DIN Rail Power Supply Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435047 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

DIN Rail Power Supply Market Size

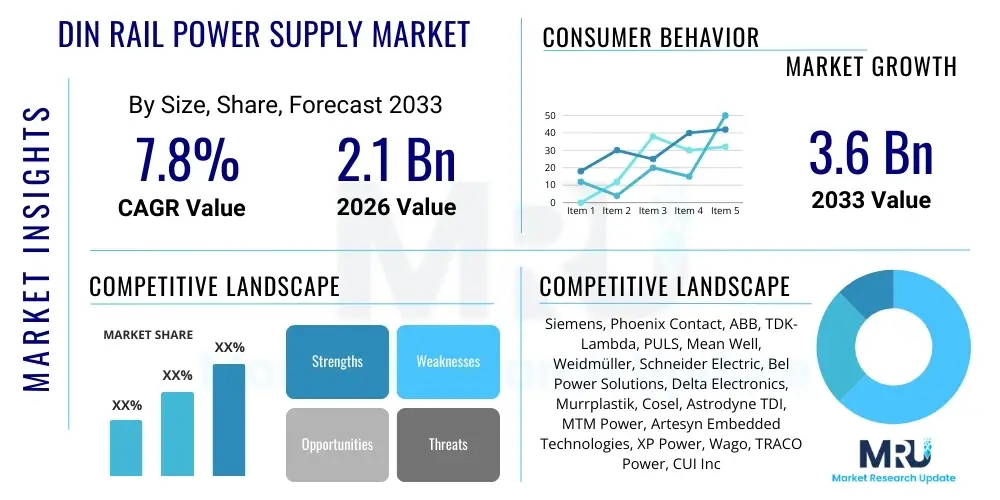

The DIN Rail Power Supply Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 3.6 Billion by the end of the forecast period in 2033.

DIN Rail Power Supply Market introduction

The DIN Rail Power Supply Market encompasses devices designed to convert AC voltage into regulated DC voltage, specifically packaged in housings optimized for mounting on standard DIN rails (TS-35, TS-32, or TS-15) commonly found within industrial control cabinets and automation systems. These power supplies are critical components in ensuring reliable and stable operation of sensitive electronic equipment, programmable logic controllers (PLCs), human-machine interfaces (HMIs), sensors, and actuators. Their robust design, compact form factor, and ease of installation make them indispensable in demanding industrial environments where space efficiency and uptime are paramount.

Major applications span across diverse sectors, including discrete manufacturing, process industries, and infrastructure development, driven by the ongoing global trend toward digitalization and automation. The primary benefits of utilizing DIN rail power supplies include enhanced system reliability due to features like short-circuit protection and overload safeguards, improved thermal management, and rapid scalability for complex control systems. Furthermore, their modular nature facilitates easier maintenance and integration into existing setups, significantly reducing overall operational costs for end-users.

Key driving factors propelling market growth include the robust expansion of Industry 4.0 initiatives, necessitating high-efficiency and intelligent power management solutions. Regulatory requirements mandating safer and more energy-efficient industrial machinery, particularly in regions like Europe and North America, further stimulate demand. The increasing deployment of distributed control systems and smart factory environments directly translates into a higher adoption rate of modular, high-performance DIN rail power supplies capable of handling transient loads and communicating diagnostic data.

DIN Rail Power Supply Market Executive Summary

The global DIN Rail Power Supply Market is characterized by moderate to high growth, fundamentally fueled by pervasive industrial automation and the infrastructural requirements of smart factories. Business trends highlight a significant shift towards high-power density units, modular designs, and power supplies equipped with communication interfaces (like IO-Link or Modbus) for predictive maintenance and remote monitoring. Manufacturers are intensely focused on developing products with high Mean Time Between Failures (MTBF) and achieving stringent efficiency standards (e.g., 80 PLUS levels) to meet energy conservation goals, making innovation in switched-mode power supply (SMPS) technology a critical competitive differentiator.

Regional trends indicate that Asia Pacific (APAC), particularly China and India, maintains its position as the fastest-growing market due to massive capital investments in manufacturing capacity expansion and infrastructure modernization. North America and Europe, while mature, demonstrate strong demand for premium, highly certified products emphasizing cyber-security features and extreme temperature tolerance necessary for specialized applications in oil & gas or renewable energy storage. The regulatory push towards electromagnetic compatibility (EMC) compliance is particularly strong in European markets, influencing product design specifications globally.

Segmentation trends show that the 24V DC output voltage segment continues to dominate the market share, being the standard operating voltage for most industrial control components. However, demand for higher current ratings (above 10A) is surging, reflecting the increasing power requirements of modern integrated automation cells. In terms of type, three-phase power supplies are gaining traction in heavy industrial machinery and large-scale renewable energy installations where higher efficiency and balanced load distribution are mandatory. The industrial automation and process control sectors remain the largest end-users, driving specifications toward ruggedization and advanced diagnostic capabilities.

AI Impact Analysis on DIN Rail Power Supply Market

User inquiries regarding AI's influence on the DIN Rail Power Supply Market primarily center on three areas: how AI facilitates predictive maintenance of power systems, the role of power supplies in supporting AI-enabled edge computing devices, and the design requirements for powering highly efficient neural processing units (NPUs) within industrial controllers. Users are concerned about whether current DIN rail technology can reliably supply clean, transient-free power to sophisticated AI hardware and whether these supplies can integrate seamlessly into AI-driven monitoring platforms. Expectations include AI leading to power supplies that self-diagnose, dynamically adjust voltage output based on real-time load prediction, and optimize energy consumption across entire control networks, moving beyond simple static fault detection.

The integration of AI algorithms profoundly enhances the operational lifespan and reliability of DIN rail power supplies. By analyzing continuous diagnostic data, such as internal temperature fluctuations, output ripple, and input voltage stability trends, AI can predict potential component failure long before conventional monitoring systems trigger alerts. This shift from reactive or preventive maintenance to predictive maintenance significantly boosts uptime in critical infrastructure. Furthermore, AI tools are increasingly used in the design phase, enabling manufacturers to simulate complex thermal and electrical stress scenarios, optimizing the physical layout and component selection to achieve unprecedented levels of efficiency and miniaturization, crucial for high-density industrial applications.

Moreover, AI fuels the need for increasingly sophisticated edge computing devices deployed in manufacturing facilities for real-time data processing and decision-making. These high-performance computing modules require stable, high-quality power delivery, often necessitating specialized DIN rail power supplies with advanced features like Power over Ethernet (PoE) functionality or extremely low noise profiles. As industrial IoT (IIoT) sensors and edge gateways become smarter and AI-dependent, the power supply must transition from a passive converter to an active, communicative component that reports its own health metrics directly to the centralized AI management system, thereby becoming an integral part of the overarching data ecosystem.

- AI-Driven Predictive Maintenance: Enables forecasting of power supply failures based on ripple analysis and temperature trends, maximizing equipment uptime.

- Enhanced Design Optimization: AI algorithms accelerate the design process, improving thermal efficiency and power density of new DIN rail units.

- Support for Edge Computing: High-quality, low-noise DIN rail power supplies are essential for reliably powering sensitive AI/ML hardware at the network edge.

- Dynamic Load Management: Future AI integration allows power supplies to dynamically adjust output parameters based on predicted industrial loads, improving energy efficiency.

- Self-Diagnosis and Communication: AI enables power supplies to communicate complex health status and operational data autonomously to central control systems.

DRO & Impact Forces Of DIN Rail Power Supply Market

The DIN Rail Power Supply Market is fundamentally shaped by powerful drivers such as accelerating industrial automation adoption and the subsequent demand for highly reliable, standardized components. Restraints primarily involve supply chain volatility, particularly concerning semiconductor components, and intense price competition, especially in lower-power segments where standardization is high. Opportunities lie in developing specialized, high-efficiency products targeting niche markets like renewable energy storage and explosion-proof environments (ATEX/IECEx certified). The impact forces, characterized by technological advancements in wide-bandgap semiconductors (SiC/GaN) and stringent regulatory mandates for energy efficiency, compel manufacturers to continuously innovate and upgrade their product offerings.

Drivers: The dominant driver remains the global push towards Industry 4.0, which integrates cyber-physical systems and IIoT devices, demanding standardized and reliable power infrastructure. Coupled with this is the continuous growth in processing control systems, requiring redundant and highly efficient power solutions. The modularity and standardization offered by DIN rail mounting drastically reduce installation complexity and downtime, making them the preferred choice over chassis-mount power supplies in factory environments. Furthermore, regulatory bodies increasingly emphasize safety standards (e.g., UL 508, IEC 60950) and robust electromagnetic compatibility (EMC) compliance, favoring high-quality, certified DIN rail units.

Restraints: The primary restraint is the vulnerability of the supply chain to global geopolitical events and raw material shortages, particularly for specialized components required in high-power density designs. Another significant challenge is the commoditization in the low-power (e.g., 12V and 24V up to 5A) standard segment, where intense competition from Asian manufacturers drives down margins, pressuring established players to maintain quality while cutting costs. Technical restraints include managing the thermal output in increasingly compact designs, limiting the overall power density achievable within standard DIN rail form factors.

Opportunities: Significant growth potential exists in high-reliability applications, such as medical devices, transportation infrastructure (railway signaling), and critical data centers, which require specialized certifications and ultra-long lifecycles. The renewable energy sector, particularly solar and battery energy storage systems (BESS), presents a robust opportunity for high-voltage and specialized DC/DC DIN rail converters. Additionally, integrating advanced features like predictive maintenance diagnostics, digital communication protocols (e.g., EtherCAT), and built-in energy metering capabilities transforms the power supply into a smarter, higher-value component, opening new revenue streams.

- Drivers:

- Rapid global adoption of Industrial Automation and IIoT devices.

- Mandatory safety and efficiency regulations (e.g., UL, IEC, 80 PLUS).

- Need for modular, space-saving power solutions in control cabinets.

- Expansion of discrete manufacturing and process industries globally.

- Restraints:

- Volatility and shortages in the global semiconductor supply chain.

- Intense price competition and commoditization in lower-power segments.

- Technical challenges associated with thermal management in high-density designs.

- Opportunity:

- Growing demand from the renewable energy and electric vehicle charging infrastructure sectors.

- Development of digitally communicative and diagnostic-enabled power supplies.

- Penetration into specialized high-reliability sectors (e.g., medical, railway).

- Impact Forces:

- Technological integration of SiC and GaN materials boosting efficiency and reducing size.

- Standardization requirements ensuring interoperability across different vendor systems.

- Climate change policies driving demand for ultra-high efficiency (>95%) power solutions.

Segmentation Analysis

The DIN Rail Power Supply Market is comprehensively segmented based on key technical parameters, enabling detailed analysis of specific growth pockets within the industrial power electronics ecosystem. These segmentation factors include output voltage, which dictates compatibility with industrial components; current rating, defining the capacity for powering large systems; the application, highlighting the primary end-user industry; and the type (phase configuration), crucial for deployment in varying operational environments. Understanding these segments is vital for manufacturers to tailor product development and market penetration strategies, addressing the precise needs of industrial consumers ranging from small-scale discrete automation to large-scale infrastructure projects.

The output voltage segmentation confirms the dominance of the 24V DC standard, which is the foundational operating voltage for most sensors, PLCs, and relays globally. However, the 48V DC segment is demonstrating robust growth, particularly driven by applications in telecommunications infrastructure, specialized industrial lighting, and higher-power servo drives. Current rating trends show a clear shift: while low-current units (<5A) remain volume leaders, the highest growth rates are observed in units exceeding 10A, reflecting the centralization and complexity of modern control cabinets which consolidate numerous high-power components demanding reliable single-point power sources.

From an application standpoint, industrial automation and machine building collectively represent the largest market share, serving as the core consumer base for modular power solutions. The fastest-emerging application segment is renewable energy, where DIN rail power supplies are integral for monitoring and controlling solar inverters, wind turbine pitch controls, and BESS interfaces. Type segmentation differentiates between single-phase units, ubiquitous in standard factory environments and commercial buildings, and three-phase units, mandatory for heavy-duty industrial machinery, large motors, and high-power applications requiring balanced load management and resilience against phase loss.

- By Output Voltage:

- 5V DC

- 12V DC

- 24V DC (Dominant Segment)

- 48V DC

- Other (e.g., 15V, 30V)

- By Current Rating:

- Less than 5 Amperes

- 5 Amperes – 10 Amperes

- More than 10 Amperes (Highest Growth Rate)

- By Application:

- Industrial Automation (e.g., PLCs, HMI, Control Cabinets)

- Process Control

- Telecommunications

- Healthcare and Medical Devices

- Renewable Energy (Solar, Wind)

- Transportation (Railway, Marine)

- By Type:

- Single Phase Input

- Three Phase Input

- By Design Topology:

- Switch-Mode Power Supply (SMPS)

- Linear Power Supply (Niche Applications)

Value Chain Analysis For DIN Rail Power Supply Market

The value chain for DIN Rail Power Supplies begins with upstream suppliers providing critical raw materials and specialized electronic components. Upstream analysis focuses heavily on semiconductor manufacturers, particularly those supplying MOSFETs, IGBTs, and increasingly, SiC/GaN components, which dictate the efficiency and power density of the final product. Other essential upstream inputs include specialized magnetic components (transformers and inductors), aluminum for housing and heat dissipation, and control ICs necessary for implementing advanced features like power factor correction (PFC) and digital control. Price stability and technical innovation in the semiconductor sector directly influence the cost structure and performance limits of the entire market.

The manufacturing stage involves design, assembly, and rigorous testing, where competitive differentiation is achieved through thermal management expertise, robust electronic design, and adherence to global certification standards (e.g., UL, TUV, ATEX). Once manufactured, products are distributed through a dual channel strategy. The direct channel involves selling high-volume or highly customized units directly to large Original Equipment Manufacturers (OEMs) who integrate the power supplies into complex industrial machines or control panels. The indirect channel, which accounts for the majority of market reach, relies on a network of specialized industrial distributors, electrical wholesalers, and system integrators who provide local stock, technical support, and logistical services to smaller integrators and maintenance professionals.

Downstream analysis focuses on the final end-users, primarily categorized by industrial sectors such as automotive manufacturing, food and beverage, pharmaceuticals, and infrastructure. System integrators play a crucial mediating role, selecting and procuring the appropriate DIN rail power supplies based on specific project requirements, ensuring compatibility and compliance. The effectiveness of the distribution channel—its ability to offer readily available stock and technical assistance—is paramount, as industrial users often require immediate replacement or integration components to minimize production downtime. The long-term value generated downstream is tied to the reliability and longevity of the power supply, minimizing the total cost of ownership (TCO) for the end-user.

DIN Rail Power Supply Market Potential Customers

The primary customers for DIN Rail Power Supplies are diverse entities across the industrial and infrastructural landscape, primarily those involved in designing, building, or maintaining automated control systems. These end-users fall mainly into three categories: Original Equipment Manufacturers (OEMs), System Integrators (SIs), and Maintenance/Engineering Departments of end-user facilities. OEMs, such as machinery builders in the packaging, robotics, and textile industries, are high-volume buyers, integrating power supplies directly into their standard products, prioritizing compact size, high reliability, and competitive pricing for bulk orders.

System Integrators represent a significant customer base, as they undertake complex, customized automation projects for factories, process plants, and public infrastructure (e.g., traffic control, water treatment). SIs typically require a wide portfolio of products with various voltages and current ratings, favoring suppliers that offer advanced diagnostic features and modular accessories (like redundancy modules or buffer units). Their purchasing decisions are heavily influenced by ease of installation, technical support availability, and product certification required by specific industry standards.

Finally, maintenance and engineering departments in large industrial facilities (e.g., refineries, power generation plants, large factories) serve as aftermarket customers. They purchase DIN rail power supplies for replacement, expansion, or refurbishment of existing control cabinets. This segment emphasizes immediate availability, backward compatibility, and the robustness of the unit, often opting for premium brands known for extended warranty periods and resilience in harsh environments characterized by high vibration, wide temperature swings, or corrosive elements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.6 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens, Phoenix Contact, ABB, TDK-Lambda, PULS, Mean Well, Weidmüller, Schneider Electric, Bel Power Solutions, Delta Electronics, Murrplastik, Cosel, Astrodyne TDI, MTM Power, Artesyn Embedded Technologies, XP Power, Wago, TRACO Power, CUI Inc., SICK AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

DIN Rail Power Supply Market Key Technology Landscape

The DIN Rail Power Supply market is undergoing a significant technological transformation, moving towards higher power density, increased efficiency, and advanced communication capabilities. The most critical technological shift involves the adoption of wide-bandgap (WBG) semiconductors, specifically Silicon Carbide (SiC) and Gallium Nitride (GaN). These materials allow devices to operate at significantly higher switching frequencies than traditional silicon-based components, resulting in smaller magnetics (transformers and inductors), reduced component count, and ultimately, much higher power density within the constrained DIN rail form factor. This innovation directly addresses the market demand for compact, powerful units in crowded control cabinets.

Furthermore, digital control techniques are becoming standard, replacing older analog control loops. Digital Signal Processors (DSPs) and high-speed microcontrollers enable precise control over output voltage and current, rapid response to transient loads, and sophisticated features like active power factor correction (PFC), ensuring optimal power quality. Digital control also facilitates integration of predictive maintenance features, allowing the power supply to monitor its internal health metrics (temperature, component aging) and communicate them via standard industrial protocols like Modbus TCP or IO-Link. This data transparency is vital for Industry 4.0 environments, turning the power supply into an active participant in the automation network.

Advancements are also prevalent in thermal management and redundancy features. Improved heat sink designs, often integrating advanced materials and computational fluid dynamics (CFD) optimization, allow for reliable operation at high ambient temperatures without derating. Redundancy modules (N+1 configurations) and buffer modules (capacitor banks) are increasingly integrated as specialized DIN rail accessories, ensuring momentary power loss protection and seamless failover. These technological advancements collectively drive the market towards robust, intelligent, and highly efficient power solutions crucial for maintaining modern industrial uptime and energy conservation goals.

Regional Highlights

The global DIN Rail Power Supply Market exhibits strong regional disparities in terms of technological adoption, growth rate, and regulatory influence, shaping market performance across key geographical areas. Each region presents a unique set of drivers and consumer demands, dictating the focus of major manufacturers regarding product certification and feature sets. Understanding these regional dynamics is paramount for market penetration strategies.

Asia Pacific (APAC) is the undisputed leader in terms of market growth, driven primarily by extensive infrastructure development and massive investments in manufacturing automation across China, India, South Korea, and Southeast Asia. The region’s rapid industrialization necessitates high volumes of standardized DIN rail power supplies for new factory builds and modernization projects. While cost-competitiveness is a major factor, there is an increasing demand for high-reliability, premium units, particularly in high-tech sectors like semiconductor manufacturing and electric vehicle (EV) battery production, which require extremely stable and clean power. Local manufacturing strength contributes significantly to the supply volume in this region.

Europe represents a mature yet highly quality-driven market. Growth here is steady, powered by the continuous modernization of existing industrial infrastructure and stringent regulatory frameworks concerning energy efficiency (ErP Directive) and safety (CE marking, ATEX for hazardous areas). European consumers place a premium on certification, long product lifecycles, and advanced features such as integrated diagnostics (IO-Link). Germany, as the hub of advanced manufacturing (Industry 4.0), drives demand for highly efficient, communicating DIN rail power supplies optimized for decentralized control architectures and smart factory applications.

North America is characterized by high adoption rates of advanced automation technologies and a strong focus on high-power and specialized applications, particularly in oil & gas, aerospace, and data centers. The market requires compliance with specific standards like UL 508 and CSA certifications. Demand is strong for highly ruggedized units capable of handling extreme environmental conditions and providing redundant power capabilities. The integration of IIoT devices across the manufacturing sector further fuels the need for digitally managed power supplies that can interface with enterprise-level monitoring systems.

Latin America (LATAM) is an emerging market experiencing moderate growth, primarily tied to fluctuating investments in mining, oil and gas, and automotive manufacturing in countries like Brazil and Mexico. The market often prioritizes essential functionality and favorable pricing, although there is a growing trend towards adopting standardized, internationally certified products to improve operational safety and efficiency in key industrial sectors. Infrastructure projects, particularly in energy transmission and water management, are key drivers.

Middle East and Africa (MEA) growth is largely dependent on large-scale governmental infrastructure projects, especially in the energy, petrochemical, and smart city sectors in the GCC countries. The extreme ambient temperatures prevalent in this region create a specific demand for DIN rail power supplies with extended operating temperature ranges and robust thermal management systems, often necessitating specialized cooling solutions. Reliability under harsh conditions is the primary purchasing criterion, often prioritizing established international brands known for durability.

- Asia Pacific (APAC): Highest growth rate; driven by massive industrialization, high volume production, and EV manufacturing investments. Key focus on volume and cost-efficiency, with emerging demand for high-tech applications.

- Europe: Stable, mature market; demand fueled by Industry 4.0, stringent energy efficiency regulations, and a preference for high-quality, diagnostic-enabled power supplies (e.g., IO-Link integration).

- North America: Focus on high-power, specialized applications (Oil & Gas, data centers), strong adherence to UL certifications, and rising adoption of IIoT technologies requiring digitally managed power.

- Latin America (LATAM): Moderate growth tied to infrastructure and resource extraction industries; balancing cost efficiency with internationally certified product requirements.

- Middle East and Africa (MEA): Growth dependent on critical infrastructure (petrochemicals, energy); essential requirement for extreme temperature tolerance and high reliability under harsh desert conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the DIN Rail Power Supply Market.- Siemens

- Phoenix Contact

- ABB

- TDK-Lambda

- PULS

- Mean Well

- Weidmüller

- Schneider Electric

- Bel Power Solutions

- Delta Electronics

- Murrplastik

- Cosel

- Astrodyne TDI

- MTM Power

- Artesyn Embedded Technologies

- XP Power

- Wago

- TRACO Power

- CUI Inc.

- SICK AG

Frequently Asked Questions

Analyze common user questions about the DIN Rail Power Supply market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the DIN Rail Power Supply Market?

The principal driver is the accelerated global proliferation of industrial automation, including Industry 4.0 initiatives and the widespread integration of IIoT devices, which necessitates standardized, high-reliability, and space-efficient power delivery solutions within control cabinets.

Why is 24V DC the most common output voltage for DIN rail power supplies?

24V DC is the de facto industrial standard voltage worldwide, utilized by the majority of programmable logic controllers (PLCs), sensors, actuators, relays, and interface modules, making 24V units essential for interoperability and easy system integration.

How does the shift to SiC and GaN materials affect DIN rail power supplies?

The adoption of Silicon Carbide (SiC) and Gallium Nitride (GaN) allows manufacturers to achieve significantly higher switching frequencies, resulting in reduced component size, improved power density, higher energy efficiency (up to 96%), and better thermal performance within the same or smaller physical footprint.

What are the key technical features differentiating premium DIN rail power supplies?

Premium units are distinguished by features such as integrated diagnostic communication (e.g., IO-Link or Modbus), high MTBF ratings, active power factor correction (PFC), wide input voltage ranges, and extensive safety certifications (UL 508, ATEX/IECEx) for harsh or hazardous environments.

Which geographical region demonstrates the fastest growth rate for this market?

Asia Pacific (APAC), particularly driven by industrial expansion in China and India, registers the fastest market growth due to large-scale investments in new manufacturing capacity, factory automation projects, and infrastructure modernization efforts.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Din Rail Power Supply Market Size Report By Type (Single-Phase, Two-Phase, Three-Phase), By Application (Semiconductor Industry, Electrical and Electronics Industry, Pharmaceutical Industry, Food and Beverage Industry, Aerospace Industry, Chemical Industry), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- DIN Rail Power Supply Market Size Report By Type (Single-Phase, Two-Phase, Three-Phase), By Application (IT, Industry, Power & Energy, Oil & Gas, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager