Dioctyl Terephthalate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438885 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Dioctyl Terephthalate Market Size

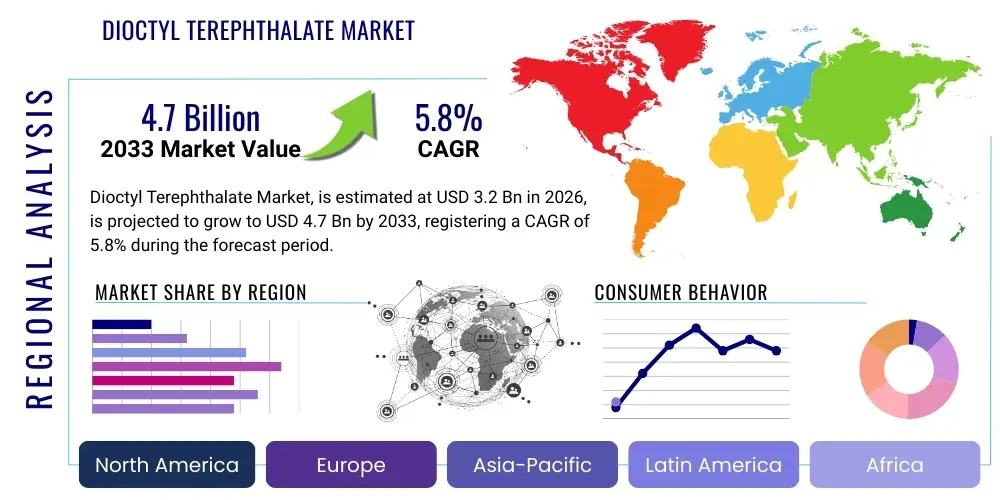

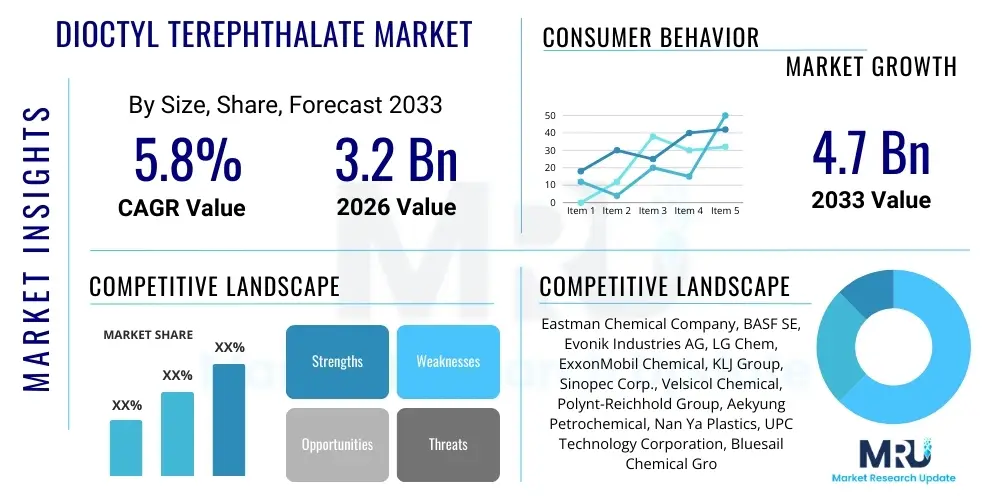

The Dioctyl Terephthalate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.2 Billion in 2026 and is projected to reach USD 4.7 Billion by the end of the forecast period in 2033. This robust expansion is primarily fueled by increasing global regulatory pressure restricting the use of traditional phthalates, particularly in sensitive applications such as children's products and medical devices, thereby positioning DOTP as a preferred, non-phthalate plasticizer solution globally. The growing construction and automotive sectors, demanding high-performance and durable PVC compounds, further solidify this growth trajectory, particularly across emerging economies in the Asia Pacific region.

Dioctyl Terephthalate Market introduction

Dioctyl Terephthalate (DOTP), also known as Bis(2-ethylhexyl) terephthalate, stands as a high-performance, non-phthalate plasticizer widely adopted across the polymers industry, primarily for Polyvinyl Chloride (PVC) processing. As regulatory scrutiny concerning the health risks associated with traditional ortho-phthalate plasticizers intensifies globally, DOTP has emerged as the leading substitution compound, offering excellent compatibility, superior electrical properties, and low volatility. Chemically, DOTP is derived from terephthalic acid (TPA) and 2-ethylhexanol, making it environmentally and toxicologically safer than its predecessors, aligning with stringent international standards such as REACH and CPSIA.

The primary applications of DOTP span a wide range of durable and flexible PVC products, including essential building materials and consumer goods. Its inclusion enhances the flexibility, resilience, and processing characteristics of PVC, making it indispensable in modern manufacturing. Key areas of application include automotive components (dashboard skins, underbody coatings), construction materials (roofing membranes, flooring, wall coverings), and wire and cable insulation, where its superior volume resistivity and heat aging resistance are highly valued. Furthermore, its benign toxicological profile makes it suitable for sensitive applications like food contact materials and certain medical tubing, significantly expanding its market relevance.

Key benefits driving the adoption of DOTP include its non-phthalate structure, contributing to environmental safety and consumer acceptance. It offers comparable, and often superior, performance metrics to Dioctyl Phthalate (DOP) in terms of plasticizing efficiency, resistance to extraction, and thermal stability. Major driving factors for market growth encompass the increasing global urbanization necessitating large-scale construction activities, the rebound of the automotive manufacturing sector requiring flexible PVC parts, and mandatory regulatory shifts across North America and Europe mandating non-phthalate alternatives. These drivers ensure sustained demand for high-quality, safety-compliant plasticizers, solidifying DOTP’s market position.

Dioctyl Terephthalate Market Executive Summary

The Dioctyl Terephthalate (DOTP) market is characterized by robust regulatory arbitrage, where strict bans on older, hazardous phthalates drive mandatory substitution toward safer alternatives. Current business trends indicate significant investment in expanding DOTP production capacity, particularly in Asia Pacific, to cater to booming PVC consumption in infrastructure and manufacturing sectors. Manufacturers are focusing on process optimization to reduce raw material costs, specifically related to the procurement of terephthalic acid and 2-ethylhexanol, enhancing the competitive positioning of DOTP against other alternatives like DINP or DOA. Supply chain resilience, following recent global disruptions, is a critical area of focus, encouraging regionalization of manufacturing to stabilize prices and ensure timely delivery to key end-user industries.

Regionally, the Asia Pacific dominates the market share due to rapid industrialization, extensive construction projects in China and India, and the establishment of large-scale wire and cable manufacturing hubs. Europe and North America, while having mature markets, serve as primary drivers for quality and safety standards, characterized by high adoption rates of premium, certified DOTP grades in automotive and medical applications. Segment trends highlight that the flexible PVC application segment remains the largest consumer, but demand growth is accelerating fastest in the automotive interiors and consumer goods segments, spurred by stringent consumer safety standards and greater product customization requirements. The high purity grade of DOTP is also witnessing increased traction in specialized film and sheeting applications.

Overall, the market trajectory is highly positive, supported by structural changes in chemical safety regulations and persistent demand from high-volume industries. The shift towards sustainable chemistry and the operational efficiency of DOTP compared to other non-phthalate alternatives solidify its dominance. Key challenges involve managing the volatility of crude oil-derived raw material costs and navigating the complexity of regional environmental certifications, which vary widely across different jurisdictions, demanding localized market strategies from major international producers.

AI Impact Analysis on Dioctyl Terephthalate Market

Common user questions regarding AI's impact on the Dioctyl Terephthalate (DOTP) market primarily revolve around operational efficiency, supply chain optimization, and materials science innovation. Users frequently inquire about how AI can predict volatile raw material prices (terephthalic acid and 2-ethylhexanol), optimize production reaction conditions to maximize yield and purity, and automate quality control processes to ensure compliance with stringent non-phthalate standards. Another significant concern centers on predictive maintenance for polymer processing machinery, where DOTP is utilized, minimizing downtime and optimizing throughput for PVC manufacturers. Furthermore, users explore AI's role in accelerating the research and development pipeline for next-generation plasticizers or optimizing DOTP formulations for specific, high-performance applications like extreme-temperature cable insulation or biomedical devices, seeking to leverage machine learning for faster formulation development cycles.

The application of Artificial Intelligence and Machine Learning (ML) algorithms is poised to transform the DOTP manufacturing landscape from input sourcing to product delivery. By integrating predictive analytics, producers can forecast demand fluctuations and preemptively adjust inventory levels, mitigating risks associated with supply chain bottlenecks. In chemical synthesis, AI models can analyze thousands of reaction parameters—temperature, pressure, catalyst concentration—to identify the optimal conditions for the esterification process, significantly improving DOTP yield and reducing energy consumption per unit of production. This operational optimization translates directly into reduced manufacturing costs and enhanced environmental compliance, a critical competitive differentiator in the specialty chemical sector.

Moreover, AI contributes heavily to enhanced material traceability and regulatory adherence. Blockchain technologies, often paired with AI analytics, can track the entire lifecycle of DOTP, from raw material extraction to final product integration in end-user goods, providing irrefutable documentation necessary for international regulatory bodies such as the European Chemicals Agency (ECHA). This automated compliance monitoring addresses a major complexity for global market players. The integration of advanced computational chemistry, powered by ML, also allows researchers to simulate the long-term migration behavior and toxicological profile of new DOTP variants faster than traditional laboratory testing, accelerating the time-to-market for specialized, high-performance grades targeting niche markets like aerospace materials or sustainable packaging solutions.

- AI-driven predictive analytics stabilize raw material cost forecasting (TPA, 2-EH).

- Machine Learning optimizes esterification reaction parameters for higher DOTP yield and purity.

- Automated vision systems enhance quality control for purity and color stability in manufacturing.

- AI integrates supply chain data to optimize inventory management and logistics efficiency.

- Predictive maintenance schedules for processing equipment minimize operational downtime in PVC plants.

- Computational chemistry accelerates R&D for new, customized DOTP formulations.

- Blockchain integration paired with AI ensures end-to-end traceability for regulatory compliance (e.g., REACH certification).

- AI modeling helps forecast market demand shifts in key application areas like automotive and construction.

DRO & Impact Forces Of Dioctyl Terephthalate Market

The Dioctyl Terephthalate market is shaped by a complex interplay of regulatory mandates (Drivers), cost volatility (Restraints), and the emergence of new plasticizer technologies (Opportunities). The fundamental impact force propelling the market is the irreversible global trend toward non-toxic materials, driven by heightened consumer awareness regarding endocrine disruption and carcinogenic risks associated with legacy plasticizers like DOP. This regulatory shift creates a compelling, non-negotiable demand for substitutes like DOTP. However, the market’s reliance on petrochemical feedstocks means its profitability is susceptible to geopolitical events and fluctuations in global crude oil prices, which directly influence the cost of key precursors like PX (p-xylene) used to manufacture TPA, posing a significant restraint on sustained margins.

The primary Drivers center on stringent environmental and health regulations enacted across developed regions, notably the EU’s REACH initiative and US EPA guidelines, effectively phasing out high-volume phthalates and providing a clear path for DOTP adoption in high-specification products such as automotive interiors, medical equipment, and children's toys. Furthermore, the burgeoning demand for flexible PVC in infrastructure development, driven by global urbanization and rapid development in APAC nations, ensures a robust foundational requirement for high-performance plasticizers. The inherent benefits of DOTP, including excellent electrical insulation properties and low extractability, further reinforce its position, especially in critical applications like high-voltage cable jackets and advanced electrical wiring, where longevity and safety are paramount.

Restraints are dominated by the price volatility of raw materials, which frequently compress the profit margins of DOTP producers, making financial planning challenging. Additionally, competition from emerging bio-based and specialty plasticizers, such as citrate esters and epoxidized vegetable oils (ESBO), presents a technical substitution threat, particularly as sustainability mandates gain traction among major brand owners seeking 100% renewable inputs. While DOTP is safer than DOP, it is still derived from fossil fuels, prompting R&D into alternative, entirely bio-derived plasticizers. Lastly, the significant capital investment required for switching plasticizer production lines poses a market entry barrier for new competitors and creates inertia among existing players considering transitioning to highly specialized, non-DOTP alternatives.

Opportunities for growth lie in two major areas: geographic expansion and technological refinement. Expanding production and sales infrastructure into underpenetrated high-growth regions like Latin America and Africa, which are seeing significant infrastructural investment, offers substantial untapped market potential. Technologically, there is an opportunity to develop specialized, higher molecular weight DOTP grades with improved performance characteristics, such as enhanced UV stability or compatibility with novel polymer blends (e.g., bio-PVC). Strategic partnerships between DOTP manufacturers and major PVC compounders can also unlock custom formulations for niche industrial applications, further differentiating DOTP from generic alternatives. The rising trend of closed-loop recycling and the need for plasticizers that maintain performance through multiple recycling cycles also present a significant R&D opportunity for DOTP innovators.

Segmentation Analysis

The Dioctyl Terephthalate (DOTP) market segmentation provides a granular view of demand distribution across various dimensions, primarily categorized by Application, Type (Grade), and End-Use Industry. Understanding these segments is crucial for strategic planning, as different applications require distinct purity levels and performance characteristics from the plasticizer. The market is overwhelmingly driven by the flexible PVC industry, which leverages DOTP’s efficiency and regulatory compliance to produce goods ranging from construction materials to consumer products. The Type segmentation often distinguishes between high-purity, general-purpose, and specialty grades, catering to medical/food-contact requirements versus standard industrial uses.

By application, the wire and cable segment represents a cornerstone of demand due to DOTP’s superior electrical resistivity and thermal stability, making it ideal for insulation and jacketing compounds. The flooring and wall coverings segment, fueled by global real estate and commercial construction, utilizes DOTP to impart flexibility, durability, and easy maintenance to PVC surfaces. The automotive segment is experiencing high growth, adopting DOTP in interior trims, protective coatings, and seals to meet stringent volatile organic compound (VOC) emissions standards and regulatory requirements concerning passenger safety, moving entirely away from conventional phthalates.

The strategic importance of segmentation lies in identifying high-growth pockets. For instance, while general-purpose DOTP dominates volume, the higher-margin growth resides in specialized applications like toys and medical devices, which mandate ultra-high purity DOTP grades compliant with complex global standards. Geographic segmentation further reveals that demand drivers and regulatory influences vary significantly; while APAC provides the bulk of manufacturing volume, North America and Europe lead in the adoption of high-specification, compliant DOTP, setting the pace for quality and innovation.

- Segmentation by Application:

- Wire and Cable

- Flooring and Wall Coverings

- Film and Sheeting

- Automotive Components

- Coated Fabrics

- Consumer Goods (Toys, Footwear)

- Medical Devices

- Segmentation by Grade/Type:

- General Purpose Grade

- High Purity Grade (Phthalate-Free Certified)

- Segmentation by End-Use Industry:

- Construction and Infrastructure

- Automotive

- Consumer Goods

- Healthcare and Medical

- Electrical and Electronics

- Segmentation by Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, India, Japan, South Korea, Southeast Asia, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East and Africa (GCC Countries, South Africa, Rest of MEA)

Value Chain Analysis For Dioctyl Terephthalate Market

The value chain for the Dioctyl Terephthalate market is intricate, starting from upstream raw material procurement and extending through specialized synthesis, distribution, and ultimately, integration into final polymer products. Upstream activities involve sourcing critical petrochemical intermediates: p-xylene (which yields purified terephthalic acid or PTA) and propylene (which yields 2-ethylhexanol or 2-EH). This segment is capital-intensive and subject to extreme volatility based on global oil and gas prices. Major chemical producers typically dominate this stage, often integrating vertically to secure reliable raw material supply, thereby mitigating exposure to price fluctuations and ensuring cost competitive manufacturing of the final DOTP product.

The midstream phase encompasses the chemical synthesis of DOTP, primarily through the esterification reaction of PTA/TPA and 2-EH. This process requires specialized catalytic technology and high purity standards, particularly for grades used in sensitive applications. DOTP manufacturers focus heavily on optimizing conversion yields and reducing processing impurities to meet demanding regulatory compliance standards, especially in Europe and North America. After synthesis, the product moves through the logistics and distribution channel. The channel is bifurcated: direct distribution is common for large-volume PVC compounders who purchase high volumes directly from the producer, while indirect channels utilize chemical distributors, agents, and local traders to service smaller fabricators and diverse geographical markets efficiently.

The downstream segment represents the application industries, dominated by flexible PVC compounders who blend DOTP with PVC resins and various stabilizers to create usable polymer compounds. These compounds are then fabricated into final products across the construction (e.g., flooring, pipes), automotive (e.g., wire harnesses, interior skins), and consumer goods sectors. Key drivers at this stage include minimizing plasticizer migration, achieving desired product flexibility, and ensuring long-term product durability. The success of the downstream market relies heavily on the consistent quality and performance specifications provided by the upstream DOTP suppliers, making seamless communication and quality assurance across the value chain paramount for sustained market growth and regulatory compliance.

Dioctyl Terephthalate Market Potential Customers

The primary potential customers and end-users of Dioctyl Terephthalate are large-scale industrial companies that specialize in polymer compounding and the manufacturing of flexible Polyvinyl Chloride (PVC) products. These customers encompass several distinct industrial segments, most notably the construction industry, where PVC is critical for flooring, roofing membranes, and specialized piping. For construction end-users, DOTP is valued for its ability to impart long-lasting flexibility, resistance to weathering, and regulatory compliance, making it a staple in modern, sustainable building materials that must meet stringent fire and structural codes.

Another major customer group is the automotive manufacturing sector, including Tier 1 and Tier 2 suppliers who produce interior components, wire harnesses, gaskets, and protective coatings. Automotive buyers prioritize DOTP due to its low volatile organic compound (VOC) emissions, crucial for achieving strict air quality standards inside vehicle cabins, coupled with excellent heat resistance and durability required for under-the-hood applications. Furthermore, the electronics and electrical sector, specifically cable manufacturers, constitutes a significant customer base, valuing DOTP’s superior electrical insulation properties and volume resistivity for high-performance and safety-critical wiring and cable jacketing materials.

In addition to these industrial giants, smaller but high-value customers exist in the consumer goods and healthcare sectors. Manufacturers of children’s toys, footwear, and specialized medical devices (such as blood bags and tubing) require ultra-high purity, certified non-phthalate DOTP grades. These buyers demand rigorous documentation and compliance with global safety standards (like the EU's CLP Regulation or the US CPSC rules). Strategic engagement with these diverse customer segments necessitates differentiated marketing, ranging from high-volume, cost-competitive offerings for construction to specialized, traceable, and premium-priced DOTP grades for the sensitive medical and toy markets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.2 Billion |

| Market Forecast in 2033 | USD 4.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eastman Chemical Company, BASF SE, Evonik Industries AG, LG Chem, ExxonMobil Chemical, KLJ Group, Sinopec Corp., Velsicol Chemical, Polynt-Reichhold Group, Aekyung Petrochemical, Nan Ya Plastics, UPC Technology Corporation, Bluesail Chemical Group, Shandong Hongqiao Energy Group, Guangdong Naiker New Materials, S&P Chemical, OXEA GmbH, Mitsubishi Chemical Corporation, Hanwha Solutions, Perstorp Holding AB |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dioctyl Terephthalate Market Key Technology Landscape

The technological landscape of the Dioctyl Terephthalate market is centered around refining the synthesis process and improving the integration efficiency of the plasticizer into PVC compounds. The primary manufacturing technology involves a highly efficient esterification process, where 2-ethylhexanol reacts with terephthalic acid or dimethyl terephthalate (DMT). Modern production utilizes continuous esterification processes, often enhanced by proprietary heterogeneous catalysts, to achieve higher reaction rates, reduce energy consumption, and minimize the formation of undesirable byproducts. Producers are constantly investing in catalyst research to achieve high selectivity and longer lifespan, directly influencing the cost structure and environmental footprint of the resulting DOTP.

A key focus area in current technological research is the purification and quality control of DOTP, especially for sensitive end-use applications. Techniques such as molecular distillation and advanced filtration are employed post-synthesis to remove trace impurities, unreacted starting materials, and color bodies, ensuring the final product is colorless, odorless, and meets the stringent regulatory requirements for food contact or medical device components. Innovations in this area include utilizing spectroscopic techniques (e.g., NMR, FTIR) and automated chromatography for real-time, in-line quality monitoring, ensuring batch-to-batch consistency—a non-negotiable requirement for major polymer compounders globally.

Furthermore, technology related to compounding and formulation is crucial downstream. PVC compounders are utilizing sophisticated compounding equipment, such as high-shear mixers and twin-screw extruders, coupled with advanced dosing systems to ensure uniform dispersion of DOTP within the PVC matrix. Research is also progressing into developing specialized DOTP blends tailored for specific high-performance requirements, such as formulations offering enhanced flame retardancy or superior compatibility with recycled PVC resins. The adoption of digital twin technology in manufacturing and compounding plants allows producers to simulate and optimize complex processes, reducing waste and accelerating the introduction of new DOTP-containing products to the market.

Regional Highlights

The global Dioctyl Terephthalate (DOTP) market exhibits distinct growth patterns and regulatory environments across major geographical regions, influencing consumption and production dynamics. The Asia Pacific (APAC) region currently holds the largest market share and is projected to demonstrate the highest growth rate during the forecast period. This dominance is attributed to massive industrial expansion, rapid urbanization, and extensive government investment in infrastructure projects across nations like China, India, and Southeast Asian countries. The APAC region is not only a substantial consumer of flexible PVC in construction (flooring, piping, wiring) but also serves as the world’s primary manufacturing hub for automotive parts and consumer electronics, driving high-volume demand for cost-effective, non-phthalate plasticizers. Local manufacturers are actively expanding capacity to meet both domestic and export needs, although regulatory enforcement regarding phthalate bans is often less uniform compared to Western jurisdictions, creating a diversified demand environment.

North America represents a mature, high-value market characterized by early and robust adoption of non-phthalate plasticizers driven by consumer safety concerns and federal regulations, notably the Consumer Product Safety Improvement Act (CPSIA). The U.S. and Canada maintain a strong focus on high-performance DOTP in specialized applications, including automotive interiors (where low VOC requirements are paramount) and medical devices. Although consumption volumes are lower than in APAC, the average price realization for high-purity, certified DOTP grades is significantly higher. Market dynamics here are highly influenced by the stable but cyclical demands of the residential construction and automotive sectors, with innovation focused on bio-based alternatives and specialty DOTP formulations that offer ultra-low extractability and enhanced thermal properties.

Europe stands as a pivotal market, acting as the global benchmark for chemical safety standards, primarily enforced by the REACH regulation (Registration, Evaluation, Authorisation and Restriction of Chemicals). The strict enforcement of phthalate restrictions across the continent has ensured a nearly complete transition to DOTP and similar non-phthalate alternatives in all sensitive applications. European demand is robust across the construction (driven by green building mandates) and electrical sectors. Manufacturers in this region prioritize sustainable sourcing, circular economy principles, and developing transparent supply chains, leading to a strong demand for high-quality, fully traceable DOTP. Germany, France, and the UK are major consumption centers, with stringent standards promoting premium product consumption and driving continuous innovation towards more environmentally benign synthesis routes.

Latin America and the Middle East & Africa (MEA) represent emerging growth markets. Latin America, particularly Brazil and Mexico, is experiencing growing industrialization and infrastructure development, boosting demand for construction-related PVC products. However, economic instability and fluctuating import duties often influence pricing. In MEA, infrastructure megaprojects in the GCC countries (UAE, Saudi Arabia) drive demand, particularly for wire and cable insulation required for new utility networks. While these regions are currently smaller contributors to global demand, their forecasted growth rates are attractive. Adoption of non-phthalate plasticizers is growing, often mandated by international project specifications rather than purely domestic regulation, offering significant expansion opportunities for global DOTP producers seeking to diversify their geographical revenue streams and capitalize on nascent economic development.

- Asia Pacific (APAC): Dominates market share; highest growth driven by large-scale infrastructure, automotive manufacturing, and high-volume consumption in China and India.

- North America: Mature market focusing on high-purity, specialty DOTP; strong regulatory push (CPSIA) drives adoption in medical and low-VOC automotive applications.

- Europe: Regulatory leader (REACH); high demand for premium, sustainable, and traceable DOTP grades across construction and electrical industries.

- Latin America: Emerging market with growth tied to infrastructure development in Brazil and Mexico; susceptible to economic volatility.

- Middle East and Africa (MEA): Growth fueled by large-scale construction and utility projects (especially in GCC nations); increasing adoption driven by international quality standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dioctyl Terephthalate Market.- Eastman Chemical Company

- BASF SE

- Evonik Industries AG

- LG Chem

- ExxonMobil Chemical

- KLJ Group

- Sinopec Corp.

- Velsicol Chemical

- Polynt-Reichhold Group

- Aekyung Petrochemical

- Nan Ya Plastics

- UPC Technology Corporation

- Bluesail Chemical Group

- Shandong Hongqiao Energy Group

- Guangdong Naiker New Materials

- S&P Chemical

- OXEA GmbH

- Mitsubishi Chemical Corporation

- Hanwha Solutions

- Perstorp Holding AB

Frequently Asked Questions

Analyze common user questions about the Dioctyl Terephthalate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Dioctyl Terephthalate (DOTP) and why is it replacing traditional plasticizers?

Dioctyl Terephthalate (DOTP) is a non-phthalate plasticizer widely used in Polyvinyl Chloride (PVC) applications to impart flexibility and durability. It is rapidly replacing traditional plasticizers like Dioctyl Phthalate (DOP) because DOTP possesses a superior toxicological profile, aligning with stringent global health regulations (e.g., REACH, CPSIA) that restrict the use of phthalates in consumer goods, especially children's toys and medical equipment. Its key advantage is regulatory compliance coupled with comparable performance in terms of thermal stability and plasticizing efficiency.

Which end-use industries are the primary consumers of DOTP?

The primary consumers of DOTP are industries utilizing large volumes of flexible PVC compounds. These include the construction and infrastructure sector (for flooring, wall coverings, and roofing membranes), the electrical and electronics sector (specifically for wire and cable insulation and jacketing due to its excellent electrical properties), and the automotive sector (for interior skins, coatings, and seals that require low VOC emissions and high durability. The consumer goods sector, particularly for toys and footwear, also represents a significant, high-value consumer base.

How does the volatility of raw material prices affect the DOTP market?

DOTP synthesis relies on petrochemical derivatives, mainly p-xylene (for terephthalic acid) and propylene (for 2-ethylhexanol). Since the cost of these raw materials is directly tied to fluctuations in global crude oil and natural gas prices, DOTP manufacturing margins are inherently volatile. Price spikes in feedstock materials can increase the final cost of DOTP, potentially slowing substitution away from cheaper, less regulated alternatives in price-sensitive markets, thus posing a persistent restraint on market stability and profitability for manufacturers.

What are the key growth opportunities for DOTP manufacturers?

Key growth opportunities lie in geographical expansion into fast-developing economies in the Asia Pacific (APAC), Latin America, and MEA regions where infrastructure investment is surging. Furthermore, manufacturers can capitalize on developing and commercializing specialized, high-purity DOTP grades targeted at high-margin niches such as sensitive medical applications and aerospace components. Strategic investment in research focusing on performance enhancement (e.g., UV stability, low migration) and optimizing sustainability in the manufacturing process will also unlock new premium market segments.

Is Dioctyl Terephthalate considered a sustainable or bio-based chemical?

While DOTP is recognized as a significantly safer and less toxic alternative to traditional phthalates, it is not inherently considered a bio-based chemical, as its current commercial production relies on fossil fuel-derived petrochemical precursors (terephthalic acid and 2-ethylhexanol). However, the market is seeing increased R&D effort aimed at developing sustainable pathways, including the use of bio-derived precursors or bio-TPA, to synthesize 'bio-DOTP'. This innovation aims to align the product with circular economy principles and meet the growing demand for sustainable polymer additives without sacrificing performance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager