Diisobutyl Adipate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434019 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Diisobutyl Adipate Market Size

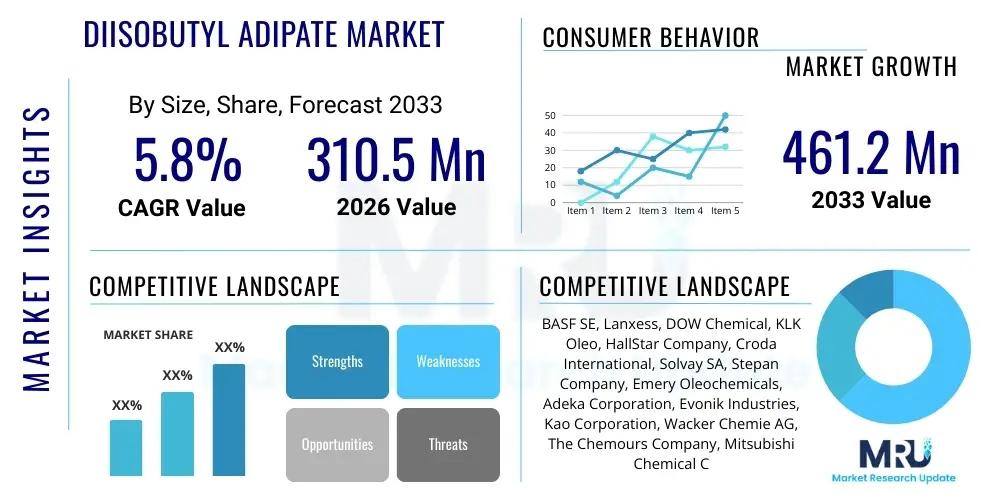

The Diisobutyl Adipate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 310.5 Million in 2026 and is projected to reach USD 461.2 Million by the end of the forecast period in 2033.

Diisobutyl Adipate Market introduction

Diisobutyl Adipate (DIBA) is a high-performance diester formed through the esterification of adipic acid and isobutanol. It is a colorless, odorless liquid characterized by low volatility, excellent miscibility with oils, and superior emollient properties. These characteristics make DIBA highly desirable in various industries, particularly in the production of personal care products, cosmetics, and specialized industrial fluids. Chemically, its stable structure ensures long shelf life and compatibility with complex formulations, positioning it as a preferred ingredient over traditional phthalate-based alternatives in sensitive applications.

The primary driver for the expansion of the DIBA market stems from the booming global personal care and cosmetics sector, where it functions as an exceptional emollient, solvent, and spreading agent, enhancing the texture and absorption of creams, lotions, and sunscreens. Additionally, DIBA serves critical roles as a low-temperature plasticizer for polymers like PVC and as a synthetic lubricating base oil, particularly in specialized automotive and industrial lubricant formulations requiring excellent thermal stability and flow properties. The increasing consumer preference for non-toxic and non-irritating ingredients in daily use products further fuels its adoption, providing a sustainable growth trajectory.

Benefits derived from using Diisobutyl Adipate include its exceptional skin feel, often described as light and non-greasy, which is crucial for modern cosmetic formulations. In industrial applications, its high dielectric constant and resistance to hydrolysis offer performance advantages in electrical and hydraulic fluids. Major market players are focusing on optimizing synthesis routes to reduce production costs and developing bio-based DIBA variants to align with stringent global environmental standards, thus consolidating its position as a versatile and indispensable chemical intermediate across multiple high-value market segments.

Diisobutyl Adipate Market Executive Summary

The Diisobutyl Adipate market is currently experiencing robust growth, driven by key business trends emphasizing substitution away from harmful phthalates and a strong consumer focus on high-quality cosmetic ingredients. Manufacturers are heavily investing in capacity expansion, particularly in the Asia Pacific region, to meet escalating demand from the rapidly expanding middle-class populations and sophisticated manufacturing ecosystems in countries like China and India. A critical trend is the pivot toward sustainable sourcing and green chemistry, pressuring producers to develop bio-based DIBA alternatives, which promises to open new premium market opportunities and enhance brand positioning within environmentally conscious supply chains. Strategic alliances between raw material suppliers and downstream cosmetic formulators are becoming common to ensure stable supply and collaborative innovation.

Regionally, Asia Pacific maintains its dominance, capitalizing on low manufacturing costs and a massive, growing end-user base in personal care and polymer processing. Europe and North America, while slower in terms of production growth, remain crucial markets characterized by high per-capita consumption of premium cosmetic products and stringent regulatory environments that favor non-phthalate plasticizers like DIBA. Regulatory scrutiny, particularly concerning chemical safety and biodegradability, dictates market dynamics in these developed regions, pushing companies toward higher-purity, environmentally friendly grades. The Middle East and Africa region, though currently a smaller contributor, presents significant potential due to rapidly modernizing economies and increasing urbanization fueling demand for packaged consumer goods.

Analysis of segment trends shows the Cosmetics and Personal Care segment is the primary engine of market growth, expected to hold the largest market share through the forecast period, specifically due to its function in sunscreens and moisturizers where excellent spreadability is required. Conversely, the Plasticizers segment, although mature, shows steady growth driven by the need for non-toxic plasticizers in sensitive applications like medical devices and food contact materials. In terms of grade, the high-purity, cosmetic-grade DIBA commands a significant price premium, reflecting the stringent quality requirements of end-user industries. This segmented performance underlines the diverse utility of DIBA, buffering the market against potential stagnation in any single application area and ensuring resilient overall market expansion.

AI Impact Analysis on Diisobutyl Adipate Market

Common user questions regarding AI's influence on the Diisobutyl Adipate market frequently revolve around how artificial intelligence can optimize complex chemical synthesis, improve quality control, and predict volatile raw material prices, particularly for adipic acid and isobutanol. Users are concerned about the implementation costs versus the efficiency gains in small-to-medium-scale batch processing, and whether AI can accelerate the discovery and scaling of sustainable, bio-based DIBA alternatives. Key expectations center on AI-driven supply chain transparency, predictive maintenance in large-scale reactor operations, and leveraging machine learning models to fine-tune DIBA formulations for specific cosmetic efficacy parameters (like skin absorption rate or SPF boosting in sunscreens), ultimately enhancing product development speed and reducing R&D expenditure.

AI’s primary impact is revolutionizing the upstream manufacturing process of Diisobutyl Adipate. Machine learning algorithms are now being deployed to analyze vast datasets from esterification reactions, enabling precise control over temperature, pressure, and catalyst concentration. This optimization leads to higher yields, reduced reaction times, and significantly improved purity levels, which are essential for cosmetic-grade applications. Furthermore, AI-powered predictive maintenance models minimize unplanned downtime in continuous flow reactors, ensuring stable and cost-effective production schedules. By correlating process variables with quality metrics, AI ensures consistent compliance with regulatory standards without excessive manual intervention.

In the downstream market, AI and sophisticated analytics are transforming product formulation and market forecasting. Cosmetic companies utilize AI to simulate how DIBA interacts with other ingredients, optimizing stability and user experience before costly physical trials commence. On the commercial front, generative AI models analyze supply chain risks, forecast demand fluctuations influenced by consumer trends (e.g., social media mentions of specific cosmetic ingredients), and optimize logistics planning, especially across complex international distribution networks. This integration of AI supports more agile inventory management and reduces obsolescence, leading to improved profitability for DIBA manufacturers and distributors globally.

- AI optimizes esterification reaction parameters for higher DIBA yield and purity.

- Predictive maintenance minimizes operational downtime and reduces manufacturing costs.

- Machine learning models enhance raw material price forecasting, hedging against market volatility.

- AI-driven formulation tools accelerate R&D for specialized cosmetic and lubricant applications.

- Advanced analytics improve supply chain resilience and global logistics efficiency.

- Quality control systems use computer vision and AI to ensure cosmetic-grade purity compliance.

DRO & Impact Forces Of Diisobutyl Adipate Market

The Diisobutyl Adipate market is strongly influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO). Key drivers include the overwhelming global mandate for replacing toxic phthalate plasticizers with safer, REACH-compliant alternatives, which directly benefits DIBA in PVC and polymer applications. Furthermore, the relentless growth of the personal care industry, particularly in emerging Asian economies, fuels demand for high-quality, lightweight emollients. These factors create significant upward pressure on market volume. However, the market faces critical restraints, predominantly the volatility of feedstock prices, specifically adipic acid (derived from benzene or cyclohexane) and isobutanol, which directly impacts profit margins and competitive pricing strategies. Stringent global transportation regulations for bulk chemicals also pose logistical challenges.

Opportunities for market expansion are centered around innovation and geographical penetration. The development and commercialization of bio-based Diisobutyl Adipate, synthesized from renewable resources (such as bio-based adipic acid), presents a major growth avenue, aligning with corporate sustainability goals and consumer preferences for eco-friendly products. Secondly, exploring niche, high-value applications such as biodegradable agricultural films, specialty inks, and high-performance adhesives could diversify the revenue base away from the reliance on the cyclical personal care market. These opportunities rely heavily on continuous investment in green chemistry and strategic partnerships with niche industrial manufacturers seeking sustainable input materials.

The overall impact forces are predominantly positive, favoring market expansion. Regulatory forces, particularly in Europe and North America, act as a catalyst for DIBA adoption by banning competing, less safe plasticizers. Simultaneously, economic forces, driven by increasing disposable income globally, especially in APAC, ensure sustained demand for luxury and mid-range personal care items, DIBA's largest application base. Technological advancements in esterification efficiency and purification processes help mitigate some of the manufacturing restraints by lowering operational costs and improving product consistency, thereby reinforcing DIBA's competitive advantage against other synthetic emollients and plasticizers.

Segmentation Analysis

The Diisobutyl Adipate market is comprehensively segmented based on its application type, purity grade, and geographical region, reflecting its diverse industrial utility. Understanding these segments is crucial for manufacturers to tailor production capabilities and for distributors to optimize supply chains. The primary application segmentation highlights the dominance of personal care and cosmetics, followed closely by the industrial uses in plasticizers and lubricants, demonstrating the dual market penetration of the chemical. Purity grade segmentation differentiates between industrial grades and the highly specialized cosmetic/pharmaceutical grades, which demand significantly more rigorous quality control and command premium pricing. Geographic segmentation underscores the shifting economic power dynamics, emphasizing the rapid expansion of Asia Pacific demand relative to the mature markets of North America and Europe.

In terms of product grades, the Cosmetic Grade segment is projected to exhibit the highest CAGR due to the increasing regulatory focus on ingredient quality and safety in finished consumer products. This grade requires minimal impurities and superior performance characteristics, justifying its higher cost. Conversely, Industrial Grade DIBA, used primarily in general-purpose PVC compounds and as a carrier solvent in inks and paints, remains a significant volume driver, particularly in infrastructure and construction industries across developing nations where cost efficiency is paramount.

Application diversity ensures market stability. While personal care provides the growth impetus, the Plasticizer segment acts as a volume stabilizer. DIBA is valued here for its excellent cold flexibility and low extraction rate, making it suitable for specialized plastics requiring resilience in low-temperature environments, such as outdoor wiring and specialized vehicle components. Furthermore, its role as a solvent or coalescing agent in coatings and inks is expanding as companies seek VOC-compliant alternatives, cementing DIBA's indispensable role across various manufacturing ecosystems.

- By Application:

- Cosmetics and Personal Care (Emollient, Solvent, Spreading Agent)

- Plasticizers (PVC, Rubbers, Polymers)

- Lubricants and Functional Fluids (Base stock, Additive)

- Coatings, Paints, and Inks (Coalescing Agent, Solvent)

- Others (Adhesives, Chemical Intermediates)

- By Purity Grade:

- Cosmetic Grade (High Purity)

- Industrial Grade

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Diisobutyl Adipate Market

The value chain for Diisobutyl Adipate begins upstream with the sourcing and production of key raw materials: adipic acid and isobutanol. Adipic acid is predominantly derived from petrochemical sources (cyclohexane/benzene), making its pricing highly sensitive to crude oil and refinery output. Isobutanol is commonly produced through hydroformylation of propylene or through newer fermentation processes for bio-based variants. Upstream efficiency and cost management are critical, as raw material costs constitute the largest portion of the final product price. Integration backwards into adipic acid production offers a significant competitive advantage to large chemical conglomerates by ensuring supply stability and controlling input costs, mitigating the frequent volatility observed in commodity chemical markets.

The core manufacturing stage involves the esterification reaction, typically catalyzed, followed by rigorous purification processes like distillation and filtration to achieve the required purity, especially for cosmetic and food-contact grades. Manufacturers must invest heavily in specialized, corrosion-resistant reactors and sophisticated separation technology. Post-production, the chain moves into distribution. DIBA is transported in bulk tankers, IBCs, or drums. Distribution channels are bifurcated: direct sales to large end-users (e.g., major cosmetic houses or large PVC compounders) and indirect sales through specialized chemical distributors and agents, particularly serving smaller manufacturers or geographically dispersed markets. Indirect channels play a crucial role in providing technical support and managing smaller lot sizes.

Downstream analysis focuses on the end-use industries. The largest consumption occurs in the personal care sector, where DIBA is formulated into final products like sunscreens, foundations, and skin moisturizers. The plasticizer segment is the second major consumer, incorporating DIBA into polymers destined for medical devices, cables, and automotive interiors. The final consumers dictate product specifications, particularly concerning purity and regulatory compliance (e.g., EU cosmetic directives, FDA approvals). Therefore, successful navigation of the value chain requires manufacturers to maintain close relationships with downstream formulators and stay abreast of evolving consumer trends and global chemical regulations to ensure continuous market relevance and uptake.

Diisobutyl Adipate Market Potential Customers

The primary customer base for Diisobutyl Adipate consists of large multinational corporations and specialized small-to-medium enterprises operating within the cosmetics, personal care, and polymer processing industries. Cosmetic manufacturers represent the most significant segment, utilizing DIBA extensively as an emollient, non-greasy solvent, and excellent pigment dispersant in formulations such as makeup, anti-aging creams, and especially sun protection products where spreading properties are essential for uniform coverage and effectiveness. These customers require ultra-high purity grades and compliance with rigorous international standards like COSMOS or EcoCert, necessitating robust certification from DIBA suppliers.

A secondary, yet highly critical, customer group includes producers of specialty plastics and PVC compounds. These companies seek DIBA as a non-phthalate plasticizer to impart flexibility and durability, particularly in products requiring excellent performance at low temperatures. Key sectors here are automotive component manufacturers (for dashboards and interior trim), medical device producers (for tubing and bags), and wire and cable manufacturers. These industrial customers prioritize stability, low volatility, and bulk supply consistency, often negotiating long-term contracts to ensure stable pricing and supply volumes for their continuous manufacturing processes.

Furthermore, specialty chemical formulators and lubricant blenders constitute a growing clientele. Lubricant manufacturers use DIBA as a synthetic base stock or additive in high-performance synthetic lubricants and hydraulic fluids, benefiting from its thermal stability and favorable viscosity index. Potential buyers also include manufacturers in the paints, coatings, and inks sector, where DIBA functions as a high-boiling solvent or coalescing agent, contributing to film formation and improving gloss. Sales efforts toward these customers must emphasize technical specifications, performance data, and regulatory support documentation related to industrial safety and environmental impact.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 310.5 Million |

| Market Forecast in 2033 | USD 461.2 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Lanxess, DOW Chemical, KLK Oleo, HallStar Company, Croda International, Solvay SA, Stepan Company, Emery Oleochemicals, Adeka Corporation, Evonik Industries, Kao Corporation, Wacker Chemie AG, The Chemours Company, Mitsubishi Chemical Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Diisobutyl Adipate Market Key Technology Landscape

The core technology for Diisobutyl Adipate production centers on the catalytic esterification of adipic acid and isobutanol. Traditionally, this process utilizes strong acid catalysts (like sulfuric acid or p-toluenesulfonic acid) under high temperature and pressure in batch reactors. However, current technological advancements emphasize the shift toward continuous flow reactors and the use of heterogeneous catalysts, such as solid acid resins or immobilized enzymes. Continuous processing significantly enhances productivity, ensures consistent product quality, and allows for more efficient heat management, which is crucial for maximizing yield and reducing byproduct formation. Furthermore, the selection of highly selective and recyclable catalysts is a major technological focus aimed at minimizing environmental waste and simplifying the downstream purification steps, thereby improving overall economic viability.

Purification technology forms a vital component of the landscape, especially for achieving high-purity cosmetic grades. Advanced fractional distillation techniques, often combined with solvent extraction or membrane separation technology, are employed to remove residual catalysts, unreacted raw materials, and undesirable monoester or diester byproducts. The industry is increasingly adopting vacuum distillation and thin-film evaporation to protect the thermal sensitivity of the diester molecule and reduce energy consumption. Modern analytical tools, including Gas Chromatography-Mass Spectrometry (GC-MS), are now standard practice to ensure strict quality assurance, verifying that impurity levels meet the stringent requirements of pharmaceutical and cosmetic applications, thereby sustaining the premium pricing structure of the high-grade material.

A significant emerging technological trend is the push toward sustainable synthesis methods, including enzymatic esterification and the utilization of supercritical CO2 as a reaction medium. Enzymatic routes, leveraging lipases, offer the benefit of high specificity, mild reaction conditions, and the elimination of strong acid waste, aligning perfectly with green chemistry principles. Furthermore, researchers are exploring non-conventional feedstock sources, such as bio-adipic acid derived from glucose or renewable resources, which necessitates new catalytic systems optimized for these specific inputs. This technological migration aims not only at environmental compliance but also at diversifying the feedstock base, providing long-term resilience against petrochemical market fluctuations.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market and is projected to exhibit the highest CAGR during the forecast period. This growth is primarily fueled by rapid urbanization, increasing disposable income, and the corresponding expansion of local cosmetic, personal care, and polymer manufacturing industries in China, India, and Southeast Asian countries. Favorable government policies encouraging domestic chemical production, combined with lower operational costs, attract significant foreign investment and facilitate large-scale DIBA manufacturing capacity, establishing APAC as both the largest producer and consumer base.

- Europe: Europe is characterized by stringent regulatory oversight, particularly the REACH legislation, which has strongly promoted the substitution of traditional, toxic plasticizers with safer alternatives like DIBA. Although manufacturing growth is moderate, the region commands high value due to its mature, premium cosmetic market and its leading role in specialized industrial applications requiring certified non-phthalate plasticizers. Germany, France, and the UK are key markets, focusing on high-grade DIBA imports for advanced formulation.

- North America: North America represents a mature and technologically advanced market where DIBA demand is steady, driven by the large beauty and pharmaceutical sectors. Market growth is robustly supported by a consumer base willing to pay a premium for products labeled "phthalate-free" and "clean label." The U.S. remains the primary consumer, utilizing DIBA extensively in sun care products and sophisticated lubricant applications, with market dynamics often dictated by innovations and quality standards set by major chemical and consumer goods corporations.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions are emerging markets displaying strong potential. LATAM, led by Brazil and Mexico, shows increasing demand for cosmetic ingredients due to expanding local manufacturing and rising beauty consciousness. MEA growth is linked to economic diversification and growing infrastructure projects that require DIBA for specialty coatings and high-performance plasticizers. While currently smaller in volume, these regions offer significant future expansion opportunities as their consumer sectors mature and regulatory frameworks develop.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Diisobutyl Adipate Market.- BASF SE

- Lanxess

- DOW Chemical

- KLK Oleo

- HallStar Company

- Croda International

- Solvay SA

- Stepan Company

- Emery Oleochemicals

- Adeka Corporation

- Evonik Industries

- Kao Corporation

- Wacker Chemie AG

- The Chemours Company

- Mitsubishi Chemical Corporation

- Eastman Chemical Company

- Huntsman Corporation

- Rütten Chemie

- Fujian Zishan Group

- Shandong Novista Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Diisobutyl Adipate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Diisobutyl Adipate (DIBA) and its primary function?

Diisobutyl Adipate (DIBA) is a synthetic diester chemical primarily used as a high-performance emollient, solvent, and spreading agent in cosmetics and personal care products. It also functions effectively as a non-phthalate plasticizer in various polymer systems.

Why is DIBA experiencing high demand in the cosmetics industry?

DIBA is highly valued for providing a light, non-greasy skin feel, excellent solubility for UV filters (crucial in sunscreens), and high spreadability, which enhances the aesthetic and functional quality of lotions, creams, and makeup formulations globally.

How do regulatory changes impact the growth of the DIBA market?

Stringent regulations, particularly the phase-out of traditional phthalate plasticizers (such as DEHP) in Europe and North America, strongly favor the adoption of safer alternatives like DIBA in PVC, medical, and food-contact applications, acting as a major market driver.

Which region dominates the global Diisobutyl Adipate market?

The Asia Pacific (APAC) region currently dominates the market both in terms of production capacity and consumption, driven by high manufacturing growth rates and the massive expansion of the consumer goods and personal care sectors in countries like China and India.

What are the key raw materials required for DIBA production?

The two critical raw materials for Diisobutyl Adipate synthesis are Adipic Acid, typically derived from petrochemicals, and Isobutanol, which is increasingly being sourced from bio-based routes to improve product sustainability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager