DIN Rail Channel Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434814 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

DIN Rail Channel Market Size

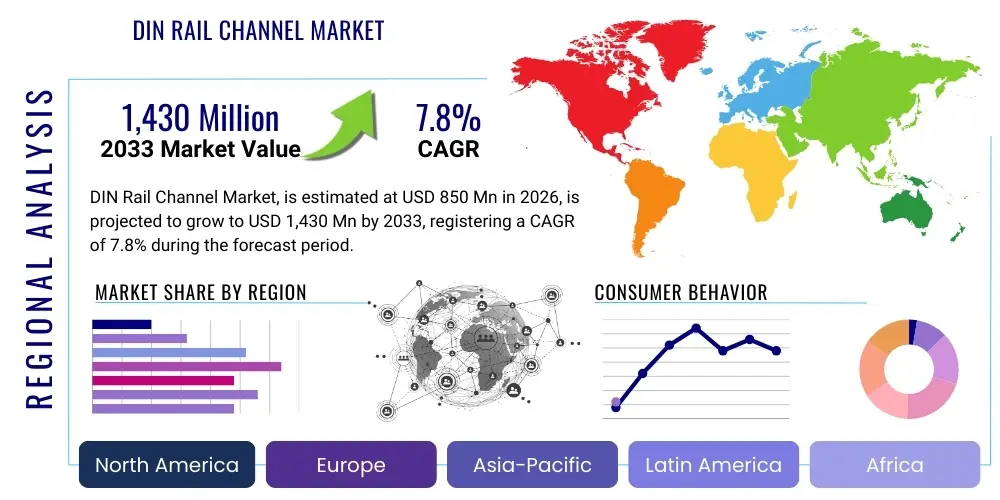

The DIN Rail Channel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,430 Million by the end of the forecast period in 2033.

DIN Rail Channel Market introduction

The DIN Rail Channel Market encompasses standardized metal rails used extensively in industrial control cabinets and equipment racks for mounting circuit breakers, terminal blocks, relays, power supplies, and various electronic devices. These rails adhere to specific European standards (such as EN 60715) established by the Deutsches Institut für Normung (DIN), ensuring interchangeability and system compatibility globally. The primary product descriptions include the ubiquitous Top Hat rail (TS 35), the G-type rail, and the Mini DIN rail (TS 15), differentiated by cross-sectional profiles and load-bearing capacities. The standardization of these channels is critical for maintaining efficiency and organization within complex electrical and control systems, serving as the foundational physical infrastructure for automated environments.

Major applications for DIN rail channels span across high-growth sectors, particularly industrial automation, where they form the backbone of Programmable Logic Controllers (PLC) panels and distribution boards. Other critical applications include power distribution in commercial and residential buildings, telecommunications infrastructure, railway signaling systems, and specialized medical equipment. The inherent benefit of using DIN rails lies in their ability to facilitate quick assembly, modification, maintenance, and easy replacement of components, thereby reducing system downtime and labor costs. This modularity is a key advantage in modern manufacturing environments focused on flexibility and rapid deployment.

The market is primarily driven by the continuous global expansion of industrial automation (Industry 4.0 initiatives), the increasing necessity for standardized and compliant electrical installations, and significant investments in smart infrastructure projects worldwide. Furthermore, the rising adoption of modular power supplies and sophisticated electronic control gear requires robust, organized mounting solutions that only DIN rails can consistently provide. Regulatory compliance concerning electrical safety and standardization also acts as a strong driver, mandating the use of tested and certified mounting hardware in all professional installations.

DIN Rail Channel Market Executive Summary

The global DIN Rail Channel Market is characterized by robust business trends centered on material innovation, particularly the shift towards specialized aluminum alloys and advanced polymers designed for lighter weight and enhanced corrosion resistance in harsh industrial settings. Key business developments involve mergers and acquisitions aimed at consolidating manufacturing capabilities and supply chain optimization, allowing leading players to offer integrated cabinet solutions rather than just standalone rail components. Furthermore, the focus on sustainable manufacturing practices and the development of rails suitable for high-vibration and extreme temperature environments represent significant areas of competitive differentiation among market stakeholders seeking long-term contract stability with major system integrators.

Regional trends indicate that Asia Pacific (APAC) is emerging as the fastest-growing market, driven by massive infrastructure spending, rapid industrialization, and the establishment of new manufacturing hubs, especially in China, India, and Southeast Asian nations. North America and Europe, while mature, maintain strong market shares fueled by the continuous modernization of existing industrial infrastructure and stringent regulatory requirements that necessitate frequent upgrades and standardization compliance. These regions exhibit a higher demand for premium, specialized materials and pre-assembled solutions that expedite installation processes, reflecting a higher labor cost environment and a focus on maximizing system efficiency.

Segmentation trends highlight the enduring dominance of the Top Hat (TS 35) segment due to its universal compatibility with most industrial control components. However, there is a measurable shift in material preference, with galvanized steel remaining the volume leader, but aluminum witnessing accelerated growth in applications where weight reduction and heat dissipation are critical factors, such as in telecommunications and data centers. The industrial automation and control panels segment remains the largest application area, benefitting directly from global manufacturing output growth and the increasing complexity of modern machinery that requires organized component mounting for reliable operation.

AI Impact Analysis on DIN Rail Channel Market

Common user questions regarding the impact of AI on the DIN Rail Channel Market often revolve around whether AI-driven design tools will obsolete standardized physical infrastructure or if AI integration will simply optimize the maintenance and operational life of control cabinets. Users are concerned about how predictive maintenance facilitated by AI affects the longevity requirements of physical components like rails and terminal blocks, and whether AI can optimize cabinet layouts for improved thermal management. The underlying theme is the transition from static, physical infrastructure planning to dynamic, data-driven optimization within the control panel environment, raising questions about material needs, mounting density, and real-time structural monitoring.

The convergence of AI with industrial hardware primarily influences the design phase and the ongoing operational management of control panels where DIN rails reside. AI algorithms are increasingly being used in Computer-Aided Engineering (CAE) tools to automatically generate optimal panel layouts, minimizing wire lengths, balancing heat loads, and maximizing component density on the rail. This optimization ensures that manufacturers require specific lengths and specialized DIN rail accessories, moving away from generalized bulk purchases toward highly customized, pre-cut, and pre-drilled solutions tailored by AI-driven designs. This shift significantly affects the supply chain, demanding just-in-time delivery of application-specific rail formats.

Operationally, AI contributes to predictive maintenance systems that monitor environmental factors (temperature, vibration) within the control cabinet. While the DIN rail itself is a passive component, the data gathered by AI-linked sensors mounted on or near the rail provides insights into potential hardware failures, allowing for proactive intervention. This capability increases the demand for DIN rails that incorporate features like integrated grounding pathways or accessory slots for sensor mounting, making the rail an active part of the intelligent ecosystem. Ultimately, AI elevates the requirement for high-precision manufacturing and material consistency to ensure the foundational integrity of the intelligent control system.

- AI-driven optimization facilitates denser, more efficient component arrangement on DIN rails, reducing cabinet size requirements.

- Predictive maintenance systems, enabled by AI, increase the expectation for long-term structural integrity and material durability of the installed rails.

- AI tools are influencing custom cutting and machining requirements, shifting demand toward application-specific, non-standard rail lengths.

- Enhanced thermal modeling via AI mandates the increased use of heat-dissipating materials like aluminum alloys for DIN rail construction.

- Integration of smart sensors for environmental monitoring may lead to demand for DIN rails with specialized mounting features or integrated data conduits.

DRO & Impact Forces Of DIN Rail Channel Market

The dynamics of the DIN Rail Channel Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the market’s impact forces. Key drivers include the accelerated global trend toward industrial digitalization and the deployment of modular control systems across manufacturing, energy, and infrastructure sectors, which fundamentally rely on standardized mounting systems. This reliance is countered by significant restraints, primarily revolving around intense price competition, particularly for standard steel rails, leading to suppressed margins, and the challenge of managing volatile raw material costs, especially steel and aluminum, which directly impact the final product cost and procurement planning for end-users.

Opportunities in this market are significant and primarily reside in product specialization and geographic expansion. The development of specialized DIN rails designed for specific harsh environments (e.g., marine, chemical processing) using high-grade stainless steel or advanced engineering plastics presents a high-margin opportunity. Furthermore, penetration into emerging economies in APAC and Latin America, coupled with the establishment of local manufacturing facilities to shorten supply chains, offers substantial growth potential. Strategic partnerships with major Original Equipment Manufacturers (OEMs) and system integrators to co-develop custom cabinet solutions also represent a crucial pathway for market players to capture value beyond commodity sales.

The impact forces driving the market forward are primarily technological standardization (EN 60715), which ensures a large, consistent addressable market, and the inexorable rise of factory automation, which creates ongoing, non-negotiable demand for physical mounting solutions. Restraining forces related to supply chain volatility and intellectual property challenges concerning proprietary profile designs temper growth ambitions. The overarching impact force remains the necessity of safety and compliance; as long as electrical and electronic components require secure, standardized, and easily accessible physical mounting within enclosures, the DIN rail channel market will experience sustained, moderate growth, propelled by mandatory industry regulations and the pursuit of operational excellence.

Segmentation Analysis

The DIN Rail Channel Market is segmented based on product type, material composition, and application area to provide a granular understanding of consumer purchasing patterns and technological demands. Analyzing these segments is essential for identifying high-growth niches, such as specialized materials or tailored industrial applications. The segmentation strategy reflects the diverse operational environments in which control systems are deployed, ranging from clean, temperature-controlled data centers to harsh, corrosive outdoor industrial sites, thereby influencing the choice of rail profile and construction material.

Segmentation by product type centers on the standardized profiles mandated by international norms, with the TS 35 (Top Hat) rail representing the largest volume segment due to its universal acceptance and compatibility. Segmentation by material reveals a crucial divergence in demand: galvanized steel dominates high-volume, cost-sensitive projects, while stainless steel and aluminum capture higher-value segments requiring specific properties like chemical resistance or thermal conductivity. Material selection is increasingly critical, as modern control systems generate more heat, necessitating materials that aid in passive cooling within the cabinet structure.

Application-based segmentation demonstrates the foundational importance of DIN rails in the industrial ecosystem. The industrial automation and control panels segment leads significantly, driven by factory upgrades and new plant installations. The emergence of smart grids and renewable energy infrastructure is bolstering the power supplies and energy management application segment. Effective market strategy requires targeting these specific application needs with corresponding material and profile specifications to maximize market penetration and command premium pricing for specialized solutions.

- By Type:

- Top Hat Rail (TS 35)

- G-Type Rail

- Mini DIN Rail (TS 15)

- C-Section Rail

- By Material:

- Galvanized Steel

- Stainless Steel (304, 316 Grades)

- Aluminum

- PVC/Nylon

- By Application:

- Industrial Automation and Control Panels

- Power Supplies and Distribution

- Telecommunications and Networking Equipment

- Building Infrastructure and HVAC Controls

- Railway and Transportation Systems

- OEM (Original Equipment Manufacturing) Specific Applications

Value Chain Analysis For DIN Rail Channel Market

The value chain for the DIN Rail Channel Market begins with upstream activities focused heavily on raw material sourcing and primary processing. Key upstream inputs are standardized metals—primarily high-quality steel (often cold-rolled or galvanized) and aluminum billets, along with specialized engineering plastics for certain lightweight applications. Efficiency in this stage is determined by global commodity pricing and the ability of processors to achieve precise tolerances during the extrusion or rolling processes. Suppliers maintaining long-term contracts with large steel and aluminum producers benefit from stabilized input costs, which is a major competitive advantage in this commodity-intensive sector.

The core manufacturing stage involves shaping these raw materials into standardized DIN profiles, typically through rolling, forming, or drawing processes, followed by precision cutting, drilling, and finishing treatments (such as zinc plating or powder coating for corrosion resistance). Downstream activities primarily involve system integration and final installation. Manufacturers often supply rails directly to large-scale cabinet builders and electrical wholesalers (indirect distribution). System integrators then utilize these rails to assemble complex control panels for end-users in automotive, food and beverage, or petrochemical industries. The increasing demand for customization means that some manufacturers now offer value-added services like pre-assembly or kitting, minimizing labor requirements at the system integration level.

Distribution channels in this market are bifurcated into direct sales to large, captive OEM customers requiring high volumes and specific logistical requirements, and indirect sales through a vast network of electrical distributors, industrial supply houses, and specialized automation component retailers. The indirect channel relies heavily on large inventory holdings and rapid fulfillment capabilities due to the standardized nature of the product. Manufacturers leverage both channels to ensure broad market reach, but margin pressure is typically higher in the indirect distribution channel, necessitating robust branding and logistical efficiency to maintain profitability and ensure widespread availability of products like the ubiquitous TS 35 rail.

DIN Rail Channel Market Potential Customers

The primary potential customers and end-users of DIN Rail Channel products are entities involved in the design, assembly, and maintenance of electrical and electronic control systems across various sectors. These customers include large industrial automation firms (system integrators), Original Equipment Manufacturers (OEMs) specializing in machinery production, and major utility providers managing power distribution infrastructure. These customers require high volumes of standardized and reliable rails to serve as the structural foundation for their proprietary control panels and operational equipment. Their purchasing decisions are driven equally by adherence to international standards (EN 60715), material quality, and competitive pricing for bulk procurement.

A second major category of customers comprises commercial and residential building infrastructure developers, including HVAC (Heating, Ventilation, and Air Conditioning) system providers and building management system (BMS) installers. These users typically utilize smaller quantities but frequently require specialized plastic or galvanized rails for localized distribution boards and less demanding environmental conditions. Electrical contractors and maintenance service providers also form a continuous stream of aftermarket customers, purchasing replacement or extension rails during system upgrades or repairs, emphasizing the need for robust retail and distribution support.

Furthermore, specialized industries like transportation (railway and marine) and telecommunications represent high-value customer segments. Railway systems, for instance, demand rails made from corrosion-resistant and vibration-dampening materials due to extreme operational stresses, leading to the adoption of specialized stainless steel profiles. Telecommunications customers, particularly those managing data centers, prioritize lightweight aluminum rails for easier installation in high-density rack environments and superior thermal performance. Targeting these niche applications with material-specific product lines allows manufacturers to achieve superior margins and secure long-term, specialized contracts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,430 Million |

| Growth Rate | CAGR 7.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Phoenix Contact, Weidmuller Interface GmbH & Co. KG, ABB Ltd., Schneider Electric SE, TE Connectivity Ltd., Rittal GmbH & Co. KG, WAGO Kontakttechnik GmbH & Co. KG, Eaton Corporation plc, Hammond Manufacturing Co. Ltd., Altech Corporation, Adels Contact, Cembre S.p.A., Lutze Inc., Dinkle International Co., Ltd., Zucchini S.p.A., Rockwell Automation, Inc., Hubbell Incorporated, Mencom Corporation, Conta-Clip, Block Transformatoren-Elektronik GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

DIN Rail Channel Market Key Technology Landscape

The technology landscape for the DIN Rail Channel Market centers less on disruptive electronic innovation and more on precision manufacturing, material science advancements, and integration capabilities. A critical technological aspect is the precision rolling and extrusion techniques employed to ensure the rails meet the strict dimensional tolerances required by the EN 60715 standard. Any deviation in profile geometry can compromise the secure mounting of components, necessitating continuous investment in advanced forming machinery, often involving multi-stage cold rolling, which guarantees uniform thickness and dimensional stability across vast production runs, directly impacting product quality and interchangeability.

Material technology is another significant area of focus, driven by the need to address specific application challenges. The development of specialized corrosion-resistant coatings, such as advanced galvanization processes and specialized finishes for stainless steel (e.g., passivation), is essential for penetrating markets like wastewater treatment or offshore oil and gas platforms. Similarly, research into lightweight, high-strength aluminum alloys that offer better heat dissipation without compromising mechanical load-bearing capacity is vital for modern, densely packed control cabinets where thermal management is a primary concern for system reliability and longevity.

Furthermore, technology is applied in the area of value-added services and integration design. This includes the use of automated, high-speed CNC machining centers for pre-cutting, punching, and marking rails according to customer-specific schematics. The ability to integrate features directly into the rail profile, such as shielded grounding connections or unique mounting slots for cable management systems, constitutes a key technological differentiator. This holistic approach, integrating manufacturing precision with design flexibility, is essential for high-volume suppliers to maintain market leadership and align with the principles of efficient modular manufacturing.

Regional Highlights

The DIN Rail Channel Market exhibits diverse growth trajectories across major geographical regions, heavily influenced by local manufacturing maturity, infrastructure investment cycles, and regulatory environments. Europe, as the region where the DIN standard originated, maintains a highly mature market characterized by stringent quality demands, high regulatory compliance standards, and a robust replacement cycle for industrial equipment. Germany, in particular, remains a technological hub, driving demand for premium, highly specified rail systems used in sophisticated machine building and advanced automation projects across various industrial verticals.

North America demonstrates consistent growth, driven by significant investments in modernizing aging infrastructure, expanding renewable energy projects, and revitalizing domestic manufacturing capabilities. The market here focuses on quick installation systems and customized solutions that reduce labor costs. The demand for galvanized steel rails remains strong, but there is a rapidly increasing uptake of aluminum rails in data center and telecommunications applications where structural weight and heat management are paramount design considerations, often prioritizing rails that adhere to UL safety standards alongside EN specifications.

Asia Pacific (APAC) is projected to experience the fastest growth rate throughout the forecast period. This rapid expansion is fueled by massive government investments in developing smart cities, railway networks, and large-scale industrial parks, particularly in emerging economies like India, Vietnam, and Indonesia. While price sensitivity characterizes a significant portion of the APAC market, driving demand for cost-effective galvanized steel rails, the simultaneous adoption of Industry 4.0 technologies by multinational corporations setting up operations in the region is creating substantial pockets of demand for high-specification, specialized rail solutions, ensuring a balanced growth profile across material types.

- Asia Pacific (APAC): Highest projected CAGR due to rapid urbanization, massive infrastructure development (railways, smart grids), and significant investment in industrial automation across China and India.

- Europe: Mature market characterized by high quality and regulatory compliance demand; focused on machine building, system modernization, and specialized rail systems (e.g., stainless steel for hazardous areas).

- North America: Stable growth driven by factory upgrades, telecommunications expansion, and high adoption rates of aluminum rails for weight and thermal advantages, emphasizing UL compliance alongside EN standards.

- Latin America (LATAM): Emerging market driven by oil and gas sector investments and domestic manufacturing expansion, although growth is often sensitive to economic stability and capital expenditure cycles.

- Middle East and Africa (MEA): Growth concentrated in large-scale energy projects (oil & gas, renewables) and commercial building development, requiring high-grade, often corrosion-resistant, galvanized and stainless steel rails.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the DIN Rail Channel Market.- Phoenix Contact

- Weidmuller Interface GmbH & Co. KG

- ABB Ltd.

- Schneider Electric SE

- TE Connectivity Ltd.

- Rittal GmbH & Co. KG

- WAGO Kontakttechnik GmbH & Co. KG

- Eaton Corporation plc

- Hammond Manufacturing Co. Ltd.

- Altech Corporation

- Adels Contact

- Cembre S.p.A.

- Lutze Inc.

- Dinkle International Co., Ltd.

- Zucchini S.p.A.

- Rockwell Automation, Inc.

- Hubbell Incorporated

- Mencom Corporation

- Conta-Clip

- Block Transformatoren-Elektronik GmbH

Frequently Asked Questions

Analyze common user questions about the DIN Rail Channel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for galvanized steel DIN rails versus aluminum rails?

The primary driver for galvanized steel DIN rails is cost-effectiveness and mechanical strength, making them ideal for high-volume, general industrial control panel applications. Aluminum rails, conversely, are driven by applications requiring superior corrosion resistance, lighter weight, and enhanced thermal dissipation capabilities, such as in telecommunications equipment and harsh outdoor environments, justifying their higher unit cost.

How does the EN 60715 standard influence global DIN rail market dynamics and supply chain?

The EN 60715 standard provides mandatory dimensional and profile specifications (e.g., TS 35 for Top Hat rails), ensuring component interchangeability globally. This standardization minimizes inventory complexity for system integrators, promotes open competition among manufacturers, and ensures that the DIN rail remains a universally reliable foundation for industrial control systems regardless of geographic location.

Which application segment holds the largest market share and why is it dominant?

The Industrial Automation and Control Panels segment holds the largest market share. This dominance is due to the exponential growth in factory automation, PLC systems, and machinery manufacturing worldwide, where standardized DIN rails are indispensable for securely mounting thousands of crucial electronic and electrical control components in an organized and accessible manner.

What are the most significant technological trends impacting the material development of DIN rails?

Key technological trends include advanced surface treatments (e.g., specialized plating or coating) to combat environmental corrosion in extreme conditions, and material science innovation focusing on high-purity aluminum alloys for optimal heat management and reduction of overall cabinet weight. These trends cater directly to the increasing density and thermal load of modern control equipment.

How does raw material price volatility specifically affect manufacturers and end-users in the DIN rail market?

For manufacturers, volatility in steel and aluminum prices directly impacts production costs and gross margins, requiring sophisticated hedging and procurement strategies. For end-users, especially large system integrators, price fluctuations complicate long-term project budgeting and may prompt strategic decisions regarding the substitution of higher-cost materials like stainless steel with specialized galvanized options.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager