Direct Carrier Billing Platform Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436420 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Direct Carrier Billing Platform Market Size

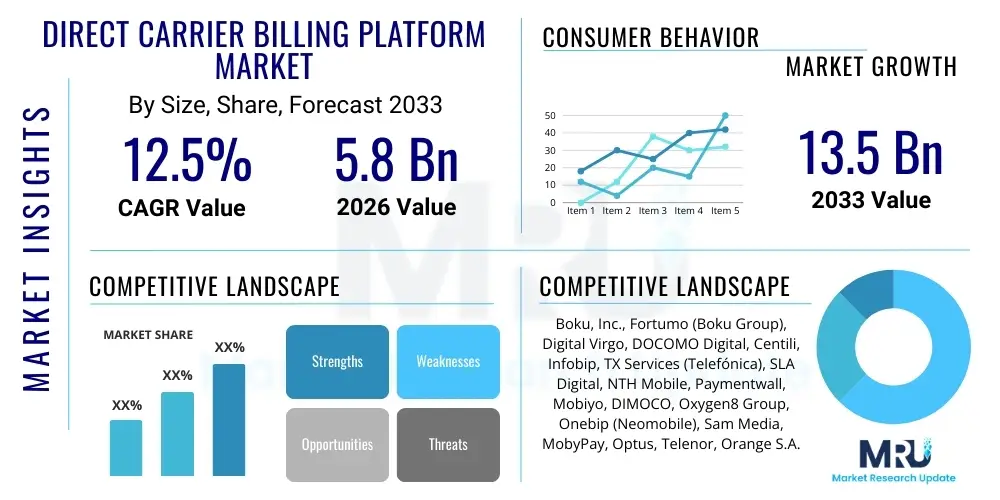

The Direct Carrier Billing Platform Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at $5.8 Billion in 2026 and is projected to reach $13.5 Billion by the end of the forecast period in 2033.

Direct Carrier Billing Platform Market introduction

The Direct Carrier Billing (DCB) Platform Market encompasses sophisticated technological solutions that enable consumers to purchase digital goods and services by charging the cost directly to their mobile phone bill. This mechanism serves as a crucial alternative payment method, particularly favored in regions with low banking penetration or where consumers prioritize transaction speed and simplicity. DCB platforms act as intermediaries, integrating mobile network operators (MNOs) with digital merchants, handling complex processes such as secure authentication, transaction routing, and settlement. The reliability and ubiquitous nature of mobile phones position DCB as a high-potential payment method for the expanding global digital economy.

Major applications for DCB platforms span a wide range of digital consumption categories, including mobile gaming, subscription video-on-demand (SVOD) services, digital music streaming, mobile app purchases, and micro-transactions for virtual goods. Key benefits driving the market include unparalleled payment accessibility, instantaneous transaction completion leading to reduced customer friction, and enhanced security compared to sharing credit card details online. The inherent trust relationship between the customer and their MNO further bolsters adoption rates. Moreover, DCB significantly lowers the barrier to entry for digital purchases among the globally unbanked or underbanked populations, making it a powerful tool for market expansion.

The primary driving factors fueling the expansion of the DCB platform market include the exponential rise in smartphone penetration across emerging economies, coupled with increasing consumption of digital content and micro-services. Furthermore, the persistent growth of the mobile gaming industry, which relies heavily on low-friction payment systems for in-app purchases, provides a sustained revenue stream. The evolution of DCB technology to support subscription models and premium services, alongside governmental initiatives promoting digital financial inclusion, solidifies its position as a vital element of the modern digital payments ecosystem.

Direct Carrier Billing Platform Market Executive Summary

The Direct Carrier Billing (DCB) Platform Market is witnessing robust growth, driven primarily by the global shift towards mobile-first commerce and the necessity for frictionless payment solutions in the digital content space. Business trends indicate a strong focus on platform interoperability and enhanced fraud detection capabilities, with major platform providers aggressively pursuing partnerships with tier-one Mobile Network Operators (MNOs) to expand their geographical footprint. Strategic mergers and acquisitions are common as companies seek to consolidate market share and integrate complementary technologies, particularly those focused on risk management and regulatory compliance, such as adherence to revised payment directives like PSD2 in Europe. The market is also evolving towards supporting higher average transaction values (ATVs) and facilitating utility payments, moving beyond traditional low-cost digital goods.

Regionally, the Asia Pacific (APAC) market dominates in terms of transaction volume due to the vast mobile subscriber base and high proportion of unbanked consumers, particularly in Southeast Asia and India. However, Europe exhibits high revenue per user, driven by stringent regulatory frameworks that ensure consumer protection and sophisticated integration with premium digital content providers. North America focuses on high-value digital subscriptions and leverages DCB as a complementary payment method alongside conventional banking services. Segment trends show that the Digital Content and Gaming application segment remains the primary revenue contributor, though the emergence of IoT applications requiring micro-payments and the adoption of DCB for transit and parking services represent significant areas of future diversification.

Overall, the market is characterized by increasing technological sophistication. Platform providers are heavily investing in Application Programming Interface (API) development to simplify merchant integration and time-to-market. The competitive landscape is intense, favoring providers that offer scalability, multi-currency support, and robust back-office features including detailed reporting and analytics for MNOs and merchants. The future trajectory suggests a closer integration between DCB and emerging payment technologies, potentially bridging the gap between traditional telecom billing infrastructure and modern fintech solutions.

AI Impact Analysis on Direct Carrier Billing Platform Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Direct Carrier Billing (DCB) Platform Market revolve heavily around improving security, optimizing transaction flow, and enhancing personalization. Users frequently ask: "How can AI reduce the rising incidence of fraudulent DCB transactions?" or "Will AI enable personalized content recommendations based on DCB purchase history?" and "How does machine learning improve the efficiency of MNO revenue assurance processes?" These questions highlight key themes: the urgent need for sophisticated fraud prevention, the potential for using rich purchase data for customer engagement, and the necessity of automating complex operational tasks like billing reconciliation.

AI's most immediate and critical impact lies in transforming risk management and fraud detection within DCB ecosystems. Traditional rule-based fraud systems often struggle against complex, evolving attacks such as Account Takeover (ATO) and unauthorized third-party transactions. AI and machine learning algorithms can analyze billions of historical transactions in real-time, identifying subtle behavioral anomalies, geographical inconsistencies, and transaction patterns indicative of fraud with far greater accuracy than human analysts or static models. This capability significantly reduces financial losses for MNOs and merchants, thereby boosting confidence in DCB as a secure payment method.

Furthermore, AI is pivotal in optimizing the customer experience and enhancing revenue opportunities. By analyzing user purchasing behavior data collected through the DCB platform, machine learning models can segment customers effectively and predict the optimal time, price point, and type of content a user is likely to purchase next. This drives highly effective personalized marketing and targeted promotions by both MNOs and integrated merchants, improving conversion rates and Average Revenue Per User (ARPU). Operationally, AI also streamlines dispute resolution and compliance checks, leading to faster settlements and reduced operational expenditure for platform providers.

- Enhanced Real-Time Fraud Detection: Utilizing machine learning to identify anomalous transaction patterns and prevent financial losses instantly.

- Dynamic Risk Scoring: Continuous algorithmic assessment of transaction risk based on device data, location, and historical spending patterns.

- Optimized Conversion Funnels: AI-driven adjustments to the billing flow interface to minimize drop-off rates and maximize successful transactions.

- Personalized Offerings: Leveraging purchase data to segment customers and offer highly relevant digital content or subscription upgrades.

- Automated Revenue Assurance: Machine learning algorithms streamlining the reconciliation process between merchants, platform providers, and MNOs, minimizing billing errors.

- Predictive Churn Analysis: Identifying customers likely to cease using DCB based on changes in usage behavior, allowing proactive intervention.

DRO & Impact Forces Of Direct Carrier Billing Platform Market

The Direct Carrier Billing (DCB) Platform Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively constitute the critical impact forces steering its evolution. A primary driver is the necessity for digital payment solutions that bypass traditional banking infrastructure, especially in emerging markets characterized by high mobile penetration but low credit card adoption. This factor significantly enhances market reach for digital merchants. Coupled with this is the extreme convenience offered to banked users who prefer the one-click, low-friction payment process for micro-transactions, avoiding the repeated input of card details. However, the market faces substantial restraints, primarily regulatory complexities which vary widely across countries, demanding continuous technological adaptation for compliance, such as GDPR and region-specific payment mandates. Furthermore, the persistent threat of mobile payment fraud and chargeback liability poses a significant financial risk to MNOs and platforms, often necessitating high investment in security infrastructure.

Opportunities for growth are abundant, particularly in integrating DCB capabilities into new sectors like the Internet of Things (IoT), where micro-payments for connected devices and services (e.g., smart home utilities, connected cars) will become commonplace. Another major opportunity lies in expanding DCB acceptance within B2B environments, facilitating secure internal transactions or low-value supplier payments. The standardization of payment APIs and the global rollout of 5G networks, which promises lower latency and higher data speeds, will further accelerate the adoption of real-time digital services that rely on DCB for instantaneous monetization.

The overall impact forces are strongly positive, suggesting sustained expansion, provided the industry successfully navigates the regulatory fragmentation and continuously enhances its fraud mitigation strategies. The growing digital appetite globally, particularly for content and gaming, ensures a steady demand base, making DCB a crucial utility rather than merely an alternative payment method. Strategic partnerships between telecom operators, platform vendors, and global content providers will be key determinants of future market dominance.

Segmentation Analysis

The Direct Carrier Billing Platform Market is strategically segmented to provide a detailed view of its composition, revenue generation mechanisms, and application areas. Primary segmentation is based on Transaction Type, focusing on whether purchases are one-time or subscription-based, which significantly impacts revenue assurance and platform complexity. Further categorization relies on the Application vertical, identifying the major end-use sectors driving transaction volume, such as gaming, digital content, and utilities. Analyzing these segments helps stakeholders understand prevailing consumer spending habits and identify high-growth areas for platform investment and merchant acquisition strategies. The complexity inherent in managing differing regulatory and tax requirements across various geographic regions also necessitates robust regional segmentation.

- By Transaction Type:

- One-Time Purchases (Micro-transactions, Single Content Downloads)

- Subscription Services (Recurring Monthly/Annual Charges for Streaming, Apps)

- By Channel:

- Web-Based (In-browser purchases redirected to carrier billing)

- App-Based (In-app purchases utilizing DCB APIs)

- By Operating System:

- Android

- iOS (Limited adoption, primarily via carrier bundling)

- Others

- By Application:

- Digital Content and Media (Music, Video Streaming, eBooks)

- Gaming (In-app purchases, Virtual Currency)

- Utility and Ticketing (Public Transport, Parking, Software Licensing)

- App Stores and Marketplaces

- E-commerce (Low-value physical goods)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Direct Carrier Billing Platform Market

The Direct Carrier Billing platform value chain is complex and involves multiple interconnected entities, starting from upstream infrastructure providers and culminating in the end consumer. Upstream activities are dominated by Mobile Network Operators (MNOs) who own the billing relationship with the consumer and the crucial network infrastructure. Platform providers sit centrally in the chain, offering the technological backbone—including secure APIs, aggregation services, and settlement engines—that bridges MNO capabilities with merchant demands. The efficiency and security of this central platform are paramount, as they determine the success rate of transactions and the speed of integration.

Midstream involves payment gateways and aggregation services provided by the DCB platforms themselves. These entities are responsible for fraud management, regulatory compliance checks, tax calculation, and accurate billing transmission to the MNOs. Downstream activities involve digital merchants and content providers (the direct clients of the platform), who integrate the DCB option into their checkout processes. The final recipient is the end consumer, who relies on a seamless and trustworthy payment experience. Effective distribution channels are characterized by both direct integration (large merchants connecting directly to a platform) and indirect distribution, where smaller merchants utilize third-party aggregators or payment facilitators who, in turn, leverage the core DCB platform.

The value generated is shared primarily through revenue splits between the MNO (who takes the largest share for customer ownership and billing risk), the DCB platform provider (for technology and aggregation services), and the merchant (for the content/service provided). Transparency, low latency, and robust reconciliation systems are critical for maintaining trust and efficiency across this multi-party ecosystem. The trend leans towards platform providers offering more sophisticated ancillary services, such as data analytics and dynamic pricing tools, to capture greater value share.

Direct Carrier Billing Platform Market Potential Customers

Potential customers and primary end-users of Direct Carrier Billing platforms are fundamentally divided into two major groups: the enterprises that utilize the technology for monetization, and the consumers who employ it for purchases. The primary enterprise buyers are digital content providers, notably those in mobile gaming and subscription video or music services, requiring frictionless global payment collection. Telecom operators themselves are also key customers, leveraging platforms to manage third-party service billing efficiently and securely, often seeking enhanced fraud mitigation tools provided by the platform vendors.

Beyond traditional media, emerging buyers include utility companies seeking simplified micro-payment collection for IoT services and smart city applications. Furthermore, global application stores and marketplaces use DCB platforms to facilitate purchases for users without traditional bank cards. From the consumer perspective, the most frequent buyers are mobile users located in emerging economies (the underbanked population) and youth demographics globally who prefer using their mobile balance or bill for spontaneous digital purchases.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.8 Billion |

| Market Forecast in 2033 | $13.5 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Boku, Inc., Fortumo (Boku Group), Digital Virgo, DOCOMO Digital, Centili, Infobip, TX Services (Telefónica), SLA Digital, NTH Mobile, Paymentwall, Mobiyo, DIMOCO, Oxygen8 Group, Onebip (Neomobile), Sam Media, MobyPay, Optus, Telenor, Orange S.A., Vodafone Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Direct Carrier Billing Platform Market Key Technology Landscape

The technological landscape of the Direct Carrier Billing (DCB) market is defined by robust, highly scalable infrastructure designed to handle billions of transactions annually while ensuring regulatory compliance and paramount security. Central to this landscape is the widespread adoption of standardized Application Programming Interfaces (APIs), which allow merchants and content providers to integrate the payment option quickly and reliably across various MNOs globally. Modern DCB platforms rely heavily on RESTful APIs for real-time authentication, transaction processing, and status feedback, minimizing latency crucial for enhancing the consumer experience. Furthermore, the underlying infrastructure often utilizes cloud-native architectures to ensure elasticity and geographic distribution of processing power, essential for supporting peak traffic loads, especially during major gaming or content releases.

Security and compliance technology represent another cornerstone. This includes sophisticated mechanisms for fraud prevention, often incorporating advanced AI/ML algorithms to analyze transactional metadata in milliseconds. Compliance technology is heavily focused on adherence to regulations such as the EU’s Payment Services Directive 2 (PSD2), requiring Strong Customer Authentication (SCA) for many transaction types. Platforms utilize tokenization and encryption techniques to safeguard customer data during the billing process, ensuring that sensitive information is never exposed to the merchant. The necessity for high-level data security drives continuous investment in advanced security protocols and monitoring systems, often certified to meet stringent industry standards.

Moreover, the technological evolution is moving towards sophisticated data analytics and reporting tools. DCB platforms now offer MNOs and merchants granular, real-time insights into consumer behavior, conversion rates, and revenue performance across different countries and content types. These reporting dashboards are critical for optimizing pricing strategies and managing chargeback rates effectively. The ongoing integration with 5G technology is expected to further enhance the speed and reliability of these platforms, enabling entirely new use cases requiring ultra-low latency billing, such as instantaneous payment for augmented reality (AR) or virtual reality (VR) content accessed via mobile devices.

The transition toward greater financial transparency mandates better integration with core MNO Business Support Systems (BSS) and Operations Support Systems (OSS). Modern DCB platforms must seamlessly interface with these legacy systems, utilizing microservices architecture to ensure modularity and scalability. This technological evolution allows for rapid deployment of new payment rules, tariff changes, and promotional campaigns, thereby maintaining competitive agility in a fast-moving digital market. The capacity to handle recurring billing reliably and manage the intricacies of subscription lifecycle management (e.g., failed payments, renewals, cancellations) is a key technical differentiator among leading platform providers.

Regional Highlights

The Direct Carrier Billing (DCB) Platform Market demonstrates significant regional variation in terms of maturity, regulatory complexity, and primary growth drivers.

- Asia Pacific (APAC): APAC represents the largest market globally for DCB in terms of transaction volume, driven by massive mobile subscriber bases and substantial unbanked populations across countries like Indonesia, India, and the Philippines. In these high-growth areas, DCB often serves as the primary gateway for digital purchases. The market dynamics here are characterized by fierce competition among platform providers to integrate with numerous regional MNOs and cater to the booming mobile gaming sector. Regulatory environments are generally supportive of digital payments but often mandate localization of billing procedures. Growth is accelerating as DCB expands into utility payments and micro-finance services, moving beyond just digital content. The rapid adoption of 5G in key APAC economies, such as South Korea and China, promises higher ARPU transactions for premium mobile content.

- Europe: The European DCB market is highly mature but strictly regulated, primarily influenced by the Payment Services Directive 2 (PSD2), which necessitates Strong Customer Authentication (SCA). This regulatory environment has forced platforms to innovate, providing highly secure, frictionless authentication methods that comply with complex rules while maintaining high conversion rates. The focus in Europe is less on the unbanked and more on convenience for digital content subscriptions (SVOD, music) and premium apps. The market is segmented, with Western Europe focusing on high-value, regulated transactions, and Eastern Europe showing faster growth in transaction volumes due to increasing digital adoption. MNO cooperation is strong, often involving strategic investments in DCB platforms.

- North America: North America utilizes DCB primarily as an alternative payment method for premium digital goods, such as specialized software and entertainment bundles, rather than a primary payment rail for the unbanked. The market is defined by high average transaction values (ATVs) and a strong reliance on subscription models. Fraud detection and revenue assurance are major focuses for MNOs and platform providers, as the liability structures are stringent. DCB platforms often operate by integrating directly with major content ecosystems like Google Play and specific streaming services, positioning themselves as a trusted, complementary option to credit cards.

- Latin America (LATAM): LATAM exhibits explosive growth potential, mirroring the dynamics of APAC due to high mobile penetration and significant underbanked populations, particularly in Brazil and Mexico. The challenge here is market fragmentation, characterized by varying tax structures, currency volatility, and regional regulatory differences. DCB is vital for monetizing mobile gaming and social media content, and its growth is strongly tied to the expansion of local MNO partnerships and the capacity of platforms to handle multi-currency operations and local language support effectively.

- Middle East and Africa (MEA): The MEA region is developing rapidly, with the Gulf Cooperation Council (GCC) states focusing on high-value entertainment services and African nations leveraging DCB for essential services and financial inclusion. DCB platforms are essential in areas with poor physical banking infrastructure, acting as a crucial enabler for basic mobile commerce and fintech integration. Regulatory environments are evolving quickly, demanding platform flexibility to support rapidly changing governmental directives regarding digital transactions and mobile money integration.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Direct Carrier Billing Platform Market.- Boku, Inc.

- Digital Virgo

- DOCOMO Digital

- Centili

- Infobip

- Fortumo (Boku Group)

- DIMOCO

- SLA Digital

- TX Services (Telefónica)

- NTH Mobile

- Paymentwall

- Mobiyo

- Oxygen8 Group

- Onebip (Neomobile)

- Sam Media

- MobyPay

- Mach (part of Boku)

- Pulsar Platform

- Argus Telematics

- Telepin Software

Frequently Asked Questions

Analyze common user questions about the Direct Carrier Billing Platform market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Direct Carrier Billing (DCB) and how does it work for consumers?

Direct Carrier Billing (DCB) is a mobile payment method where purchases of digital content, apps, or services are charged directly to the user's mobile phone bill or deducted from their prepaid balance. It works by having the DCB platform securely authenticate the transaction with the user’s Mobile Network Operator (MNO), bypassing the need for credit cards or bank details, offering a high-frictionless payment experience.

Which application segments drive the most revenue for DCB platforms?

The most significant revenue drivers for DCB platforms globally are the Digital Content and Mobile Gaming segments. Mobile gaming, including in-app purchases and virtual currency sales, benefits immensely from DCB's speed and convenience, while subscription services for video streaming and music also contribute substantially, particularly in mature markets.

What are the primary security concerns associated with Direct Carrier Billing?

The primary security concerns revolve around mobile payment fraud, including "clickjacking," account takeover (ATO), and unauthorized third-party charges. Market solutions increasingly rely on sophisticated AI and machine learning techniques to analyze behavioral data in real-time, enhancing fraud detection and risk scoring to mitigate these financial liabilities.

How does global regulation, such as PSD2, impact the DCB market?

Regulations like PSD2 (Payment Services Directive 2) in Europe impose stringent requirements, primarily demanding Strong Customer Authentication (SCA) for most DCB transactions. This has necessitated technological upgrades for platform providers to maintain compliance and security while preserving the low-friction user experience crucial for DCB adoption.

In which geographical region is the DCB market exhibiting the fastest growth?

The Asia Pacific (APAC) region, specifically Southeast Asia and India, is currently exhibiting the fastest growth in the DCB market in terms of transaction volume. This accelerated expansion is fueled by the region's massive mobile penetration rates and the large population of consumers who remain unbanked or underbanked, relying on mobile credit as their primary purchasing power.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager