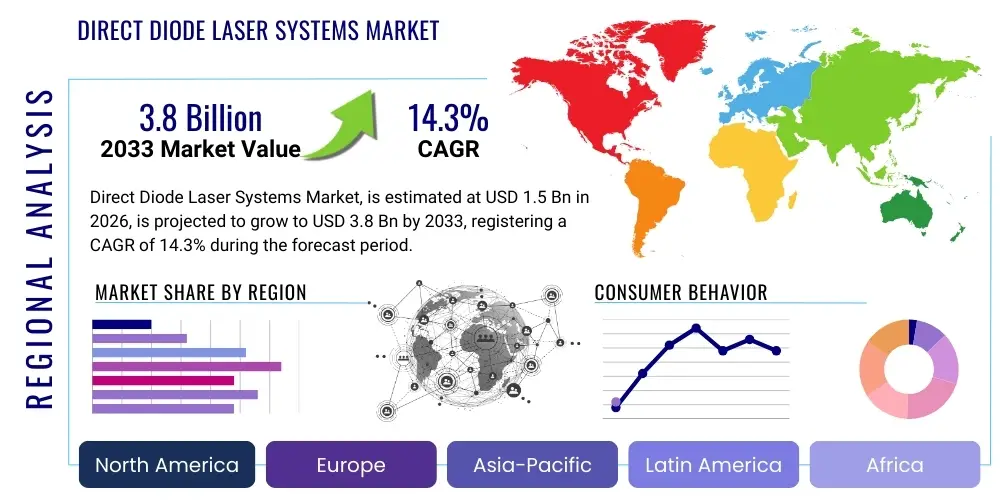

Direct Diode Laser Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438865 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Direct Diode Laser Systems Market Size

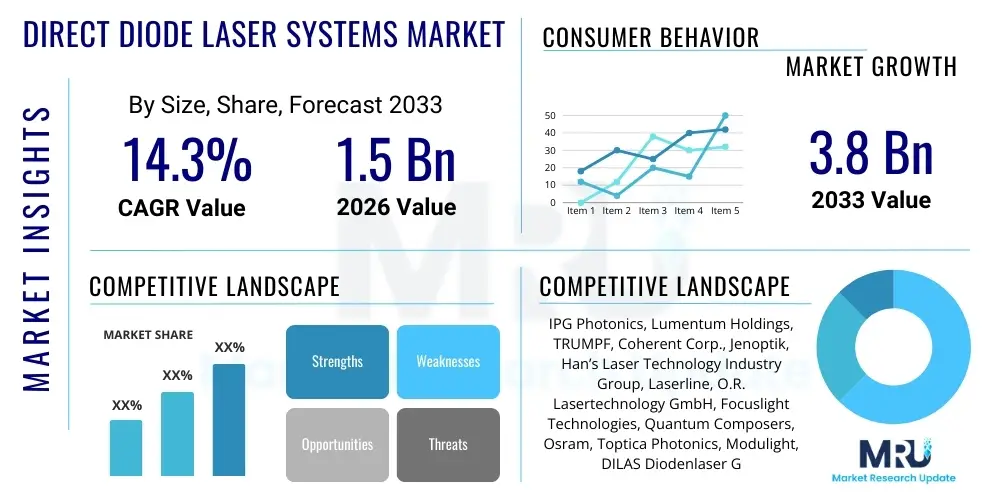

The Direct Diode Laser Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.3% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 3.8 Billion by the end of the forecast period in 2033.

Direct Diode Laser Systems Market introduction

The Direct Diode Laser (DDL) Systems Market encompasses laser technology where the light is directly emitted from semiconductor diodes, offering high efficiency, compact size, and superior electrical-to-optical conversion. These systems are increasingly replacing traditional solid-state and gas lasers across diverse industrial and medical applications due to their exceptional power scalability and reduced maintenance requirements. The intrinsic advantages of DDLs, such as their small footprint and robust nature, make them highly desirable for integration into automated manufacturing lines and precision medical devices, driving steady adoption across global industries focused on optimization and cost reduction.

Major applications of DDL systems span high-power material processing, including welding, cladding, heat treatment, and brazing, particularly within the automotive, aerospace, and heavy machinery sectors. Additionally, DDLs are critical in the medical field for dermatological procedures, tissue welding, and surgical applications, offering precise energy delivery and minimal invasiveness. The market growth is fundamentally supported by the continuous advancements in diode technology, enabling higher power outputs and improved beam quality, which previously limited their effectiveness in certain high-precision tasks.

Key benefits driving market expansion include their energy efficiency, significantly lower total cost of ownership compared to older laser technologies, and operational simplicity. The primary driving factors are the rapid expansion of electric vehicle manufacturing, which demands high-speed, precise battery welding capabilities, and the growing demand for minimally invasive surgical tools. Furthermore, the global trend towards Industry 4.0 and smart manufacturing necessitates integrated, highly reliable laser sources, further solidifying the position of DDL systems as foundational components in modern industrial processes.

Direct Diode Laser Systems Market Executive Summary

The Direct Diode Laser Systems Market is characterized by robust commercial growth, driven primarily by the escalating demand for high-power, energy-efficient laser sources in advanced manufacturing and medical technology sectors. Key business trends include aggressive mergers and acquisitions among diode manufacturers and system integrators focused on consolidating market share and achieving vertical integration, alongside significant investment in developing high-brightness, quasi-continuous wave (QCW) diodes. The shift toward higher integration levels, where the laser source is modularly built into the machine tool, rather than being a standalone unit, represents a critical development influencing procurement patterns among large industrial end-users, thereby streamlining supply chains and accelerating deployment times across global markets.

Regionally, the Asia Pacific (APAC) stands as the dominant and fastest-growing market, propelled by massive industrial expansion in China, South Korea, and Japan, particularly within the consumer electronics, automotive (especially EV battery production), and shipbuilding industries. North America and Europe maintain strong market shares, driven by high-value applications requiring precision, such as aerospace component manufacturing and advanced medical device production, coupled with stringent environmental regulations favoring energy-efficient DDL systems over traditional alternatives. Segment trends reveal that the Material Processing application segment, particularly high-power cladding and heat treatment, accounts for the largest revenue share, while the Medical segment is projected to exhibit the highest CAGR, spurred by technological advancements in fiber coupling and multi-wavelength laser therapy systems.

Technological progression continues to focus on improving beam quality and increasing kilowatt-class power levels while maintaining diode longevity and reliability. The introduction of wavelength beam combining (WBC) and spectral beam combining (SBC) techniques is a crucial development, enabling DDLs to achieve power densities previously exclusive to fiber or disk lasers. Overall, the market remains highly competitive, demanding continuous innovation in semiconductor fabrication and thermal management to address the increasing performance requirements set by sophisticated industrial applications globally, ensuring sustained high growth throughout the forecast period.

AI Impact Analysis on Direct Diode Laser Systems Market

Common user questions regarding AI’s impact on Direct Diode Laser Systems center around how artificial intelligence and machine learning (ML) can optimize complex laser parameters, enhance process quality control, and predict system failures. Users are keen to understand if AI can effectively overcome the historical limitations of DDLs, such as beam divergence, and how automation driven by ML can revolutionize industrial applications like laser welding and additive manufacturing. Key themes emerging from these inquiries include the potential for AI-driven adaptive process control—where the laser parameters (power, focus, speed) adjust in real-time based on material feedback—and the implementation of predictive maintenance routines, minimizing costly downtime associated with high-throughput manufacturing environments.

The integration of AI directly impacts the operational efficiency and precision of DDL systems. By leveraging machine vision and deep learning algorithms, DDL systems can analyze weld pool dynamics, surface quality, or tissue response during medical procedures instantaneously. This capability allows the system to make minute adjustments—such as modulating the pulse duration or shifting the focal point—significantly improving consistency and reducing defects, especially in critical applications like complex joining processes in battery modules or high-strength steel components. This autonomous optimization capability fundamentally transforms DDLs from programmable tools into truly intelligent manufacturing assets.

Furthermore, AI is instrumental in managing the vast datasets generated by high-power DDL installations regarding thermal stability, power degradation, and component wear. Predictive maintenance models built using this data can anticipate potential diode failure before it occurs, ensuring maximized uptime and optimizing inventory management for spare parts. This transition from reactive maintenance to proactive operational management using AI enhances the overall value proposition of DDL systems, making them more attractive for 24/7 industrial operations where reliability and throughput are paramount considerations for manufacturers across the automotive, aerospace, and heavy industrial sectors.

- AI-driven Adaptive Process Control: Real-time optimization of laser parameters (power, speed, focus) to ensure consistent weld quality and material interaction.

- Predictive Maintenance: Use of machine learning models to analyze thermal and performance data, predicting diode failure and minimizing system downtime.

- Enhanced Beam Shaping and Quality Control: Utilizing deep learning for instantaneous analysis of laser output and adjustments to compensate for inherent beam imperfections.

- Automated Defect Detection: Implementing machine vision and AI to identify and classify defects during material processing (e.g., porosity, cracks) without human intervention.

- Process Optimization for Additive Manufacturing: ML algorithms defining optimal DDL scanning strategies and power profiles for high-resolution 3D printing applications.

DRO & Impact Forces Of Direct Diode Laser Systems Market

The Direct Diode Laser Systems Market is significantly influenced by a dynamic interplay of Drivers, Restraints, and Opportunities, collectively forming the core Impact Forces shaping its trajectory. The primary driver is the ongoing industrial shift toward high-efficiency, compact, and low-maintenance laser sources, particularly spurred by the growth of electric vehicle manufacturing, which relies heavily on precise and high-speed DDL welding for battery components. This is coupled with the inherent energy efficiency of DDLs compared to conventional lasers, making them attractive in an era focused on reducing operational carbon footprints. However, the market faces significant restraints, chiefly related to the relatively poorer beam quality (higher divergence) of high-power DDLs compared to fiber or disk lasers, limiting their penetration into ultra-high-precision cutting and deep penetration welding applications. Furthermore, the high initial capital investment required for installing high-power DDL integration systems can be a deterrent for Small and Medium Enterprises (SMEs), particularly in emerging economies.

Opportunities for exponential growth are concentrated in advanced beam combining technologies, such as spectral and spatial beam combining, which effectively address the historical limitation of beam quality, paving the way for DDLs to compete directly in the kilowatt-class material processing market. Another significant opportunity lies in expanding applications within the consumer electronics sector for micro-processing and display manufacturing, where the small footprint and pulsed operation capabilities of DDLs offer distinct advantages. The Impact Forces ultimately favor technological innovation; the market demands systems that maintain the diode's high efficiency while achieving near-diffraction-limited beam quality. Manufacturers who successfully integrate sophisticated beam shaping optics and robust thermal management systems stand to gain a substantial competitive advantage, driving market consolidation toward high-performance DDL solutions.

The overarching impact force is the Total Cost of Ownership (TCO) advantage offered by DDLs; their superior wall-plug efficiency (often exceeding 50%) translates directly into reduced energy consumption and lower operating expenses compared to fiber lasers (typically 30-40% efficiency) or CO2 lasers (typically less than 20% efficiency). This economic compelling factor, combined with the increasing demand for precision manufacturing in regions undergoing rapid industrialization, ensures sustained market expansion. However, the continuous pressure to increase power levels while miniaturizing the physical size of the system necessitates ongoing investment in semiconductor fabrication techniques and packaging, making technological scaling a critical determinant of market success and competitive differentiation over the forecast period.

Segmentation Analysis

The Direct Diode Laser Systems Market is comprehensively segmented based on power output, application, and end-user industry, reflecting the diverse operational requirements across different sectors. Power output classification is crucial as it dictates the suitability of the DDL system for tasks ranging from delicate medical procedures to heavy industrial welding, distinguishing between low-power, medium-power, and high-power categories. The application segment provides granular insights into key usage areas, with material processing dominating the market, followed by medical applications (dermatology, surgery) and telecommunications, each exhibiting unique growth drivers and technological demands based on required wavelength and pulse characteristics.

End-user segmentation highlights the primary consumers of DDL technology, including the automotive industry (the largest consumer due to battery manufacturing), aerospace and defense (for precision component welding and cladding), and the electronics sector (for micro-processing and marking). Geographical segmentation is also vital, identifying regions with rapid industrial adoption (APAC) versus established markets focusing on high-precision, niche applications (North America and Europe). This structured approach to segmentation allows stakeholders to accurately gauge market penetration, identify high-growth segments, and tailor product development strategies to specific industrial needs and regulatory environments globally.

- By Power Output:

- Low Power (Up to 100 W)

- Medium Power (100 W to 1 kW)

- High Power (Above 1 kW)

- By Application:

- Material Processing (Welding, Cladding, Brazing, Hardening, Cutting)

- Medical and Aesthetic (Dermatology, Surgery, Dental)

- Telecommunications

- Pumping (as a pump source for other lasers)

- By End-User Industry:

- Automotive (EV Battery Manufacturing, Body Welding)

- Aerospace and Defense

- Electronics and Semiconductor

- Heavy Industry (Shipbuilding, Oil & Gas)

- Healthcare

- By Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Direct Diode Laser Systems Market

The value chain for Direct Diode Laser Systems begins with the upstream segment, dominated by semiconductor fabrication firms responsible for producing high-quality laser diode chips, wafers, and bars. This stage requires significant capital expenditure in cleanroom facilities and specialized lithography equipment, focusing intensely on material science (e.g., GaAs, InP substrates) to maximize efficiency and lifetime. Key upstream activities include epitaxial growth, chip processing, and subsequent testing, which are critical determinants of the final system's brightness and power output. Competitive advantage at this stage hinges on intellectual property surrounding chip design and robust thermal management techniques at the chip level.

The midstream component involves system integrators and laser manufacturers who take the diode bars, package them into modular components, and combine them with optics, power supplies, and cooling systems to create a functional DDL unit or system. This stage involves complex engineering related to beam shaping, fiber coupling, and packaging techniques (e.g., conduction cooling, micro-channel cooling). Distribution channels are diverse, utilizing both direct and indirect routes. Direct sales are common for high-value, customized industrial systems, involving direct engagement between the manufacturer and large automotive or aerospace end-users. Indirect channels utilize specialized distributors and value-added resellers (VARs) who provide localized service, maintenance, and integration expertise, particularly to smaller industrial clients and the medical sector.

The downstream segment involves the end-user industries where the DDL systems are deployed, primarily for automated material processing tasks. High-power systems are integrated into CNC machines, robotic arms, and specialized production lines. The final value added in the downstream segment includes applications engineering support, ongoing maintenance contracts, and the provision of consumables. Success in this part of the chain is driven by strong partnerships with machinery manufacturers and the ability to offer comprehensive service packages that guarantee high uptime and performance reliability crucial for sophisticated manufacturing environments across the globe.

Direct Diode Laser Systems Market Potential Customers

Potential customers and end-users of Direct Diode Laser Systems are primarily large-scale industrial manufacturers and specialized healthcare providers who require precise, high-efficiency energy delivery for critical processes. The automotive sector, particularly companies involved in manufacturing Electric Vehicle (EV) batteries, constitutes the largest customer base. These firms utilize DDLs extensively for high-speed, contamination-free welding of battery cells, modules, and packs, demanding kilowatt-class, highly reliable systems to support mass production throughput. The robustness and efficiency of DDLs are ideal for the demanding, continuous operation required in automotive assembly lines.

Another significant group of customers includes aerospace and defense contractors focused on advanced component manufacturing. These organizations use DDL systems for laser cladding, providing protective and wear-resistant coatings for turbine blades and high-stress airframe components, as well as precision welding of specialized alloys. The ability of DDLs to deliver stable, uniform heat input over large areas makes them highly valued for these high-specification applications where material integrity is non-negotiable. Furthermore, medical device manufacturers and specialized dermatological clinics form a growing customer segment, utilizing DDLs for surgical cutting, coagulation, and various aesthetic treatments due to the precise control over wavelength and energy delivery.

The electronics and semiconductor industry represents an expanding customer segment, where DDLs are employed for intricate micro-processing tasks, marking, and localized heat treatment of sensitive components. As devices shrink and demand for high-throughput fabrication increases, the compact nature and high modulation capability of DDLs offer a distinct advantage over bulkier laser technologies. Overall, the ideal potential customer is one prioritizing low TCO, energy efficiency, high automation capability, and system reliability within their capital-intensive manufacturing or treatment environments, ensuring the DDL system provides a rapid and substantial return on investment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 3.8 Billion |

| Growth Rate | CAGR 14.3% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IPG Photonics, Lumentum Holdings, TRUMPF, Coherent Corp., Jenoptik, Han’s Laser Technology Industry Group, Laserline, O.R. Lasertechnology GmbH, Focuslight Technologies, Quantum Composers, Osram, Toptica Photonics, Modulight, DILAS Diodenlaser GmbH, NKT Photonics, TeraDiode (Coherent), Spectrogon AB, Rofin-Sinar Technologies (Coherent), Alpha Laser, Array Photonics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Direct Diode Laser Systems Market Key Technology Landscape

The technological landscape of the Direct Diode Laser Systems Market is rapidly evolving, primarily focused on overcoming the inherent limitations of high beam divergence to compete effectively with established fiber and disk lasers. Central to this evolution is the advancement in semiconductor fabrication, particularly the engineering of emitter geometry and the use of high-brightness epitaxial materials (like quantum dot structures) that increase power density while maintaining wall-plug efficiency. Furthermore, packaging and thermal management technologies are undergoing continuous refinement. High-power systems increasingly utilize micro-channel cooling and advanced heat sink materials to efficiently dissipate the significant waste heat generated, which is crucial for maximizing diode longevity and ensuring stable output power during continuous, high-duty cycle industrial operation, thereby improving overall system reliability.

A transformative area in the technology landscape is beam conditioning and combining. Since a single diode bar lacks the power density and focus required for deep penetration welding or precision cutting, manufacturers employ sophisticated techniques such as spatial beam combining (SBC) and spectral beam combining (SBC). Spatial combining involves stacking multiple diode bars and focusing them into a fiber, while spectral combining leverages different wavelengths from multiple diodes and combines them into a single, high-power, low-divergence beam using complex diffraction gratings. These combining techniques allow DDLs to achieve multi-kilowatt outputs with a beam quality (BPP) suitable for previously inaccessible applications, making DDL systems viable alternatives for tasks traditionally reserved for expensive solid-state lasers and significantly expanding their addressable market.

The integration of monitoring and control electronics also plays a pivotal role in the modern DDL system architecture. Advanced control units manage power stability, pulse modulation, and system diagnostics, often incorporating AI and machine learning algorithms for real-time parameter adjustment and predictive maintenance. Furthermore, the development of fiber-coupled DDL systems is a key trend, offering flexibility and easier integration into robotic manufacturing cells, facilitating remote processing and protecting the sensitive laser source from harsh industrial environments. The combination of high-efficiency chips, advanced thermal management, and sophisticated beam combining strategies is collectively propelling DDLs toward mainstream adoption across demanding industrial segments globally, underscoring the shift towards highly robust and energy-efficient laser manufacturing solutions.

A detailed examination of specific technological components reveals the competitive focus areas. High-power diode arrays now employ proprietary facet protection techniques to prevent catastrophic optical mirror damage (COMD), a historical point of failure under high-power stress. This protective layering significantly extends the operational lifespan, critical for reducing TCO. The trend toward multi-wavelength systems is also gaining traction, particularly in material processing, where tailored wavelength combinations can optimize absorption rates for specific metals (e.g., copper or aluminum), which are highly reflective to standard infrared wavelengths, thereby enhancing processing speed and quality, particularly relevant for emerging EV battery manufacturing processes.

Another major technological thrust involves the transition from standard continuous wave (CW) operation to quasi-continuous wave (QCW) and pulsed modes for high peak power applications like fine cutting and drilling. QCW operation allows diodes to operate above their nominal CW rating for short durations, achieving higher peak power crucial for clean material removal while managing the average heat load effectively. This modulation capability is highly valued in the microelectronics industry and in specialized medical applications, where precise energy dosing and minimized thermal collateral damage are paramount. Furthermore, the push towards green and blue DDL systems, leveraging Gallium Nitride (GaN) technology, is opening up new possibilities for processing highly reflective materials like copper and gold, crucial for electrical component fabrication, a segment currently underserved by traditional 1-micron infrared lasers, positioning this short-wavelength DDL technology as a key differentiator for future market growth.

Finally, the standardization and modularity of DDL components are simplifying integration for original equipment manufacturers (OEMs). Modular diode stacks with standardized interfaces (electrical, optical, and cooling) reduce the complexity and cost of designing custom laser systems. This modular approach accelerates time-to-market for new end-user applications and lowers the barrier to entry for smaller system integrators. The overarching technological goal remains the continuous improvement of brightness—the crucial metric balancing power and beam quality—to ensure DDLs remain competitive against fiber lasers while retaining their inherent cost and efficiency advantages, ensuring sustained technological evolution and market relevance across a broad spectrum of industrial applications.

Regional Highlights

- Asia Pacific (APAC): Dominance in Volume and Growth

The Asia Pacific region currently holds the largest market share and is projected to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This dominance is intrinsically linked to the region’s status as the global epicenter of manufacturing, particularly in automotive (Electric Vehicles), consumer electronics, and heavy industry. Countries like China, South Korea, and Japan are heavily investing in industrial automation and advanced laser processing technologies to enhance production efficiency and quality control. The substantial capital expenditure directed towards building gigafactories for EV battery production in China and South Korea, which rely almost exclusively on high-power DDLs for welding and sealing, serves as the primary regional growth engine, driving massive demand for kilowatt-class DDL systems.

Beyond automotive, the rapid expansion of the semiconductor and display manufacturing industries in Taiwan, South Korea, and Southeast Asia further fuels DDL adoption for micro-processing, annealing, and marking applications. Government initiatives supporting manufacturing upgrade programs, coupled with the availability of a large, cost-competitive manufacturing base, make APAC a highly attractive market for DDL system suppliers. Local manufacturers in the region are also rapidly enhancing their technological capabilities, intensifying competition and leading to faster deployment of new, high-efficiency DDL technologies, often surpassing adoption rates seen in Western markets for certain volume manufacturing applications.

The regional market trajectory is characterized by a strong focus on high-throughput, reliable systems. Companies in APAC prioritize DDL systems that offer the lowest TCO and highest uptime, often adopting systems engineered specifically for integration into highly automated assembly lines. This preference reinforces the demand for robust packaging, efficient cooling, and superior fiber coupling capabilities within the DDL technology deployed across diverse high-volume manufacturing environments in the region, solidifying APAC’s position as the key demand driver globally.

- North America: Focus on Aerospace, Defense, and High-Precision Applications

North America maintains a strong position in the DDL market, characterized by high demand for sophisticated, customized laser systems tailored for niche, high-value applications in the aerospace, defense, and specialized medical sectors. The region's market growth is driven less by volume manufacturing (compared to APAC) and more by technological complexity, precision, and stringent regulatory requirements. DDLs are critical components in advanced manufacturing processes such as precision laser cladding for aerospace turbine components, where material integrity and traceability are paramount, requiring highly controlled and stable laser sources.

Furthermore, the healthcare sector in the US and Canada is a major consumer, utilizing DDL systems for advanced surgical procedures, ophthalmology, and high-end dermatological treatments. The adoption here is facilitated by significant research and development investments and the presence of leading biomedical technology firms focusing on integrating DDLs into next-generation minimally invasive surgical platforms. This sector demands systems with highly precise wavelength control, pulse modulation capabilities, and extremely high reliability, often driving technological advancements in compact, medical-grade DDL packaging.

Market trends in North America indicate a growing preference for systems incorporating AI-driven adaptive controls to ensure quality conformance, particularly in heavily regulated sectors like defense and medical devices. The competitive landscape is characterized by established global players and specialized boutique laser manufacturers who excel in developing systems utilizing advanced beam shaping techniques (like diffractive optics) to achieve near-perfect beam profiles, catering specifically to the region's requirement for ultra-high-precision material interaction and customized application solutions.

- Europe: Strength in Industrial Innovation and Automotive Heritage

The European market for Direct Diode Laser Systems is mature and robust, underpinned by strong industrial foundations, particularly in Germany's manufacturing sector and Italy's machinery production. Europe's adoption is characterized by early integration of DDL technology into advanced manufacturing concepts like Industry 4.0, favoring automation and smart factory solutions. The continent's prominent automotive industry, while facing transition challenges, is rapidly integrating DDLs for high-speed welding and joining processes required in battery modules and specialized vehicle body structures, especially driven by key manufacturers based in Germany and France focusing on electric vehicle production quality and efficiency.

A key differentiator for the European market is its focus on sustainability and energy efficiency, which aligns perfectly with the inherent advantages of DDL systems (highest wall-plug efficiency). Regulatory pressures and corporate environmental goals favor the replacement of older, less efficient laser technologies, providing a constant replacement and upgrade market for high-efficiency DDL units. Additionally, the region is a leader in machine tool fabrication, and European OEMs frequently integrate DDL sources into their complex machinery sold worldwide, creating sustained demand for core laser components and sub-systems.

The region also demonstrates strong research and development activity, supported by government and EU funding for collaborative projects aimed at improving DDL beam quality and exploring new processing methodologies, such as high-speed laser hardening and specialized additive manufacturing techniques using diode lasers. The high degree of technological competence and the stringent quality standards applied to industrial equipment ensure that only premium, highly reliable DDL solutions find sustainable market success across the diverse manufacturing hubs of Western and Central Europe.

- Latin America (LATAM) and Middle East & Africa (MEA): Emerging Industrialization and Infrastructure

The LATAM and MEA regions currently hold smaller market shares but are projected to experience significant growth, driven by investments in industrial infrastructure and diversification away from primary commodity production. In LATAM, countries like Brazil and Mexico are seeing increased foreign direct investment in automotive assembly (including hybrid and electric vehicles) and heavy machinery manufacturing, necessitating the adoption of modern, efficient laser systems for material processing. DDLs are preferred due to their robustness and lower maintenance requirements, which are advantages in regions with less developed specialized technical service infrastructure.

In the MEA region, market expansion is primarily linked to large-scale infrastructure projects, diversification efforts, particularly in Saudi Arabia and the UAE (focusing on manufacturing and technology), and the growing need for localized repair and maintenance capabilities in oil & gas and power generation sectors, where laser cladding using DDLs is crucial for extending the life of high-value components. The adoption rate is dependent on government policies promoting industrialization and the successful transfer of advanced manufacturing know-how, often through international partnerships and turnkey factory solutions.

For DDL manufacturers, these regions represent opportunities to provide robust, cost-effective solutions for foundational industrial applications like thick metal welding and surface treatment. Key challenges include overcoming the higher initial logistics and installation costs, along with providing accessible local support and training. However, the rapidly expanding consumer base and the push for domestic manufacturing capacity ensure these regions will contribute increasingly to global DDL system demand over the long term, favoring suppliers offering reliable, standardized, and easily serviceable modular systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Direct Diode Laser Systems Market.- IPG Photonics

- Lumentum Holdings

- TRUMPF

- Coherent Corp. (formerly II-VI Incorporated)

- Jenoptik

- Han’s Laser Technology Industry Group

- Laserline

- O.R. Lasertechnology GmbH

- Focuslight Technologies

- Quantum Composers

- Osram (amalgamated into other entities, key diode technology provider)

- Toptica Photonics

- Modulight

- DILAS Diodenlaser GmbH (a division of Coherent)

- NKT Photonics

- TeraDiode (acquired by Coherent, focusing on wavelength beam combining)

- Spectrogon AB

- Rofin-Sinar Technologies (parts acquired by Coherent and TRUMPF)

- Alpha Laser

- Array Photonics

Frequently Asked Questions

Analyze common user questions about the Direct Diode Laser Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of Direct Diode Lasers (DDLs) over traditional laser systems?

The primary advantage of Direct Diode Lasers is their superior electrical-to-optical conversion efficiency (often exceeding 50%), resulting in significantly lower operating costs and reduced thermal management needs compared to fiber, disk, or CO2 lasers, which typically possess lower wall-plug efficiencies. DDLs also offer a compact footprint and high robustness.

How is the low beam quality limitation of high-power DDLs being addressed?

Manufacturers are addressing beam quality limitations through advanced beam combining techniques, primarily Spectral Beam Combining (SBC) and Spatial Beam Combining (SBC). These methods merge the output from multiple diode emitters or bars into a single, high-power beam with improved focusability, enabling DDLs to be used in demanding precision material processing applications.

Which industry segment is the largest consumer of Direct Diode Laser Systems?

The Material Processing segment, particularly the automotive industry, is the largest consumer. This demand is heavily driven by the massive global expansion of Electric Vehicle (EV) battery manufacturing, which relies on high-speed, contamination-free DDL welding for joining battery cells and modules within large-scale production facilities.

How does AI technology influence the performance and maintenance of Direct Diode Laser Systems?

AI influences DDL systems by enabling Adaptive Process Control for real-time parameter adjustment to optimize weld quality or material interaction. Furthermore, AI-driven predictive maintenance models analyze performance data to anticipate potential component failures, maximizing system uptime and operational efficiency in industrial environments.

What is the projected Compound Annual Growth Rate (CAGR) for the Direct Diode Laser Systems Market?

The Direct Diode Laser Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.3% during the forecast period spanning from 2026 to 2033, driven largely by adoption in APAC industrial automation and high-efficiency manufacturing requirements globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager