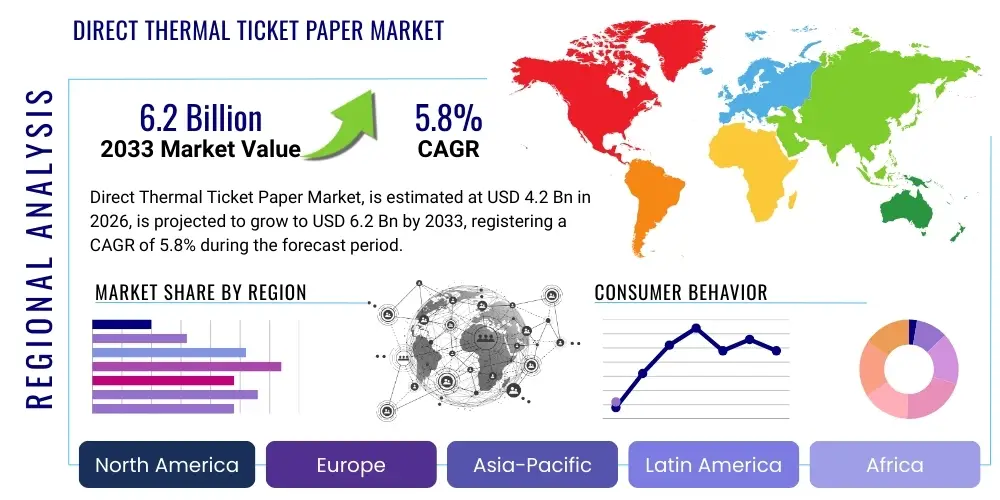

Direct Thermal Ticket Paper Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435971 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Direct Thermal Ticket Paper Market Size

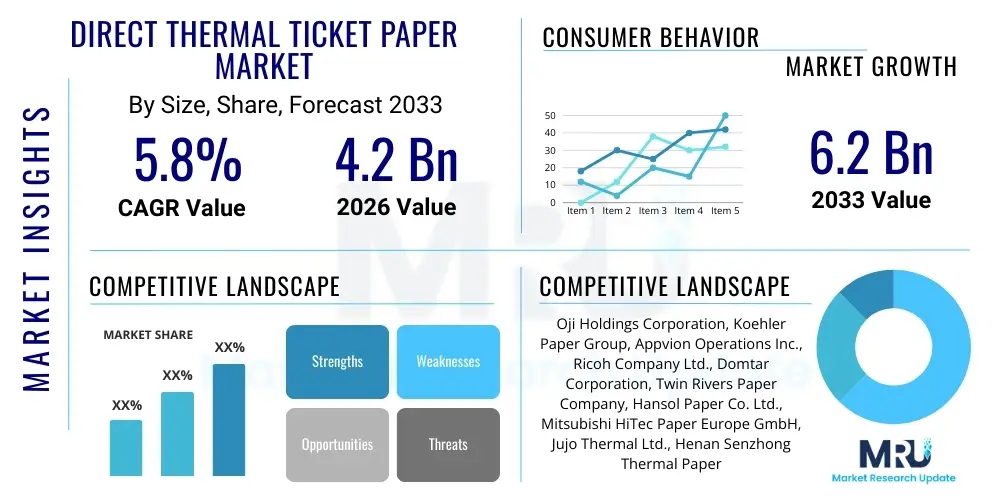

The Direct Thermal Ticket Paper Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.2 Billion in 2026 and is projected to reach USD 6.2 Billion by the end of the forecast period in 2033.

Direct Thermal Ticket Paper Market introduction

The Direct Thermal Ticket Paper Market encompasses the production, distribution, and consumption of specialized paper media treated with a thermochromic coating that changes color (typically turns black) when exposed to heat from a thermal printer head. This technology eliminates the need for ink cartridges or ribbons, offering superior speed, reliability, and cost-effectiveness compared to traditional printing methods. Direct thermal paper is widely utilized across diverse sectors where quick, durable, and reliable ticketing or receipt generation is essential, such as transportation, entertainment venues, retail point-of-sale (POS) systems, healthcare, and logistics. The simplicity of the printing mechanism and the relatively low maintenance requirements are key attributes driving adoption globally.

The core product, direct thermal paper, is manufactured by applying several layers—including the base paper, a precoat layer, and the thermal coating layer (containing leuco dye, developer, and sensitizer)—to ensure sensitivity to heat while maintaining image longevity. The primary benefits driving market expansion include the ease of integration with existing automated systems, reduced operational costs due to the absence of consumables other than the paper itself, and the ability to produce high-resolution barcodes, QR codes, and text necessary for modern tracking and access control systems. Furthermore, the increasing global emphasis on efficiency in public services and commercial transactions, particularly in high-volume environments like mass transit ticketing and event admissions, solidifies the market's trajectory.

Major applications of direct thermal ticket paper span transit passes, airline boarding passes, movie and concert tickets, parking stubs, lottery tickets, patient wristbands, baggage tags, and retail receipts. The durability requirements vary significantly depending on the application; for instance, lottery and transit tickets often require enhanced resistance to moisture, abrasions, and prolonged exposure to light, prompting manufacturers to innovate with protective topcoats. Driving factors for the market include the rapid expansion of contactless payment systems that often require a printed confirmation, the sustained growth in global air travel and public transit ridership, and the increasing sophistication of thermal paper to incorporate security features such as holographic strips or UV-sensitive markings, thereby combating counterfeiting and enhancing product integrity across sensitive applications.

Direct Thermal Ticket Paper Market Executive Summary

The Direct Thermal Ticket Paper Market is characterized by robust growth, primarily fueled by the accelerating adoption of automated ticketing solutions across high-traffic urban centers and the relentless demand from the entertainment and logistics sectors. Business trends indicate a strong pivot towards environmentally sustainable paper options, with manufacturers investing heavily in developing BPA-free, phenol-free, and recyclable thermal paper grades to address rising regulatory scrutiny and consumer preference for eco-friendly products. This push towards sustainability is significantly influencing supply chain dynamics, favoring companies that can demonstrate green manufacturing practices. Furthermore, technological innovation focuses on enhancing the durability and archival properties of thermal paper, particularly for long-term records like medical charts or warranty receipts, thereby broadening the potential application spectrum beyond short-term ticketing.

Regional trends reveal that Asia Pacific (APAC) stands as the primary growth engine, driven by massive investments in public transportation infrastructure, particularly high-speed rail networks in China and India, coupled with soaring consumer spending on entertainment and retail across emerging economies. North America and Europe maintain significant market share, characterized by mature retail POS systems and advanced logistics operations demanding high-speed label and ticket printing. These regions are also at the forefront of adopting mobile ticketing integration, where thermal paper complements digital solutions by providing reliable physical backups and operational confirmations. The shift towards event-based and dynamic pricing models further stimulates demand for on-demand thermal ticket printing capabilities at physical locations.

In terms of segments, the market sees dominant performance from the transportation segment (bus, rail, and air travel) due to the sheer volume of daily transactions. However, the entertainment and gaming segments, including cinemas, sports stadiums, and lottery operators, demonstrate the highest growth potential, capitalizing on the post-pandemic resurgence of large public gatherings. Segmentation by material type shows increasing preference for protective coated paper, which ensures image retention and protection against plasticizers, crucial for tickets handled frequently or stored in wallets. Competition remains intense, with major global players focusing on vertical integration from pulp sourcing to final coating, leveraging economies of scale to maintain cost competitiveness while simultaneously offering specialized, high-security thermal media solutions.

AI Impact Analysis on Direct Thermal Ticket Paper Market

User inquiries regarding AI's influence on the Direct Thermal Ticket Paper Market often center on two opposing themes: the potential disruption from complete digitization (mobile tickets replacing paper) versus the efficiency gains AI offers in thermal printing logistics and demand forecasting. Common questions address whether AI-driven personalization will necessitate more printing (e.g., dynamic couponing on receipts), how AI optimizes supply chain management for paper inventory, and whether predictive maintenance for thermal printers, managed by AI, will reduce paper waste and operational downtime. The core concern revolves around the balance between digital transformation, accelerated by AI and machine learning in customer interactions, and the enduring operational necessity of physical thermal tickets, particularly in regulated industries like air travel, lottery, and high-volume retail. Users seek clarity on whether AI contributes to the "paperless office" vision or instead streamlines and secures the processes that rely on thermal media, thereby extending its relevance.

The consensus suggests that while AI-powered digital ticketing platforms pose a long-term substitution threat, particularly in consumer-facing mobile applications, AI simultaneously enhances the value proposition of physical thermal paper in critical, non-substitutable applications. AI algorithms are increasingly being deployed in thermal printer firmware to optimize heat application, resulting in clearer, faster prints while conserving the thermal coating material, thus maximizing the yield per roll. In logistics, predictive analytics, often driven by AI, forecasts regional ticket demand with high accuracy, minimizing inventory holding costs and ensuring timely supply of specialized paper rolls to transit hubs and major event centers. This operational efficiency driven by AI effectively reduces waste and enhances the cost-effectiveness of thermal printing, reinforcing its competitive position against other printing technologies.

Furthermore, AI plays a pivotal role in security and authentication within the thermal ticketing ecosystem. Machine learning models analyze printed patterns, QR code degradation, and security markings on thermal tickets to instantly verify authenticity at access points, integrating seamlessly with physical security features embedded in the paper itself. AI-driven personalization, such as appending highly targeted promotions or real-time itinerary updates to boarding passes or retail receipts, transforms the thermal ticket from a mere transactional document into a dynamic marketing touchpoint. This synergy between AI-enabled dynamic content generation and reliable thermal printing ensures that physical paper remains an integral part of sophisticated, data-driven customer engagement strategies, mitigating the threat of complete displacement.

- AI optimizes thermal printer settings, reducing paper consumption and ensuring print quality longevity.

- Predictive analytics driven by AI improves supply chain efficiency, accurately forecasting demand for specialized ticket stocks globally.

- AI algorithms enhance security scanning by rapidly verifying complex barcodes and thermal printing patterns, combating counterfeiting.

- Machine Learning facilitates dynamic content printing (personalized coupons, real-time data) on receipts and tickets, increasing paper's marketing value.

- Integration of AI-driven mobile platforms with physical thermal backup systems ensures operational resilience in sectors like air travel and mass transit.

DRO & Impact Forces Of Direct Thermal Ticket Paper Market

The market for direct thermal ticket paper is shaped by a complex interplay of growth drivers, inherent constraints, and significant opportunities, which collectively define the impact forces determining its trajectory. Key drivers include the massive global expansion of transit systems, the mandatory requirement for physical verification (especially in regulated gambling and air travel sectors), and the innate operational simplicity and speed of thermal printing technology. Conversely, the market faces strong headwinds from the rapid maturation of mobile and electronic ticketing platforms, consumer preference for digital receipts, and environmental concerns surrounding the chemical composition (like Bisphenol A or S) of traditional thermal coatings. Opportunities primarily lie in the development of sustainable, high-security, and durable thermal papers, alongside market penetration into specialized niche applications such as medical record labels and long-term industrial tags. These factors create dynamic impact forces that compel continuous innovation in coating chemistry and material science to maintain market relevance.

Drivers: A primary driver is the accelerating urbanization trend, which necessitates increased investment in automated public transit ticketing systems worldwide. Thermal paper is the preferred medium for metro, bus, and train tickets due to its fast print speed and compatibility with automated fare collection gates. The explosive growth of the global entertainment sector, including major sporting events, concerts, and theme parks, generates substantial demand for secure, high-volume admissions tickets. Furthermore, the operational efficiency gains—specifically, the elimination of toner/ink costs and reduced maintenance associated with thermal printers—make it a highly attractive option for large-scale retail and logistics operations managing complex supply chains that require instant, reliable labeling and proof of delivery receipts.

Restraints: The most significant restraint is the escalating trend toward paperless solutions, driven by mobile apps, NFC technology, and QR code proliferation, particularly among digitally native consumers. This digital substitution is highly prevalent in the retail and low-security entertainment sectors. Another critical restraint involves environmental regulatory pressures concerning the chemical safety of thermal paper; the phase-out of BPA-containing papers has necessitated costly reformulations (e.g., using Bisphenol S or other developers), raising production costs and creating uncertainty in supply chains. Additionally, the limited archival life of standard thermal paper, which fades upon prolonged exposure to heat, light, or certain chemicals, restricts its use in applications requiring permanent records, pushing some users towards laser or inkjet solutions.

Opportunities: Major opportunities reside in the advancement of high-durability thermal paper, engineered with robust protective topcoats that resist scratching, moisture, and chemical degradation, thereby opening avenues in harsh industrial and outdoor environments. The development and widespread adoption of 'green' thermal papers, such as vitamin-C based or urea-based thermal coatings (phenol-free), present a significant growth opportunity by satisfying stringent environmental standards and appealing to eco-conscious corporations. Moreover, emerging markets that are rapidly modernizing their transportation and retail infrastructure represent substantial untapped potential, as these regions leapfrog older technologies directly into efficient, modern thermal ticketing systems. The integration of advanced security features, like embedded RFID chips or highly covert UV features within the thermal layers, also creates high-value niche segments.

Segmentation Analysis

The Direct Thermal Ticket Paper Market is rigorously segmented based on application, material type, print durability, and security features, reflecting the diverse end-user requirements across major industries. Analyzing these segments provides a clear view of where growth acceleration is occurring and how specialized product development is differentiating market offerings. The application segmentation, ranging from high-volume transit tickets to specialized medical wristbands, dictates the necessary paper thickness, coating stability, and inherent security level required. Material type segmentation primarily addresses the environmental and regulatory landscape, distinguishing between standard, BPA-free, and phenol-free alternatives, which now form the cornerstone of sustainable procurement strategies for large organizations. The overarching trend is the move toward higher-grade, coated thermal papers that offer superior protection against environmental factors, ensuring maximum longevity and reliability for critical functions.

Further granularity exists within print durability, differentiating between short-term applications (like standard grocery receipts, which last a few weeks) and long-term applications (like medical records or high-value transit passes, requiring retention for several years), which heavily influence the choice of protective topcoat. The importance of security features has grown exponentially, especially in government-regulated sectors such as lottery, customs documentation, and high-value event ticketing. This requires specialized thermal paper that can incorporate micro-printing, tamper-evident patterns, or integrated holographic elements, commanding a price premium. Understanding these segment dynamics is crucial for manufacturers to tailor their production lines—from basic, low-cost commodity paper to highly specialized, high-security thermal media—thereby optimizing their competitive positioning and addressing the stringent compliance needs of institutional buyers.

- By Application:

- Transportation Tickets (Airlines, Rail, Bus, Metro)

- Entertainment and Event Tickets (Sports, Concerts, Cinemas)

- Gaming and Lottery Tickets

- Retail Receipts and Coupons (POS)

- Logistics and Warehouse Labels/Tags (Baggage, Shipping)

- Healthcare (Patient Wristbands, Specimen Labels)

- Parking and Toll Receipts

- By Material Type:

- Standard Thermal Paper (Uncoated)

- Top Coated Thermal Paper (Protected against moisture/abrasion)

- BPA-Free Thermal Paper

- Phenol-Free Thermal Paper (BPS-free, etc.)

- By Print Durability:

- Short-Term (Less than 6 months)

- Medium-Term (6 months to 2 years)

- Long-Term (Over 2 years, often for archival or warranty purposes)

- By Width/Format:

- Standard Roll Formats (e.g., 57mm, 80mm)

- Fanfold and Continuous Forms

- Die-Cut Ticket Stock

Value Chain Analysis For Direct Thermal Ticket Paper Market

The value chain for the Direct Thermal Ticket Paper Market is inherently complex, starting with the sourcing of specialized raw materials and extending through sophisticated chemical coating processes, conversion, and global distribution. The upstream segment is dominated by suppliers of high-quality wood pulp (the base paper), chemical developers (like BPS or alternative non-phenolic compounds), leuco dyes, and sensitizers. Pricing and availability in this upstream sector are highly volatile, particularly for chemical inputs, significantly impacting the final product cost. Manufacturers engaged in thermal paper production must master the highly technical coating process, which involves applying multiple layers uniformly to ensure consistent thermal sensitivity and optimal print performance. Vertical integration, where major players control pulp production and chemical synthesis, is a common strategy to mitigate supply chain risks and enhance cost control.

The middle segment involves the conversion process, where jumbo rolls of coated thermal paper are slit, rewound, and sometimes die-cut into the specific formats required by end-users (e.g., standard POS rolls, fanfold airline tickets, or specialized lottery card stock). Quality control at this stage is critical, ensuring core diameter, roll tightness, and flawless edge cutting to prevent printer jams in high-speed applications. The downstream segment involves distribution, which is bifurcated into direct sales to large institutional buyers (transit authorities, large cinema chains, lottery operators) and indirect sales through specialized paper distributors and office supply resellers catering to small and medium enterprises (SMEs). Direct channels emphasize long-term supply contracts and customization, while indirect channels focus on volume logistics and rapid inventory fulfillment.

The distribution channel is paramount to market success. Direct sales channels, typically used for high-security or bespoke ticket formats, allow manufacturers to offer value-added services such as inventory management, just-in-time delivery, and personalized security printing advice. Indirect channels leverage established distribution networks to reach fragmented retail and hospitality markets efficiently. The rise of e-commerce platforms has also created a hybrid distribution model, particularly for standard POS rolls, increasing price transparency and competitive intensity. Effective management of this value chain, from securing sustainable, compliant chemical inputs upstream to ensuring efficient, customized delivery downstream, is essential for maintaining profitability and securing major institutional contracts, particularly those involving public sector tenders where compliance and longevity are critical factors.

Direct Thermal Ticket Paper Market Potential Customers

The primary consumers and buyers of direct thermal ticket paper are diverse commercial and governmental entities requiring instantaneous and reliable physical proof of transaction, access, or record-keeping. These potential customers operate in environments where high-speed printing, low maintenance, and clear, machine-readable output are non-negotiable operational standards. The largest end-user segments include transportation authorities (metro, bus, rail), which procure billions of short-term tickets annually, and the airline industry, which relies on thermal paper for boarding passes and baggage tags that must withstand significant handling and automated scanning processes. These buyers often prioritize durability, adherence to international standards (like IATA specifications for airlines), and the integration of sophisticated security features to prevent fraud.

A significant portion of demand originates from the entertainment and leisure sectors, including professional sports leagues, concert promoters, multiplex cinema chains, and theme parks. For these customers, the thermal ticket serves not only as proof of purchase but often as a marketing tool, requiring high-quality graphics capability and sometimes color thermal printing. Gaming and lottery corporations represent another highly valuable customer base, where regulatory compliance mandates the use of specialized, tamper-evident thermal paper with complex security markings, driving premium pricing for these specific stock types. In the logistics and retail spheres, large e-commerce fulfillment centers and retail chains utilize thermal paper extensively for shipping labels, shelf tags, and customer receipts, valuing speed and cost-efficiency above all else.

Emerging segments of potential customers include the healthcare industry, utilizing thermal paper for patient wristbands that require bio-compatible, long-term durable print, and for laboratory specimen tracking labels that must resist chemical exposure. Government agencies, especially those dealing with border control, customs, and vehicle registration, also represent high-value buyers, demanding security-enhanced thermal media for official documentation and provisional permits. Targeting these diverse customer groups requires manufacturers to offer tailored solutions—from ultra-durable synthetic thermal paper for outdoor logistics applications to highly regulated, specialized low-toxicity thermal paper for patient care settings—emphasizing compliance and application-specific performance characteristics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.2 Billion |

| Market Forecast in 2033 | USD 6.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Oji Holdings Corporation, Koehler Paper Group, Appvion Operations Inc., Ricoh Company Ltd., Domtar Corporation, Twin Rivers Paper Company, Hansol Paper Co. Ltd., Mitsubishi HiTec Paper Europe GmbH, Jujo Thermal Ltd., Henan Senzhong Thermal Paper Co., Thermal Paper Roll Factory, Gold Huasheng Paper Co., Rotolificio Bergamasco, PM Company, Tele-Paper Malaysia, NIPPR Corp., PG Paper Company, Lecta, Asia Pulp & Paper (APP), and Resolute Forest Products. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Direct Thermal Ticket Paper Market Key Technology Landscape

The key technology landscape of the Direct Thermal Ticket Paper market is primarily centered around advanced chemical synthesis, coating precision, and integration of security features. At the core, manufacturing involves highly specialized coating machinery that applies the thermal layer—a proprietary blend of leuco dyes, chemical developers, and sensitizers—with micron-level accuracy to ensure uniform heat responsiveness. A significant technological focus currently lies in the transition from traditional, less expensive Bisphenol A (BPA) chemistry to environmentally safer alternatives, such as Bisphenol S (BPS), urea-based, or vitamin-C derived developers. This shift necessitates constant R&D to maintain high image contrast and thermal sensitivity comparable to older formulas while adhering to increasingly strict global health regulations, particularly in the European Union.

Beyond the thermal coating itself, significant technological advancements are occurring in the area of topcoat protection. High-durability thermal papers utilize advanced polymer topcoats that provide resistance against common degrading factors such as plasticizers (found in PVC wallets), moisture, oils, and physical abrasion. This technology is critical for extending the archival life of tickets used in high-contact environments like transit and logistics, where labels and tickets may be exposed to harsh conditions. Furthermore, the integration of specialized security features is driving innovation in multi-layer printing. Techniques include embedding UV-fluorescent fibers into the base paper, applying micro-text printing, or integrating heat-sensitive inks that react differently than the standard thermal coating, creating layered authentication mechanisms crucial for combating counterfeiting in high-stakes applications like lottery and tax documents.

Finally, technology related to printing hardware compatibility is essential. Manufacturers are continuously optimizing paper characteristics, such as smoothness and thickness, to ensure seamless operation with high-speed thermal printers used in kiosks and automated ticketing machines. This includes developing anti-static properties to prevent paper jams and utilizing high-sensitivity coatings that allow for faster printing at lower energy settings, thus extending the life of the thermal print heads. Ongoing research in "two-color" thermal paper—which uses two different dye layers that activate at distinct temperatures—allows for enhanced visual signaling and complex document design, further expanding the functional utility of thermal tickets beyond simple monochromatic receipt generation and securing its technological relevance against digital alternatives.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant and fastest-growing region in the Direct Thermal Ticket Paper Market, underpinned by rapid infrastructural expansion and massive demographic growth. Countries like China and India are spearheading global investments in high-speed rail, metropolitan transit networks, and automated retail infrastructure, all of which rely heavily on fast, reliable thermal ticketing and receipt systems. The booming e-commerce market in Southeast Asia also drives substantial demand for logistics labels and thermal shipping tags. Furthermore, the region's increasing disposable income leads to greater spending on entertainment and gaming, necessitating high volumes of secure thermal event tickets and lottery slips. The market here is highly price-sensitive, balancing demand for commodity paper rolls with growing acceptance of coated, high-durability stocks for critical government and transit applications.

- North America: North America represents a mature, high-value market characterized by stringent requirements for security and high-quality printing, particularly in the airline, healthcare, and regulated gambling industries. The market is primarily driven by replacement demand, the continuous upgrade of POS systems in established retail chains, and the high adoption rate of self-service kiosks (e.g., parking, movie tickets) that utilize thermal paper rolls and ticket stock. Environmental compliance is a significant factor, leading to a strong shift towards BPA-free and phenol-free thermal options. Innovation here often focuses on integrating thermal media with sophisticated mobile tracking and data management systems, ensuring seamless operational continuity even as digital methods gain popularity.

- Europe: The European market is highly regulated, primarily influenced by directives such as the European Union's restrictions on chemical usage (BPA phase-outs). This regulatory environment has forced rapid technological adoption of safer, alternative thermal chemistries, positioning Europe as a leader in sustainable thermal paper development. Demand is robust across the public transport sector, where seamless ticketing across multiple countries is required, and in the organized retail sector. However, the advanced penetration of mobile ticketing solutions, particularly in Western Europe (UK, Germany, Scandinavia), poses a structural restraint, driving manufacturers to emphasize specialized, durable, and highly compliant products rather than high-volume commodity grades.

- Latin America: This region presents significant growth potential, albeit from a lower base, driven by improving economic conditions and increased foreign direct investment in retail infrastructure and public works. The modernization of transit systems in major metropolitan areas like São Paulo, Mexico City, and Buenos Aires is creating substantial, long-term contractual opportunities for thermal paper suppliers. The market is moderately price-sensitive, with a gradual transition from basic thermal paper towards semi-coated varieties as local operations increase their focus on durability and anti-fraud measures in ticketing and receipts.

- Middle East and Africa (MEA): The MEA region is marked by high-growth pockets, particularly within the Gulf Cooperation Council (GCC) states, driven by mega-projects in infrastructure, tourism, and entertainment (e.g., Saudi Arabia’s Vision 2030 and UAE's aviation hub expansion). These large-scale developments necessitate advanced ticketing and logistics labeling solutions, often procuring high-quality, international-standard thermal media. Africa’s burgeoning retail and nascent logistics sectors also contribute to demand, specifically in POS receipts and provisional documentation, making it an emerging market for commodity thermal paper, with long-term potential for specialized anti-counterfeiting stock.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Direct Thermal Ticket Paper Market.- Oji Holdings Corporation

- Koehler Paper Group

- Appvion Operations Inc.

- Ricoh Company Ltd.

- Domtar Corporation

- Twin Rivers Paper Company

- Hansol Paper Co. Ltd.

- Mitsubishi HiTec Paper Europe GmbH

- Jujo Thermal Ltd.

- Henan Senzhong Thermal Paper Co.

- Thermal Paper Roll Factory

- Gold Huasheng Paper Co.

- Rotolificio Bergamasco

- PM Company

- Tele-Paper Malaysia

- NIPPR Corp.

- PG Paper Company

- Lecta

- Asia Pulp & Paper (APP)

- Resolute Forest Products

- International Paper Company

- Sihl GmbH

- Shelby Group

Frequently Asked Questions

Analyze common user questions about the Direct Thermal Ticket Paper market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Direct Thermal Ticket Paper Market?

The market growth is primarily driven by the global expansion of public transportation and infrastructure projects, the necessity for high-speed, reliable ticketing in the entertainment and gaming industries, and the cost-efficiency advantages of thermal printing technology (no ink or toner required) in high-volume retail and logistics operations. The need for verifiable physical records in regulated sectors such as air travel and government services further sustains demand despite digital trends.

How is the adoption of mobile and digital ticketing impacting the thermal paper market?

Mobile and digital ticketing act as a significant restraint, particularly in low-security, consumer-facing applications like general admission cinemas and casual retail. However, for high-security, high-volume, and regulated applications such as baggage tagging, airline boarding passes, lottery tickets, and transit backups, physical thermal paper remains operationally critical, often complementing digital systems to ensure redundancy and regulatory compliance.

What is the current regulatory status regarding Bisphenol A (BPA) and other phenolic developers in thermal paper?

Regulatory bodies, especially in the European Union (EU), have severely restricted the use of BPA in thermal paper due to health concerns, necessitating a major industry shift towards alternative developers like Bisphenol S (BPS), and increasingly, phenol-free alternatives (e.g., based on urea or vitamin C derivatives). This regulatory pressure drives innovation in sustainable and safer chemical coatings, increasing the market share of premium, compliant paper grades globally.

Which geographical region holds the largest market share for direct thermal ticket paper, and why?

The Asia Pacific (APAC) region currently holds the largest market share and exhibits the highest growth rate. This dominance is attributed to massive investments in transportation infrastructure (rail, metro expansion), rapid urbanization driving transit ridership, and the exponential growth of e-commerce and retail sectors in countries like China, India, and Southeast Asia, all of which require substantial volumes of thermal receipts and shipping labels.

What are 'top-coated' thermal papers, and why are they becoming increasingly important in the market?

Top-coated thermal papers feature an extra protective layer applied over the thermal coating, significantly enhancing durability. This layer shields the print from degradation caused by heat, light, moisture, oils, and physical abrasion. They are crucial for applications requiring long archival life or frequent handling, such as long-term logistics tags, patient wristbands, and durable public transit passes, ensuring the printed image remains readable throughout the document's required lifespan.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager