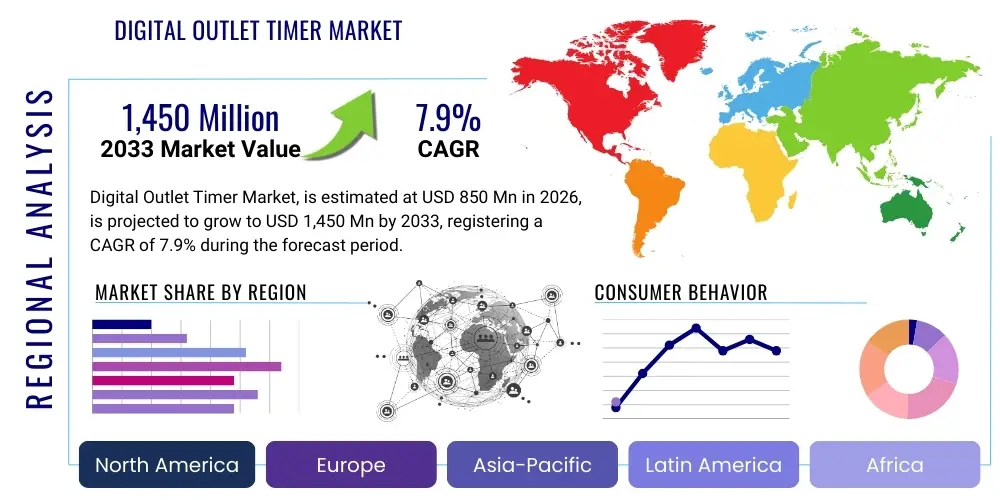

Digital Outlet Timer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438174 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Digital Outlet Timer Market Size

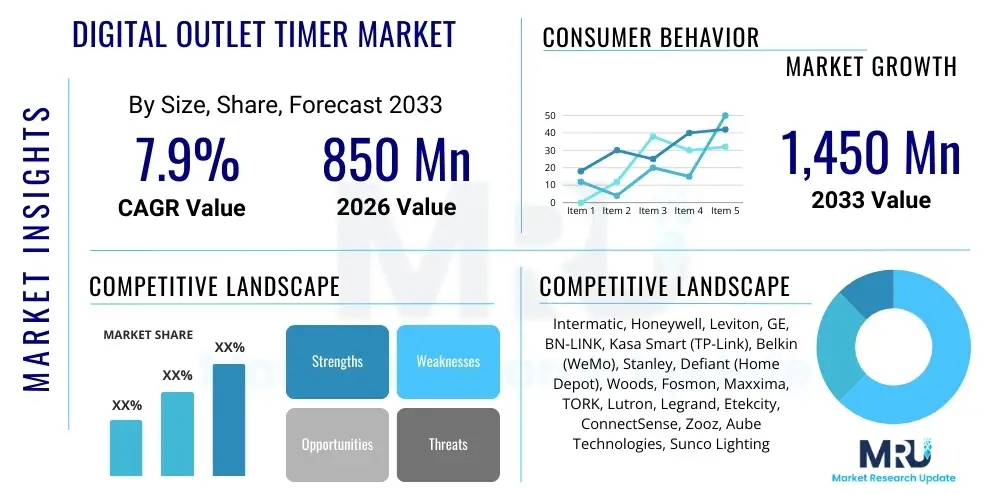

The Digital Outlet Timer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.9% between 2026 and 2033. The market is estimated at USD 850 million in 2026 and is projected to reach USD 1,450 million by the end of the forecast period in 2033.

Digital Outlet Timer Market introduction

The Digital Outlet Timer Market encompasses a range of devices designed to automatically control the power supply to connected electrical appliances based on preset schedules or real-time commands. Unlike traditional mechanical timers, digital timers utilize microprocessors and precise internal clocks, offering superior accuracy, programmability, and versatility. These devices are increasingly fundamental components in modern energy management systems, enabling users, from residential consumers to industrial operators, to optimize electricity usage, enhance safety, and automate routine tasks. The evolution of this market is strongly tied to advancements in semiconductor technology and the broader proliferation of interconnected smart home and building infrastructure, moving beyond simple on/off functionality to incorporate complex features like random mode scheduling for security and daylight savings time adjustments.

Key applications for digital outlet timers span across various sectors, prominently including residential lighting control, holiday decoration management, security system simulations (vacation mode), and aquarium or hydroponics environmental regulation. In commercial settings, they are deployed for controlling signage, HVAC auxiliary systems, and office equipment to minimize standby power consumption during non-operating hours. The inherent benefit of these devices lies in their ability to deliver substantial energy savings by preventing unnecessary power draw, thereby reducing utility bills and contributing to global sustainability efforts. Furthermore, the enhanced programmability allows for intricate scheduling that improves operational efficiency and user convenience, contrasting sharply with the limited functionality of their analog predecessors.

Driving factors for the robust growth of this market include the global surge in electricity prices, increased consumer awareness regarding energy conservation, and governmental mandates promoting efficiency standards in both consumer electronics and building codes. The rapid expansion of the Internet of Things (IoT) ecosystem is perhaps the most significant catalyst, transforming basic timers into smart devices capable of integration with voice assistants and centralized home automation platforms. This technological convergence enables remote control, monitoring, and sophisticated optimization features, fundamentally shifting the product category from a simple accessory to a core component of smart energy infrastructure. Moreover, the reliability and long operational life of solid-state digital components further solidify their attractiveness compared to older mechanical alternatives.

Digital Outlet Timer Market Executive Summary

The Digital Outlet Timer Market is experiencing a pivotal transformation driven by the accelerated adoption of smart home technology and a critical global focus on energy efficiency. Current business trends indicate a definitive shift towards high-margin, connectivity-enabled devices, particularly those incorporating Wi-Fi and Bluetooth capabilities, which allow for seamless integration into existing smart ecosystems and offer enhanced user experience through mobile application control. Manufacturers are heavily investing in developing user-friendly interfaces, robust cybersecurity features, and compatibility standards (such as Matter and Thread) to capture market share in this increasingly competitive environment. Furthermore, the demand for ruggedized, weather-resistant outdoor timers for landscape lighting and commercial applications remains a consistent driver, pushing innovation in durability and reliability testing.

Regionally, Asia Pacific (APAC) is projected to exhibit the highest growth rate, fueled by rapid urbanization, massive infrastructural investments in smart cities, and burgeoning disposable incomes leading to higher penetration of smart appliances in countries like China, India, and South Korea. North America and Europe, while already mature markets, maintain significant traction due to stringent energy regulations and a high consumer propensity for technologically advanced, energy-saving gadgets. The European market, in particular, is witnessing growth driven by initiatives like the European Green Deal, which encourages the deployment of intelligent control systems across residential and commercial buildings. Challenges such as varying electrical standards and frequency requirements across different regions necessitate localized product development and certification, influencing go-to-market strategies.

Segment trends highlight the dominance of the residential application segment, primarily driven by the convenience and security features offered by digital timers. However, the commercial and industrial segments are expanding rapidly, valuing the precision timing and large-load handling capabilities required for facility management, process automation, and load shedding programs. Technology segmentation shows a clear migration away from non-connected digital timers toward smart Wi-Fi enabled timers, which command a price premium but offer superior functionality, real-time energy monitoring, and remote diagnostics. This trend is compelling traditional electrical accessory manufacturers to partner with or acquire software and IoT specialists to maintain competitive relevance.

AI Impact Analysis on Digital Outlet Timer Market

User questions regarding AI's influence on the Digital Outlet Timer Market commonly revolve around themes of predictive optimization, automated scheduling complexity, and the integration of timers within holistic energy management systems. Users are keenly interested in whether AI can move timers beyond simple time-based routines to truly intelligent systems that learn behavioral patterns, predict peak energy costs, and adjust schedules proactively to maximize savings without user intervention. Concerns often center on data privacy, the required sophistication of setup, and the reliability of AI algorithms in dynamic environments. The consensus expectation is that AI integration will transform timers from passive scheduling tools into active, adaptive energy management nodes capable of significantly improving household or facility efficiency.

The most immediate and impactful application of AI in this domain is the enablement of predictive scheduling. Traditional digital timers rely on fixed programming; however, AI algorithms can analyze historical usage data, external variables such as weather forecasts, time-of-day utility rates, and even occupancy patterns (via integrated sensor data) to dynamically adjust connected device schedules. For instance, an AI-powered timer might delay a high-draw appliance startup until off-peak hours or preemptively turn off landscape lighting based on calculated sunrise data specific to the geographical location, leading to marginal but cumulative energy savings that are practically impossible with manual scheduling.

Furthermore, AI facilitates deeper integration within broader smart home platforms, utilizing natural language processing (NLP) for voice command interpretation and complex situational automation. This evolution drastically simplifies the user experience; instead of manually setting dozens of schedules, users can issue high-level commands like "Optimize my pool pump schedule for minimum cost this month," allowing the underlying AI to configure the optimal timing routines. This shifts the value proposition of the digital timer from a hardware device to a sophisticated, self-optimizing software service layer embedded within the hardware, potentially enabling new subscription models for advanced energy optimization services.

- AI enables predictive scheduling based on learned user habits and real-time environmental data.

- Integration with utility providers allows for dynamic load shifting based on fluctuating electricity tariffs.

- Improved energy consumption profiling provides granular insights into device usage patterns.

- Facilitation of complex automation rules (e.g., triggering devices only when humidity levels or occupancy is detected).

- Enhancement of cybersecurity through behavioral anomaly detection on the connected network.

- Optimization of battery management in integrated backup power systems utilizing advanced forecasting.

- Simplification of user setup via automated initial configuration and natural language interfaces.

DRO & Impact Forces Of Digital Outlet Timer Market

The dynamics of the Digital Outlet Timer Market are significantly shaped by a combination of strong market drivers, persistent restraining factors, and emerging opportunities, all of which contribute to the overall impact forces defining market growth trajectory. The predominant driver is the escalating global emphasis on energy conservation, mandated both by regulatory bodies and voluntary corporate sustainability goals. This focus directly translates into demand for precise control devices that eliminate energy waste associated with appliances left running unnecessarily. Coupled with this is the explosive growth of the IoT and smart home ecosystems, positioning digital timers as essential, affordable entry points for consumers looking to digitize their homes and take advantage of remote management and automation capabilities. These drivers create a powerful upward force on market expansion and innovation.

However, the market faces notable restraints that temper rapid growth. A primary concern for advanced, Wi-Fi enabled timers is the inherent cybersecurity risk; connected devices represent potential entry points for network breaches, causing consumer hesitancy and requiring manufacturers to invest heavily in security protocols, which increases unit cost. Additionally, the complexity of setting up and integrating sophisticated smart timers can be a barrier to adoption for non-technical users, particularly in older demographic segments. Furthermore, the market is highly competitive, characterized by intense price wars, especially in the basic digital segment, which compresses profit margins and limits the ability of smaller players to innovate significantly. These restraints necessitate strategic differentiation focused on security and user simplicity.

Opportunities within the sector are vast, particularly concerning large-scale industrial and commercial applications where timers can be integrated into Building Energy Management Systems (BEMS) for enterprise-wide control and compliance. The development of specialized industrial-grade timers capable of handling heavy-duty loads, extreme environmental conditions, and integration with PLC systems presents a high-value niche. Another major opportunity lies in expanding service-based models, offering AI-driven optimization subscriptions or bundled energy audit services alongside the hardware. The ongoing refinement of wireless communication standards (e.g., low-power wide-area networks) also creates avenues for developing extremely reliable, long-range outdoor and distributed timers, thus opening new avenues in smart agriculture and utility infrastructure management.

Segmentation Analysis

The Digital Outlet Timer Market is comprehensively segmented based on technology, application, and type, providing granular insights into demand patterns across different user groups and technical requirements. Segmentation by technology is currently the most dynamic area, reflecting the shift from simple, non-connected digital timers—which rely solely on local programming—to advanced, smart timers that leverage connectivity standards like Wi-Fi, Bluetooth, Zigbee, and Z-Wave. The smart segment, driven by the desire for remote control and integration with virtual assistants, commands premium pricing and is the primary engine of value growth in the market, although the standard digital timers still hold significant volume share due to their cost-effectiveness and operational simplicity.

Application segmentation reveals the residential sector as the largest consumer base, utilizing timers primarily for convenience, security (simulating occupancy), and modest energy savings on small appliances. Conversely, the commercial and industrial segments, while lower in volume, represent high-value opportunities due to the need for robust, reliable scheduling devices for high-load equipment such as commercial lighting, pumps, motors, and manufacturing machinery. These segments require timers that meet rigorous safety standards and often integrate seamlessly with centralized building management software, necessitating sophisticated API support and industrial-grade durability. The type segmentation, differentiating between indoor and ruggedized outdoor units, highlights the growing demand for devices designed to withstand harsh weather conditions for exterior applications like landscape lighting, patio heaters, and security cameras.

- By Technology

- Standard Digital Timers (Non-Connected)

- Smart Timers (Wi-Fi Enabled)

- Smart Timers (Bluetooth/Zigbee/Z-Wave Enabled)

- By Type

- Indoor Timers

- Outdoor/Weatherproof Timers

- By Application

- Residential

- Commercial

- Industrial

- Horticultural/Aquatic

- By Distribution Channel

- Online Retail

- Offline Retail (Hardware Stores, Electronics Stores)

- Direct Sales (B2B, Electrical Wholesalers)

Value Chain Analysis For Digital Outlet Timer Market

The value chain for the Digital Outlet Timer Market begins with the upstream procurement of essential raw materials, dominated by electronic components such as microcontrollers (MCUs), specialized semiconductor chips, relays, and high-quality plastic resins or flame-retardant polymers for housing construction. The reliability and cost structure of the final product are highly dependent on the stability of the semiconductor supply chain. Manufacturers engage in detailed design and engineering phases, focusing on miniaturization, power efficiency, and compliance with various international electrical safety standards (e.g., UL, CE). Smart timers necessitate additional software development, including cloud services architecture and mobile application design, adding complexity and requiring substantial investment in R&D and intellectual property protection.

Manufacturing constitutes the core transformation phase, where components are assembled, tested for timing accuracy and load handling, and packaged. This phase often involves specialized contract manufacturers in cost-effective regions, particularly in Southeast Asia, demanding stringent quality control measures to ensure longevity and safety. The distribution channel is bifurcated into direct and indirect routes. Direct distribution involves B2B sales targeting large commercial or industrial clients, often requiring customization and installation support. Indirect channels, which dominate the residential market, leverage extensive networks of third-party intermediaries, including online retail giants (e-commerce platforms), big-box retailers (Home Depot, Lowes), and specialized electrical wholesalers.

Downstream activities center around sales, marketing, and post-purchase support. E-commerce platforms are increasingly vital, offering high visibility, comparative pricing transparency, and direct consumer feedback loops. Service provisioning, particularly for smart timers, extends into software updates, maintenance of cloud connectivity, and technical troubleshooting regarding integration with home networks. The value addition at this stage is focused on enhancing the user experience, ensuring interoperability, and maintaining high levels of data security and privacy, which are crucial for retaining customer trust in connected smart devices. Successful companies strategically manage inventory across diverse retail channels while simultaneously investing in robust server infrastructure to support cloud-enabled functionalities.

Digital Outlet Timer Market Potential Customers

The market for digital outlet timers addresses a diverse spectrum of end-users, broadly categorized into residential consumers, small and medium-sized enterprises (SMEs), and large industrial or governmental organizations. Residential consumers represent the largest volume segment, primarily driven by the fundamental needs for safety, security, and minor convenience improvements. Homeowners utilize these products for automating lighting sequences to deter intruders when away (security), controlling irrigation systems, or managing high-draw appliances like water heaters and pool pumps during off-peak hours to save on monthly utility costs. The shift toward smart home technology is transitioning this customer base toward products that offer app control and voice integration, viewing the timers as essential components of a unified smart ecosystem.

Commercial customers, including retail stores, office buildings, restaurants, and schools, focus on operational efficiency and regulatory compliance. Their purchasing decisions are motivated by the need for precise, centralized control over non-essential loads such as exterior signage, display lighting, and HVAC supplementary equipment. The primary buyer persona here is the facility manager or building engineer, who prioritizes reliability, ease of integration with existing BEMS, and demonstrable Return on Investment (ROI) through reduced electricity consumption. They typically require industrial-grade timers capable of handling higher amperage and featuring advanced scheduling flexibility to align with dynamic business hours and energy-saving protocols imposed by corporate sustainability mandates.

The industrial and governmental sectors represent the most specialized end-users, requiring heavy-duty timers for mission-critical applications such as process automation, specialized machinery control, and sophisticated load management strategies within utility grids or manufacturing plants. These customers, including utilities implementing demand response programs, require devices that offer extreme accuracy, high durability, and complex communication capabilities (e.g., Modbus or Ethernet connectivity). The purchasing cycle in this segment is longer, involving stringent specifications, rigorous certifications, and bulk purchasing, often through direct contracts with specialized electrical equipment suppliers. Growth in hydroponics, vertical farming, and smart agricultural installations is also creating a new specialized commercial end-user base demanding precise environmental control enabled by rugged digital timers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,450 Million |

| Growth Rate | CAGR 7.9% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Intermatic, Honeywell, Leviton, GE, BN-LINK, Kasa Smart (TP-Link), Belkin (WeMo), Stanley, Defiant (Home Depot), Woods, Fosmon, Maxxima, TORK, Lutron, Legrand, Etekcity, ConnectSense, Zooz, Aube Technologies, Sunco Lighting |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Digital Outlet Timer Market Key Technology Landscape

The technological evolution of the Digital Outlet Timer Market is characterized by a strong convergence between traditional electrical engineering and advanced information technology. At the core of every digital timer is a highly efficient microcontroller (MCU) responsible for executing the programmed scheduling logic, maintaining clock accuracy, and managing power consumption. Modern MCUs must support ultra-low power modes to ensure the internal clock and display remain active even when the device is not actively switching a load. The shift to smart timers has mandated the inclusion of specialized communication modules, primarily Wi-Fi (for broad network compatibility and high-bandwidth cloud interaction) and low-power mesh network protocols like Zigbee and Z-Wave, which offer superior reliability and range within a localized smart home ecosystem, crucial for uninterrupted operation.

A significant technological focus is placed on the power switching components, moving away from lower-rated mechanical switches to high-reliability, solid-state relays (SSRs) in many commercial and smart units. SSRs offer faster switching times, significantly longer operational lifetimes, and silent operation, addressing key limitations of older technologies. Furthermore, the integration of precise current and voltage sensors is becoming standard in smart timers, enabling real-time energy monitoring. This feature allows users to track exactly how much power a connected device is consuming, facilitating informed decisions about energy usage and providing data essential for AI-driven optimization algorithms. The accuracy of these integrated sensors is a core competitive differentiator, impacting the timer's value proposition as an energy management tool.

Software and cloud infrastructure are paramount in the current landscape. Manufacturers must maintain scalable and secure cloud platforms to handle millions of simultaneous device connections, process data for remote management, and deliver over-the-air (OTA) firmware updates. The development of user-friendly mobile applications that simplify complex scheduling and integration with third-party platforms (like Amazon Alexa or Google Home) is non-negotiable. Interoperability standards, such as the open-source Matter protocol, are gaining momentum, promising to reduce fragmentation and simplify the integration process for both manufacturers and end-users. Future advancements will likely center on incorporating edge computing capabilities within the timers themselves to perform immediate data processing and execute time-sensitive decisions without constant reliance on cloud latency.

Regional Highlights

Regional dynamics play a vital role in shaping the demand, technology preferences, and regulatory landscape of the Digital Outlet Timer Market. Each major geographical region presents unique drivers and growth challenges, requiring tailored market penetration strategies from key industry participants.

- North America: This region is characterized by high adoption rates of smart home technology and a strong consumer focus on convenience and security. The United States and Canada are mature markets where advanced, Wi-Fi enabled timers are highly prevalent. Growth is sustained by replacements of older units, the high penetration of voice assistants, and utility-led demand response programs that often mandate the use of connected load control devices. Stringent safety standards (UL certification) drive product quality and differentiation in this competitive region.

- Europe: The European market is highly influenced by strict energy efficiency directives and a high cost of electricity, making energy savings a primary consumer motivator. Germany, the UK, and Scandinavian countries show high demand, particularly for timers that comply with the EU’s ErP (Energy-related Products) directive. The market is witnessing a strong preference for secure, open-standard technologies like Zigbee, driven by sophisticated users and a robust ecosystem of specialized smart home brands.

- Asia Pacific (APAC): APAC is the fastest-growing region, driven by rapid urbanization, expanding middle-class populations, and large-scale smart city projects, particularly in China and India. While basic digital timers dominate the volume, the rapid deployment of high-speed internet and government initiatives promoting energy conservation are accelerating the shift toward affordable smart timers. Manufacturing hubs in this region also make it a critical area for production and innovation in supply chain optimization.

- Latin America (LATAM): Growth in LATAM is gradually increasing, driven by rising energy costs and improving connectivity infrastructure. The market is primarily focused on cost-effective digital timers, though metropolitan areas in Brazil and Mexico show early adoption of basic smart timers, motivated largely by security concerns and remote control needs in regions with varying electrical grid stability.

- Middle East and Africa (MEA): This region presents potential growth opportunities tied to new construction and smart building initiatives, especially in the Gulf Cooperation Council (GCC) states. Timers are often used in commercial and public sector projects for managing complex lighting and cooling systems in large structures, requiring specialized industrial-grade and highly reliable devices that can withstand extreme temperatures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Digital Outlet Timer Market.- Intermatic

- Honeywell

- Leviton

- GE (General Electric)

- BN-LINK

- Kasa Smart (TP-Link)

- Belkin (WeMo)

- Stanley

- Defiant (Home Depot Private Label)

- Woods (Coleman Cable)

- Fosmon

- Maxxima

- TORK

- Lutron

- Legrand

- Etekcity

- ConnectSense

- Zooz

- Aube Technologies

- Sunco Lighting

Frequently Asked Questions

Analyze common user questions about the Digital Outlet Timer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a digital outlet timer and a smart outlet timer?

A digital outlet timer relies solely on local button programming and an internal clock to execute fixed schedules. A smart outlet timer, however, connects to a network (usually Wi-Fi) allowing for remote control via a mobile application, integration with voice assistants, real-time energy monitoring, and dynamic scheduling capabilities.

Are digital outlet timers effective for reducing energy consumption and utility bills?

Yes, digital outlet timers are highly effective for energy management, particularly by eliminating phantom power draw from devices that do not need to be constantly on, such as water heaters, entertainment systems, or chargers. They ensure precise timing, preventing waste that occurs with manual or mechanical switching errors.

What are the key safety considerations when selecting an outdoor digital outlet timer?

Outdoor digital timers must carry an appropriate IP (Ingress Protection) rating, typically IP65 or higher, indicating resistance to dust and jetting water, and should be rated for handling the specific amperage of outdoor equipment like pumps or landscape lighting. Ensure the product is certified by relevant safety organizations like UL or ETL for reliable and safe operation in variable weather conditions.

How does AI technology enhance the functionality of modern digital timers?

AI significantly enhances timer functionality by enabling predictive scheduling. It analyzes user habits, weather patterns, and utility rate fluctuations to automatically optimize the on/off cycles of connected appliances, maximizing energy savings and convenience without requiring continuous manual intervention or complex programming.

Which regional market is currently demonstrating the highest growth rate for digital outlet timers?

The Asia Pacific (APAC) region is currently exhibiting the highest Compound Annual Growth Rate (CAGR) for the Digital Outlet Timer Market. This accelerated growth is primarily attributed to extensive government investments in smart city infrastructure, rapid urbanization, and increasing consumer adoption of smart home technologies across countries like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager