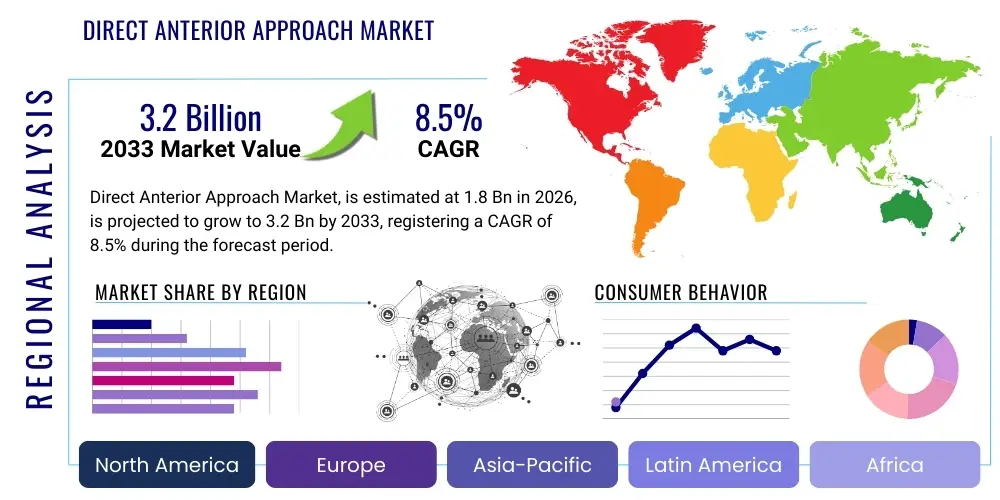

Direct Anterior Approach Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439554 | Date : Jan, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Direct Anterior Approach Market Size

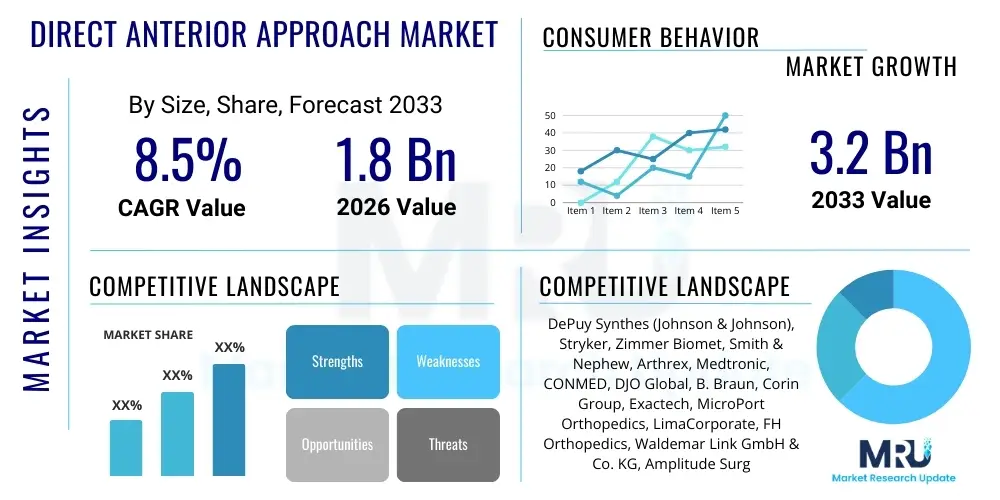

The Direct Anterior Approach Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 3.2 Billion by the end of the forecast period in 2033.

Direct Anterior Approach Market introduction

The Direct Anterior Approach (DAA) in total hip arthroplasty (THA) represents a cutting-edge surgical technique gaining significant traction within the orthopedic landscape. This minimally invasive method allows surgeons to access the hip joint from the front, traversing a natural intermuscular plane without detaching muscles or tendons from the bone. This preservation of muscle integrity is a cornerstone of the DAA's appeal, promising enhanced post-operative recovery and functional outcomes for patients undergoing hip replacement surgery, reducing patient discomfort and accelerating the return to normal activities.

The DAA involves specialized instrumentation and positioning techniques designed to facilitate access through the interval between the tensor fascia lata and the sartorius muscles. Key products associated with this approach include specifically designed retractors, a specialized operating table (often a 'Hana table' or similar traction table), and a range of hip implant systems optimized for anterior insertion. These tools are crucial for achieving optimal visualization and precise component placement while minimizing soft tissue disruption, contributing significantly to the procedure's success and patient safety profiles.

Major applications for the Direct Anterior Approach primarily revolve around primary total hip arthroplasty for conditions such as osteoarthritis, rheumatoid arthritis, avascular necrosis, and hip fractures. Its benefits, including reduced post-operative pain, shorter hospital stays, earlier return to daily activities, and a lower risk of dislocation, are significant driving factors. The increasing demand for quicker recovery times and improved functional mobility among an aging global population further propels the adoption of this advanced surgical technique, positioning it as a preferred option for many surgeons and patients alike, supported by advancements in surgical education and implant design.

Direct Anterior Approach Market Executive Summary

The Direct Anterior Approach (DAA) market is experiencing robust growth, driven by an escalating demand for minimally invasive surgical solutions in total hip arthroplasty. Current business trends indicate a strong focus on advanced surgical instrumentation, robotic-assisted platforms, and enhanced training programs to overcome the technique's learning curve and broaden its adoption. Manufacturers are heavily investing in research and development to innovate implant designs specifically tailored for DAA, along with specialized tables and retraction systems that improve surgical efficiency and patient outcomes. The emphasis on value-based care models and improved patient satisfaction continues to fuel market expansion, with healthcare providers increasingly recognizing the long-term cost benefits associated with reduced hospital stays and faster rehabilitation.

Regionally, North America continues to dominate the DAA market due to its advanced healthcare infrastructure, high prevalence of orthopedic conditions, and early adoption of innovative surgical techniques. Europe follows closely, driven by an aging population and favorable reimbursement policies supporting minimally invasive procedures. The Asia Pacific region is emerging as the fastest-growing market, propelled by increasing healthcare expenditure, a rising incidence of hip disorders, and expanding access to advanced medical technologies. Latin America and the Middle East & Africa also present significant growth opportunities, albeit from a smaller base, as healthcare systems in these regions evolve and patient awareness increases regarding modern orthopedic interventions.

Segmentation trends reveal a sustained demand for primary hip arthroplasty procedures utilizing DAA, with a growing interest in its application for revision surgeries as well. The hospital segment remains the largest end-user, but ambulatory surgical centers (ASCs) are rapidly gaining prominence due to their cost-effectiveness and patient convenience, especially for elective procedures. In terms of product, the market for specialized retractors and patient positioning systems is expanding, alongside a steady demand for advanced femoral and acetabular components. The integration of digital planning tools and intraoperative navigation systems is also becoming a crucial differentiating factor within the competitive landscape, highlighting the market's trajectory towards precision and technology-driven surgical solutions.

AI Impact Analysis on Direct Anterior Approach Market

User inquiries regarding AI's impact on the Direct Anterior Approach market frequently center on how artificial intelligence can enhance surgical precision, improve patient outcomes, and streamline the pre- and post-operative phases. Concerns often include the cost implications of integrating AI, the reliability of AI algorithms in complex surgical scenarios, and the need for extensive surgeon training to leverage these technologies effectively. Users generally express high expectations for AI to revolutionize patient-specific planning, provide real-time intraoperative guidance, and personalize rehabilitation protocols, ultimately making DAA more accessible and consistently successful.

- AI-driven pre-operative planning enhances implant sizing and positioning accuracy through advanced image analysis (X-ray, CT, MRI).

- Robotic-assisted surgical systems integrated with AI provide real-time intraoperative guidance, improving precision in bone preparation and implant placement.

- AI algorithms predict patient recovery trajectories and personalize rehabilitation programs, optimizing post-operative care and outcomes.

- Machine learning models analyze vast datasets to identify optimal DAA surgical techniques and best practices, leading to continuous procedural refinement.

- AI-powered simulation and virtual reality platforms offer immersive training environments for surgeons, accelerating the DAA learning curve.

- Supply chain optimization and inventory management for DAA-specific instruments benefit from AI-driven predictive analytics.

- AI assists in identifying patients most suitable for DAA based on their anatomical and clinical profiles, improving patient selection.

- Post-market surveillance and adverse event tracking for DAA implants are enhanced by AI's ability to process and interpret large volumes of clinical data.

DRO & Impact Forces Of Direct Anterior Approach Market

The Direct Anterior Approach (DAA) market is profoundly shaped by a confluence of driving forces, significant restraints, and emerging opportunities, all underpinned by various impact forces that dictate its trajectory. Key drivers include the ever-increasing patient demand for less invasive surgical options that promise quicker recovery times, reduced pain, and improved cosmetic outcomes following total hip arthroplasty. The aging global population, coupled with a rising prevalence of degenerative hip conditions such as osteoarthritis, significantly expands the patient pool requiring hip replacement surgeries, thereby fueling the adoption of DAA due to its perceived benefits over traditional approaches. Furthermore, continuous advancements in surgical instrumentation, implant technology, and imaging techniques specifically designed to facilitate the DAA procedure contribute substantially to its widespread acceptance and efficacy. The growing body of clinical evidence supporting superior outcomes with DAA, including lower dislocation rates and faster mobilization, also acts as a powerful driver, influencing both surgeon preference and patient choice.

Despite the compelling advantages, the DAA market faces several notable restraints. The steep learning curve associated with mastering the DAA technique presents a significant barrier for many orthopedic surgeons, requiring extensive training and often a dedicated operating room setup, which can be resource-intensive. Potential for specific complications, such as lateral femoral cutaneous nerve injury, anterior thigh numbness, or unique fracture patterns (e.g., femoral fractures during broaching), though rare, can deter some practitioners. The initial investment required for specialized surgical tables and instruments, which are often more expensive than those used in conventional approaches, can also be a deterrent for healthcare facilities, particularly in budget-constrained environments. Additionally, varying reimbursement policies and lack of standardized training protocols across different regions can impede uniform adoption rates, adding a layer of complexity to market penetration.

Opportunities within the DAA market are abundant and promising, particularly in expanding geographical reach into emerging economies where healthcare infrastructure is rapidly developing and patient access to advanced orthopedic care is increasing. The integration of robotic-assisted surgery and navigation technologies with DAA procedures offers a significant avenue for growth, promising enhanced precision, reproducibility, and a reduced learning curve for surgeons, thereby potentially mitigating some existing restraints. Furthermore, the development of sophisticated surgical training simulators and virtual reality platforms can democratize access to DAA education, accelerating surgeon proficiency. The trend towards personalized medicine and patient-specific implant solutions, tailored for the DAA, also represents a lucrative opportunity for innovation and market differentiation. Strategic partnerships between medical device manufacturers and academic institutions to conduct robust clinical trials and develop evidence-based protocols will further solidify the DAA's position in the global orthopedic market. These opportunities are significantly influenced by impact forces such as technological innovation, healthcare policy shifts, demographic trends, and evolving economic landscapes.

Segmentation Analysis

The Direct Anterior Approach market is meticulously segmented to provide a comprehensive understanding of its diverse components and dynamics. This segmentation helps in identifying specific growth areas, target audiences, and competitive landscapes, offering granular insights into the market's structure and potential. The market is broadly categorized by product type, application, and end-user, with a significant geographical breakdown that highlights regional adoption patterns and market maturity. Each segment reflects unique demand characteristics, technological requirements, and strategic implications for stakeholders across the value chain, ranging from medical device manufacturers to healthcare providers.

- By Product Type:

- Hip Implants

- Femoral Components

- Acetabular Components

- Modular Systems

- Surgical Instruments

- Retractors (e.g., specific anterior approach retractors)

- Reamers

- Broaches

- Elevators and Hooks

- Specialized Tables (e.g., Hana table, traction tables)

- Navigation and Robotic Systems (used in conjunction with DAA)

- Hip Implants

- By Application:

- Primary Hip Arthroplasty (most common)

- Revision Hip Arthroplasty (growing application)

- By End-User:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Orthopedic Clinics

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, UK, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Australia, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa (UAE, Saudi Arabia, South Africa, Rest of MEA)

Value Chain Analysis For Direct Anterior Approach Market

The value chain for the Direct Anterior Approach (DAA) market is intricate, encompassing various stages from raw material sourcing to post-surgical patient care, all of which contribute to the final product and service delivery. This analysis provides a structured view of the activities involved, highlighting areas of value addition, cost drivers, and potential for efficiency gains. It begins with upstream activities focusing on the procurement of specialized materials required for manufacturing high-quality hip implants and surgical instruments, including medical-grade titanium alloys, cobalt-chromium, and ultra-high molecular weight polyethylene. Relationships with key material suppliers and adherence to strict quality standards are paramount at this initial stage to ensure product reliability and patient safety. Research and development efforts, which involve extensive biomechanical testing and clinical trials for new implant designs and surgical techniques, are also critical upstream activities that drive innovation and market differentiation.

Midstream activities involve the manufacturing and assembly of DAA-specific hip implants and surgical instruments. This stage includes precision machining, surface coating, sterilization, and packaging, all conducted under stringent regulatory guidelines (e.g., FDA, CE mark). The design and engineering of specialized retractors, patient positioning systems, and potentially robotic components require significant expertise and capital investment. Efficient manufacturing processes, quality control measures, and economies of scale are vital for producing cost-effective and high-performing products. Following manufacturing, the distribution channel plays a pivotal role in delivering these specialized products to healthcare providers globally. This involves a complex network of direct sales forces, third-party distributors, and supply chain logistics, ensuring timely and secure delivery to hospitals and ambulatory surgical centers. Effective inventory management and warehousing are essential to meet market demand and minimize stockouts, particularly for high-value and specialized DAA products.

Downstream analysis focuses on the direct and indirect channels through which DAA products and services reach the end-users. Direct channels typically involve medical device companies selling directly to large hospital networks or purchasing groups, often supported by dedicated sales representatives who also provide product training and technical support to surgeons and operating room staff. These direct relationships facilitate close collaboration, allowing for immediate feedback and customization. Indirect channels involve distributors or group purchasing organizations (GPOs) that serve smaller hospitals, clinics, or regions where a direct sales presence may not be feasible. Post-sale activities, including post-operative patient follow-up, rehabilitation support, and long-term implant performance monitoring, although not strictly part of the product value chain, contribute significantly to patient satisfaction and the overall market reputation of DAA. Furthermore, surgeon education and continuous professional development programs are integral downstream activities, as they ensure widespread adoption of best practices and maintain high surgical quality.

Direct Anterior Approach Market Potential Customers

The primary potential customers for the Direct Anterior Approach (DAA) market are diverse, yet concentrated within the orthopedic healthcare sector, reflecting a strong demand for advanced hip replacement solutions. These end-users are typically organizations and medical professionals focused on delivering high-quality surgical outcomes for patients suffering from various hip pathologies. The overarching goal of these customers is to procure the most effective, safe, and efficient tools and implants that facilitate optimal patient recovery and functional improvement, while also considering operational efficiency and economic viability within their respective healthcare settings. The increasing patient awareness regarding minimally invasive techniques further influences the purchasing decisions of these customer groups, as they strive to meet evolving patient expectations and improve competitive positioning.

The most prominent end-users and buyers of DAA products and services include hospitals, ranging from large academic medical centers to community hospitals. These institutions are major purchasers of hip implants, specialized surgical instruments, and often invest in advanced operating room equipment such as specialized tables and robotic systems. Hospitals are driven by the need to offer state-of-the-art care, attract top orthopedic surgeons, and achieve favorable patient outcomes that contribute to their reputation and financial stability. Procurement decisions within hospitals are often influenced by multiple stakeholders, including orthopedic surgeons, hospital administrators, purchasing departments, and compliance officers, all weighing clinical efficacy against cost-effectiveness and supplier reliability. The volume of orthopedic procedures performed makes hospitals critical to the market's sustained growth.

Ambulatory Surgical Centers (ASCs) represent a rapidly growing segment of potential customers for the DAA market. ASCs specialize in outpatient surgical procedures, offering a more cost-effective and convenient alternative to traditional hospital settings for elective surgeries like total hip arthroplasty, especially for healthier patients. Their purchasing decisions are heavily influenced by equipment efficiency, rapid patient turnover capabilities, and the ability to minimize post-operative complications to ensure quick patient discharge. Furthermore, independent orthopedic clinics and private practices, particularly those with dedicated surgical facilities, also constitute an important customer base. These entities seek DAA solutions that can be integrated seamlessly into their existing workflows, enhance patient satisfaction, and allow their surgeons to remain at the forefront of orthopedic innovation. These various customer segments collectively drive demand for the entire spectrum of DAA-related products and services.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 3.2 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DePuy Synthes (Johnson & Johnson), Stryker, Zimmer Biomet, Smith & Nephew, Arthrex, Medtronic, CONMED, DJO Global, B. Braun, Corin Group, Exactech, MicroPort Orthopedics, LimaCorporate, FH Orthopedics, Waldemar Link GmbH & Co. KG, Amplitude Surgical, OmniLife Science Inc., Merete Medical GmbH, Wright Medical Group N.V. (acquired by Stryker), Globus Medical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Direct Anterior Approach Market Key Technology Landscape

The Direct Anterior Approach (DAA) market is characterized by a dynamic and evolving technology landscape, continuously pushing the boundaries of surgical precision, patient safety, and recovery efficiency. Central to this evolution are the advancements in specialized surgical instrumentation, which includes a range of specifically designed retractors that allow surgeons to visualize the joint through a small incision without muscle detachment, minimizing soft tissue trauma. Custom-designed patient positioning systems, such as advanced traction tables (e.g., the Hana table or similar systems), are also crucial, enabling optimal femoral exposure and facilitating component placement by allowing precise control over leg positioning throughout the procedure. These foundational technologies are constantly refined for ergonomics, material strength, and ease of use, directly impacting surgical flow and outcomes.

Beyond basic instrumentation, the integration of advanced imaging and navigation technologies represents a significant technological leap in the DAA market. Intraoperative fluoroscopy, often paired with digital templating software, provides real-time radiographic feedback, allowing surgeons to verify implant size, position, and leg length discrepancy with high accuracy. The emergence of computer-assisted navigation systems, both imageless and image-based, further enhances precision by guiding bone preparation and implant alignment, which is particularly valuable in complex cases. These navigation tools help overcome some of the challenges associated with limited visualization in a minimally invasive field, contributing to more reproducible and predictable results. The development of specialized hip implant designs, optimized for DAA insertion pathways and featuring anti-dislocation properties, also plays a critical role in enhancing the long-term success of the procedure.

The most transformative technological trend impacting the DAA market is the increasing adoption of robotic-assisted surgical platforms. These systems provide unparalleled precision in bone cuts and implant placement, leveraging pre-operative planning data to execute the surgical plan with sub-millimeter accuracy. Robotics can significantly reduce variability in surgical outcomes, potentially shortening the learning curve for surgeons and expanding the accessibility of DAA. Furthermore, the development of augmented reality (AR) and virtual reality (VR) tools for surgical training and simulation is revolutionizing how orthopedic surgeons acquire and refine their DAA skills. These immersive platforms offer realistic, risk-free environments for practice, allowing surgeons to gain proficiency before operating on patients. These technological convergences are not only improving existing DAA procedures but also paving the way for future innovations that promise even greater patient benefits and surgical efficiencies.

Regional Highlights

- North America: Dominates the DAA market, driven by advanced healthcare infrastructure, high adoption rates of innovative surgical techniques, strong presence of key market players, high prevalence of orthopedic diseases, and favorable reimbursement policies. The U.S. is a major contributor, characterized by significant R&D investments and a large volume of hip replacement procedures.

- Europe: Represents a substantial market for DAA, fueled by an aging population, increasing awareness of minimally invasive procedures, well-established healthcare systems, and government initiatives promoting advanced surgical care. Countries like Germany, the UK, and France are leading adopters, supported by robust orthopedic research and development activities.

- Asia Pacific (APAC): Expected to be the fastest-growing region, attributed to rapidly improving healthcare infrastructure, increasing healthcare expenditure, a large patient pool with rising incidence of orthopedic conditions, and growing medical tourism. Economic development and increasing access to advanced medical technologies in countries like China, India, and Japan are key growth drivers.

- Latin America: An emerging market with significant growth potential, driven by improving economic conditions, expanding healthcare access, and increasing awareness of advanced orthopedic treatments. Brazil and Mexico are leading the adoption of DAA techniques in the region, albeit from a lower base compared to developed economies.

- Middle East and Africa (MEA): A niche but growing market, propelled by ongoing healthcare infrastructure development projects, increasing investment in medical tourism, and a rising prevalence of lifestyle-related orthopedic issues. Countries in the GCC region are at the forefront of adopting modern surgical techniques, including DAA.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Direct Anterior Approach Market.- DePuy Synthes (Johnson & Johnson)

- Stryker

- Zimmer Biomet

- Smith & Nephew

- Arthrex

- Medtronic

- CONMED

- DJO Global

- B. Braun

- Corin Group

- Exactech

- MicroPort Orthopedics

- LimaCorporate

- FH Orthopedics

- Waldemar Link GmbH & Co. KG

- Amplitude Surgical

- OmniLife Science Inc.

- Merete Medical GmbH

- Wright Medical Group N.V.

- Globus Medical

Frequently Asked Questions

What is the Direct Anterior Approach (DAA) in hip replacement surgery?

The Direct Anterior Approach (DAA) is a minimally invasive surgical technique for total hip arthroplasty where the surgeon accesses the hip joint from the front, working through a natural muscle interval without cutting muscles or tendons. This method is associated with potentially faster recovery, less post-operative pain, and reduced risk of dislocation compared to traditional approaches.

What are the main benefits of choosing the Direct Anterior Approach?

Key benefits of DAA include expedited post-operative recovery, often allowing patients to mobilize sooner and return to normal activities more quickly. Patients typically experience less pain, shorter hospital stays, and a lower incidence of post-operative hip dislocation due to the preservation of posterior hip structures. It also results in a smaller, cosmetically favorable incision.

What are the potential challenges or risks associated with the Direct Anterior Approach?

While beneficial, DAA has a steeper learning curve for surgeons, requiring specialized training and equipment. Potential risks include specific complications such as temporary or permanent damage to the lateral femoral cutaneous nerve (leading to thigh numbness), femoral fractures during implant insertion, and the need for specialized operating tables. However, with experienced surgeons, these risks are generally low.

How do robotic-assisted surgical systems impact the Direct Anterior Approach?

Robotic-assisted surgical systems significantly enhance DAA by providing sub-millimeter precision in bone preparation and implant placement, guided by pre-operative planning. This technology can lead to more consistent and accurate surgical outcomes, potentially reducing variability between cases and improving the overall success rate of the procedure.

What is the market growth outlook for the Direct Anterior Approach?

The Direct Anterior Approach market is projected for robust growth, driven by increasing patient and surgeon preference for minimally invasive techniques, an aging global population necessitating hip replacements, and continuous technological advancements in surgical instrumentation and implant design. The market is expected to expand significantly, particularly with the integration of AI and robotic technologies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager