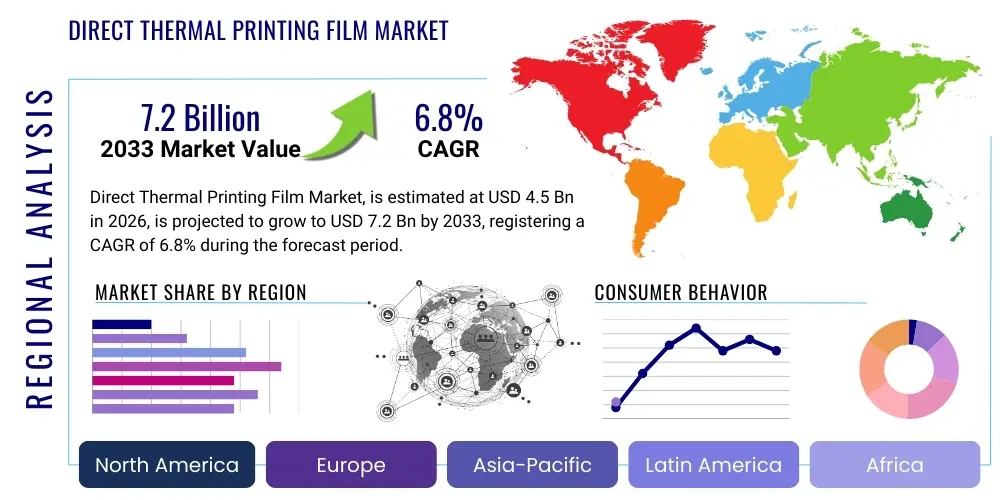

Direct Thermal Printing Film Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437771 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Direct Thermal Printing Film Market Size

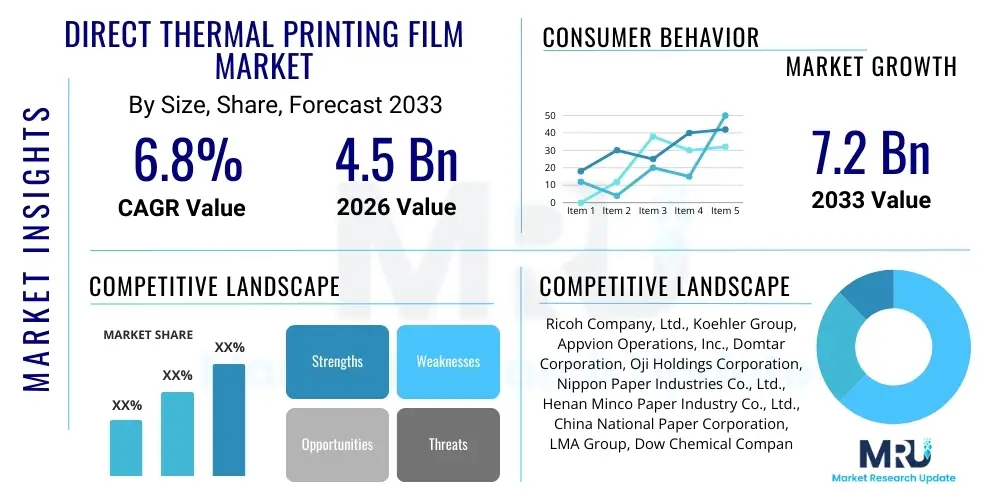

The Direct Thermal Printing Film Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Direct Thermal Printing Film Market introduction

The Direct Thermal Printing Film Market encompasses specialized substrates coated with thermosensitive materials that darken when exposed to localized heat from a thermal print head. This technology eliminates the need for ink, ribbons, or toner, positioning it as a highly cost-effective and low-maintenance solution for short-term and medium-term labeling and receipt requirements. The inherent simplicity and speed of direct thermal printing have cemented its vital role across critical sectors such as logistics, retail, and healthcare, where rapid data output and high throughput are essential operational requirements.

Direct thermal films are predominantly utilized in applications requiring variable information printing, including barcode labels, shipping documentation, temporary tags, and point-of-sale receipts. The core product offering includes standard films for dry indoor environments and specialized top-coated films designed to resist moisture, abrasion, and chemical exposure, thus extending the lifespan and utility of the printed information. Major applications include inventory tracking in warehouses, patient identification wristbands in hospitals, and fast ticketing for transit systems. The versatility and customization potential of these films regarding durability, adhesive type, and liner material contribute significantly to market expansion across diverse industrial landscapes.

Key driving factors fueling market growth include the explosive expansion of the e-commerce sector, which necessitates billions of shipping and tracking labels globally, and the growing demand for efficient inventory management systems in the retail and manufacturing industries. Furthermore, the regulatory push toward improved traceability in supply chains, particularly in the food and pharmaceutical sectors, mandates the use of reliable, machine-readable labels, often fulfilled efficiently by direct thermal technology. The environmental benefit derived from eliminating ink cartridges and ribbons also positions direct thermal solutions favorably in sustainability-conscious corporate purchasing decisions.

Direct Thermal Printing Film Market Executive Summary

The Direct Thermal Printing Film Market is characterized by robust growth driven primarily by macro-economic trends, particularly the acceleration of digitalization in logistics and retail operations worldwide. Business trends indicate a strong shift towards advanced top-coated films capable of offering enhanced image durability, which addresses the primary limitation of standard direct thermal paper—its vulnerability to heat and light exposure. Key competitive strategies focus on developing sustainable film materials, such as bio-based or recycled content, and enhancing supply chain resilience to meet the high volume demands of large e-commerce platforms and global retailers. Furthermore, integration with automated warehouse management systems (WMS) is pushing demand for specialized label formats and high-speed printable substrates.

Regionally, Asia Pacific (APAC) stands out as the dominant growth engine, fueled by rapid industrialization, the proliferation of e-commerce giants like Alibaba and Amazon, and massive investments in logistics infrastructure, particularly in countries like China, India, and Southeast Asian nations. North America and Europe maintain significant market shares, characterized by high adoption rates in pharmaceutical labeling and sophisticated retail applications, focusing heavily on regulatory compliance and premium film quality. Emerging markets in Latin America and the Middle East are exhibiting accelerated growth as modern retail chains replace traditional markets, increasing the need for standardized POS receipts and perishable goods labeling.

Segment trends reveal that the Polypropylene (PP) material segment is gaining traction over traditional paper-based films due to superior moisture resistance and durability required in cold chain logistics and outdoor applications. Application-wise, Labeling, specifically shipping and tracking labels, remains the largest revenue generator, directly correlating with global trade volumes and e-commerce transactions. There is also a notable trend toward incorporating security features within direct thermal films, such as tamper-evident capabilities, to combat counterfeiting and enhance product integrity in high-value sectors.

AI Impact Analysis on Direct Thermal Printing Film Market

User queries regarding the impact of Artificial Intelligence (AI) on the Direct Thermal Printing Film Market often center on how AI-driven optimization affects label usage, inventory efficiency, and printing technology evolution. Key themes summarized from these concerns include whether smart logistics systems will reduce the necessity for physical labels, how predictive maintenance affects thermal printer lifecycles, and the role of AI in quality control and defect detection during film manufacturing. Users seek clarity on whether AI integration in supply chain management leads to more dynamic, on-demand printing schedules, thus influencing film consumption patterns and the required speed and resolution specifications of the media.

AI's primary influence is manifested through sophisticated demand forecasting and inventory management systems, which utilize machine learning algorithms to optimize stock levels and reduce waste in the labeling process. By precisely predicting the required volume and timing for label generation, AI minimizes the need for buffer stock of pre-printed films, favoring smaller, more frequent batches of direct thermal labels produced on-demand. This shift requires thermal printing films that offer excellent shelf life and consistent performance across highly varied batch sizes. Moreover, AI-driven automation in distribution centers relies heavily on high-accuracy barcode scanning, necessitating films that guarantee maximum print contrast and resistance to smudging or fading, driving demand for premium top-coated substrates.

Furthermore, AI is increasingly deployed in the manufacturing processes of the films themselves. Computer vision systems powered by AI analyze coating consistency, detect microscopic defects, and optimize curing processes in real-time, leading to superior quality control and reduced material wastage. In printer hardware, AI-powered predictive maintenance monitors print head temperature, film feed speed, and ribbon usage (in the case of near-edge technology) to prevent operational failures, ensuring consistent print quality across massive volumes. While AI may streamline the label volume required per unit of inventory, the massive underlying growth in e-commerce and traceability requirements ensures continuous, high demand for reliable direct thermal printing film.

- AI optimizes supply chain labeling requirements, shifting demand toward on-demand printing models.

- Predictive maintenance systems utilize AI to ensure consistent, high-quality output of direct thermal films.

- AI-driven computer vision enhances quality control in film manufacturing, reducing defects and waste.

- Intelligent inventory management systems decrease overstocking of pre-printed films.

- Increased reliance on automated scanning demands high-contrast, durable top-coated films optimized by AI algorithms.

DRO & Impact Forces Of Direct Thermal Printing Film Market

The Direct Thermal Printing Film Market is governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), significantly influencing its trajectory. Key drivers include the exponential rise of the e-commerce sector, which massively increases demand for shipping and tracking labels, coupled with stringent regulatory requirements for product traceability across the food, beverage, and pharmaceutical supply chains. The simplicity, cost-effectiveness, and maintenance-free operation of direct thermal technology compared to thermal transfer or laser printing provide a strong inherent advantage, particularly in high-volume, dynamic environments like modern logistics hubs and retail points of sale.

However, the market faces notable restraints. The primary technical limitation is the relatively short image lifespan of standard direct thermal prints; they are susceptible to fading when exposed to excessive heat, sunlight (UV), or certain chemicals, making them unsuitable for long-term archival or outdoor applications. Furthermore, the increasing environmental scrutiny regarding single-use plastics and non-recyclable composite films poses a challenge, pushing manufacturers to invest heavily in sustainable, biodegradable, or recyclable film alternatives, which currently carry higher production costs and complexity. Competition from advanced digital printing methods and alternative identification technologies, such as RFID tags, also presents a moderate competitive threat in specific high-value applications.

Opportunities for growth are concentrated in product innovation and geographical expansion. Developing highly durable, top-coated direct thermal films that rival the longevity of thermal transfer prints opens up new application areas, particularly in industrial and medical fields. The shift towards sustainable packaging also presents a significant opportunity for producers of recyclable PET and biodegradable PLA-based thermal films. Geographically, untapped potential exists in rapidly digitizing emerging economies, particularly in Africa and Southeast Asia, where investments in cold chain logistics and modern retail infrastructure are scaling up rapidly, requiring reliable and accessible labeling solutions.

Segmentation Analysis

The Direct Thermal Printing Film Market is comprehensively segmented based on Type, Material, Application, and End-Use Industry, providing a detailed view of demand dynamics and market concentration across various sectors. This granular analysis is crucial for stakeholders to tailor product offerings and strategic investments, ensuring alignment with specific market needs, such as durability requirements in logistics or sensitivity requirements in point-of-sale systems. The Type segmentation, differentiating between standard and top-coated films, highlights the trade-off between cost efficiency and performance longevity, a critical decision point for end-users determining the required resistance against environmental factors.

The Material segmentation, encompassing Polypropylene (PP), Polyethylene (PE), and Polyethylene Terephthalate (PET), reflects the diversity in physical properties desired, such as flexibility, tear resistance, and moisture barriers. PP films, for instance, are widely preferred in retail due to their balance of cost and resilience, while PET films dominate demanding industrial and medical applications where high temperature and chemical resistance are mandatory. Application segmentation confirms the market's dependence on the logistical ecosystem, with barcode and shipping labels consuming the largest volume, followed by specific uses in retail POS and specialized ticketing systems.

The End-Use Industry segmentation underscores the market's reliance on the Retail & E-commerce sectors, which generate continuous, high-volume demand for short-life labels and receipts. However, the Healthcare sector is emerging as a critical high-value segment, requiring specific, high-specification films for patient identification, blood bags, and sterile packaging labels, often demanding films that can withstand sterilization procedures. Analyzing these segments reveals that future growth will be concentrated not just in volume but also in high-specification, functional films offering enhanced security, sustainability, and durability features tailored to regulated industries.

- By Type:

- Standard Direct Thermal Film

- Top-Coated Direct Thermal Film

- Premium Direct Thermal Film

- Weather-Resistant Film

- By Material:

- Polypropylene (PP)

- Polyethylene (PE)

- Polyethylene Terephthalate (PET)

- Paper-Based Films

- Synthetic Films (Other)

- By Application:

- Labeling (Barcode, Shipping, Product Identification)

- Point-of-Sale (POS) Receipts

- Ticketing (Events, Transport, Parking)

- Medical Records and Identification

- By End-Use Industry:

- Retail & E-commerce

- Logistics & Transportation

- Healthcare & Pharmaceuticals

- Food & Beverage

- Manufacturing & Industrial

Value Chain Analysis For Direct Thermal Printing Film Market

The value chain of the Direct Thermal Printing Film Market begins with upstream activities involving the sourcing and processing of raw materials. This includes the manufacturing of base substrates, primarily plastic polymers (PP, PE, PET) or specialty papers, and the chemical synthesis of leuco dyes and developers that form the thermal coating layer. Upstream suppliers are focused on achieving economies of scale and consistent quality, as the performance of the final film is highly dependent on the uniformity and purity of the chemical compounds. Fluctuations in petrochemical prices and the availability of specialized chemical ingredients significantly impact the cost structure for film manufacturers.

Midstream activities involve the complex coating and converting processes. Film manufacturers apply the thermosensitive chemical layer onto the base substrate, often requiring precision coating equipment in highly controlled environments to ensure optimal sensitivity and print quality. The converting stage involves slitting the wide rolls into specific sizes (rolls or sheets) compatible with various thermal printers and potentially adding adhesives and liners to create finished label products. Efficiency in minimizing coating defects and optimizing converting waste are crucial competitive advantages at this stage.

Downstream distribution channels are diverse, relying on both direct and indirect routes to reach the vast end-user base. Direct distribution is common for large-volume contracts with major retailers, e-commerce giants, or logistics service providers. Indirect channels, which form the bulk of market penetration, involve specialized distributors, label converters, office supply wholesalers, and resellers who provide localized inventory, customization services, and technical support to small and medium-sized enterprises (SMEs). The effectiveness of the distribution network, including logistics for heavy film rolls and just-in-time delivery capabilities, is paramount for securing market share, especially in geographically fragmented regions.

Direct Thermal Printing Film Market Potential Customers

Potential customers for Direct Thermal Printing Film are characterized by their need for rapid, high-volume, short-to-medium lifespan variable data printing solutions. The primary segment comprises the vast ecosystem of Logistics and Transportation providers, including major couriers, third-party logistics (3PL) providers, and international freight forwarders, who require millions of durable, scannable shipping labels daily for tracking packages across global networks. Their buying decision centers on label adhesion, print durability during transit, and overall cost per label, favoring standardized, volume-efficient films.

The second major segment is the Retail and E-commerce industry, which uses direct thermal films for diverse applications such as price tags, shelf labels, reduced-price labeling, and, critically, point-of-sale receipts. Large supermarkets and e-commerce fulfillment centers prioritize films that offer high processing speeds and resistance to typical retail handling environments. The increasing trend towards click-and-collect and returns management further fuels this segment's demand for versatile thermal labeling media.

A high-growth, high-specification segment is the Healthcare and Pharmaceutical sector, including hospitals, clinics, and pharmaceutical manufacturers. These entities utilize direct thermal films for vital applications like patient wristbands, specimen tracking labels, blood bag identification, and pharmacy labels. Customers in this sector demand films that are certified sterile, resistant to chemical disinfectants, and compliant with stringent regulatory standards (such as HIPAA or FDA guidelines), often necessitating premium top-coated PET films with specialized medical-grade adhesives.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ricoh Company, Ltd., Koehler Group, Appvion Operations, Inc., Domtar Corporation, Oji Holdings Corporation, Nippon Paper Industries Co., Ltd., Henan Minco Paper Industry Co., Ltd., China National Paper Corporation, LMA Group, Dow Chemical Company, Avery Dennison Corporation, 3M Company, BASF SE, Lintec Corporation, UPM Raflatac, Honeywell International Inc., RR Donnelley & Sons Company, SATO Holdings Corporation, Mitsubishi Paper Mills Limited, Intermec Corporation (Acquired by Honeywell) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Direct Thermal Printing Film Market Key Technology Landscape

The technological landscape of the Direct Thermal Printing Film Market is centered on enhancing three key attributes: thermal sensitivity, image durability, and environmental sustainability. Advancements in chemical formulations focus heavily on microencapsulation technology, where the leuco dyes and developers are encased in microscopic spheres. This sophisticated approach allows manufacturers to achieve faster reaction times at lower heat levels, which significantly increases printer speed and extends the life of the thermal print head. Furthermore, the development of multi-layer coatings, including barrier layers and protective top coats, is critical in preventing premature fading and increasing resistance to plasticizers, oils, and moisture encountered in logistics environments.

Another area of intense technological development is the transition toward film substrates that offer enhanced performance characteristics beyond traditional paper. The preference for synthetic films like Polypropylene (PP) and Polyethylene Terephthalate (PET) is driven by the need for superior mechanical strength and weather resistance, essential for applications such as durable goods labeling and cold chain tracking. Specifically, PET film technology is evolving to achieve high thermal stability while maintaining excellent opacity and smoothness, crucial for high-resolution barcode printing and scanning accuracy required in modern automated systems.

Sustainability technology is rapidly gaining prominence. This includes the development of phenol-free and BPA-free thermal coatings to address health and safety concerns, thereby creating ‘eco-friendly’ thermal papers and films. Moreover, manufacturers are exploring the use of bio-based plastics (like PLA) as base substrates and implementing solvent-free coating processes to reduce the environmental footprint. The integration of advanced nanotechnology in the coating process holds future potential for creating ultra-thin, highly sensitive films with reduced material usage while maintaining or improving durability and clarity.

Regional Highlights

The global demand for Direct Thermal Printing Film is segmented across major geographical regions, reflecting varying levels of industrial maturity, e-commerce penetration, and regulatory stringency. Asia Pacific (APAC) dominates the global market both in terms of consumption volume and growth rate. This dominance is attributed to robust economic growth in China and India, massive investments in manufacturing and infrastructure, and the unparalleled expansion of domestic and cross-border e-commerce activities, generating massive demand for shipping and packaging labels. Furthermore, the burgeoning cold chain logistics market in Southeast Asia for food and pharmaceuticals necessitates high-durability thermal films.

North America holds a substantial market share, characterized by early adoption of advanced labeling technologies, stringent traceability regulations in the food and pharmaceutical sectors, and the massive scale of e-commerce operations led by Amazon and Walmart. The focus in this region is increasingly on premium, high-performance direct thermal films (top-coated PET and specialized synthetics) that guarantee long-term readability and compliance with standards such as FDA labeling requirements. Investment in automated distribution centers throughout the U.S. and Canada drives constant demand for reliable, fast-printing media.

Europe represents a mature but highly innovation-driven market, where environmental regulations heavily influence product development. European demand is characterized by a strong push toward sustainable, BPA-free, and phenol-free thermal films, driven by consumer preference and legislative actions. The region's extensive logistics network and high concentration of organized retail contribute significantly to volume consumption. Meanwhile, Latin America and the Middle East & Africa (MEA) are emerging as high-potential regions. Growth in MEA is spurred by diversification of economies, investments in logistics hubs (like Dubai and Saudi Arabia), and the rapid expansion of modern retail concepts, increasing the need for entry-level and standard direct thermal solutions.

- North America: Focus on regulatory compliance, high-specification medical labeling, and integration with advanced automated warehouse systems.

- Europe: High demand for sustainable, phenol-free, and bio-based direct thermal films due to stringent environmental policies.

- Asia Pacific (APAC): Dominant growth region fueled by explosive e-commerce growth, logistics expansion, and rapid industrialization in China and India.

- Latin America: Growing consumption driven by the expansion of modern retail chains and improvements in cold chain infrastructure.

- Middle East and Africa (MEA): Emerging market with rising demand linked to infrastructural investments, logistics hub development, and urbanization.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Direct Thermal Printing Film Market.- Ricoh Company, Ltd.

- Koehler Group

- Appvion Operations, Inc.

- Domtar Corporation

- Oji Holdings Corporation

- Nippon Paper Industries Co., Ltd.

- Henan Minco Paper Industry Co., Ltd.

- China National Paper Corporation

- LMA Group

- Dow Chemical Company

- Avery Dennison Corporation

- 3M Company

- BASF SE

- Lintec Corporation

- UPM Raflatac

- Honeywell International Inc.

- RR Donnelley & Sons Company

- SATO Holdings Corporation

- Mitsubishi Paper Mills Limited

- Intermec Corporation (Acquired by Honeywell)

Frequently Asked Questions

Analyze common user questions about the Direct Thermal Printing Film market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using direct thermal printing film over thermal transfer technology?

Direct thermal printing is preferred for its operational simplicity and cost efficiency, as it requires no consumables like ribbons, minimizing material costs and reducing downtime associated with ribbon changes. It offers high-speed printing, making it ideal for high-volume, short-duration applications such as shipping labels and transactional receipts where speed and low maintenance are critical.

How is the Direct Thermal Printing Film Market addressing concerns regarding environmental sustainability?

Manufacturers are heavily investing in sustainable solutions by developing phenol-free (BPA/BPS-free) coatings to ensure consumer safety and creating films using bio-based polymers (e.g., PLA) or recycled PET. The industry is also exploring solvent-free coating technologies and promoting fully recyclable or compostable film structures to reduce waste and comply with stricter global environmental regulations, particularly in Europe.

Which end-use industry drives the highest demand volume for direct thermal printing films?

The Logistics and E-commerce industry collectively drives the highest volume demand. The global explosion in online retail necessitates billions of unique tracking, shipping, and fulfillment labels annually. Direct thermal films offer the required speed, clarity for barcode scanning, and cost-effectiveness essential for these massive, high-throughput operations across distribution centers and last-mile delivery services.

What is the difference between standard and top-coated direct thermal films, and when should each be used?

Standard direct thermal films lack a protective barrier, making them cost-effective but susceptible to environmental degradation (fading from heat, light, or abrasion), suitable mainly for short-term indoor uses like POS receipts. Top-coated films include a protective layer that drastically enhances resistance to moisture, chemicals, and abrasion, making them necessary for applications requiring medium-term durability, such as cold chain storage labels, outdoor tags, or pharmaceutical identification.

Will the rise of RFID technology replace direct thermal printing films in the near future?

While RFID (Radio Frequency Identification) is growing rapidly for inventory tracking and asset management, it is unlikely to fully replace direct thermal films. Direct thermal remains significantly more cost-effective for simple, high-volume variable data printing (like basic barcodes and text) and requires much less expensive hardware. RFID complements direct thermal, serving higher-value, more complex supply chain visibility needs, but the sheer volume and low cost of DT printing ensure its continued market dominance for transactional and shipping purposes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Direct Thermal Printing Film Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Direct Thermal Printing Film Market Statistics 2025 Analysis By Application (Cosmetics and Personal Care, Pharmaceutical, Food and Beverage, Luggage Tags), By Type (White Thermal Printing Film, Transparent Thermal Printing Film), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager