by a preference for premium, imported digital systems. Infrastructure development remains crucial for widespread regional penetration.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Digital Orthodontics Market.- Align Technology, Inc. (Invisalign, iTero Scanners)

- Dentsply Sirona Inc. (Orthophos SL, SureSmile)

- 3M Company (Clarity Aligners, Incognito Lingual Braces)

- Envista Holdings Corporation (Ormco, KaVo Kerr, Spark Aligners)

- Straumann Group (ClearCorrect)

- Henry Schein, Inc. (Software Distribution and Practice Management Solutions)

- 3Shape A/S (TRIOS Intraoral Scanners, Orthodontic Software)

- Carestream Dental LLC (CS 3800 Scanner, Imaging Software)

- Planmeca Oy (Planmeca PlanMill, DIXONE Software)

- Midmark Corporation (Integrated Clinical Solutions)

- Formlabs, Inc. (Form 3B/3BL 3D Printers for Dental Applications)

- Desktop Metal (Desktop Health, EnvisionTEC)

- Zimmer Biomet Holdings, Inc. (Oral Reconstruction Solutions)

- American Orthodontics (Digital Brackets)

- G&H Orthodontics (Orthodontic Supplies and Wires)

- ClearCorrect (A Straumann Group Brand for Aligners)

- TP Orthodontics, Inc. (Digital Treatment Planning)

- Great Lakes Orthodontics, Inc. (Lab Services and Appliances)

- Reliance Orthodontic Products, Inc. (Adhesive Systems)

- Ortho-Tain, Inc. (Pre-Orthodontic Appliances)

Frequently Asked Questions

Analyze common user questions about the Digital Orthodontics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving force behind the growth of the Digital Orthodontics Market?

The foremost driver is the surging global consumer demand for aesthetic, comfortable, and minimally visible orthodontic solutions, particularly clear aligners, coupled with the proven efficiencies and enhanced predictability offered by intraoral scanning and 3D printing technologies which significantly reduce treatment time and costs for clinicians, thereby increasing case acceptance rates.

How does the integration of Artificial Intelligence (AI) improve orthodontic treatment planning?

AI drastically improves planning by automating time-consuming diagnostic tasks like cephalometric tracing and landmark identification, utilizing machine learning to accurately simulate and optimize complex tooth movement sequences, leading to highly customized, predictable treatment staging and minimizing costly and lengthy refinement cycles.

Which segment of the Digital Orthodontics Market holds the largest share by application and why?

The clear aligners segment holds the largest market share by application. This dominance is primarily attributed to the high adoption rate among the adult patient population seeking aesthetic corrections, the massive global marketing efforts by segment leaders, and the technological maturity of the 3D printing and planning ecosystems supporting aligner mass production.

What are the main financial restraints affecting the adoption of digital orthodontics technology?

The major restraint is the significant initial capital expenditure required for purchasing premium integrated hardware, including high-fidelity intraoral scanners and specialized medical-grade 3D printers, alongside the high recurring costs associated with proprietary software licensing, essential maintenance contracts, and the specialized training required for clinical staff integration.

Is North America expected to maintain its leadership position in the Digital Orthodontics Market?

Yes, North America is projected to maintain its market leadership throughout the forecast period due to high consumer willingness to pay for premium aesthetic solutions, established digital infrastructure, strong insurance coverage frameworks, and continuous rapid technological integration; however, the Asia Pacific region is forecast to exhibit the fastest Compound Annual Growth Rate (CAGR).

What is the significance of open-architecture systems in digital orthodontics?

Open-architecture systems are crucial as they allow dental practices to seamlessly exchange digital data (such as STL files from scanners) between different brands of software, 3D printers, and lab services. This flexibility reduces vendor lock-in, encourages competition, and provides clinicians with greater autonomy and choice in their customized digital workflow.

How are Dental Service Organizations (DSOs) impacting the market dynamics?

DSOs are increasingly driving market dynamics by purchasing large volumes of standardized equipment and demanding enterprise-level software solutions that offer scalability and centralized management across multiple locations. Their purchasing power and focus on standardized, efficient workflows accelerate the adoption of fully integrated digital systems.

What role does 3D printing technology play beyond clear aligner fabrication?

Beyond clear aligners, 3D printing is vital for manufacturing highly accurate customized fixed orthodontic appliances, including patient-specific brackets and archwires, specialized retainers, indirect bonding trays for precise bracket placement, and surgical guides for complex orthognathic cases, significantly enhancing customization options.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager