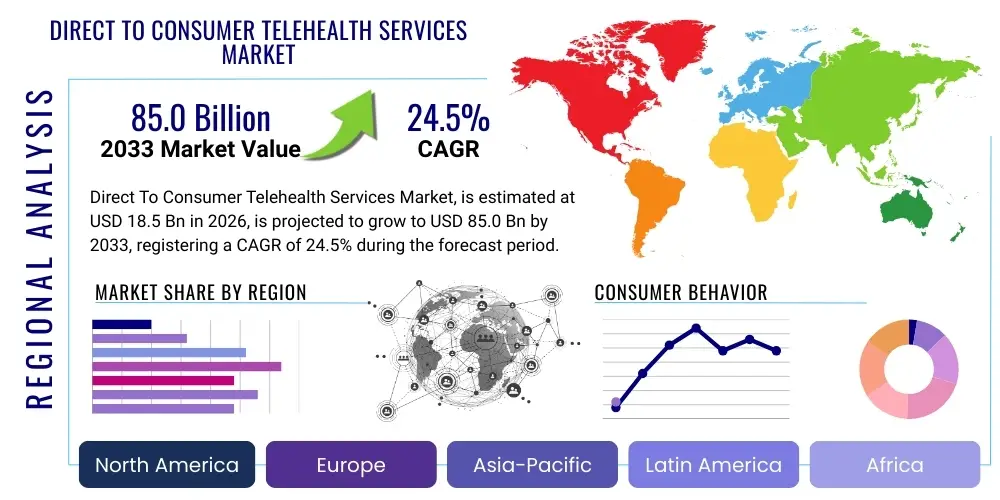

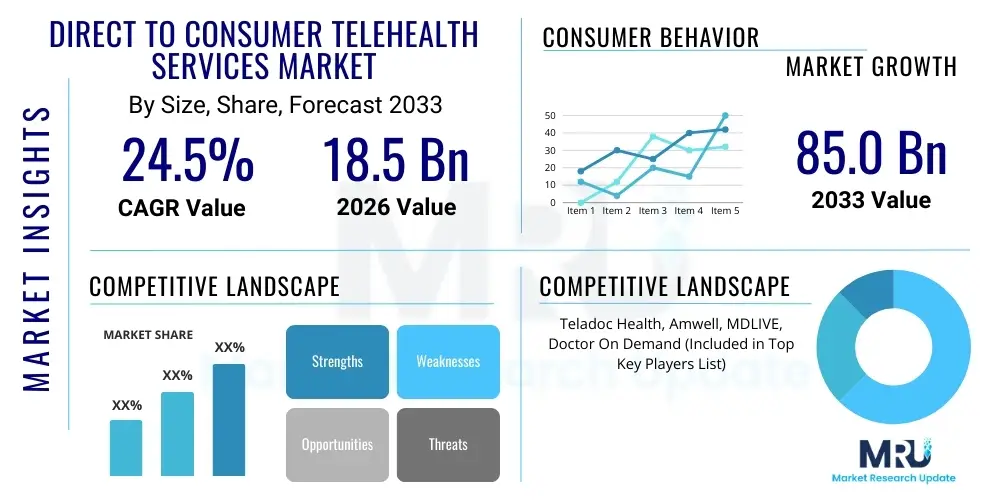

Direct To Consumer Telehealth Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432844 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Direct To Consumer Telehealth Services Market Size

The Direct To Consumer Telehealth Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 25.0% between 2026 and 2033. The market is estimated at USD 20.5 Billion in 2026 and is projected to reach USD 102.0 Billion by the end of the forecast period in 2033. This robust expansion is fueled primarily by the accelerated digitalization of healthcare delivery, favorable regulatory shifts regarding virtual care reimbursement, and the increasing demand for convenient, personalized, and cost-effective medical consultations directly accessible by patients, bypassing traditional gatekeeping mechanisms.

Direct To Consumer Telehealth Services Market introduction

The Direct To Consumer (DTC) Telehealth Services Market encompasses the provision of healthcare services, including primary care consultations, specialist visits, mental health support, and chronic disease management, delivered directly to patients via digital platforms such as video conferencing, remote patient monitoring (RPM) tools, and mobile applications. This model bypasses the traditional requirement for a patient to visit a physical clinic or hospital, offering a seamless, on-demand healthcare experience. Key products within this domain include virtual primary care subscriptions, mental wellness platforms offering therapist access, and digital dermatology services, all designed to enhance patient autonomy and access.

Major applications of DTC telehealth span acute care triage for minor illnesses, prescription refills, preventative wellness checks, and follow-up care for managed conditions. The driving factors behind market momentum are manifold: soaring patient demand for convenience, reduced geographical barriers to accessing specialized care, and the comparative affordability of virtual visits over in-person appointments. Furthermore, significant investments in digital health infrastructure by private equity firms and technology companies are rapidly expanding the serviceable population and improving the quality of virtual care delivery, ensuring high satisfaction rates among users.

The core benefit of adopting DTC telehealth services is the drastic improvement in accessibility and efficiency. Patients in rural or underserved areas gain immediate access to specialists they might otherwise wait months to see, while urban dwellers benefit from time savings associated with avoiding travel and waiting rooms. This paradigm shift not only enhances patient engagement but also empowers individuals to take a proactive role in managing their health, supported by continuous monitoring and personalized digital health interventions. The shift is permanently altering healthcare consumption habits, establishing digital pathways as essential components of modern medical infrastructure.

Direct To Consumer Telehealth Services Market Executive Summary

The Direct To Consumer Telehealth Services Market is experiencing transformative growth, driven by fundamental shifts in consumer behavior towards digital-first solutions and continuous technological integration. Key business trends highlight a move toward integrated care models where single platforms offer a blend of primary, urgent, and specialty care, moving beyond simple episodic virtual visits. Strategic partnerships between large retail chains, technology giants, and established telehealth providers are defining the competitive landscape, focusing on expanding payer coverage and ensuring regulatory compliance across diverse jurisdictions. Innovation in asynchronous communication tools and advanced diagnostic peripherals is enhancing the scope and reliability of remote assessments, thus boosting clinician confidence in virtual diagnoses.

Regionally, North America maintains market dominance due to robust insurance reimbursement policies, high penetration of smartphone and internet usage, and a mature regulatory framework facilitating interstate medical licensing flexibility. However, the Asia Pacific (APAC) region is poised for the highest growth rate, fueled by massive, underserved populations and aggressive government initiatives in countries like India and China promoting digital health adoption to overcome infrastructure shortages. European markets show steady, structured growth, often integrated closely with nationalized healthcare systems, emphasizing mental health and chronic condition management delivered through virtual channels.

Segment trends underscore the surging prominence of mental health services and chronic disease management (CDM) within the DTC model. Mental health platforms offering therapy, psychiatry, and wellness coaching via video consultations are seeing exponential user acquisition, addressing the global shortage of behavioral health professionals. Similarly, CDM platforms utilizing Remote Patient Monitoring (RPM) devices for conditions like diabetes and hypertension are moving beyond simple data collection to deliver proactive, AI-driven intervention strategies, proving substantial efficacy in reducing hospital readmissions and improving long-term patient outcomes. Technological segmentation emphasizes the shift from pure video conferencing to integrated, multi-modal platforms incorporating AI chatbots, symptom checkers, and advanced interoperability features.

AI Impact Analysis on Direct To Consumer Telehealth Services Market

Common user questions regarding AI's impact on DTC telehealth frequently revolve around trust, accuracy, and personalization. Users often ask: "Can AI diagnose me accurately?", "Will AI replace my doctor?", and "How safe is my health data when processed by AI algorithms?". These concerns highlight a dual user perspective: excitement about instant, personalized care balanced by anxiety over algorithmic bias and the loss of human empathy in medical consultation. There is significant expectation that AI will streamline access (e.g., through intelligent scheduling and triage) but also apprehension regarding regulatory safeguards ensuring AI tools meet rigorous clinical standards before widespread deployment in direct patient care settings. Users specifically seek clarity on how AI enhances, rather than diminishes, the quality and security of their virtual healthcare journey.

The implementation of Artificial Intelligence and Machine Learning (ML) models is fundamentally reshaping the operational efficiency and clinical scope of DTC telehealth platforms. AI algorithms are deployed for advanced patient triage, accurately assessing symptoms provided asynchronously and directing patients to the most appropriate level of care, whether a virtual consultation, an urgent physical visit, or self-care guidance. This capability significantly reduces unnecessary resource utilization and streamlines the intake process, improving both provider workflow and patient satisfaction. Furthermore, AI-powered natural language processing (NLP) is transforming the management of electronic health records (EHRs) by automating documentation, summarizing consultation notes, and identifying potential drug interactions or contraindications, freeing up clinician time for direct patient engagement.

Beyond operational improvements, AI is central to enhancing the personalization and effectiveness of care delivered directly to consumers. ML models analyze vast datasets of patient behavior, adherence patterns, and physiological data derived from connected devices (RPM) to generate highly tailored treatment plans and behavioral nudges. For example, in mental health, AI can analyze textual and vocal patterns during virtual therapy sessions to detect subtle shifts in mood or risk factors, providing real-time alerts to the therapist. This analytical depth allows DTC platforms to offer predictive healthcare—identifying individuals at high risk of condition exacerbation before a crisis occurs, ensuring timely and proactive virtual interventions, thereby fulfilling the promise of truly personalized, preventative digital medicine.

- AI-driven Triage and Symptom Checking: Automating initial patient assessment and routing based on severity and specialty need.

- Enhanced Data Security: Using machine learning to detect and prevent anomalous data access or cyber threats in cloud-based EHRs.

- Personalized Treatment Pathways: Utilizing ML to analyze physiological and behavioral data for custom care plans, particularly in chronic disease management.

- Automated Clinical Documentation: NLP tools summarizing virtual visits and updating patient records, reducing administrative burden on clinicians.

- Predictive Health Interventions: Identifying high-risk patients using predictive analytics for proactive engagement and virtual monitoring adjustments.

DRO & Impact Forces Of Direct To Consumer Telehealth Services Market

The DTC Telehealth Services Market is profoundly influenced by a complex interplay of digital drivers, structural restraints, and emerging opportunities, collectively shaping its trajectory and long-term viability. The primary driver is the accelerating consumer preference for convenience and immediate access to healthcare, particularly among digitally native generations and busy professionals who value time efficiency over traditional hospital visits. However, structural restraints, particularly the fragmented regulatory environment concerning cross-state licensure for providers and ongoing concerns about the security and privacy of sensitive health data transmitted over digital networks, pose significant adoption hurdles. Opportunities lie primarily in expanding the clinical scope into high-value specialty areas like virtual oncology and complex post-operative monitoring, leveraging 5G connectivity and advanced biosensors. These forces exert considerable pressure on providers to innovate continuously while maintaining stringent clinical and data protection standards.

Key drivers include the dramatic improvement in internet infrastructure globally, making high-quality video consultations reliable, and the growing acceptance of remote monitoring devices that allow clinicians to gather objective, real-time physiological data outside clinical settings. Furthermore, favorable policy shifts, catalyzed by global health crises, have permanently broadened reimbursement coverage for virtual visits by both private and public payers, ensuring financial sustainability for DTC models. The cost-efficiency realized by both patients and providers—reducing overheads for clinics and out-of-pocket costs for minor consultations—further cements the market's positive momentum. These factors combine to lower the barrier to entry for patients and increase the perceived value of digital healthcare offerings, accelerating mass adoption.

Conversely, significant restraints must be addressed for long-term growth. The digital divide remains a critical challenge, limiting access for elderly populations or those in areas with poor broadband service, potentially exacerbating health inequities. Furthermore, integrating disparate telehealth platforms with existing hospital Electronic Health Record (EHR) systems poses technical and logistical difficulties, hindering seamless data exchange and care coordination. The opportunity space, however, is expansive, particularly in developing hybrid care models that blend virtual convenience with in-person necessity (e.g., lab tests or complex procedures), known as 'medically home' strategies. There is also a substantial opportunity in global expansion, adapting platforms to meet local language, cultural, and regulatory requirements in rapidly developing economies, positioning DTC telehealth as a critical tool for global health modernization.

Segmentation Analysis

The Direct To Consumer Telehealth Services Market is critically segmented based on the type of service offered, the technology platform utilized, the application of the service, and the delivery method. This granular segmentation allows market participants to tailor offerings to specific demographic needs and clinical requirements. The primary segmentation centers around the clinical nature of the service, differentiating between Primary Care, Mental Health, Specialist Consultations, and Remote Patient Monitoring (RPM). The proliferation of dedicated mental health platforms has been a defining feature of the market's growth, while the technology segment highlights the foundational role of video conferencing, asynchronous communication, and integrated AI tools. Understanding these segments is vital for strategic investment and product development, ensuring alignment with evolving consumer demands for specialized, convenient, and technologically sophisticated care solutions.

- Service Type:

- Virtual Primary Care

- Mental and Behavioral Health Services

- Specialty Consultations (e.g., Dermatology, Cardiology)

- Chronic Disease Management (CDM)

- Urgent Care Triage

- Technology Platform:

- Video Conferencing Solutions

- Remote Patient Monitoring (RPM) Devices and Platforms

- Asynchronous Communication (Store-and-Forward)

- Mobile Apps and Wearable Integration

- Application:

- Diagnosis and Treatment

- Prescription Management

- Follow-up Care

- Preventative Wellness and Coaching

- Delivery Model:

- Subscription-Based Models

- Fee-for-Service Models

- Integrated Payer Models

Value Chain Analysis For Direct To Consumer Telehealth Services Market

The value chain for DTC telehealth services is distinctly vertical and driven by technology integration, stretching from underlying infrastructure providers to end-user patients. The upstream segment is dominated by technology infrastructure providers, including cloud service giants (e.g., AWS, Azure) supplying secure data storage and computing power, as well as specialized software developers providing proprietary telehealth platforms, EHR integration tools, and AI/ML algorithms for clinical decision support. Maintaining security compliance (such as HIPAA in the U.S. or GDPR in Europe) is a prerequisite for successful participation in this upstream layer, necessitating significant investment in robust data encryption and privacy protocols. Innovation upstream focuses heavily on interoperability and seamless integration with existing hospital and pharmacy systems to ensure continuity of care.

The core of the value chain involves the service delivery component, managed by telehealth providers who contract with licensed healthcare professionals (physicians, nurses, therapists). These providers manage the direct-to-consumer relationship, handling scheduling, billing, and quality assurance for the virtual visits. Distribution channels are predominantly direct, leveraging sophisticated digital marketing strategies, mobile applications, and proprietary web portals to reach patients directly. Indirect distribution is emerging through partnerships with employers offering telehealth as an employee benefit, or through collaborations with insurance carriers who integrate the service into their member portals. Efficiency in this segment relies heavily on high patient engagement rates and minimizing the friction points in the virtual appointment process.

The downstream segment includes pharmacies, laboratories, and specialized device manufacturers (for RPM). Pharmacies play a critical role in fulfilling digitally sent prescriptions, often requiring advanced e-prescribing capabilities integrated directly with the telehealth platform. Laboratories facilitate remote diagnostics by coordinating home-kit testing or directing patients to local physical sites for bloodwork, ensuring that virtual consultation results are grounded in objective data. The convergence of these downstream elements ensures that the consumer receives a complete healthcare experience—from diagnosis and consultation to treatment fulfillment—all mediated through the digital channel, underscoring the necessity for robust logistics and information flow management.

Direct To Consumer Telehealth Services Market Potential Customers

Potential customers for the Direct To Consumer Telehealth Services Market are broad, encompassing various demographics defined primarily by their digital literacy, geographical location, and specific clinical needs. The primary demographic includes digitally savvy individuals aged 25–55, such as working professionals, parents managing family health, and urban residents seeking immediate, convenient access to care without disrupting their busy schedules. These users often utilize the service for non-emergency urgent care, mental health support, and routine chronic condition follow-ups, prioritizing time savings and efficiency. Their purchasing decision is often influenced by employer-sponsored benefits and direct marketing highlighting convenience and affordability compared to traditional medical costs.

A second major customer group consists of patients residing in geographically isolated or rural areas who face significant barriers to accessing specialized medical services. For these individuals, DTC telehealth represents a critical lifeline, enabling them to consult with specialists located thousands of miles away without incurring travel expenses or excessive wait times. Furthermore, individuals managing chronic diseases such as diabetes, hypertension, or asthma represent a high-value customer segment, as they require frequent monitoring and interaction, which is efficiently and cost-effectively managed through RPM and frequent virtual check-ins. Platforms focusing on long-term patient relationship management and integrated device data appeal strongly to this cohort.

The final significant segment comprises individuals seeking behavioral and mental health services. Driven by the stigma associated with in-person mental health visits and the acute shortage of mental health professionals, this group highly values the privacy, accessibility, and discretion offered by DTC mental wellness platforms. Students, young adults, and those requiring ongoing therapy or psychiatric medication management are heavy users. Service providers tailor their offerings to emphasize therapist matching algorithms, flexible scheduling, and integrated wellness content, appealing directly to the need for confidential and readily available emotional support, solidifying their position as essential consumers in the evolving market landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 20.5 Billion |

| Market Forecast in 2033 | USD 102.0 Billion |

| Growth Rate | CAGR 25.0% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Teladoc Health, Amwell, MDLIVE, Doctor On Demand, PlushCare, LiveHealth Online, MeMD, Included Health, Hims & Hers, Ro, K Health, Babylon Health, 98point6, Talkspace, BetterHelp, GE Healthcare, Philips, Doctor Anywhere, Ping An Good Doctor, HealthTap |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Direct To Consumer Telehealth Services Market Key Technology Landscape

The technological landscape underpinning the DTC Telehealth Services Market is characterized by rapid evolution and convergence, driven by the necessity for secure, high-fidelity remote interactions. At the core are robust, HIPAA or GDPR-compliant cloud infrastructure systems that ensure scalability and data security for storing sensitive patient information and enabling high-availability service access. High-definition video conferencing remains the foundational technology for live virtual consultations, but its efficacy is increasingly supplemented by advanced communication protocols that prioritize low latency and stability, crucial for complex diagnostic interactions. Moreover, Application Programming Interfaces (APIs) are essential for seamless integration between the telehealth front-end, laboratory information systems, and pharmacy dispensing networks, creating a cohesive patient journey.

The market's innovation is heavily concentrated in the Remote Patient Monitoring (RPM) segment, utilizing sophisticated biomedical sensors and connected devices. These technologies range from simple wearables tracking vital signs (heart rate, sleep patterns) to complex medical-grade devices monitoring glucose levels, blood pressure, and ECGs. The key technological shift here is moving from passive data collection to active, personalized feedback loops powered by Artificial Intelligence. AI and Machine Learning are now critical for processing the massive influx of RPM data, identifying trends indicative of clinical deterioration, and delivering just-in-time nudges or alerts to both patients and providers, transforming reactive care into proactive management.

Furthermore, technologies supporting asynchronous care—the ability for patients to submit symptoms, photos, or videos for review by a provider at a later time—are becoming vital for non-urgent care, optimizing provider time and maximizing patient convenience. This store-and-forward technology, often enhanced by AI chatbots that guide the user through structured data collection, significantly improves efficiency. The future technological landscape will also rely heavily on 5G network integration, which promises ultra-low latency necessary for telesurgery or highly specialized remote diagnostics requiring massive bandwidth, further expanding the clinical depth and technical reliability of DTC telehealth offerings across all major geographical areas.

Regional Highlights

- North America (U.S. and Canada): This region is the undisputed leader in the DTC Telehealth Services Market, characterized by high consumer adoption, established reimbursement pathways, and a strong competitive environment dominated by major players like Teladoc and Amwell. Favorable governmental policies, particularly post-2020 regulatory changes that relaxed restrictions on virtual care and cross-state licensing, have solidified its leadership. The U.S. market specifically benefits from high venture capital investment in digital health startups and widespread integration of telehealth benefits into corporate health plans, driving market maturity and technological innovation, especially in mental health and specialized chronic care management.

- Europe (Germany, U.K., France): The European market demonstrates steady growth, often linked to the integration capabilities within nationalized healthcare systems (NHS in the U.K.). Growth is slower and more regulated than in the U.S., focusing heavily on data privacy compliance (GDPR) and ensuring equitable access. Key drivers include addressing physician shortages, managing high rates of chronic disease, and providing expanded mental health services. Germany and the U.K. are pioneering integrated digital care models, with specific emphasis on e-prescribing and remote patient monitoring programs tailored for elderly and high-risk populations.

- Asia Pacific (APAC) (China, India, Japan): APAC is projected to exhibit the highest CAGR due to its vast, underserved populations, rapidly improving internet penetration, and strong government backing for digital health initiatives designed to bridge urban-rural infrastructure gaps. China, led by platforms like Ping An Good Doctor, and India, with its focus on affordable virtual primary care, represent massive growth opportunities. The market here is driven by mobile-first solutions and necessity, often bypassing legacy healthcare infrastructure entirely. Challenges include varied regulatory standards across countries and achieving clinical trust among populations less accustomed to digital interaction for medical needs.

- Latin America (LATAM): The LATAM region presents a fragmented but promising market, driven by urbanization, high smartphone usage, and the significant need for accessible specialty care due to geographical barriers. Private sector initiatives and international partnerships are leading the charge, particularly in countries like Brazil and Mexico. The primary focus is on basic consultations and wellness programs, with scaling limited currently by varying regulatory clarity and insurance coverage levels, though digital connectivity improvements are rapidly enabling service expansion.

- Middle East and Africa (MEA): Growth in MEA is concentrated in the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia), where high disposable income and strong governmental digital transformation mandates are facilitating advanced telehealth adoption, often through public-private partnerships. The African segment is largely focused on essential, mobile-based health services to reach remote populations, utilizing asynchronous communication and localized health management tools to deliver basic primary and preventative care.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Direct To Consumer Telehealth Services Market.- Teladoc Health

- Amwell (American Well)

- MDLIVE (Cigna)

- Doctor On Demand (Included Health)

- PlushCare

- LiveHealth Online (Anthem)

- MeMD (Walmart)

- Hims & Hers

- Ro (Roman Health Ventures)

- K Health

- Babylon Health

- 98point6

- Talkspace

- BetterHelp (Teladoc)

- GE Healthcare (Remote Monitoring Solutions)

- Philips (Remote Patient Management)

- Doctor Anywhere

- Ping An Good Doctor

- HealthTap

- eVisit

Frequently Asked Questions

Analyze common user questions about the Direct To Consumer Telehealth Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Direct To Consumer (DTC) Telehealth and how does it differ from traditional telehealth?

DTC telehealth refers to medical services delivered directly to the patient, bypassing referral requirements or mandatory physical entry points typically associated with hospital-centric telehealth. It focuses on patient convenience, often using mobile apps or dedicated portals for on-demand access to doctors, particularly for primary care, mental health, and prescription refills.

What major regulatory hurdles impact the growth of DTC telehealth services?

The primary regulatory hurdle is the complexity of physician licensure laws, which often restrict providers from offering virtual consultations across state or national borders. Data privacy and security regulations (like HIPAA and GDPR) also require significant compliance investment, alongside evolving reimbursement policies that dictate which virtual services are covered by insurance.

Which market segment is expected to drive the highest revenue growth in DTC telehealth?

The Mental and Behavioral Health Services segment is anticipated to drive the highest revenue growth. This is due to the rising prevalence of mental health disorders, severe shortages of specialized professionals globally, and the high efficacy and discretion afforded by remote therapy and psychiatry via digital platforms.

How is Remote Patient Monitoring (RPM) integrated into Direct To Consumer models?

RPM is integrated via connected medical devices (wearables, biosensors) that transmit real-time physiological data (e.g., blood sugar, blood pressure) to the telehealth platform. This data is then used by providers to proactively manage chronic diseases, adjust treatment plans remotely, and prevent hospital admissions, creating a continuous loop of care.

What role does Artificial Intelligence (AI) play in improving DTC telehealth efficiency?

AI significantly enhances efficiency by managing automated patient triage, using symptom checkers to guide initial care, and automating complex administrative tasks such as clinical documentation and billing. This allows healthcare providers to dedicate more time to direct patient care and minimizes operational overhead for the platform.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager