Digital Output Modules Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431841 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Digital Output Modules Market Size

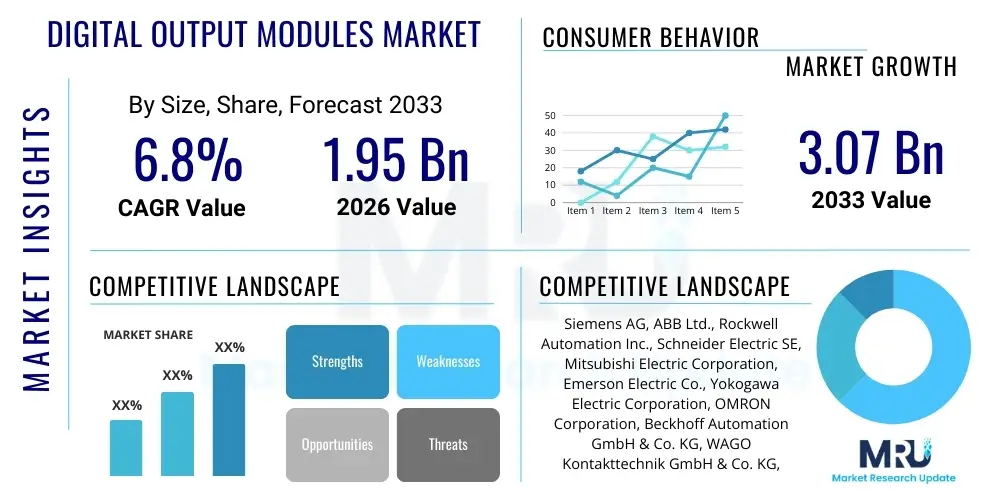

The Digital Output Modules Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.95 Billion in 2026 and is projected to reach USD 3.07 Billion by the end of the forecast period in 2033.

Digital Output Modules Market introduction

Digital Output Modules (DOMs) are essential components within industrial automation and control systems, primarily serving as interfaces between the control unit (such as a PLC or DCS) and field devices (actuators, solenoids, contactors, lamps, and alarms). Their fundamental function is to convert low-voltage digital signals received from the controller into higher-power electrical signals necessary to drive external machinery or activate specific industrial processes. These modules are critical for ensuring precise, reliable, and synchronized operation across manufacturing lines, ensuring that control decisions are executed accurately in the physical environment. The increasing complexity of modern manufacturing necessitates high-density, high-speed DOMs capable of handling diverse load types and operating in harsh industrial conditions, driving consistent innovation in module design and protection features.

The core application of Digital Output Modules spans virtually every sector requiring automated control, including discrete manufacturing (automotive, electronics), process industries (chemical, oil and gas, pharmaceuticals), and utilities (power generation, water treatment). Key benefits derived from the implementation of advanced DOMs include enhanced operational efficiency through rapid signal processing, improved system reliability due to robust isolation and short-circuit protection, and increased flexibility provided by modular and configurable I/O platforms. The seamless integration of these modules into sophisticated industrial network architectures, utilizing protocols like PROFINET, EtherCAT, and Modbus TCP, facilitates centralized monitoring and remote diagnostics, crucial for minimizing downtime and optimizing maintenance schedules in Industry 4.0 environments.

Driving factors for the substantial growth of this market include the global push toward industrial automation and smart factory implementation, fueled by rising labor costs and the demand for higher productivity and quality control. Furthermore, stringent regulatory requirements concerning functional safety (e.g., SIL standards) are leading manufacturers to adopt specialized safety-rated Digital Output Modules, which incorporate advanced diagnostics and fault detection capabilities. The proliferation of Industrial Internet of Things (IIoT) technologies demands more distributed and intelligent I/O systems, directly stimulating the demand for high-performance, compact, and field-mountable DOMs that can communicate data efficiently back to cloud-based analytics platforms for continuous process improvement.

Digital Output Modules Market Executive Summary

The Digital Output Modules market is characterized by robust growth driven by accelerating industrial digitalization across key manufacturing economies. Current business trends indicate a strong shift towards modular, high-density I/O solutions that offer flexibility and scalability, allowing end-users to optimize cabinet space and simplify wiring complexity. Key industry players are focusing heavily on developing intelligent modules integrated with sophisticated diagnostic features, enabling predictive maintenance and enhancing cybersecurity posture at the device level. The competitive landscape is marked by continuous innovation in communication protocols and ruggedized designs, catering to challenging operational environments typical of heavy industry and remote infrastructure.

Regionally, the Asia Pacific (APAC) market is experiencing the most rapid expansion, largely due to massive investments in establishing new manufacturing capabilities in countries like China, India, and Southeast Asia, particularly within the automotive and electronics sectors. North America and Europe maintain leading positions in terms of technology adoption and market maturity, driving demand for premium, safety-certified, and highly integrated DOMs compatible with advanced industrial Ethernet standards. The need for energy efficiency and compliance with evolving environmental regulations is also prompting regional growth, particularly in Europe, where smart grid and renewable energy infrastructure require sophisticated control interfaces.

Segment trends reveal a sustained dominance of the Discrete Output modules segment, although the market is seeing accelerating uptake in the Analog Output modules segment due to increased use of variable speed drives and proportional control valves requiring continuous adjustment. Technology-wise, Ethernet-enabled DOMs are quickly replacing traditional fieldbus architectures, offering superior speed and data throughput necessary for real-time control applications. End-user demand is heavily concentrated in the automotive, food and beverage, and utilities sectors, which are undergoing comprehensive digital transformations requiring reliable and scalable output interfaces to manage increasingly complex production lines and distributed assets effectively.

AI Impact Analysis on Digital Output Modules Market

Common user questions regarding the impact of AI on Digital Output Modules often revolve around several core themes: whether AI will replace traditional PLC control logic, how AI-driven predictive maintenance impacts module lifecycles, and the integration requirements for high-frequency data generated by smart I/O. Users are keen to understand how AI algorithms, often running on edge devices or in the cloud, can leverage the status data reported by advanced DOMs—such as load current, temperature, and cycle counts—to anticipate failures or optimize output timing. The primary concern is moving beyond simple feedback loops to sophisticated, self-optimizing control mechanisms that require highly reliable and fast I/O interfaces capable of acting instantly upon AI-derived commands.

The integration of Artificial Intelligence is transforming the operational paradigm of Digital Output Modules from simple actuators to intelligent data collection and execution points. AI algorithms analyze historical performance data and real-time operational metrics provided by advanced DOMs to detect subtle anomalies in current draw or response time, enabling predictive maintenance strategies that drastically reduce unplanned downtime. This capability shifts the focus from time-based maintenance to condition-based maintenance, optimizing module utilization and extending system longevity. Furthermore, AI enhances process optimization by dynamically adjusting output parameters based on external variables like material viscosity or ambient temperature, ensuring optimal resource use and product consistency, which demands DOMs with higher resolution and faster switching capabilities.

As AI applications move toward the industrial edge, the demand for embedded intelligence within I/O systems increases. Future Digital Output Modules will likely incorporate microprocessors capable of executing localized AI models for tasks such as rapid fault detection, local data pre-processing, and immediate control adjustments without reliance on the central controller. This decentralization of intelligence reduces network latency and improves the speed of critical actions, essential in high-speed manufacturing environments. This transition drives module manufacturers to focus on enhanced communication bandwidth, onboard processing power, and standardized data structures compatible with various machine learning frameworks, fundamentally changing the product roadmap for industrial I/O hardware.

- Increased demand for high-speed, low-latency DOMs to execute real-time AI control decisions.

- Integration of advanced onboard diagnostics for generating rich, time-series data crucial for training predictive AI models.

- Development of intelligent I/O modules capable of edge processing for localized control optimization and faster anomaly detection.

- Enhanced focus on cybersecurity protocols within DOMs, protecting against unauthorized manipulation stemming from network vulnerabilities exploited by AI threats.

- Acceleration of modular and software-defined I/O solutions to accommodate rapidly changing AI-driven control requirements and network topologies.

DRO & Impact Forces Of Digital Output Modules Market

The Digital Output Modules market expansion is heavily propelled by the imperative for increased automation, driven globally by the adoption of Industry 4.0 principles, particularly in emerging economies where automation is replacing manual processes for quality and efficiency gains. These drivers are balanced by significant restraints, primarily the high initial capital expenditure associated with implementing complex, modern I/O systems and the pervasive challenge of cybersecurity risks inherent in highly interconnected industrial networks. Opportunities lie in the burgeoning segments of renewable energy infrastructure and the modernization of aging industrial facilities, which require highly reliable and specialized DOMs. These forces collectively shape the market's trajectory, mandating manufacturers to deliver resilient, cost-effective, and future-proof automation components.

Key drivers include the pervasive integration of Industrial IoT (IIoT), which mandates the use of intelligent field devices capable of bi-directional communication, turning traditional output points into sources of operational data. Furthermore, the stringent demand for functional safety (e.g., compliance with IEC 61508) in high-risk industries like chemical processing and aerospace fuels the demand for safety-rated Digital Output Modules with built-in redundancies and sophisticated diagnostics. Restraints often center on the technical complexity involved in integrating diverse vendor components and the persistent shortage of skilled personnel capable of designing, installing, and maintaining advanced industrial control systems. Additionally, the long lifecycle of installed industrial hardware can slow down the adoption rate of newer, more sophisticated DOM technologies.

Opportunities for market stakeholders are abundant in niche applications, such as high-density I/O solutions for compact machine builders and specialized DOMs designed for extreme environments (high temperature, vibration, corrosive atmospheres). The increasing standardization of industrial protocols, particularly OPC UA and TSN (Time-Sensitive Networking), opens new avenues for interoperability, reducing integration hurdles and accelerating market penetration. Impact forces emphasize technological advancement, requiring continuous investment in miniaturization and integration capabilities. The market dynamics are highly sensitive to global economic stability, as industrial automation investments often mirror capital expenditure cycles in manufacturing and infrastructure development worldwide.

Segmentation Analysis

The Digital Output Modules market is broadly segmented based on the type of output signal (Digital vs. Analog), the design architecture (Modular vs. Fixed), the form factor (Rack-Based vs. Distributed), and the end-use industry. This structure allows for precise categorization of product demand, reflecting the varying requirements of different industrial environments—from high-density, centralized control found in large process plants to highly ruggedized, distributed I/O preferred in remote infrastructure or heavy machinery applications. Understanding these segments is crucial for manufacturers to tailor their R&D efforts and marketing strategies to specific vertical demands.

- By Output Type:

- Digital Output Modules (Discrete)

- Analog Output Modules (Proportional)

- By Design Architecture:

- Modular Output Modules

- Fixed Output Modules

- By Form Factor:

- Rack-Based Modules

- Distributed/Remote Modules

- By Communication Protocol:

- Industrial Ethernet (EtherCAT, PROFINET, Ethernet/IP)

- Fieldbus (PROFIBUS, Modbus, DeviceNet)

- By End-Use Industry:

- Automotive

- Chemical and Petrochemical

- Food and Beverage

- Pharmaceuticals

- Energy and Power Generation

- Water and Wastewater Treatment

- Pulp and Paper

- Metals and Mining

- By Voltage Type:

- DC Output Modules (24V DC, 48V DC)

- AC Output Modules (120V AC, 230V AC)

Value Chain Analysis For Digital Output Modules Market

The value chain for the Digital Output Modules market begins with upstream activities involving the procurement of critical raw materials and electronic components, including semiconductors, ASICs, robust housing materials, and connectivity components. This stage is dominated by specialized electronic component suppliers, requiring manufacturers to secure stable supply chains, especially for microprocessors and high-reliability relay components. Emphasis in the upstream segment is placed on sourcing components that meet stringent industrial temperature ranges, electromagnetic compatibility (EMC) standards, and long-term availability requirements, given the prolonged operational lifespan expected of industrial hardware.

The core manufacturing stage involves design, assembly, and rigorous testing of the modules, where major automation vendors integrate components onto PCBs, applying advanced surface-mount technology (SMT) and ensuring adherence to international quality and safety certifications (e.g., UL, CE, SIL). The complexity here lies in achieving high channel density while maintaining effective thermal management and electrical isolation necessary for reliable operation. Downstream activities involve distribution channels, which are typically bifurcated into direct sales for large, complex projects (like refinery upgrades or new automotive plants) and indirect sales through a vast network of authorized distributors, system integrators, and value-added resellers (VARs) who provide localized technical support and integration services to smaller and medium-sized enterprises (SMEs).

The final segment of the value chain is focused on installation, system integration, and post-sales support, where system integrators play a pivotal role in linking the DOMs with PLCs, HMI systems, and higher-level SCADA or MES platforms. Direct channels are preferred for high-volume, custom solutions where detailed engineering collaboration is necessary. Indirect channels, relying on distributors, ensure broad market reach and efficient supply of standard catalog products. The effectiveness of the indirect channel is highly dependent on the technical expertise of the partners, who often provide initial configuration and troubleshooting services to the end-users across various geographically dispersed industries.

Digital Output Modules Market Potential Customers

The primary end-users, or potential customers, of Digital Output Modules are vast and diverse, centered around any industry employing automated control systems. Core demand stems from large-scale manufacturing sectors, particularly automotive assembly, where DOMs are critical for controlling robotic arms, welding equipment, conveyor systems, and complex sequencing operations. The key requirement for automotive end-users is high-speed switching capabilities and extreme reliability due to the non-stop nature of production lines, leading to a preference for high-density, rack-based modules that simplify maintenance and module replacement processes.

Another major cluster of potential customers resides in the process industries, including oil and gas, chemical manufacturing, and pharmaceuticals. These industries require specialized, often ruggedized, and explosion-proof DOMs that can withstand corrosive substances and high temperatures. Furthermore, safety integrity levels (SIL) compliance is paramount in these sectors, driving the adoption of specialized, certified safety Digital Output Modules designed for emergency shutdown (ESD) systems. Utility sectors, specifically power generation and water/wastewater treatment, are also significant buyers, utilizing DOMs for controlling pump stations, valve actuators, circuit breakers, and grid synchronization equipment across geographically distributed assets, necessitating robust, remote I/O solutions with integrated communication capabilities.

The rapid expansion of the food and beverage industry, driven by automation for hygiene compliance and rapid changeover capabilities, represents a growing customer base. Here, DOMs are used to control bottling lines, packaging machinery, and sterilization equipment. These users prioritize modules with hygienic designs and fast diagnostic capabilities to minimize downtime during frequent washdown cycles. As industrial facilities increasingly adopt digitalization, the market for retrofitting existing machinery with modern, networked Digital Output Modules also presents a significant growth opportunity across all end-user verticals seeking to enhance operational visibility and extend the life of legacy assets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.95 Billion |

| Market Forecast in 2033 | USD 3.07 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens AG, ABB Ltd., Rockwell Automation Inc., Schneider Electric SE, Mitsubishi Electric Corporation, Emerson Electric Co., Yokogawa Electric Corporation, OMRON Corporation, Beckhoff Automation GmbH & Co. KG, WAGO Kontakttechnik GmbH & Co. KG, Eaton Corporation plc, Advantech Co., Ltd., B&R Industrial Automation GmbH, Fuji Electric Co., Ltd., Honeywell International Inc., Phoenix Contact GmbH & Co. KG, Bosch Rexroth AG, General Electric (GE), Keyence Corporation, Moxa Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Digital Output Modules Market Key Technology Landscape

The technology landscape for Digital Output Modules is rapidly evolving, moving away from legacy point-to-point wiring toward highly integrated, network-enabled systems. A significant technological driver is the dominance of Industrial Ethernet protocols such as EtherCAT, PROFINET, and Ethernet/IP, which offer high-speed, deterministic communication capabilities necessary for complex, synchronized industrial processes. This shift necessitates DOMs that incorporate advanced microcontrollers and communication chips capable of handling massive data throughput and supporting Time-Sensitive Networking (TSN) standards, which promise unprecedented levels of synchronization and interoperability across the control network. Furthermore, the trend toward modular and decentralized I/O systems, like remote terminal units (RTUs) and field-mountable IP67-rated blocks, is simplifying installation and reducing cabling costs, particularly in large or physically expansive facilities.

Another crucial technological advancement is the focus on integrated diagnostics and intelligent features at the module level. Modern DOMs incorporate features such as load monitoring, short-circuit protection with quick recovery, wire break detection, and internal temperature monitoring. These diagnostics provide granular health status information back to the controller or the cloud, supporting predictive maintenance and minimizing operational risks. The adoption of solid-state relay (SSR) technology is also increasing, replacing traditional electromechanical relays in high-cycle applications to enhance switching speed, extend lifespan, and reduce electromagnetic interference (EMI). These technological improvements are non-negotiable for industries prioritizing high uptime and operational excellence.

The development of functional safety technology, certified to standards up to SIL 3, represents a vital subset of the DOM technology landscape. Safety-rated modules are designed with internal redundancy, comprehensive self-testing mechanisms, and secured communication channels to ensure that critical outputs fail predictably and safely, often requiring specialized communication protocols like PROFIsafe or CIP Safety. Future innovations are centering on enhanced security features, including secure boot mechanisms and encrypted communication within the module firmware, to protect the integrity of the output signals against growing cyber threats. High-density design, utilizing push-in or spring clamp terminals instead of screw terminals, also remains a continuous focus to reduce installation time and increase wiring reliability in cramped control cabinets.

Regional Highlights

The global Digital Output Modules market demonstrates distinct characteristics across major geographical regions, influenced by the pace of industrialization, infrastructure spending, and regional regulatory frameworks concerning automation and safety. North America, driven primarily by the United States, represents a mature market characterized by high technology penetration and a strong emphasis on modernization and system integration within existing manufacturing facilities. The region leads in adopting advanced, safety-critical DOMs, particularly in the oil and gas, aerospace, and pharmaceutical industries, demanding high-performance, integrated solutions compatible with leading industrial networking standards like EtherNet/IP.

Europe, particularly Germany and the Nordic countries, is a highly competitive region where technological innovation, driven by the Industrie 4.0 initiative, sets global benchmarks. European manufacturers prioritize efficiency, quality control, and adherence to rigorous safety and environmental standards. The high adoption rate of modular, decentralized I/O systems utilizing protocols like PROFINET and EtherCAT is prominent here. The regional growth is also significantly supported by the extensive investment in automotive manufacturing automation and renewable energy infrastructure, both of which require precise and reliable digital control interfaces for optimum operational performance.

The Asia Pacific (APAC) region is the fastest-growing market globally, fueled by rapid industrial expansion, particularly in China, India, South Korea, and Southeast Asian nations. This growth is underpinned by massive government investments in new manufacturing plant construction, coupled with the rising demand for domestic consumer goods. While cost sensitivity remains a factor, the region is rapidly transitioning from traditional I/O to networked, standardized DOMs to improve export quality and efficiency. China, as the global manufacturing hub, dominates the volume demand, while countries like Japan and South Korea focus on high-end automation in electronics and precision machinery. Latin America and the Middle East & Africa (MEA) present emerging market opportunities, primarily driven by investments in mining, energy, and infrastructure projects, which necessitate rugged and reliable remote I/O solutions suitable for harsh operating conditions.

- Asia Pacific (APAC): Characterized by the highest growth rate due to new factory build-outs, especially in electronics, automotive, and heavy machinery across China and India. Focus on balancing cost-effectiveness with increasing automation standards.

- North America: Mature market focusing on retrofitting, functional safety (SIL certification), and highly integrated solutions in process and discrete industries. Strong adoption of proprietary and open industrial Ethernet protocols.

- Europe: Driven by advanced automation standards (Industry 4.0), emphasis on energy efficiency, environmental compliance, and modular, distributed I/O architecture. Germany and Italy are major innovation hubs.

- Latin America: Growth tied to resource extraction (mining, oil and gas) and food processing industries, driving demand for robust and remote monitoring-capable DOMs.

- Middle East and Africa (MEA): Growth concentrated in large infrastructure and energy projects (oil & gas, power generation). High reliance on internationally standardized, certified modules for mission-critical applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Digital Output Modules Market.- Siemens AG

- ABB Ltd.

- Rockwell Automation Inc.

- Schneider Electric SE

- Mitsubishi Electric Corporation

- Emerson Electric Co.

- Yokogawa Electric Corporation

- OMRON Corporation

- Beckhoff Automation GmbH & Co. KG

- WAGO Kontakttechnik GmbH & Co. KG

- Eaton Corporation plc

- Advantech Co., Ltd.

- B&R Industrial Automation GmbH

- Fuji Electric Co., Ltd.

- Honeywell International Inc.

- Phoenix Contact GmbH & Co. KG

- Bosch Rexroth AG

- General Electric (GE)

- Keyence Corporation

- Moxa Inc.

Frequently Asked Questions

Analyze common user questions about the Digital Output Modules market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a Digital Output Module (DOM) in an industrial control system?

A DOM acts as the crucial interface between the low-voltage control logic (e.g., PLC CPU) and high-power field devices like actuators, solenoids, or motors. Its core function is converting digital control signals into the necessary voltage and current levels to switch external machinery on or off, ensuring precise execution of automated commands.

How do safety-rated Digital Output Modules differ from standard modules, and why are they important?

Safety-rated DOMs, often compliant with IEC 61508 (SIL standards), incorporate features like redundancy, continuous self-diagnostics, and fail-safe behavior to ensure reliable shutdown in hazardous conditions. They are essential in industries such as chemical, oil and gas, and pharmaceutical manufacturing where equipment failure poses significant risk to personnel and environment.

What are the key advantages of adopting distributed Digital Output Modules over traditional rack-based systems?

Distributed DOMs (remote I/O) offer superior flexibility and reduced wiring complexity, as they are mounted closer to the field devices, minimizing long cable runs back to a central cabinet. This configuration significantly lowers installation costs, facilitates easier system expansion, and improves noise immunity in large industrial plants.

Which industrial trends are driving the demand for high-density and intelligent Digital Output Modules?

The pervasive adoption of Industry 4.0 and the Industrial Internet of Things (IIoT) is the main driver. These trends demand modules that offer high channel counts in a compact form factor (high density) and incorporate onboard processing and diagnostic capabilities (intelligence) to feed real-time operational data back for predictive maintenance and advanced analytics.

What role does Industrial Ethernet play in the future development of the Digital Output Modules market?

Industrial Ethernet protocols (PROFINET, EtherCAT, Ethernet/IP) are replacing traditional fieldbuses by providing faster, deterministic, and higher-bandwidth communication. This enables the integration of more sophisticated, networked DOMs that can handle large data volumes, support synchronized control actions, and integrate seamlessly with cloud and enterprise systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager