Dimmer Switch Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432586 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Dimmer Switch Market Size

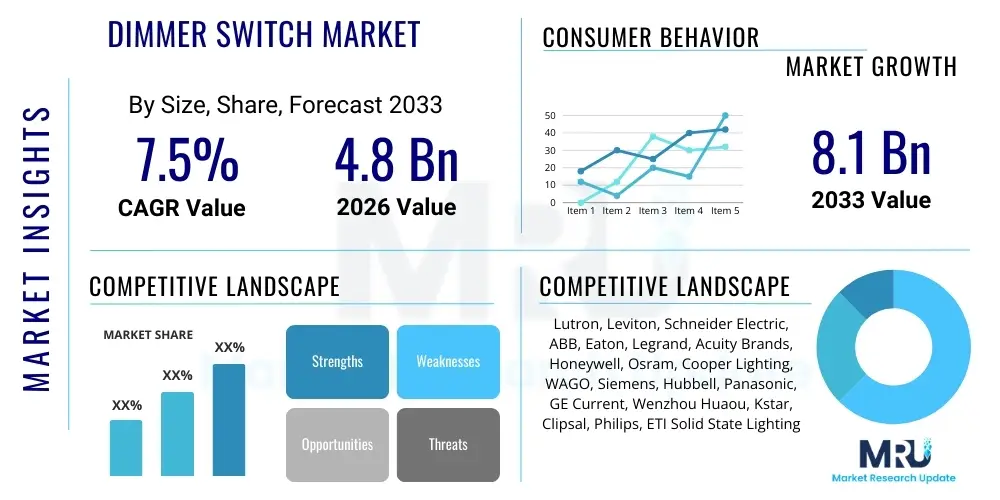

The Dimmer Switch Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 8.1 Billion by the end of the forecast period in 2033.

Dimmer Switch Market introduction

The Dimmer Switch Market encompasses the manufacturing, distribution, and sales of electrical devices used to adjust the brightness or intensity of lighting fixtures. These devices are critical components in modern lighting systems, evolving significantly from rudimentary rheostats to sophisticated solid-state and digital controls capable of managing diverse load types, particularly energy-efficient Light Emitting Diodes (LEDs). The primary function of a dimmer switch is two-fold: enhancing the aesthetic environment by creating desired ambiance and generating substantial energy savings by reducing power consumption when full lighting intensity is not required. This evolution is driven by consumer demand for personalized lighting solutions and the global shift towards sustainable building practices.

Modern dimmer switches offer substantial benefits over traditional on/off switches, including extended lifespan for connected bulbs—especially LEDs—due to reduced thermal stress, and seamless integration into smart building management systems. Major applications span residential settings, where they enhance comfort and mood control in living spaces, and commercial environments, such as hotels, restaurants, and conference facilities, where precise scene control is essential for operational aesthetics and energy management. The product range includes simple mechanical sliders, rotary controls, and complex digital touchpads offering remote and centralized control capabilities, reflecting a continuous focus on user experience and system reliability.

The core driving factors propelling the Dimmer Switch Market include the widespread global adoption of LED lighting, which necessitates compatible and highly efficient dimming solutions to prevent flicker and ensure optimal performance. Furthermore, the exponential growth of the smart home and building automation sector fuels the demand for internet-enabled, wireless dimmer switches that can be controlled via smartphones or voice commands. Increased governmental mandates promoting energy efficiency in new construction and retrofitting projects worldwide also exert significant upward pressure on market growth, positioning dimmer switches as integral components of green building strategies aimed at reducing overall carbon footprints.

Dimmer Switch Market Executive Summary

The Dimmer Switch Market is characterized by robust growth, primarily influenced by the convergence of lighting technology with IoT and smart home ecosystems. Key business trends indicate a strong industry pivot toward wireless communication protocols such as Zigbee, Z-Wave, and proprietary mesh networks, prioritizing ease of installation and interoperability across different smart platforms. Manufacturers are focusing heavily on developing highly compatible dimmers optimized specifically for varying qualities and types of LED loads, addressing historical issues like buzzing and flickering. Furthermore, strategic partnerships between lighting control manufacturers and major tech giants (e.g., Amazon, Google) are streamlining product integration and expanding the market reach of smart dimming solutions into mainstream consumer electronics channels, driving higher adoption rates globally.

Regionally, the market presents varying adoption dynamics. North America and Europe currently hold the largest market shares, attributed to high existing penetration of smart homes, robust regulatory frameworks mandating energy-efficient lighting in commercial spaces, and strong consumer awareness regarding the long-term cost benefits of dimming technology. Conversely, the Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR), fueled by massive urbanization, rapid infrastructure development, and substantial investments in smart city projects, particularly across economic powerhouses like China, Japan, and South Korea. This growth in APAC is predominantly driven by new construction projects implementing modern, energy-saving controls from the outset.

Segment trends highlight the dominance of the residential application segment in terms of volume, while the commercial segment contributes significantly to value due to the deployment of sophisticated, high-cost centralized lighting control systems. By connectivity type, the Wireless/Smart Dimmer segment is accelerating rapidly, overtaking the growth rate of traditional wired dimmers. Within the technology segment, solid-state dimmers optimized for Leading Edge (forward phase) and Trailing Edge (reverse phase) control are essential, with the latter gaining prominence for its superior performance with sensitive LED drivers. These market shifts necessitate that leading companies continuously innovate in semiconductor technology and software development to maintain competitive advantage.

AI Impact Analysis on Dimmer Switch Market

The analysis of common user questions related to AI's impact reveals a strong interest in predictive lighting capabilities, energy optimization potential, and the automation of personalized environments. Users frequently inquire whether AI can dynamically adjust light levels based on real-time factors beyond simple pre-set schedules, and how AI integration affects installation complexity and system costs. The overarching concern centers on moving dimming technology from reactive control to proactive, intelligent management, ensuring maximum comfort and minimum energy waste. This focus confirms that the market anticipates AI as a crucial element for the next generation of smart lighting systems.

The integration of Artificial Intelligence and Machine Learning (ML) transforms dimmer switches from simple mechanical controls into intelligent nodes within a larger lighting ecosystem. AI algorithms utilize data streams—such as occupancy sensors, ambient daylight levels, time-of-day, utility tariff information, and historical usage patterns—to predict and automate optimal dimming profiles without continuous user intervention. This predictive capability allows commercial buildings to execute sophisticated daylight harvesting strategies and residential users to enjoy automatically tailored lighting 'scenes,' enhancing both energy efficiency and occupant well-being far beyond the capabilities of static programming.

Furthermore, AI significantly enhances the interoperability and reliability of complex smart dimming systems. ML models can rapidly learn the precise operational characteristics of various attached light fixtures and drivers, automatically calibrating the dimmer output to eliminate issues like flicker, subtle surges, or incompatibility errors that plague mixed-load installations. This automatic calibration capability reduces installation complexity for professional contractors and improves the overall quality of light provided to the end-user. In large-scale commercial deployments, AI also aids in predictive maintenance by monitoring performance degradation, signaling potential issues with dimmers or fixtures before they fail completely.

- AI enables predictive dimming based on occupancy, ambient light, and historical data.

- Machine Learning optimizes energy usage by minimizing consumption during peak tariff hours.

- AI facilitates automated, personalized scene setting and ambiance creation.

- Algorithms enhance system reliability by calibrating output for diverse LED load characteristics.

- AI integration improves voice command accuracy and natural language processing for lighting control.

- Predictive maintenance driven by AI detects and reports dimmer unit failures proactively.

DRO & Impact Forces Of Dimmer Switch Market

The dynamic interplay of Drivers, Restraints, and Opportunities (DRO) dictates the growth trajectory of the Dimmer Switch Market. The market is primarily driven by the increasing global emphasis on energy conservation and the mandated phasing out of inefficient incandescent lighting, propelling the demand for high-performance LED-compatible dimmers. A critical driver is the accelerating penetration of smart home technology, where consumers prioritize convenience, remote access, and integration of lighting control with security and environmental systems. Conversely, market growth faces restraints, most notably the higher initial cost associated with sophisticated smart dimmers and integrated control systems compared to traditional switches, which can deter adoption in price-sensitive markets or retrofit scenarios where budgets are constrained. Additionally, complex installation and potential interoperability issues among diverse smart home protocols present a barrier to mass-market adoption.

Significant opportunities are present in the massive existing building stock requiring lighting modernization (the retrofit market), particularly in commercial and institutional sectors looking to comply with stricter building codes and achieve sustainability certifications. The technological shift towards Power over Ethernet (PoE) lighting systems offers a distinct opportunity for simplified infrastructure, centralizing power and data management and reducing the complexity of installing digital dimmers. Furthermore, developing markets in APAC and MEA, undergoing rapid electrification and infrastructure expansion, offer untapped potential for deploying state-of-the-art dimming solutions in new construction, positioning manufacturers to achieve significant economies of scale and penetrate high-growth territories.

The market is constantly shaped by powerful internal and external impact forces. Technologically, the continuous evolution of semiconductor manufacturing leads to smaller, more reliable, and lower-cost microcontrollers, essential for smart dimmer functionality. Regulatory forces, such as mandatory energy performance certificates and carbon reduction targets implemented by major economies, exert external pressure, forcing developers and property owners to invest in advanced lighting control like dimmers. Supply chain volatility, particularly related to the sourcing of crucial electronic components (e.g., semiconductor chips), remains a significant impact force affecting production volumes and product pricing across all market segments, demanding robust risk management strategies from key players.

Segmentation Analysis

The Dimmer Switch Market is comprehensively segmented based on technology, product type, connectivity, and application, allowing for a granular understanding of consumer behavior and technological preferences across different regions. The fundamental differentiation lies between traditional mechanical dimmers and advanced digital solid-state dimmers, with the latter dominating due to its compatibility with low-power LED loads. The most significant area of market transformation is the Connectivity segment, where the rapid acceptance of wireless solutions is fundamentally changing how control systems are designed and deployed, shifting focus from hardware complexity to seamless software integration and user-friendly interfaces.

- By Technology:

- Leading Edge (Forward Phase)

- Trailing Edge (Reverse Phase)

- Digital (0-10V, DALI, DMX)

- Mechanical/Rotary

- By Product Type:

- Single Pole Dimmer

- Three-Way Dimmer

- Multi-Location Dimmer

- By Connectivity:

- Wired Dimmer Switches

- Wireless/Smart Dimmer Switches (Wi-Fi, Zigbee, Z-Wave, Bluetooth Mesh)

- By Application:

- Residential

- Commercial (Office Spaces, Hospitality, Retail)

- Industrial

Value Chain Analysis For Dimmer Switch Market

The value chain for the Dimmer Switch Market begins with the highly specialized upstream analysis focused on the procurement of critical raw materials and electronic components. This includes the sourcing of semiconductor devices (TRIACs, microcontrollers, communication chips), high-grade plastics for housing, and metals for heat dissipation and internal wiring. The upstream segment is characterized by reliance on global electronic component suppliers, particularly those based in Asia, introducing significant dependency and potential vulnerability to geopolitical and supply chain disruptions. The quality and reliability of these upstream components directly dictate the performance, efficiency, and longevity of the final dimmer switch product, especially in the context of advanced smart dimming capabilities.

Midstream activities involve the intricate processes of design, manufacturing, and assembly. Manufacturers focus on product development, ensuring compatibility with evolving international standards (e.g., IEC, UL, CE) and optimizing performance for LED loads to prevent noise and flicker. The manufacturing phase involves circuit board assembly, rigorous quality control, and firmware flashing for smart units. Distribution channels are complex and bifurcated: Direct channels involve sales to major Electrical Original Equipment Manufacturers (OEMs) or large building integrators for large projects. Indirect channels heavily rely on wholesale electrical distributors, specialized lighting showrooms, and increasingly, major e-commerce platforms and DIY retail chains, particularly for consumer-grade smart products that emphasize ease of self-installation.

The downstream analysis focuses on the installation, integration, and end-user engagement. For commercial and high-end residential applications, specialized electrical contractors and smart home integrators play a crucial role in installation, commissioning, and system programming. They represent the final point of service delivery, often influencing brand choice based on reliability and ease of integration. End-users interact with the product, providing feedback that loops back to the R&D stage. The efficiency of the downstream segment is vital, as poor installation or integration can negate the technological advantages of the dimmer, making professional support and comprehensive documentation essential for market success.

Dimmer Switch Market Potential Customers

The primary segment of potential customers comprises the large and diverse residential sector, ranging from individual homeowners undertaking DIY renovations to high-net-worth individuals commissioning bespoke home automation systems. These customers are driven by aesthetic improvements, enhanced comfort, and perceived energy savings. The modern residential consumer increasingly prioritizes smart features, seeking switches that integrate seamlessly with existing home assistants (like Alexa or Google Home), offering mobile control and personalized automation schedules. The residential market is highly sensitive to product design, installation simplicity, and overall cost-effectiveness, driving demand for retrofit-friendly, wireless solutions.

The commercial sector represents another critical customer base, demanding robustness, centralized control, and compliance with stringent energy standards. Key customers include operators of hospitality venues (hotels, restaurants) utilizing dimmers to create flexible and sophisticated ambiance control; office building managers implementing daylight harvesting and occupancy-based dimming to meet sustainability goals and reduce operating expenditures; and retail environments utilizing scene control to highlight merchandise. For commercial buyers, the total cost of ownership (TCO), system scalability, reliability, and integration capabilities with larger Building Management Systems (BMS) are paramount considerations, favoring robust digital systems like DALI or 0-10V controls.

A specialized segment of potential customers includes industrial facilities and institutional buyers (schools, hospitals, government bodies). While industrial applications traditionally focused on sheer utility, modern industrial facilities are increasingly adopting advanced controls in areas like high-bay lighting and warehousing to optimize maintenance cycles and conserve energy. Institutional buyers prioritize longevity, adherence to safety codes, and ease of maintenance, making long-term product support and high component reliability essential purchasing criteria. These customers typically engage directly with manufacturers or large systems integrators for procurement and implementation, focusing on long-life, low-maintenance solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 8.1 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lutron, Leviton, Schneider Electric, ABB, Eaton, Legrand, Acuity Brands, Honeywell, Osram, Cooper Lighting, WAGO, Siemens, Hubbell, Panasonic, GE Current, Wenzhou Huaou, Kstar, Clipsal, Philips, ETI Solid State Lighting |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dimmer Switch Market Key Technology Landscape

The technological landscape of the Dimmer Switch Market is predominantly defined by the evolution of solid-state electronic control systems designed to interface reliably with modern low-wattage lighting loads, primarily LEDs. The shift from older triac-based Leading Edge (forward phase) technology to more sophisticated Trailing Edge (reverse phase) dimming is crucial, as the latter offers superior performance with electronic LED drivers, minimizing flicker and noise. Furthermore, the increasing adoption of Digital Addressable Lighting Interface (DALI) and 0-10V analog controls provides the necessary framework for precise, networked lighting management in large-scale commercial and industrial applications, allowing individual fixture control and energy monitoring.

Connectivity standards are arguably the most dynamic aspect of the current technological environment. Wireless communication protocols like Zigbee, Z-Wave, and proprietary Wi-Fi solutions enable smart dimmers to integrate seamlessly into IoT ecosystems, offering remote diagnostics and firmware updates. The proliferation of these standards demands high levels of hardware compatibility and rigorous testing to ensure interoperability. The emerging use of Bluetooth Mesh further extends the range and robustness of decentralized control networks within commercial spaces, offering a lower-power alternative to traditional wired systems and facilitating massive-scale device deployments.

Innovation is also centered on enhancing the user interface and system resilience. Manufacturers are incorporating advanced microprocessors to manage complex load profiles and offer features like minimum/maximum trimming adjustments, ensuring optimal performance regardless of the attached fixture. The integration of sensors—such as ambient light and ultrasonic occupancy sensors—directly into the switchplate hardware is becoming common, enabling localized automation. Looking forward, Power over Ethernet (PoE) technology is gaining traction, promising to fundamentally simplify commercial installations by delivering both power and data over standard Ethernet cabling, positioning digital dimmers as crucial endpoints in the convergence of IT and building services.

Regional Highlights

- North America: This region maintains a leading position, driven by high consumer spending on smart home technology, stringent energy regulations (particularly Title 24 in California), and the presence of major industry players like Lutron and Leviton. The market here is mature but experiences high-value growth through the continuous adoption of advanced smart controls and widespread retrofit projects in aging commercial infrastructure.

- Europe: Europe is a key market characterized by strong regulatory commitment to energy efficiency (e.g., EU Ecodesign Directive) and a high preference for sustainable and certified building materials. Germany, the UK, and the Nordics are major markets, focusing heavily on digital standards like DALI for large commercial installations and prioritizing robust, aesthetically pleasing designs for residential use.

- Asia Pacific (APAC): APAC is the fastest-growing market, propelled by rapid urbanization and large-scale smart city initiatives in countries such as China, India, and Southeast Asia. The growth here is primarily concentrated in new construction, where the focus is on integrating cost-effective, high-volume smart dimming solutions into residential high-rises and new commercial hubs, emphasizing wireless solutions.

- Latin America (LATAM): The LATAM market is emerging, with adoption rates linked closely to economic stability and infrastructure investment. While price sensitivity remains a factor, increasing awareness of energy costs and the slow but steady penetration of international smart home brands are stimulating demand, particularly in major economies like Brazil and Mexico.

- Middle East and Africa (MEA): Growth in MEA is highly localized, concentrated in the Gulf Cooperation Council (GCC) states (UAE, Saudi Arabia) due to large-scale, high-value commercial and hospitality projects requiring premium lighting control systems. Energy management is a critical driver, supporting high-end digital and automated dimming solutions in luxurious new developments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dimmer Switch Market.- Lutron Electronics Co., Inc.

- Leviton Manufacturing Co., Inc.

- Schneider Electric SE

- ABB Ltd.

- Eaton Corporation plc

- Legrand SA

- Acuity Brands, Inc.

- Honeywell International Inc.

- Osram GmbH

- Cooper Lighting Solutions

- WAGO Kontakttechnik GmbH & Co. KG

- Siemens AG

- Hubbell Incorporated

- Panasonic Corporation

- GE Current (A Daintree Company)

- Wenzhou Huaou Electronic Co., Ltd.

- Kstar Corporation

- Clipsal by Schneider Electric

- Philips (Signify)

- ETI Solid State Lighting

Frequently Asked Questions

Analyze common user questions about the Dimmer Switch market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Leading Edge and Trailing Edge dimmers?

Leading Edge dimmers (forward phase) are traditional, robust controls often used for incandescent and magnetic low-voltage loads. Trailing Edge dimmers (reverse phase) are more sophisticated, offer smoother control, and are specifically recommended and optimized for use with sensitive, low-wattage LED and electronic low-voltage loads, minimizing potential flicker or incompatibility issues.

How is the growth of the IoT impacting the Dimmer Switch Market?

IoT integration is fundamentally shifting the market towards wireless, smart dimmer switches (Wi-Fi, Zigbee, Z-Wave). This allows for remote control, voice activation, and integration into comprehensive home automation systems, driving substantial growth in the premium and residential retrofit segments by prioritizing user convenience and data-driven energy management.

Which application segment holds the largest market share for dimmer switches?

While the Commercial segment drives high-value adoption of advanced digital systems (like DALI), the Residential segment typically holds the largest market share in terms of volume. Residential demand is fueled by DIY installers and professional integrators seeking easy-to-use, aesthetically pleasing, and energy-saving controls for general living spaces.

What is DALI and why is it important in commercial dimming?

DALI (Digital Addressable Lighting Interface) is a technical standard for networked lighting control used predominantly in commercial buildings. It is crucial because it allows individual control and monitoring of every fixture on the network, enabling precise, centralized management of complex lighting systems required for advanced energy harvesting and reporting.

What challenges do manufacturers face in maintaining LED dimmer compatibility?

The primary challenge stems from the vast variability in quality and design across different LED drivers and fixtures. Manufacturers must develop dimmers capable of reliably handling diverse minimum load requirements, managing electrical noise, and preventing flickering across all potential loads, requiring constant hardware and firmware optimization.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager