Digital Power Meter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432094 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Digital Power Meter Market Size

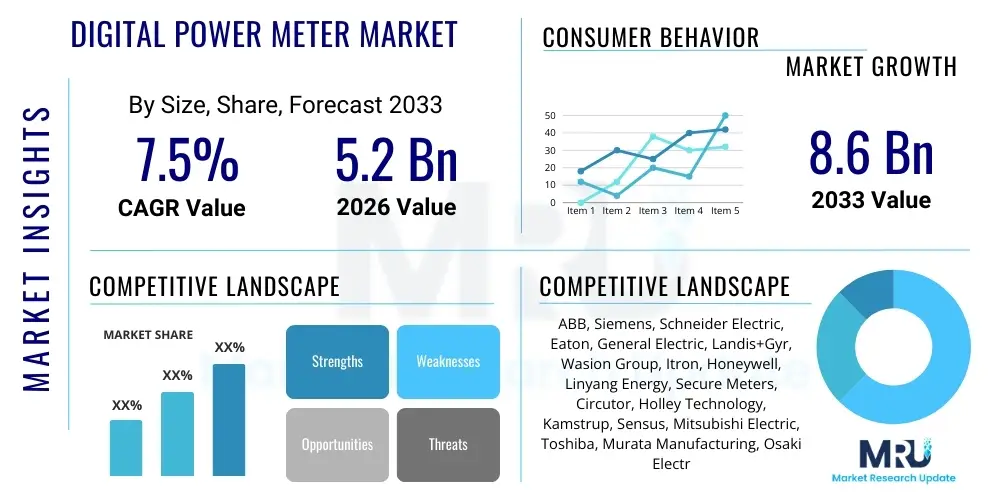

The Digital Power Meter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 8.6 Billion by the end of the forecast period in 2033.

Digital Power Meter Market introduction

The Digital Power Meter Market encompasses advanced electronic devices fundamentally transforming electricity consumption measurement and management across global power grids. These sophisticated instruments offer high precision, multi-parameter measurement capabilities, moving far beyond the simple consumption registration of legacy mechanical meters. Digital meters are crucial for modernizing infrastructure, providing utilities and end-users with real-time data on energy usage, power quality, and billing cycles. Key products include smart meters integrated with Advanced Metering Infrastructure (AMI), which facilitate two-way communication, enabling remote disconnect/reconnect services and dynamic pricing schemes. This technological shift is central to improving operational efficiency and reducing non-technical losses in the distribution network.

Major applications for digital power meters span residential smart home integration, complex commercial building energy management systems, and intensive industrial load monitoring. In the industrial sector, these meters are indispensable for power quality analysis, monitoring critical assets, and facilitating proactive maintenance based on energy signature changes. The increasing decentralization of energy production, driven by distributed renewable sources like rooftop solar panels, has amplified the need for digital meters capable of handling bi-directional power flows accurately. Furthermore, the mandatory implementation of energy auditing and reporting standards in many jurisdictions ensures a continuous, high demand for certified digital metering solutions across all end-use sectors.

The primary benefits driving the widespread adoption of digital power meters include enhanced grid reliability, substantial improvements in revenue assurance for utilities, and increased transparency for consumers regarding their consumption habits. Driving factors propelling this market forward are stringent regulatory mandates concerning energy efficiency, massive global investments in smart city projects that rely heavily on interconnected metering systems, and the imperative need to upgrade aging electrical infrastructure worldwide. The integration of Internet of Things (IoT) platforms and cloud-based analytics further leverages the data generated by these meters, transforming raw measurements into actionable intelligence for load forecasting and demand-side management.

Digital Power Meter Market Executive Summary

The Digital Power Meter Market is characterized by robust growth, primarily fueled by the accelerating global transition towards smart grid technologies and the necessity for accurate, real-time energy monitoring. Business trends indicate a shift towards highly secure, interoperable metering solutions that comply with international standards such as DLMS/COSEM and ensure seamless integration with various communication platforms (e.g., PLC, RF Mesh, Cellular). Key industry players are focusing on developing hybrid communication modules and leveraging edge computing within meters to process data locally, minimizing latency and maximizing security. Strategic mergers, acquisitions, and partnerships between meter manufacturers and software solution providers are common, aimed at offering comprehensive, end-to-end AMI solutions rather than standalone hardware.

Regionally, Asia Pacific maintains market dominance due to massive smart grid rollouts in countries like China and India, driven by government initiatives to electrify remote areas and reduce power theft. North America and Europe, while having mature markets, are focusing on second-generation smart meter deployments, emphasizing advanced features like power quality monitoring, cybersecurity enhancements, and demand response capabilities crucial for integrating high levels of intermittent renewable energy. Latin America and the Middle East & Africa are emerging as high-growth regions, driven by rapidly increasing urbanization, infrastructure modernization projects, and substantial investments in utility efficiency programs aimed at tackling systemic transmission and distribution losses.

Segment trends reveal that the industrial segment continues to represent the highest revenue share due to the necessity for granular energy accountability in manufacturing and processing plants, often requiring high-end, multi-function power quality analyzers. However, the residential segment is expected to exhibit the fastest volume growth, propelled by large-scale mandated smart meter installations mandated by regulatory bodies globally. Furthermore, the three-phase digital meter segment is experiencing increased adoption across commercial and light industrial applications, displacing single-phase meters due to higher load requirements and the need for comprehensive monitoring across multiple power lines.

AI Impact Analysis on Digital Power Meter Market

Users frequently inquire about how Artificial Intelligence (AI) algorithms can leverage the vast amounts of consumption data generated by digital power meters, moving beyond basic meter-to-bill processes. Key user questions revolve around AI’s role in predictive maintenance for grid infrastructure, identifying sophisticated power theft patterns undetectable by traditional methods, and optimizing energy trading and storage decisions based on real-time consumption forecasts. Concerns often center on data privacy, the computational burden on existing meter infrastructure, and the interoperability required to feed data from millions of edge devices into centralized AI models. The overarching expectation is that AI will unlock the true value of AMI data, transforming utilities from reactive service providers into proactive, predictive grid managers.

AI's influence is rapidly shifting the operational paradigm of the Digital Power Meter Market, focusing the value proposition away from hardware and towards data intelligence. AI-driven analytics platforms utilize machine learning models to analyze load profiles, voltage trends, and power factor data collected by digital meters. This allows utilities to create highly accurate load forecasting models, minimizing the reliance on costly peaker plants and ensuring resource allocation efficiency. Crucially, AI facilitates advanced anomaly detection, moving beyond simple high-consumption alerts to identifying specific equipment failures or behavioral patterns indicative of tampering, significantly improving operational security and reducing non-revenue water/electricity.

Furthermore, AI significantly enhances demand-side management programs. By analyzing historical and real-time meter data, AI algorithms can accurately segment customers and predict their responsiveness to dynamic pricing signals. This capability is essential for balancing intermittent renewable generation, allowing the grid to instantaneously adjust demand during periods of high strain or low supply. The future integration of AI directly into edge computing within advanced digital meters is expected, enabling faster decision-making (e.g., localized fault detection and isolation) without constant reliance on central cloud processing, thus improving the resilience and responsiveness of the distribution network.

- AI-driven Predictive Maintenance: Analyzing load signatures for transformer health and fault anticipation.

- Advanced Fraud Detection: Machine learning models identifying complex, non-linear patterns of power theft and meter tampering.

- Optimized Load Forecasting: Improving grid stability and resource dispatch through highly accurate short-term and long-term consumption prediction.

- Enhanced Demand Response: Granular customer segmentation and real-time responsiveness to fluctuating energy prices and supply conditions.

- Automated Power Quality Analysis: Real-time detection and classification of harmonic distortions and voltage sags captured by digital meters.

DRO & Impact Forces Of Digital Power Meter Market

The dynamics of the Digital Power Meter Market are shaped by a complex interplay of governmental mandates, technological innovation, and inherent infrastructure challenges. Key drivers include accelerating governmental initiatives across Asia and Africa compelling utilities to implement smart metering to curb technical and commercial losses, coupled with the global push for decarbonization which necessitates accurate monitoring of distributed energy resources (DERs). These external pressures mandate significant capital expenditure in smart grid deployment, solidifying the demand for advanced digital measurement devices capable of handling bi-directional energy flows. The high cost of initial deployment, especially in developing regions where legacy infrastructure modernization is expensive, serves as a significant restraint, often requiring substantial public financing or regulatory incentives.

Restraints also include widespread public concerns regarding data privacy and cybersecurity vulnerabilities inherent in interconnected AMI systems. If meters are compromised, they could be exploited to disrupt grid operations or leak sensitive consumption data, leading to regulatory backlash and slowed adoption rates. Opportunities, however, are vast, particularly in the rapid expansion of smart city infrastructure and the burgeoning market for power quality monitoring solutions in high-tech industrial manufacturing. The evolution of communication standards, particularly the move towards 5G-enabled IoT connectivity for meters, presents a substantial opportunity for vendors to offer faster, more reliable, and lower-latency data transmission services, critical for effective real-time grid management.

The key impact forces influencing market trajectory include continuous downward pressure on hardware pricing due to competitive manufacturing bases in Asia Pacific, balanced by increasing demand for sophisticated software and services (SaaS models) related to data analytics and AMI management. Regulatory environment shifts, particularly mandates concerning interoperability and standardized communication protocols (like OpenADR for demand response), force manufacturers to adapt quickly. Furthermore, the global momentum of ESG (Environmental, Social, and Governance) investing encourages corporations and utilities to prioritize sustainable operations, thereby accelerating the adoption of energy management tools underpinned by digital power meters for accurate carbon footprint reporting.

Segmentation Analysis

The Digital Power Meter Market is structurally diverse, segmented primarily based on phase type, component, application, and end-user, reflecting the varied requirements of global electricity infrastructure. The market segmentation highlights the distinct technological needs between single-phase metering, primarily serving residential users, and three-phase systems, essential for managing high loads in industrial and commercial environments. Component segmentation differentiates between the core metering hardware and the associated communication modules and software platforms that enable data intelligence and remote management. This layered structure allows market players to tailor solutions ranging from basic replacement meters to comprehensive, integrated Advanced Metering Infrastructure (AMI) systems.

Application-wise, the distinction between utility metering (revenue measurement) and sub-metering (internal cost allocation and energy efficiency) drives product feature specialization. Utility-grade meters prioritize accuracy and tamper resistance, while sub-meters focus on granular data collection and seamless integration with Building Management Systems (BMS). The end-user classification is crucial, with industrial consumers demanding highly robust, multi-function meters capable of detailed power quality analysis, contrasting with the high-volume, cost-sensitive requirements of the residential sector where functionality often prioritizes remote reading and bi-directional measurement capabilities suitable for rooftop solar installations.

The fastest-growing segment is anticipated to be the software and services component, driven by the increasing complexity of grid management and the need to process the exponential growth in meter data. As hardware becomes standardized, competitive differentiation increasingly relies on advanced analytics, cybersecurity features, and cloud-based platforms that deliver actionable insights to both utilities and consumers. This trend underscores the market’s evolution from simple hardware provision to sophisticated data monetization and integrated solution delivery.

- By Phase Type:

- Single-Phase Digital Power Meters

- Three-Phase Digital Power Meters

- By Component:

- Hardware (Meter Unit)

- Software & Services (AMI Systems, Data Analytics, Communication Modules)

- By Application:

- Utility Metering (Revenue)

- Sub-Metering (Internal Monitoring)

- By End-User:

- Residential

- Commercial

- Industrial

- Others (Smart Grid Infrastructure)

- By Communication Technology:

- Wired (PLC, Ethernet)

- Wireless (RF Mesh, Cellular, Wi-Fi)

Value Chain Analysis For Digital Power Meter Market

The value chain for the Digital Power Meter Market begins with the upstream raw material and component suppliers, including manufacturers of high-precision electronic components such as microcontrollers, communication chips, current transformers, and measurement integrated circuits. Given the technical complexity, reliance on specialized semiconductor fabrication is high. Upstream activities are critical as the accuracy, reliability, and lifespan of the digital meter are directly dependent on the quality of these sensitive electronic components. Strategic sourcing and establishing resilient supply chains for specialized microprocessors are key competitive advantages in this stage.

Midstream involves the core activities of meter manufacturing, assembly, software integration, and calibration, where major Original Equipment Manufacturers (OEMs) dominate. This stage includes sophisticated industrial design to ensure tamper resistance and adherence to stringent international metrology standards (e.g., IEC, ANSI). The distribution channel relies heavily on direct sales to large governmental utilities, often involving competitive bidding processes and long-term contracts for large-scale AMI rollouts. Indirect distribution, leveraging system integrators and electrical wholesalers, is more prevalent for sub-metering products aimed at commercial and industrial end-users, requiring sales teams with deep technical knowledge of complex building management integration.

Downstream activities focus on deployment, installation, system integration (connecting meters to the utility’s Head-End System), and post-sales services, including data analytics and maintenance. The growth in the market is increasingly driven by this downstream service layer, as utilities seek comprehensive solutions rather than just hardware. The overall efficiency and profitability of the value chain are significantly influenced by regulatory approval cycles and standardization efforts, which determine market access and ensure the interoperability required for widespread smart grid deployment.

Digital Power Meter Market Potential Customers

The potential customer base for the Digital Power Meter Market is highly diversified yet primarily anchored by large governmental and private utility providers globally. These entities represent the largest procurement volume, driven by national mandates for grid modernization and revenue protection initiatives. Utility customers require certified, mass-producible meters, robust communication infrastructure, and sophisticated head-end software capable of managing millions of installed units simultaneously. Their buying decisions are governed by technical specifications, compliance, cost-effectiveness over the meter’s lifecycle, and the robustness of the vendor's cybersecurity measures.

Another major category of buyers includes Commercial and Industrial (C&I) enterprises, which utilize digital power meters extensively for sub-metering, optimizing energy consumption within their facilities, and ensuring compliance with ISO 50001 (Energy Management System) standards. These customers, such as data centers, manufacturing plants, and large retail chains, seek advanced multi-function meters offering detailed power quality analysis, historical data logging, and seamless integration with existing operational technology (OT) systems. The purchase motivation here is cost savings through efficiency gains and maintaining operational resilience.

Finally, property developers, infrastructure management companies, and smart city project developers form a growing customer segment. They require meters for new residential and commercial construction projects, often prioritizing features like remote monitoring, integration with renewable energy sources, and the capability to support localized microgrids. For these customers, ease of installation, scalability, and support for emerging IoT protocols are critical buying criteria, positioning digital power meters as foundational components of modern, sustainable urban infrastructure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 8.6 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB, Siemens, Schneider Electric, Eaton, General Electric, Landis+Gyr, Wasion Group, Itron, Honeywell, Linyang Energy, Secure Meters, Circutor, Holley Technology, Kamstrup, Sensus, Mitsubishi Electric, Toshiba, Murata Manufacturing, Osaki Electric, E.ON. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Digital Power Meter Market Key Technology Landscape

The technological landscape of the Digital Power Meter Market is dominated by the continuous evolution of communication standards and the integration of highly sophisticated sensing and processing capabilities. The transition from legacy Power Line Communication (PLC) to advanced cellular (e.g., LTE-M, NB-IoT) and robust RF Mesh networks is a major trend, aiming to improve data transmission reliability, scalability, and reduce latency, which is critical for real-time applications like demand response. The core metering technology relies on advanced measurement integrated circuits (ICs) that perform high-speed sampling and computation to achieve high accuracy (often Class 0.5 or better) and simultaneously monitor multiple parameters beyond kWh, including power factor, voltage/current sag, and harmonic content.

Another pivotal technological development involves the incorporation of edge computing and enhanced cybersecurity features directly within the meter hardware. Edge computing allows digital meters to execute basic data validation, anomaly detection, and localized fault isolation without requiring constant communication with the central utility system, thereby enhancing grid resilience and reducing network traffic load. Security is paramount, with meters increasingly featuring hardware security modules (HSMs), robust encryption standards (e.g., AES-128 or better), and secure firmware update mechanisms to protect against cyber intrusions and unauthorized manipulation, meeting stringent national security guidelines imposed by regulatory bodies.

Furthermore, the future growth trajectory is heavily influenced by interoperability standards. Protocols such as DLMS/COSEM (Device Language Message Specification/Companion Specification for Energy Metering) and OpenADR (Open Automated Demand Response) ensure that meters from different manufacturers can seamlessly communicate with diverse Head-End Systems (HES) and Advanced Metering Infrastructure (AMI) platforms. This standardization reduces vendor lock-in for utilities and accelerates the deployment of integrated, multi-vendor smart grid ecosystems. The continuous miniaturization of components and improvements in energy efficiency of the meter itself are also enabling broader deployment in challenging environments where power supply might be unstable.

Regional Highlights

The Digital Power Meter Market exhibits diverse regional adoption patterns driven by varying regulatory environments, economic development levels, and infrastructure maturity.

- Asia Pacific (APAC): Dominates the global market share and growth prospects, driven primarily by massive government-led initiatives in China, India, and Southeast Asia focused on reducing Aggregate Technical and Commercial (AT&C) losses, which are significantly high in these regions. The large-scale deployment of smart meters to improve billing efficiency, curb power theft, and manage rapidly increasing electricity demand due to industrialization and urbanization is the central market driver.

- North America: Characterized by mature smart meter penetration, the focus is now on second-generation AMI deployment, emphasizing data analytics, integration of high volumes of distributed energy resources (DERs), and enhancing grid resilience against weather events and cyber threats. Key markets like the United States and Canada are driving innovation in demand response and decentralized grid management.

- Europe: Driven by ambitious EU mandates (e.g., the 2020/2030 energy efficiency targets) requiring smart meter rollout across member states. The market prioritizes interoperability, strong data privacy standards (GDPR compliance), and functionality supporting complex energy balancing needed for high levels of wind and solar power integration, particularly in countries like Germany, the UK, and France.

- Latin America (LATAM): Represents an emerging high-potential market. Growth is catalyzed by the need for utility efficiency improvements and power theft reduction, particularly in Brazil and Mexico. Regulatory frameworks are gradually being established to support large-scale smart metering investments, often utilizing cellular communication technologies due to sprawling geographic areas.

- Middle East and Africa (MEA): Growth is driven by large-scale infrastructure investments in the Gulf Cooperation Council (GCC) nations to support rapidly expanding smart city developments. In Africa, the push is primarily focused on reducing losses and improving revenue collection efficiency in rapidly urbanizing areas, with pilot programs demonstrating the clear benefits of digital metering in preventing energy diversion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Digital Power Meter Market.- ABB

- Siemens

- Schneider Electric

- Eaton

- General Electric

- Landis+Gyr

- Wasion Group

- Itron

- Honeywell

- Linyang Energy

- Secure Meters

- Circutor

- Holley Technology

- Kamstrup

- Sensus (Xylem)

- Mitsubishi Electric

- Toshiba

- Murata Manufacturing

- Osaki Electric

- E.ON

Frequently Asked Questions

Analyze common user questions about the Digital Power Meter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a digital power meter and an analog meter?

A digital power meter utilizes electronic circuitry to measure consumption with higher accuracy, supports two-way communication (smart functionality), and records multiple parameters (e.g., voltage, power factor, time-of-use), while an analog meter uses a mechanical disc for simple cumulative kilowatt-hour tracking.

How does the deployment of digital power meters support smart grid infrastructure?

Digital meters are foundational to the smart grid, enabling real-time data collection necessary for load balancing, automated fault detection, remote disconnection/reconnection services, and supporting dynamic pricing schemes essential for effective demand response programs.

Which communication technologies are most commonly used in Advanced Metering Infrastructure (AMI)?

The most common communication technologies include Power Line Communication (PLC) for low-bandwidth applications, RF Mesh networks for high density urban areas, and cellular networks (2G, 4G LTE-M, and 5G NB-IoT) for broader coverage and low-latency, real-time data exchange.

What are the major challenges restraining the adoption rate of digital power meters globally?

Significant restraints include the high upfront capital expenditure required for large-scale AMI rollouts, pervasive concerns regarding cybersecurity and the privacy of consumer energy consumption data, and the challenges associated with standardizing protocols across diverse international markets.

In which end-user segment is the demand for multi-functional digital power meters highest?

The Industrial segment exhibits the highest demand for multi-functional digital power meters, primarily because manufacturing and processing plants require detailed power quality monitoring, harmonic analysis, and precise sub-metering for energy cost allocation and operational efficiency improvements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager