Digital Temperature Gauge Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434676 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Digital Temperature Gauge Market Size

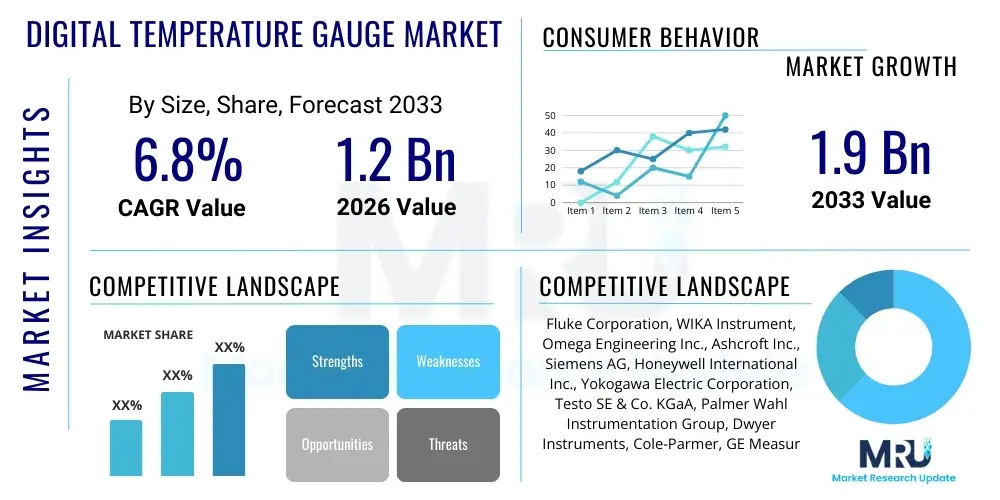

The Digital Temperature Gauge Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.9 Billion by the end of the forecast period in 2033.

Digital Temperature Gauge Market introduction

The Digital Temperature Gauge Market encompasses the manufacturing, distribution, and utilization of electronic instruments designed to measure, display, and often log temperature readings with high precision and clarity. These devices utilize various sensor technologies, including Resistance Temperature Detectors (RTDs), thermocouples, and thermistors, to convert thermal energy into an electrical signal, which is then processed and displayed digitally. Unlike traditional analog thermometers, digital gauges offer superior resolution, faster response times, and enhanced accuracy, making them indispensable across a spectrum of critical industrial and commercial applications.

Digital temperature gauges are characterized by their versatility and integration capabilities, frequently featuring advanced functionalities such as data logging, alarm settings, and connectivity options (e.g., Bluetooth, Wi-Fi, 4-20mA output) for seamless integration into Supervisory Control and Data Acquisition (SCADA) systems and Industrial Internet of Things (IIoT) platforms. Major applications span industries requiring stringent process control and monitoring, including chemical processing, oil and gas extraction, food and beverage production, pharmaceuticals, and HVAC systems in commercial infrastructure. The shift from manual monitoring to automated, high-precision measurement systems is a primary driver for market expansion.

The core benefits derived from utilizing digital temperature gauges include enhanced operational efficiency due to precise readings, reduced risk of spoilage or catastrophic equipment failure through real-time monitoring and alerting, and improved compliance with strict regulatory standards (such as FDA and ISO requirements) pertaining to temperature control. Driving factors for the market include the global push towards industrial automation, increasing investments in infrastructure development (especially smart buildings and cold chain logistics), and the imperative for energy optimization across industrial sectors where accurate temperature measurement is crucial for minimizing waste and maximizing throughput. The continuous evolution of sensor technology, offering smaller, more robust, and more energy-efficient gauges, further supports sustained market growth.

Digital Temperature Gauge Market Executive Summary

The Digital Temperature Gauge Market is witnessing substantial growth, fueled by convergent trends in industrial digitalization, stricter global safety regulations, and the proliferation of IoT-enabled sensing devices. Business trends indicate a strong move toward multifunctionality, where gauges not only measure temperature but also incorporate pressure sensing and advanced diagnostic capabilities, leading to consolidated monitoring solutions. Furthermore, the demand for battery-powered, intrinsically safe (IS) models is rising significantly, particularly within hazardous environments such as petrochemical plants and mining operations, compelling manufacturers to focus heavily on power efficiency and certification compliance for explosion-proof applications. Strategic mergers and acquisitions aimed at integrating advanced sensing technologies and expanding regional distribution networks are defining the competitive landscape, pushing smaller, innovative firms into the purview of major global instrumentation providers.

Regionally, Asia Pacific (APAC) is projected to be the fastest-growing market, driven primarily by massive industrial expansion, rapid urbanization, and significant government investments in developing smart cities and advanced manufacturing facilities, particularly in China and India. North America and Europe, while mature, maintain dominant market shares due to stringent regulatory frameworks governing food safety, pharmaceuticals, and environmental emissions, necessitating continuous upgrades to high-accuracy digital monitoring equipment. The Middle East and Africa (MEA) market is exhibiting robust growth tied directly to substantial capital expenditures in the oil and gas infrastructure, where precise downhole temperature monitoring and pipeline integrity checks rely heavily on durable, high-performance digital gauges.

Segment-wise, the Industrial Processing segment remains the largest application area, encompassing sectors like metallurgy and chemical manufacturing where maintaining narrow temperature windows is non-negotiable for product quality and safety. Technology trends favor Resistance Temperature Detectors (RTDs) for applications requiring high accuracy and stability over a moderate temperature range, while thermocouples dominate high-temperature environments. The Handheld gauge segment is seeing elevated demand due to its utility in field testing, quality control inspection, and maintenance tasks across diverse industries, prioritizing portability and robust construction. Overall, the market trajectory is firmly aligned with global megatrends toward process automation, demanding reliable, interconnected, and highly accurate digital measurement tools.

AI Impact Analysis on Digital Temperature Gauge Market

Common user inquiries regarding AI's influence on the Digital Temperature Gauge Market often center on its role in predictive maintenance, data normalization, and enhancing the self-calibration capabilities of sensing devices. Users are concerned about how AI algorithms can process the vast amounts of temperature data generated across large industrial facilities to identify subtle thermal anomalies indicative of impending equipment failure, thereby shifting maintenance strategies from reactive to predictive models. Furthermore, there is significant interest in AI’s potential to filter noise and environmental interference from temperature readings, ensuring higher data integrity, and automating complex calibration routines that currently require specialized technicians. The key themes revolve around maximizing operational uptime, minimizing false alerts, and achieving a higher level of autonomy in temperature monitoring systems through machine learning integration.

The integration of Artificial Intelligence transforms digital temperature gauges from simple measurement devices into intelligent endpoints within a broader industrial ecosystem. AI algorithms, particularly those leveraging machine learning, enable sophisticated pattern recognition across time-series temperature data, allowing systems to establish complex baseline operating conditions that account for environmental variables and operational load fluctuations. When temperature readings deviate marginally from these learned baselines, an AI-powered system can immediately generate high-confidence alerts, offering lead time for maintenance intervention long before a critical failure occurs. This capability fundamentally changes asset management by reducing unplanned downtime and optimizing resource allocation for preventative repairs, significantly enhancing the return on investment for high-precision digital gauges.

Moreover, AI is pivotal in advancing the performance of digital temperature sensors in challenging industrial environments. Machine learning models can be trained on historical drift and degradation patterns, effectively predicting sensor lifespan and triggering automated recalibration or replacement schedules. In complex processes, such as chemical reactors or heat exchangers, where temperature variations are subject to multiple interacting variables, AI provides crucial context-aware analysis. This enables the digital gauge system to provide not just the temperature reading, but also actionable insights into the underlying process health, improving energy efficiency, and ensuring optimal process output quality. This transition towards 'smart sensing' is paramount for industries adopting Industry 4.0 principles.

- AI facilitates predictive maintenance by identifying subtle temperature deviations indicating impending equipment failure.

- Machine learning algorithms enhance data accuracy by filtering noise and environmental variables from sensor outputs.

- AI enables autonomous calibration checks and drift compensation, reducing manual intervention and maintenance costs.

- Advanced analytics provide context-aware process optimization, correlating temperature data with energy consumption and product quality metrics.

- Integration supports decentralized decision-making at the edge, reducing latency in critical response scenarios.

DRO & Impact Forces Of Digital Temperature Gauge Market

The Digital Temperature Gauge Market is primarily driven by the escalating demand for operational efficiency and regulatory compliance across high-stakes industrial sectors. Restraints, conversely, include the high initial capital expenditure associated with implementing advanced, interconnected digital monitoring systems and the inherent complexity of integrating diverse legacy systems within brownfield industrial sites. Opportunities are vast, particularly in emerging applications such as cold chain logistics monitoring for pharmaceuticals and perishable goods, and the expansion of smart building infrastructure requiring integrated HVAC temperature control. These factors collectively create significant impact forces pushing manufacturers toward innovation in wireless connectivity, battery life, and intrinsic safety certification.

Drivers: A fundamental driver is the global move towards Industry 4.0, which necessitates the deployment of interconnected sensors to provide continuous, real-time data streams for automated decision-making. Secondly, increasingly stringent governmental and international safety regulations (e.g., those pertaining to emission control, food handling, and pharmaceutical manufacturing) mandate verifiable and traceable temperature records, which only digital gauges can reliably provide. Furthermore, the rising awareness of the financial and environmental costs associated with energy waste is prompting industrial consumers to upgrade outdated analog instrumentation to precise digital gauges, enabling optimized heating, cooling, and process control loops, directly contributing to energy savings and reduced operational expenditure.

Restraints: The primary restraint remains the considerable cost associated with high-precision digital gauges, especially certified models required for hazardous locations (intrinsically safe or explosion-proof). This high entry cost can deter small and medium-sized enterprises (SMEs) from rapid adoption. Another significant hurdle is the vulnerability of electronic sensors to harsh industrial environments, including extreme vibrations, chemical exposure, and electromagnetic interference, which necessitates costly protective measures and frequent maintenance. The challenge of cybersecurity within networked temperature monitoring systems also poses a restraint, as interconnected sensors represent potential entry points for malicious actors, demanding robust data encryption and secure network protocols.

Opportunities: Significant market opportunities exist in the expansion of cold chain monitoring, driven by the global distribution of vaccines and complex biopharmaceuticals requiring ultra-low and highly stable temperature environments. The development of smart infrastructure and smart grids presents another fertile ground, as digital gauges are integral to optimizing energy flow and maintaining reliable building management systems (BMS). Technological advancements, particularly in highly durable, low-power wireless sensor networks (WSNs), open up new retrofit opportunities in geographically remote or previously inaccessible monitoring locations, reducing wiring costs and enhancing deployment flexibility across sprawling industrial campuses.

- Drivers: Adoption of Industry 4.0, stringent regulatory mandates (FDA, ISO), demand for improved energy efficiency, and technological advancements in sensor accuracy.

- Restraints: High initial capital investment, complexity of integrating with legacy systems, vulnerability of electronic components to harsh industrial conditions, and cybersecurity concerns related to networked devices.

- Opportunities: Rapid growth in cold chain logistics, expansion of smart building and city infrastructure, development of low-power wireless sensor networks (WSNs) for remote monitoring, and increased demand for multifunctional gauges (T&P measurement).

- Impact Forces: Strong pressure for intrinsic safety certification, rapid development cycles focused on battery life extension, and standardization efforts for communication protocols (e.g., OPC UA).

Segmentation Analysis

The Digital Temperature Gauge Market is comprehensively segmented based on Type, Sensor Technology, and Application, reflecting the diverse industrial requirements and functional needs of end-users. This multi-dimensional segmentation allows manufacturers to tailor products precisely for specific operational environments, ranging from highly sensitive laboratory settings to rugged, high-temperature industrial processes. The segment performance is heavily influenced by regional industrial maturity and prevailing regulatory climate, with mature economies prioritizing higher accuracy and integration features, while emerging markets focus on cost-effectiveness and durability.

Segmentation by Sensor Technology is critical, defining the gauge's operational limits in terms of temperature range, stability, and responsiveness. Resistance Temperature Detectors (RTDs) are favored where accuracy is paramount, offering excellent stability over moderate ranges, typically utilized in food and beverage and pharmaceutical production. Thermocouples, conversely, dominate high-temperature applications in metallurgy, furnaces, and power generation due to their broad measurement range and robustness. Thermistors, while offering lower range, excel in high sensitivity and fast response times, making them suitable for HVAC and certain consumer electronics applications.

Application segmentation illustrates market adoption patterns; Industrial Processing holds the largest share due to the sheer volume and complexity of temperature-critical operations in chemical, petrochemical, and manufacturing sectors. The Heating, Ventilation, and Air Conditioning (HVAC) sector is also a significant consumer, driven by continuous efforts toward energy efficiency in commercial and residential buildings. Furthermore, the specialized needs of the Pharmaceutical and Biotechnology segment, which requires precise, validated temperature mapping and monitoring for storage and process validation, drives demand for the highest-accuracy, certified digital gauges. The strategic focus on these specialized sectors highlights the market's trajectory towards high-value, niche applications.

- By Type:

- Handheld Digital Gauges

- Panel Mount Digital Gauges

- Fixed/Wireless Digital Gauges

- By Sensor Technology:

- Resistance Temperature Detectors (RTDs)

- Thermocouples

- Thermistors

- Infrared/Non-Contact Sensors

- By Application:

- Industrial Processing (Chemicals, Metallurgy, Manufacturing)

- HVAC & Building Automation

- Food & Beverage Industry

- Pharmaceutical & Biotechnology

- Oil & Gas and Energy

- Laboratory and Scientific Research

- By Display Type:

- LCD Display

- LED Display

Value Chain Analysis For Digital Temperature Gauge Market

The value chain for the Digital Temperature Gauge Market is characterized by a high degree of technological specialization, starting with the complex manufacturing of highly sensitive sensor components. The upstream segment involves critical material sourcing, notably specialized metals (e.g., platinum for RTDs, various alloys for thermocouples) and semiconductor components essential for signal conditioning and digital processing chips. Key players in this stage focus intensely on R&D to enhance sensor durability, linearity, and precision. Suppliers of high-grade platinum wire, specialized ceramics, and microcontrollers play a crucial role, influencing the final gauge performance and cost structure. Optimization at the upstream level is essential for competitive pricing and meeting stringent accuracy standards required by regulatory bodies.

The midstream segment involves the core manufacturing, assembly, calibration, and packaging of the gauges. Manufacturers combine the sensor elements with proprietary signal conditioners, digital displays, protective housings, and connectivity modules (like integrated microprocessors for data logging). Calibration labs are an integral part of this stage, ensuring compliance with NIST or equivalent international standards, adding significant value through certification and quality assurance. Direct distribution strategies are common for high-volume, standard products, while complex, specialized gauges often rely on technical sales teams and system integrators to ensure proper application and integration into larger industrial control systems. Efficient inventory management and modular design are key operational priorities in the midstream.

Downstream analysis highlights the critical role of distribution channels and end-user engagement. The distribution network is multifaceted, encompassing direct sales teams targeting major industrial clients, specialized distributors focusing on instrumentation and process control, and e-commerce platforms for standard gauges and maintenance spares. Indirect channels, such as authorized resellers and system integrators, are vital for providing post-sale support, installation, and complex configuration services, especially in large capital projects like new chemical plants or refinery upgrades. The interaction with potential customers requires deep application knowledge, as the choice of gauge (e.g., thermocouple type, sheath material, connection interface) is highly dependent on the specific process fluid, pressure, and temperature extremes of the application.

Digital Temperature Gauge Market Potential Customers

The potential customer base for the Digital Temperature Gauge Market is highly diversified, spanning multiple sectors that rely on precise temperature management for safety, quality control, and operational efficiency. The primary end-users are large industrial facilities, including petrochemical refineries, power generation plants (nuclear, fossil fuel, renewable), and heavy manufacturing plants such as steel mills and automotive assembly lines. These customers utilize fixed, highly robust gauges integrated into distributed control systems (DCS) for continuous monitoring of critical processes, boilers, turbines, and reaction vessels. Their purchase decisions are heavily influenced by mean time between failures (MTBF), intrinsic safety certification, and compatibility with existing industrial communication protocols (e.g., HART, Foundation Fieldbus).

Another crucial segment comprises infrastructure operators and commercial real estate managers, particularly those overseeing smart buildings, data centers, and large cold storage warehouses. In these applications, potential customers prioritize energy efficiency, network connectivity, and ease of installation. Digital gauges are integral to optimizing HVAC performance and maintaining precise environmental control for sensitive equipment (like servers) or regulated goods (like perishable foods). These customers often opt for wireless or panel-mount solutions that can seamlessly feed data into Building Management Systems (BMS) and utilize specialized distributors that can offer full system integration and long-term maintenance contracts.

Specialized potential customers include pharmaceutical and biotechnology companies, clinical laboratories, and healthcare facilities. For this segment, the critical factors are compliance (FDA 21 CFR Part 11 requirements), calibration traceability, and high accuracy for validated processes, such as sterile manufacturing or cold storage of sensitive biological samples. These buyers require gauges with comprehensive data logging capabilities, audit trail features, and frequent, certified recalibration services, often provided directly by the gauge manufacturer or highly specialized third-party validation companies. The purchasing cycle in this segment is typically longer and more rigorous, focused entirely on validation and regulatory adherence rather than merely initial cost.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fluke Corporation, WIKA Instrument, Omega Engineering Inc., Ashcroft Inc., Siemens AG, Honeywell International Inc., Yokogawa Electric Corporation, Testo SE & Co. KGaA, Palmer Wahl Instrumentation Group, Dwyer Instruments, Cole-Parmer, GE Measurement & Control, Rototherm Group, Emerson Electric Co., Endress+Hauser Group Services AG, PCE Instruments, Keller America Inc., Setra Systems, Ebro Electronic GmbH, Vaisala |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Digital Temperature Gauge Market Key Technology Landscape

The technological landscape of the Digital Temperature Gauge Market is rapidly evolving, driven by advancements in sensor materials, connectivity, and power management. A pivotal technological trend is the miniaturization and enhancement of Micro-Electro-Mechanical Systems (MEMS) sensors, which offer faster response times and lower power consumption compared to traditional bulky probes. Furthermore, there is a substantial focus on developing advanced material science for sensor sheathing and protective coatings to improve resistance to corrosion, extreme pressure, and abrasive environments, particularly crucial for downhole oil and gas applications and harsh chemical processing.

Connectivity remains a central technological battleground. Modern digital gauges are increasingly incorporating sophisticated wireless communication protocols, moving beyond traditional 4-20mA wired outputs. Low-Power Wide-Area Network (LPWAN) technologies, such as LoRaWAN and NB-IoT, are gaining traction for deploying large-scale sensor networks in remote areas where wiring is impractical or costly. Furthermore, the adoption of industrial Ethernet standards (e.g., EtherCAT, Profinet) ensures seamless, high-speed integration into complex industrial control networks. The underlying microprocessors utilized in these gauges are becoming more powerful, enabling on-board data processing, self-diagnostics, and edge computing capabilities to reduce reliance on centralized control systems.

A third significant area of technological investment is intrinsic safety and power management. For deployment in Zone 0 and Zone 1 hazardous areas, manufacturers are rigorously pursuing certifications (ATEX, IECEx) for intrinsically safe designs that limit energy levels to prevent ignition. This necessitates ultra-low-power electronics and optimized battery chemistries to ensure long operational lifecycles without compromising safety. Additionally, ongoing research into non-contact temperature measurement using advanced infrared thermography and fiber optic sensors is expanding the application scope, allowing for safe monitoring of extremely high-temperature materials or moving parts where traditional contact probes are unsuitable or pose maintenance risks, thereby addressing unmet needs in sectors like metallurgy and high-speed manufacturing.

Regional Highlights

- North America: This region holds a significant share of the global market, characterized by early adoption of advanced monitoring technologies and the presence of stringent regulatory frameworks, particularly in the pharmaceutical, oil and gas, and aerospace sectors. The high maturity level of industrial automation necessitates continuous upgrading to highly accurate, networked digital gauges compatible with modern SCADA and DCS systems. The U.S. market, driven by robust investments in chemical manufacturing and the revitalization of aging infrastructure, demands sophisticated gauges featuring robust cybersecurity protections and compliance with NIST traceability standards. Furthermore, the rapid expansion of hyper-scale data centers drives continuous demand for precise temperature and humidity monitoring systems.

- Europe: Europe is a dominant region defined by its emphasis on environmental sustainability, energy efficiency, and adherence to meticulous quality control standards (e.g., EU GMP guidelines). Countries like Germany and the UK lead in adopting digital gauges within sophisticated industrial machinery and smart grid infrastructure. The market is highly segmented, favoring high-precision RTDs and certified instruments for the automotive and specialty chemical industries. The region’s focus on renewable energy production and associated infrastructure monitoring further bolsters the demand for durable, weather-resistant digital temperature sensing solutions with long-range wireless communication capabilities.

- Asia Pacific (APAC): APAC represents the fastest-growing market globally, primarily fueled by rapid industrialization, massive infrastructure projects, and increasing foreign direct investment in manufacturing capabilities across China, India, and Southeast Asian nations. The region’s growth is characterized by high-volume demand for cost-effective yet reliable digital gauges in burgeoning sectors like electronics manufacturing and automotive production. The expansion of cold chain logistics, particularly in developing economies, to support growing populations and complex supply chains, is a critical growth catalyst. While initial purchasing decisions may prioritize cost, the long-term trend is shifting towards higher-accuracy, IoT-enabled gauges to meet international export quality standards.

- Latin America (LATAM): The LATAM market growth is closely tied to its dominant primary industries, including mining, oil and gas exploration (especially offshore), and large-scale agricultural processing. Market expansion is gradual but steady, driven by the need to modernize existing operational infrastructure to improve safety records and reduce operational losses. Brazil and Mexico are key markets, characterized by demand for robust, field-serviceable digital gauges capable of withstanding remote, often harsh operating conditions. Opportunities are concentrated in municipal water treatment and large-scale power generation projects requiring reliable, durable instrumentation.

- Middle East and Africa (MEA): Growth in the MEA region is overwhelmingly driven by the massive capital investments in the oil, gas, and petrochemical sectors, centered primarily in the GCC countries. Digital temperature gauges are essential for ensuring process safety, monitoring pipeline integrity, and managing highly explosive refining operations, resulting in exceptionally high demand for certified intrinsically safe and explosion-proof models. Infrastructure development, including district cooling systems and large commercial building projects, also contributes to demand for advanced digital HVAC monitoring solutions. Market dynamics are strongly influenced by global oil prices and national diversification strategies aimed at developing non-oil industrial bases.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Digital Temperature Gauge Market.- Fluke Corporation

- WIKA Instrument, LP

- Omega Engineering Inc.

- Ashcroft Inc.

- Siemens AG

- Honeywell International Inc.

- Yokogawa Electric Corporation

- Testo SE & Co. KGaA

- Palmer Wahl Instrumentation Group

- Dwyer Instruments, Inc.

- Cole-Parmer

- GE Measurement & Control

- Rototherm Group

- Emerson Electric Co.

- Endress+Hauser Group Services AG

- PCE Instruments

- Keller America Inc.

- Setra Systems

- Ebro Electronic GmbH

- Vaisala

Frequently Asked Questions

Analyze common user questions about the Digital Temperature Gauge market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between RTDs and Thermocouples in digital temperature gauges?

RTDs (Resistance Temperature Detectors) are fundamentally more accurate and stable than thermocouples, particularly in moderate temperature ranges (typically up to 600°C), making them ideal for high-precision applications like pharmaceutical validation and food safety monitoring. However, thermocouples are favored for extremely high-temperature applications (up to 1700°C) and environments where durability and broad range are prioritized over micro-level precision, owing to their rugged construction and faster response time in drastic temperature changes. The choice often depends on the required accuracy tolerance and the maximum temperature exposure.

How does Industry 4.0 affect the functionality and connectivity requirements of digital temperature gauges?

Industry 4.0 mandates that digital gauges must transcend simple measurement to become intelligent, networked endpoints. This translates into demands for enhanced connectivity features, such as integrated wireless communication (e.g., LoRa, Wi-Fi, 5G-IoT), standardized protocols (e.g., OPC UA, MQTT) for seamless integration with cloud platforms and SCADA systems, and built-in edge computing capabilities for local data processing and self-diagnostics. These enhancements enable real-time condition monitoring, predictive maintenance scheduling, and improved data traceability across the manufacturing value chain, moving towards fully autonomous industrial operations.

What are the key safety certifications required for digital gauges used in the Oil and Gas sector?

Digital temperature gauges utilized in the Oil and Gas sector, especially refineries and drilling platforms (hazardous locations), strictly require intrinsic safety (IS) certifications, such as ATEX and IECEx, to prevent explosions caused by electrical sparks. These certifications confirm that the gauge's electrical energy is limited to a level incapable of igniting flammable gases or dust present in the atmosphere. Furthermore, NEMA ratings (for ingress protection against dust and moisture) and compliance with specific API standards are often mandatory to ensure durability and operational safety under harsh environmental conditions.

Which application segment drives the largest demand for digital temperature gauges, and why?

The Industrial Processing segment drives the largest global demand for digital temperature gauges. This includes the chemical, petrochemical, and heavy manufacturing sectors. The sheer volume of temperature-critical processes—such as distillation, reactor control, heat treatment, and curing—necessitates continuous, highly reliable monitoring to ensure both product quality and operational safety. Any failure in temperature control in these environments can lead to catastrophic damage or significant material loss, making digital gauges an indispensable component of process control and regulatory compliance infrastructure.

How significant is the role of data logging in modern digital temperature gauge adoption?

Data logging is a critical feature driving modern gauge adoption, transforming the instrument from a simple readout device into a valuable record-keeping tool. It is essential for compliance in highly regulated industries (e.g., FDA requirements for cold chain integrity and HACCP in food safety), providing an undeniable audit trail of temperature history. Advanced logging capabilities, including timestamping, secure memory storage, and easy retrieval via USB or wireless means, support quality assurance, dispute resolution, and forensic analysis in case of process anomalies, thereby enhancing accountability and operational transparency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager