Direct to Consumer Microbiome Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432998 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Direct to Consumer Microbiome Market Size

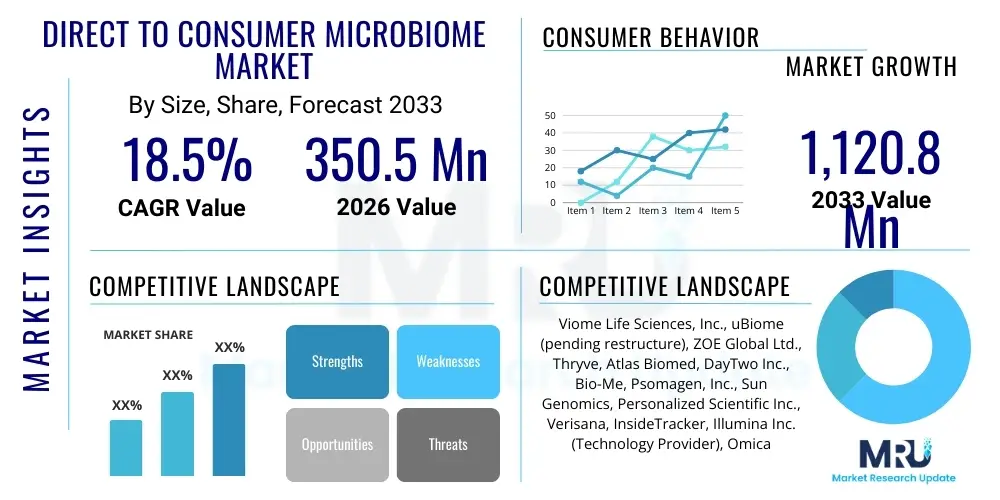

The Direct to Consumer Microbiome Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 350.5 Million in 2026 and is projected to reach USD 1,120.8 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating consumer interest in personalized health and wellness solutions, coupled with technological advancements that have significantly lowered the cost and increased the accessibility of sophisticated genomic and metabolomic sequencing, making self-administered testing viable for a mass audience.

Direct to Consumer Microbiome Market introduction

The Direct to Consumer (DTC) Microbiome Market encompasses health and wellness products and services, primarily diagnostic testing kits and personalized therapeutic recommendations, that are sold directly to consumers without requiring a prescription or intermediation from healthcare providers. These services typically involve analyzing biological samples (fecal, oral, skin) to map the unique microbial composition of an individual. The core product offering includes comprehensive analysis reports, targeted dietary and lifestyle advice, and often, customized probiotic or prebiotic supplement recommendations designed to optimize gut, skin, or overall metabolic health based on the derived microbiome profile.

Major applications for DTC microbiome testing span preventive healthcare, chronic condition management (such as irritable bowel syndrome and metabolic disorders), performance nutrition, and aesthetic concerns like skin health. The primary benefit derived by consumers is the acquisition of highly personalized, actionable health data that empowers them to make informed choices regarding diet, supplementation, and lifestyle adjustments. This focus on prevention and optimization, rather than reactive treatment, positions DTC microbiome products as a crucial component of the burgeoning personalized wellness ecosystem, particularly among health-conscious millennials and Generation Z consumers seeking bio-optimization.

Key driving factors propelling this market growth include the rising prevalence of chronic lifestyle diseases heavily linked to gut dysbiosis, such as obesity and Type 2 diabetes, which increases the demand for root-cause analysis rather than symptomatic relief. Furthermore, aggressive investments in next-generation sequencing technologies (NGS) have dramatically improved the accuracy and throughput of testing while simultaneously lowering costs. Media coverage and academic research highlighting the critical role of the microbiome-gut-brain axis in mental health and immunity also significantly fuel consumer curiosity and trust in these personalized health modalities, pushing market adoption across diverse demographic segments.

Direct to Consumer Microbiome Market Executive Summary

The Direct to Consumer Microbiome Market is experiencing robust acceleration, characterized by rapid innovation in bioinformatics and a convergence of diagnostic services with personalized nutrition and digital health platforms. Current business trends indicate a strong shift towards subscription models, where consumers receive periodic testing and continuous, dynamic feedback loops to adjust their regimen over time, ensuring long-term engagement and recurring revenue streams for market players. Furthermore, strategic partnerships between DTC testing companies and established functional food and beverage manufacturers are becoming prevalent, facilitating seamless integration of personalized results into tangible consumer products, thereby widening the market's commercial reach beyond initial diagnostic kits.

Regional trends clearly delineate North America as the dominant market, primarily due to high consumer spending on personal health technologies, a conducive regulatory landscape for wellness products, and the presence of major technological hubs that facilitate cutting-edge research and rapid product commercialization. Europe follows closely, driven by public awareness regarding chronic diseases and strong academic research into gut health, though it faces slightly stricter data privacy regulations (GDPR) which influence data handling practices. The Asia Pacific region is poised for the fastest expansion, fueled by increasing disposable incomes, a large population base with growing awareness of preventive medicine, and the rapid adoption of digital health platforms in countries like China and India.

Segment trends reveal that the testing and screening segment, particularly utilizing 16S rRNA sequencing and shotgun metagenomics, holds the largest market share due to its foundational importance in obtaining microbial data. However, the personalized supplements and therapeutics segment is projected to exhibit the highest CAGR, driven by the immediate consumer need for tangible, actionable solutions following testing. Within applications, the Gut Health segment remains paramount, though the Skin Microbiome segment is emerging rapidly, offering specialized testing and product recommendations to address conditions like eczema, acne, and overall skin resilience, broadening the market appeal beyond traditional digestive concerns and into the highly profitable cosmetic and cosmeceutical sectors.

AI Impact Analysis on Direct to Consumer Microbiome Market

User inquiries concerning the impact of Artificial Intelligence (AI) in the Direct to Consumer Microbiome Market predominantly revolve around the accuracy, personalization depth, ethical implications of data usage, and the transition speed from raw data to actionable clinical insights. Consumers frequently question how AI algorithms distinguish meaningful microbial patterns from noise, and whether the personalized recommendations generated are significantly superior to generic wellness advice. Key concerns also center on the security of sensitive biological data, particularly in unregulated or semi-regulated consumer environments, and the potential for algorithmic bias in diverse populations, creating a demand for transparency and validation in AI-driven health recommendations.

AI's fundamental role in this domain is transformative, moving the industry beyond simple compositional reporting towards predictive modeling and dynamic personalization. Machine learning (ML) models are essential for processing the massive, complex datasets generated by sequencing technologies, enabling companies to correlate specific microbial signatures with diverse phenotypic outcomes, ranging from mood stability to athletic performance. This sophisticated analysis is not achievable through traditional statistical methods alone, allowing for the identification of novel biomarkers and highly targeted interventions. AI integration standardizes the interpretation process, reduces variability across analyses, and facilitates the continuous refinement of algorithmic recommendations as global datasets expand.

Furthermore, AI algorithms are instrumental in optimizing the commercial and logistical aspects of the DTC market. They power personalized customer interfaces, predict product churn based on initial usage patterns, and manage complex inventory for customized supplement blends. The implementation of natural language processing (NLP) helps companies scale customer support by interpreting nuanced consumer reports and addressing specific health queries, thereby enhancing the overall user experience. This comprehensive application of AI, from laboratory analysis to consumer interaction, is critical for achieving scalability and maintaining the high degree of personalization that defines this competitive market sector, effectively serving as the central engine for value generation.

- AI enhances diagnostic accuracy by processing vast sequencing data to identify complex microbial patterns indicative of health status.

- Machine learning enables dynamic personalization of dietary, lifestyle, and supplemental recommendations based on individual microbiome profiles.

- Predictive modeling powered by AI forecasts the efficacy of specific prebiotics or probiotics before they are clinically tested, accelerating product development.

- AI algorithms assist in the classification of novel bacterial strains and the understanding of metabolic pathways, creating new intellectual property opportunities.

- Natural language processing (NLP) improves consumer interaction and education by translating complex biological results into understandable, actionable reports.

- AI systems are deployed for data security and privacy compliance, monitoring unusual data access patterns, though they also introduce new ethical oversight requirements.

DRO & Impact Forces Of Direct to Consumer Microbiome Market

The Direct to Consumer Microbiome Market is significantly shaped by a powerful interplay of accelerating drivers and persistent restraints, anchored by compelling long-term opportunities that promise market resilience and expansion. The primary driving force stems from the global paradigm shift towards preventive and personalized medicine, where consumers are increasingly willing to invest in proactive health monitoring tools. This movement is complemented by the rapid technological evolution in sequencing and bioinformatics, which makes complex biological analysis affordable and accessible outside of traditional clinical settings. These forces combine to create an environment where novel health insights are instantaneously marketable, accelerating consumer adoption rates.

Conversely, the market faces significant headwinds primarily related to regulatory uncertainty and public skepticism regarding the scientific validity and clinical utility of some DTC claims. Since these tests often bypass healthcare professionals, the lack of rigorous FDA or EMA oversight for many wellness claims raises concerns about data interpretation quality and potential consumer misinformation, which acts as a crucial restraint. Additionally, data privacy remains a critical constraint; the handling of highly sensitive genomic and biological data requires robust security protocols, and any perceived breach of privacy can severely erode consumer trust, particularly under strict regimes like GDPR in Europe and expanding privacy laws in North America.

Despite these challenges, the market is rich with opportunities, especially through synergistic integration with the broader digital health and telehealth ecosystem. Opportunities exist in establishing verifiable, evidence-based partnerships with clinical organizations to validate DTC findings, enhancing consumer confidence and potentially paving the way for eventual insurance reimbursement for specific diagnostic panels. Furthermore, the expansion into specialized application segments, such as personalized performance nutrition for athletes or highly targeted cosmeceuticals utilizing skin microbiome insights, offers avenues for premium product differentiation and access to lucrative niche markets, ensuring long-term commercial viability and growth beyond the foundational gut health segment.

Segmentation Analysis

The Direct to Consumer Microbiome Market is segmented based on product type, application, and distribution channel, providing a multilayered view of consumer demand and market structure. This segmentation is essential for companies to tailor their marketing strategies and product development pipelines to specific consumer needs, ranging from casual wellness monitoring to specialized health management. The complexity of the microbiome itself necessitates diverse product offerings, ensuring that market players can address both diagnostic requirements and subsequent therapeutic intervention demands across different health domains, leading to distinct revenue streams and competitive niches.

Analyzing segmentation highlights the dynamic interplay between the informational value derived from testing kits and the tangible action taken through personalized supplements. While testing kits serve as the initial gatekeeper to market entry and provide valuable recurring data, the personalized supplements segment drives higher continuous lifetime customer value. Furthermore, the application segmentation reflects the market's maturity; Gut Health, as the foundational segment, provides stable revenue, but emerging segments like Skin and Oral Microbiome are key indicators of future growth, responding to consumer desires for personalized approaches to beauty and systemic health management that extend beyond digestive wellness.

The distribution channel analysis demonstrates the critical reliance on online platforms, which are inherently suited for the DTC model, facilitating direct engagement, detailed educational content dissemination, and subscription management. However, the slow but steady integration into established retail environments (pharmacies, specialty wellness stores) signifies a move towards mainstream acceptance and offers credibility through physical presence, catering to consumers who prefer immediate access and the ability to interact with sales staff regarding complex health products, effectively balancing digital convenience with physical trust.

- By Product Type:

- Testing & Screening Kits (e.g., Sequencing Kits, Metabolomic Kits)

- Personalized Supplements (e.g., Custom Probiotics, Prebiotics)

- Data Analysis & Interpretation Services (Subscription-based platforms)

- By Application:

- Gut Health and Nutrition (e.g., IBS management, dietary advice)

- Metabolic Health (e.g., Weight management, diabetes risk assessment)

- Skin Health and Aesthetics (e.g., Eczema, acne, personalized skincare)

- Oral Health

- Mental Health (e.g., Microbiome-Gut-Brain Axis monitoring)

- By Technology:

- 16S rRNA Sequencing

- Shotgun Metagenomic Sequencing

- Metabolomics

- By Distribution Channel:

- Online Platforms (Direct Sales, E-commerce, Subscription Services)

- Retail Pharmacies and Specialty Stores

- Clinician Partnerships (Hybrid Models)

Value Chain Analysis For Direct to Consumer Microbiome Market

The value chain for the Direct to Consumer Microbiome Market begins with the upstream procurement and technological development phase, which is highly sensitive to innovations in molecular biology and high-throughput sequencing. This phase involves sourcing specialized laboratory consumables, developing proprietary sequencing protocols, and acquiring sophisticated bioinformatics hardware and software necessary for initial data generation. Key upstream partners include NGS platform providers, reagents suppliers, and specialized research institutions. Efficiency at this stage is crucial, as the unit cost of sequencing directly influences the final price point and mass-market accessibility of the DTC product, demanding strong relationships with technology providers to ensure cost-effectiveness and scalability.

The midstream phase focuses on core operations: sample collection, logistics, laboratory processing, and proprietary data analysis. The distribution channel, predominantly direct and indirect through e-commerce platforms, plays a crucial role here, facilitating the delivery of collection kits to the consumer and the secure, temperature-controlled return of samples to the lab. DTC companies must excel in developing secure, intuitive digital platforms for results delivery and interpretation. Direct channels, characterized by subscription services and owned websites, maximize profit margins and direct customer data collection, whereas indirect channels utilize third-party e-commerce giants to achieve broader market visibility and trust, though often at the expense of margin and direct control over the customer experience.

The downstream segment centers on consumer engagement, personalized intervention, and feedback loops. This involves marketing and sales, delivering personalized supplement recommendations, and providing ongoing support through educational content and consultation services. The effectiveness of the downstream value capture is heavily reliant on the quality and perceived actionability of the personalized advice; high customer lifetime value is achieved when consumers transition seamlessly from the diagnostic kit purchase to long-term, subscription-based supplement consumption. The integration of telehealth professionals or registered dietitians into the downstream offering significantly enhances the perceived clinical utility and trustworthiness of the overall service.

Direct to Consumer Microbiome Market Potential Customers

The primary end-users and buyers in the Direct to Consumer Microbiome Market are generally grouped into two major categories: the Proactive Wellness Seekers and individuals managing specific Chronic Health Concerns. Proactive Wellness Seekers represent the largest and fastest-growing segment; these are highly educated, technologically proficient individuals, often aged 25 to 55, who are dedicated to bio-optimization, preventative health measures, and performance enhancement. They are typically early adopters of health technology, possess higher-than-average disposable income, and actively seek personalized data to optimize areas like athletic performance, cognitive function, and general vitality, driven by a desire to extend healthspan rather than merely treat illness.

The second major segment, Chronic Health Concerns sufferers, includes individuals who have been diagnosed with or suspect they have conditions linked to gut dysbiosis, such as Irritable Bowel Syndrome (IBS), Inflammatory Bowel Disease (IBD), persistent skin issues like eczema, or metabolic disorders. These customers are motivated by a failure to find effective relief through traditional medical approaches and are searching for root-cause analysis through personalized, non-pharmacological interventions. They are often less concerned with the novelty of the technology and more focused on demonstrated efficacy and scientific credibility, frequently accessing the DTC market after recommendations from functional medicine practitioners or through online support communities focused on specific conditions.

A rapidly emerging sub-segment comprises individuals interested in personalized weight management and sports nutrition. These customers, including professional athletes and dedicated fitness enthusiasts, leverage microbiome data to fine-tune their nutritional intake, enhance nutrient absorption, and optimize recovery times. This group is particularly receptive to products that link microbial markers to metabolic efficiency and inflammatory responses. Overall, the market targets self-empowered consumers who prioritize highly individualized solutions over one-size-fits-all treatments and are willing to pay a premium for convenience, scientific depth, and continuous health monitoring provided by accessible digital platforms and at-home testing solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350.5 Million |

| Market Forecast in 2033 | USD 1,120.8 Million |

| Growth Rate | 18.5% ( Include CAGR Word with % Value ) |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Viome Life Sciences, Inc., uBiome (pending restructure), ZOE Global Ltd., Thryve, Atlas Biomed, DayTwo Inc., Bio-Me, Psomagen, Inc., Sun Genomics, Personalized Scientific Inc., Verisana, InsideTracker, Illumina Inc. (Technology Provider), Omica Life, Microba Life Sciences, The BioCollective, Gencove, General Biosystems, Aemetis, Inc., Bione Ventures. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Direct to Consumer Microbiome Market Key Technology Landscape

The technological landscape underpinning the Direct to Consumer Microbiome Market is predominantly driven by high-throughput sequencing methods, coupled with advanced bioinformatics and artificial intelligence for data interpretation. The most prevalent technology remains 16S rRNA gene sequencing, which is cost-effective and provides a reliable, albeit limited, snapshot of the microbial composition (identifying 'who is there'). This method is widely adopted for baseline DTC screening due to its established methodology and affordability, making it highly scalable for mass-market testing. However, the limitation of 16S sequencing is its inability to precisely define microbial function and metabolic potential, which increasingly drives demand for more sophisticated solutions.

The emerging technological standard is Shotgun Metagenomic Sequencing (SMS), which sequences the entire DNA content of the sample, providing comprehensive information not only on microbial species identification but also on their functional capacity, including metabolic pathways and genetic potential (identifying 'what they can do'). While SMS is significantly more expensive and computationally demanding than 16S sequencing, its superior data resolution is becoming crucial for companies aiming to provide highly granular, clinically relevant personalization, especially for chronic disease management and therapeutic development. The ongoing decline in SMS costs, driven by competition among sequencing instrument manufacturers, is a primary enabler for its wider deployment within the DTC sphere.

Beyond gene sequencing, Metabolomics technology is gaining traction as a vital complementary tool. Metabolomics focuses on identifying and quantifying small molecules (metabolites) produced by the human body and its associated microbiota, offering a real-time, functional view of microbial activity (identifying 'what they are doing right now'). Integrating metabolomic data with genomic sequencing provides a powerful multi-omic approach, allowing DTC companies to move beyond correlation and towards identifying causation, significantly increasing the predictive accuracy of personalized interventions. Furthermore, secure cloud computing, essential for handling petabytes of biological data, and proprietary AI/ML algorithms designed to synthesize these multi-omic data points are foundational technological assets for competitive market players, transforming raw data into accessible, actionable consumer insights.

Regional Highlights

North America dominates the global Direct to Consumer Microbiome Market, attributed to several converging factors including high consumer health spending, an entrenched culture of self-care and technological adoption, and the presence of leading biotechnology and bioinformatics hubs, particularly in the United States. The region benefits from a dynamic competitive environment where established companies and well-funded startups continuously push the boundaries of testing accuracy and personalized recommendation efficacy. Regulatory bodies, while maintaining skepticism regarding clinical claims, generally allow broad latitude for wellness-focused DTC products, enabling rapid commercialization. High disposable incomes allow consumers to afford the premium pricing often associated with highly personalized, subscription-based health monitoring services, making it the most lucrative market globally for microbiome testing and personalized supplements.

Europe represents the second-largest market, characterized by strong governmental investment in microbiome research and a highly health-aware population, particularly in Western European nations like Germany, the UK, and France. However, the market operates under stricter regulatory scrutiny, particularly concerning the General Data Protection Regulation (GDPR), which imposes rigorous requirements on the collection, processing, and storage of sensitive biological data, impacting operational complexity and technological requirements for market entry. European consumers prioritize scientific validation and privacy, driving demand for products that demonstrate clear clinical utility and offer transparent data handling policies. The European market sees robust adoption driven by academic research collaborations and integration with functional medicine practitioners, emphasizing evidence-based solutions.

Asia Pacific (APAC) is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is driven by massive population density, increasing rates of lifestyle-related chronic diseases (especially diabetes and obesity), and burgeoning middle-class populations with rising disposable incomes across major economies like China, Japan, and South Korea. Furthermore, governments in key APAC countries are investing heavily in genomics and personalized medicine initiatives. The region is quickly embracing digital health technologies, making the adoption of DTC testing platforms straightforward. However, the APAC market is highly fragmented, necessitating culturally appropriate marketing and product localization, especially concerning dietary recommendations. Consumer interest is often initially spurred by cosmetic and anti-aging applications (skin microbiome) before transitioning to core gut health concerns.

- North America: Market leader; High technological adoption; Driven by personalized wellness trends and high consumer expenditure on health technology.

- Europe: Second largest market; Growth driven by strong research base and high health awareness; Heavily influenced by strict GDPR data protection standards.

- Asia Pacific (APAC): Fastest-growing region; Fueled by increasing disposable income, urbanization, and high prevalence of metabolic disorders; Focus on digital health integration.

- Latin America (LATAM): Emerging market; Growth hampered by economic instability and variable healthcare infrastructure; Potential driven by rising awareness in major economies like Brazil and Mexico.

- Middle East and Africa (MEA): Nascent stage; Adoption concentrated in affluent Gulf Cooperation Council (GCC) nations; Limited infrastructure and regulatory frameworks present barriers to mass market penetration.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Direct to Consumer Microbiome Market.- Viome Life Sciences, Inc.

- ZOE Global Ltd.

- Atlas Biomed

- Thryve, Inc.

- DayTwo Inc.

- Psomagen, Inc.

- Sun Genomics

- Bio-Me AS

- Microba Life Sciences

- Omica Life

- Personalized Scientific Inc.

- Verisana

- InsideTracker

- uBiome (Restructuring/Re-entry Potential)

- Onegevity Health (a division of Thorne HealthTech)

- Genetic Analysis AS

- Bione Ventures

- Gencove

- General Biosystems, Inc.

- Aemetis, Inc.

Frequently Asked Questions

Analyze common user questions about the Direct to Consumer Microbiome market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Direct to Consumer Microbiome Market?

The Direct to Consumer Microbiome Market is anticipated to exhibit a robust growth trajectory, projecting a CAGR of 18.5% over the forecast period spanning from 2026 to 2033. This high growth rate is indicative of the rapid commercialization of personalized health technologies and increasing consumer willingness to invest in preventative and bio-optimization services, driven by continuous technological advancements in sequencing affordability.

How does Artificial Intelligence (AI) enhance the value proposition of DTC microbiome testing?

AI, specifically machine learning algorithms, is crucial for transforming vast amounts of raw sequencing data into actionable, personalized health recommendations. AI models enhance diagnostic accuracy, predict metabolic health risks, and dynamically optimize dietary or supplemental regimens, significantly increasing the clinical utility and personalization depth compared to traditional, static reporting methods.

What are the key differences between 16S rRNA sequencing and Shotgun Metagenomic Sequencing (SMS) in this market?

16S rRNA sequencing is a cost-effective method used primarily to identify microbial species (composition), offering a good baseline analysis. In contrast, Shotgun Metagenomic Sequencing (SMS) is more expensive but provides comprehensive data on both species identity and their functional capacity (metabolic genes), allowing for superior insight into specific microbial activities and therapeutic targets, positioning it as the emerging gold standard for in-depth analysis.

Which application segment currently holds the largest market share in the Direct to Consumer Microbiome Market?

The Gut Health and Nutrition segment currently holds the largest market share, serving as the foundational application for DTC microbiome products. Consumer interest in managing digestive issues, improving nutrient absorption, and linking gut health to systemic wellness, including immunity and mental health, continues to drive demand in this core area, although the Skin Health segment is rapidly gaining momentum.

What major restraints are impacting the growth and mainstream adoption of DTC microbiome products?

The primary restraints include persistent regulatory ambiguity, as many DTC claims lack formal clinical validation from bodies like the FDA or EMA, leading to public skepticism. Furthermore, high consumer concerns surrounding the security and privacy of sensitive biological and genomic data (particularly under regulations like GDPR) pose a significant challenge to achieving widespread, non-subscription based market penetration.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager