Directors and Officers Insurance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434236 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Directors and Officers Insurance Market Size

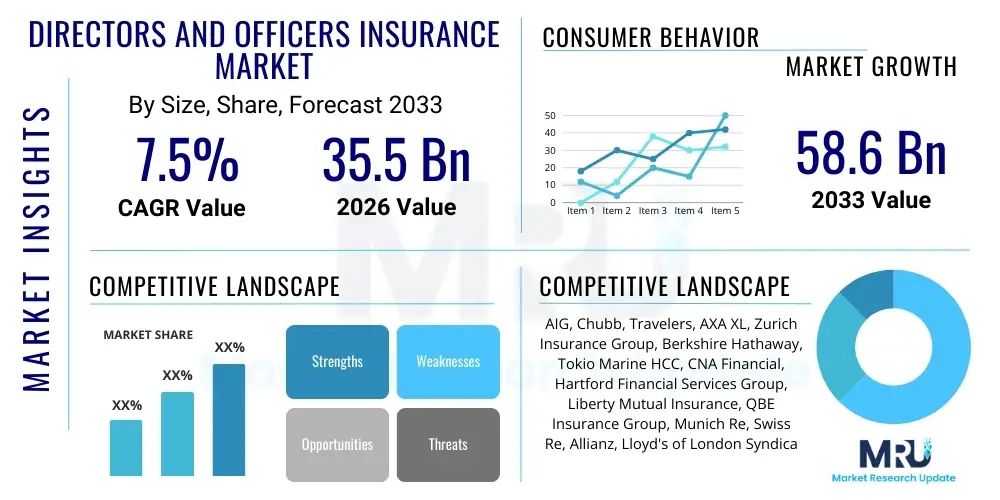

The Directors and Officers Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 35.5 Billion in 2026 and is projected to reach USD 58.6 Billion by the end of the forecast period in 2033.

Directors and Officers Insurance Market introduction

The Directors and Officers (D&O) Insurance Market provides critical liability coverage for corporate directors and officers against claims arising from wrongful acts committed while managing the company. Wrongful acts can encompass breaches of fiduciary duty, misstatements, misrepresentations, employment practices violations, and failures to comply with regulatory mandates. As global regulatory complexity increases, particularly concerning Environmental, Social, and Governance (ESG) criteria, cybersecurity breaches, and financial transparency, the necessity for robust D&O policies has intensified across all public and private entities. This insurance acts as a fundamental risk mitigation tool, protecting the personal assets of decision-makers and ensuring that companies can attract and retain top executive talent without undue personal financial risk from litigation.

Major applications for D&O insurance span across shareholder derivative actions, securities class action lawsuits, regulatory investigations (such as those initiated by the SEC or equivalent bodies globally), and claims related to mergers and acquisitions activity. The primary benefit of D&O coverage is providing defense costs, which can often be exorbitant, even if the director or officer is ultimately exonerated, alongside indemnification for settlements and judgments not covered by corporate indemnification clauses. Furthermore, the coverage extends to corporate reimbursement for defense costs incurred, typically referred to as Side B coverage, ensuring corporate liquidity remains intact during extensive legal proceedings.

Driving factors for sustained market growth include the rising frequency and severity of corporate litigation globally, especially in sophisticated markets like North America and Europe. The increasing enforcement activity by governmental and supranational bodies concerning antitrust, data privacy (like GDPR), and corporate governance standards compels businesses to seek higher limits of liability protection. Moreover, the recent volatility introduced by global economic shifts, supply chain disruptions, and the rapid expansion of digital transformation initiatives introduce novel risks that directors must navigate, making D&O insurance an indispensable component of the corporate risk management portfolio.

Directors and Officers Insurance Market Executive Summary

The Directors and Officers Insurance Market is undergoing a significant transformation characterized by hardening premium rates in response to sustained loss ratios, particularly within the segment covering publicly traded companies facing securities litigation. Business trends highlight a pronounced flight to quality, where carriers are increasingly selective about the risks they underwrite, focusing heavily on robust corporate governance structures, audited financial health, and comprehensive pre-claim risk mitigation strategies. There is a strong movement towards integrating specialized liability coverages, such as those related to cyber risk and fiduciary liability, within broader D&O structures, acknowledging the interconnectedness of modern corporate exposures. Furthermore, the capacity constraints observed in recent years are gradually stabilizing, though pricing remains elevated for high-risk industries like biotechnology, emerging technology, and highly leveraged financial institutions.

Regionally, North America maintains its dominance due to its highly litigious environment, particularly concerning class action securities fraud suits and robust regulatory enforcement by agencies like the Department of Justice and the Securities and Exchange Commission. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, driven by increasing corporate globalization, stricter enforcement of corporate governance codes in countries like India and China, and the expansion of Initial Public Offerings (IPOs) necessitating public company D&O coverage. European markets, specifically those within the EU, are primarily influenced by complex cross-border litigation, stringent data privacy regulations, and growing shareholder activism related to climate change and sustainability mandates.

Segment trends reveal that the 'Public Company' segment continues to account for the largest market share by premium volume, driven by the systemic risk associated with market capitalization and shareholder accountability. Conversely, the 'Private Company' and 'Non-Profit Organization' segments are exhibiting strong growth, primarily due to the misconception that only public entities face significant D&O risk; in reality, private entities face substantial risks related to employment practices liability, creditor claims, and regulatory actions. In terms of coverage type, Side A Difference in Conditions (DIC) coverage, which provides direct protection to directors when corporate indemnification is unavailable or prohibited by law, is gaining importance as carriers compete on providing enhanced, non-indemnifiable protection layers for individual officers.

AI Impact Analysis on Directors and Officers Insurance Market

Users frequently inquire whether Artificial Intelligence (AI) will automate the underwriting process entirely, reduce the prevalence of D&O claims by improving corporate performance, or introduce entirely new categories of liability that existing policies cannot address. The central themes reveal concerns about algorithmic bias leading to discriminatory decisions, the traceability of liability when an autonomous system causes harm (algorithmic liability), and the ability of AI to accurately model future litigation risks, especially those stemming from novel technological failures. Users expect AI to streamline claims processing and predictive modeling, but they are wary of the new risk landscape created by complex AI-driven governance decisions, particularly regarding ethical oversight and data utilization, which could expose directors to unprecedented claims of negligent supervision or inadequate control mechanisms.

- AI algorithms enhance risk assessment models by processing vast amounts of litigation data, financial performance metrics, and governance ratings, leading to more granular and dynamic pricing structures for D&O premiums.

- Predictive analytics driven by machine learning helps underwriters identify companies with weak internal controls or higher propensity for securities class actions, leading to highly customized policy terms and exclusions.

- The rise of 'Algorithmic Liability' introduces new risk exposure categories for directors, particularly concerning regulatory penalties or civil claims arising from biased AI outputs, errors in automated trading, or data integrity failures managed by autonomous systems.

- AI facilitates faster claims triage and fraud detection in the claims processing stage, improving operational efficiency for insurers but demanding specialized expertise to assess complex, technology-driven claims.

- The implementation of AI decision-making tools necessitates updated corporate governance policies, creating an immediate need for directors to purchase coverage specifically addressing alleged failures in oversight of responsible AI deployment and ethical compliance.

DRO & Impact Forces Of Directors and Officers Insurance Market

The Directors and Officers Insurance Market is driven primarily by escalating global litigation trends, amplified regulatory scrutiny across key industrial sectors, and the fundamental necessity for corporations to protect the personal assets of their executive leadership against rising corporate complexity. These factors are reinforced by the increasing prevalence of third-party litigation funding, which incentivizes shareholder activism and class action suits, thus increasing the frequency of D&O claims. Simultaneously, the market faces significant restraints, including the cyclical hardening of the insurance market, characterized by high premiums and reduced capacity following periods of poor underwriting results, making comprehensive coverage financially restrictive for smaller enterprises. Furthermore, inherent policy ambiguities and disputes over coverage exclusions, particularly those related to insolvency or specific environmental claims, often lead to friction between insureds and carriers.

Opportunities for market expansion are abundant, particularly in integrating D&O coverage with emerging governance risks such as climate change litigation (known as 'greenwashing' claims), systemic cyber risk management, and specialized risk transfer solutions for intellectual property litigation. The burgeoning regulatory environment surrounding Environmental, Social, and Governance (ESG) criteria mandates that directors actively manage sustainability risks, opening a new frontier for D&O policy endorsements specifically tailored to cover alleged failures in ESG disclosures or execution. The geopolitical landscape also presents an opportunity for specialized D&O products catering to directors of multinational corporations operating in high-risk jurisdictions or those subjected to complex sanctions regimes.

The impact forces shaping this market are substantial and multi-directional. Societal impact forces include increasing public demand for corporate accountability and transparency, pressuring regulators and plaintiffs’ attorneys to pursue claims aggressively against alleged directorial misconduct. Economic impact forces are tied to volatile capital markets and recessionary pressures, which frequently trigger securities class action lawsuits following significant stock price declines or bankruptcy filings. Technological impact forces, driven by rapid digital transformation and the increasing adoption of cloud computing and AI, continually redefine the risk profile of companies, requiring continuous innovation in policy drafting and risk modeling by D&O insurers to remain relevant and solvent.

Segmentation Analysis

The Directors and Officers Insurance Market is extensively segmented based on the type of company (public or private), the scope of coverage provided, the limit of liability purchased, and the industry vertical of the insured entity. This granular segmentation allows carriers to tailor risk pricing and policy conditions to the specific regulatory and litigation exposures faced by different corporate structures. The distinction between public and private companies is critical, as public entities generally require more expensive and comprehensive policies to address the inherent risks of securities offerings and high shareholder count, while private companies typically focus on risks related to employment practices and fiduciary responsibilities. Furthermore, segmentation by coverage type, specifically Side A (non-indemnifiable), Side B (corporate reimbursement), and Side C (securities entity coverage), dictates the allocation of risk and the cost structure of the premium.

- By Entity Type:

- Public Companies (Listed entities subject to securities laws)

- Private Companies (Non-listed firms, including startups and mid-market enterprises)

- Non-Profit Organizations (Charities, foundations, educational institutions)

- By Coverage Type:

- Side A Coverage (Non-indemnifiable protection for directors/officers)

- Side B Coverage (Corporate reimbursement for indemnified losses)

- Side C Coverage (Entity coverage for securities claims)

- Employment Practices Liability Insurance (EPLI) Endorsements

- Fiduciary Liability Coverage (often packaged or endorsed)

- By Industry Vertical:

- Financial Services and Banking (BFSI)

- Technology, Media, and Telecommunications (TMT)

- Healthcare and Pharmaceuticals

- Manufacturing and Industrials

- Energy and Utilities

- Retail and Consumer Goods

- By Policy Limit:

- Primary Coverage Layers

- Excess Coverage Layers

- Tower Structures (Layered policies)

Value Chain Analysis For Directors and Officers Insurance Market

The value chain for the Directors and Officers Insurance Market is complex, involving multiple specialized intermediaries ensuring the efficient transfer and mitigation of executive liability risk. The upstream segment is dominated by the capital providers, including primary insurance carriers and reinsurance companies, who pool and bear the ultimate financial risk. Key activities in the upstream involve sophisticated actuarial analysis, policy wording development, and capital deployment strategies to support substantial policy limits. Insurers rely heavily on proprietary data models and external legal counsel to assess evolving litigation trends and regulatory changes, which dictate the capacity they are willing to offer in a highly volatile product line. Reinsurers play a crucial role in stabilizing the market by absorbing large, catastrophic losses, thereby maintaining the financial resilience of the primary carriers.

The downstream segment focuses on risk placement and servicing. This stage is dominated by specialized insurance brokers and risk consultants who act as the essential bridge between the corporate customer and the insurer. Brokers, particularly global brokerage houses, are responsible for structuring complex insurance towers, negotiating favorable terms, ensuring compliance with local regulatory requirements, and managing the placement of excess and surplus lines coverage. These intermediaries provide critical advisory services, helping clients understand the intricate interplay between various policy segments (Side A, B, C) and identifying potential gaps in protection, particularly those related to foreign subsidiaries or emerging risks like cyber liability and ESG-related exposures.

Distribution channels for D&O insurance are predominantly indirect, relying almost exclusively on expert insurance brokers, due to the bespoke nature and complexity of the product. Direct distribution is rare, typically limited to highly standardized, low-limit policies for smaller private companies or non-profits. The indirect channel ensures that the client benefits from market expertise, leveraging the broker’s relationships with multiple carriers to achieve optimal pricing and coverage customization. The high-stakes nature of D&O claims necessitates this expert intermediation, ensuring policy language is precise and defense counsel provisions are robust, underscoring the vital role of specialized knowledge in the distribution and servicing components of the value chain.

Directors and Officers Insurance Market Potential Customers

The primary consumers and potential customers of Directors and Officers Insurance encompass virtually all legally incorporated entities that utilize a board of directors or an equivalent management structure, spanning both the public and private sectors, regardless of size or geographic footprint. The most significant and frequent purchasers are publicly traded corporations, particularly those listed on major exchanges (e.g., NYSE, NASDAQ, LSE), where the risk of shareholder derivative actions and securities class action lawsuits is paramount. These companies typically purchase large, layered policies, often exceeding hundreds of millions of dollars in limits, reflecting their high market capitalization and significant regulatory exposure. Companies undergoing initial public offerings (IPOs) are a critical growth demographic, as securing D&O coverage is a non-negotiable prerequisite for listing.

Beyond public entities, the private company sector represents a rapidly expanding customer base. While historically private firms might have viewed D&O coverage as optional, increasing exposure to risks such as employment practices liability, creditor claims during insolvency, and aggressive litigation against management following mergers, acquisitions, or capital raises (e.g., venture capital funding rounds) has made the coverage essential. High-growth, venture-backed technology startups are a notable segment, as their aggressive growth strategies and reliance on intellectual property often attract regulatory scrutiny and litigation risk, making their directors vulnerable to personal asset exposure.

Furthermore, specialized organizations such as large non-profit institutions, universities, hospitals, and municipal entities constitute a vital segment of potential buyers. Although these organizations do not face shareholder risk, their directors are exposed to claims arising from alleged mismanagement of funds, breach of fiduciary duty to stakeholders, regulatory violations (e.g., HIPAA compliance in healthcare), and general governance failures. The continued emphasis on accountability and transparent governance across all sectors ensures a broad and expanding pool of organizations that recognize D&O insurance as a crucial component of their enterprise risk management framework.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.5 Billion |

| Market Forecast in 2033 | USD 58.6 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AIG, Chubb, Travelers, AXA XL, Zurich Insurance Group, Berkshire Hathaway, Tokio Marine HCC, CNA Financial, Hartford Financial Services Group, Liberty Mutual Insurance, QBE Insurance Group, Munich Re, Swiss Re, Allianz, Lloyd's of London Syndicates, Beazley, RLI Corp, W. R. Berkley Corporation, Arch Capital Group, Everest Re Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Directors and Officers Insurance Market Key Technology Landscape

The technology landscape supporting the Directors and Officers Insurance market is rapidly evolving, moving beyond traditional statistical modeling to embrace advanced predictive analytics and digital platforms designed to enhance underwriting precision and claims efficiency. A critical technology is the utilization of sophisticated data aggregation and machine learning models that process non-traditional data sources, such as corporate social media sentiment, news media analysis, and regulatory filing histories, to create dynamic risk scores for individual companies and their management teams. These tools allow underwriters to move from static, historical assessments to continuous, forward-looking evaluations, enabling real-time adjustments to premium pricing and exposure modeling, especially concerning high-frequency risks like securities litigation propensity.

Furthermore, technology is playing a crucial role in policy management and service delivery. Blockchain technology and smart contracts are being explored, though adoption is nascent, to improve transparency and efficiency in the complex process of placing large, layered D&O towers involving multiple carriers and reinsurers. Automated policy issuance and digital documentation management reduce administrative overhead and accelerate the binding process. For claims handling, Artificial Intelligence and Natural Language Processing (NLP) are employed to rapidly analyze massive volumes of legal documents, court filings, and regulatory correspondence, significantly accelerating the claims triage and discovery phases, thus reducing the costly loss adjustment expenses that often plague D&O claims.

The technological focus extends significantly into risk mitigation and value-added services offered by carriers and brokers. Specialized governance technology platforms (GovTech) provide insured clients with tools for continuous compliance monitoring, internal control assessments, and ESG reporting frameworks. By proactively helping clients manage and document their corporate governance responsibilities, insurers are leveraging technology to reduce the likelihood of claims, transforming the insurer-client relationship from transactional to partnership-based. This technological shift, integrating data science with legal and financial expertise, is redefining the competitive advantage in the D&O underwriting space, favoring carriers capable of translating complex data into actionable risk mitigation strategies.

Regional Highlights

- North America (Dominance and High Litigation Risk): North America, particularly the United States, holds the largest market share due to the highly developed corporate sector and its extremely litigious legal environment. The region is characterized by frequent securities class action lawsuits, high jury awards, and rigorous enforcement by the SEC and DOJ. Demand for high-limit D&O coverage, especially Side A DIC, is driven by substantial litigation defense costs and the need for personalized protection against non-indemnifiable claims. The integration of cyber and D&O risks is most advanced here.

- Europe (Regulatory Compliance and ESG Focus): Europe represents the second-largest market, strongly influenced by pan-European regulations such as GDPR, the EU Taxonomy, and intensifying scrutiny of corporate behavior concerning climate change and social issues. Shareholder activism is growing, particularly in jurisdictions like the UK and Germany. The focus here is on policies that provide comprehensive coverage for cross-border regulatory fines and defense costs arising from complex global investigations.

- Asia Pacific (APAC) (Highest Growth Trajectory): APAC is the fastest-growing market, driven by increasing foreign direct investment, a surge in IPO activity, and the progressive adoption of Western-style corporate governance standards in major economies like China, Japan, and India. While traditional D&O risk awareness is lower than in the West, local regulatory bodies are strengthening enforcement, leading to increased demand for locally tailored policies that accommodate unique legal frameworks and state-owned enterprise dynamics.

- Latin America (Emerging Regulatory Environments): The Latin American market is poised for expansion as countries improve their regulatory oversight and financial market transparency. The primary drivers are political and economic instability, which increase the risk of bankruptcy-related D&O claims, and the fight against corruption, necessitating coverage for directors facing investigations by anti-corruption agencies.

- Middle East and Africa (MEA) (Infrastructure and Governance Development): The MEA region is characterized by strong demand linked to major infrastructure projects, economic diversification initiatives, and the adoption of international financial reporting standards. D&O adoption is increasing among large government-linked enterprises and multinational firms operating in the region, focusing on political risk and governance failure coverage.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Directors and Officers Insurance Market.- AIG

- Chubb

- Travelers

- AXA XL

- Zurich Insurance Group

- Berkshire Hathaway

- Tokio Marine HCC

- CNA Financial

- Hartford Financial Services Group

- Liberty Mutual Insurance

- QBE Insurance Group

- Munich Re

- Swiss Re

- Allianz

- Lloyd's of London Syndicates

- Beazley

- RLI Corp

- W. R. Berkley Corporation

- Arch Capital Group

- Everest Re Group

Frequently Asked Questions

Analyze common user questions about the Directors and Officers Insurance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Directors and Officers (D&O) Insurance?

The primary function of D&O insurance is to protect the personal assets of corporate directors and officers against legal costs and judgments arising from allegations of wrongful acts committed in their capacity as corporate managers. It provides necessary defense costs and indemnification, ensuring executives can make difficult business decisions without undue personal financial exposure.

How is D&O insurance segmented by coverage type?

D&O insurance is typically segmented into three main types: Side A provides non-indemnifiable coverage directly to individuals; Side B reimburses the corporation for its legally permissible indemnification payments to the directors; and Side C (Entity Coverage) protects the corporation itself against securities claims.

Are private companies also at risk and do they need D&O coverage?

Yes, private companies face significant D&O risk, primarily from claims related to employment practices liability (EPL), creditor claims during bankruptcy, regulatory investigations, and allegations of mismanagement by investors or stakeholders. D&O coverage is crucial for attracting and retaining executive talent in the private sector.

What major factors are currently driving the growth of the D&O Market?

The growth of the D&O market is primarily driven by the proliferation of securities class action lawsuits globally, the heightened regulatory focus on corporate governance and transparency (especially regarding ESG criteria and data privacy), and the increasing cost and complexity of corporate litigation.

How does AI technology affect D&O underwriting and risk assessment?

AI technology enhances D&O underwriting by utilizing machine learning to analyze vast data sets (including litigation history, corporate financials, and sentiment analysis) to provide dynamic, predictive risk scoring. This allows insurers to price policies more accurately and identify emerging risks like algorithmic liability exposure before claims occur.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager