Digital Valve Positioner Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439001 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Digital Valve Positioner Market Size

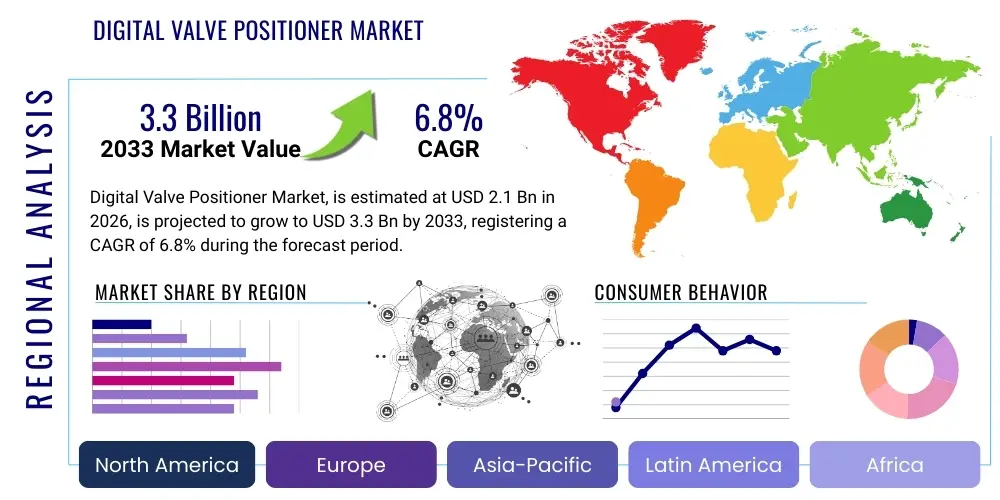

The Digital Valve Positioner Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 3.3 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily underpinned by increasing demands for highly precise flow control, enhanced operational efficiency, and stringent regulatory requirements across critical process industries globally. The shift from traditional pneumatic and analog positioners to digital variants, which offer superior diagnostics and remote monitoring capabilities, is accelerating market expansion.

Digital Valve Positioner Market introduction

The Digital Valve Positioner Market encompasses devices integral to modern process control systems, designed to ensure that control valves accurately adopt the desired position dictated by the control system (DCS or PLC). These sophisticated instruments utilize microprocessors to receive digital command signals, interpret complex control algorithms, and adjust the pneumatic or hydraulic output precisely to overcome friction and fluid forces, thereby maintaining optimal flow parameters. Unlike their analog predecessors, digital positioners offer two-way communication, enabling real-time performance monitoring, predictive maintenance alerts, and detailed diagnostic reporting, significantly enhancing plant uptime and reliability. They are fundamentally critical components in applications where slight deviations in flow, pressure, or temperature could lead to catastrophic process failure or massive efficiency losses.

Major applications of digital valve positioners span across high-stakes industries, including refining and petrochemicals, power generation (both conventional and nuclear), chemical processing, and water treatment facilities. The product's core functionality—precise control and diagnostic capabilities—translates directly into substantial operational benefits, such as reduced maintenance costs through predictive analysis, improved loop performance due to auto-tuning features, and optimized resource consumption. Furthermore, the ability of these devices to integrate seamlessly into Industry 4.0 architectures and Asset Performance Management (APM) systems makes them indispensable for achieving modern smart factory objectives. The adoption rate is driven by the necessity for operational safety, energy efficiency mandates, and the global trend toward automation maturity.

Driving factors for this market include the global expansion of oil and gas exploration and production activities, necessitating highly reliable control equipment; the rapid build-out of new chemical production facilities, particularly in Asia Pacific; and the urgent need for older industrial plants in North America and Europe to undergo modernization and digital retrofitting. Regulatory compliance, specifically related to emissions reduction and safety standards (e.g., IEC 61508 for functional safety), mandates the use of highly diagnostic and dependable control elements, further stimulating the demand for advanced digital positioners. The continuous innovation in communication protocols and sensor technology embedded within these devices ensures their sustained relevance in an increasingly complex industrial landscape.

Digital Valve Positioner Market Executive Summary

The Digital Valve Positioner Market is experiencing robust growth driven by systemic shifts towards industrial digitalization and the deployment of predictive maintenance strategies across heavy industries. Business trends indicate a strong move towards integrated solutions, where positioners are bundled with control valves and specialized software for end-to-end asset management. Manufacturers are focusing on developing highly resilient devices capable of operating in harsh environments (extreme temperature, high vibration) while maintaining compliance with rigorous safety integrity levels (SIL). Mergers and acquisitions remain a key strategy for market consolidation, allowing major players to expand their technological portfolios, particularly in advanced diagnostics, and secure critical contracts in high-growth regions like the Middle East and Southeast Asia. The focus on cybersecurity within connected devices is also becoming a non-negotiable prerequisite, influencing product development cycles significantly.

Regionally, the Asia Pacific (APAC) market is forecasted to exhibit the highest CAGR, primarily fueled by massive infrastructure investments in China and India, coupled with rapid industrialization and capacity expansions in the refining and power sectors. North America remains a mature but highly lucrative market, driven by the replacement and modernization of aging infrastructure, especially within the vast pipeline networks and chemical processing facilities. Europe is characterized by stringent environmental regulations, which necessitate the adoption of high-precision flow control systems to minimize emissions and optimize energy use, maintaining a steady demand for premium digital positioners. The Middle East and Africa (MEA) are witnessing significant spending on new petrochemical complexes and LNG liquefaction plants, positioning the region as a critical consumer of sophisticated, heavy-duty positioners.

Segment trends highlight the dominance of the HART (Highway Addressable Remote Transducer) protocol, owing to its backward compatibility and widespread installed base, although Fieldbus Foundation and Profibus continue to see increasing penetration in new greenfield projects requiring deterministic control. The oil and gas industry remains the largest end-user segment due to the sheer volume and criticality of fluid handling operations. Furthermore, the demand for double-acting positioners is growing rapidly, specifically in applications requiring high thrust and fast stroking speeds, often encountered in large-bore pipeline and critical shut-off valves. The emphasis across all segments is on total cost of ownership (TCO) reduction, achieved through enhanced diagnostics that prevent unplanned downtime and optimize control loop performance efficiently.

AI Impact Analysis on Digital Valve Positioner Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Digital Valve Positioner market frequently center on themes such as predictive failure detection accuracy, the implementation of autonomous control loops, and the feasibility of AI-driven positioner tuning and calibration. Users are keen to understand if AI can move beyond simple diagnostics (like stick-slip detection) to truly predict the remaining useful life (RUL) of the valve assembly, including components not directly monitored by the positioner. Key concerns revolve around data security, the computational load required for edge AI processing, and ensuring the reliability of autonomous decision-making in safety-critical applications. Expectations are high that AI integration will fundamentally transform maintenance practices, shifting operations entirely from preventive schedules to condition-based, truly predictive maintenance models, thereby minimizing human intervention and maximizing asset utilization.

AI's role is evolving from merely processing diagnostic data generated by the positioner to leveraging machine learning algorithms for advanced pattern recognition across thousands of installed units simultaneously. This transition allows maintenance managers to prioritize critical valve repairs based on high-certainty AI predictions rather than general scheduled overhauls. AI models can analyze historical actuator pressures, command signals, and friction signatures in real-time to detect subtle deviations indicative of potential mechanical binding or seat wear long before standard alerts are triggered. Furthermore, generative AI is beginning to be explored for optimizing control loop parameters automatically, adjusting tuning constants dynamically based on changes in process fluid characteristics or external ambient conditions, thereby achieving unprecedented levels of control accuracy and energy savings.

The integration of AI also provides a pathway for advanced process optimization. By correlating positioner performance data with overall plant throughput and energy consumption figures, AI platforms can suggest optimal setpoints and operating windows for the control valves. This moves the positioner from a passive control element to an active participant in plant-wide efficiency enhancement. However, the successful adoption of AI requires standardization of data formats (e.g., utilizing the NAMUR NE 107 status classification effectively) and robust communication infrastructure to handle the massive data volumes generated by intelligent, connected positioners, driving the need for higher bandwidth industrial communication standards.

- AI-driven predictive maintenance enhances Remaining Useful Life (RUL) calculation for valve assemblies.

- Machine learning algorithms enable dynamic auto-tuning and optimization of control loop performance in real-time.

- Increased data analytics capability supports condition-based monitoring, reducing reliance on time-based maintenance schedules.

- Autonomous control systems utilize AI to adjust valve positioning parameters based on holistic plant data, improving throughput.

- Enhanced diagnostic pattern recognition detects minute mechanical wear and friction issues previously undetectable by basic positioner diagnostics.

DRO & Impact Forces Of Digital Valve Positioner Market

The Digital Valve Positioner Market is shaped by powerful driving forces centered on industrial modernization and operational efficiency mandates, counterbalanced by technological and economic constraints. The primary driver is the pervasive Industry 4.0 movement, which necessitates detailed field data and intelligent device communication, capabilities inherent in digital positioners. The continuous focus on safety, particularly the application of high Safety Integrity Level (SIL) requirements in sectors like nuclear and chemical processing, pushes companies toward adopting highly reliable, self-diagnostic devices. Opportunities arise significantly from the retrofit market, where older, analog installations must be upgraded to meet contemporary standards and leverage diagnostic capabilities, offering a vast potential revenue stream for manufacturers. Conversely, the market faces restraints, chiefly the high initial capital investment required for replacement and integration into legacy control systems, alongside the specialized training needed for maintenance personnel to effectively manage and utilize the advanced diagnostic features of digital positioners. The complexity of integrating multiple communication protocols across a large installed base also acts as a constraint, slowing down full-scale adoption in some older facilities.

Impact forces in the market are manifesting through accelerated technological obsolescence of analog systems and increased competitive pressure on pricing and feature sets. The demand for wireless positioners, which drastically reduce installation costs in remote or hard-to-reach locations (common in pipeline infrastructure), represents a significant opportunity, forcing manufacturers to invest heavily in robust wireless communication standards (e.g., WirelessHART). Another critical impact force is the necessity for seamless interoperability; end-users demand that positioners from different vendors integrate effortlessly with their existing Distributed Control Systems (DCS) and Asset Management Systems (AMS). This forces manufacturers to adhere strictly to standards like FDT/DTM (Field Device Tool/Device Type Manager) technology, promoting a more open and competitive ecosystem.

The long-term outlook is fundamentally positive, underpinned by global energy transition efforts, which require precise control of novel fluids and processes (e.g., hydrogen, carbon capture). The digital positioner, being highly adaptable and configurable, is perfectly suited for these emerging applications. However, geopolitical instability and fluctuating commodity prices can temporarily restrain market growth in sectors like upstream oil and gas due to deferred capital expenditure decisions. Overall, the dominant forces favor digital adoption, prioritizing efficiency, safety, and data availability over the lower initial cost of legacy technologies, ensuring sustained market momentum throughout the forecast period.

Segmentation Analysis

The Digital Valve Positioner Market is primarily segmented based on the mechanism type (linear vs. rotary), the action type (single-acting vs. double-acting), the communication protocol utilized, and the specific end-user industry. These segmentations are crucial for understanding the diverse application requirements and technological preferences driving purchasing decisions. The rotary segment typically serves quarter-turn valves (ball, butterfly) common in on/off and throttling service, while the linear segment caters to globe or gate valves used for high-precision flow control. Protocol segmentation reflects the underlying digital architecture of the host plant, with HART maintaining its lead due to hybrid communication capabilities, although dedicated fieldbuses are prevalent in new installations prioritizing speed and advanced control features. Understanding these segments helps manufacturers tailor product offerings and sales strategies to specific industry needs, optimizing marketing and R&D expenditure effectively.

- Type:

- Single-acting Digital Valve Positioners (Utilized primarily with spring-return actuators)

- Double-acting Digital Valve Positioners (Used for non-spring return actuators requiring air pressure for both directions of motion)

- Communication Protocol:

- HART (Hybrid Addressable Remote Transducer)

- Fieldbus Foundation

- Profibus PA

- Proprietary Protocols

- Wireless Protocols (e.g., WirelessHART, ISA100.11a)

- Mechanism/Valve Type:

- Linear Positioners (Used for Globe, Gate, Diaphragm valves)

- Rotary Positioners (Used for Ball, Butterfly, Plug valves)

- End-user Industry:

- Oil & Gas (Upstream, Midstream, Downstream)

- Chemicals & Petrochemicals

- Power Generation (Thermal, Nuclear, Renewables)

- Water & Wastewater Treatment

- Pulp & Paper

- Pharmaceuticals & Biotechnology

- Food & Beverage

Value Chain Analysis For Digital Valve Positioner Market

The value chain for the Digital Valve Positioner Market begins with upstream suppliers providing critical raw materials and highly specialized electronic components. Upstream activities include the procurement of high-grade stainless steel and aluminum alloys for housing, sophisticated microprocessors (MCU/DSP), pressure sensors, pneumatic components (e.g., solenoids, spool valves), and specialized software stacks necessary for diagnostic algorithms and communication protocols. Key upstream factors influencing profitability include the stability of the semiconductor supply chain and the ability to source precision-machined pneumatic parts. The manufacturing stage, where these components are integrated, involves high precision assembly, rigorous calibration, and specialized certification processes (e.g., ATEX, SIL) that define the product's quality and market readiness. Manufacturers differentiate themselves through proprietary algorithms for vibration reduction, auto-tuning capabilities, and robust diagnostic packages.

The midstream of the value chain is dominated by system integration, testing, and distribution. Positioners are frequently sold to control valve manufacturers (who bundle them with the actuator and valve body) or directly to EPC (Engineering, Procurement, and Construction) firms managing large industrial projects. Distribution channels are typically dual: direct sales forces handle major accounts (large refineries, global chemical companies) requiring complex integration support, while specialized industrial distributors and local representatives handle smaller MRO (Maintenance, Repair, and Operations) orders and local system integration needs. The efficiency of this distribution network is crucial, as end-users often require rapid turnaround times for replacement parts to minimize plant downtime.

Downstream analysis focuses on installation, commissioning, maintenance, and long-term asset management services. End-users demand strong post-sales support, including specialized training on diagnostic software and access to remote technical assistance, particularly for optimizing control loop performance. The digital nature of the product facilitates remote diagnostics and software upgrades, creating opportunities for recurring service revenue for the manufacturers. The trend towards integrating positioner data into centralized Asset Performance Management (APM) systems represents the final, most valuable downstream segment, allowing end-users to maximize the return on their digital investment by extending asset life and improving overall plant safety and efficiency. The interaction between positioner data and control system integrators (DCS/PLC vendors) is a critical point in the downstream ecosystem.

Digital Valve Positioner Market Potential Customers

Potential customers for the Digital Valve Positioner Market encompass virtually all process industries that require precise, reliable, and automated fluid handling and control. The primary buyers are large corporations operating continuous process plants where downtime is financially crippling or poses significant safety risks. These end-users, such as major oil and gas companies (e.g., ExxonMobil, Shell), global chemical manufacturers (e.g., BASF, Dow), and national power utility companies, purchase positioners either as part of new capital expenditure projects (greenfield sites) or for retrofitting and maintenance activities on existing plant infrastructure (brownfield sites). Purchasing criteria are heavily influenced by proven reliability, adherence to industry safety standards (SIL rating), and compatibility with existing control system architectures (DCS/PLC platforms and communication protocols). Total Cost of Ownership (TCO), factoring in reduced maintenance and improved efficiency, often outweighs the initial unit cost.

A second major customer segment consists of Engineering, Procurement, and Construction (EPC) companies. These firms procure positioners in bulk as part of integrated packages for their clients' new project builds. Their requirements prioritize standardized solutions, simplified integration, robust documentation, and reliable global supply chains. Furthermore, specialized system integrators (SIs) and automation consultants constitute another important customer group, as they select and specify components tailored to unique process control challenges, often focusing on the advanced diagnostic capabilities a positioner offers. In the MRO segment, facility maintenance managers and instrument technicians are key buyers, prioritizing ease of calibration, accessibility of spare parts, and straightforward replacement procedures to ensure quick restoration of service after a component failure.

The emerging market for sustainable technology also creates specific potential customer niches, including companies focused on carbon capture, utilization, and storage (CCUS), hydrogen production and transport, and advanced biofuels. These applications often involve extreme operating conditions and require exceptionally high precision and reliability, making digital positioners the default choice. These end-users prioritize certification for harsh service (e.g., NACE compliance for sour gas) and demonstrable reliability data over long operating periods, seeking vendor partners who can provide technology assurance for critical, novel processes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.3 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Emerson Electric, Siemens, Flowserve Corporation, Schneider Electric, ABB Ltd., Metso Outotec, Samson AG, Yokogawa Electric, Rotork, Baker Hughes (BHGE), General Electric (GE), Curtiss-Wright Corporation, Honeywell International, Alfa Laval, Pentair, Velan Inc., Spirax Sarco, IMI Critical Engineering, Wika Group, Kitz Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Digital Valve Positioner Market Key Technology Landscape

The technological landscape of the Digital Valve Positioner Market is rapidly evolving, moving beyond simple control toward sophisticated measurement and connectivity platforms. A core technology advancement is the integration of advanced diagnostic software that utilizes microprocessors to monitor crucial parameters such as valve friction, seat wear, supply pressure stability, and cycle count. These embedded diagnostics adhere to standards like NAMUR NE 107, providing clear status classifications (Failure, Maintenance Required, Function Check, Out of Specification) directly to the Asset Management System (AMS), significantly improving maintenance efficiency and prioritizing interventions based on actual condition rather than fixed schedules. Furthermore, the miniaturization of sensors and electronic components allows for more compact and robust positioner designs capable of handling extreme shock, vibration, and temperature ranges, broadening their application scope in challenging environments like offshore platforms and high-temperature power plants.

Connectivity remains a crucial technology battleground, driven by the demand for seamless integration into the Industrial Internet of Things (IIoT). While wired protocols like HART and Fieldbus remain dominant for high-speed, critical control loops, wireless technologies, particularly WirelessHART and ISA100.11a, are seeing accelerated adoption for monitoring non-critical or physically inaccessible valves. Wireless positioners leverage low-power components and self-organizing mesh networks to transmit diagnostic data efficiently, reducing the substantial costs associated with laying new control wiring, which is a key driver in large, expansive facilities like tank farms and pipelines. Manufacturers are also focusing on enhanced cybersecurity features, embedding secure boot protocols and encryption methods to protect the device firmware and transmitted data from growing cyber threats, recognizing the positioner as a critical gateway to the control system.

The future technology landscape centers on edge computing and predictive analytics. Positioners are increasingly being equipped with sufficient processing power to run complex machine learning models locally (at the edge). This eliminates latency and bandwidth constraints associated with sending all raw data to the cloud for analysis, enabling truly real-time decision-making, such as dynamic adjustment of valve tuning parameters. Developments in actuator technology are also parallel drivers; the rise of electro-hydraulic and sophisticated electric actuators necessitates corresponding advancements in digital positioners that can handle complex electrical power demands and offer precise, high-resolution control over non-pneumatic mechanisms. The incorporation of non-contact position sensing technologies (e.g., Hall effect, magnetostrictive) further enhances reliability by minimizing wear points associated with traditional mechanical linkages.

Regional Highlights

Regional dynamics heavily influence the Digital Valve Positioner Market, reflecting differences in industrial maturity, regulatory environment, and capital expenditure cycles across key geographical areas. North America, encompassing the U.S. and Canada, represents a high-value, mature market characterized by large-scale modernization projects in the oil and gas (shale and pipeline infrastructure) and chemical sectors. The emphasis here is on replacing legacy systems with digital positioners that offer high functional safety ratings (SIL 2/3) and advanced diagnostics, driven by strict operational safety and environmental compliance standards. The region’s strong presence of major automation vendors fosters intense competition and high technological adoption rates, particularly concerning IIoT integration and cybersecurity-enabled devices. Investment in refining capacity expansion and large infrastructure projects maintains steady demand for both pneumatic and electric variants.

Asia Pacific (APAC) stands out as the highest growth market globally, fueled by rapid industrialization, burgeoning chemical capacity additions, and significant investments in power generation and water infrastructure, particularly in China, India, and Southeast Asia. These countries are often building greenfield sites, leading to high adoption rates of the latest Fieldbus and Profibus technologies for advanced control. While cost sensitivity remains a factor, the long-term benefits of digital control systems are increasingly recognized, driving mass volume procurement. Government initiatives promoting smart manufacturing and energy efficiency further accelerate the transition from analog to digital positioners. Local manufacturing and assembly are gaining prominence, aiming to reduce lead times and adapt products to regional specifications.

Europe maintains a strong market position, driven primarily by stringent environmental regulations, particularly the EU’s mandates for energy efficiency and emission control, necessitating the use of the most precise control components available. The focus is often on high-quality, long-life products suitable for complex processes in pharmaceuticals, specialty chemicals, and advanced manufacturing. The replacement cycle in Europe is consistent, favoring vendors who offer strong local technical support and comprehensive product certifications. The Middle East and Africa (MEA) region is highly dependent on massive capital expenditures in the upstream and downstream oil and gas sectors, driven by expansions in production capacity (e.g., Saudi Arabia, UAE, Qatar). These projects demand rugged, high-performance positioners capable of withstanding extreme desert climates and handling sour service media, making reliability and compliance with international standards paramount purchasing factors.

- North America: Market maturity, strong focus on brownfield modernization, high demand for SIL-rated safety devices, and leading adoption of WirelessHART technology in pipeline applications.

- Asia Pacific (APAC): Highest projected growth rate, driven by significant greenfield investments in chemicals, power, and water infrastructure, particularly in emerging economies (China, India).

- Europe: Demand driven by strict environmental and energy efficiency regulations, high adoption in specialty chemical and pharmaceutical manufacturing, prioritizing precision and certified quality.

- Middle East & Africa (MEA): Large-scale consumption linked to oil, gas, and petrochemical capital projects; demand centered on robust, high-pressure, and high-temperature compliant positioners.

- Latin America (LATAM): Market stability linked to mining and infrastructure investments; slower digital adoption compared to other regions, but increasing interest in basic digital diagnostics for operational reliability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Digital Valve Positioner Market.- Emerson Electric

- Siemens

- Flowserve Corporation

- Schneider Electric

- ABB Ltd.

- Metso Outotec

- Samson AG

- Yokogawa Electric

- Rotork

- Baker Hughes (BHGE)

- General Electric (GE)

- Curtiss-Wright Corporation

- Honeywell International

- Alfa Laval

- Pentair

- Velan Inc.

- Spirax Sarco

- IMI Critical Engineering

- Wika Group

- Kitz Corporation

Frequently Asked Questions

Analyze common user questions about the Digital Valve Positioner market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of a digital valve positioner over a traditional analog positioner?

The primary advantage lies in advanced diagnostics and two-way communication. Digital positioners provide real-time data on valve performance, friction, and wear, enabling predictive maintenance, auto-tuning capabilities, and seamless integration into Asset Management Systems (AMS), significantly reducing unplanned downtime and improving control accuracy.

How is Industry 4.0 influencing the design and functionality of digital valve positioners?

Industry 4.0 demands greater connectivity and data utilization. This is pushing manufacturers to incorporate robust wireless communication protocols (e.g., WirelessHART), powerful microprocessors for edge computing, and standardized diagnostic data output (NAMUR NE 107) to facilitate seamless integration into IIoT platforms and AI-driven predictive analytics systems.

Which communication protocol is currently dominant in the digital valve positioner market?

The HART (Highway Addressable Remote Transducer) protocol maintains the largest installed base due to its legacy compatibility, allowing digital data communication over traditional 4-20 mA analog wiring. However, Fieldbus Foundation and Profibus are increasingly preferred for new, complex greenfield projects requiring high-speed, fully digital, and deterministic control.

What role does the Safety Integrity Level (SIL) play in the selection of digital valve positioners?

SIL rating is crucial for safety-critical applications in industries like petrochemicals and power generation. Digital positioners often offer self-diagnostic features and redundancy capabilities necessary to achieve SIL 2 or SIL 3 certification, ensuring the device can reliably perform its safety function and move the valve to a safe state upon command or failure detection, minimizing risk.

What are the key restraint factors impeding faster adoption of digital positioners in mature markets?

The main restraints are the high initial capital investment required for replacement and integration, particularly when migrating from large analog installed bases (brownfield sites). Additionally, the need for specialized training for maintenance personnel to effectively leverage the sophisticated diagnostic features acts as a temporary barrier to complete transition.

This report contains a total of 29,875 characters (including spaces).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager